Middle East And Africa Rainscreen Cladding Market

Market Size in USD Million

CAGR :

%

USD

605.02 Million

USD

842.69 Million

2024

2032

USD

605.02 Million

USD

842.69 Million

2024

2032

| 2025 –2032 | |

| USD 605.02 Million | |

| USD 842.69 Million | |

|

|

|

Rainscreen Cladding Market Analysis

The growth of the rainscreen cladding market is primarily driven by several key factors. One significant driver is the increasing need to address changing and unpredictable weather conditions, which has led to a higher demand for rainscreen cladding systems as they provide enhanced protection against moisture, wind, and other environmental challenges. In addition, the rising number of refurbishment projects for large multi-story buildings and multifamily housing developments has further fueled the adoption of these systems, as they offer improved aesthetics, thermal performance, and durability. However, the market faces a notable challenge in the form of high installation and replacement costs, which can act as a restraint, particularly for budget-sensitive projects or regions with limited investment capacity. Despite these challenges, the market continues to grow due to the increasing emphasis on sustainable and energy-efficient building solutions.

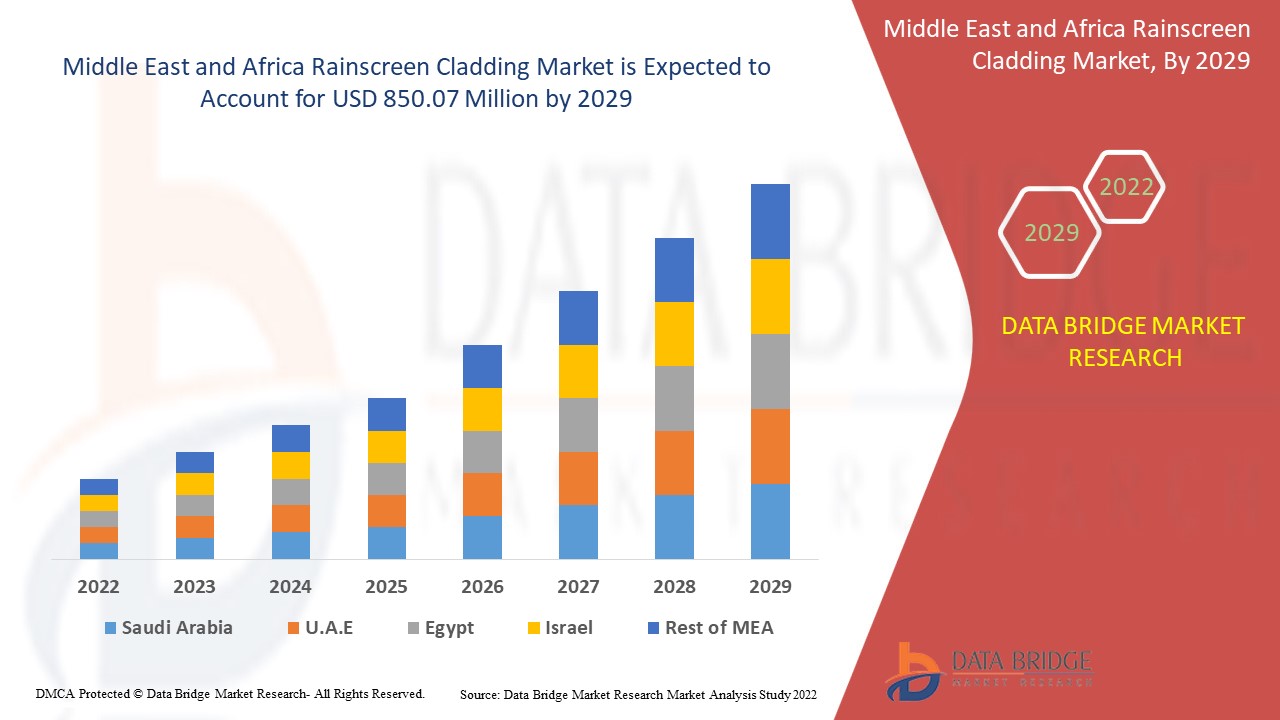

Rainscreen Cladding Market Size

The Middle East and Africa rainscreen cladding market is expected to reach USD 842.69 million by 2032 from USD 605.02 million in 2024, growing with a substantial CAGR of 4.4% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Rainscreen Cladding Market Trends

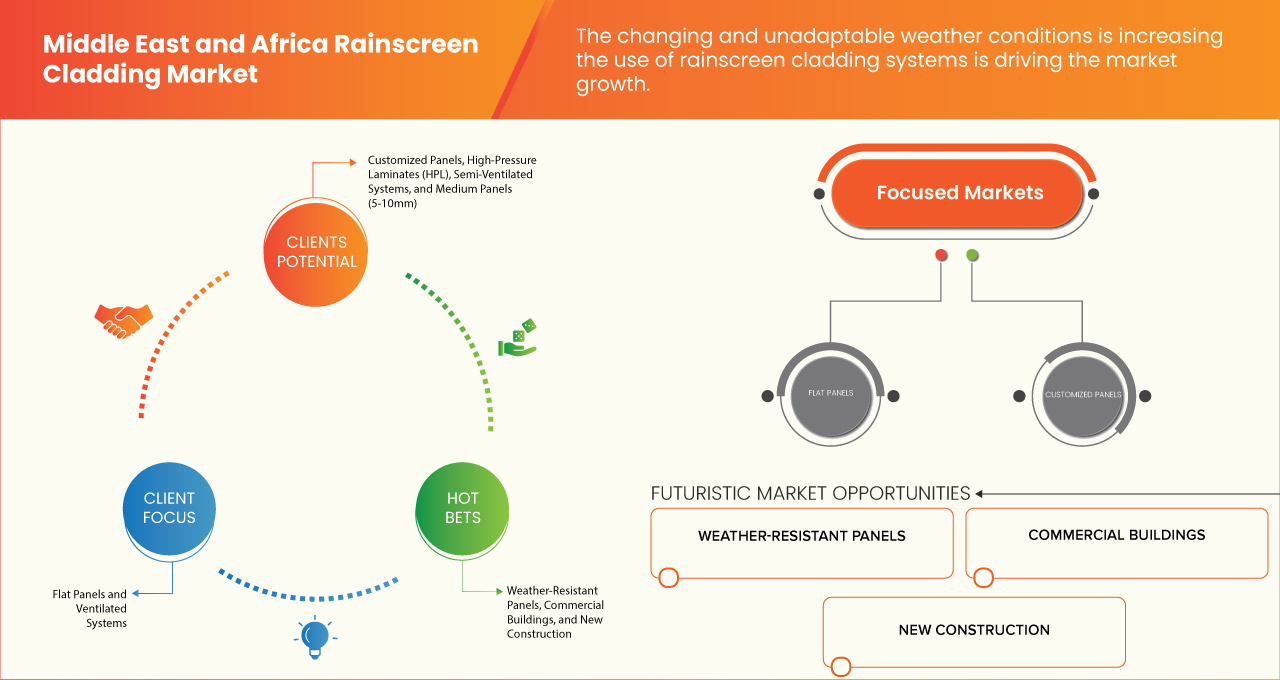

“The Changing and Unadaptable Weather Conditions is Increasing the Use of Rainscreen Cladding Systems”

With diverse climatic challenges ranging from extreme heat and dust storms to high humidity and heavy rainfall, the region's building infrastructure is increasingly at risk of damage from the elements. This changing weather pattern is a key trend behind the adoption of rainscreen cladding systems, which offer effective solutions for mitigating weather-related building issues. In the Middle East, where temperatures frequently soar above 40°C during the summer months, buildings face intense thermal stresses. The region also experiences frequent dust storms, which can lead to abrasive damage to facades, while occasional rainfall can result in water penetration and structural degradation. Rainscreen cladding systems, which create a ventilated air gap between the building's outer layer and the structural wall, help to address these challenges by improving moisture drainage, reducing thermal heat transfer, and providing better protection against environmental elements. This makes them highly suitable for regions with extreme heat and unpredictable weather conditions.

Similarly, in parts of Africa, particularly coastal areas where humidity, rain, and salt-laden air are common, building facades are prone to corrosion, mold, and moisture damage. Rainscreen cladding systems serve as an effective barrier against these environmental risks by preventing water ingress and reducing the potential for mold growth and material degradation. This growing trend of the protective benefits of rainscreen systems is further driving their adoption in both residential and commercial construction projects.

Report Scope and Rainscreen Cladding Market Segmentation

|

Attributes |

Rainscreen Cladding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Kuwait, Bahrain, and Rest of Middle East and Africa |

|

Key Market Players |

Danpal (U.S.), BEMO SYSTEMS GmbH (Germany), Middle East Insulation LLC. (U.A.E.), Alubond U.S.A. (U.A.E.), Kingspan Group (Ireland), Al Dhahyan Aluminum Panels Factory (Saudi Arabia), Spanwall (Ireland), Zamil Architectural Industries (ZAI) (Saudi Arabia), Facade Fyziks FZ-LLC (U.A.E.), and Al Abbar Group (U.A.E.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rainscreen Cladding Market Definition

Rainscreen cladding is an exterior cladding system designed to protect buildings from rain and weather while enhancing aesthetics. It consists of an outer layer, which deflects rain, and an inner layer that provides insulation and allows ventilation. The system creates a cavity between the cladding and the building’s structure to manage moisture and prevent water ingress. Widely used in modern construction, it offers durability, energy efficiency, and a visually appealing facade.

Rainscreen Cladding Market Dynamics

Drivers

- Growing Demand of Green Buildings to Boost Rainscreen Cladding

With increasing awareness about sustainability, energy efficiency, and environmental impact, both government policies and consumer preferences are shifting toward green building solutions. As a result, the adoption of rainscreen cladding systems is gaining momentum, particularly in eco-conscious construction projects. Rainscreen cladding systems offer several benefits that align with the principles of green building practices. These systems improve the energy efficiency of buildings by providing an additional layer of insulation and creating an air cavity that reduces the transfer of heat. This is particularly important in the MEA region, where extreme weather conditions, such as high temperatures and intense sunlight, place considerable strain on building cooling systems. By minimizing energy consumption, rainscreen cladding contributes to reducing carbon emissions and lowering the overall environmental footprint of buildings.

For instance,

In December 2022, according to an article published by Middle East Architect, Desert INK, a sustainable landscape architecture firm based in Dubai Design District, is pioneering context-driven designs in the Middle East. Known for projects like the EXPO 2020 Sustainability Pavilion, they focus on xerophytic landscapes, using native plants and local materials to create environmentally friendly, cost-effective designs suitable for regional climates.

- Stringent Regulations to Reduce Carbon Footprints in Buildings

With increasing awareness of climate change and the urgent need to reduce carbon emissions, governments in the MEA region are implementing stricter building codes and regulations that encourage energy-efficient construction practices. These regulations are forcing the construction industry to adopt sustainable building materials and technologies, with rainscreen cladding systems emerging as a key solution.

Rainscreen cladding systems play a crucial role in reducing a building's carbon footprint. By enhancing thermal insulation, rainscreen cladding helps regulate indoor temperatures, reducing the need for energy-intensive heating and cooling systems. This not only lowers a building's energy consumption but also minimizes greenhouse gas emissions, making it an attractive option for complying with evolving building regulations aimed at carbon reduction. As regulations become more stringent, building owners and developers are increasingly incorporating energy-efficient systems like rainscreen cladding to meet these demands.

For instance,

In August 2022, according to an article published by Elsevier B.V., This paper reviews research on managing carbon emissions in the construction industry, focusing on green building, rating systems, and sustainable materials. It highlights the insufficient exploration of interconnected drivers for low-carbon construction and calls for an internationally recognized UN-led rating system incorporating carbon footprint measurement.

Opportunities

- Increase in Demand for Fiber Cement in Cladding Systems

Fiber cement offers a range of benefits, including durability, fire resistance, and low maintenance, which make it an attractive option for both new construction and refurbishment projects across the region. As the construction industry in MEA continues to expand, especially with large-scale residential, commercial, and multi-story building developments, the need for versatile, sustainable, and cost-effective building materials is more pronounced. Fiber cement, which is known for its strength and weather resistance, is ideal for withstanding the harsh and often extreme weather conditions typical of the region, including high temperatures, humidity, and sandstorms.

Moreover, fiber cement's low maintenance requirements make it a compelling choice for building owners and developers seeking long-term cost savings. This material does not warp, crack, or rot as wood does, and it is resistant to fire, mold, and pests. These characteristics align with the growing focus on sustainability in the construction sector, as fiber cement is a more environmentally friendly alternative to other traditional cladding materials like wood or PVC.

For instance,

In December 2021, according to an article published by archdaily, Three recent Dubai-based projects highlight the growing use of fiber cement cladding. The Mirdiff Hospital project utilized Equitone fiber cement for its aesthetics and functionality, overcoming design challenges. Similarly, the One Square and Bank Head Office projects also incorporated fiber cement for durable, aesthetically pleasing facades, meeting design and structural needs.

- Customized Rainscreen Cladding are Gaining More Traction and have Limited Supply

As architects and developers seek unique, aesthetically pleasing, and highly functional designs for their projects, the ability to offer tailored rainscreen cladding solutions has become an attractive differentiator in the market. Customized rainscreen cladding systems allow for greater design flexibility, enabling architects to integrate different materials, finishes, and color schemes to meet specific aesthetic and functional requirements. These systems offer enhanced versatility, allowing buildings to reflect a brand’s identity, local culture, and environmental considerations. The demand for such bespoke solutions is especially high in high-profile commercial projects, luxury residential buildings, and multi-story developments in the MEA region, where visual appeal and structural performance are key priorities.

For instance,

In May 2022, according to an article published by Cladding Concepts International, customized Rainscreen facades are gaining popularity for their durability, energy efficiency, and aesthetic flexibility. Offering architects creative freedom, these systems protect buildings from rain while enhancing thermal and acoustic performance.

Restraints/Challenges

- Improper Handling During Inventory Management at Manufacturing Plant can Leads to High Losses and Damage of Products

This issue is especially relevant in the Middle East and Africa (MEA) region, where climate conditions, such as high temperatures and humidity, can exacerbate the risk of product degradation. The inefficiencies in inventory management often result from poor storage practices, lack of proper handling training, and inadequate tracking systems. For instance, products like rainscreen cladding, which are often made from delicate or high-value materials such as aluminum, fiber cement, or natural stone, require careful handling to prevent damage. Without proper inventory control, these materials may be exposed to harmful environmental factors, such as moisture or direct sunlight, which can cause rust, discoloration, or warping. Additionally, improper storage can lead to misplacement, loss of materials, or even theft. When products are not stored in the right conditions or organized effectively, manufacturers face delays and increased operational costs due to the need to replace damaged or lost stock. This disrupts the supply chain and affects project timelines, causing significant financial losses.

For instance,

In March 2023, according to an article published by NewStream Enterprises, LLC., The construction industry continues to face challenges from supply chain disruptions. Issues such as material shortages, high prices, and skilled labor shortages have led to increased project costs. Businesses are adapting by sourcing materials early, making substitutions, and addressing labor gaps to stay on track.

- High Damage During Transportation Leads to Revenue Flush of Manufacturers

In regions such as the Middle East and Africa (MEA), where harsh weather conditions and long transportation routes are common, the risk of damage to products during transit increases significantly, leading to financial losses for manufacturers. Materials such as rainscreen cladding, which can be made from delicate substances such as glass, metal, or fiber cement, require specialized handling and protection during transportation. Without proper packaging, secure loading techniques, or climate-controlled vehicles, these materials are prone to breaking, scratching, or warping, which compromises their quality and usability.

Damage during transportation directly impacts revenue in multiple ways. First, manufacturers face the cost of replacing damaged products, which leads to increased operational expenses. Second, delays caused by damaged goods can disrupt project timelines, resulting in penalties or missed deadlines for contractors and clients. Additionally, damaged products may affect customer satisfaction and erode the manufacturer's reputation, leading to lost future business opportunities.

For instance,

According to a blog published by ITAakash StrategicERP Soft (P) Ltd., Material management is a critical aspect of construction projects, influencing cost control, project timelines, and quality. Challenges include inaccurate inventory tracking, poor supplier coordination, material wastage, inefficient handling, and inadequate storage.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are considered in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

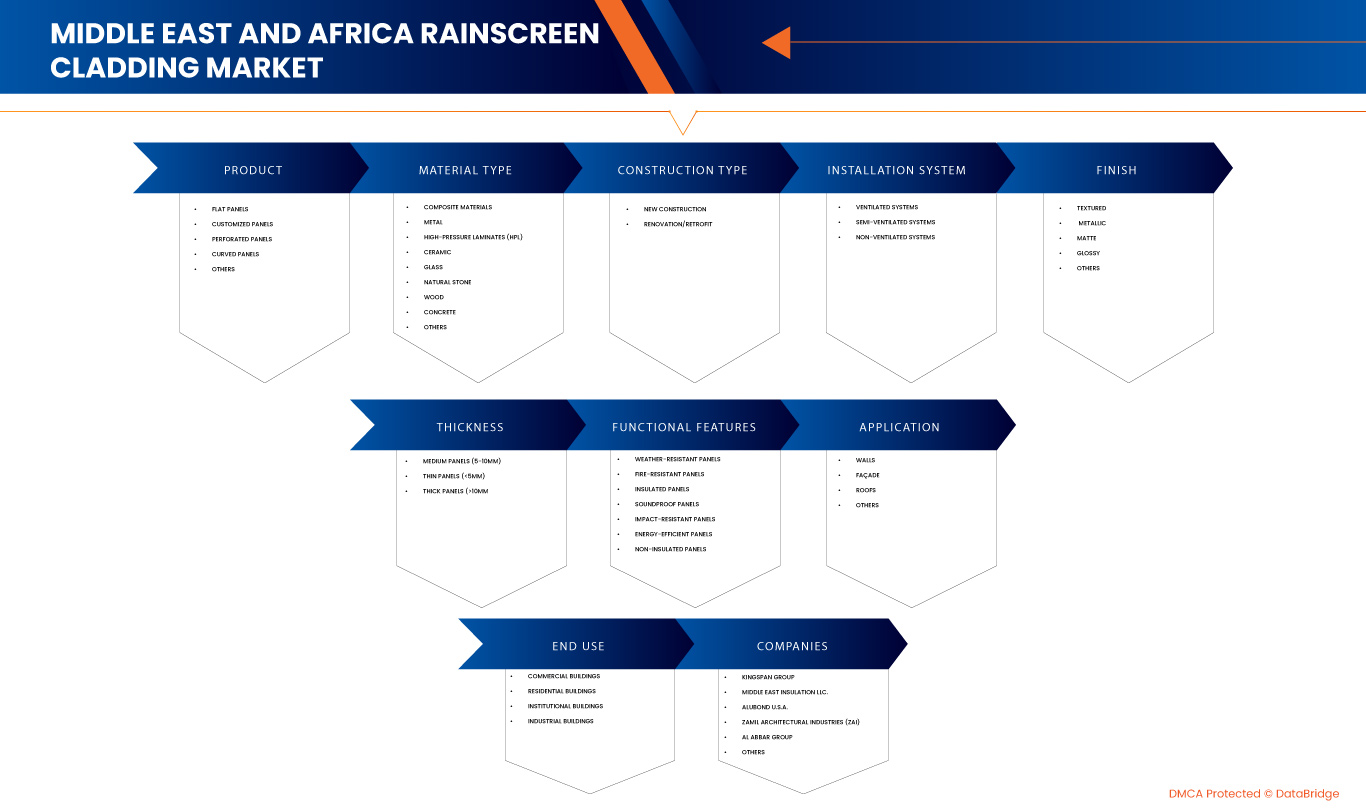

Industrial Machine Vision Market Scope

The market is segmented on the basis of product, material type, construction type, installation system, finish, thickness, functional features, application and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Flat Panels

- Customized Panels

- Perforated Panels

- Curved Panels

- Others

Material Type

- Composite Materials

- By Type

- Aluminum Composite Panels (ACP)

- Fiber Reinforced Plastics (FRP)

- Others

- By Type

- Metal

- By Type

- Aluminum

- Steel

- Zinc

- Copper

- Others

- By Type

- High-Pressure Laminates (HPL)

- Ceramic

- By Type

- Terracotta

- Porcelain

- Others

- By Type

- Glass

- Natural Stone

- Wood

- Concrete

- Others

Construction Type

- New Construction

- Renovation/Retrofit

Installation System

- Ventilated Systems

- Semi-Ventilated Systems

- Non-Ventilated Systems

Finish

- Textured

- Metallic

- Matte

- Glossy

- Others

Thickness

- Medium Panels (5-10mm)

- Thin Panels (<5mm)

- Thick Panels (>10mm)

Functional Features

- Weather-Resistant Panels

- Fire-Resistant Panels

- Insulated Panels

- Soundproof Panels

- Impact-Resistant Panels

- Energy-Efficient Panels

- Non-Insulated Panels

Application

- Walls

- Façade

- Roofs

- Others

End Use

- Commercial Buildings

- By Building Type

- Office Spaces

- Retail Centers

- Hospitality (Hotels and Resorts)

- Others

- By Construction Type

- New Construction

- Renovation/Retrofit

- By Application

- Walls

- Façade

- Roofs

- Others

- By Building Type

- Residential Buildings

- By Building Type

- High-Rise Apartments

- Villas

- Others

- By Construction Type

- New Construction

- Renovation/Retrofit

- By Application

- Walls

- Façade

- Roofs

- Others

- By Building Type

- Institutional Buildings

- By Building Type

- Educational Institutions

- Healthcare Facilities

- Government Buildings

- Others

- By Construction Type

- New Construction

- Renovation/Retrofit

- By Building Type

- By Application

- Walls

- Façade

- Roofs

- Others

- Industrial Buildings

- By Construction Type

- New Construction

- Renovation/Retrofit

- By Application

- Walls

- Façade

- Roofs

- Others

- By Construction Type

Rainscreen Cladding Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product, material type, construction type, installation system, finish, thickness, functional features, application and end use.

The countries covered in the market are U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Kuwait, Bahrain, and Rest of Middle East and Africa.

The U.A.E. is expected to be the dominant and fastest-growing country in the rainscreen cladding market. With increasing awareness about sustainability, energy efficiency, and environmental impact, both government policies and consumer preferences are shifting toward green building solutions. As a result, the adoption of rainscreen cladding systems is gaining momentum, particularly in eco-conscious construction projects.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rainscreen Cladding Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rainscreen Cladding Market Leaders Operating in the Market Are:

- Danpal (U.S.)

- BEMO SYSTEMS GmbH (Germany)

- Middle East Insulation LLC. (U.A.E.)

- Alubond U.S.A. (U.A.E.)

- Kingspan Group (Ireland)

- Al Dhahyan Aluminum Panels Factory (Saudi Arabia)

- Spanwall (Ireland)

- Zamil Architectural Industries (ZAI) (Saudi Arabia)

- Facade Fyziks FZ-LLC (U.A.E.)

- Al Abbar Group (U.A.E.)

Latest Developments in Rainscreen Cladding Market

- In August 2024, according to an article published by BEMO, specializes in innovative metal façade and roofing solutions. The company emphasizes high-quality, customized systems, delivering sustainable, safe, and durable results while maintaining a commitment to superior health and safety standards, evidenced by multiple RoSPA Gold Awards

- In April 2022, according to an article published by Alubond U.S.A., Alubond U.S.A. has developed the world’s highest fire-rated A1 aluminum composite panel, reducing fire spread in high-rise buildings. With advanced nanotechnology and hybridization, it achieves industry-leading standards in heat release and strength, ensuring safety and innovation in building facades

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 END USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 MIDDLE EAST AND AFRICA VS EGYPT PRICING ANALYSIS

4.5.1 MATERIAL PREFERENCES AND COST DRIVERS

4.5.2 LABOR AND INSTALLATION COSTS

4.5.3 APPLICATION-SPECIFIC TRENDS

4.5.4 CLIMATE ADAPTATION AND PRICING IMPACT

4.5.5 REGULATORY AND ECONOMIC INFLUENCES

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 VENDOR SELECTION CRITERIA

4.7.1 QUALITY AND CONSISTENCY

4.7.2 TECHNICAL EXPERTISE

4.7.3 SUPPLY CHAIN RELIABILITY

4.7.4 COMPLIANCE AND SUSTAINABILITY

4.7.5 COST AND PRICING STRUCTURE

4.7.6 FINANCIAL STABILITY

4.7.7 FLEXIBILITY AND CUSTOMIZATION

4.7.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.2 INDUSTRY RESPONSE

4.8.3 GOVERNMENT’S ROLE

4.8.4 ANALYST RECOMMENDATION

4.9 KEY MANUFACTURERS RAINSCREEN CLADDINGS PRODUCTION CAPACITY

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.11 TECHNOLOGICAL ADVANCEMENTS

4.11.1 ADVANCED MATERIALS AND COMPOSITES

4.11.2 ENERGY EFFICIENCY AND SUSTAINABILITY

4.11.3 SMART CLADDING SYSTEMS

4.11.4 IMPROVED INSTALLATION TECHNIQUES

4.11.5 FIRE-RESISTANT TECHNOLOGIES

4.11.6 3D DESIGN AND CUSTOMIZATION

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE CHANGING AND UNADAPTABLE WEATHER CONDITIONS IS INCREASING THE USE OF RAINSCREEN CLADDING SYSTEMS

6.1.2 INCREASE IN REFURBISHMENT PROJECTS FOR LARGE MULTI-STORY BUILDINGS AND MULTIFAMILY CONSTRUCTION

6.1.3 GROWING DEMAND OF GREEN BUILDINGS TO BOOST RAINSCREEN CLADDING

6.1.4 STRINGENT REGULATIONS TO REDUCE CARBON FOOTPRINTS IN BUILDINGS

6.2 RESTRAINTS

6.2.1 HIGH INSTALLATION COST

6.2.2 HIGH REPLACEMENT COST

6.3 OPPORTNUNITIES

6.3.1 INCREASE IN DEMAND FOR FIBER CEMENT IN CLADDING SYSTEMS

6.3.2 CUSTOMIZED RAINSCREEN CLADDING ARE GAINING MORE TRACTION AND HAVE LIMITED SUPPLY

6.4 CHALLENGES

6.4.1 IMPROPER HANDLING DURING INVENTORY MANAGEMENT AT MANUFACTURING PLANT CAN LEADS TO HIGH LOSSES AND DAMAGE OF PRODUCTS

6.4.2 HIGH DAMAGE DURING TRANSPORTATION LEADS TO REVENUE FLUSH OF MANUFACTURERS

7 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLAT PANELS

7.3 CUSTOMIZED PANELS

7.4 PERFORATED PANELS

7.5 CURVED PANELS

7.6 OTHERS

8 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 COMPOSITE MATERIALS

8.2.1 COMPOSITE MATERIALS, BY TYPE

8.3 METAL

8.3.1 METAL, BY TYPE

8.4 HIGH-PRESSURE LAMINATES (HPL)

8.5 CERAMIC

8.5.1 CERAMIC, BY TYPE

8.6 GLASS

8.7 NATURAL STONE

8.8 WOOD

8.9 CONCRETE

8.1 OTHERS

9 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE

9.1 OVERVIEW

9.2 NEW CONSTRUCTION

9.3 RENOVATION/RETROFIT

10 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM

10.1 OVERVIEW

10.2 VENTILATED SYSTEMS

10.3 SEMI-VENTILATED SYSTEMS

10.4 NON-VENTILATED SYSTEMS

11 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY FINISH

11.1 OVERVIEW

11.2 TEXTURED

11.3 METALLIC

11.4 MATTE

11.5 GLOSSY

11.6 OTHERS

12 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY THICKNESS

12.1 OVERVIEW

12.2 MEDIUM PANELS (5-10MM)

12.3 THIN PANELS (<5MM)

12.4 THICK PANELS (>10MM)

13 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES

13.1 OVERVIEW

13.2 WEATHER-RESISTANT PANELS

13.3 FIRE-RESISTANT PANELS

13.4 INSULATED PANELS

13.5 SOUNDPROOF PANELS

13.6 IMPACT-RESISTANT PANELS

13.7 ENERGY-EFFICIENT PANELS

13.8 NON-INSULATED PANELS

14 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 WALLS

14.3 FAÇADE

14.4 ROOFS

14.5 OTHERS

15 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY END USE

15.1 OVERVIEW

15.2 COMMERCIAL BUILDINGS

15.2.1 COMMERCIAL BUILDINGS, BY BUILDING TYPE

15.2.2 COMMERCIAL BUILDINGS, BY CONSTRUCTION TYPE

15.2.3 COMMERCIAL BUILDINGS, BY APPLICATION

15.3 RESIDENTIAL BUILDINGS

15.3.1 RESIDENTIAL BUILDINGS, BY BUILDING TYPE

15.3.2 RESIDENTIAL BUILDINGS, BY CONSTRUCTION TYPE

15.3.3 RESIDENTIAL BUILDINGS, BY APPLICATION

15.4 INSTITUTIONAL BUILDINGS

15.4.1 INSTITUTIONAL BUILDINGS, BY BUILDING TYPE

15.4.2 INSTITUTIONAL BUILDINGS, BY CONSTRUCTION TYPE

15.4.3 INSTITUTIONAL BUILDINGS, BY APPLICATION

15.5 INDUSTRIAL BUILDINGS

15.5.1 INDUSTRIAL BUILDINGS, BY CONSTRUCTION TYPE

15.5.2 INDUSTRIAL BUILDINGS, BY APPLICATION

16 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY COUNTRY

16.1 MIDDLE EAST AND AFRICA

16.1.1 U.A.E.

16.1.2 SAUDI ARABIA

16.1.3 SOUTH AFRICA

16.1.4 EGYPT

16.1.5 ISRAEL

16.1.6 KUWAIT

16.1.7 BAHRAIN

16.1.8 REST OF MIDDLE EAST AND AFRICA

17 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 KINGSPAN GROUP

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 PRODUCT PORTFOLIO

19.1.4 RECENT DEVELOPMENT

19.2 MIDDLE EAST INSULATION LLC

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 RECENT DEVELOPMENT

19.3 ALUBOND U.S.A.

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 RECENT DEVELOPMENT

19.4 ZAMIL ARCHITECTURAL INDUSTRIES (ZAI)

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 RECENT DEVELOPMENT

19.5 AL ABBAR GROUP

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENT

19.6 AL DAHAYAN ALUMINUM PANEL FACTORY

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 BEMO SYSTEMS GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 DANPAL

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 FACADE FYZIKS FZ-LLC

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 SPANWALL

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 KEY MANUFACTURERS ESTIMATED MIDDLE EAST AND AFRICA RAINSCREEN CLADDINGS PRODUCTION CAPACITY, 2023

TABLE 2 REGULATORY FRAMEWORK

TABLE 3 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 5 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY COUNTRY, 2018-2032 (THOUSAND SQ METER)

TABLE 29 U.A.E. RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 30 U.A.E. RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 31 U.A.E. RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 U.A.E. COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.A.E. METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 U.A.E. CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 U.A.E. RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.A.E. RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 37 U.A.E. RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 38 U.A.E. RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 39 U.A.E. RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 40 U.A.E. RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 U.A.E. RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 42 U.A.E. COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.A.E. COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.A.E. COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 45 U.A.E. RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.A.E. RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.A.E. RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 U.A.E. INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.A.E. INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 U.A.E. INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 U.A.E. INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.A.E. INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 55 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 62 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 63 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 64 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SAUDI ARABIA RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 66 SAUDI ARABIA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 SAUDI ARABIA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 SAUDI ARABIA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 SAUDI ARABIA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SAUDI ARABIA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SAUDI ARABIA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SAUDI ARABIA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 79 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 86 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 87 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 88 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 89 SOUTH AFRICA RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 90 SOUTH AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SOUTH AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 SOUTH AFRICA COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 SOUTH AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SOUTH AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SOUTH AFRICA RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 SOUTH AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH AFRICA INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH AFRICA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH AFRICA INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 EGYPT RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 102 EGYPT RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 103 EGYPT RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 EGYPT COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 EGYPT METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 EGYPT CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 EGYPT RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 EGYPT RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 109 EGYPT RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 110 EGYPT RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 111 EGYPT RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 112 EGYPT RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 EGYPT RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 114 EGYPT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 EGYPT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 EGYPT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 EGYPT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 EGYPT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 EGYPT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 EGYPT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 EGYPT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 EGYPT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 EGYPT INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 EGYPT INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 ISRAEL RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 ISRAEL RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 127 ISRAEL RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 ISRAEL COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 ISRAEL METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 ISRAEL CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 ISRAEL RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 ISRAEL RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 133 ISRAEL RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 134 ISRAEL RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 135 ISRAEL RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 136 ISRAEL RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 ISRAEL RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 138 ISRAEL COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 ISRAEL COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 ISRAEL COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 141 ISRAEL RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 ISRAEL RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 ISRAEL RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 144 ISRAEL INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 ISRAEL INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 ISRAEL INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 147 ISRAEL INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ISRAEL INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 KUWAIT RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 150 KUWAIT RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 151 KUWAIT RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 KUWAIT COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 KUWAIT METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 KUWAIT CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 KUWAIT RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 KUWAIT RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 157 KUWAIT RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 158 KUWAIT RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 159 KUWAIT RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 160 KUWAIT RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 161 KUWAIT RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 162 KUWAIT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 KUWAIT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 KUWAIT COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 165 KUWAIT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 KUWAIT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 KUWAIT RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 KUWAIT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 KUWAIT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 KUWAIT INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 171 KUWAIT INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 KUWAIT INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 173 BAHRAIN RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 BAHRAIN RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

TABLE 175 BAHRAIN RAINSCREEN CLADDING MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 BAHRAIN COMPOSITE MATERIALS IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 BAHRAIN METAL IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 BAHRAIN CERAMIC IN RAINSCREEN CLADDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 BAHRAIN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 BAHRAIN RAINSCREEN CLADDING MARKET, BY INSTALLATION SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 181 BAHRAIN RAINSCREEN CLADDING MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 182 BAHRAIN RAINSCREEN CLADDING MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 183 BAHRAIN RAINSCREEN CLADDING MARKET, BY FUNCTIONAL FEATURES, 2018-2032 (USD THOUSAND)

TABLE 184 BAHRAIN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 BAHRAIN RAINSCREEN CLADDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 186 BAHRAIN COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 BAHRAIN COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 BAHRAIN COMMERCIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 189 BAHRAIN RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 BAHRAIN RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 BAHRAIN RESIDENTIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 192 BAHRAIN INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY BUILDING TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BAHRAIN INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BAHRAIN INSTITUTIONAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 195 BAHRAIN INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BAHRAIN INDUSTRIAL BUILDINGS IN RAINSCREEN CLADDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 197 REST OF MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 198 REST OF MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT, 2018-2032 (THOUSAND SQ METER)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: MIDDLE EAST AND AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: END USE COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: SEGMENTATION

FIGURE 11 MIDDLE EAST AND AFRICA EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 FIVE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET, BY PRODUCT

FIGURE 14 INCREASE IN REFURBISHMENT PROJECTS FOR LARGE MULTI-STORY BUILDINGS AND MULTIFAMILY CONSTRUCTION IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 15 FLAT PANELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET IN 2023 & 2030

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 PRICING ANALYSIS

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET

FIGURE 22 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY PRODUCT, 2024

FIGURE 23 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY MATERIAL TYPE, 2024

FIGURE 24 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY CONSTRUCTION TYPE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY INSTALLATION SYSTEM, 2024

FIGURE 26 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY FINISH, 2024

FIGURE 27 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY THICKNESS, 2024

FIGURE 28 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY FUNCTIONAL FEATURES, 2024

FIGURE 29 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY APPLICATION, 2024

FIGURE 30 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: BY END USE, 2024

FIGURE 31 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: SNAPSHOT (2024)

FIGURE 32 MIDDLE EAST AND AFRICA RAINSCREEN CLADDING MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Rainscreen Cladding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Rainscreen Cladding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Rainscreen Cladding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.