Market Analysis and Insights: Middle East and Africa Processed Meat Market

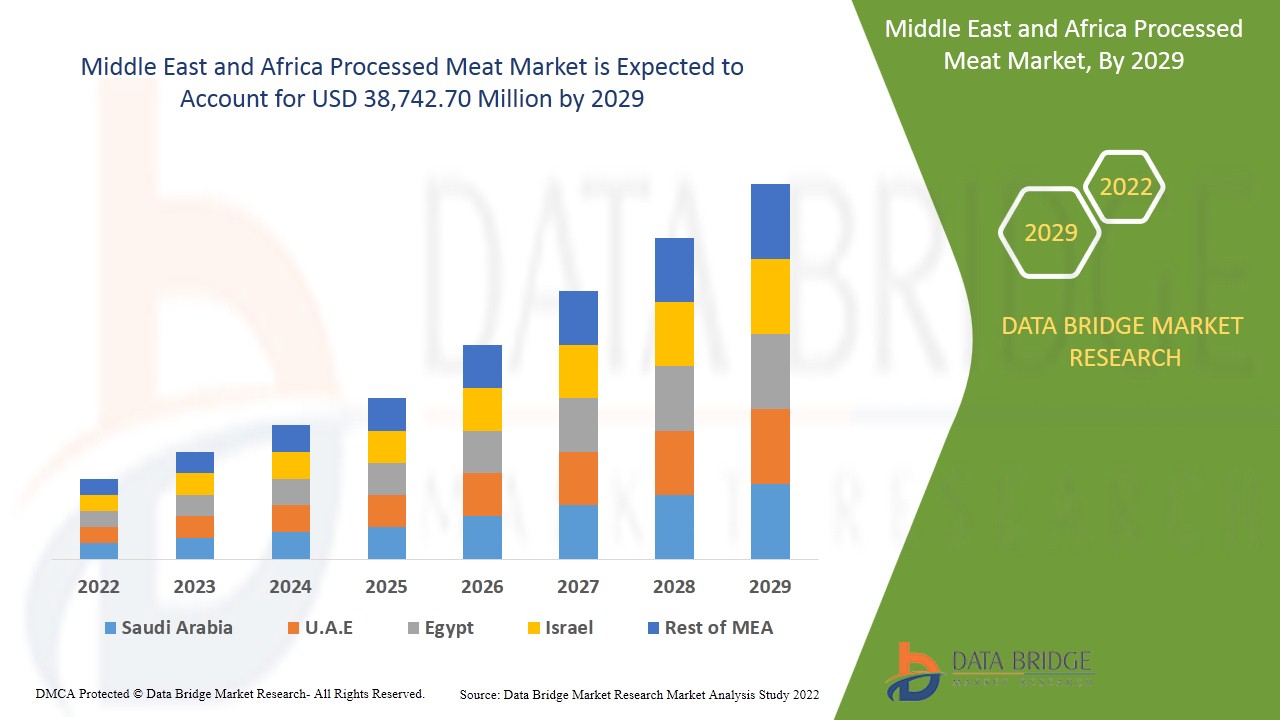

Middle East and Africa processed meat market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.2% in the forecast period of 2022 to 2029 and is expected to reach USD 38,742.70 million by 2029. Increased demand for processed meat in the food and pharmaceutical industries may drive growth in the Middle East and Africa processed meat market.

Processed meat can be defined as meat supplemented with several additives and preservatives such as acidifiers, minerals, salts, and various other seasoning and flavoring agents. The meat is primarily processed to enhance its quality, prevent degeneration, and add flavors to its original composition. It can be red meat or white meat from swine, poultry, cattle, or sea animal meat.

Meat such as beef, pork, turkey, chicken, and lamb are commonly used to produce processed meat. Various processed meat products include pepperoni, jerky, hot dogs, and sausages. Certain preservatives are added to the meat to prevent bacteria and other organisms from spoiling.

Major factors that are expected to boost the growth of the Middle East and Africa processed meat market in the forecast period are the increase in disposable income. Moreover, the decrease in the time taken to cook meat at home because of the hectic lifestyle is estimated further to supplement the growth of the Middle East and Africa processed meat market.

- On the other hand, the rise in the incidences of obesity because of the high consumption of processed meat-based products is projected to impede the growth of the Middle East and Africa processed meat market in the timeline period. In addition, growing fast food and restaurant chains can further provide potential opportunities for the growth of the processed meat market in the coming years. However, the stringent government regulations might further challenge the growth of the Middle East and Africa processed meat market.

The Middle East and Africa processed meat market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the processed meat market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Processed Meat Market Scope and Market Size

Middle East and Africa processed meat market is segmented based on product type, type, category, nature, packaging type, packaging material, end-user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the Middle East and Africa processed meat market is segmented into fresh processed meat, frozen meat, chilled meat, canned meat, dried/semi dried meat, fermented meat, and others. In 2022, the fresh processed meat segment is expected to dominate the market due to the growing demand for fresh processed meat in the region.

- On the basis of product type, the Middle East and Africa processed meat market is segmented into beef, pork, goat, lamb, chicken, turkey, duck, and fish. In 2022, the chicken segment is expected to dominate the market due to the growing demand for chicken in the region.

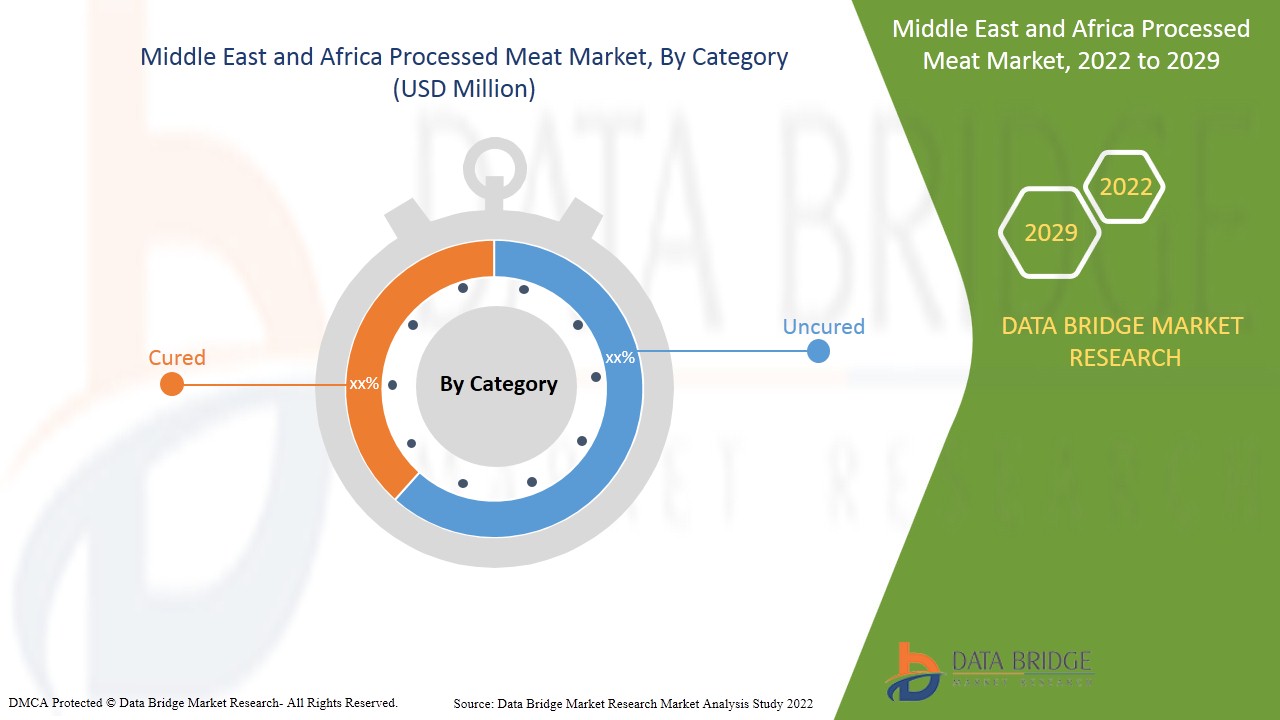

- On the basis of category, the Middle East and Africa processed meat market is segmented into cured and uncured. In 2022, the cured segment is expected to dominate the market as cured meat can be stored for a longer period.

- On the basis of nature, the Middle East and Africa processed meat market is segmented into organic and conventional. In 2022, the conventional segment is expected to dominate the market due to the cheaper availability of conventional meat in the region

- On the basis of packaging type, the Middle East and Africa processed meat market is segmented into trays, pouches, boxes, cannisters, and others. In 2022, the pouches segment is expected to dominate the market due to the low weight of pouches.

- On the basis of packaging material, the Middle East and Africa processed meat market is segmented into plastic, glass, paper/cardboard, metal, and others. In 2022, the plastic segment is expected to dominate the market easy to handle nature of plastic packages.

- On the basis of end-user, the Middle East and Africa processed meat market is segmented into household and food service sector. In 2022, the food service sector segment is expected to dominate the processed meat market due to the growing popularity and wide expansion of various foodservice outlets in the region.

- On the basis of distribution channel, the Middle East and Africa processed meat market is segmented into store based retailers and non-store based retailers. In 2022, the store based retailers segment is expected to dominate the market due to greater availability of meat products in the store based retailers.

Middle East and Africa Processed Meat Market Country Level Analysis

Middle East and Africa processed meat market is segmented based on product type, type, category, nature, packaging type, packaging material, end-user and distribution channel.

The countries covered in the Middle East and Africa processed meat market report are South Africa, U.A.E, Qatar, Saudi Arabia, Kuwait, Oman and Rest of the Middle East and Africa.

South Africa is expected to dominate the Middle East and Africa processed meat market because of the growing popularity of processed meat in the region. Saudi Arabia is projected to dominate the region due to growing urbanization increased consumption of processed meat products.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players is Boosting the Market Growth of Middle East and Africa Processed Meat Market

Middle East and Africa processed meat market also provides you with detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and Middle East and Africa Processed Meat Market Share Analysis

Middle East and Africa processed meat market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Middle East and Africa processed meat market.

Some of the major companies dealing in the Middle East and Africa processed meat market are Cargill, Incorporated, JBS Foods, Tyson Foods, Inc., Smithfield Foods, Inc, Hormel Foods Corporation, NH Foods Ltd., Louis Dreyfus Company, HKScan, Gruppo Veronesi, OSI Group, Charoen Pokphand Foods PCL., The Kraft Heinz Company, among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which also accelerates the Middle East and Africa processed meat market.

For instance,

- In May 2021, Charoen Pokphand Foods PLC (CPF) Launched “MEAT ZERO,” the meat made from plants and manufactured to feel, taste, and appear like real meat. The new product was expected to appeal to health-conscious consumers. The product is affordable and available as ready-to-cook material and a ready-to-eat menu through 7-Eleven and modern trade outlets across Thailand

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player is enhancing the company footprints in the processed meat market, which also provides the benefit for the organization’s profit growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS (VOLUME %)

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.2.1 GROWING UTILIZATION OF NEW TECHNOLOGIES IN MEAT PROCESSING

4.2.2 GROWING COLLABORATIONS AND PARTNERSHIPS

4.2.3 CONSUMER OPTING FOR HEALTHEIR MEAT PRODUCTS WITH DECREASED FAT LEVEL, CHOLESTEROL,

5 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS

6.1.2 PREFERENCE FOR ANIMAL-BASED PROTEINS OVER PLANT-BASED PROTEINS

6.1.3 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.4 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

6.2 RESTRAINTS

6.2.1 HIGH INVESTMENT COST IN POULTRY BUSINESS

6.2.2 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 GROWING FAST FOOD AND RESTAURANT CHAINS

6.3.2 INCREASING AUTOMATION IN MEAT PROCESSING INDUSTRY

6.3.3 GROWING PREFERENCE FOR ORGANIC MEAT

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT REGULATIONS

6.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7 COVID-19 IMPACT ON MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY TYPE

8.1 FRESH PROCESSED MEAT

8.2 FROZEN MEAT

8.3 CHILLED MEAT

8.4 CANNED MEAT

8.5 DRIED/SEMI DRIED MEAT

8.6 FERMENTED MEAT

9 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW:

9.2 BEEF

9.3 PORK

9.4 GOAT

9.5 LAMB

9.6 CHICKEN

9.7 TURKEY

9.8 DUCK

9.9 FISH

10 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PACKAGING TYPE

10.1 TRAYS

10.2 POUCHES

10.3 BOXES

10.4 CANNISTERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY END USER:

11.1 OVERVIEW:

11.2 HOUSEHOLD

11.3 FOOD SERVICE SECTOR

12 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY CATEGORY:

12.1 OVERVIEW:

12.2 CURED

12.3 UNCURED

13 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY NATURE:

13.1 OVERVIEW:

13.2 ORGANIC

13.3 CONVENTIONAL

14 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL

14.1 STORE BASED RETAILER

14.2 NON-STORE BASED RETAILER

15 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SOUTH AFRICA

15.1.2 SAUDI ARABIA

15.1.3 UAE

15.1.4 QATAR

15.1.5 KUWAIT

15.1.6 OMAN

15.1.7 REST OF MIDDLE EAST AND AFRICA

16 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 JBS FOODS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUS ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TYSON FOODS, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VION FOOD GROUP

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CARGILL, INCORPORATED

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 DANISH CROWN A.M.B.A

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CHAROEN POKPHAND FOODS PUBLIC CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 SMITHFIELD FOODS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 TÖNNIES GROUP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HORMEL FOODS CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUS ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 NATIONAL BEEF PACKING COMPANY L.L.C.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GAUSEPOHL FLEISCH DEUTSCHLAND GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GROUPE BIGARD

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GRUPPO VERONESI

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUS ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 HKSCAN

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUS ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KOCH FOODS.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LOUIS DREYFUS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARFRIG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MÜLLER GRUPPE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 NH FOODS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUS ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 OSI GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 PERDUE FARMS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SANDERSON FARMS, INCORPORATED.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TERRENA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THE KRAFT HEINZ COMPANY

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 WESTFLEISCH SCE MBH

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: MIDDLE EAST & AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: DBMR POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA PROCESSED MEAT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS IS DRIVING THE GROWTH OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PROCESSED MEAT MARKET IN 2022 & 2029

FIGURE 13 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA PROCESSED MEAT MARKET

FIGURE 15 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY TYPE (2021)

FIGURE 16 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PRODUCT TYPE (2021)

FIGURE 17 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY PACKAGING TYPE (2021)

FIGURE 18 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY END-USER (2021)

FIGURE 19 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY CATEGORY

FIGURE 20 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY NATURE (2021)

FIGURE 21 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL (2021)

FIGURE 22 MIDDLE EAST & AFRICA SNAPSHOT, 2021

FIGURE 23 MIDDLE EAST & AFRICA SUMMARY, 2021

FIGURE 24 MIDDLE EAST & AFRICA SUMMARY, 2022 & 2029

FIGURE 25 MIDDLE EAST & AFRICA SUMMARY, 2021 & 2029

FIGURE 26 MIDDLE EAST & AFRICA SUMMARY BY PRODUCT, 2022 - 2029

FIGURE 27 MIDDLE EAST & AFRICA PROCESSED MEAT MARKET: COMPANY SHARE 2021 (VOLUME %)

Middle East And Africa Processed Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Processed Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Processed Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.