Middle East and Africa Leather Goods Market Analysis and Insights

Increasing innovation in leather goods with new features and designs and introducing bio-based leather are expected to provide opportunities in the Middle East and Africa leather goods market. However, rising awareness regarding the detrimental effects of unethical practices in producing leather goods and lack of skills, technology, intermediate inputs, and processing equipment is projected to challenge the market growth. The low availability of raw materials, the availability of synthetic alternatives such as plastic leather, and the availability of leather goods at low cost are some factors restraining the market growth.

The Middle East and Africa leather goods market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

The Middle East and Africa leather goods market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyzes that the market is growing with a CAGR of 6.0% in the forecast period of 2023 to 2030 and is expected to reach USD 53,660.54 by 2030. The major factor driving the market growth is the increasing demand for premium and high-quality luxury leather products and low-cost and heavy-duty construction of synthetic leather products is expected to propel market growth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Year |

2021 (Customizable to 2020-2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

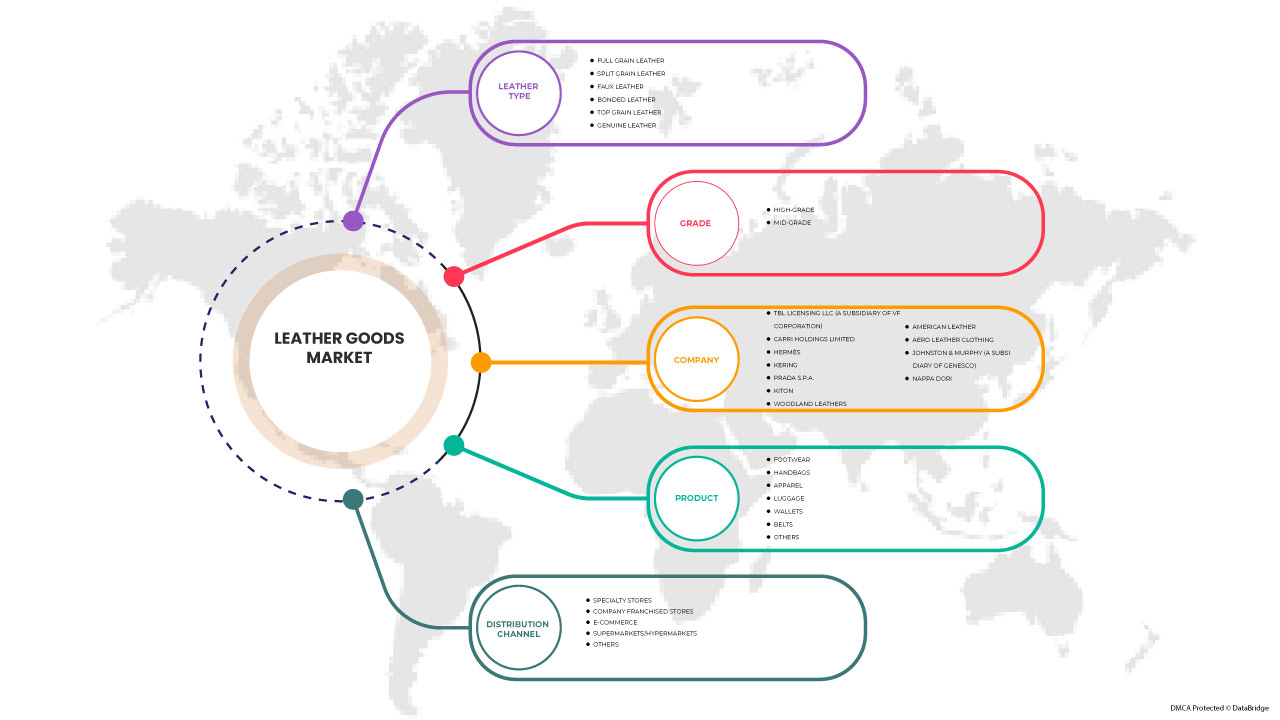

By Leather Type (Full Grain Leather, Split Grain Leather, Top Grain Leather, Genuine Leather, Faux Leather, and Bonded Leather), Product (Footwear, Handbags, Apparel, Luggage, Wallets, Belts, and Others), Grade (High-Grade and Mid-Grade), Distribution Channel (Specialty Stores, Company Franchised Stores, E-Commerce, Supermarkets/Hypermarkets, and Others). |

|

Countries Covered |

Egypt, Saudi Arabia, UNITED ARAB EMIRATES, South Africa, Israel, and rest of Middle East and Africa. |

|

Market Players Covered |

TBL Licensing LLC (A Subsidiary of VF Corporation), CAPRI HOLDINGS LIMITED, Hermès, KERING, PRADA S.P.A., Kiton, Woodland Leathers, American Leather, Aero Leather Clothing, JOHNSTON & MURPHY (A Subsidiary of Genesco), and NAPPA DORI among others |

Market Definition

Leather goods are articles that are made out of leather. They can come in various products such as clothing, footwear, bags, gloves, and others. Due to the characteristics of leather such as dustproof, fireproof, and durability, leather goods are preferred over other resources. The increasing leather requirement in clothing production is driving market growth.

Middle East and Africa Leather Goods Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increase in the demand for premium and high-quality luxury leather products

The rapidly expanding fashion industry has greatly increased consumer demand for high-quality, premium, and luxury leather products. Customers value aesthetics and seek high-end products to create a fashion statement. Moreover, an increasing number of High-Net-Worth Individuals (HNWIs), coupled with the growing trend of designer and branded clothes in major markets, such as the U.S., France, and China, is boosting the demand for luxury leather products. Leather goods are exclusive and often premium priced.

- Low-cost and heavy-duty construction of synthetic leather products

Synthetic leather, which is also known as Faux leather, is cheaper than real leather, animal-friendly, can be produced in virtually every color, can be manufactured to feature a high gloss finish, can be easily cleaned with a damp cloth, requires little maintenance, does not crack as easy as real leather, is UV fade resistant and does not have the real leather smell, which is expected to draw its demand in the forecast period. Faux Leather is a man-made product and is very durable. These days Faux Leather is usually stronger than real leather. Artificial leather such as pleather, Naugahyde, vegan leather, barkcloth, cork, glazed cotton, and recycled PET polyester is available in the market. Pleather is commonly used to make artificial leather clothing. It is made from plastic and is less costly and lighter than genuine leather. Products made from pleather are available in a variety of colors. Another material used for leather is Naugahyde which looks similar to animal skin. All these factors and advantages offered by synthetic leather are expected to drive market growth.

- The rise in the demand for comfortable, trendy, fancy leather apparel, footwear, and accessories

Leather goods come in various products like gloves, bags, footwear, watches, furniture, and many others. The increase in the demand for leather in the production of clothing is one of the major driving factors that may positively affect the market growth. Moreover, the special characteristics of leather, such as the fireproof, dustproof, and crack-proof nature and durability of leather goods, are often preferred over other resources and materials, which has helped increase the demand and sales of the market.

Opportunities

- Increase in innovation in leather goods with new features and designs

Consumer behavior has changed substantially over the past decade. As the old technologies have been exploited more, especially in developing and marketing fashion products, companies are getting new possibilities for fulfilling customer needs with product varieties. The development of new surface finishes and embellishments with viable techniques is needed to develop innovative products and add uniqueness and value to the products.

With the fast evolution and changing lifestyle daily, and rising disposable income, consumers are more inclined toward fashionable products. Consumers are improving their living standards based on their disposable income and are consuming more fashionable products. So these kinds of consumer inclinations will create an opportunity for the market players operating in the market.

- Introduction of bio-biased leather

The bio-based leather manufacturing process has no adverse consequences on the ecosystem. Synthetic leather manufactured from natural fibers like flax cotton or cotton fibers coupled with corn, palm, soybean, and others should be the focus of manufacturers to gain a competitive market share in the Middle East and Africa leather goods market with the advent of bio-based leather. Apart from this, leaves of pineapple fruit are indeed being utilized to manufacture "Pinatex," a novel synthetic leather item. These pineapple leaves have an elastic and solid fiber that makes them excellent for usage in the manufacturing procedure.

Restraints/Challenges

- The availability of cheaper leather goods and the shortage of leather goods worldwide

The high cost of natural leather is a factor that has driven the need for natural leather replacements. The low quality of leather and the shortage of leather all over the world are bottlenecks for the leather goods industry. Some kinds of leather goods available in the market have low costs. It will also hamper the supply and demand for good quality leather products and their price. Moreover, the worldwide shortage of leather goods and raw materials, such as genuine leather, is driving up the price of these products. As a result, European buyers are looking for low-cost suppliers who can produce leather from exotic animals like pythons and alligators. These factors are restraining market growth. Also, the low availability of raw materials, the availability of synthetic alternatives such as plastic leather, and the availability of leather goods at low cost are some factors restraining market growth.

- Strict governmental regulations on the production and use of natural leather

Stringent government regulations in regions such as Europe and the U.S., among others, are closing various tanneries and leather processing units. These governments have enforced regulations regarding leather use, which will act as a restraint for market growth in the coming years. Government policies have made new synthetic alternatives, such as plastic leather, available in the market.

- Lack of skills, technology, intermediate inputs and processing equipment

The scarcity of home universities that offers leather technology degrees contributes to this situation. This has created a skill gap that needs to be the priority in the leather sector development. The lack of professionals and inadequate training centers to train technicians and operators required in the sector are the causes of the prevailing situation. The lack of technology, skill, and intermediate is a challenge for the leather goods market as these features help to produce high-quality leather goods. The quality of leather goods is most important for the industry to grow.

Recent Development

- In August 2017, the Swiss luxury brand, Bally, launched its first flagship store in India in a joint-venture partnership with Reliance Brands Limited. This store includes women's and men's shoes, accessories, and premium leather goods.

Middle East and Africa Leather Goods Market Scope

The Middle East and Africa leather goods market is categorized into four notable segments based on leather type, product, grade, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Leather Type

- Full Grain Leather

- Split Grain Leather

- Faux Leather

- Bonded Leather

- Top Grain Leather

Based on leather type, the market is segmented into full grain leather, split grain leather, top grain leather, genuine leather, faux leather, bonded leather, and others.

Product

- Footwear

- Handbags

- Apparel

- Luggage

- Wallets

- Belts

- Others

Based on product, the market is segmented into footwear, handbags, apparel, luggage, wallets, belts, and others.

Grade

- High-Grade

- Mid-Grade

Based on grade, the market is segmented into high-grade and mid-grade.

Distribution Channel

- Specialty Stores

- Company Franchised Stores

- E-Commerce

- Supermarkets/Hypermarkets

- Others

Based on distribution channel, the market is segmented into specialty stores, company franchised stores, e-commerce, supermarkets/hypermarkets, and others.

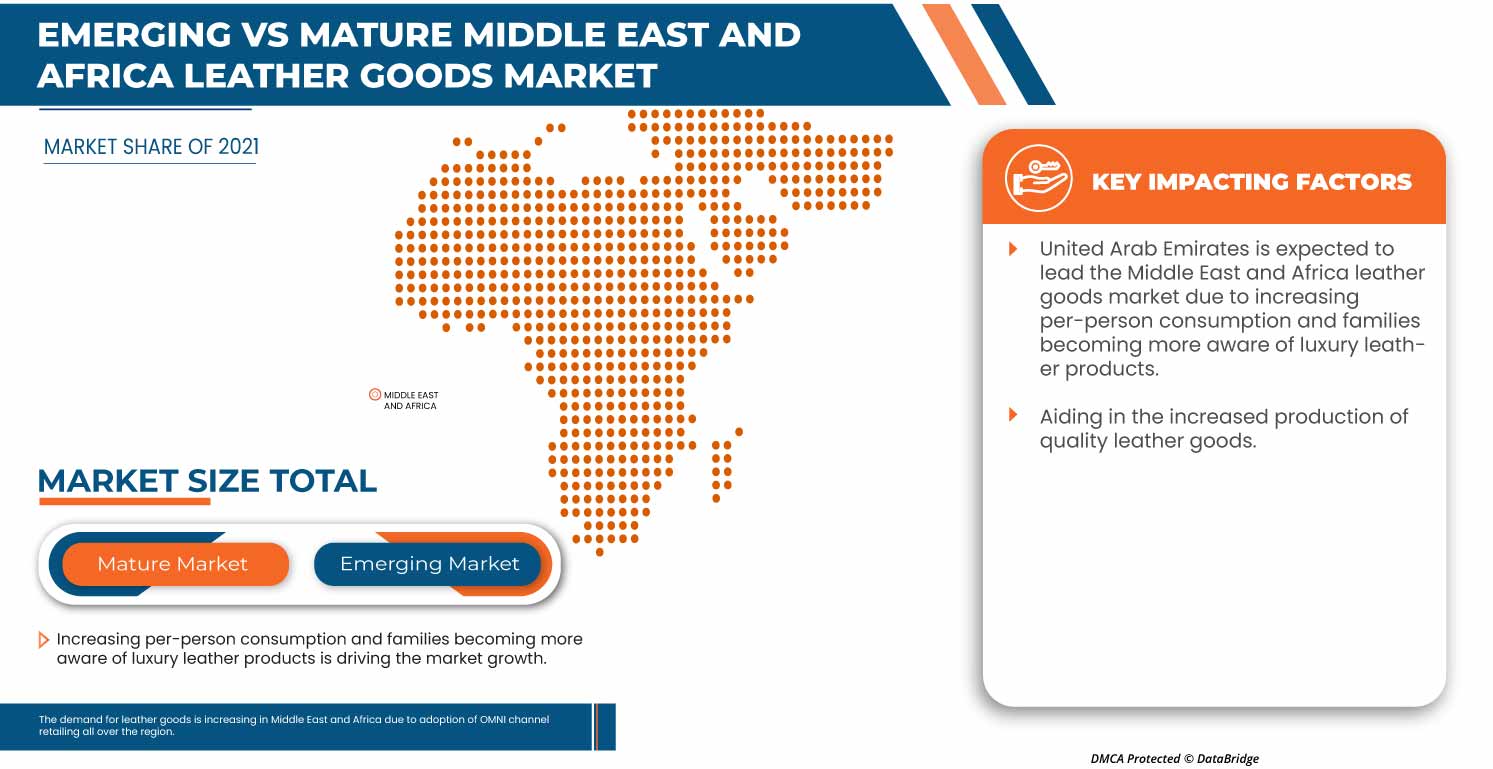

Middle East and Africa Leather Goods Market Regional Analysis/Insights

The Middle East and Africa leather goods market is segmented based on leather type, product, grade, and distribution channel.

The countries in the Middle East and Africa leather goods market are Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel, and rest of Middle East and Africa. United Arab Emirates is dominating the Middle East and Africa leather goods market in terms of market share and market revenue due to the growing urbanization and industrialization that has led to the growth of the economies.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Leather Goods Market Share Analysis

Middle East and Africa leather goods market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East and Africa leather goods market.

Some of the prominent participants operating in the Middle East and Africa leather goods market are TBL Licensing LLC (A Subsidiary of VF Corporation), CAPRI HOLDINGS LIMITED, Hermès, KERING, PRADA S.P.A., Kiton, American Leather, Aero Leather Clothing, JOHNSTON & MURPHY (A Subsidiary of Genesco), and NAPPA DORI among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA LEATHER GOODS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 THE RISE IN THE DEMAND FOR COMFORTABLE, TRENDY, FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES

5.1.2 INCREASE IN THE DEMAND FOR PREMIUM AND HIGH-QUALITY LUXURY LEATHER PRODUCTS

5.1.3 LOW-COST AND HEAVY-DUTY CONSTRUCTION OF SYNTHETIC LEATHER PRODUCTS

5.1.4 RISE IN THE EXPENDITURE ON HOME FURNISHING AND RENOVATION

5.2 RESTRAINTS

5.2.1 THE AVAILABILITY OF CHEAPER LEATHER GOODS AND THE SHORTAGE OF LEATHER GOODS WORLDWIDE

5.2.2 STRICT GOVERNMENTAL REGULATIONS ON THE PRODUCTION AND USE OF NATURAL LEATHER

5.3 OPPORTUNITIES

5.3.1 INCREASE IN INNOVATION IN LEATHER GOODS WITH NEW FEATURES AND DESIGNS

5.3.2 INTRODUCTION OF BIO-BIASED LEATHER

5.4 CHALLENGES

5.4.1 RISE IN THE AWARENESS REGARDING THE DETRIMENTAL EFFECTS OF UNETHICAL PRACTICES IN THE PRODUCTION OF LEATHER GOODS

5.4.2 LACK OF SKILLS, TECHNOLOGY, INTERMEDIATE INPUTS, AND PROCESSING EQUIPMENT

6 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 FOOTWEAR

6.2.1 FOOTWEAR, BY TYPE

6.2.1.1 BOOTS

6.2.1.2 FORMAL SHOES

6.2.1.3 LOAFERS

6.2.1.4 BALLERINAS

6.2.1.5 SANDALS

6.2.1.6 OTHERS

6.3 HANDBAGS

6.3.1 HANDBAGS, BY TYPE

6.3.1.1 SLING BAG

6.3.1.2 CLUTCHES

6.3.1.3 SATCHEL BAG

6.3.1.4 TOTE BAGS

6.3.1.5 WRISTLET BAG

6.3.1.6 OTHERS

6.4 APPAREL

6.4.1 APPAREL, BY TYPE

6.4.1.1 JACKET

6.4.1.2 CAPS

6.4.1.3 SUIT

6.4.1.4 WAISTCOAT

6.4.1.5 SHIRTS

6.4.1.6 OTHERS

6.5 LUGGAGE

6.5.1 LUGGAGE, BY TYPE

6.5.1.1 TRAVEL BAGS

6.5.1.2 BUSINESS BAGS

6.5.1.3 DUFFEL BAGS

6.5.1.4 SUITCASE & BRIEFCASE

6.5.1.5 ROLLABLE LUGGAGE

6.5.1.6 OTHERS

6.6 WALLETS

6.7 BELTS

6.8 OTHERS

7 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY LEATHER TYPE

7.1 OVERVIEW

7.2 FULL GRAIN LEATHER

7.3 SPLIT GRAIN LEATHER

7.4 TOP GRAIN LEATHER

7.5 GENUINE LEATHER

7.6 FAUX LEATHER

7.7 BONDED LEATHER

8 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY GRADE

8.1 OVERVIEW

8.2 HIGH-GRADE

8.3 MID-GRADE

9 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 SPECIALTY STORES

9.3 COMPANY FRANCHISED STORES

9.4 E-COMMERCE

9.5 SUPERMARKETS/HYPERMARKETS

9.6 OTHERS

10 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 U.A.E.

10.1.2 SAUDI ARABIA

10.1.3 SOUTH AFRICA

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

11.2 EVENT

11.3 ACQUISITION

11.4 AWARD

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 KERING

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 PRADA S.P.A.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 CAPRI HOLDINGS LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 HERMÈS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 TBL LICENSING LLC (A SUBSIDIARY OF VF CORPORATION)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AERO LEATHER CLOTHING

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 AMERICAN LEATHER

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 JOHNSTON & MURPHY (A SUBSIDIARY OF GENESCO)

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 KITON

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 NAPPA DORI

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 WOODLAND LEATHERS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TRUNKS, SUITCASES, VANITY CASES, EXECUTIVE CASES, BRIEFCASES, SCHOOL SATCHELS, SPECTACLE CASES, AND OTHER GOODS PRODUCED USING LEATHER AND SIMILAR MATERIALS; HS CODE – 4202 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA FOOTWEAR IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HANDBAGS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA APPAREL IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA LUGGAGE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WALLETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA BELTS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA FULL GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SPLIT GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TOP GRAIN LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA GENUINE LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA FAUX LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BONDED LEATHER IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HIGH-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA MID-GRADE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SPECIALTY STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA COMPANY FRANCHISED STORES IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA E-COMMERCE IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN LEATHER GOODS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 40 U.A.E. LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 41 U.A.E. FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E. HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 U.A.E. APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.A.E. LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 47 U.A.E. LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 56 SOUTH AFRICA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 57 SOUTH AFRICA FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SOUTH AFRICA HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SOUTH AFRICA APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 SOUTH AFRICA LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 SOUTH AFRICA LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 62 SOUTH AFRICA LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 63 SOUTH AFRICA LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 64 EGYPT LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 EGYPT FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 EGYPT HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 EGYPT APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 EGYPT LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 EGYPT LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 70 EGYPT LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 71 EGYPT LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 ISRAEL LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 73 ISRAEL FOOTWEAR IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 ISRAEL HANDBAGS IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 ISRAEL APPAREL IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 ISRAEL LUGGAGE IN LEATHER GOODS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 ISRAEL LEATHER GOODS MARKET, BY LEATHER TYPE, 2021-2030 (USD MILLION)

TABLE 78 ISRAEL LEATHER GOODS MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 79 ISRAEL LEATHER GOODS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST AND AFRICA LEATHER GOODS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA LEATHER GOODS MARKET

FIGURE 2 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: SEGMENTATION

FIGURE 13 RISING DEMAND FOR COMFORTABLE, TRENDY, AND FANCY LEATHER APPAREL, FOOTWEAR, AND ACCESSORIES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA LEATHER GOODS MARKET IN THE FORECAST PERIOD

FIGURE 14 FOOTWEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA LEATHER GOODS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA LEATHER GOODS MARKET

FIGURE 16 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: BY PRODUCT, 2022

FIGURE 17 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: BY LEATHER TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: BY GRADE, 2022

FIGURE 19 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET: SNAPSHOT (2022)

FIGURE 21 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET: BY COUNTRY (2022)

FIGURE 22 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA LEATHER GOODS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 25 MIDDLE EAST & AFRICA LEATHER GOODS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.