Middle East And Africa Microbial Air Sampler Market

Market Size in USD Million

CAGR :

%

USD

17.08 Million

USD

32.08 Million

2025

2033

USD

17.08 Million

USD

32.08 Million

2025

2033

| 2026 –2033 | |

| USD 17.08 Million | |

| USD 32.08 Million | |

|

|

|

|

Middle East and Africa Microbial Air Sampler Market Size

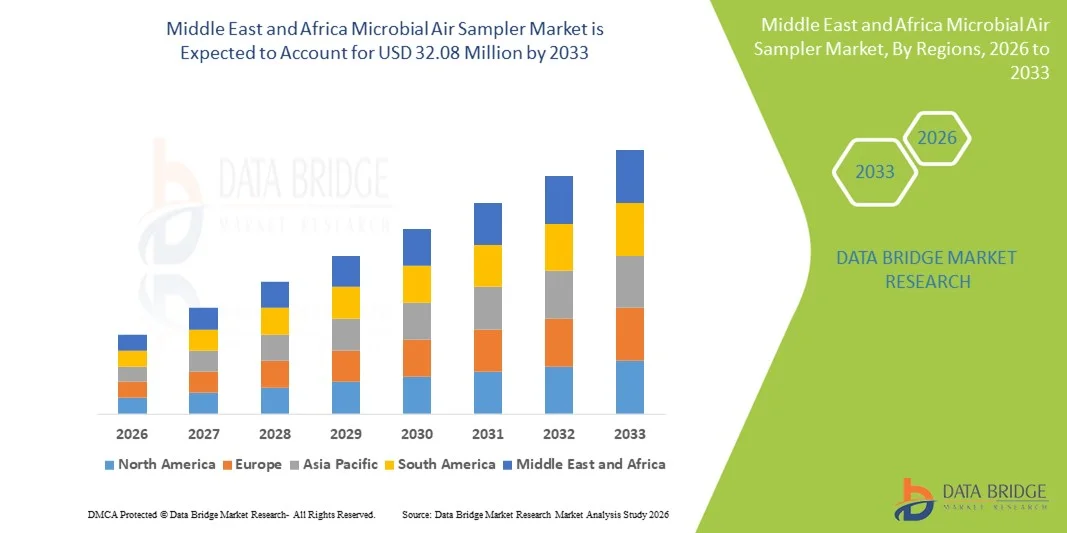

- The Middle East and Africa microbial air sampler market size was valued at USD 17.08 million in 2025 and is expected to reach USD 32.08 million by 2033, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by increased investments in healthcare infrastructure, rising adoption of air quality monitoring in pharmaceutical and research facilities, and strengthening regulatory focus on contamination control across the region

- Furthermore, growing demand for advanced environmental monitoring solutions in hospitals, pharmaceuticals, and food processing plants is driving the adoption of microbial air samplers as essential equipment for ensuring air safety and compliance, significantly boosting industry growth

Middle East and Africa Microbial Air Sampler Market Analysis

- Microbial air samplers, used for detecting and monitoring airborne microorganisms in healthcare, pharmaceutical, and industrial environments, are increasingly critical for maintaining air quality and ensuring regulatory compliance across the Middle East and Africa due to rising awareness of contamination control and infection prevention

- The growing demand for microbial air samplers is primarily driven by increasing investments in healthcare infrastructure, stricter regulatory standards for cleanroom and laboratory environments, and heightened focus on occupational health and safety in hospitals, pharmaceutical manufacturing, and research facilities

- Saudi Arabia dominated the MEA microbial air sampler market with a revenue share of 28.5% in 2025, attributed to rapid healthcare modernization, expanding pharmaceutical industries, and adoption of advanced air monitoring solutions

- Egypt is expected to be the fastest growing market during the forecast period due to increasing industrialization, rising healthcare spending, and growing awareness of air quality monitoring in hospitals and laboratories

- Portable microbial air sampler segment dominated the MEA microbial air sampler market with a share of 41.2% in 2025, owing to their flexibility, ease of use in multiple locations, and suitability for quick environmental monitoring and compliance verification in laboratories and healthcare facilities

Report Scope and Middle East and Africa Microbial Air Sampler Market Segmentation

|

Attributes |

Middle East and Africa Microbial Air Sampler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Microbial Air Sampler Market Trends

Advanced Monitoring and Automation Integration

- A significant and accelerating trend in the MEA microbial air sampler market is the integration of advanced monitoring technologies with automated data logging and cloud-based analysis, which is enhancing operational efficiency and real-time contamination control in hospitals, pharmaceutical labs, and industrial facilities

- For instance, the SAS Super ISO integrates automated sampling with cloud reporting, allowing facility managers to remotely monitor microbial air quality and maintain compliance with international standards. Similarly, the Biotest Rapid Sampler provides automated alerts for deviations in microbial counts

- Automation in microbial air samplers enables features such as continuous environmental monitoring, automatic sample analysis, and predictive maintenance alerts, improving lab safety and reducing manual errors. For instance, some LITE Air samplers can trigger notifications if microbial counts exceed predefined thresholds and log data automatically for regulatory audits

- The integration of microbial air samplers with centralized laboratory management systems facilitates consolidated monitoring of multiple cleanroom areas through a single interface, enhancing operational oversight and compliance tracking

- This trend towards intelligent, automated, and interconnected monitoring systems is reshaping expectations for environmental safety in critical facilities. Consequently, companies such as Merck and Andersen are developing samplers with automated reporting, cloud connectivity, and predictive alert systems

- The demand for microbial air samplers with advanced automation and monitoring capabilities is growing rapidly across hospitals, pharmaceutical manufacturing, and research facilities, as operational efficiency and regulatory compliance become top priorities

- Integration with IoT-enabled facility management systems allows real-time alerts, data visualization, and predictive insights, helping administrators proactively prevent contamination events. For instance, some advanced samplers can trigger HVAC system adjustments based on microbial load readings

Middle East and Africa Microbial Air Sampler Market Dynamics

Driver

Increasing Demand Due to Healthcare Modernization and Regulatory Compliance

- The growing modernization of healthcare and pharmaceutical facilities, coupled with stricter contamination control regulations, is a key driver for the increased adoption of microbial air samplers in the MEA region

- For instance, in April 2025, Merck announced the launch of an automated air monitoring solution for cleanrooms in Saudi Arabia, aimed at ensuring compliance with GMP standards. Such initiatives by key companies are expected to accelerate market growth in the forecast period

- As hospitals, laboratories, and industrial facilities prioritize infection prevention and product safety, microbial air samplers offer advanced features such as continuous monitoring, automated alerts, and precise data logging, providing a reliable alternative to manual sampling

- Furthermore, the rising prevalence of pharmaceuticals and biotechnology manufacturing in countries such as Saudi Arabia, UAE, and Egypt is creating a strong need for integrated air quality monitoring solutions to ensure operational safety and compliance

- The ease of automated sampling, remote monitoring, and compatibility with facility management software is driving adoption, while the growing trend of smart laboratories and IoT-enabled equipment further supports market expansion

- Increasing awareness among healthcare professionals and lab managers about the risks of airborne contamination is encouraging investments in microbial air samplers as part of infection prevention strategies. For instance, some hospitals in UAE have implemented continuous air monitoring protocols using advanced samplers

- Government initiatives and public health campaigns promoting cleanroom safety and industrial hygiene standards are boosting market demand. For instance, the Saudi Food and Drug Authority has recommended air quality monitoring in pharmaceutical manufacturing, creating new procurement opportunities

Restraint/Challenge

High Cost and Technical Complexity

- The relatively high initial cost of advanced microbial air samplers and the technical expertise required for operation pose significant challenges to widespread adoption in developing MEA markets

- For instance, high-end automated samplers from Andersen or Merck can be cost-prohibitive for smaller hospitals or research labs, limiting access despite their advanced capabilities

- Addressing these adoption barriers requires offering cost-effective, user-friendly models and training personnel on equipment use and maintenance. In addition, frequent calibration and maintenance requirements can increase operational costs and reduce accessibility for budget-conscious facilities

- While portable and semi-automated models are becoming more affordable, premium features such as automated cloud reporting or real-time predictive alerts still carry higher costs, which can slow adoption in price-sensitive institutions

- Overcoming these challenges through modular product designs, lower-cost alternatives, and technical support programs will be essential for sustained growth and broader adoption across the MEA microbial air sampler market

- Limited awareness and technical training in smaller labs and hospitals can lead to underutilization of advanced features, reducing the perceived value of high-end samplers. For instance, some facilities in Egypt have purchased automated samplers but rely mainly on manual sampling due to lack of trained staff

- Supply chain constraints and long lead times for importing sophisticated samplers can delay adoption and increase costs, particularly in African countries with less-developed distribution networks. For instance, delayed shipments of advanced Andersen units have impacted deployment schedules in South Africa

Middle East and Africa Microbial Air Sampler Market Scope

The market is segmented on the basis of product, collection technique, end user, and distribution channel.

- By Product

On the basis of product, the MEA microbial air sampler market is segmented into portable microbial air samplers, desktop microbial air samplers, and accessories. Portable microbial air samplers dominated the market with the largest revenue share of 41.2% in 2025, driven by their flexibility and ability to be used across multiple locations for spot checks and compliance audits. Hospitals, pharmaceutical labs, and research institutes prioritize portable samplers due to their ease of deployment and minimal space requirements. These samplers allow for real-time monitoring of airborne microorganisms without the need for permanent installations, making them highly suitable for multi-purpose facilities. Furthermore, portable samplers are often easier to operate and maintain, reducing the training requirements for staff. The growing awareness of infection prevention and the need for rapid detection in critical areas such as operating rooms or cleanrooms has further boosted demand for portable devices. Advanced portable models now also integrate automated data logging and wireless reporting, enhancing operational efficiency and regulatory compliance.

Desktop microbial air samplers are expected to witness the fastest growth rate of 18.6% from 2026 to 2034, fueled by increasing investments in research and pharmaceutical labs in Saudi Arabia, UAE, and Egypt. These samplers offer higher sampling volumes, more precise microbial collection, and advanced analytical capabilities compared to portable models. Desktop samplers are preferred in laboratories where continuous monitoring is required in a fixed location, allowing for integration with laboratory information management systems (LIMS). Their robust design ensures stability during long-term sampling and can accommodate multiple collection media simultaneously. Increasing R&D activities, particularly in biotechnology and vaccine manufacturing, are driving the adoption of desktop air samplers. Manufacturers are also focusing on enhancing automation, digital connectivity, and predictive analytics features in desktop samplers to meet growing regulatory and operational demands.

- By Collection Technique

On the basis of collection technique, the market is segmented into impact air samplers, impinge air samplers, surface air samplers, compressed air samplers, real-time samplers, and others. Impact air samplers dominated the market with a revenue share of 37.8% in 2025 due to their accuracy, reliability, and established use in regulatory compliance monitoring. They work by drawing air onto agar plates or collection media, allowing for the quantification of viable microorganisms. Their robust performance in cleanrooms, pharmaceutical manufacturing, and hospital settings makes them a preferred choice for continuous environmental monitoring. Regulatory authorities often recommend impact samplers for validation and routine testing, enhancing their market penetration. For instance, Andersen impact samplers are widely adopted in GCC countries for routine cleanroom monitoring due to their repeatability and ease of maintenance. The widespread availability of accessories and compatible culture media further supports market dominance.

Real-time samplers are expected to witness the fastest CAGR of 19.4% from 2026 to 2034, driven by the growing demand for immediate contamination detection in hospitals, pharmaceutical labs, and food manufacturing facilities. These samplers provide instantaneous monitoring of airborne microorganisms and allow facility managers to implement corrective actions immediately. For instance, Biotest real-time samplers provide automated alerts and remote data access, enabling proactive contamination control. The integration with digital dashboards, IoT-enabled monitoring, and predictive analytics further boosts their adoption. Their ability to reduce manual sampling labor and improve response times to microbial contamination is particularly appealing to large-scale and high-risk facilities. Increasing emphasis on infection prevention and real-time compliance monitoring is expected to drive rapid growth in this segment.

- By End User

On the basis of end user, the market is segmented into research & academic institutes, hospitals & clinics, pharmaceutical & biotechnology companies, food & beverage, personal care industries, and others. Hospitals & clinics dominated the market with a revenue share of 33.5% in 2025, owing to the increasing need for infection prevention and continuous air quality monitoring in patient care areas. Microbial air samplers are essential in operating rooms, ICUs, and isolation wards to prevent nosocomial infections. Hospitals also prioritize portable and real-time samplers for rapid detection of airborne pathogens. For instance, King Faisal Hospital in Saudi Arabia has implemented advanced impact samplers to monitor microbial loads in critical zones. The rising prevalence of healthcare-associated infections and stringent health regulations is driving strong demand. In addition, increasing hospital infrastructure investments in countries such as UAE and Saudi Arabia are expanding the base for microbial air sampler adoption.

Pharmaceutical & biotechnology companies are expected to be the fastest-growing end-user segment with a CAGR of 20.1% from 2026 to 2034, driven by strict regulatory requirements for cleanroom monitoring, contamination control, and product safety. These industries require high-precision desktop and real-time samplers to meet GMP and ISO standards. For instance, a UAE-based biotech company utilizes real-time samplers for continuous monitoring of production suites, ensuring rapid detection of contamination. Growing pharmaceutical manufacturing in Egypt, Saudi Arabia, and South Africa is contributing to increased demand. In addition, the integration of IoT-enabled samplers with laboratory management systems allows for automated reporting and remote monitoring, enhancing operational efficiency and compliance. Rising investments in R&D facilities and biologics manufacturing are expected to further accelerate market growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, third-party distributor, and others. Direct tender dominated the market with a revenue share of 44.7% in 2025, driven by bulk procurement by hospitals, pharmaceutical companies, and government institutions. Direct tenders provide buyers with customized solutions, maintenance contracts, and after-sales support, which is critical for high-value microbial air samplers. For instance, the Saudi Ministry of Health procures impact and real-time samplers directly from manufacturers to equip multiple hospitals with standardized monitoring systems. Direct tenders also enable procurement of advanced desktop and portable samplers with software integration, reducing installation and training challenges. Large facilities prefer this channel due to guaranteed supply, warranty coverage, and technical support. Furthermore, direct procurement allows for negotiation on pricing for large-volume orders, enhancing cost efficiency.

Third-party distributor is expected to witness the fastest growth rate of 18.9% from 2026 to 2034, fueled by the increasing presence of regional distributors in Africa and the Middle East, enabling wider market penetration for small to medium-scale healthcare and research facilities. Distributors offer flexibility in product options, faster delivery, and localized technical support. For instance, distributors in South Africa provide portable samplers and consumables to multiple labs, ensuring accessibility and timely maintenance. The expansion of distributor networks allows manufacturers to reach remote regions and smaller institutions that cannot engage in direct tenders. Growth in e-commerce platforms and digital sales portals for laboratory equipment further supports this channel’s rapid adoption.

Middle East and Africa Microbial Air Sampler Market Regional Analysis

- Saudi Arabia dominated the MEA microbial air sampler market with a revenue share of 28.5% in 2025, attributed to rapid healthcare modernization, expanding pharmaceutical industries, and adoption of advanced air monitoring solutions

- Facilities in the region prioritize the use of microbial air samplers to maintain strict air quality standards in hospitals, research labs, and pharmaceutical production units. Real-time monitoring, automated reporting, and portable sampling solutions are highly valued for their ability to enhance operational safety and ensure regulatory compliance

- This widespread adoption is further supported by growing government investments in healthcare infrastructure, expanding laboratory and industrial facilities, and increasing awareness of airborne contamination risks, establishing microbial air samplers as essential equipment across hospitals, pharmaceutical companies, and research institutes in the region

The Saudi Arabia Microbial Air Sampler Market Insight

The Saudi Arabia microbial air sampler market captured the largest revenue share of 28.5% in 2025, driven by rapid healthcare modernization, growing pharmaceutical manufacturing, and increased focus on air quality compliance in hospitals and research laboratories. Facilities are increasingly investing in real-time and portable samplers to ensure strict microbial monitoring and regulatory adherence. The expansion of biotechnology and vaccine manufacturing further propels the market. Moreover, government initiatives to strengthen cleanroom standards and infection prevention protocols are significantly contributing to market growth. The rising adoption of automated and IoT-enabled sampling systems is enhancing operational efficiency and accuracy across the country.

United Arab Emirates Microbial Air Sampler Market Insight

The UAE microbial air sampler market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the country’s investments in healthcare infrastructure and pharmaceutical R&D. Rising awareness about air contamination control and strict regulatory compliance is fostering the adoption of advanced samplers in hospitals, laboratories, and manufacturing units. The growing number of multi-specialty hospitals and research institutes is increasing demand. Furthermore, the UAE is emerging as a regional hub for biotech and pharmaceutical manufacturing, encouraging adoption of both portable and desktop microbial air samplers. Smart integration with facility management systems and automation is further enhancing efficiency and market uptake.

Egypt Microbial Air Sampler Market Insight

The Egypt microbial air sampler market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased industrialization, expansion of healthcare facilities, and rising focus on cleanroom compliance. Hospitals and laboratories are prioritizing microbial air monitoring solutions to meet regulatory standards and reduce contamination risks. For instance, several private hospitals in Cairo have implemented automated desktop samplers for continuous monitoring. The government’s emphasis on improving laboratory infrastructure and infection prevention is further stimulating demand. Portable and real-time samplers are increasingly being adopted for rapid detection in hospitals and research labs.

Kenya Microbial Air Sampler Market Insight

The Kenya microbial air sampler market is poised to grow at the fastest CAGR during the forecast period, driven by rising investments in healthcare infrastructure, expanding laboratory facilities, and increasing awareness about airborne contamination. Portable and semi-automated samplers are gaining traction due to their ease of use and flexibility for research and hospital environments. For instance, several private and public laboratories in Nairobi have adopted portable samplers for routine air quality checks. Growing urbanization and government initiatives supporting cleanroom compliance are further boosting adoption. In addition, the increasing presence of third-party distributors ensures accessibility and support for smaller institutions.

Middle East and Africa Microbial Air Sampler Market Share

The Middle East and Africa Microbial Air Sampler industry is primarily led by well-established companies, including:

- BIOMÉRIEUX (U.S.)

- Avantor, Inc. (U.S.)

- Sartorius AG (Germany)

- VWR International, LLC (U.S.)

- MBV AG (Switzerland)

- Sarstedt AG & Co. KG (Germany)

- Bertin Technologies (France)

- Climet Instruments (U.S.)

- Orum International S.r.l (Italy)

- IUL S.A. (Spain)

- Aquaria S.r.l (Italy)

- Qingdao Junray Intelligent Instrument Co., Ltd. (China)

- EMTEK LLC (U.S.)

- Tianjin Hengao Technology Co., Ltd. (China)

- SKC Inc. (U.S.)

- Andersen Instruments International, LLC (U.S.)

- Zefon International, Inc. (U.S.)

- Bioscience International Inc (U.S.)

- Neutec Group (U.S.)

What are the Recent Developments in Middle East and Africa Microbial Air Sampler Market?

- In July 2025, Pharmagraph announced a significant upgrade to its iVAS active air sampler, enabling operation at a lower flow rate (25 L/min) for extended sampling durations while maintaining compliance with GMP Annex 1. This enhancement allows longer continuous monitoring sessions with fewer plate changes beneficial for pharmaceutical cleanrooms

- In February 2025, Southern Group Laboratory (SGL) partnered to promote the iVAS Roam Portable Microbial Air Sampler across broader markets. The collaboration highlights features such as RFID tracking, barcode plate recording, and “Tour Configurator” functionality, simplifying systematic sampling of critical areas in regulated facilities

- In June 2024, environmental monitoring specialist Pharmagraph launched the iVAS Roam portable microbial air sampler, which complies with EN 17141:2020 standards. The iVAS Roam is designed with a user‑friendly interface and improved biological efficiency, marking a significant upgrade in portable air sampling tech that regional healthcare and industrial labs could adopt for enhanced real‑time air quality and contamination control

- In June 2024, Plair SA launched the Rapid‑C+, a combined real‑time air microbial particle counter and active air sampler designed to transform cleanroom contamination monitoring. The device uses patented biofluorescent particle counting technology to detect viable microorganisms in real time while continuously sampling air onto standard agar media, enhancing contamination control and efficiency in pharmaceutical and sterile processing environments

- In March 2021, Particle Measuring Systems introduced the MiniCapt Mobile Microbial Air Sampler an instrument designed to prevent contamination during monitoring and support clean environments. It featured antibacterial housing, filtered exhaust, and a gloved‑friendly touchscreen, enhancing usability and contamination control in pharmaceutical and research facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.