Middle East And Africa Sorbitol Market

Market Size in USD Million

CAGR :

%

USD

94.33 Million

USD

137.26 Million

2025

2033

USD

94.33 Million

USD

137.26 Million

2025

2033

| 2026 –2033 | |

| USD 94.33 Million | |

| USD 137.26 Million | |

|

|

|

|

What is the Middle East and Africa Sorbitol Market Size and Growth Rate?

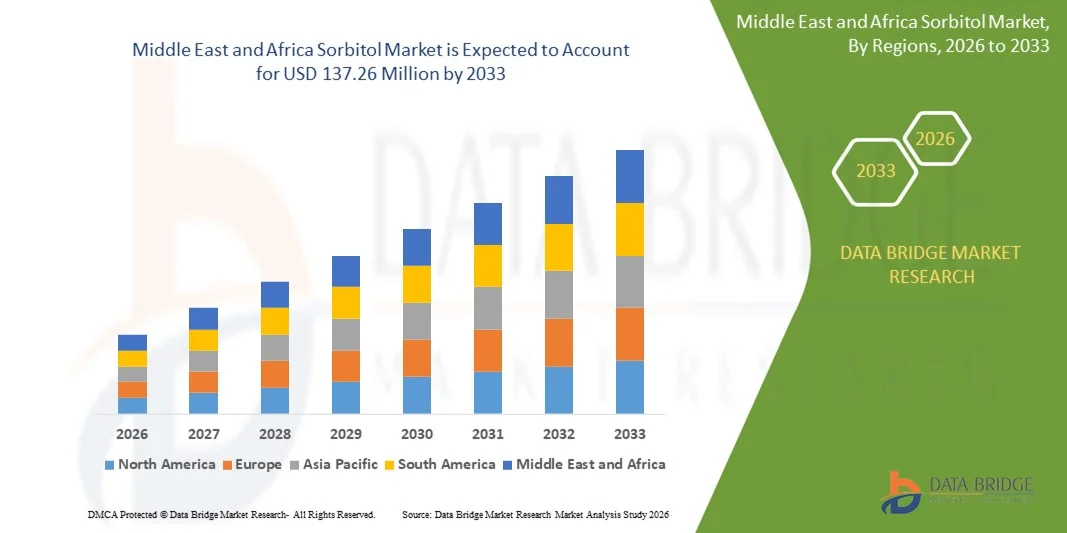

- The Middle East and Africa sorbitol market size was valued at USD 94.33 million in 2025 and is expected to reach USD 137.26 million by 2033, at a CAGR of 4.80% during the forecast period

- The rise in awareness regarding the health benefits of sorbitol and an increase in demand for sugar alternatives such as sorbitol in the various industries will boost the growth of the sorbitol market

What are the Major Takeaways of Sorbitol Market?

- The Increase in demand for low-calorie food among consumers is expected to propel the market growth in the forecast period. The major significant reasons for the restraint of the sorbitol market are ambiguity related to the side effects of sorbitol and fluctuation in raw material supply due to seasonal variation or post-harvest losses

- The fluctuations in prices and supply of sugar and growing demand of sorbitol in the food & beverages industry coupled with growing demand for low-calorie artificial sweetener, acts as an opportunity for the Sorbitol market. Availability of substitute for sorbitol in the market and regulations on sorbitol products acts as challenge for the Sorbitol market growth

- Saudi Arabia dominated the sorbitol market with an estimated 39.64% revenue share in 2025, driven by increasing demand from food & beverages, pharmaceuticals, oral care, and cosmetics industries

- The U.A.E. is projected to register the fastest CAGR of 8.49% from 2026 to 2033 due to high consumption of sugar-free confectionery, cosmetics, and pharmaceutical products

- The Inorganic segment dominated the market with an estimated 72.4% share in 2025, owing to its widespread availability, cost-effectiveness, and extensive use across food, pharmaceutical, and industrial applications

Report Scope and Sorbitol Market Segmentation

|

Attributes |

Sorbitol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sorbitol Market?

Rising Shift Toward Clean-Label, Low-Calorie, and Functional Sorbitol Applications

- The sorbitol market is witnessing growing adoption of low-calorie sweeteners and functional polyols in food, pharmaceutical, and personal care formulations, driven by rising health consciousness

- Manufacturers are expanding application-specific sorbitol grades for sugar-free confectionery, diabetic foods, oral care products, and pharmaceutical excipients

- Increasing demand for clean-label, plant-derived, and non-cariogenic ingredients is accelerating sorbitol usage across global consumer goods industries

- For instance, companies such as Cargill, ADM, Roquette, Ingredion, and Tereos are investing in capacity expansions and sustainable starch-based sorbitol production

- Rising use of sorbitol as a humectant, texturizer, and stabilizer in cosmetics, toothpaste, and skincare formulations further supports market adoption

- As demand for healthier sweetening and multifunctional ingredients grows, Sorbitol will remain a critical input across food, pharma, and personal care value chains

What are the Key Drivers of Sorbitol Market?

- Rising consumption of sugar-free, reduced-calorie, and diabetic-friendly foods and beverages across global markets

- For instance, during 2024–2025, leading producers such as Roquette, Ingredion, and ADM expanded sorbitol output to meet demand from confectionery and pharmaceutical customers

- Growing application of sorbitol as a pharmaceutical excipient in syrups, tablets, and vitamin formulations is driving steady demand

- Expanding use in oral care products, particularly toothpaste and mouthwash, due to its moisture-retention and non-tooth-decay properties

- Increasing demand from the personal care and cosmetics industry for humectants that improve texture, shelf life, and skin hydration

- Supported by urbanization, rising disposable incomes, and health-focused consumer behavior, the Sorbitol market is expected to grow steadily

Which Factor is Challenging the Growth of the Sorbitol Market?

- Volatility in raw material prices, particularly corn and wheat starch, impacts production costs and profit margins

- For instance, during 2024–2025, fluctuations in agricultural commodity prices and energy costs affected sorbitol pricing across several regions

- High competition from alternative sweeteners and polyols such as xylitol, erythritol, and maltitol increases substitution risk

- Regulatory scrutiny related to digestive tolerance limits and labeling requirements can restrict consumption levels in food applications

- Limited awareness in developing regions regarding functional benefits of sorbitol slows market penetration

- To overcome these challenges, companies are focusing on cost optimization, sustainable sourcing, product differentiation, and expanded application development to strengthen global adoption of Sorbitol

How is the Sorbitol Market Segmented?

The market is segmented on the basis of category, form, source, function, and application.

- By Category

On the basis of category, the sorbitol market is segmented into Organic and Inorganic. The Inorganic segment dominated the market with an estimated 72.4% share in 2025, owing to its widespread availability, cost-effectiveness, and extensive use across food, pharmaceutical, and industrial applications. Inorganic sorbitol is commonly used in sugar-free confectionery, oral care products, and pharmaceutical syrups due to consistent quality and scalable production.

The Organic segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer preference for clean-label, plant-based, and certified organic ingredients. Increasing demand for organic dietary supplements, natural personal care products, and premium food formulations is supporting rapid growth. Growing regulatory support for organic food processing and higher willingness to pay for natural ingredients further strengthens the outlook for organic sorbitol.

- By Form

On the basis of form, the market is segmented into Crystallized, Liquid, and Powder. The Liquid segment dominated the market with a 48.6% share in 2025, supported by its ease of handling, high solubility, and extensive use in beverages, pharmaceutical syrups, toothpaste, and cosmetic formulations. Liquid sorbitol enables precise dosing, efficient blending, and improved texture control in end products.

The Powder segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand from dry food mixes, tablets, capsules, and industrial applications requiring longer shelf life and easier transportation. Powdered sorbitol is increasingly preferred in nutraceuticals and solid dosage pharmaceuticals due to stability and formulation flexibility, supporting strong growth momentum.

- By Source

On the basis of source, the sorbitol market is segmented into Corn, Wheat, Rye, and Others. The Corn segment dominated the market with an estimated 64.1% share in 2025, owing to abundant raw material availability, well-established corn wet milling infrastructure, and cost-efficient production processes. Corn-based sorbitol is widely used across food, oral care, and pharmaceutical industries globally.

The Wheat segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by diversification of raw material sourcing, regional agricultural preferences, and increasing demand in Europe. Wheat-derived sorbitol is gaining traction where corn supply volatility or GMO concerns influence sourcing strategies, supporting gradual but steady market expansion.

- By Function

On the basis of function, the market is segmented into Humectant, Sweetener, Bulking Agent, Stabilizer, Softener and Emulsifier, and Others. The Sweetener segment dominated the market with a 41.8% share in 2025, driven by strong demand for low-calorie, sugar-free, and diabetic-friendly food and beverage products. Sorbitol’s low glycemic index and non-cariogenic properties make it a preferred sweetener in confectionery and chewing gum.

The Humectant segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use in oral care, cosmetics, and pharmaceutical formulations. Its moisture-retention properties improve product stability, texture, and shelf life, boosting adoption across personal care and healthcare industries.

- By Application

On the basis of application, the sorbitol market is segmented into Food and Beverages, Animal Feed, Pharmaceuticals, Oral Care, Cosmetics, Industrial Sector, and Others. The Food and Beverages segment dominated the market with a 38.9% share in 2025, driven by rising consumption of sugar-free confectionery, baked goods, and functional foods. Sorbitol is extensively used as a sweetener, bulking agent, and texture enhancer.

The Pharmaceuticals segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing use as an excipient in syrups, tablets, and vitamin formulations. Growing healthcare demand, expanding pharmaceutical manufacturing, and rising preference for non-sugar excipients are accelerating segment growth globally.

Which Region Holds the Largest Share of the Sorbitol Market?

- Saudi Arabia dominated the sorbitol market with an estimated 39.64% revenue share in 2025, driven by increasing demand from food & beverages, pharmaceuticals, oral care, and cosmetics industries. Rising consumption of sugar-free foods, expanding healthcare expenditure, and growing awareness of low-calorie sweeteners are key factors supporting regional demand

- Ongoing industrial diversification, improving food processing capabilities, and growing pharmaceutical manufacturing—particularly in Gulf countries and South Africa—are strengthening the region’s position in the global sorbitol market

- Increasing focus on clean-label ingredients, functional excipients, and preventive healthcare, along with expanding urban populations, continues to accelerate sorbitol adoption across food, healthcare, and industrial applications in the region

U.A.E. Sorbitol Market Insight

The U.A.E. is projected to register the fastest CAGR of 8.49% from 2026 to 2033 due to high consumption of sugar-free confectionery, cosmetics, and pharmaceutical products. A strong import network, advanced retail infrastructure, and rising health awareness support sustained demand for sorbitol-based formulations.

South Africa Sorbitol Market Insight

South Africa contributes significantly, driven by a well-established food and beverage sector, growing pharmaceutical production, and increasing use of sorbitol in oral care and personal care products. Expansion of local processing capabilities continues to support long-term market growth.

Which are the Top Companies in Sorbitol Market?

The sorbitol industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Ingredion Incorporated (U.S.)

- Roquette Frères (France)

- TEREOS (France)

- ADM (U.S.)

- Kasyap (India)

- PT. Ecogreen Oleochemicals (Indonesia)

- Mitsubishi Corporation Life Sciences Limited (Japan)

- Global Sweeteners Holdings Limited (China)

- Qinhuangdao Lihua Starch Co. Ltd. (China)

- Sunar Misir (Turkey)

- The Sukhjit Starch & Chemicals Ltd. (India)

- Gulshan Polyols Ltd. (India)

- MAIZE PRODUCTS (India)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- StartingLine S.p.A. (Italy)

- Zhucheng Dongxiao Biological Technology Co., Ltd. (China)

- Alsiano (Italy)

- Foodchem International Corporation (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Sorbitol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Sorbitol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Sorbitol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.