Middle East And Africa Point Of Care Poc Drug Abuse Testing Market

Market Size in USD Million

CAGR :

%

USD

63.21 Million

USD

81.96 Million

2024

2032

USD

63.21 Million

USD

81.96 Million

2024

2032

| 2025 –2032 | |

| USD 63.21 Million | |

| USD 81.96 Million | |

|

|

|

|

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Size

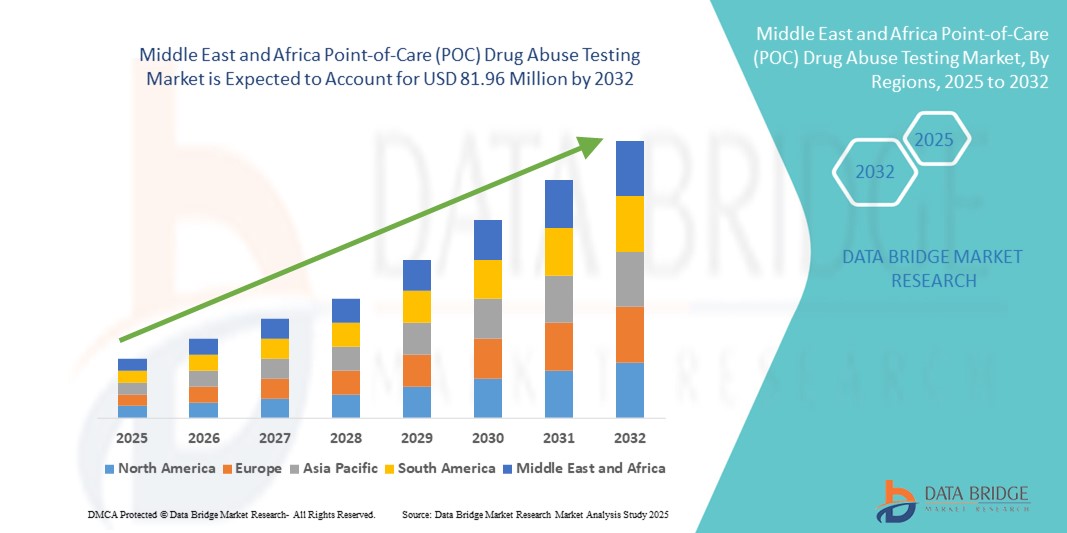

- The Middle East and Africa point-of-care (POC) drug abuse testing market size was valued at USD 63.21 million in 2024 and is expected to reach USD 81.96 million by 2032, at a CAGR of 3.30% during the forecast period

- The market growth is primarily driven by the increasing prevalence of substance abuse and the urgent need for rapid diagnostic solutions across law enforcement, workplaces, and healthcare facilities

- In addition, growing government initiatives to curb drug misuse, along with the rising use of portable and user-friendly testing devices, is establishing POC drug testing as a vital tool for early detection and intervention. These converging factors are driving strong demand across the region, significantly accelerating market expansion

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Analysis

- Point-of-care drug abuse testing, which provides rapid detection of drugs and their metabolites at or near the site of patient care, is increasingly becoming an essential tool across law enforcement, workplace screening, and emergency medical settings in the Middle East and Africa due to its portability, speed, and ease of use

- The growing demand for POC drug abuse testing is primarily driven by rising substance abuse cases, expanding public health initiatives, and a growing emphasis on workplace and traffic safety across key countries such as Saudi Arabia, South Africa, and the United Arab Emirates (UAE)

- Saudi Arabia dominated the Middle East and Africa point-of-care (POC) drug abuse testing market with the largest revenue share of 33.1% in 2024, attributed to increased governmental spending on anti-narcotics programs, frequent roadside drug testing, and mandatory workplace screenings in sensitive sectors such as oil & gas and aviation

- South Africa is expected to be the fastest growing country in the point-of-care (POC) drug abuse testing during the forecast period, due to high prevalence of drug misuse, increased availability of rapid testing kits, and growing integration of POC testing in both public and private healthcare facilities

- Urine segment dominated the point-of-care (POC) drug abuse testing market with a share of 47.1% in 2024, due to its non-invasive nature, cost-effectiveness, and broad acceptance as a reliable method for detecting a wide range of substances

Report Scope and Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Segmentation

|

Attributes |

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Trends

Increasing Deployment of Rapid Testing in Law Enforcement and Workplaces

- A prominent and rapidly advancing trend in the Middle East and Africa POC drug abuse testing market is the expanding use of portable diagnostic kits by law enforcement agencies, emergency responders, and corporate employers. This shift is being driven by the need for rapid, on-site detection of substance use to enable timely intervention and ensure public and workplace safety

- For instance, in South Africa, local police forces and border control units have ramped up the use of saliva-based and urine-based POC tests at roadside checkpoints and ports of entry, enabling swift identification of drug-impaired individuals. Similarly, oil and gas companies in Saudi Arabia and the UAE have adopted on-site screening to comply with zero-tolerance drug policies

- The evolution of POC test kits now includes multi-panel detection formats that allow simultaneous testing for several commonly abused substances, increasing both diagnostic efficiency and cost-effectiveness. Devices from companies such as Abbott and Securetec are tailored to meet regional needs and regulatory requirements while offering compact designs suited for use in mobile units and remote locations

- In addition, growing awareness and support from public health authorities are facilitating greater availability and acceptance of rapid drug testing, even in lower-resource settings. Campaigns targeting schools and community centers in countries such as Kenya and Nigeria are encouraging early screening and education

- The move toward real-time results and digital connectivity in some newer devices also supports centralized data reporting and integration with electronic medical records, which can be valuable for public health surveillance and rehabilitation tracking

- This ongoing shift toward fast, accurate, and field-deployable testing tools is redefining substance abuse control strategies across the region, driving innovation in product development and boosting adoption across both public and private sectors

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Dynamics

Driver

Escalating Substance Abuse and Government-Backed Screening Programs

- The alarming rise in substance misuse, especially among youth and high-risk occupational groups, is a key driver fueling the demand for point-of-care drug abuse testing across the Middle East and Africa

- For instance, in April 2024, the Saudi Ministry of Interior expanded its mobile drug testing program in collaboration with the Health Ministry to intensify screenings in schools and public transportation hubs. Similarly, South Africa’s Department of Health has partnered with clinics to offer free POC drug screening as part of its broader harm-reduction strategy

- POC devices provide fast results and are well-suited for remote and high-volume testing environments, aligning with government priorities to reduce dependency rates and ensure timely referrals for treatment

- With support from organizations such as the African Union and the United Nations Office on Drugs and Crime (UNODC), several countries have secured funding to equip local clinics and border agencies with modern testing kits, especially in underserved regions

- The increasing accessibility of compact and user-friendly devices, combined with growing awareness about drug-related harm, is enabling early intervention and prevention, thus fostering market expansion across both urban and rural areas

Restraint/Challenge

Cost Constraints and Regulatory Inconsistencies

- A major challenge facing the market is the high cost of imported diagnostic kits and the inconsistent regulatory landscape across different countries in the region. Many lower-income areas struggle with limited healthcare budgets, which constrains large-scale adoption of commercial POC drug tests

- For instance, some public facilities in Nigeria and Ethiopia continue to rely on outdated or manually intensive testing methods due to the higher per-unit cost of rapid test kits and the lack of standardized procurement procedures

- Furthermore, inconsistent regulatory frameworks and the absence of unified drug testing policies across borders hinder widespread implementation, particularly in cross-border transport and international trade zones

- To overcome these barriers, there is a growing need for localized manufacturing, harmonization of regulatory standards, and public-private partnerships that can subsidize the cost of testing. Global manufacturers such as Abbott and Roche are increasingly working with regional distributors to improve affordability and supply chain reliability

- Building sustainable, cost-effective testing infrastructure and training healthcare workers in rural regions will be crucial to extending the reach of these life-saving diagnostics and ensuring equitable access across the Middle East and Africa

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Scope

The market is segmented on the basis of drug type, products, prescription type, sample type, testing type, application, end user, and distribution channel.

- By Drug Type

On the basis of drug type, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into amphetamines, opiates, cannabinoids, cocaine, barbiturates, benzodiazepines, methadone, phencyclidine, tricyclic antidepressants, and others. The cannabinoids segment dominated the market with the largest market revenue share of 28.3% in 2024, driven by the widespread prevalence of cannabis use, especially among young populations and urban regions. Cannabinoid testing remains the most frequently administered due to its regulatory priority and ease of detection in various sample types.

The amphetamines segment is anticipated to witness the fastest growth rate of 9.6% from 2025 to 2032, fueled by rising misuse of stimulants and growing adoption of screening in educational institutions and employment settings. Increasing awareness of amphetamine-related health risks is contributing to demand for early, frequent, and portable detection solutions.

- By Products

On the basis of products, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into devices and consumables and accessories. The devices segment dominated the market with the largest market revenue share of 57.4% in 2024, driven by the increased use of handheld analyzers and multi-panel test kits in high-throughput environments such as hospitals, border checkpoints, and correctional facilities. Their ability to provide instant, on-site results supports real-time decision-making.

The consumables and accessories segment is anticipated to witness the fastest growth rate of 10.2% from 2025 to 2032, driven by recurring demand for test strips, specimen containers, buffer solutions, and calibration tools. Growing test frequency in private and government-led programs continues to boost demand for these recurring supplies.

- By Prescription

On the basis of prescription, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into over-the-counter testing and prescription-based testing. The prescription-based testing segment dominated the market with the largest market revenue share of 64.1% in 2024, supported by its widespread use in formal medical settings, legal investigations, and workplace compliance programs, where accuracy, documentation, and chain of custody are critical.

The over-the-counter testing segment is anticipated to witness the fastest growth rate of 11.3% from 2025 to 2032, fueled by rising self-testing trends among parents and individuals, and increasing product availability at pharmacies and online retailers.

- By Sample Type

On the basis of sample type, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into urine, saliva, blood, hair, breath, and others. The urine segment dominated the market with the largest market revenue share of 47.1% in 2024, driven by its cost-effectiveness, ease of collection, and ability to detect a wide range of substances over longer detection windows. Urine tests are commonly used in both workplace and clinical settings across the region.

The saliva segment is anticipated to witness the fastest growth rate of 10.7% from 2025 to 2032, fueled by its suitability for rapid roadside and field testing by law enforcement and its growing adoption in occupational health programs.

- By Testing Type

On the basis of testing type, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into random testing, post-incident testing, and abstinence testing. The random testing segment dominated the market with the largest market revenue share of 38.5% in 2024, driven by its deployment in law enforcement, corporate, and rehabilitation environments as a deterrent strategy and monitoring tool.

The post-incident testing segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, due to increased regulatory requirements for testing after workplace accidents or criminal investigations to establish liability or impairment.

- By Application

On the basis of application, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into medical screening, workplace screening, law enforcement and criminal justice, pain management, substance abuse treatment and rehabilitation, parental or home drug testing, sports and athletics testing, drug screening in schools and educational institutions, and others. The law enforcement and criminal justice segment dominated the market with the largest market revenue share of 30.2% in 2024, driven by government mandates and rising efforts to reduce drug-related crimes across Saudi Arabia, South Africa, and the UAE.

The parental or home drug testing segment is anticipated to witness the fastest growth rate of 11.5% from 2025 to 2032, driven by increased public awareness, easy access to OTC kits, and growing concerns over adolescent drug use.

- By End User

On the basis of end user, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into healthcare facilities, employers, government institutes, and others. The government institutes segment dominated the market with the largest market revenue share of 41.6% in 2024, supported by large-scale anti-drug initiatives, border control efforts, and criminal justice screenings funded by national and local authorities.

The employers segment is anticipated to witness the fastest growth rate of 10.9% from 2025 to 2032, fueled by increasing enforcement of workplace drug policies in industries such as construction, transport, and mining, particularly in GCC countries.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa point-of-care (POC) drug abuse testing market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with the largest market revenue share of 53.9% in 2024, driven by high-volume procurement by ministries of health, military organizations, and correctional institutions under government contracts.

The retail sales segment is anticipated to witness the fastest growth rate of 12.1% from 2025 to 2032, as demand rises for self-testing kits through pharmacies and e-commerce platforms, enabling wider accessibility for individual users and families.

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa Middle East and Africa point-of-care (POC) drug abuse testing market with the largest revenue share of 33.1% in 2024, attributed to increased governmental spending on anti-narcotics programs, frequent roadside drug testing, and mandatory workplace screenings in sensitive sectors such as oil & gas and aviation

- Authorities and healthcare providers in the country increasingly prioritize rapid and on-site drug testing as a proactive measure to address rising substance abuse, ensure public safety, and comply with national drug-free policies

- This widespread adoption is further supported by strong regulatory mandates, rising public awareness, and investments in modern diagnostic technologies, positioning Saudi Arabia as a regional leader in implementing point-of-care drug testing across both urban and remote areas

The Saudi Arabia POC Drug Abuse Testing Market Insight

The Saudi Arabia point-of-care (POC) drug abuse testing market captured the largest revenue share of 33.1% in 2024 within the Middle East and Africa region, supported by strict anti-drug legislation and wide-scale implementation of mobile screening units. The government’s proactive role in deploying testing in schools, traffic stops, and high-risk industries such as energy and aviation is accelerating adoption. In addition, partnerships with global diagnostic companies and public health agencies are enhancing testing infrastructure and access across the Kingdom, positioning Saudi Arabia as a regional benchmark in drug testing efforts.

South Africa POC Drug Abuse Testing Market Insight

The South Africa point-of-care (POC) drug abuse testing market is projected to expand at a significant CAGR throughout the forecast period, fueled by a high prevalence of substance abuse and a strong push from the healthcare sector to implement early detection. Government and NGO-led harm-reduction programs are supporting community-level testing, while private clinics and employers are increasingly integrating POC diagnostics into screening protocols. The rise in local manufacturing and distribution of test kits is also improving affordability and availability, making South Africa one of the fastest-growing markets in the region.

United Arab Emirates (UAE) POC Drug Abuse Testing Market Insight

The UAE point-of-care (POC) drug abuse testing market is anticipated to grow at a noteworthy CAGR, driven by rigorous drug control regulations, a strong corporate compliance culture, and rising healthcare investments. The country’s commitment to workplace safety, especially in logistics, aviation, and construction sectors, is promoting widespread adoption of portable drug test kits. In addition, growing public awareness campaigns and integration of POC diagnostics in both government and private medical facilities are reinforcing market growth, particularly in Dubai and Abu Dhabi.

Nigeria POC Drug Abuse Testing Market Insight

The Nigeria point-of-care (POC) drug abuse testing market is expected to expand at a considerable CAGR, driven by growing concern over drug dependency among youth and increasing demand for accessible screening solutions. While infrastructural challenges exist, ongoing support from international bodies such as the UNODC and World Health Organization is facilitating outreach programs and diagnostic deployment. Community health centers and rehabilitation facilities are adopting portable devices for early detection and intervention, with mobile health initiatives helping extend services into underserved rural areas

Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market Share

The Middle East and Africa Point-of-Care (POC) Drug Abuse Testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Alfa Scientific Designs, Inc. (U.S.)

- OraSure Technologies, Inc. (U.S.)

- Securetec Detektions-Systeme AG (Germany)

- MP Biomedicals, LLC (U.S.)

- Danaher Corporation (U.S.)

- Randox Laboratories Ltd. (U.K.)

- Omega Diagnostics Group PLC (U.K.)

- T&D Diagnostics Canada, Inc. (Canada)

- Nova Biomedical Corporation (U.S.)

- Lifeloc Technologies, Inc. (U.S.)

- Biosure (UK) Ltd (U.K.)

- Premier Biotech, Inc. (U.S.)

- Alcolizer Technology Pty Ltd (Australia)

- Neogen Corporation (U.S.)

What are the Recent Developments in Middle East and Africa Point-of-Care (POC) Drug Abuse Testing Market?

- In June 2024, Saudi Arabia’s Ministry of Health partnered with private healthcare providers to implement rapid point-of-care drug testing kits in emergency and trauma centers across major cities, including Riyadh and Jeddah. This initiative aims to enhance early detection and response to substance abuse cases, particularly involving amphetamines and opioids, which are rising in prevalence. The deployment reflects the government’s growing investment in fast-response diagnostics and underscores its commitment to curbing drug misuse through modern clinical technologies

- In April 2024, South Africa’s National Council on Substance Abuse announced a pilot rollout of mobile POC drug testing units targeting rural and underserved areas. These mobile clinics are equipped with immunoassay-based rapid tests for cannabinoids, methamphetamines, and opiates. The move marks a significant step toward increasing accessibility and community outreach in drug detection and prevention, highlighting the country’s effort to decentralize substance abuse diagnostics and improve public health outcomes

- In March 2024, Abbott Laboratories expanded the distribution of its i-STAT Alinity handheld blood analyzer to several Gulf Cooperation Council (GCC) countries, including the UAE and Kuwait. Designed for rapid drug toxicity assessment, the device is now being integrated into both emergency response systems and workplace testing programs. This expansion emphasizes the rising demand for portable and real-time drug screening technologies across the Middle East region

- In February 2024, Randox Laboratories announced a collaboration with regional forensic institutions in Egypt to supply multiplex POC drug testing platforms. These platforms offer simultaneous detection of multiple drug classes and are tailored for judicial and law enforcement use. The partnership underscores the increasing reliance on advanced diagnostic tools for legal and correctional environments, reinforcing Randox’s position in the MEA drug testing landscape

- In January 2024, Omega Diagnostics Group launched a localized version of its DOA (Drugs of Abuse) rapid test panels for the African market, with manufacturing support based in Morocco. These CE-marked test kits are designed for affordability and ease of use, targeting high-volume use in public health centers and addiction recovery clinics. The initiative aligns with growing regional efforts to scale up cost-effective diagnostic solutions amid rising drug-related health burdens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.