Middle East And Africa Octabin Market

Market Size in USD Million

CAGR :

%

USD

836.07 Million

USD

1,179.91 Million

2025

2033

USD

836.07 Million

USD

1,179.91 Million

2025

2033

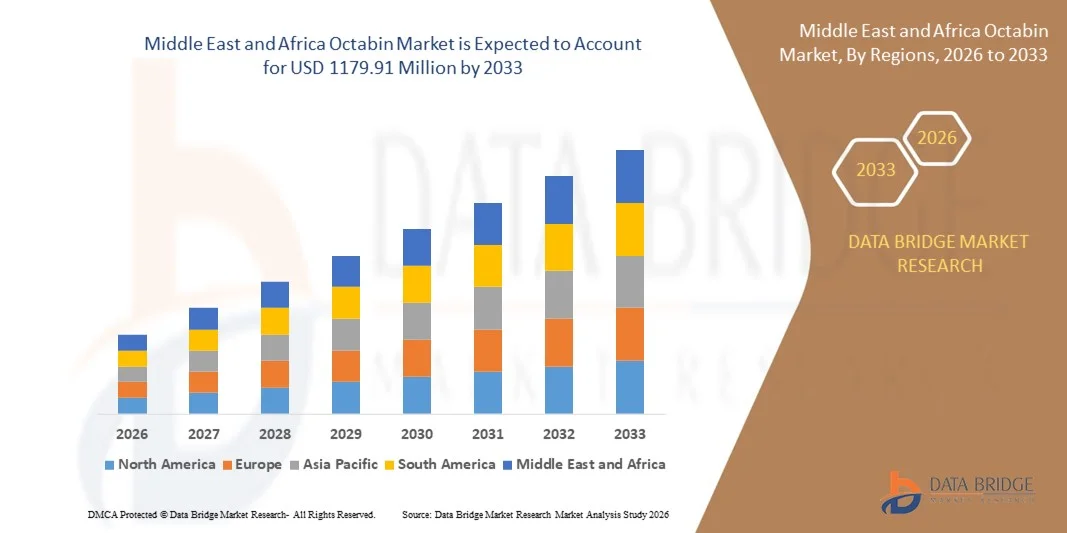

| 2026 –2033 | |

| USD 836.07 Million | |

| USD 1,179.91 Million | |

|

|

|

|

Middle East and Africa Octabin Market Size

- The Middle East and Africa octabin market size was valued at USD 836.07 million in 2025 and is expected to reach USD 1179.91 million by 2033, at a CAGR of 4.4% during the forecast period

- The market growth is largely fueled by rising demand for cost-effective, sustainable, and space-efficient bulk packaging solutions across industries such as chemicals, food, and pharmaceuticals, leading to increased adoption of octabins for large-volume material handling and international shipping

- Furthermore, the growing emphasis on recyclable and lightweight packaging, combined with regulatory pressures to reduce plastic usage, is positioning octabins as a preferred alternative for bulk transport. These converging factors are accelerating the adoption of octabin solutions, thereby significantly boosting the industry's growth

Middle East and Africa Octabin Market Analysis

- Octabins are high-strength, multi-layer corrugated containers designed for the bulk packaging and transportation of dry flowable products such as resins, powders, and food ingredients. Their structural integrity, cost efficiency, and compatibility with automated handling systems make them suitable for high-volume industrial use

- The escalating demand for octabins is primarily driven by increasing globalization of supply chains, rising exports of granular and powdered materials, and growing pressure to reduce packaging waste through the use of eco-friendly, collapsible solutions

- Saudi Arabia dominated the octabin market in 2025, due to rapid expansion of petrochemicals, plastics, chemicals, and food processing industries, along with increasing demand for bulk packaging solutions supporting industrial exports and domestic distribution

- U.A.E. is expected to be the fastest growing region in the octabin market during the forecast period due to its position as a regional manufacturing, trading, and re-export hub and the rapid expansion of free zones, ports, and distribution centers

- Standard segment dominated the market with a market share of 58.3% in 2025, due to its consistency in load-bearing, ease of stacking, and alignment with standardized shipping and warehousing systems. Companies dealing with recurring bulk packaging needs, especially in the petrochemical and agricultural sectors, frequently opt for standard sizes to simplify handling and reduce operational errors

Report Scope and Octabin Market Segmentation

|

Attributes |

Octabin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Octabin Market Trends

Rising Shift Towards Eco-Friendly Materials

- The octabin market is increasingly influenced by a shift toward eco-friendly and sustainable materials due to growing environmental awareness and stricter packaging regulations. Corrugated cardboard octabins, known for their recyclability and lower environmental impact compared to plastic or metal alternatives, are gaining prominence

- For instance, leading companies such as WestRock Company and Smurfit Kappa Group are expanding their production of corrugated octabins, capitalizing on demand from food and beverage sectors that prioritize sustainable packaging solutions. This aligns with consumers’ preference for green packaging and regulatory pushes encouraging waste reduction

- Innovations include bio-based adhesives and coatings that improve durability while maintaining eco-compliance

- The rise of e-commerce and bulk shipping drives adoption of lightweight, recyclable octabins that reduce transportation carbon footprint

- Brand strategies now emphasize circular economy principles by offering reusable or returnable octabin models

- Regional governments across various region are promoting sustainable packaging standards that further propel eco-friendly octabin growth

Middle East and Africa Octabin Market Dynamics

Driver

Increased Use in Agriculture and Food Processing

- The agriculture and food processing industries are major end-users propelling octabin demand due to the need for robust, cost-effective bulk packaging that ensures product safety, preserves quality, and simplifies logistics

- For instance, companies such as International Paper and Packaging Corporation of America supply octabins extensively to agricultural exporters and food manufacturers to transport fruits, grains, nuts, and powders safely and efficiently

- Octabins' strength and stackability reduce spoilage and losses in transit, critical for perishable goods and high-volume shipments

- Increased global demand for fresh produce and processed food products, alongside the rise in fruit exports (notably apples and citrus) from regions such as China, India, and the U.S., further accelerates market growth

- The pharmaceutical sector's growing need for bulk packaging of dry ingredients and chemicals also supports octabin market expansion. Expansion of cold chain logistics and e-commerce platforms enhances adoption as businesses require flexible, secure containers for various supply chain stages

Restraint/Challenge

Regulatory Compliance and Packaging Standards

- Stringent and evolving regulatory compliance requirements and packaging standards pose challenges for octabin manufacturers and users across industries, impacting material selection, design, and certification processes

- For instance, regulations ensuring food-contact safety, hazardous material containment, and sustainability certifications require octabin producers such as International Paper and WestRock to invest heavily in testing, quality assurance, and documentation, increasing costs and lead times

- Divergent regional standards complicate global supply chains by necessitating tailored packaging solutions for different markets, adding complexity and operational expense

- Compliance with sustainability directives such as the EU's Packaging and Packaging Waste Directive often mandates use of recyclable materials and limits on certain plastics or chemicals, restricting some material options

- Failure to comply risks legal penalties, product recalls, and brand reputation damage, leading to cautious adoption in some sectors. Continuous harmonization efforts and investments in certification programs are underway but add to entry barriers and operational challenges for new players and smaller manufacturers

Middle East and Africa Octabin Market Scope

The market is segmented on the basis of product type, capacity, and end-user.

- By Product Type

On the basis of product type, the octabin market is segmented into free flow base octabin, base discharge octabin, self-assembly octabin, standard octabin, and telescopic octabin. The standard octabin segment accounted for the largest revenue share in 2025 due to its widespread application across diverse industries including chemicals, food, and consumer goods. Its structural simplicity, cost-effectiveness, and ready-to-use format make it a preferred choice for bulk packaging of granules, resins, and powders. Moreover, its compatibility with standard pallets and efficient space utilization during transport further enhance its demand among industrial packagers.

The self-assembly octabin segment is projected to register the fastest growth from 2026 to 2033, driven by its lightweight construction, reduced storage costs, and ease of on-site assembly. As companies look to minimize logistics expenses and streamline storage, the demand for flat-packed, user-friendly packaging solutions such as self-assembly octabins is rising significantly. Their adaptability to customized branding and structural variations also makes them ideal for exporters and businesses focused on sustainable, scalable packaging.

- By Capacity

On the basis of capacity, the octabin market is segmented into customized and standard. The standard capacity segment led the market with a share of 58.3% in 2025, favored for its consistency in load-bearing, ease of stacking, and alignment with standardized shipping and warehousing systems. Companies dealing with recurring bulk packaging needs, especially in the petrochemical and agricultural sectors, frequently opt for standard sizes to simplify handling and reduce operational errors.

The customized capacity segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing preference for tailored packaging that fits specific logistic constraints or product volumes. Industries such as pharmaceuticals and specialty chemicals, where material sensitivity or volume optimization is crucial, are increasingly turning toward custom-built octabins. Customization also enables businesses to address branding, safety compliance, and sustainability mandates more effectively.

- By End-User

On the basis of end-user, the octabin market is segmented into chemical industry, food industry, consumer goods, pharmaceutical, and others. The chemical industry segment dominated the market share in 2025 due to the extensive use of octabins for transporting polymers, plastic granules, and powdered chemicals in a safe and contamination-free manner. Their rigid structure, load stability, and resistance to spillage make them highly suitable for hazardous and high-volume material handling.

The food industry segment is expected to grow at the fastest pace from 2026 to 2033, propelled by increasing global food exports and the rising demand for hygienic, eco-friendly, and bulk packaging options. Octabins are gaining traction in this sector for the storage and shipment of dry food ingredients such as grains, pulses, and powdered mixes. Their recyclability and compliance with food safety standards further position them as a sustainable choice for food-grade packaging.

Middle East and Africa Octabin Market Regional Analysis

- Saudi Arabia dominated the octabin market with the largest revenue share in 2025, driven by rapid expansion of petrochemicals, plastics, chemicals, and food processing industries, along with increasing demand for bulk packaging solutions supporting industrial exports and domestic distribution

- Strong growth in manufacturing clusters, industrial cities, and logistics infrastructure, coupled with rising preference for space-efficient, stackable, and recyclable bulk containers, continues to accelerate octabin adoption across chemical resins, fertilizers, and processed food supply chains

- The presence of regional packaging manufacturers and international bulk packaging suppliers, along with investments in modern warehousing, port expansion, and industrial diversification initiatives under Vision 2030, reinforces Saudi Arabia’s leadership while supporting large-volume handling and export-oriented packaging operations

U.A.E. Octabin Market Insight

The U.A.E. is projected to record the fastest CAGR in the Middle East and Africa octabin market from 2026 to 2033, supported by its position as a regional manufacturing, trading, and re-export hub and the rapid expansion of free zones, ports, and distribution centers. For instance, DS Smith’s bulk packaging solutions supplied to industrial and food manufacturers in the U.A.E. are enhancing efficiency in handling plastic resins and dry food ingredients across export supply chains. Rising demand from chemicals, polymers, and food & beverage sectors, combined with strong growth in contract manufacturing and third-party logistics services, is accelerating octabin penetration, while ongoing investments in automated warehousing and sustainable packaging solutions further position the U.A.E. as the fastest-growing market in the region.

South Africa Octabin Market Insight

South Africa is expected to witness steady growth between 2026 and 2033, driven by expanding chemical processing, agriculture-based industries, and food manufacturing activities, along with sustained demand for bulk packaging in domestic distribution and exports. Increasing use of octabins for grains, sugar, fertilizers, and industrial raw materials is supporting consistent market demand. The presence of established packaging manufacturers and suppliers such as Mpact, along with improving access to recycled paperboard and corrugated materials, is strengthening local production capabilities. Ongoing logistics infrastructure upgrades, growth in agro-exports, and rising focus on cost-efficient and recyclable bulk packaging solutions are contributing to stable long-term growth in South Africa’s octabin market.

Middle East and Africa Octabin Market Share

The octabin industry is primarily led by well-established companies, including:

- DS Smith (U.K.)

- Smurfit Kappa (Ireland)

- VPK Group (Belgium)

- Mondi (U.K.)

- International Paper (U.S.)

- Quadwall (U.K.)

- WestRock Company (U.S.)

- Klingele Paper & Packaging SE & Co. KG (Germany)

- Rondo Ganahl AG (Austria)

- WEBER Paletten & Verpackung (Germany)

- S Lester Packing Materials Ltd. (U.K.)

- TRICOR AG (Germany)

- Tape and Go Europe (Netherlands)

Latest Developments in Middle East and Africa Octabin Market

- In February 2024, TRICOR AG completed a ceremony, for the modern plant in Weeze-Goch, symbolizing a significant investment of 170 million euros. The plant, constructed to the highest energy efficiency standards, employed over 200 people and featured a 3.3-megawatt photovoltaic system. The company emphasizes a sustainable and modern working environment. The strategic location near the Dutch border positions TRICOR AG as a leading European provider of industrial packaging. The plant, equipped with innovative technology, set new standards in heavy corrugated board manufacturing and processing

- In October 2023, VPK Group acquired a majority stake in Zetacarton, an Italian corrugated cardboard company, marking its entry into Italy. Zetacarton specializes in fanfold and big-box packaging, complementing VPK Group's fit2size offering. The move expands VPK's geographic coverage for Fanfold, catering to e-commerce logistics distribution centers across Europe. Zetacarton's recent investment in a new digital single-pass printer enhances its product range, contributing to its sustainable growth. The acquisition aligns with VPK Group's long-term strategy for sustainable expansion in the market

- In December 2023, Klingele Paper & Packaging SE & Co. KG, finalized plans to introduce a Kyoto Group Heatcube at its Werne site. The Heatcube, an innovative molten salt thermal energy storage technology, aims to replace natural gas at the Werne plant and reduce CO2 emissions by over 3,400 tonnes annually. The signing of a term sheet outlined project details, with an engineering study starting in January 2024 and an intended purchase agreement for the Heatcube set for April 2024. The initiative helps the company to implement environmentally friendly practices in the paper and corrugated board industry which will help them to position the company among the market players in terms of sustainability

- In May 2023, Rondo Ganahl AG marked its 52nd anniversary by opening a new printing center in St. Ruprecht. With a USD 37.5 million investment, the facility aims to increase production by up to 30% annually, meeting the rising demand for eco-friendly corrugated board packaging, particularly from the food industry. The new print center, equipped with advanced technology, contributes to the company’s commitment to reducing environmental impact, utilizing solar energy for production, and generating 2.5 million kilowatt hours of clean energy annually in St. Ruprecht

- In April 2023, Mondi invested in new technology to increase the production capacity of the functional barrier paper range. This investment includes a new extruder, coating machine rebuilding, improvements, and efficiency of machine utilization. This expansion will help the company to meet the demand and improve its revenue in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Octabin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Octabin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Octabin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.