Market Analysis and Size

Retail system integrators are being highly deployed in the recent years as they deliver services including business process outsourcing (BPO) and strategic consulting to IT, among others. This technology allows plants to deploy and upgrade software and hardware solution.

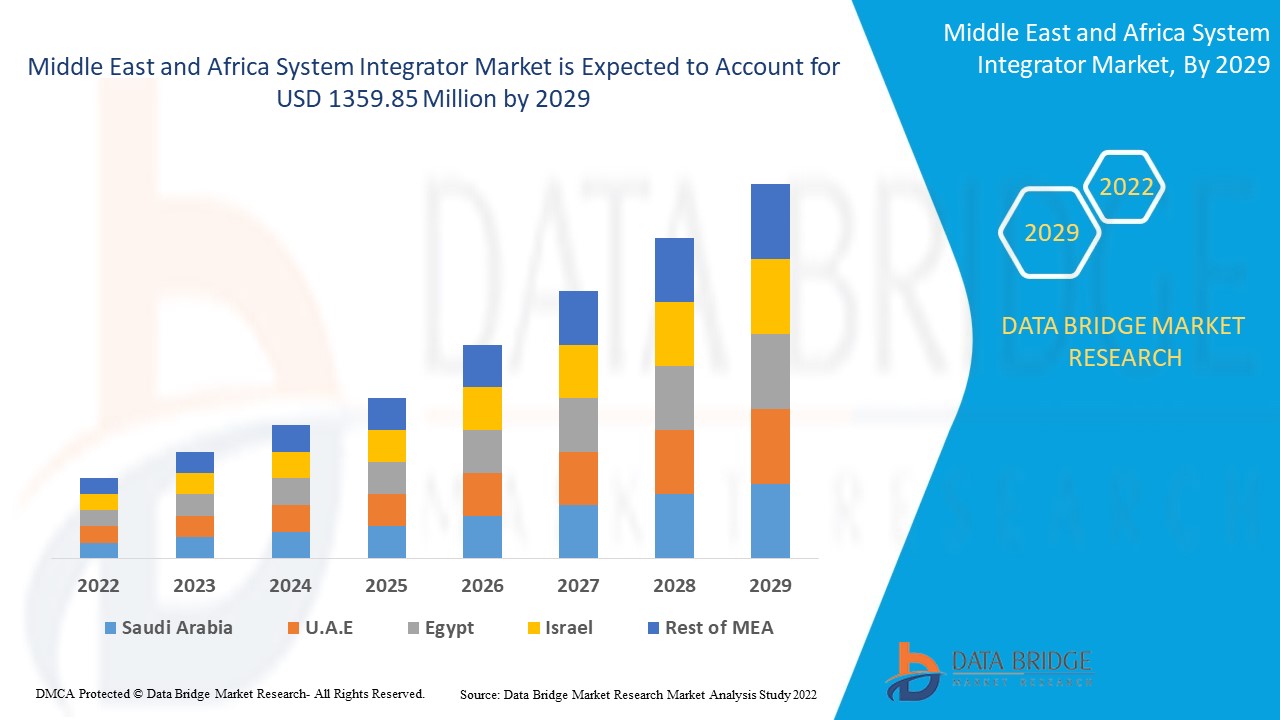

Middle East and Africa System Integrator Market for Retail and Consumer Goods was valued at USD 474.20 million in 2021 and is expected to reach USD 1359.85 million by 2029, registering a CAGR of 11.30% during the forecast period of 2022-2029. Barcode and RFID accounts for the largest product type segments in the respective market owing to the rise in digitalization in the retail sector. . The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Market Definition

System integration is a cost efficient method for IT application software and infrastructure exist around the world. It guarantees the improved infrastructure management, it lessens data redundancy, and provides data integrity, causing in enhanced organizational efficiency and effectiveness. Moreover, the organizations situated around the world are impacted by technological developments for example as the hardware and software solutions, flexibility applications, and big data management software.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Service Type (Consulting Services, Application System Integration and Infrastructure Integration), Technology (Supervisory Control and Data Acquisition (SCADA), Distributed Control System (DCS), Human Machine Interface (HMI), Product Lifecycle Management (PLM), Safety Automation System, Programmable Controller Logic (PLC), Manufacturing Execution System (MES), Advanced Process Control (APC) and Operator Training Simulators (OTS)), Product Type (Barcode and RFID, Point of Sales, Camera, Electronic Shelf Labels, Others), End User (Retail and Consumer Goods) |

|

Countries Covered |

Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Capgemini (France), Accenture (Ireland), IBM Corporation (US), Logic (India), Infosys Limited (India), Magic Software Enterprises (Isreal), HCL Technologies Limited (India), Atos SE (France), SAP SE (Germany), Schneider Electric (France), Wipro Limited (India), Cognizant (US), Tata Consultancy Services Limited (India), among others |

|

Market Opportunities |

|

Middle East and Africa System Integrator Market for Retail and Consumer Goods Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Inclination for Computerisation Technologies

The rise in inclination for computerisation technologies acts as one of the major factors driving the growth of system integrator market for retail and consumer goods. The increase in need from the corporations to increase the effectiveness of their present systems has a positive impact on the market.

- Advancements in Cloud Technologies

The rise in advancements in cloud technologies along with use of the Internet of Things (IoT) accelerate the market growth. Also, the rise in investment in distributed information technology systems drive the growth of market.

- Advent of Big Data Technology

The increase in the advent of big data technology offering benefits to organizations in implementing big data further influence the market. Organizations require advanced data integration tools for combining the information silos assisting to get valuable business insights.

Opportunities

Furthermore, demand for remote operating owing to COVID-19 and emergence of Industry 4.0 extend profitable opportunities to the market players in the forecast period of 2022 to 2029.

Restraints/Challenges

On the other hand, high investments required for automation implementation and maintenance, and fall in crude oil prices are expected to obstruct market growth. Also, system interoperability and Security vulnerability in SCADA systems are projected to challenge the system integrator market for retail and consumer goods in the forecast period of 2022-2029.

This system integrator market for retail and consumer goods report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on system integrator market for retail and consumer goods contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Middle East and Africa System Integrator Market for Retail and Consumer Goods

The COVID-19 had a negative impact on the system integrator market for retail and consumer goods. The COVID-19 epidemic has caused a number of initiatives to be postponed, including infrastructure construction, reorganization, and renovation. Increased government attention on overcompensating for impacts by enhancing operations when opportunities occur would accelerate industry growth. Government actions to reopen major industries, manufacturing facilities, and infrastructure projects, on the other hand, will support corporate growth.

Middle East and Africa System Integrator Market for Retail and Consumer Goods Scope and Market Size

The system integrator market for retail and consumer goods is segmented on the basis of service type, product type, technology and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Consulting Services

- Application System Integration

- Infrastructure Integration

Technology

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Human Machine Interface (HMI)

- Product Lifecycle Management (PLM)

- Safety Automation System, Programmable Controller Logic (PLC)

- Manufacturing Execution System (MES)

- Advanced Process Control (APC)

- Operator Training Simulators (OTS)

Product Type

- Barcode and RFID

- Point Of Shelf

- Camera

- Electronic Shelf Labels

- Others

End User

- Retail

- Consumer Goods

Middle East and Africa System Integrator Market for Retail and Consumer Goods Regional Analysis/Insights

The system integrator market for retail and consumer goods is analysed and market size insights and trends are provided by country, service type, product type, technology and end user as referenced above.

The countries covered in the Middle East and Africa system integrator market for retail and consumer goods report are Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

The U.A.E. is dominating in the Middle East and Africa system integrator market for retail and consumer goods as the central government increase their investment in the e-commerce industry which has increased integration of system for the retail and consumer goods.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa System Integrator Market for Retail and Consumer Goods

The system integrator market for retail and consumer goods competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to system integrator market for retail and consumer goods.

Some of the major players operating in the system integrator market for retail and consumer goods are

- Capgemini (France)

- Accenture (Ireland)

- IBM Corporation (US)

- Logic (India)

- Infosys Limited (India)

- Magic Software Enterprises (Isreal)

- HCL Technologies Limited (India)

- Atos SE (France)

- SAP SE (Germany)

- Schneider Electric (France)

- Wipro Limited (India)

- Cognizant (US)

- Tata Consultancy Services Limited (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

1.4 SCOPE OF THE MARKET STUDY

1.5 CURRENCY AND PRICING

1.6 LIMITATIONS

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING USE OF INTERNET OF THINGS (IOT)

5.1.2 GROWING CONCERN FOR ENTERPRISE RESOURCE PLANNING

5.1.3 INCREASE IN SMARTPHONE PENETRATION AND BROADBAND INFRASTRUCTURE

5.1.4 INCREASING ORGANIZATIONAL AND CONSUMER DATA

5.1.5 INCREASING DIGITAL TRANSFORMATION IN RETAIL AND CONSUMER GOODS INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH IMPLEMENTATION COST AND TIME

5.2.2 LACK OF TECHNICAL SKILLED EMPLOYEE IN THE DEVELOPING COUNTRIES

5.2.3 LACK OF ADOPTION RATE IN SMALL SCALE BUSINESS

5.3 OPPORTUNITIES

5.3.1 HIGH INVESTMENTS IN INFORMATION TECHNOLOGY BY THE MARKET PLAYERS

5.3.2 DIGITIZATION AND CENTRALIZATION OF BUSINESS PROCESSES

5.3.3 RISING ADOPTION OF INDUSTRY 4.0 IN RETAIL SECTOR

5.3.4 RISING INVESTMENTS OF RETAIL SECTOR IN CLOUD SERVICES

5.4 CHALLENGES

5.4.1 SECURITY VULNERABILITY IN SYSTEMS

5.4.2 COMPLEXITIES FOR INTEGRATING SYSTEMS

6 COVID-19 IMPACT ON SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND AND SUPPLY CHAIN

6.4 CONCLUSION

7 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICE

7.1 OVERVIEW

7.2 INFRASTRUCTURE INTEGRATION

7.2.1 ENTERPRISE MANAGEMENT

7.2.2 NETWORK MANAGEMENT

7.2.3 DATA CENTER MANAGEMENT

7.2.4 CLOUD BASED MANAGEMENT

7.2.5 BUILDLING MANAGEMENT

7.2.6 SECURITY & SURVEILLANCE MANAGEMENT

7.3 APPLICATION INTEGRATION

7.3.1 APPLICATION SOFTWARE INTEGRATION

7.3.2 SYSTEM & DATA INTEGRATION

7.3.3 UNIFIED COMMUNICATION

7.3.4 INTERGRATED SOCIAL SOFTWARE

7.3.5 OTHERS

7.4 CONSULTING SERVICES

7.4.1 BUSINESS PROCESS INTEGRATION

7.4.2 BUSINESS TRANSFORMATION

7.4.3 APPLICATION LIFECYCLE MANAGEMENT

8 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS , BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BARCODE & RFID

8.3 POINT OF SALES

8.4 CAMERA

8.5 ELECTRONIC SHELF LABELS

8.6 OTHERS

9 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PRODUCT LIFECYCLE MANAGEMENT(PLM)

9.3 MANUFACTURING EXECUTION SYSTEM(MES)

9.4 SAFETY AUTOMATION SYSTEM

9.5 ADVANCED PROCESS CONTROL

9.6 DISTRIBUTED CONTROL SYSTEM(DCS)

9.7 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

9.8 HUMAN MACHINE INTERFACE(HMI)

9.9 PROGRAMMABLE CONTROLLER LOGIC(PLC)

9.1 OPERATOR TRAINING SIMULATOR

10 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USER

10.1 OVERVIEW

10.2 RETAIL

10.3 CONSUMER GOODS

11 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 IBM CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICE PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 ACCENTURE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 CAPGEMINI

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICE PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 COGNIZANT

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SERVICE PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 HCL TECHNOLOGIES LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOS SE

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SOLUTION PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AISG

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICE PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 BTM MIDDLE EAST & AFRICA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 JITTERBIT

14.9.1 COMPANY SNAPSHOT

14.9.2 SOLUTION PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFOSYS LIMITED

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 LOGIC

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICEPORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MAGIC SOFTWARE ENTERPRISES

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 TATA CONSULTANCY SERVICES LIMITED

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 SADA, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SOPRA STERIA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 SAP SE

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 SCHNEIDER ELECTRIC

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SOLUTION PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 WIPRO LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 SERVICE PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TYCO.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICE, 2018-2027 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CONSULTING SERVICES IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA BARCODE & RFID IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA POINT OF SALES IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA CAMERA IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ELECTRONIC SHELF LABELS IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PRODUCT LIFECYCLE MANAGEMENT(PLC) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MANUFACTURING EXECUTION SYSTEM(MES) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)/

TABLE 14 MIDDLE EAST & AFRICA SAFETY AUTOMATION SYSTEM IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA ADVANCED PROCESS CONTROL IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)/

TABLE 16 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM(DCS) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HUMAN MANCHINE INTERFACE(HMI) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PROGRAMMABLE CONTROLLER LOGIC(PLC) IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OPERATOR TRAINING SIMULATOR IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY REGION,2018-2027, (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY DATA CENTER TYPE, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA RETAIL IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA CONSUMER GOODS DATA CENTER IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS MARKET, BY REGION,2018-2027, (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 32 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 33 U.A.E INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 34 U.A.E APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 35 U.A.E CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 36 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 37 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 38 U.A.E SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 39 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 40 SAUDI ARABIA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 41 SAUDI ARABIA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 42 SAUDI ARABIA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 43 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 44 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 45 SAUDI ARABIA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 46 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 47 SOUTH AFRICA INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 48 SOUTH AFRICA APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 49 SOUTH AFRICA CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 50 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 51 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 52 SOUTH AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 53 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 54 EGYPT INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 55 EGYPT APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 56 EGYPT CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 57 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 58 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 59 EGYPT SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 60 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

TABLE 61 ISRAEL INFRASTRUCTURE INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 62 ISRAEL APPLICATION INTEGRATION IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 63 ISRAEL CONSULTING IN SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SOLUTIONS, 2018-2027 (USD MILLION)

TABLE 64 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY TECHNOLOGY, 2018-2027 (USD MILLION)

TABLE 65 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY PRODUCT TYPE, 2018-2027 (USD MILLION)

TABLE 66 ISRAEL SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY END-USE, 2018-2027 (USD MILLION)

TABLE 67 REST OF MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS, BY SERVICES TYPE, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SEGMENTATION

FIGURE 10 GROWING USE OF INTERNET OF THINGS (IOT) IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 INFRASTRUCTURE INTEGRATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS

FIGURE 13 SIZE OF THE IOT MARKET WORLDWIDE FROM 2017 TO 2019, FORECAST FOR 2020-2025

FIGURE 14 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 15 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 16 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY SERVICE, 2019

FIGURE 17 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY PRODUCT TYPE, 2019

FIGURE 18 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY TECHNOLOGY, 2019

FIGURE 19 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY DATA CENTER TYPE, 2019

FIGURE 20 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2019)

FIGURE 22 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2020 & 2027)

FIGURE 23 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY COUNTRY (2019 & 2027)

FIGURE 24 MIDDLE EAST AND AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: BY SERVICE TYPE (2020-2027)

FIGURE 25 MIDDLE EAST & AFRICA SYSTEM INTEGRATOR MARKET FOR RETAIL AND CONSUMER GOODS: COMPANY SHARE 2019 (%)

Middle East And Africa System Integrator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa System Integrator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa System Integrator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.