Middle East And Africa Ultrasound Imaging Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

2.17 Billion

2021

2029

USD

1.17 Billion

USD

2.17 Billion

2021

2029

| 2022 –2029 | |

| USD 1.17 Billion | |

| USD 2.17 Billion | |

|

|

|

Market Analysis and Size

Urological treatment procedures are becoming increasingly popular all around the world. The growing number of medical operations involving the kidneys, ureters, bladder, urethra, prostate gland, and reproductive health have broadened the field of expansion for ultrasound imaging instruments. Increasing the implementation of new technology in these medical systems would even further boost their efficiency in healthcare processes.

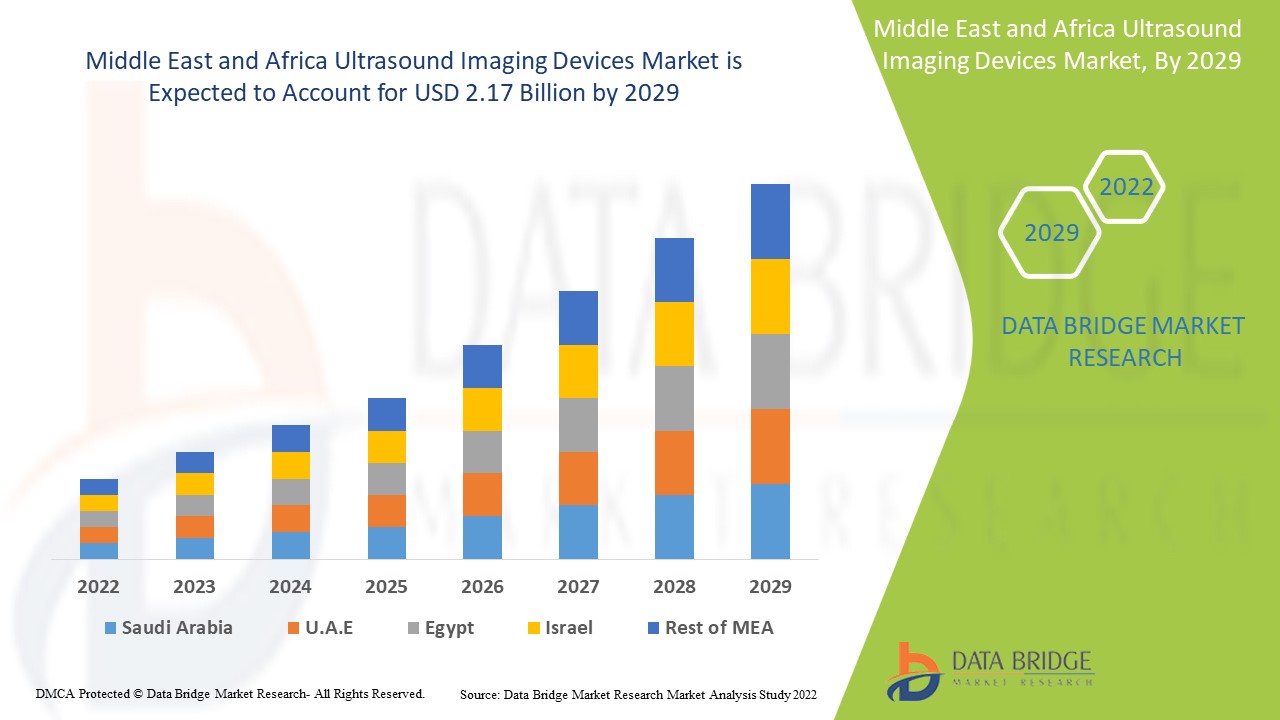

Data Bridge Market Research analyses that the ultrasound imaging devices market which was USD 1.17 billion in 2021, would rocket up to USD 2.17 billion by 2029, and is expected to undergo a CAGR of 8.00% during the forecast period 2022 to 2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Market Definition

Ultrasound imaging devices are devices that use high-frequency sound waves to produce images of the inside of the body. The ultrasound system uses ultrasonic imaging technology. Ultrasound equipment can generate real-time images of biological components that demonstrate how the body moves. A transducer and an ultrasonic detector, or probe, make up an ultrasound system. This minimally invasive diagnostic technology does not use ionizing radiation to diagnose or treat body illnesses.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Array Format (Phased Array, Linear Array, Curved Linear Array, Others), Device Display (Color Ultrasound Devices, Black and White (B/W) Ultrasound Devices), Device Portability (Trolley/Cart-Based Ultrasound Devices, Compact/Handheld Ultrasound Devices, Stationary Ultrasound Devices, Point-of-Care Ultrasound Devices), Technology (Diagnostic Ultrasound, Therapeutic Ultrasound), Application (Radiology/General Imaging, Obstetrics and Gynecology, Cardiovascular, Gastroenterology, Vascular, Urological, Orthopedic and Musculoskeletal, Pain Management, Emergency Department, Critical Care, Others), End User (Hospitals, Surgical Centers, Research and Academia, Maternity Centers, Ambulatory Care Centers, Diagnostic Centers, Others), Distribution Channel (Direct Tender, Third Party Distributors, Retail Sales) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Koninklijke Philips N.V. (Netherlands), CANON MEDICAL SYSTEMS CORPORATION (Japan), Hitachi, Ltd. (Japan), Siemens (Germany), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.), CHISON Medical Technologies Co., Ltd. (U.S.), EDAN Instruments, Inc. (China), ESAOTE SPA (Italy), FUJIFILM Corporation (Japan), FUKUDA DENSHI (Japan), Hologic, Inc. (U.S.), SAMSUNG HEALTHCARE (U.S.), Analogic Corporation (U.S.), General Electric (U.S.), TOSHIBA CORPORATION (Japan), Trivitron Healthcare (India) |

|

Market Opportunities |

|

Ultrasound Imaging Devices Market Dynamics

Drivers

- Rising prevalence of diseases

The increasing frequency of acute and chronic diseases and disorders worldwide due to various reasons is one of the key factors driving the market's rise. For example, the increasing prevalence of cancer tumours, gallstones, fatty liver disease, and other disorders directly and positively impacts market growth. In 2015, USD 415 million individuals worldwide have diabetes; by 2040, that number will rise to 642 million.

- Research and development proficiencies

Rising research and development expenditures, particularly in developed and developing nations, in the field of medical equipment and devices, will provide even more profitable market growth prospects. The market growth rate is further bolstered by research and development capabilities relevant to developments in medical imaging technologies.

- Growing investment for healthcare facilities

Another major element driving market expansion is a renewed focus on improving the state of healthcare facilities and the overall healthcare infrastructure. The growing number of public-private partnerships and strategic cooperation on funding and deployment of new and enhanced technologies is providing even more profitable market prospects. Furthermore, increased government measures to raise awareness about the necessity of early diagnosis are boosting the market's growth rate once again.

- Demand for ultrasound imaging devices

With rising demand for minimally invasive diagnostic and therapeutic uses of ultrasound imaging devices and the launch of more technologically advanced ultrasound equipment, ultrasound imaging device demand has increased compared to the previous year. Furthermore, government measures to raise awareness about the need of early diagnosis have increased demand for ultrasonic imaging instruments.

Opportunities

Chronic disease incidence is predicted to rise, resulting in an increase in patients requiring enhanced diagnostic and therapeutic options. Emerging markets would be the most affected, as population growth in developing countries, particularly India and China, is expected to be large, increasing healthcare expenditure in these countries. Advances in disease identification and diagnosis will also help keep the expense of treating chronic illnesses in check. According to the World Health Organization, chronic illness prevalence is anticipated to increase by 57% by 2020, with obesity rates and incidences of diseases like diabetes on the rise, driving the need for ultrasound devices to identify patients. Using ultrasound technologies to diagnose patients earlier helps reduce total healthcare costs. The use of ultrasound devices is predicted to increase as patients with chronic conditions rise, fueling the market's expansion.

Restraints/Challenges

On the other hand, market expansion is likely to be hampered by high costs associated with research and development capabilities, inadequate infrastructure facilities, uneven distribution of medical services, and a lack of awareness in backward nations. In addition, in the forecast period of 2022-2029, the market is expected to be challenged by a lack of favourable reimbursement scenario and technology penetration in developing economies, a decline in healthcare expenses in advanced countries, rising patent expiry, government pricing pressure, high cost of ultrasound devices, and a lack of suitable infrastructure in low- and middle-income countries.

The expansion of the ultrasound imaging devices market is being hampered by stringent clearances and regulations by government entities such as the US Food and Drug Administration (FDA). Aside from the standard registration process, manufacturers must comply with a number of rules, including device quality control, labelling, premarket approval, device investigation, and reporting.

This ultrasound imaging devices market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the ultrasound imaging devices market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Ultrasound Imaging Devices Market

The market response to COVID-19 has been minimal. The decrease in the rate of medical device manufacture has had a negative impact on revenue. The demand for ultrasound equipment fell as the use of imaging systems fell due to a decline in the requirement for emergency treatment. On the other hand, the post-pandemic period is projected to put the market back on track. COVID-19 is a fluid disease that can damage a variety of tissues and organs as it develops. As a result, the impact of the disease at all stages and organs necessitates a functional and versatile imaging technology capable of dynamically detecting particularities or abnormalities. Ultrasonography meets all of these criteria and has various advantages over other imaging modalities, such as portability, affordability, and biosafety. Throughout the COVID-19 epidemic, ultrasonography performed a critical role in triage, monitoring, detecting organ damage, and allowing patients to make tailored therapy decisions. This review focuses on the primary pathogenic outcomes associated with COVID-19-induced ultrasonography alterations in the lungs, heart, and liver.

Recent Development

- Hitachi, Ltd. began international sales of the ARIETTA 750, a new model from the ARIETTA diagnostic ultrasound platform series, in March 2020. Hitachi, Ltd. enhanced its product portfolio and market demand with this new launch, resulting in increased revenue in the future.

- In February 2022, Butterfly Network, Inc. and Ambra Health announced a collaboration to speed and simplify bedside imaging data exchange. This partnership will improve access to and shareability of valuable ultrasound information across hospitals and health systems, enhancing the scalability of Butterfly Blueprint, Butterfly's enterprise platform.

Middle East and Africa Ultrasound Imaging Devices Market Scope

The ultrasound imaging devices market is segmented on the basis of product, device display, device portability, application, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Array Format

- Phased Array

- Linear Array

- Curved Linear Array

- Others

Technology

- Diagnostic Ultrasound Systems

- 2D Imaging Systems

- 3D & 4D Imaging Systems

- Doppler Imaging

- Therapeutic Ultrasound Systems

- High-Intensity Focused Ultrasound (HIFU)

- Extracorporeal Shockwave Lithotripsy (ESWL)

Device Display

- Colour Ultrasound Devices

- Black & White (B/W) Ultrasound Devices

Device Portability

- Trolley/Cart-Based Ultrasound Devices

- Compact/Handheld Ultrasound Devices

Application

- Radiology/General Imaging

- Cardiology

- Obstetrics/Gynecology

- Vascular

- Urology

- Others

End-user

- Hospitals

- Surgical Centers

- Research and Academia

- Maternity Centers

- Ambulatory Care Centers

- Diagnostic Centers

- Others

Distribution channel

- Direct Tender

- Third Party Distributors

- Retail Sales

Ultrasound Imaging Devices Market Regional Analysis/Insights

The ultrasound imaging devices market is analysed and market size insights and trends are provided by country, product, device display, device portability, application, end-user and distribution channel as referenced above.

The countries covered in the ultrasound imaging devices market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa is dominating the Middle East and Africa market with the rapid transition in healthcare infrastructure leading to high demand for medical equipment including ultrasound imaging devices. Because ultrasound is less expensive than other imaging modalities, there is a significant demand for these equipment in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The ultrasound imaging devices market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for ultrasound imaging devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the ultrasound imaging devices market. The data is available for historic period 2010-2020.

Competitive Landscape and Ultrasound Imaging Devices Market Share Analysis

The ultrasound imaging devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to ultrasound imaging devices market.

Some of the major players operating in the ultrasound imaging devices market are:

- Koninklijke Philips N.V. (Netherlands)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Hitachi, Ltd. (Japan)

- Siemens (Germany)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- ALPINION MEDICAL SYSTEMS Co., Ltd (U.S.)

- CHISON Medical Technologies Co., Ltd. (U.S.)

- EDAN Instruments, Inc. (China)

- ESAOTE SPA (Italy)

- FUJIFILM Corporation (Japan)

- FUKUDA DENSHI (Japan)

- Hologic, Inc. (U.S.)

- SAMSUNG HEALTHCARE (U.S.)

- Analogic Corporation (U.S.)

- General Electric (U.S.)

- TOSHIBA CORPORATION (Japan)

- Trivitron Healthcare (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 ARRAY FORMAT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 TECHNOLOGICAL ADVANCEMENTS IN ULTRASOUND IMAGING SYSTEM

5.1.2 INCREASE INCIDENCE RATES OF CHRONIC DISEASES

5.1.3 INCREASE IN NUMBER OF ULTRASOUND DIAGNOSTIC IMAGING PROCEDURES IN OBSTETRICS & GYNECOLOGY FIELD

5.1.4 RISE IN AWARENESS FOR EARLY DISEASE DIAGNOSIS

5.1.5 REIMBURSEMENT FOR ULTRASOUND GUIDED PROCEDURES

5.2 RESTRAINTS

5.2.1 HIGH COST OF ULTRASOUND IMAGING DEVICES

5.2.2 DEARTH OF SKILLED AND EXPERIENCED SONOGRAPHERS WORLDWIDE.

5.2.3 STRINGENT GOVERNMENT REGULATIONS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR MINIMALLY INVASIVE TECHNOLOGY

5.3.2 RISING DISPOSABLE INCOME

5.3.3 EMERGENCE OF POC ULTRASOUND DEVICES

5.4 CHALLENGES

5.4.1 LIMITATIONS OF ULTRASOUND IMAGING

5.4.2 INCREASING ADOPTION OF REFURBISHED IMAGING SYSTEM

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 PRICE IMPACT

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 STRATEGIC DECISIONS FOR MANUFACTURERS

6.5 CONCLUSION

7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT

7.1 OVERVIEW

7.2 CURVED LINEAR ARRAY

7.3 LINEAR ARRAY

7.4 PHASED ARRAY

7.5 OTHERS

8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY

8.1 OVERVIEW

8.2 COLOR ULTRASOUND DEVICES

8.2.1 MID-END COLOR DOPPLER

8.2.2 LOW-END COLOR DOPPLER

8.2.3 HIGH-END COLOR DOPPLER

8.2.4 PREMIUM-END COLOR DOPPLER

8.3 BLACK AND WHITE (B/W) ULTRASOUND DEVICES

9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY

9.1 OVERVIEW

9.2 TROLLEY/CART-BASED ULTRASOUND DEVICES

9.2.1 MID-RANGE

9.2.2 LOW-END

9.2.3 HIGH-END

9.2.4 PREMIUM

9.3 STATIONARY ULTRASOUND DEVICES

9.3.1 MID-RANGE

9.3.2 LOW-END

9.3.3 HIGH-END

9.3.4 PREMIUM

9.4 POINT-OF-CARE ULTRASOUND DEVICES

9.5 COMPACT/HANDHELD ULTRASOUND DEVICES

9.5.1 MID-RANGE

9.5.2 LOW-END

9.5.3 HIGH-END

9.5.4 PREMIUM

10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 DIAGNOSTIC ULTRASOUND

10.2.1 3D AND 4D ULTRASOUND

10.2.2 2D IMAGING

10.2.3 DOPPLER IMAGING

10.3 THERAPEUTIC ULTRASOUND

10.3.1 SHOCKWAVE LITHOTRIPSY

10.3.2 OTHERS

11 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 RADIOLOGY/GENERAL IMAGING

11.3 CARDIOVASCULAR

11.4 OBSTETRICS AND GYNECOLOGY

11.5 UROLOGICAL

11.6 ORTHOPEDIC AND MUSCULOSKELETAL

11.7 GASTROENTEROLOGY

11.8 EMERGENCY DEPARTMENT

11.9 CRITICAL CARE

11.1 PAIN MANAGEMENT

11.11 VASCULAR

11.12 OTHERS

12 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 THIRD PARTY DISTRIBUTORS

13 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 DIAGNOSTIC CENTERS

13.4 MATERNITY CENTERS

13.5 AMBULATORY CARE CENTERS

13.6 SURGICAL CENTERS

13.7 RESEARCH AND ACADEMIA

13.8 OTHERS

14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY GEOGRAPHY

14.1 MIDDLE EAST & AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E.

14.1.4 ISRAEL

14.1.5 EGYPT

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GE HEALTHCARE (A SUBSIDIARY OF GENERAL ELECTRIC)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 KONINKLIJKE PHILIPS N.V.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANON MEDICAL SYSTEMS CORPORATION (A SUBSIDIARY OF CANON INC.)

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HITACHI, LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SIEMENS HEALTHCARE GMBH

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ALPINION MEDICAL SYSTEMS CO., LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHISON

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 EDAN INSTRUMENTS, INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 ESAOTE SPA

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FUJIFILM CORPORATION (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 FUKUDA DENSHI

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HOLOGIC, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 MOBISANTE

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 SAMSUNGHEALTHCARE (A SUBSIDIARY OF SAMSUNG ELECTRONICS CO., LTD.)

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 SHIMADZU MEDICAL SYSTEMS USA NORTHWEST BRANCH (A SUBSIDIARY OF SHIMADZU CORPORATION)

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 SONOSCAPE MEDICAL CORP.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 TRIVITRON HEALTHCARE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 ULTRASOUND DEVICES USED IN OBSTETRICS & GYNECOLOGY

TABLE 2 LIST OF PRIZES OF ULTRASOUND IMAGING DEVICES

TABLE 3 POC ULTRASOUND DEVICES

TABLE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA CURVED LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA LINEAR ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA PHASED ARRAY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA BLACK AND WHITE (B/W) ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA POINT-OF-CARE ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RADIOLOGY/GENERAL IMAGING IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CARDIOVASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OBSTETRICS AND GYNECOLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA UROLOGICAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA ORTHOPEDIC AND MUSCULOSKELETAL IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA GASTROENTEROLOGY IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EMERGENCY DEPARTMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA CRITICAL CARE IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PAIN MANAGEMENT IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA VASCULAR IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA DIRECT TENDER IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA RETAIL SALES IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA THIRD PARTY DISTRIBUTORS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA HOSPITALS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA DIAGNOSTIC CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA MATERNITY CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA AMBULATORY CARE CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SURGICAL CENTERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA RESEARCH AND ACADEMIA IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA OTHERS IN ULTRASOUND IMAGING DEVICES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 55 MIDDLE EAST & AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 66 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 68 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 69 SOUTH AFRICA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 70 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 71 SOUTH AFRICA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 72 SOUTH AFRICA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 73 SOUTH AFRICA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 74 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 75 SOUTH AFRICA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 76 SOUTH AFRICA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 77 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 79 SOUTH AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 80 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 81 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 82 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 83 SAUDI ARABIA COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 84 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 94 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 95 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 96 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 97 U.A.E. COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 98 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 99 U.A.E. TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 100 U.A.E. STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 101 U.A.E. COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 102 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 103 U.A.E. DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 104 U.A.E. THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 105 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 106 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 107 U.A.E. ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 108 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 109 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 110 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 111 ISRAEL COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 112 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 113 ISRAEL TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 114 ISRAEL STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 115 ISRAEL COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 116 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 117 ISRAEL DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 118 ISRAEL THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 119 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 120 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 121 ISRAEL ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 122 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

TABLE 123 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 124 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (UNITS)

TABLE 125 EGYPT COLOR ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE DISPLAY, 2018-2027 (USD MILLION)

TABLE 126 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 127 EGYPT TROLLEY/CART-BASED ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 128 EGYPT STATIONARY ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 129 EGYPT COMPACT/HANDHELD ULTRASOUND DEVICES IN ULTRASOUND IMAGING DEVICES MARKET, BY DEVICE PORTABILITY, 2018-2027 (USD MILLION)

TABLE 130 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 131 EGYPT DIAGNOSTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 132 EGYPT THERAPEUTIC ULTRASOUND IN ULTRASOUND IMAGING DEVICES MARKET, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 133 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 134 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY END USER, 2018-2027 (USD MILLION)

TABLE 135 EGYPT ULTRASOUND IMAGING DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2018-2027 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET, BY ARRAY FORMAT, 2018-2027 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SEGMENTATION

FIGURE 11 TECHNOLOGICAL ADVANCEMENT IN ULTRASOUND IMAGING SYSTEM AND INCREASED INCIDENCE RATES OF CHRONIC DISEASES ARE DRIVING THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN THE FORECAST PERIOD 2020 TO 2027

FIGURE 12 CURVED LINEAR ARRAY IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET

FIGURE 14 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019

FIGURE 15 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, 2019-2027 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, CAGR (2020-2027)

FIGURE 17 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019

FIGURE 19 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, 2019-2027 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, CAGR (2020-2027)

FIGURE 21 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE DISPLAY, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019

FIGURE 23 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, 2019-2027 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, CAGR (2020-2027)

FIGURE 25 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DEVICE PORTABILITY, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019

FIGURE 27 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, 2019-2027 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, CAGR (2020-2027)

FIGURE 29 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019

FIGURE 31 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, 2019-2027 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, CAGR (2020-2027)

FIGURE 33 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019

FIGURE 35 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2020-2027)

FIGURE 37 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019

FIGURE 39 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, 2019-2027 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, CAGR (2020-2027)

FIGURE 41 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: SNAPSHOT (2019)

FIGURE 43 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019)

FIGURE 44 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 45 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 46 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: BY ARRAY FORMAT (2020-2027)

FIGURE 47 MIDDLE EAST & AFRICA ULTRASOUND IMAGING DEVICES MARKET: COMPANY SHARE 2019 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.