Market Analysis and Insights

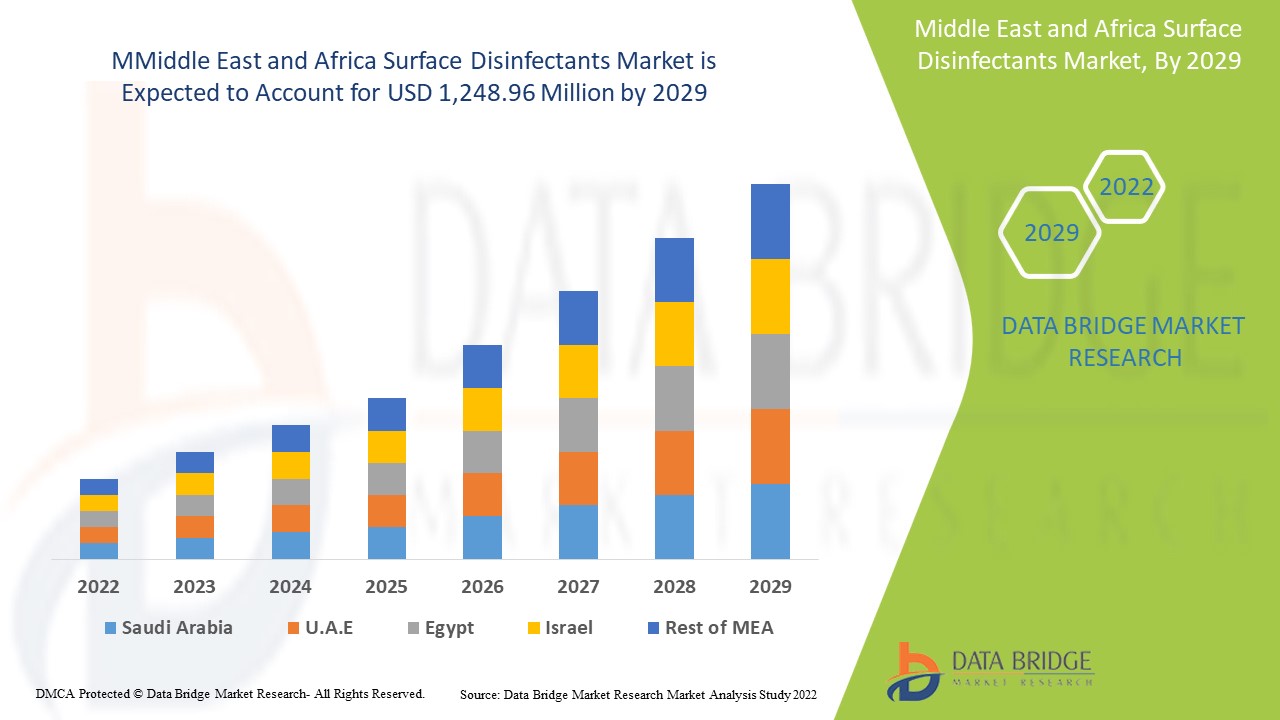

The Middle East and Africa surface disinfectants market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.2% in the forecast period of 2022 to 2029 and is expected to reach USD 1,248.96 million by 2029. The primary factor driving the growth of the surface disinfectants market is the increasing demand from healthcare facilities, rise in occurrences of chronic disorders, rising product demand after Covid-19, and shifting consumers' preference toward the use of bio-based and nature-friendly disinfectants.

Disinfectants are the antimicrobials used to kill harmful bacteria, germs, and other microorganisms present on various surfaces and therefore are most usually used to disinfect floors, washrooms, tiles, furniture, and instruments.

A surface disinfectant is a chemical compound used to kill or inactivate microorganisms, usually on a solid surface. These disinfectants can be found in various chemical compounds and work in various pathways to destroy microorganisms. They can be incorporated in different forms, such as liquids, wipes, and sprays. The outbreak of COVID-19 increased the need for surface disinfection and cleaning practices significantly. All the known measures are being taken to curb the spread of the deadly virus, including disinfection and cleaning of surfaces. This increased the demand for the surface disinfectant to multiple folds.

The Middle East and Africa surface disinfectants market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilograms, Pricing in USD |

|

Segments Covered |

By Composition (Alcohols, Chlorine, Quaternary Ammonium, Aldehydes, Peroxides, Biodisinfectants), Type (Liquid, Sprays, Wipes), Application (Surface Disinfection, Instrument Disinfection, And Other Applications), End User (Hospitals, Diagnostic and Research Laboratories, Pharmaceutical and Biotechnology Companies, Food & Beverage and Residential) |

|

Countries Covered |

Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and the Rest of the Middle East and Africa |

|

Market Players Covered |

3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc, GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, S.C. Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG, and Diversey Holdings LTD. |

Market Definition

Increasing demand from healthcare facilities, a rise in chronic disorders, and shifting consumers' preference toward bio-based and nature-friendly disinfectants are expected to propel the growth of the Middle East and Africa surface disinfectants market. Rising awareness among the population and increasing focus on research and development (R&D) initiatives will provide opportunities in the Middle East and Africa surface disinfectants market. However, environmental & health hazards associated with disinfectants are projected to challenge the surface disinfectants market growth.

Middle East and Africa Surface Disinfectants Market Dynamics

Drivers

- Increasing demand from healthcare facilities

With the increasing number of surgeries conducted in hospitals, there have been more and more disinfectants in surgical procedures to avoid infection and provide quality patient care and hygiene maintenance. The rising use of disinfectants to disinfect various surfaces such as reusable medical instruments like endoscopes, improper sterilization of medical equipment, and insufficient high-level disinfection may lead to severe and adverse effects on patients.

- Rise in occurrences of chronic disorders

The increasing population of old aged patients is expected to change healthcare services' delivery and working systems and create a greater market for surface disinfectants, as the old aged population is prone to acquiring hospital-acquired infections (HAIs). In addition, a rise in chronic diseases such as cardiovascular diseases, and others, require an extended hospital stay. Hence, there is an increase in the number of cases of hospital-acquired infection with these stays.

- Rising product demand post the outbreak of Covid-19

The pandemic disrupted all healthcare systems worldwide due to the increasing influx of hospital patients. Several temporary hospitals were also set up to deal with an increasing disease incidence to control this. Hence, the spread of COVID-19 has caused a surge in demand for cleaning and disinfection products due to the growing awareness about safety, hygiene, and health. Therefore, increasing healthcare expenditure and the increase in the number of temporary hospitals are also driving the demand for surface disinfectants. In addition, factors such as the increasing demand for hospital beds and ICUs and the rising number of isolation facilities have greatly boosted the demand for surface disinfectants.

- Shifting consumers' preference toward the use of bio-based and nature-friendly disinfectants

Bio-based surface disinfectants are being widely preferred among consumers due to the increasing inclination toward using environment-friendly products and products that do not have toxic effects on health and the surroundings. Moreover, stringent regulations pertaining to the excessive use of chemicals have propelled the growth of bio-based disinfectants over the few years. Bio-based surface disinfectants are also highly effective. They help kill germs without leaving toxic chemical residue and eliminate the hazardous effects on the skin, eyes, and respiratory system. These benefits have attracted consumer attention to bio-based surface disinfectant products. In addition, the rising focus of surface disinfectant manufacturers on investing in research & development to develop new bio-based formulations and increasing the use of bio-based surface disinfectants as an alternative to chemical-based products is also driving the growth of the market.

Opportunities

- Rising awareness among a large percentage of the population

Government and non-governmental organizations such as the World Health Organization have also launched awareness programs and guidelines regarding spreading awareness among consumers about health and hygiene and the proper use of disinfectants in their respective places. All this is expected to provide a host of opportunities for the growth and development of the Middle East and Africa surface disinfectant market.

- Increasing focus on research and development (R&D) initiatives

The manufacturers in the surface disinfectant market are also upgrading their production facilities to meet the increased demand for disinfectants due to the novel coronavirus outbreak, apart from launching products with new formulations that effectively kill the germs and bacteria on various surfaces. Therefore, the increasing focus and development of research and development initiatives will create opportunities to tap upon the growth of the Middle East and Africa surface disinfectant market.

Restraints/Challenges

- Lack of understanding regarding the use of standard disinfection practices by end-users

In environmental and healthcare facilities, cleaning is a complex infection prevention and control intervention requiring a multi-dimensional approach. This includes training, proper monitoring, regular audits and feedback, and displaying SOPs in key areas. Training of cleaning staff should be on the policies and SOPs of the healthcare facility and national guidelines of the region.

- Availability of alternative products and technologies in the market

Some of the technologies for disinfection include UV light and steam. Steam with high temperature, low-moisture, or dry steam does not leave a residue or chemical film. This is very effective and suitable for many surfaces. UV-C light is appropriate for specific disinfecting applications. It can disinfect unoccupied medical rooms and high-tech electronic devices and can be used inside air ducts to disinfect the air. In addition, newer no-touch and automated decontamination technologies have gained adoption, including aerosol and vaporized hydrogen peroxide, mobile devices that emit continuous ultraviolet (UV-C) light, and high-intensity narrow-spectrum (405 nm) light. These technologies have shown a reduction of bacterial contamination on the surfaces. Therefore, the availability of a wide range of alternative products and technologies to surface disinfectants in the market is the limiting factor for the growth and, thus, restraining the development of the Middle East and Africa surface disinfectants market.

- Environmental & health hazards associated with the use of disinfectants

Many surface disinfectants slowly or biodegrade into more toxic, persistent, and bio-accumulative chemicals, threatening aquatic life. Ingredients such as phosphorus or nitrogen contribute to nutrient-loading in water bodies, leading to adverse effects on water quality and the aquatic life present there. Moreover, volatile organic compounds (VOC) in cleaning products may also affect indoor air quality and contribute to smog formation in outdoor air. There are various ill effects and hazards associated with surface disinfectants, which act as a severe challenge for the Middle East and Africa surface disinfectant market to grow in the near future.

- The higher price of chemical-based surface disinfectants compared to bio-based disinfectants

The chemical-based surface disinfectants hold a major share in the Middle East and Africa surface disinfectant market due to their vast applications in various facilities such as hospitals, clinics, industries, and public places. Therefore, their high prices will impact the market negatively and act as a challenge for the Middle East and Africa surface disinfectant market.

COVID-19 had a Minimal Impact on the Middle East and Africa Surface Disinfectants Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the surface disinfectant market. Surface disinfectants' operations and supply chain, with multiple manufacturing facilities, were still operating in the region. The service providers continued offering surface disinfectants following sanitation and safety measures in the post-COVID scenario.

Recent Development

In May 2022, BETCO launched two new on-demand modules to assist with sharing valuable information regarding general disinfecting and facility-specific disinfection. These modules cover disinfectants working along with types of disinfectants and how to recommend or select the most effective disinfectants.

Middle East and Africa Surface Disinfectants Market Scope

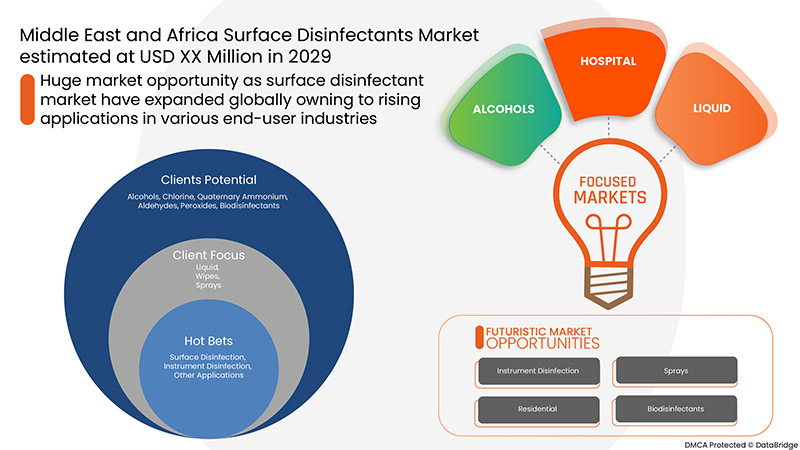

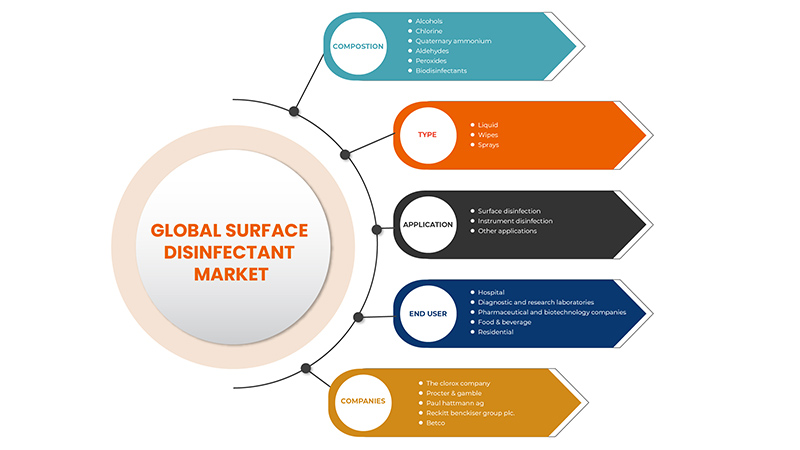

The Middle East and Africa surface disinfectants market is categorized based on composition, type, application, and end user. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Composition

- Alcohols

- Chlorine

- Quaternary Ammonium

- Aldehydes

- Peroxides

- Biodisinfectants

Based on composition, the Middle East and Africa surface disinfectants market is classified into six segments are alcohols, chlorine, quaternary ammonium, aldehydes, peroxides, and biodisinfectants.

Type

- Liquid

- Wipes

- Sprays

Based on type, the Middle East and Africa surface disinfectants market is classified into three segments liquid, wipes, and sprays.

Application

- Surface Disinfection

- Instrument Disinfection

- Other Applications

Based on the application, the Middle East and Africa surface disinfectants market is segmented into surface disinfection, instrument disinfection, and other applications.

End User

- Hospital

- Diagnostic and Research Laboratories

- Pharmaceutical and Biotechnology Companies

- Food & Beverage

- Residential

Based on end user, the Middle East and Africa surface disinfectants market is segmented into hospital, diagnostic and research laboratories, pharmaceutical and biotechnology companies, food & beverage, and residential.

Middle East and Africa Surface Disinfectants Market Regional Analysis/Insights

The Middle East and Africa surface disinfectants market in the healthcare industry is segmented based on composition, type, application, and end user.

The Middle East and Africa surface disinfectants market countries are Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel, and the Rest of the Middle East and Africa.

Saudi Arabia dominates the Middle East and Africa surface disinfectants market in market share and market revenue. It will continue to flourish its dominance during the forecast period. This is due to the increase in footfalls in hospitals and diagnostic centers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and the Middle East and Africa Surface Disinfectants Market Share Analysis

The Middle East and Africa surface disinfectants market competitive landscape provide details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the Middle East and Africa Surface disinfectants market.

Some of the prominent participants operating in the Middle East and Africa surface disinfectants market are 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc, GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, S.C. Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG, and Diversey Holdings LTD.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPOSITION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 U.S SURFACE DISINFECTANT ANALYSIS

4.2 EPIDEMIOLOGY

4.2.1 INCIDENCE

4.2.2 TREATMENT RATE

4.2.3 MORTALITY RATE

4.2.4 PATIENT TREATMENT SUCCESS RATE

4.3 INDUSTRIAL INSIGHTS:

4.3.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.2 KEY PRICING STRATEGIES

4.3.2.1 PRICES OF RAW MATERIALS:

4.3.2.2 FLUCTUATION IN DEMAND AND SUPPLY

4.3.2.3 LEVELS OF DISINFECTION

4.3.3 QUALITY:

4.3.4 KEY CONSUMER ENROLLMENT STRATEGIES

4.3.5 INTERVIEWS WITH DISINFECTION PRODUCT MANUFACTURERS

4.3.6 INTERVIEWS WITH INFECTIOUS DISEASE SCIENTISTS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.5.1 THREAT OF NEW ENTRANTS:

4.5.2 THREAT OF SUBSTITUTES:

4.5.3 CUSTOMER BARGAINING POWER:

4.5.4 SUPPLIER BARGAINING POWER:

4.5.5 INTERNAL COMPETITION (RIVALRY):

5 MIDDLE EAST & AFRICA SURFACE DISINFECTANT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FROM HEALTHCARE FACILITIES

6.1.2 RISE IN OCCURRENCES OF CHRONIC DISORDERS

6.1.3 RISING PRODUCT DEMAND POST THE OUTBREAK OF COVID-19

6.1.4 SHIFTING CONSUMERS' PREFERENCE TOWARD USE OF BIO-BASED AND NATURE-FRIENDLY DISINFECTANTS

6.2 RESTRAINTS

6.2.1 LACK OF UNDERSTANDING REGARDING THE USE OF STANDARD DISINFECTION PRACTICES BY END-USERS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS AND TECHNOLOGIES IN THE MARKET

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AMONG A LARGE PERCENTAGE OF POPULATION

6.3.2 INCREASING FOCUS ON RESEARCH AND DEVELOPMENT (R&D) INITIATIVES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL & HEALTH HAZARDS ASSOCIATED WITH THE USE OF DISINFECTANTS

6.4.2 HIGHER PRICE OF CHEMICAL-BASED SURFACE DISINFECTANTS COMPARED TO BIO-BASED DISINFECTANTS

7 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, COMPOSITION

7.1 OVERVIEW

7.2 ALCOHOLS

7.3 CHLORINE

7.4 QUATENARY AMMONIUM

7.5 ALDEHYDES

7.6 PEROXIDES

7.7 BIO DISINFECTANTS

8 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 LIQUID

8.3 WIPES

8.4 SPRAYS

9 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SURFACE DISINFECTION

9.3 INSTRUMENT DISINFECTION

9.4 OTHER APPLICATIONS

10 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DIAGNOSTIC AND RESEARCH LABORATORIES

10.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.5 FOOD & BEVERAGES

10.6 RESIDENTIAL

11 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 EGYPT

11.1.3 U.A.E.

11.1.4 SOUTH AFRICA

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA SURFACE DISINFECTANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.1.1 COLLABORATION

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

12.1.4 EVENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATE

14.2 PAUL HARTMANN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 PROCTER & GAMBLE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 DIVERSEY HOLDINGS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 RECKITT BENCKISER GROUP PLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 BETCO

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BRULIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CARROLLCLEAN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 CETYLITE, INC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONTEC, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 ECOLAB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT UPDATES

14.12 GESCO HEALTHCARE PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 GOJO INDUSTRIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 KINNOS INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 MEDALKAN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 MEDIVATORS, INC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MEDLINE INSUSTRIES, LP.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 METREX RESEARCH, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 OXY PHARM

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 PAL INTERNATIONAL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

14.21 PDI, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 PHARMAX LIMITED

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATES

14.23 PURPOSEBUILT BRANDS

14.23.1 COMPANY SNAPSHOT

14.23.2 RECENT UPDATE

14.24 RUHOF

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATE

14.25 S.C. JOHNSON & SON INC.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT UPDATES

14.26 SPARTAN CHEMICAL COMPANY, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT UPDATES

14.27 STERIS

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 RECENT UPDATES

14.28 WHITELEY

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCT PORTFOLIO

14.28.3 RECENT UPDATES

14.29 ZEP INC.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT UPDATES

14.3 3M

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 2 EXPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CHLORINE IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA PEROXIDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA BIO DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 13 MIDDLE EAST & AFRICA LIQUID IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA WIPES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SPRAYS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA INSTRUMENT DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHER APPLICATIONS IN SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA DIAGNOSTIC AND RESEARCH LABORATORIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PHARMACEUTICAL AND BIOTECHNOLOGIES COMPANIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA RESIDENTIAL IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 30 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 SAUDI ARABIA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 33 SAUDI ARABIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 SAUDI ARABIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 35 SAUDI ARABIA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 EGYPT SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 38 EGYPT SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EGYPT SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 40 EGYPT SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 EGYPT SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.A.E. SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 43 U.A.E. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.A.E. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 45 U.A.E. SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 U.A.E. SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 50 SOUTH AFRICA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 55 ISRAEL SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 REST OF MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: COMPOSITION LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: END USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 INCREASING DEMAND FROM HEALTH CARE FACILITIES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET IN THE FORECAST PERIOD

FIGURE 16 ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET

FIGURE 18 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2021

FIGURE 19 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, BY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, APPLICATION, 2021

FIGURE 21 MIDDLE EAST & AFRICA SURFACE DISINFECTANTS MARKET, END USER, 2021

FIGURE 22 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST AND AFRICA SURFACE DISINFECTANTS MARKET: BY COMPOSITION (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA SURFACE DISINFECTANT MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.