Middle East And Africa Super Hydrophobic Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.82 Billion

USD

3.61 Billion

2025

2033

USD

1.82 Billion

USD

3.61 Billion

2025

2033

| 2026 –2033 | |

| USD 1.82 Billion | |

| USD 3.61 Billion | |

|

|

|

|

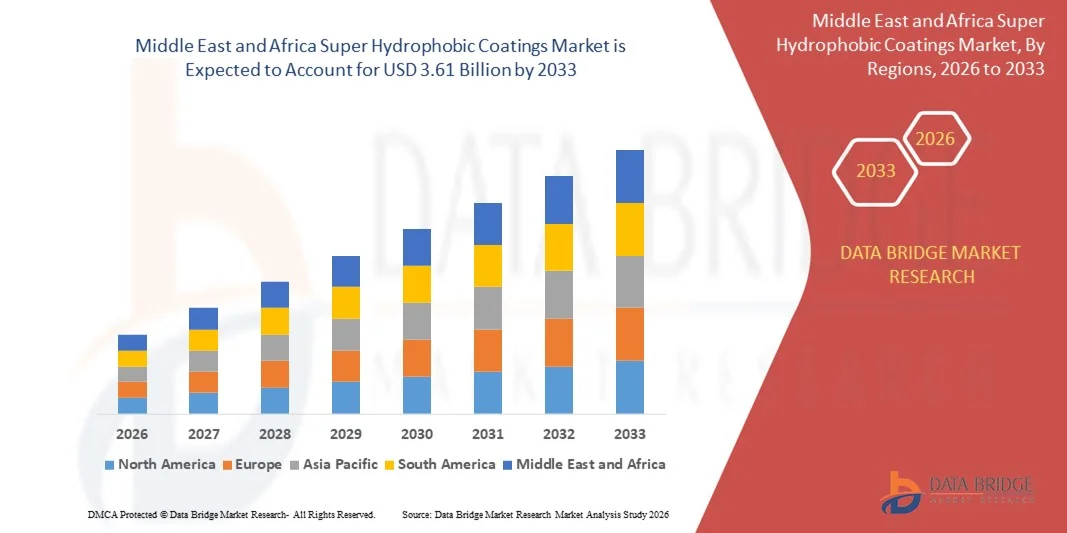

What is the Middle East and Africa Super Hydrophobic Coatings Market Size and Growth Rate?

- The Middle East and Africa super hydrophobic coatings market size was valued at USD 1.82 billion in 2025 and is expected to reach USD 3.61 billion by 2033, at a CAGR of 8.9% during the forecast period

- The market growth is largely fuelled by the increasing demand for self-cleaning, anti-corrosion, and water-repellent surfaces across automotive, electronics, textiles, and construction industries

- In addition, advancements in nanotechnology and growing investments in R&D are enhancing the performance, versatility, and commercial viability of superhydrophobic coatings across diverse end-use applications

What are the Major Takeaways of Super Hydrophobic Coatings Market?

- Rising consumer preference for low-maintenance, durable surfaces is boosting the adoption of superhydrophobic coatings in applications such as smartphones, windshields, and solar panels

- Innovation in nanotechnology and material science is enhancing the performance and cost-efficiency of these coatings

- Saudi Arabia dominated the Middle East and Africa super hydrophobic coatings market with an estimated 35.26% revenue share in 2025, driven by rising adoption across oil & gas infrastructure, construction, industrial equipment, and water management applications

- The U.A.E. is projected to register the fastest CAGR of 10.36% during the forecast period, driven by rapid expansion of construction, aviation, renewable energy, and marine infrastructure

- The self-cleaning segment dominated the market with the largest revenue share in 2024, driven by its wide adoption in electronics, automotive, and construction applications

Report Scope and Super Hydrophobic Coatings Market Segmentation

|

Attributes |

Super Hydrophobic Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Super Hydrophobic Coatings Market?

Rising Demand for Self-Cleaning and Anti-Fouling Surfaces across Industries

- There is a growing need for superhydrophobic coatings in self-cleaning applications across electronics, construction, and automotive sectors

- These coatings reduce the adhesion of water, dust, and contaminants, extending product lifespan and minimizing maintenance

- In construction, they are used on solar panels and glass surfaces to maintain energy efficiency and visual clarity

- The coatings are increasingly adopted in electronics to protect against water and dust damage

- For instance, Apple integrates hydrophobic coatings into iPhones to enhance water resistance and reduce repair costs

What are the Key Drivers of Super Hydrophobic Coatings Market?

- Superhydrophobic coatings are extensively used in smartphones and wearable devices to improve moisture resistance

- In the automotive sector, these coatings enhance visibility and reduce the need for frequent cleaning

- The rise in electric and autonomous vehicles increases demand for coatings that protect sensors and cameras

- The durability and protective benefits contribute to longer product lifecycles and user convenience

- For instance, Samsung employs advanced water-repellent coatings in its Galaxy series to meet consumer demand for water-resistant devices

Which Factor is Challenging the Growth of the Super Hydrophobic Coatings Market?

- Manufacturing superhydrophobic coatings involves costly nanomaterials and complex application techniques

- Limited durability under real-world conditions, such as abrasion or UV exposure, reduces long-term effectiveness

- Environmental concerns and regulatory challenges hinder adoption of certain chemical-based coatings

- High production costs limit usage in price-sensitive industries such as textiles and consumer packaging

- For instance, Many textile brands hesitate to integrate superhydrophobic technology due to its high cost and limited wash durability

How is the Super Hydrophobic Coatings Market Segmented?

The market is segmented on the basis of product type, raw material, and end-user industry.

- By Product Type

On the basis of product type, the superhydrophobic coating market is segmented into anti-corrosion, anti-icing, self-cleaning, and anti-wetting. The self-cleaning segment dominated the market with the largest revenue share in 2024, driven by its wide adoption in electronics, automotive, and construction applications. These coatings significantly reduce maintenance needs and extend product lifespan by preventing dirt accumulation and moisture penetration. Increased consumer demand for low-maintenance surfaces, especially in electronics and solar panels, contributes to the rising demand for self-cleaning coatings.

The anti-corrosion segment is expected to witness a fastest growth rate from 2025 to 2032, fuelled by its increasing use in the automotive and industrial sectors. These coatings provide superior resistance against rust and surface degradation, especially in extreme weather conditions or marine environments. Their ability to prolong equipment life and reduce repair costs positions them as a critical innovation in surface protection technology.

- By Raw Material

On the basis of raw material, the market is segmented into carbon nanotubes, graphene, manganese oxide polystyrene, precipitated calcium carbonate, zinc oxide polystyrene, and silica nanoparticle. The silica nanoparticle segment held the largest revenue share in 2024 due to its widespread use across various product formulations offering excellent hydrophobicity and cost-effectiveness. Silica-based coatings are preferred for their versatility, transparency, and ease of application across surfaces such as glass, metal, and fabric.

The graphene segment is expected to witness a fastest growth rate from 2025 to 2032, attributed to its superior mechanical strength, conductivity, and barrier properties. With increasing R&D investments and demand from high-tech industries, graphene-based coatings are gaining momentum for premium applications in electronics, aerospace, and defense.

- By End-User Industry

On the basis of end-user industry, the superhydrophobic coating market is segmented into textile and footwear, automotive, building and construction, and others. The textile and footwear segment dominated the market in 2024, owing to high consumer demand for water-repellent and stain-resistant apparel and accessories. These coatings enhance product durability and aesthetic quality, making them highly attractive in the performance wear and lifestyle segments.

The automotive segment is expected to witness a fastest growth rate from 2025 to 2032, propelled by increasing adoption of these coatings on windshields, sensors, and vehicle exteriors. Their role in maintaining visibility, preventing grime accumulation, and extending component life makes them valuable in modern vehicle maintenance and design.

Which Region Holds the Largest Share of the Super Hydrophobic Coatings Market?

- Saudi Arabia dominated the Middle East and Africa super hydrophobic coatings market with an estimated 35.26% revenue share in 2025, driven by rising adoption across oil & gas infrastructure, construction, industrial equipment, and water management applications. Increasing demand for surface protection against corrosion, moisture, dust, and extreme climatic conditions is significantly supporting market growth

- Strong presence of large-scale industrial facilities, petrochemical complexes, and infrastructure development projects, combined with government-led initiatives under Vision 2030, is accelerating the adoption of advanced super hydrophobic coatings across industrial and commercial sectors

- Growing focus on asset longevity, reduced maintenance costs, and improved operational efficiency in harsh environments continues to drive demand for super hydrophobic coatings across the Middle East and Africa

U.A.E. Super Hydrophobic Coatings Market Insight

The U.A.E. is projected to register the fastest CAGR of 10.36% during the forecast period, driven by rapid expansion of construction, aviation, renewable energy, and marine infrastructure. Increasing adoption of advanced coating technologies for glass facades, solar panels, aerospace components, and high-end architectural projects, along with strong emphasis on smart cities and sustainable infrastructure, is supporting robust market growth.

South Africa Super Hydrophobic Coatings Market Insight

South Africa is witnessing steady growth in the Super Hydrophobic Coatings market, supported by rising demand from mining, automotive, building & construction, and industrial manufacturing sectors. Government investments in infrastructure rehabilitation, increasing need for corrosion-resistant coatings, and growing awareness of surface protection technologies are expected to support long-term market expansion across the country.

Which are the Top Companies in Super Hydrophobic Coatings Market?

The super hydrophobic coatings industry is primarily led by well-established companies, including:

- P2i Ltd. (U.K.)

- NEI Corporation (U.S.)

- UltraTech International Inc. (U.S.)

- Aculon Inc. (U.S.)

- Lotus Leaf Coatings, Inc. (U.S.)

- Rust-Oleum (U.S.)

- Cytonix (U.S.)

- NASIOL NANO COATINGS (Turkey)

- The President and Fellows of Harvard College (U.S.)

- LiquiGlide Inc. (U.S.)

- Surfactis Technologies (France)

- PearlNano (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Keronite (U.K.)

- Nanoshel LLC (U.S.)

- Nanorh (U.S.)

What are the Recent Developments in Middle East and Africa Super Hydrophobic Coatings market?

- In August 2023, Aculon announced a strategic partnership with Ellsworth Adhesives to distribute its NanoProof 3 series. This development serves as a direct alternative to 3M’s Novec coatings, aiming to provide advanced moisture and corrosion resistance. The partnership enhances Aculon’s global reach and expands product options in the superhydrophobic coating market

- In June 2023, NEI Corporation expanded its manufacturing facilities and introduced LMFP Electrode Sheets for lithium-ion batteries. This capacity boost was initiated to meet rising market demand and includes advancements in protective coatings. The move strengthens NEI's presence in the superhydrophobic coating space by increasing production and diversifying its product offerings

- In November 2021, Henkel AG & Co. integrated Extra Horizon into its partner network to drive innovation in healthcare digitization. This collaboration combines Henkel’s materials science with Extra Horizon’s digital health technology. The initiative is set to introduce smart coating solutions, positively influencing the development of next-generation superhydrophobic applications in healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Super Hydrophobic Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Super Hydrophobic Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Super Hydrophobic Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.