Middle East And Africa Stroke Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

193.66 Million

USD

279.64 Million

2025

2033

USD

193.66 Million

USD

279.64 Million

2025

2033

| 2026 –2033 | |

| USD 193.66 Million | |

| USD 279.64 Million | |

|

|

|

|

Middle East and Africa Stroke Diagnostics Market Size

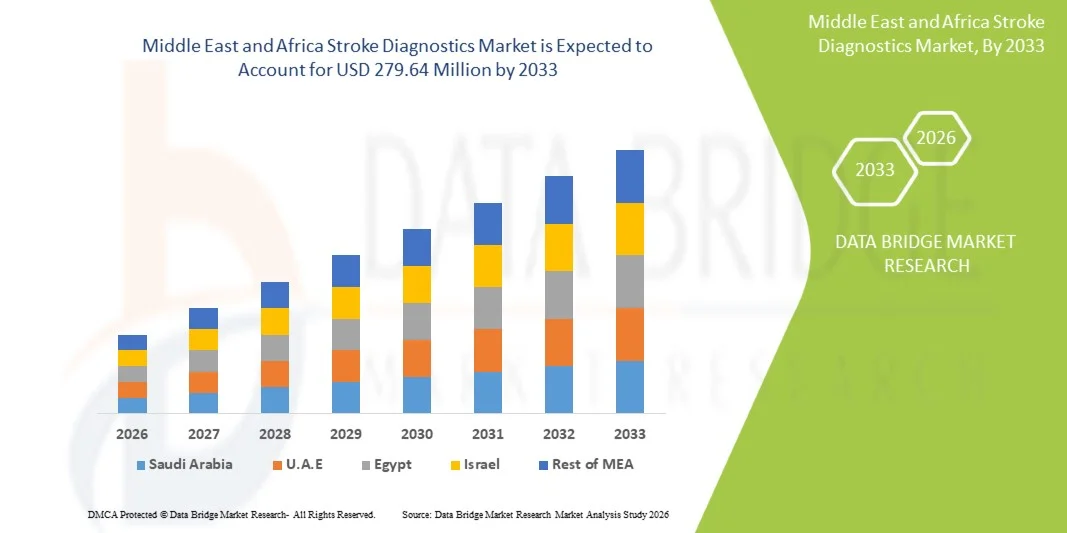

- The Middle East and Africa stroke diagnostics market size was valued at USD 193.66 million in 2025 and is expected to reach USD 279.64 million by 2033, at a CAGR of 4.7% during the forecast period

- This regional growth is largely fueled by increasing healthcare investments, government initiatives to improve early detection and treatment, and a growing burden of chronic diseases such as hypertension and diabetes, which heighten the need for rapid and accurate stroke diagnosis

- Furthermore, enhanced awareness about stroke management, integration of digital and AI‑assisted diagnostics, and expanding hospital and clinic networks are accelerating market adoption across both residential and clinical settings in the Middle East and Africa

Middle East and Africa Stroke Diagnostics Market Analysis

- Stroke diagnostics, encompassing imaging technologies such as CT, MRI, and ultrasound for early detection and monitoring of cerebrovascular events, are becoming increasingly essential in healthcare systems across the Middle East and Africa due to rising stroke prevalence, growing awareness of timely intervention, and the integration of advanced diagnostic tools in hospitals and clinics

- The increasing demand for stroke diagnostic solutions is primarily driven by the growing burden of cardiovascular and metabolic diseases, rising geriatric population, and heightened focus on improving patient outcomes through early detection and rapid treatment

- Saudi Arabia dominated the Middle East stroke diagnostics market with the largest revenue share of 35.4% in 2025, supported by robust healthcare infrastructure, high healthcare expenditure, government initiatives to improve stroke management, and the presence of leading diagnostic service providers and advanced imaging centers

- South Africa is expected to be the fastest-growing country in the stroke diagnostics market during the forecast period due to expanding healthcare infrastructure, increasing availability of modern imaging equipment, and rising investment in healthcare programs to tackle non-communicable diseases

- Computed Tomography (CT Scan) segment dominated the stroke diagnostics market with a market share of 50.2% in 2025, driven by its widespread availability, cost-effectiveness, rapid imaging capability, and critical role in the acute diagnosis and management of stroke patients

Report Scope and Middle East and Africa Stroke Diagnostics Market Segmentation

|

Attributes |

Middle East and Africa Stroke Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Stroke Diagnostics Market Trends

“AI-Enabled and Tele-Radiology Integration”

- A key trend in the Middle East and Africa stroke diagnostics market is the increasing adoption of AI-enabled imaging software and tele-radiology services, which enhance the speed and accuracy of stroke detection across hospitals and remote healthcare facilities

- For instance, AI-based CT and MRI analysis platforms are being integrated in major hospitals in Saudi Arabia, allowing radiologists to quickly identify ischemic and hemorrhagic strokes and prioritize critical cases for immediate treatment

- AI algorithms in stroke diagnostics can predict stroke severity, suggest optimal intervention strategies, and provide real-time alerts for anomalies, improving clinical decision-making and patient outcomes. Tele-radiology enables expert neurologists to remotely review scans from underserved regions, bridging access gaps

- The integration of AI and tele-radiology with existing imaging infrastructure facilitates centralized patient monitoring, faster reporting, and coordinated care among multidisciplinary teams, enhancing operational efficiency across healthcare networks

- This trend towards intelligent, connected diagnostic solutions is transforming expectations for stroke care, prompting companies and hospitals to invest in AI-powered imaging tools and tele-radiology networks

- Rising investment in mobile imaging units and portable CT/MRI scanners is another emerging trend, enabling stroke diagnosis in emergency and remote care settings

- Collaboration between hospitals and health tech startups to develop region-specific AI diagnostic models tailored to local patient demographics is gaining traction, driving innovation in stroke care solutions

Middle East and Africa Stroke Diagnostics Market Dynamics

Driver

“Rising Stroke Incidence and Geriatric Population”

- The increasing prevalence of stroke cases, particularly among the aging population and patients with comorbidities such as hypertension and diabetes, is a major driver for stroke diagnostics adoption in the Middle East and Africa

- For instance, in 2025, Saudi Arabian hospitals expanded CT and MRI diagnostic units in response to rising stroke admissions, improving timely detection and intervention for acute cases

- Healthcare providers are focusing on early diagnosis and risk assessment to reduce stroke-related morbidity and mortality, driving demand for advanced imaging and monitoring solutions

- Growing investments in modern diagnostic infrastructure, government-led awareness campaigns, and integration of stroke care programs in national healthcare policies are further accelerating market growth

- The expansion of hospital networks, public-private partnerships, and digital health initiatives enables broader access to stroke diagnostics, especially in urban and semi-urban regions

- The combination of increased stroke prevalence, aging demographics, and strategic healthcare investments continues to propel the adoption of stroke diagnostic technologies across the region

- Increased adoption of cloud-based imaging storage and sharing solutions is helping hospitals manage patient data efficiently, improving workflow and reducing diagnosis time

- Awareness programs targeting high-risk groups and routine health screenings are encouraging early detection, indirectly boosting demand for advanced stroke diagnostic services

Restraint/Challenge

“High Costs and Infrastructure Limitations”

- The relatively high cost of advanced imaging equipment and limited diagnostic infrastructure in certain Middle East and African countries remain key challenges for market expansion

- For instance, some rural hospitals in South Africa and Nigeria lack access to CT and MRI scanners, delaying stroke diagnosis and reducing the potential reach of advanced diagnostic solutions

- Cost barriers and insufficient insurance coverage for imaging procedures can hinder adoption among patients, particularly in low- and middle-income regions

- In addition, a shortage of trained radiologists and neurologists to operate sophisticated imaging systems and interpret results poses operational challenges for healthcare providers

- Overcoming these issues requires government support, investment in training programs, and scalable, cost-effective diagnostic solutions to expand coverage in underserved areas

- Addressing financial, infrastructural, and workforce constraints is critical to ensure broader adoption of stroke diagnostics and improved outcomes across the Middle East and Africa

- Inconsistent electricity supply and lack of maintenance support in some regions can affect the reliability and uptime of imaging equipment, posing a barrier to continuous operations

- Regulatory hurdles and slow approval processes for importing advanced imaging devices can delay market entry and adoption, particularly for cutting-edge AI-enabled diagnostic solutions

Middle East and Africa Stroke Diagnostics Market Scope

The market is segmented on the basis of severity, type, application, end user, distribution channel, and stage.

- By Severity

On the basis of severity, the market is segmented into mild, moderate, and severe stroke. The severe stroke segment dominated the market with a 42% revenue share in 2025, due to the high clinical complexity of severe stroke cases that require advanced imaging and continuous monitoring. Hospitals prioritize severe stroke diagnostics to plan immediate interventions and manage critical patient care. Patients with severe strokes often need repeated imaging such as CT and MRI, which increases equipment utilization. Government-funded stroke programs focusing on critical care further drive this segment. The segment benefits from integration of AI-assisted diagnostic tools that improve decision-making. Increasing prevalence of comorbidities such as hypertension and diabetes also contributes to the high demand in this segment.

The mild stroke segment is expected to witness the fastest growth rate of 19% from 2026 to 2033, driven by rising awareness about early stroke detection and preventive care. Mild stroke patients are increasingly undergoing screening with CT or MRI to prevent progression to severe stroke. Tele-radiology solutions allow remote evaluation of mild stroke cases in underserved areas. AI-powered imaging is also helping radiologists detect subtle abnormalities earlier. Routine health checkups and preventive programs in aging populations further boost demand. Early diagnosis initiatives in Saudi Arabia, UAE, and South Africa are supporting market expansion in this segment.

- By Type

On the basis of type, the market is segmented into CT Scan, CTA, MRI, MRA, Transcranial Doppler Ultrasound, VHIT, and others. The CT scan segment dominated with a 50.2% share in 2025, as CT scans are fast, cost-effective, and critical for acute stroke diagnosis. Hospitals rely on CT scans for rapid triage of ischemic and hemorrhagic strokes. Repeated imaging and emergency use make CT highly demanded in hospitals. Integration with AI-based software enhances detection accuracy and workflow efficiency. CT scans are widely available in both public and private hospitals, further supporting dominance. High patient inflow and government investments in acute care infrastructure strengthen this segment’s position.

The MRI segment is expected to witness the fastest CAGR of 20% from 2026 to 2033, due to superior soft tissue imaging and early ischemia detection. Advanced hospitals in Saudi Arabia, UAE, and South Africa are increasingly adopting MRI for follow-up and high-risk patient screening. Faster scanning sequences and AI-assisted diagnostics improve operational efficiency. Insurance coverage and premium diagnostic services make MRI more accessible. MRI is preferred for monitoring complex cases and treatment planning. Rising investment in state-of-the-art diagnostic equipment supports rapid growth in this segment.

- By Application

On the basis of application, the market is segmented into ischemic stroke, hemorrhagic stroke, and TIAs. The ischemic stroke segment dominated with a 55% share in 2025, due to its higher prevalence and urgent need for early thrombolytic treatment. Hospitals and stroke centers prioritize ischemic stroke imaging for rapid intervention. Advanced AI tools aid in predicting tissue at risk, improving treatment decisions. Recurrent ischemic stroke monitoring also drives repeated imaging use. Government stroke care programs focus primarily on ischemic cases, enhancing adoption. Integration of tele-radiology further expands access in remote regions.

The TIA segment is expected to witness the fastest growth rate of 18% from 2026 to 2033, driven by increasing awareness and preventive care. Early detection of TIAs reduces risk of full strokes, boosting demand for imaging solutions. Tele-radiology allows remote neurologists to provide timely assessments. Portable CT and ultrasound units are increasingly deployed in semi-urban and rural hospitals. Preventive healthcare programs targeting high-risk patients support adoption. AI-assisted diagnostic platforms help identify subtle abnormalities in TIA cases.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, and home healthcare. The hospital segment dominated with a 60% revenue share in 2025, due to high patient inflow and the presence of advanced imaging infrastructure. Hospitals manage severe stroke cases requiring multi-modal imaging and continuous monitoring. AI-enabled diagnostics and tele-radiology infrastructure are widely implemented in hospitals. Government-funded hospitals in Saudi Arabia, UAE, and South Africa have significant procurement budgets. Hospitals also invest in staff training and workflow optimization for stroke care. High reliance on pre- and post-operative imaging supports dominance of this segment.

The home healthcare segment is expected to witness the fastest growth of 22% from 2026 to 2033, fueled by remote monitoring and follow-up diagnostics. Portable CT and ultrasound devices enable timely home-based evaluations. Aging populations and post-stroke rehabilitation programs increase demand. Telemedicine integration allows neurologists to provide virtual consultations. Wearable devices and mobile apps support continuous monitoring of stroke patients. Expansion of private home healthcare services accelerates market growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated with a 58% share in 2025, driven by bulk procurement by government hospitals and large private healthcare networks. Direct tenders offer competitive pricing, maintenance contracts, and compliance assurance. High-value equipment such as CT and MRI scanners are often procured via tenders. Large hospital chains prefer this channel for consistency and reliability. Government initiatives in Saudi Arabia and UAE support tender-based procurement. Long-term service and support agreements strengthen adoption in this segment.

The third-party distributors segment is expected to witness the fastest CAGR of 19% from 2026 to 2033, due to rising adoption in semi-urban hospitals and clinics. Distributors provide flexible financing and localized service support. Smaller hospitals and clinics gain access to advanced diagnostic tools through distributors. Expansion in Africa and underserved regions drives distributor growth. Partnerships with equipment manufacturers facilitate rapid supply. Distributors also help in regulatory compliance and training support.

- By Stage

On the basis of stage, the market is segmented into pre-operative, peri-operative, and post-operative. The pre-operative segment dominated with a 52% share in 2025, as imaging before intervention is critical for treatment planning. Accurate pre-operative diagnostics determine the type and severity of stroke. Hospitals rely on CT, CTA, and MRI scans during this stage. AI-assisted pre-operative imaging improves triage and reduces errors. High prevalence of acute ischemic and hemorrhagic strokes supports demand. Pre-operative imaging also aids in emergency response and prioritization.

The post-operative segment is expected to witness the fastest growth of 21% from 2026 to 2033, driven by follow-up imaging and monitoring of recovery. Post-operative diagnostics ensure early detection of complications and secondary stroke prevention. Tele-radiology enables remote follow-ups in urban and rural areas. Hospitals and home healthcare providers increasingly adopt AI-assisted tools. Growth in rehabilitation programs also boosts imaging demand. Rising awareness of long-term monitoring for stroke patients supports segment expansion.

Middle East and Africa Stroke Diagnostics Market Regional Analysis

- Saudi Arabia dominated the Middle East stroke diagnostics market with the largest revenue share of 35.4% in 2025, supported by robust healthcare infrastructure, high healthcare expenditure, government initiatives to improve stroke management, and the presence of leading diagnostic service providers and advanced imaging centers

- Patients and healthcare providers in the region increasingly prioritize rapid, accurate, and AI-assisted diagnostic tools such as CT, MRI, and CTA for timely stroke intervention and improved patient outcomes

- This dominance is further supported by substantial healthcare spending, the presence of leading diagnostic service providers, investments in tele-radiology services, and high awareness of stroke management programs, establishing Saudi Arabia as the key hub for stroke diagnostics in the Middle East

The Saudi Arabia Stroke Diagnostics Market Insight

The Saudi Arabia stroke diagnostics market captured the largest revenue share of 35.4% in 2025, driven by increasing stroke prevalence, expanding healthcare infrastructure, and government initiatives to improve early detection and management. Hospitals and specialty clinics are investing in advanced imaging technologies such as CT, MRI, and CTA to ensure timely and accurate diagnosis. The growing integration of AI-assisted diagnostics and tele-radiology services is enhancing workflow efficiency and patient outcomes. Moreover, rising awareness about stroke symptoms and preventive care is boosting adoption across both urban and semi-urban areas. Strong public and private healthcare funding further supports market expansion.

United Arab Emirates Stroke Diagnostics Market Insight

The UAE stroke diagnostics market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by high healthcare expenditure, modern hospital infrastructure, and the rising demand for advanced imaging solutions. The adoption of AI-enabled imaging tools and tele-radiology platforms is facilitating faster and more accurate stroke detection. Growing urbanization, coupled with an increase in cardiovascular risk factors, is fostering market demand. Healthcare providers are focusing on both acute stroke management and long-term monitoring, encouraging investments in advanced diagnostic technologies. The market is witnessing growth in hospitals, clinics, and rehabilitation centers.

South Africa Stroke Diagnostics Market Insight

The South Africa stroke diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by the growing burden of stroke and other cerebrovascular diseases. Limited access to diagnostic facilities in rural areas is being addressed through portable imaging solutions and tele-radiology services. Public-private partnerships and government programs are promoting early stroke detection and treatment. Awareness campaigns targeting high-risk populations are further boosting adoption. Hospitals and specialty clinics are increasingly deploying CT, MRI, and ultrasound technologies for comprehensive stroke diagnostics. The focus on improving post-stroke outcomes is driving investment in advanced diagnostic infrastructure.

Egypt Stroke Diagnostics Market Insight

The Egypt stroke diagnostics market is poised to grow at a robust CAGR during the forecast period, driven by rising incidence of stroke, expanding healthcare infrastructure, and increasing availability of imaging technologies. Hospitals in urban centers are adopting multi-modal diagnostic approaches to manage ischemic and hemorrhagic strokes effectively. The integration of AI-assisted platforms for faster image interpretation is gaining traction. Government programs promoting early diagnosis and preventive care are supporting market growth. Tele-radiology services are helping bridge gaps in rural healthcare delivery. The demand for both pre-operative and post-operative stroke diagnostics is increasing steadily.

Middle East and Africa Stroke Diagnostics Market Share

The Middle East and Africa Stroke Diagnostics industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

- FUJIFILM Holdings Corporation (Japan)

- Analogic Corporation (U.S.)

- Aspect Imaging Ltd (Israel)

- Carestream Health (U.S.)

- Esaote S.p.A (Italy)

- Hologic, Inc. (U.S.)

- IMRIS Inc. (Canada)

- Fonar Corporation (U.S.)

- Medfield Diagnostics AB (Sweden)

- MEDTRON AG (Germany)

- SAMSUNG Medison (South Korea)

- Shenzhen Anke High Tech Co., Ltd. (China)

- Shimadzu Corporation (Japan)

- ALPINION MEDICAL SYSTEMS Co., Ltd. (South Korea)

- BPL Medical Technologies (India)

What are the Recent Developments in Middle East and Africa Stroke Diagnostics Market?

- In August 2025, Cleveland Clinic Abu Dhabi introduced the Artisse Intrasaccular Flow Modulator for neurovascular treatment, marking the first deployment of this advanced stroke‑related device in the MENA region to support safer, minimally invasive interventions for complex cerebrovascular conditions

- In June 2025, Siemens Healthineers unveiled next‑generation imaging technology at Africa Health Excon, including AI‑powered photon‑counting CT and mobile CT solutions that support high‑precision diagnostics directly in clinical and critical care environments across Egypt and the region

- In June 2025, Philips showcased AI‑enabled CT and advanced imaging solutions (such as the AI‑powered CT 5300 with smart workflows) at Africa Health ExCon in Egypt, aiming to enhance clinical decision‑making, improve patient positioning, and shorten time‑to‑diagnosis in stroke and emergency settings

- In March 2025, the World Stroke Organization and Merz Therapeutics launched the African Educational Initiative to expand acute stroke and rehabilitation services in Nigeria and Tanzania through structured training and capacity building for stroke specialists, aiming to improve diagnostic and care delivery systems

- In October 2024, King Faisal Specialist Hospital & Research Centre (KFSHRC) launched the first‑of‑its‑kind Mobile Stroke Ambulance Unit in the Middle East and North Africa, equipped with on‑board CT imaging and emergency stroke care capabilities to provide diagnoses and treatment directly at patient locations, significantly reducing time to intervention

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.