Middle East And Africa Thermal Cyclers Market

Market Size in USD Billion

CAGR :

%

USD

271.76 Billion

USD

453.15 Billion

2025

2033

USD

271.76 Billion

USD

453.15 Billion

2025

2033

| 2026 –2033 | |

| USD 271.76 Billion | |

| USD 453.15 Billion | |

|

|

|

|

Middle East and Africa Thermal Cyclers Market Size

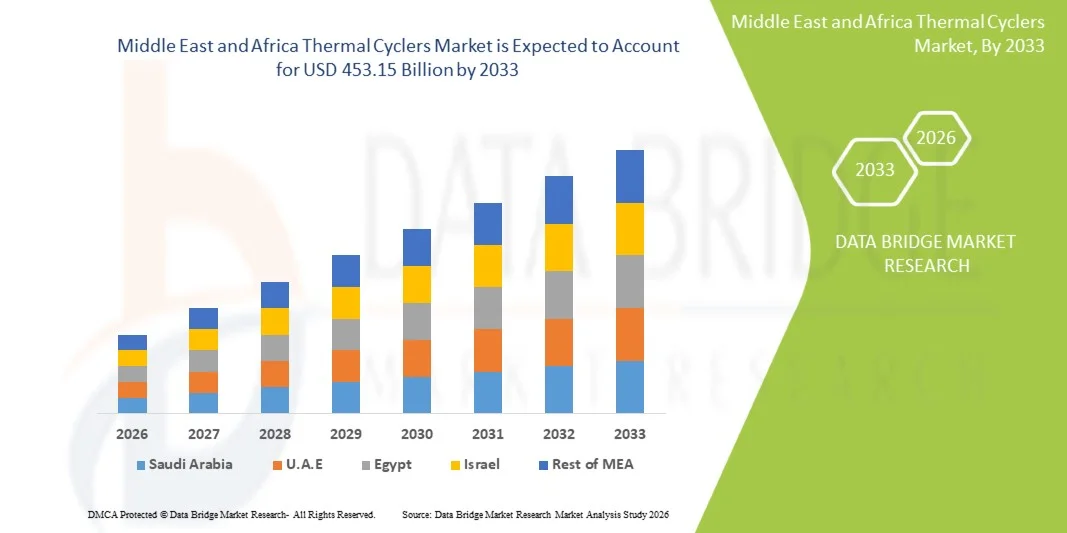

- The Middle East and Africa Thermal Cyclers Market size was valued at USD 271.76 billion in 2025 and is expected to reach USD 453.15 billion by 2033, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the increasing adoption of molecular biology techniques, rising demand for polymerase chain reaction (PCR) testing in research, diagnostics, and clinical laboratories, and continuous technological advancements in automation, speed, and precision of thermal cyclers, leading to enhanced efficiency in DNA amplification and gene analysis

- Furthermore, growing emphasis on rapid and accurate disease detection, expanding use of PCR-based applications in genomics, personalized medicine, and infectious disease testing, and increasing investment in life sciences research are establishing thermal cyclers as indispensable tools in modern laboratories. These converging factors are accelerating the uptake of Thermal Cyclers solutions, thereby significantly boosting the industry’s growth

Middle East and Africa Thermal Cyclers Market Analysis

- Thermal cyclers, essential for PCR-based applications in molecular biology, diagnostics, and research laboratories, are increasingly vital due to their ability to provide precise, rapid, and reproducible DNA amplification, enabling advanced genomics, infectious disease testing, and personalized medicine initiatives

- The escalating demand for thermal cyclers is primarily fueled by growing investment in life sciences research, increasing adoption of automated and high-throughput laboratory systems, and rising focus on rapid and accurate disease detection. These converging factors are accelerating the uptake of Thermal Cyclers solutions, thereby significantly boosting the industry’s growth

- Saudi Arabia dominated the Middle East and Africa Thermal Cyclers Market with the largest revenue share of 37.6% in 2025, supported by significant government investment in healthcare and research infrastructure, expansion of specialty and tertiary laboratories, increasing adoption of advanced diagnostic technologies, and strong initiatives to strengthen genomic and molecular biology research capabilities

- The U.A.E. is expected to be the fastest-growing region in the Middle East and Africa Thermal Cyclers Market, registering a CAGR of 11.4% during the forecast period, driven by rapid development of private laboratories, growing medical and research tourism, rising adoption of cutting-edge molecular diagnostics, and government support for biotechnology and personalized medicine programs

- The instruments segment dominated with a 61.4% market share in 2025, supported by rising demand for reliable thermal cycling equipment across research, clinical, and industrial applications

Report Scope and Middle East and Africa Thermal Cyclers Market Segmentation

|

Attributes |

Middle East and Africa Thermal Cyclers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Thermal Cyclers Market Trends

“Growing Demand for Molecular Diagnostics and Research Applications”

- The rising prevalence of chronic and infectious diseases worldwide, including cancer, tuberculosis, HIV, and emerging viral outbreaks, is significantly increasing the demand for thermal cyclers. These instruments are crucial for DNA/RNA amplification in diagnostic tests, enabling faster and more accurate disease detection

- For instance, in 2024, the National Health Laboratory in South Africa installed over 50 high-throughput thermal cyclers to strengthen its tuberculosis and HIV screening programs, drastically reducing turnaround times and improving patient outcomes

- The expanding field of genomics, personalized medicine, and pharmacogenomics is creating a strong need for precise and reproducible PCR-based testing, which is dependent on advanced thermal cyclers. Research institutions and pharmaceutical companies are increasingly investing in these instruments for drug development and molecular research

- Growing awareness of preventive healthcare and early disease diagnosis in both developed and developing nations is further boosting the adoption of thermal cyclers. Hospitals and diagnostic laboratories are expanding molecular testing capabilities to meet patient demand for quicker and more reliable results

- Government funding programs and public health initiatives targeting infectious disease control and genomic research also serve as strong growth enablers. For example, in 2023, the Brazilian Ministry of Health supported the acquisition of thermal cyclers for state diagnostic laboratories to enhance COVID-19 testing capacity

Middle East and Africa Thermal Cyclers Market Dynamics

Driver

“Increasing Adoption and Expansion in Emerging Markets”

- Emerging economies in Asia-Pacific, the Middle East, and Africa are experiencing rapid growth in the Middle East and Africa Thermal Cyclers Market due to rising investment in healthcare infrastructure and growing awareness of molecular diagnostics

- For instance, in 2025, the Indian Ministry of Health funded the installation of advanced thermal cyclers in over 100 public diagnostic laboratories to enhance dengue, malaria, and COVID-19 surveillance, supporting early detection and outbreak control

- Partnerships between manufacturers and local distributors are improving equipment availability and affordability, making high-throughput thermal cyclers accessible to smaller hospitals and regional diagnostic centers

- The trend is driven by increasing research and development in molecular biology, rising university and academic research programs, and government grants supporting biotech and genomics initiatives

- As diagnostic capabilities expand, countries like China, India, and Brazil are strengthening public health laboratories with modern thermal cyclers to handle large-scale testing requirements for infectious diseases and genetic research

- Furthermore, the global emphasis on pandemic preparedness is encouraging investment in advanced PCR infrastructure, resulting in wider adoption of thermal cyclers for both routine diagnostics and emergency response

Restraint/Challenge

“High Costs, Maintenance Complexity, and Limited Skilled Workforce”

- Advanced thermal cyclers come with high upfront procurement costs, often limiting adoption in small- and medium-sized laboratories, especially in emerging markets. The expense includes not only the instrument itself but also maintenance, calibration, and software updates

- For instance, in 2023, several mid-sized diagnostic labs in Nigeria postponed acquiring new thermal cyclers due to budget constraints and a lack of access to authorized service centers, continuing to rely on outdated PCR systems

- Operating these sophisticated instruments requires trained laboratory personnel. The shortage of skilled professionals in many regions increases operational challenges, as improper handling can affect accuracy and instrument lifespan

- Maintenance requirements, including regular calibration and part replacements, can incur additional costs over the instrument’s life, acting as a barrier for budget-conscious laboratories

- Infrastructural limitations, such as unreliable electricity or insufficient laboratory space, also restrict the deployment of high-end thermal cyclers in rural or underdeveloped areas

Middle East and Africa Thermal Cyclers Market Scope

The Middle East and Africa Thermal Cyclers Market is segmented on the basis of type, product type, technique, application, approach, sample type, end user, and distribution channel.

• By Type

On the basis of type, the Middle East and Africa Thermal Cyclers Market is segmented into Bench Top, Floor Stand Type, and Others. The bench top segment dominated the market with a 54.6% revenue share in 2025, driven by its versatility, ease of use, and suitability for both academic laboratories and clinical settings. Bench top thermal cyclers are preferred due to their compact footprint, reduced setup requirements, and compatibility with a wide range of PCR applications including conventional, real-time, and multiplex PCR. They are highly favored in laboratories where space is constrained, including hospitals, research institutes, and diagnostic centers. The segment benefits from ongoing technological advancements such as touchscreen interfaces, programmable thermal profiles, and wireless connectivity for remote monitoring. Increased adoption of molecular diagnostics and life science research globally further supports bench top cycler demand. Hospitals and academic institutions often standardize bench top cyclers due to cost efficiency and flexibility for multiple sample types. Continuous improvements in user-friendly software and integration with laboratory information management systems (LIMS) enhance workflow efficiency. The segment’s strong presence in developed markets with high research expenditure also sustains dominance. In addition, rising applications in clinical testing, infectious disease detection, and personalized medicine drive further adoption. Bulk procurement by diagnostic centers and collaborative research facilities further strengthens segment revenue.

The floor stand type segment is expected to witness the fastest CAGR of 8.3% from 2026 to 2033, owing to its suitability for high-throughput workflows and industrial applications. These units are designed for large-scale testing environments, including pharmaceutical quality control and high-capacity clinical laboratories. Floor stand cyclers often support automated sample handling, large block capacities, and multiple simultaneous PCR runs, making them ideal for manufacturing and research facilities requiring high productivity. Growing investment in genomics and molecular diagnostic infrastructure globally is driving demand. The rising need for standardized, automated systems in manufacturing and large-scale testing workflows further accelerates adoption. Floor stand cyclers are increasingly integrated with robotic liquid handling systems, allowing for faster and error-free operation. In emerging markets, expansion of molecular diagnostic laboratories and centralized testing facilities also contributes to growth. The segment benefits from increased funding in infectious disease research, particularly post-pandemic. Manufacturers are introducing advanced floor stand cyclers with improved thermal uniformity and energy efficiency. Collaboration with software providers to offer real-time data analytics is further enhancing their appeal. Large-scale research institutions and biotech companies continue to prefer these systems for intensive testing environments.

• By Product Type

On the basis of product type, the market is segmented into Instruments, Reagents, Consumables, and Software Services. The instruments segment dominated with a 61.4% market share in 2025, supported by rising demand for reliable thermal cycling equipment across research, clinical, and industrial applications. Instruments remain the core of PCR workflows, encompassing both bench top and floor stand cyclers. Technological advancements such as real-time PCR capabilities, multiplex analysis, and integration with cloud-based platforms strengthen the segment. Hospitals, diagnostic labs, and research institutes heavily invest in high-performance instruments for infectious disease testing, oncology research, and genomic studies. Rising adoption of molecular diagnostics for early disease detection and personalized medicine further boosts demand. The segment’s dominance is reinforced by strong brand recognition of leading thermal cycler manufacturers. Bulk procurement by academic and pharmaceutical laboratories also contributes to the segment’s revenue share. Regulatory approvals and quality certifications enhance trust in these instruments. The market sees continuous upgrades to instrument designs, offering enhanced thermal accuracy, reduced run times, and improved energy efficiency. The COVID-19 pandemic increased demand for instruments in large-scale diagnostic testing. Overall, the instruments segment continues to be the primary revenue driver in the Middle East and Africa Thermal Cyclers Market.

The consumables segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, due to growing repeat purchase demand for PCR tubes, plates, tips, and related laboratory supplies. Consumables are essential for every PCR run, ensuring reliability and avoiding contamination. The increase in diagnostic testing, high-throughput molecular research, and industrial QC testing drives recurring purchases. Innovations such as pre-sterilized consumables, low-retention tips, and barcoded plates improve workflow efficiency and accuracy. Rising home testing and point-of-care applications also increase consumable consumption. Academic and research institutions with high sample throughput significantly contribute to growth. The segment benefits from expanding distribution channels, including online lab supply platforms. As the number of PCR-based studies and COVID-19 screening continues globally, consumable demand remains strong. Manufacturers continue to introduce environmentally-friendly, recyclable, and automated-compatible consumables. Consumables revenue grows steadily in both mature and emerging markets, reinforcing their high-growth potential.

• By Technique

On the basis of technique, the market is segmented into Conventional PCR, Real-Time PCR, Hot-Start PCR, Reverse Transcriptase PCR, Multiplex Thermal PCR, Solid-Phase PCR, Digital PCR, Quantitative PCR (qPCR), and Other PCR Technologies. The real-time PCR segment dominated with 47.2% revenue share in 2025, driven by its high sensitivity, rapid results, and critical role in infectious disease detection and genomic research. Real-time PCR is widely adopted for quantitative applications, pathogen detection, and monitoring gene expression. Clinical laboratories rely on it for SARS-CoV-2, influenza, and oncology testing. Integration with fluorescence detection and automated software analytics enhances accuracy. The segment benefits from widespread use in hospital, academic, and research labs globally. Technological advancements, such as multiplex capabilities and portable real-time PCR devices, further reinforce adoption. Regulatory approvals for clinical diagnostic applications continue to increase market penetration. Rising awareness of molecular diagnostics among healthcare providers supports demand. Expansion of personalized medicine and translational research contributes to segment dominance. The COVID-19 pandemic accelerated real-time PCR adoption worldwide. Laboratory automation integration and workflow optimization further strengthen its leading market position.

The digital PCR segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, owing to its ability to deliver absolute quantification and higher precision in low-copy-number target detection. Digital PCR finds applications in oncology, rare mutation detection, and virology research. The increasing need for ultra-sensitive diagnostic tests and growing genomic research funding accelerate adoption. Technological improvements reducing cost per reaction and instrument miniaturization enhance commercial feasibility. Pharmaceutical and biotechnology companies increasingly use digital PCR for biomarker validation and quality control. Academic research institutes adopt digital PCR for high-precision studies. Integration with software analytics and cloud-based monitoring further drives growth. Rising awareness of precision diagnostics and regulatory encouragement in molecular testing also support uptake. The segment is poised to grow rapidly, especially in developed markets with high research expenditure.

• By Application

On the basis of application, the market is segmented into Clinical, Life Science & Related Research, Manufacturing & Quality Control Testing, Forensics, and Others. The clinical segment dominated with 52.8% revenue share in 2025, driven by the increasing adoption of PCR-based diagnostics for infectious diseases, oncology, and genetic disorders. Hospitals and diagnostic centers are primary consumers of thermal cyclers for rapid and accurate testing. The segment benefits from rising molecular diagnostics adoption, increasing government healthcare initiatives, and the expansion of private diagnostic labs. Continuous introduction of compact and user-friendly instruments supports clinical adoption. Regulatory approvals and reimbursement policies for molecular diagnostic testing further drive market penetration. Integration of automated workflows improves efficiency in high-throughput clinical labs. Rapid response requirements for pandemic and epidemic situations further strengthen demand. Technological improvements, such as faster thermal cycling and real-time monitoring, enhance clinical utility. Adoption of point-of-care testing also complements clinical applications. Overall, clinical testing remains the largest end-user application segment.

The life sciences & related research segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by increasing genomic studies, drug discovery, and personalized medicine research. Academic institutes and biotech companies increasingly invest in PCR platforms for high-precision studies. Rising research funding and government grants globally fuel adoption. Innovations in multi-plexing and automation enhance lab productivity. The segment also benefits from collaborative research projects and industry-academia partnerships. Advanced research in oncology, microbiology, and virology further boosts demand. Growing awareness of molecular biology techniques in emerging countries contributes to growth. Increasing number of high-throughput genomics laboratories accelerates adoption. Expansion of research initiatives related to precision medicine and gene editing drives the need for advanced PCR techniques. Integration with cloud-based data analytics and remote monitoring supports lab efficiency and precision. Emerging markets, including Asia-Pacific and Latin America, show strong growth potential for research-based thermal cycler usage.

• By Approach

On the basis of approach, the market is segmented into In-Vitro Diagnostic (IVD), Point of Care Testing (POCT), and Molecular Diagnostic (MDx). The Molecular Diagnostic (MDx) segment dominated the market with 55.1% revenue share in 2025, driven by the growing adoption of PCR-based assays for genetic testing, infectious disease detection, and oncology diagnostics. MDx applications require highly precise and reproducible thermal cycling, making advanced cyclers essential for laboratories. Hospitals, research institutes, and biotech companies increasingly rely on MDx for disease diagnosis, treatment monitoring, and drug development studies. The segment benefits from the integration of automated workflows, real-time PCR, and multiplexing capabilities. Government initiatives promoting precision medicine and early disease detection further enhance adoption. The COVID-19 pandemic significantly accelerated the deployment of molecular diagnostic platforms globally. MDx platforms are also expanding in emerging markets due to rising healthcare investment and diagnostic infrastructure. Regulatory approvals for MDx kits and instruments reinforce the segment’s reliability and clinical trust. Continuous R&D in nucleic acid detection improves assay sensitivity and specificity. Pharmaceutical and biotechnology sectors utilize MDx extensively for biomarker validation and clinical trials. Overall, MDx remains the most critical and revenue-generating approach for thermal cyclers.

The Point-of-Care Testing (POCT) segment is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, fueled by the increasing need for rapid, on-site testing in hospitals, clinics, and decentralized healthcare settings. POCT solutions are growing in popularity due to their ability to deliver near-patient results with minimal equipment and training. Integration of portable thermal cyclers and microfluidic-based PCR systems enhances POCT adoption. Rising demand for infectious disease testing, including COVID-19, influenza, and emerging pathogens, drives growth. Advances in battery-operated and handheld cyclers support field diagnostics. POCT adoption is expanding in remote areas and home-based care setups, particularly in emerging countries. Government programs supporting rapid diagnostics for epidemic and pandemic preparedness further accelerate adoption. Miniaturization of devices, ease of operation, and cloud-enabled connectivity enhance segment growth. Pharmaceutical and clinical research labs are leveraging POCT for rapid screening in multicenter trials. Increasing awareness of early diagnostics and rapid patient triage boosts demand. Strategic partnerships between cycler manufacturers and healthcare providers are promoting market expansion.

• By Sample Type

On the basis of sample type, the market is segmented into Blood, Urine, Saliva, Sweat, Nasopharyngeal Specimen (NP), Oropharyngeal (OP), and Others. The blood sample segment dominated with 45.7% market share in 2025, driven by the high frequency of blood-based PCR assays for viral, bacterial, and genetic testing. Blood remains the most common biological specimen in clinical diagnostics, molecular research, and pharmaceutical testing. Hospitals, diagnostic labs, and research institutes rely on blood PCR assays for accuracy and reproducibility. Rising prevalence of infectious diseases, oncology screening, and cardiovascular genomics contribute to segment dominance. Blood samples are used across multiple PCR techniques, including real-time, multiplex, and digital PCR. Automation in sample preparation and integration with thermal cyclers enhance workflow efficiency. Regulatory approvals and standardized protocols for blood-based testing increase adoption. Academic and clinical research continues to prefer blood as the gold standard sample type. Expansion of blood collection programs in emerging markets boosts the segment. Continuous innovation in anticoagulants, stabilization reagents, and prefilled collection tubes further strengthens demand.

The nasopharyngeal (NP) specimen segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, primarily driven by its role in respiratory pathogen detection, including SARS-CoV-2, influenza, and RSV. Nasopharyngeal swabs are critical for COVID-19 and other respiratory viral PCR testing, fueling global demand for thermal cyclers capable of high-throughput NP sample analysis. The segment benefits from rapid adoption in hospitals, diagnostic centers, and POCT setups. Improved swab designs, pre-filled transport media, and high-efficiency RNA extraction kits support enhanced test accuracy. Government and private initiatives promoting mass respiratory testing contribute to growth. NP specimens are preferred due to high viral load recovery and reproducibility. Increased screening programs in schools, workplaces, and airports enhance utilization. Integration with automated sample prep systems accelerates adoption. Laboratories increasingly adopt multiplex PCR for NP samples to detect multiple pathogens simultaneously. Regulatory mandates for pathogen testing support sustained growth. Rising awareness of infectious disease monitoring in emerging markets further fuels expansion.

• By End User

On the basis of end user, the market is segmented into Diagnostic Centres & Hospitals, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Forensic Laboratories, and Others. The Diagnostic Centres & Hospitals segment dominated with 51.8% revenue share in 2025, driven by the growing implementation of PCR-based testing for infectious diseases, oncology, and genetic diagnostics. Hospitals are primary consumers due to the need for routine testing, patient screening, and emergency diagnostics. High adoption of molecular diagnostics and automation in hospital laboratories reinforces segment dominance. Government-funded hospital programs, private laboratory expansion, and pandemic preparedness further support adoption. Hospitals often maintain multiple thermal cyclers to meet throughput requirements. Real-time PCR adoption in clinical labs for rapid diagnostics also strengthens market share. Integration with hospital information systems ensures data management efficiency. Continuous upgrades to cycler instruments and high-quality consumables maintain clinical trust. Hospitals’ purchasing power and bulk procurement contracts favor sustained revenue generation. Expansion in emerging markets and urban healthcare infrastructure boosts segment growth.

The Academic & Research Institutes segment is expected to witness the fastest CAGR of 9.7% from 2026 to 2033, fueled by increasing genomic studies, drug discovery, and molecular biology research globally. Academic institutions invest in bench top and floor stand thermal cyclers for high-throughput PCR, teaching, and research applications. Rising government funding and private research grants drive expansion. Universities and research labs adopt advanced PCR techniques such as multiplexing, digital PCR, and real-time PCR for precision studies. Collaborations with biotechnology companies for translational research further increase instrument adoption. Academic research often requires consumables and reagents in large quantities, adding recurring revenue to the segment. Growth is particularly notable in Asia-Pacific and Latin America due to expansion of molecular biology programs. The trend toward integrated laboratory automation and software analytics accelerates adoption. Publications, patents, and research output drive continued investment in thermal cyclers. Emerging fields such as CRISPR-based research and personalized medicine increase demand. The segment’s growth reflects the rising global emphasis on scientific research and innovation.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tenders, Retail Sales, and Third Party Distribution. The Direct Tenders segment dominated with 47.5% revenue share in 2025, primarily due to hospitals, diagnostic centers, and government laboratories procuring thermal cyclers and related instruments directly from manufacturers or authorized distributors. Direct tendering ensures bulk procurement, warranty coverage, post-sale support, and compliance with regulatory standards. High-value instruments such as bench top and floor stand cyclers are commonly purchased through tenders. Government and institutional tenders for public hospitals also contribute significantly to revenue. Direct contracts often include bundled packages of instruments, consumables, reagents, and service contracts, strengthening manufacturer-customer relationships. Long-term procurement agreements enhance predictability and supply chain stability. This channel dominates in developed regions such as North America and Europe. Bulk procurement for infectious disease monitoring and pandemic response programs further increases share. Manufacturers benefit from predictable order volumes and stronger brand visibility.

The Third Party Distribution segment is expected to witness the fastest CAGR of 9.3% from 2026 to 2033, driven by expansion in emerging markets and smaller diagnostic laboratories lacking procurement infrastructure. Third-party distributors, including e-commerce platforms and regional suppliers, provide flexible access to instruments, consumables, and software services. The segment benefits from increasing online sales channels and rapid delivery capabilities. Pharmaceutical and biotech companies also use distributors to reach multiple labs efficiently. Cost-effective procurement via distributors attracts smaller research centers and POCT setups. Partnerships between manufacturers and third-party distributors enhance market penetration. Expanding molecular diagnostic testing and academic research in Asia-Pacific and Latin America further accelerate adoption. Distribution networks also provide after-sales service, technical support, and training for end users. The segment is increasingly integrating inventory management and digital ordering platforms. Overall, third-party distribution facilitates wider adoption of thermal cyclers globally.

Middle East and Africa Thermal Cyclers Market Regional Analysis

- The Middle East and Africa Thermal Cyclers Market is witnessing rapid growth, driven by increasing investments in healthcare infrastructure

- Expanding research capabilities, and growing awareness of molecular diagnostics

- The region is experiencing significant adoption of thermal cyclers in hospitals, diagnostic laboratories, and research institutions, reflecting a broader trend toward advanced molecular biology and genomic research

Saudi Arabia Middle East and Africa Thermal Cyclers Market Insight

Saudi Arabia Middle East and Africa Thermal Cyclers Market dominated the Middle East and Africa Thermal Cyclers Market with the largest revenue share of 37.6% in 2025, supported by substantial government investment in healthcare and research infrastructure, expansion of specialty and tertiary laboratories, increasing adoption of advanced diagnostic technologies, and strong initiatives to strengthen genomic and molecular biology research capabilities. For instance, in 2024, King Abdulaziz University launched a high-throughput molecular diagnostics lab equipped with state-of-the-art thermal cyclers to support genomic research and infectious disease testing, reinforcing Saudi Arabia’s leadership in the region.

U.A.E. Middle East and Africa Thermal Cyclers Market Insight

U.A.E. Middle East and Africa Thermal Cyclers Market is expected to be the fastest-growing market, registering a CAGR of 11.4% during the forecast period, driven by the rapid development of private laboratories, growing medical and research tourism, rising adoption of cutting-edge molecular diagnostic technologies, and government support for biotechnology and personalized medicine programs. For example, in 2025, a leading diagnostic center in Dubai incorporated advanced thermal cyclers into its molecular testing workflows, enabling high-throughput COVID-19, cancer, and genetic screening services for both residents and international patients.

Middle East and Africa Thermal Cyclers Market Share

The Thermal Cyclers industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Eppendorf AG (Germany)

- Qiagen N.V. (Netherlands)

- Danaher Corporation (U.S.)

- PerkinElmer, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- Analytik Jena AG (Germany)

- Roche Diagnostics (Switzerland)

- Bioneer Corporation (South Korea)

- Hettich Lab Technology (Germany)

- LongGene Scientific Instruments Co., Ltd. (China)

- Applied Biosystems (Thermo Fisher) (U.S.)

- Bio Molecular Systems (Australia)

- Gene Company Limited (Japan)

- Labnet International, Inc. (U.S.)

- SunGene Biotech Co., Ltd. (China)

- Promega Corporation (U.S.)

- Corbett Life Science (Australia)

Latest Developments in Middle East and Africa Thermal Cyclers Market

- In July 2023, Eppendorf SE introduced the Mastercycler X40 thermal cycler, a new PCR instrument designed with improved ergonomics and sustainability in mind, aimed at routine lab workflows to ensure reproducible nucleic acid amplification with enhanced temperature uniformity and consistency. This launch demonstrated the ongoing innovation from established laboratory equipment manufacturers to increase performance and sustainability in molecular biology instruments

- In September 2023, Bio‑Rad Laboratories, Inc. launched its PTC Tempo 48/48 and PTC Tempo 384 thermal cycler systems, offering dual‑block flexibility for independent protocols and automation‑friendly design for high‑throughput applications, respectively. These products were developed to support complex PCR workflows in research and quality control laboratories, reflecting strong industry focus on increasing throughput and automation

- In November 2023, F. Hoffmann‑La Roche Ltd officially launched the LightCycler PRO System, an advanced qPCR platform combining improved performance and usability for both clinical diagnostics and research applications. This system enhanced Roche’s molecular testing portfolio with features targeting greater flexibility and analytical precision for pathogen detection, oncology testing, and translational science

- In September 2024, Thermo Fisher Scientific completed the acquisition of Dragon Lab Instruments, strengthening its digital PCR and thermal cycler technology offerings. This strategic acquisition reflected consolidation in the thermal cycler market and accelerated Thermo Fisher’s expansion into cutting‑edge nucleic acid amplification technologies

- Also in October 2024, Bio‑Rad Laboratories introduced the CFX Connect Touch Thermal Cycler, featuring enhanced multiplexing capabilities and a user‑friendly touchscreen interface designed for academic and clinical laboratory applications. The product aimed to simplify multiplex PCR workflows while maintaining robust performance under high‑demand testing conditions

- In February 2025, Thermo Fisher Scientific launched the QuantStudio Ultra real‑time PCR system, incorporating AI‑driven protocol optimization and cloud connectivity to provide faster, more accurate diagnostics and research results. This launch underscored the growing trend toward AI‑enhanced automation and connectivity in thermal cyclers

- In June 2025, Bio‑Rad Laboratories expanded its digital PCR portfolio with four new Droplet Digital PCR (ddPCR) platforms, including the QX Continuum system and the QX700 series, designed to deliver higher throughput and improved efficiency for biomarker analysis in clinical and research settings. These launches represented a significant expansion of Bio‑Rad’s offerings in digital quantification technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.