Middle East And Africa Oil Field Specialty Chemicals Market

Market Size in USD Million

CAGR :

%

USD

192.61 Million

USD

273.92 Million

2025

2033

USD

192.61 Million

USD

273.92 Million

2025

2033

| 2026 –2033 | |

| USD 192.61 Million | |

| USD 273.92 Million | |

|

|

|

|

What is the Middle East and Africa Oil Field Specialty Chemicals Market Size and Growth Rate?

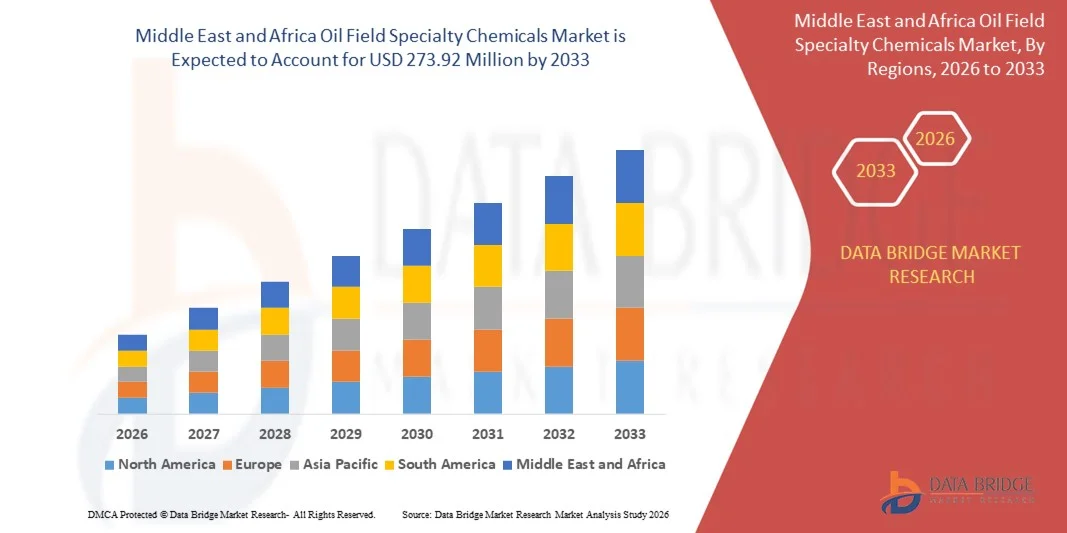

- The Middle East and Africa oil field specialty chemicals market size was valued at USD 192.61 million in 2025 and is expected to reach USD 273.92 million by 2033, at a CAGR of 4.50% during the forecast period

- Rising oil and gas exploration and production activities, increasing demand for enhanced oil recovery (EOR) techniques, growing deepwater and ultra-deepwater drilling operations, higher usage of corrosion inhibitors and demulsifiers, expanding shale gas development, and rising focus on improving well efficiency and flow assurance are some of the major factors expected to drive the growth of the Oil Field Specialty Chemicals market

What are the Major Takeaways of Oil Field Specialty Chemicals Market?

- Growing investments in upstream oil & gas projects across developing economies, along with increasing adoption of advanced drilling fluids and production chemicals, are expected to create significant growth opportunities for the oil field specialty chemicals market

- Volatility in crude oil prices, stringent environmental regulations, high operational costs, and concerns related to chemical disposal and toxicity are expected to act as key restraining factors for the growth of the oil field specialty chemicals market

- Saudi Arabia dominated the Middle East and Africa oil field specialty chemicals market with the largest revenue share of 38.7% in 2024, driven by substantial investments in upstream and downstream oil and gas operations

- The U.A.E. oil field specialty chemicals market is experiencing robust growth with a CAGR of 10.2%, fueled by large-scale oilfield projects and investments in enhanced oil recovery (EOR) techniques

- The Surfactants segment dominated the market with a 28.6% share in 2025, owing to their extensive use in drilling fluids, enhanced oil recovery (EOR), and production operations. Surfactants play a critical role in reducing interfacial tension, improving oil displacement efficiency, and enhancing fluid performance across both conventional and unconventional reservoirs

Report Scope and Oil Field Specialty Chemicals Market Segmentation

|

Attributes |

Oil Field Specialty Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Oil Field Specialty Chemicals Market?

Increasing Shift Toward High-Performance, Eco-Friendly, and Application-Specific Oil Field Specialty Chemicals

- The oil field specialty chemicals market is witnessing growing adoption of high-performance and application-specific chemicals designed to enhance drilling efficiency, production optimization, and reservoir performance across complex oilfield environments

- Manufacturers are increasingly developing advanced surfactants, inhibitors, polymers, and friction reducers that offer improved thermal stability, corrosion resistance, and compatibility with high-pressure and high-temperature (HPHT) wells

- Rising focus on environmentally friendly and biodegradable chemical formulations is driving innovation to comply with stringent environmental regulations, especially in offshore and sensitive regions

- For instance, companies such as BASF SE, Halliburton, Baker Hughes, and Clariant have introduced low-toxicity, water-based, and high-efficiency oilfield chemical solutions to improve operational sustainability

- Increasing demand for enhanced oil recovery (EOR), shale gas development, and deepwater exploration is accelerating the shift toward specialized, high-value chemical formulations

- As oil and gas operations become more complex and efficiency-driven, oil field specialty chemicals will remain critical for maximizing recovery, reducing downtime, and improving overall well economics

What are the Key Drivers of Oil Field Specialty Chemicals Market?

- Rising demand for efficient drilling, stimulation, and production chemicals to improve well productivity, flow assurance, and reservoir longevity is driving market growth

- For instance, during 2024–2025, major oilfield service providers such as Schlumberger, Halliburton, and Baker Hughes expanded their specialty chemical portfolios to support unconventional and deepwater projects

- Growing investments in upstream oil & gas exploration, including shale, tight oil, and offshore fields, are boosting demand for surfactants, demulsifiers, corrosion inhibitors, and biocides across the U.S., Middle East, and Middle East and Africa

- Advancements in chemical formulation technologies, including nano-enabled additives and high-performance polymers, are enhancing efficiency while reducing chemical consumption

- Increasing adoption of enhanced oil recovery (EOR) techniques such as chemical flooding and polymer injection is creating sustained demand for specialty oilfield chemicals

- Supported by expanding energy demand, improved drilling technologies, and recovery optimization initiatives, the Oil Field Specialty Chemicals market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Oil Field Specialty Chemicals Market?

- Volatility in crude oil prices significantly impacts exploration and production spending, thereby affecting demand for oilfield specialty chemicals

- For instance, during 2024–2025, fluctuating oil prices and project delays led to reduced chemical procurement across several upstream projects Middle East and Africaly

- Stringent environmental regulations related to chemical toxicity, disposal, and offshore discharge increase compliance costs and limit the use of certain formulations

- High operational and formulation costs associated with advanced, HPHT-compatible, and environmentally compliant chemicals restrict adoption among smaller operators

- Supply chain disruptions and raw material price fluctuations create cost pressures for manufacturers and reduce profit margins

- To overcome these challenges, companies are focusing on sustainable formulations, cost-efficient production methods, and region-specific chemical solutions to strengthen market adoption of oil field specialty chemicals

How is the Oil Field Specialty Chemicals Market Segmented?

The market is segmented on the basis of type, location, and application.

- By Type

On the basis of type, the oil field specialty chemicals market is segmented into Surfactants, Demulsifiers, Inhibitors, Biocides, Additives, Acids, Deformers, Polymers, Friction Reducers, Emulsifiers, Iron Control Agents, Dispersants, Viscosifiers, Wetting Agents, Retarders, and Others. The Surfactants segment dominated the market with a 28.6% share in 2025, owing to their extensive use in drilling fluids, enhanced oil recovery (EOR), and production operations. Surfactants play a critical role in reducing interfacial tension, improving oil displacement efficiency, and enhancing fluid performance across both conventional and unconventional reservoirs. Their wide applicability, cost-effectiveness, and continuous formulation improvements support strong demand across Middle East and Africa oilfields.

The Polymers segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of polymer flooding in EOR, rising shale gas exploration, and growing demand for viscosity control and fluid loss reduction. Advancements in high-temperature and high-salinity-resistant polymers are further accelerating growth.

- By Location

On the basis of location, the oil field specialty chemicals market is segmented into Onshore and Offshore. The Onshore segment dominated the market with a 64.2% share in 2025, supported by extensive onshore oil and gas exploration activities, particularly in shale formations, tight oil reservoirs, and mature fields across the U.S., China, and the Middle East. Onshore operations require large volumes of drilling fluids, production chemicals, corrosion inhibitors, and biocides, driving sustained demand for specialty chemicals. Lower operational costs and easier logistics compared to offshore projects further strengthen onshore dominance.

The Offshore segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising deepwater and ultra-deepwater exploration activities in regions such as the Gulf of Mexico, Brazil, and West Africa. Increasing investment in offshore developments and stringent flow assurance requirements are boosting demand for high-performance, environmentally compliant specialty chemicals.

- By Application

On the basis of application, the oil field specialty chemicals market is segmented into Drilling, Stimulation, Production, Enhanced Oil Recovery (EOR), Cementing, Workover & Completion, and Others. The Production segment dominated the market with a 31.4% share in 2025, as production operations require continuous use of corrosion inhibitors, demulsifiers, scale inhibitors, and biocides to maintain flow assurance, equipment integrity, and operational efficiency throughout the life of a well. Increasing focus on maximizing output from mature fields has further strengthened demand for production chemicals Middle East and Africaly.

The Enhanced Oil Recovery (EOR) segment is expected to register the fastest CAGR from 2026 to 2033, driven by declining conventional reserves and growing adoption of chemical EOR techniques such as polymer flooding and surfactant injection. Rising emphasis on improving recovery rates and extending reservoir life is significantly accelerating demand for specialty chemicals in EOR applications.

Which Region Holds the Largest Share of the Oil Field Specialty Chemicals Market?

- Saudi Arabia dominated the Middle East and Africa oil field specialty chemicals market with the largest revenue share of 38.7% in 2024, driven by substantial investments in upstream and downstream oil and gas operations

- The country’s focus on expanding oil production capacity, coupled with government initiatives to modernize refineries and petrochemical plants, is propelling demand for specialty chemicals. Local and international manufacturers such as SABIC (Saudi Arabia) and Clariant (Switzerland) are innovating in surfactants, biocides, and corrosion inhibitors to enhance efficiency and sustainability

- Saudi Arabia’s ongoing Vision 2030 initiatives, emphasizing industrial diversification and technological R&D, solidify its position as a regional hub for Middle East and Africa’s Oil Field Specialty Chemicals innovation and export growth

U.A.E. Oil Field Specialty Chemicals Market Insight

The U.A.E. oil field specialty chemicals market is experiencing robust growth with a CAGR of 10.2%, fueled by large-scale oilfield projects and investments in enhanced oil recovery (EOR) techniques. Demand is particularly strong in offshore drilling and petrochemical operations, where high-performance additives, friction reducers, and demulsifiers are essential. Government-backed industrial zones and free zones are attracting multinational chemical manufacturers, fostering innovation in environmentally compliant and high-efficiency formulations. The UAE’s strategic location and logistics infrastructure further support market expansion across the region.

Nigeria Oil Field Specialty Chemicals Market Insight

The Nigeria oil field specialty chemicals market is expanding steadily, supported by growing upstream oil exploration and production activities in the Niger Delta region. Rising demand for inhibitors, biocides, and polymers for enhanced production efficiency is driving market adoption. Government incentives for local content development, combined with ongoing investments in refining and pipeline infrastructure, are creating opportunities for manufacturers. Nigeria is emerging as a key market in West Africa for high-performance and cost-effective oilfield chemical solutions.

Egypt Oil Field Specialty Chemicals Market Insight

The Egypt oil field specialty chemicals market is projected to grow at a CAGR of 9.1%, driven by increasing oil and gas exploration in the Western Desert and the Mediterranean offshore basins. Specialty chemicals, including surfactants, demulsifiers, and viscosity modifiers, are in high demand for drilling and production applications. Egypt’s regulatory support for sustainable and efficient chemical use, along with rising foreign direct investment in oil and gas infrastructure, is enhancing market growth. The country is positioning itself as a regional manufacturing and distribution hub for oilfield chemicals in North Africa.

Which are the Top Companies in Oil Field Specialty Chemicals Market?

The oil field specialty chemicals industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Solvay (Belgium)

- Dow (U.S.)

- Baker Hughes Company (U.S.)

- Clariant (Switzerland)

- Evonik Industries AG (Germany)

- Kemira (Finland)

- Thermax Limited (India)

- Huntsman International LLC. (U.S.)

- Colonial Chemical Inc. (U.S.)

- Zirax (Russia)

- Innospec (U.S.)

- CES Energy Solutions Corp. (Canada)

- Stepan Company (U.S.)

- EMEC (Italy)

- Chevron Phillips Chemical Company LLC (U.S.)

- KRATON CORPORATION. (U.S.)

- Jiaxing Midas Oilfield Chemical Mfg Co., Ltd (China)

- Versalis S.p.A. (Italy)

- Halliburton (U.S.)

- Albemarle Corporation (U.S.)

What are the Recent Developments in Middle East and Africa Oil Field Specialty Chemicals Market?

- In May 2024, the industry witnessed rising adoption of digitalization and automation technologies, with specialty oilfield chemical suppliers developing remotely monitored and controlled solutions to optimize treatment processes and improve operational efficiency, highlighting the sector’s shift toward smarter and more efficient oilfield operations

- In March 2024, consolidation activity continued within the specialty oilfield chemicals market as leading players engaged in mergers and acquisitions to expand product portfolios and strengthen geographic presence, indicating an industry-wide focus on scale, competitiveness, and long-term growth

- In October 2023, The Lubrizol Corporation announced a new distribution agreement with IMCD Group, a leading Middle East and Africa distributor and developer of specialty chemicals and ingredients, reinforcing Lubrizol’s market reach and supply chain capabilities

- In July 2022, Solvay SA stated that it would seek advisory support from Bank of America to evaluate the potential sale of its oilfield chemicals business as part of a strategic review, reflecting efforts to streamline operations and refocus on core growth areas

- In March 2022, Halliburton inaugurated its first oilfield specialty chemical manufacturing plant in Saudi Arabia to support next-generation chemical solutions and strengthen regional production capabilities, marking a significant expansion of the company’s footprint in the eastern hemisphere

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Oil Field Specialty Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Oil Field Specialty Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Oil Field Specialty Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.