Market Analysis and Insights : Middle East and Africa Session Initiation Protocol (SIP) Trunking Services Market

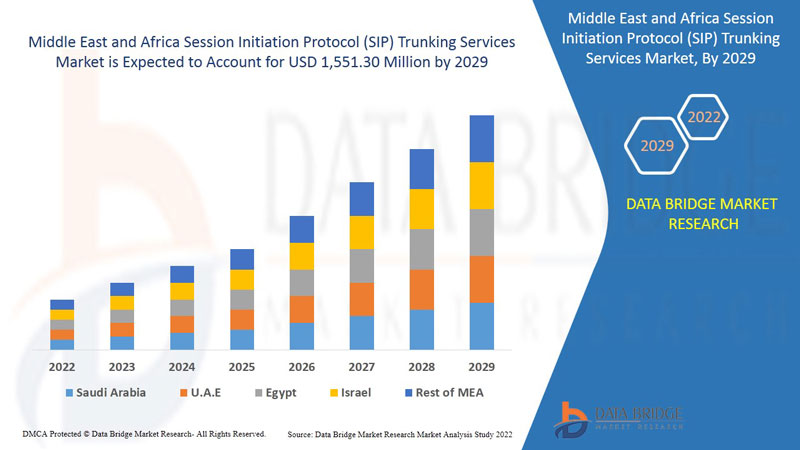

Middle East and Africa session initiation protocol (SIP) trunking services market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 10.3% in the forecast period of 2022 to 2029 and expected to reach USD 1,551.30 million by 2029. Increase in the requirement of quick-decision making process in biotechnology is expected to drive the growth of the market significantly.

The session initiation protocol (SIP) is an application layer protocol that allows the user to use their phone system over an internet connection instead of traditional phone lines. The backbone of phone lines used by various users that connects to a telephone network is referred to as trunking. SIP trunks connect an on-premise phone system to the public switched telephone network, often known as PSTN, via Voice over Internet Protocol (VoIP). For instance, an office may already have a PBX for phone service. SIP trunks give phone service to the entire office, allowing them to communicate with the rest of the world.

SIP trunking is mostly used to replace PRI technology. SIP trunking makes use of VoIP technologies to deliver voice and data. Other data, such as instant messages and video conferencing, is also supported by SIP. Thus, SIP trunking is used for call setup, management, and teardown. It is very flexible, reliable, and quite lightweight solution.

Growing focus on reducing operational cost and improving organizational performance is the major driving factor in the market. Lack of skilled work force and technological expertise can prove to be a challenge however increasing investment by government and investors prove to be an opportunity. The restraint is high cost of installation and maintenance. Also challenges faced due to the impact of Covid-19 on the supply chain of the raw materials are the restraining factors.

The session initiation protocol (SIP) trunking services market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the Session initiation protocol (SIP) trunking services market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Session Initiation Protocol (SIP) Trunking Services Market Scope and Market Size

The Middle East and Africa session initiation protocol (SIP) trunking services market is segmented into four notable segments which are based on the type, organization size, application and vertical.

- On the basis of type, the Middle East and Africa session initiation protocol (SIP) trunking services market is segmented into hosted and on premise. In 2022, on premise segment is expected to dominate the Middle East and Africa session initiation protocol (SIP) trunking services market due to the high demand for this category in large enterprises for better flexibility of operations.

- On the basis of organization size, the Middle East and Africa session initiation protocol (SIP) trunking services market is segmented into large enterprises, and small and medium-sized enterprises (SMEs). In 2022, large enterprises is expected to dominate the Middle East and Africa session initiation protocol (SIP) trunking services market due to high capital availability for implementation of SIP trunking infrastructure.

- On the basis of application, the Middle East and Africa session initiation protocol (SIP) trunking services market has been segmented into voice, video, streaming media, web conferencing, and desktop sharing. In 2022, voice segment is expected to dominate the Middle East and Africa session initiation protocol (SIP) trunking services market due to increasing demand in call centers for customer service.

- On the basis of vertical, the Middle East and Africa session initiation protocol (SIP) trunking services market has been segmented into banking, financial services and insurance, healthcare and life sciences, telecommunication and IT, government and public sector, manufacturing, consumer goods, and retail, media, and entertainment, and others. In 2022, banking, financial services and insurance segment dominates the Middle East and Africa session initiation protocol (SIP) trunking services market due to the high demand for efficient customer interaction channel.

Session Initiation Protocol (SIP) Trunking Services Market Country Level Analysis

The session initiation protocol (SIP) trunking services market is analyzed and market size information is provided by country, type, organization size, application, and vertical as referenced above.

The countries covered in the session initiation protocol (SIP) trunking services market report are the South Africa, Israel, U.A.E., Saudi Arabia, Egypt, Rest of Middle East and Africa. South Africa dominates the Middle East and Africa region as they are demonstrating strong commitment towards the development and implementation of unified communication platforms.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing in the Adoption of Cloud and Unified Communication Solutions is Boosting the Market Growth of Session Initiation Protocol (SIP) Trunking Services Market.

The session initiation protocol (SIP) trunking services market also provides you with detailed market analysis for every country growth in particular market. Additionally, it provides the detail information regarding the market players’ strategy and their geographical presence. The data is available for historic period 2011 to 2020.

Competitive Landscape and Session Initiation Protocol (SIP) Trunking Services Market Share Analysis

Session initiation protocol (SIP) trunking services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to session initiation protocol (SIP) trunking services market.

Some of the major players operating in the Middle East and Africa session initiation protocol (SIP) trunking services market are 3CX, 8X8, Inc., BT, Fusion Incorporated, GTT Communications, Inc., Mitel Networks Corp., ORANGE, Rogers Communications, TELSTRA, TWILIO Inc., Verizon, Vonage, IBM Corporation among others.

Many new product developments, business expansions, contracts and agreements are also initiated by the companies’ worldwide which are also accelerating the session initiation protocol (SIP) trunking services market.

For instance,

- In December 2021, Vonage had accelerate their digital transformation with online sales system provider bellFace’s video call solution. This had further enable companies sales and support systems to maximize sales results and productivity with this advance analytics platform.

- In November 2021, Fusion Connect, Inc. had expanded service guarantee covering voice and data services, including Unified Communications (UCaaS) and SD-WAN. This had further helped the company to enhance its service portfolio in the premium market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 THE MARKET CHALLENGE MATRIX

2.9 MULTIVARIATE MODELING

2.1 TYPE TIMELINE CURVE

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDY

4.1.1 3CX

4.1.2 FUSION CONNECT, INC.

4.1.3 BT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROW IN FOCUS ON REDUCING OPERATIONAL COST AND IMPROVING ORGANIZATIONAL PERFORMANCE

5.1.2 INCREASE IN PENETRATION OF INTERNET SERVICES

5.1.3 INCREASE IN DEMAND FOR PROCUREMENT OUTSOURCING SERVICES IN THE RETAIL SECTORS

5.1.4 INCREASE IN THE ADOPTION OF CLOUD AND UNIFIED COMMUNICATIONS SOLUTION

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE

5.2.2 CONCERNS OVER SECURITY AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 INCREASE IN INVESTMENTS BY GOVERNMENT AND INVESTORS

5.3.3 GROW IN MARKET POTENTIAL FOR SMALL & MEDIUM BUSINESSES

5.4 CHALLENGES

5.4.1 LACK OF SKILLED WORKFORCE AND TECHNOLOGICAL EXPERTISE

5.4.2 REQUIREMENT OF HIGH BANDWIDTH

6 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE

6.1 OVERVIEW

6.2 ON PREMISE

6.3 HOSTED

7 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISES

7.3 SMALL & MID-SIZED ENTERPRISES (SMES)

8 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 VOICE

8.3 VIDEO

8.4 WEB CONFERENCING

8.5 STREAMING MEDIA

8.6 DESKTOP SHARING

9 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL

9.1 OVERVIEW

9.2 BANKING FINANCIAL SERVICES AND INSURANCE

9.3 TELECOMMUNICATIONS AND IT

9.4 CONSUMER GOODS AND RETAIL

9.5 MEDIA AND ENTERTAINMENT

9.6 HEALTHCARE AND LIFE SCIENCES

9.7 GOVERNMENT AND PUBLIC SECTOR

9.8 MANUFACTURING

9.9 OTHERS

10 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION

10.1 MIDDLE EAST & AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 U.A.E.

10.1.4 ISRAEL

10.1.5 EGYPT

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CENTURYLINK

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSSI

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 BT

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSSI

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 8X8, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSSI

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ORANGE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSSI

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENT

13.5 VERIZON

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSSI

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 3CX

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 COLT TECHNOLOGY SERVICES GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 FUSION CONNECT, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 GTT COMMUNICATIONS, INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 TECHNOLOGY PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 IBM CORPORATION

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 TECHNOLOGY PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 INTELEPEER CLOUD COMMUNICATIONS LLC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 INTRADO

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MITEL NETWORKS CORP

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 NET2PHONE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 NEXTIVA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 ROGERS COMMUNICATIONS INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 TELSTRA

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 TWILIO INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 VONAGE

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 VOYANT COMMUNICATIONS

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ON PREMISE IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA HOSTED IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA LARGE ENTERPRISES IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SMALL & MID-SIZED ENTERPRISES (SMES) IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA VOICE IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA VIDEO IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA WEB CONFERENCING IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA STREAMING MEDIA IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA DESKTOP SHARING IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA BANKING FINANCIAL SERVICES AND INSURANCE IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA TELECOMMUNICATIONS AND IT IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CONSUMER GOODS AND RETAIL IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA MEDIA AND ENTERTAINMENT IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HEALTHCARE AND LIFE SCIENCES IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA GOVERNMENT AND PUBLIC SECTOR IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MANUFACTURING IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY CORRECTED, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA OTHERS IN SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 27 SOUTH AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 SOUTH AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 SOUTH AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 31 SAUDI ARABIA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 SAUDI ARABIA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 33 SAUDI ARABIA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 SAUDI ARABIA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 35 U.A.E. SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.A.E. SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 37 U.A.E. SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 U.A.E. SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 39 ISRAEL SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ISRAEL SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 ISRAEL SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 ISRAEL SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 43 EGYPT SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EGYPT SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 45 EGYPT SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 EGYPT SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 47 REST OF MIDDLE EAST AND AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: SEGMENTATION

FIGURE 11 GROWING FOCUS ON REDUCING OPERATIONAL COST AND IMPROVING ORGANIZATIONAL PERFORMANCE IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET FROM 2022 TO 2029

FIGURE 12 ON-PREMISE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA TO HOLD THE LARGEST SHARE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET DURING THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET

FIGURE 15 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 17 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY APPLICATION, 2021

FIGURE 18 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY VERTICAL, 2021

FIGURE 19 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: BY TYPE (2022-2029)

FIGURE 24 MIDDLE EAST & AFRICA SESSION INITIATION PROTOCOL (SIP) TRUNKING SERVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.