Middle East and Africa Sustainable Aviation Fuel Market Analysis and Size

The aviation industry is keen on bringing down carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. Alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, the adoption of sustainable aviation fuels such as E-fuels, synthetic fuels, green jet fuels, bio jet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation.

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. Factors such as a rise in a number of airline passengers, growing disposable income, increase in air transportation, and increase in consumption of synthetic lubricants supplement the growth of the Middle East and Africa sustainable aviation fuel market. However, the lack of infrastructure act as a restraining factor for the market.

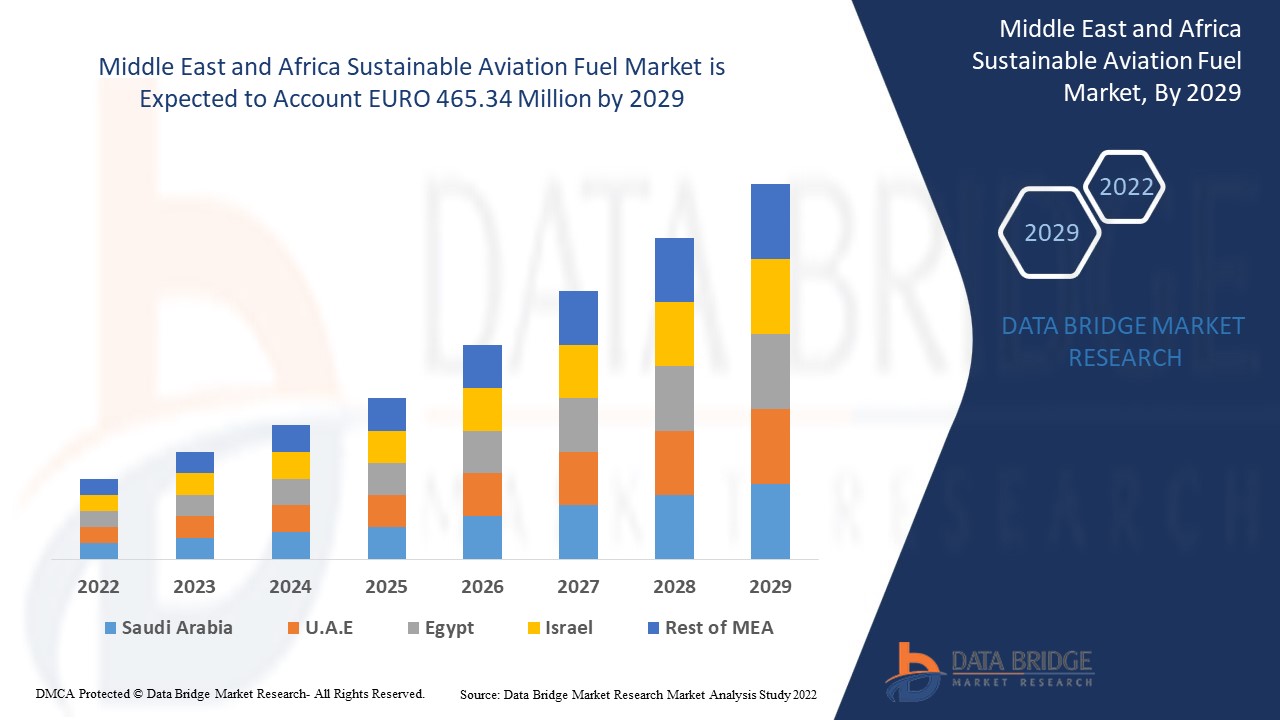

Data Bridge Market Research analyses that the sustainable aviation fuel market is expected to reach the value of EURO 465.34 million by 2029, at a CAGR of 40.7% during the forecast period. “Bio Fuel" accounts for the largest technology segment in the sustainable aviation fuel market due to increase in air transportation consumption of synthetic lubricants. The sustainable aviation fuel market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in EURO Million, Volumes in Units, Pricing in EURO |

|

Segments Covered |

By Fuel Type (Bio Fuel, Hydrogen Fuel And Power To Liquid Fuel), By Manufacturing Technology (Hydroprocessed Fatty Acid Esters And Fatty Acids - Synthetic Paraffinic Kerosene (Hefa-Spk), Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic Iso-Paraffin From Fermented Hydroprocessed Sugar (Hfs-Sip), Fischer Tropsch (Ft) Synthetic Paraffinic Kerosene With Aromatics (FT-SPK/A), Alcohol To Jet Spk (ATJ-SPK) and Catalytic Hydrothermolysis Jet (CHJ)), By Blending Capacity (Below 30 %, 30 % To 50 % and Above 50%), By Blending Platform(Commercial Aviation, Military Aviation, Business & General Aviation, And Unmanned Aerial Vehicle) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and the rest of the Middle East and Africa (MEA) in Middle East and Africa , |

|

Market Players Covered |

Neste, Gevo, VELOCYS,Fulcrum BioEnergy, SkyNRG, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Preem AB, Eni , Sasol Ltd, BP p.l.c. among others. |

Market Definition

Sustainable aviation fuel is a unique form of fuel designed for use in aircraft and at the same time will increase the performance of aircraft. Sustainable aviation fuels are derived from sustainable feedstock and could be very comparable in their chemistry to standard fossil jet fuel. An increase in the utility of sustainable aviation fuels bring about a reduction in carbon emissions in comparison to the traditional jet fuel because it replaces the lifecycle of the fuel.

The aviation enterprise is willing towards bringing down carbon footprints to obtain a sustainable environment and meet stringent regulatory requirements on emissions. Moreover, enhancing aero-engine performance through layout modifications, hybrid-electric and all-electric powered aircraft, renewable jet fuels, are being adopted by numerous stakeholders of the aviation industry however the adoption of sustainable aviation fuel is taken into consideration the maximum dependable and viable opportunity solutions with respect to socio and economic advantages while in comparison to others, which contributes extensively to mitigating modern and anticipated future environmental impacts of aviation.

Sustainable Aviation Fuel Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increasing Need for Reduction in GHG Emissions in the Aviation Industry

Human-caused greenhouse gas (GHG) emissions amplify the greenhouse effect, causing climate change. Carbon dioxide is emitted primarily through the combustion of fossil fuels such as coal, oil, and natural gas. Some of the biggest polluters Middle East and Africaly are China and Russia. This pollutions is mostly caused due to the OPEC (Organization of the Petroleum Exporting Countries) owned coal, oil and gas corporations. Carbon dioxide levels in the atmosphere have grown by around 50% from pre-industrial times due to human-caused emissions.

Pollutants emitted by aircraft engines are equivalent to those emitted by fossil fuel combustion. At higher altitudes, aircraft emissions have a greater concentration of contaminants. These emissions create serious environmental issues, both in terms of their Middle East and Africa effect and their impact on local air quality

- Increase in Air Transportation, and Increase in Consumption of Synthetic Lubricants

Air travel is a critical component in achieving economic growth and development. On a national, regional, and worldwide scale, air travel fosters integration into the Middle East and Africa economy and offers crucial linkages. It contributes to the growth of trade, tourism, and job possibilities. The aviation system is evolving and will continue to evolve. However, in the long run, it will be difficult for the air transportation system to adapt quickly enough to fulfil changing needs in terms of capacity, environmental impact, consumer happiness, safety, and security, all while maintaining service providers' economic viability.

The pandemic of Covid-19, along with government backing and technological discoveries, particularly in the field of fuel technology, has accelerated the aviation industry's transition to sustainable aviation fuel (SAF). While the use of sustainable aviation fuel (SAF) is on the rise, non-synthetic lubricants are on the decline. Synthetic and semi-synthesis lubricants are expected to benefit from the transition because most aircrafts employ advanced grade lubricants. The worldwide sustainable aviation fuel (SAF) market is predicted to be driven by this factor.

- Increase in Demand for Sustainable Aviation Fuel by Airlines

The aviation sector is adopting "urgent action" to meet the world's climate objective, which includes reducing air travel growth and swiftly scaling up the use of sustainable aviation fuels (SAF). SAF's purpose is to recycle carbon from existing sustainable biomass or gases into jet fuel as a replacement for fossil jet fuel refined from petroleum crude oil. SAF's purpose is to recycle carbon from existing sustainable biomass or gases into jet fuel as a replacement for fossil jet fuel refined from petroleum crude oil. The aviation sector as a whole, as well as IATA member airlines, are committed to attaining aggressive emissions reduction objectives. SAFs (sustainable aviation fuels) have been highlighted as a key component in reaching these goals. It will take government support to use sustainable aviation fuels to satisfy the industry's climate goals

As the key industry players are recognizing the need for sustainable aviation fuels (SAF), therefore the service providers have started embracing various sustainable aviation fuels (SAF) alternatives in various airlines, which is expected to further drive the growth of the sustainable aviation fuels (SAF) significantly.

- Inadequate Availability of Feedstock and Refineries to Meet Sustainable Aviation fuel Production Demand

Sustainable aviation fuels (SAFs), which are made from bio-based feedstock’s, are an important part of the plan to decrease aviation's carbon footprint. Technically, substituting and mixing SAFs with jet fuel is possible; in fact, the aviation industry has been using SAFs for over a decade. However, because of supply and demand constraints, consumption levels remain exceedingly low.

Oil crops, sugar crops, algae, waste oil, and other biological and non-biological resources are the raw materials that play an essential part in the whole production chain of alternative aviation fuels such as synthetic fuels, e-fuels, and bio jet fuels. The need for sustainable aviation fuel may come to a standstill due to a paucity of raw materials required for manufacture. Because of a scarcity of raw materials necessary for its manufacture, demand for sustainable aviation fuel may come to a halt. Furthermore, refinery restrictions, which play a critical role in the optimal exploitation of these feedstock, add to the total process of SAF manufacturing. Low fuel supply also puts a strain on the fuel's mixing capacity, resulting in lower efficiency.

When competition from the road gasoline sector for feedstock that meets sustainability standards grows, feedstock availability becomes a bottleneck. Feedstock costs are a significant part of the SAF cost, and price fluctuation can cause supply issues for fuel producers. Therefore, a higher fuel surcharge by a carrier is further hindering the growth of the market to an extent.

- Fluctuations in Crude Oil Prices and Contamination of Lubricants

Increasing Middle East and Africa competition and cost pressure force enterprises and supply chains to discover undetected cost-saving potentials. In particular, interfaces to the crude oil market are a promising field for improvement. In today’s business environment, every organization faces some risk of fluctuation in the price of crude oil and lubricant commodities. In production, manufacturers may rely on a significant amount of oil commodities, and as a result can be especially impacted by price volatility in the oil products they procure directly and indirectly through components and subassemblies. Volatile and unstable Middle East and Africa markets have widespread implications for manufacturing organizations. From rising energy costs to unexpected fluctuations in crude oil manufacturing costs, unforeseen obstacles are destabilizing supply chains and making it difficult for manufacturers to remain in the black. With supplies of many raw materials becoming harder to secure, commodity price volatility may not be just a temporary phenomenon, and it is up to manufacturers to either absorb additional costs, find new ways to mitigate the expenses, or pass price increases along to customers who are already reluctant to spend. Since pricing is affected by the tightening of supply markets, this trend shows no indication of changing anytime soon. Thus, the fluctuating cost of crude oil and other lubricants acts as a major restrain for the Middle East and Africa sustainable aviation fuel (SAF) market.

Carbon fragments are typically not hard enough or big enough to cause pump failure. They could, however, be big enough to block tiny filters or nozzles. Another cause of operational contamination is the presence of sand, grit, and metallic particles in the lubrication system. Which acts as a restraining factor for the Middle East and Africa sustainable aviation fuel (SAF) market.

- Reduction in Carbon Foot Print due to Low Capability of Sustainable Aviation Fuel

Sustainable aviation fuel (SAF) reduces carbon emissions over the lifespan of the fuel as compared to the traditional jet fuel it replaces. Cooking oil and other non-palm waste oils from animals or plants are common feedstock, as are solid waste from homes and companies, such as packaging, paper, textiles, and food scraps that would otherwise be disposed of in landfills or incinerated. Forest debris, such as waste wood, and energy crops, such as fast-growing plants and algae, are also possible sources.

Depending on the sustainable feedstock utilized, production process, and supply chain to the airport, SAF can reduce carbon emissions by up to 80% during the lifespan of the fuel compared to the traditional jet fuel it replaces.

SAF may be mixed up to 50% with standard jet fuel and undergoes the same quality testing as traditional jet fuel. After then, the mix is recertified as Jet A or Jet A-1. It can be handled in the same manner as standard jet fuel is, thus no changes to the fuelling infrastructure or aircraft that desire to utilize SAF are necessary which creates an opportunity for the growth of the Middle East and Africa sustainable aviation fuel market.

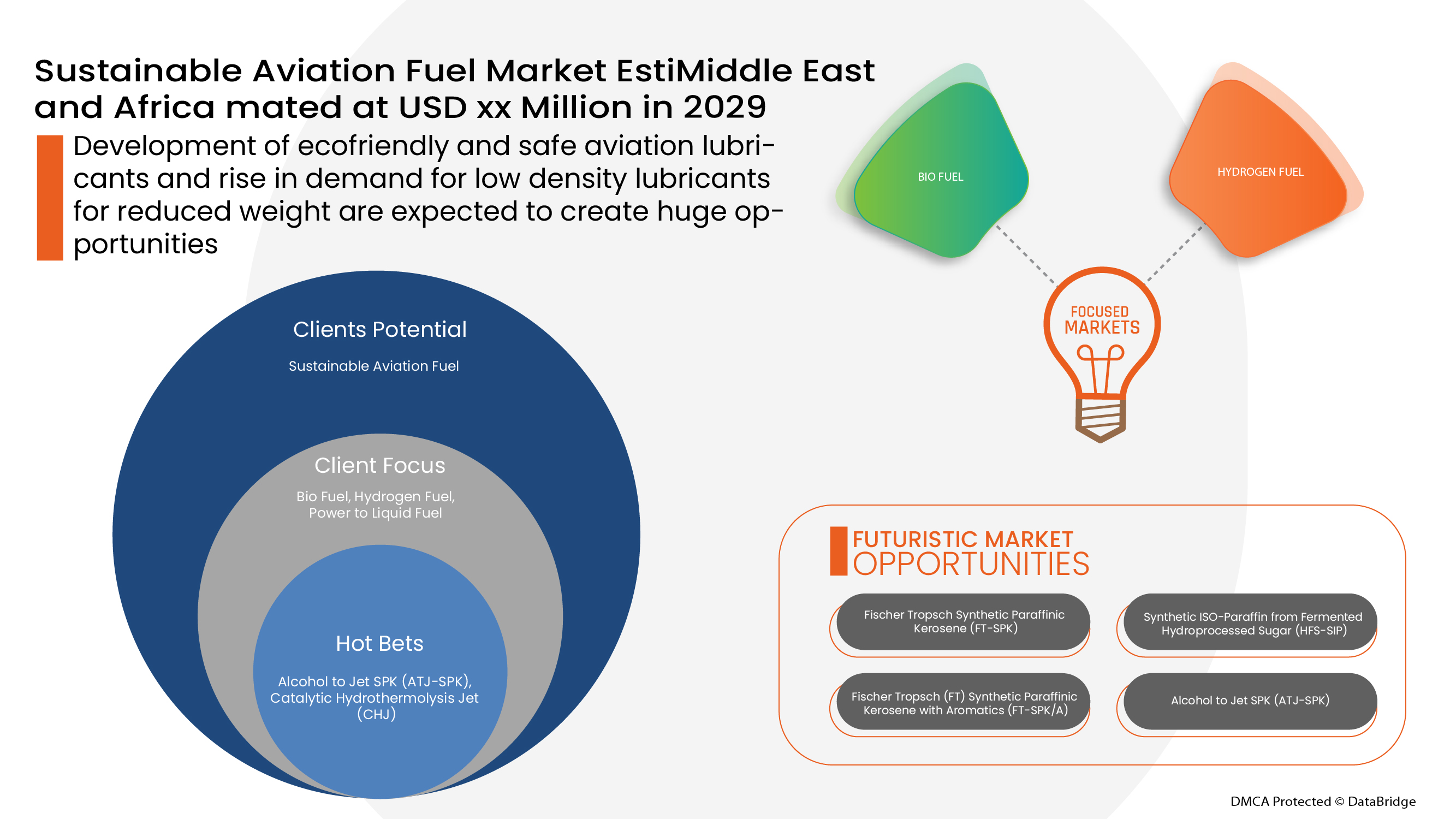

- Development of Eco-Friendly and Safe Aviation Lubricants

In today's world, the aviation industry is booming, resulting in increased rivalry among aircraft aviation fuel producers in all areas. Alternative environmentally friendly sources for long-term aviation fuel production are expected to have a future influence on the aviation fuel sector. The market for sustainable aviation fuel has grown significantly over the years, owing to the growing trend of advanced fuels being utilized in airplanes all over the world.

Growing biomass crops for sustainable aviation fuel production also allows farmers to make more money in the off-season by contributing feedstock to this new industry, while simultaneously securing agricultural advantages such as nutrient loss reduction and improved soil quality. Thereby, creating an opportunity for the growth of Middle East and Africa sustainable aviation fuel (SAF) market.

- High cost of Sustainable Aviation Fuel Increases the Operating Cost of Airlines

Labour and fuel expenditures are the two most significant expenses that airlines face. In the near term, labour expenses are usually stable, but fuel prices fluctuate significantly depending on the price of oil. Fuel is a significant part of the cost of running an airline, accounting for 20-30% of total expenditures. Oil price spikes have been some of the toughest moments for airlines. Airlines can prepare for gradually rising prices by raising ticket prices or lowering the number of flights, but unexpected increases in pricing cause many airlines to lose money.

Targets for the use of sustainable aviation fuel (SAF) will begin adding to the cost of fuel this year, making things even more difficult for airlines. According to the International Air Transport Association (IATA), Middle East and Africa SAF production is only approximately 100 million litres per year, or 0.1 percent of all aviation fuel utilised. Various airlines, on the other hand, have pledged to increase this percentage to 10% by 2030, a genuinely lofty objective.

Unfortunately, because of the limited volume of manufacturing, the cost is likewise expensive. The cost of SAF is estimated to be between two and four times that of fossil fuels by IATA, while a recent disclosure by Air France-KLM suggested that the cost disparity might be closer to four to eight times that of kerosene.

Governments have been urged by the International Air Transport Association (IATA) and others to encourage the development of SAF, but in the form of economic stimulation. This paves way for the increase in prices of sustainable aviation fuel (SAF) thereby acting as a challenge for Middle East and Africa sustainable aviation fuel market.

Post COVID-19 Impact on Sustainable Aviation Fuel Market

COVID-19 created a major impact on the sustainable aviation fuel market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the sustainable aviation fuel market is increasing due to need for reduction in GHG emissions in the aviation industry. However, factors such as inadequate availability of feedstock and refineries to meet sustainable aviation fuel production demand in sustainable aviation fuel are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the sustainable aviation fuel. With this, the companies will bring advanced and accurate controllers to the market. In addition, the use of sustainable aviation fuel by government authorities in air freight has led to the market's growth.

Recent Development

- In March 2022, Neste in collaboration with DHL Express announced one of the largest ever sustainable aviation fuel deals. This agreement is Neste’s largest for sustainable aviation fuel (SAF) to date and one of the largest SAF agreements in the aviation industry. This collaboration will enhance Neste’s current network by offering seamless connectivity all over the world

- In March 2022, BP ventures has made a £3 million equity investment in Flylogix – a pioneering unmanned aerial vehicle (UAV) business that uses drones to aid methane detection. These BP ventures focuses on connecting and growing new energy business and current network by offering seamless connectivity all over the world

Middle East and Africa Sustainable Aviation Fuel Market Scope

The sustainable aviation fuel market is segmented on the basis of fuel type, manufacturing technology, blending capacity, and blending platform. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Fuel Type

- Bio Fuel

- Hydrogen Fuel

- Power To Liquid Fuel

On the basis of fuel type, the Middle East and Africa sustainable aviation fuel market is segmented into bio fuel, hydrogen fuel and power to liquid fuel

Manufacturing Technology

- Hydroprocessed Fatty Acid Esters and Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK)

- Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK)

- Synthetic Iso-Paraffin from Fermented Hydroprocessed Sugar (HFS-SIP)

- Fischer Tropsch (FT) Synthetic Paraffinic Kerosene with Aromatics (FT-SPK/A)

- Alcohol to Jet Spk (ATJ-SPK)

- Catalytic Hydrothermolysis Jet (CHJ)

On the basis of manufacturing technology, the Middle East and Africa sustainable aviation fuel market has been segmented into hydroprocessed fatty acid esters and fatty acids - synthetic paraffinic kerosene (HEFA-SPK), fischer tropsch synthetic paraffinic kerosene (FT-SPK), synthetic Iso-paraffin from fermented hydroprocessed sugar (HFS-SIP), fischer tropsch (FT) synthetic paraffinic kerosene with aromatics (FT-SPK/A), alcohol to jet SPK (ATJ-SPK) and catalytic hydrothermolysis jet (CHJ).

Blending Capacity

- Below 30 %

- 30 % To 50 %

- Above 50%

On the basis of blending capacity, the Middle East and Africa sustainable aviation fuel market has been segmented into below 30 %, 30 % to 50 % and above 50%.

Blending Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicle

On the basis of blending platform, the Middle East and Africa sustainable aviation fuel market has been segmented into commercial aviation, military aviation, business & general aviation, and unmanned aerial vehicle

Sustainable Aviation Fuel Market Regional Analysis/Insights

The sustainable aviation fuel market is analysed and market size insights and trends are provided by country, fuel type, manufacturing technology, blending capacity, and blending platform industry as referenced above.

The countries covered in the sustainable aviation fuel market report are South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and the rest of the Middle East and Africa in Middle East and Africa

South Africa dominates the Middle East and Africa sustainable aviation fuel market, this is attributable to the growing demand and regulations for an efficient sustainable aviation fuel market. In addition, increased R&D investments in developing sustainable aviation fuel in the region. The demand in this region is projected to be driven by governments as increasingly investing in the new projects and taking initiatives towards decarbonize aviation emissions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Sustainable Aviation Fuel Market Share Analysis

The sustainable aviation fuel market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to sustainable aviation fuel market.

Some of the major players operating in the sustainable aviation fuel market are Neste, Gevo, VELOCYS,Fulcrum BioEnergy, SkyNRG, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Preem AB, Eni , Sasol Ltd, BP p.l.c. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 ISRAEL

10.1.4 EGYPT

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 MIDDLE EAST & AFRICA BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 MIDDLE EAST & AFRICA HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 MIDDLE EAST & AFRICA POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 MIDDLE EAST & AFRICA HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 MIDDLE EAST & AFRICA FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 MIDDLE EAST & AFRICA SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 MIDDLE EAST & AFRICA FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 MIDDLE EAST & AFRICA ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 MIDDLE EAST & AFRICA CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 MIDDLE EAST & AFRICA BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 MIDDLE EAST & AFRICA 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 MIDDLE EAST & AFRICA ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 MIDDLE EAST & AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 MIDDLE EAST & AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 MIDDLE EAST & AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 MIDDLE EAST & AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 MIDDLE EAST & AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 MIDDLE EAST & AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 MIDDLE EAST & AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 27 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 28 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 30 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 33 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 34 MIDDLE EAST AND AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 35 MIDDLE EAST AND AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 40 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 41 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 42 SOUTH AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 43 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 44 SOUTH AFRICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 45 SOUTH AFRICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 46 SOUTH AFRICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 SOUTH AFRICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 50 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 51 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 52 SAUDI ARABIA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 53 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 SAUDI ARABIA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 55 SAUDI ARABIA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 56 SAUDI ARABIA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 SAUDI ARABIA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 60 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 61 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 62 ISRAEL SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 63 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 64 ISRAEL COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 65 ISRAEL BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 66 ISRAEL MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 ISRAEL UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 68 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 69 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 70 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 71 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 72 EGYPT SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 73 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 74 EGYPT COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 75 EGYPT BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 76 EGYPT MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 77 EGYPT UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 78 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 79 REST OF MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 10 THE INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 11 BIO FUEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 13 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET

FIGURE 15 MIDDLE EAST & AFRICA AIR TRANSPORT PASSENGER DEMAND

FIGURE 16 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY TECHNOLOGY, 2021

FIGURE 17 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY MANUFACTURING TECHNOLOGY, 2021

FIGURE 18 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING CAPACITY, 2021

FIGURE 19 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING PLATFORM, 2021

FIGURE 20 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA SUSTAINABLE AVIATION FUEL MARKET: BY FUEL TYPE (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.