Middle East and Africa Silicon Carbide Wafers Market, By Wafer Size (2 Inch, 4 Inch, 6-Inch and Above), Device (SiC Discrete Devices, SiC Bare Die), Application (Power Grid Device, RF Device & Cellular Base Station, Flexible AC Transmission Systems, High-Voltage, Direct Current, Electronic Combat System, Lighting Control, Power Supply and Inverter, Industrial Motor Drive, EV Charging, EV Motor Drive, Solar Energy, Wind Energy, Flame Detector, Others), Industry (Telecommunication, Energy & Power, Power Electronics, Automotive, Renewable Power Generation, Defense, Others), Country (South Africa, Saudi Arabia, U.A.E., Egypt, Israel and Rest of Middle East), Industry Trends and Forecast to 2029.

Market Analysis and Insights: Middle East and Africa Silicon Carbide Wafers Market

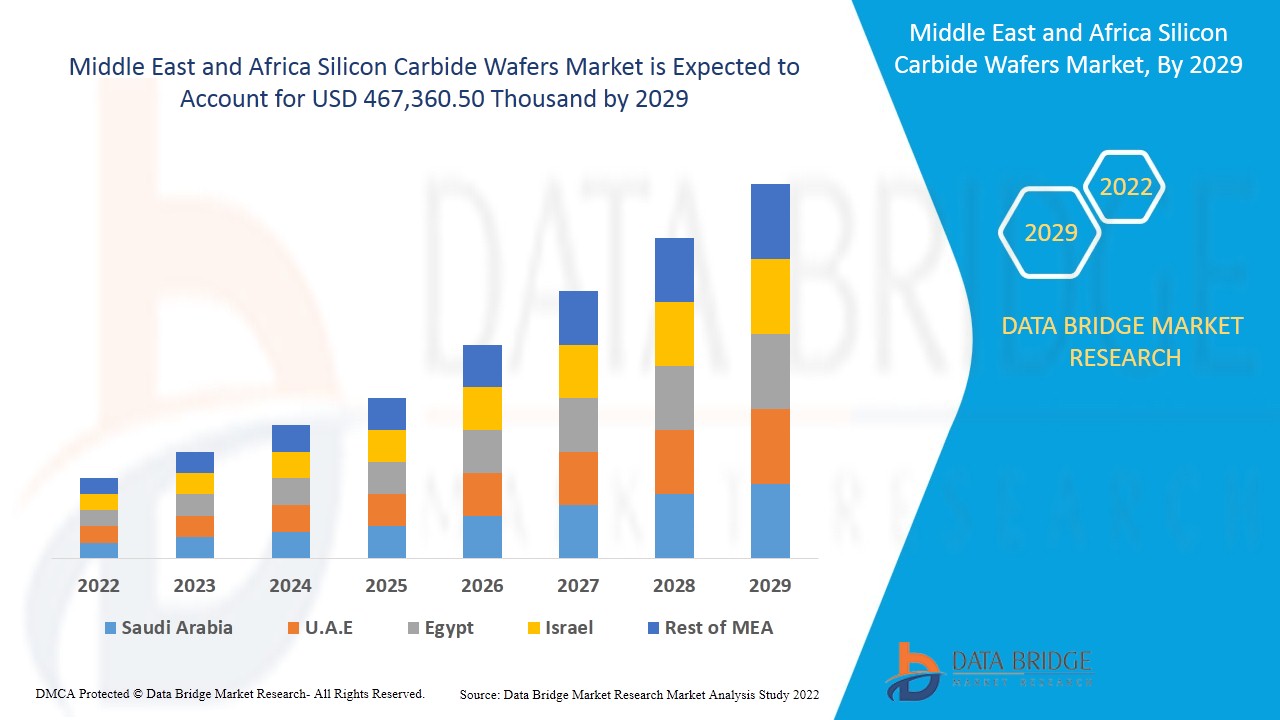

Middle East and Africa silicon carbide wafers market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 20.9% in the forecast period of 2022 to 2029 and is expected to reach USD 467,360.50 thousand by 2029.

Silicon carbide wafers refer to the type of semiconductor that contains carbon and silicon, which operates at very high voltage and temperature. Silicon carbide wafers can be used in producing a strong as well as a very hard material. Silicon carbide wafers can be implemented in various sectors such as telecommunication, energy & power, automotive, renewable power generation, and in different other areas. They are basically considered due to higher maximum thermal conductive properties that have widened the area of application. Silicon carbide wafers are the devices that are considered being high-frequency power devices that are majorly applicable in wireless communications.

The major factors that are expected to drive the growth of the silicon carbide wafers market are increasing usage of power electronics and shifting towards renewable energy generation, fuelling demand for silicon carbide wafers products. On the other hand, the release of poisonous gases during production may act as a major restraint for the silicon carbide wafers market. Increasing demand for silicon carbide for EV power electronics is expected to create opportunities for the growth of the market. However, a shift towards gallium nitride wafers in semiconductor applications may act as a major challenge for the growth of the market.

This Middle East and Africa silicon carbide wafers market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Silicon Carbide Wafers Market Scope and Market Size

Middle East and Africa silicon carbide wafers market is segmented into four notable segments based on wafer size, device, applications and industry.

- On the basis of wafer size, the Middle East and Africa silicon carbide wafers market is segmented into 2 inch, 4 inch, and 6-inch and above. In 2022, the 4 inch segment is expected to dominate the market as SiC is being widely used for high power monolithic microwave integrated circuit applications, and 4 inch wafers are extensively used for the fabrication of very high-voltage and high-power devices such as diodes, power transistors, among others.

- On the basis of device, the Middle East and Africa silicon carbide wafers market is segmented into SiC discrete devices and SiC bare die. In 2022, SiC discrete devices segment is expected to dominate the market as these the fabrication of very high-voltage and high-power devices such as diodes, power transistors.

- On the basis of application, the Middle East and Africa silicon carbide wafers market is segmented into power grid device, industrial motor drive, EV motor drive, RF device & cellular base station, solar energy, wind energy, flexible AC transmission systems, high-voltage, direct current, electronic combat system, lighting control, EV charging, power supply and inverter, flame detector, and others. In 2022, the power grid device segment is expected to dominate the market as the region has witnessed high investments in smart grids and flexible power grids.

- On the basis of industry, the Middle East and Africa silicon carbide wafers market is segmented into telecommunication, energy & power, renewable power generation, automotive, power electronics, defense, and others. In 2022, the telecommunication segment is expected to dominate the market as this industry has attracted huge investments in power electronics to develop the entertainment, news, social connectivity, and e-commerce sectors.

Middle East and Africa Silicon Carbide Wafers Market Country Level Analysis

Middle East and Africa silicon carbide wafers market is segmented into four notable segments based on wafer size, device, applications and industry.

The countries covered in the Middle East and Africa silicon carbide wafers market report are South Africa, Saudi Arabia, U.A.E, Egypt, Israel, the rest of the Middle East and Africa.

Saudi Arabia is expected to dominate the market in the Middle East and Africa region due to the increasing usage of power electronics and the rise in the application of silicon carbide wafers in the semiconductor industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand for Silicon Carbide Wafers

The Middle East and Africa silicon carbide wafers market also provides you with detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development in silicon carbide wafers, and changes in regulatory scenarios with their support for the Silicon carbide wafers market. The data is available for the historical period 2011 to 2020.

Competitive Landscape and the Middle East and Africa Silicon Carbide Wafers Market Share Analysis

Middle East and Africa Silicon carbide wafers market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Middle East and Africa silicon carbide wafers market.

Some of the major players operating in the report are silicon carbide wafers market are Entegris, Fuji Electric Co., Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, MTI Corporation, PI-KEM Limited, Renesas Electronics Corporation, Robert Bosch GmbH, SEMIKRON, STMicroelectronics, Texas Instruments Incorporated and TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of the Middle East and Africa silicon carbide wafers market.

For instance,

- In December 2021, Entegris announced the acquisition of CMC Materials, a supplier of advanced materials primarily for the semiconductor industry. With this, the company aims to broaden its solutions set, creating a comprehensive electronic materials offering. This enabled the company to complement its technology platforms to bring a broader range of innovative solutions to market. These enhanced materials and processes helped customers improve productivity, performance, and total cost of ownership

- In May 2021, Infineon Technologies AG announced the conclusion of a supply contract with the Japanese wafer manufacturer Showa Denko K.K. for an extensive range of silicon carbide material (SiC), including epitaxy. This move came amidst the growing demand for SiC-based products. This enabled the company to secure more base material for the growing demand

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also provides the benefit for the organization to improve their offering for Silicon carbide wafers through an expanded range of sizes.

SKU-