Middle East And Africa Laxative Market

Market Size in USD Billion

CAGR :

%

USD

587.70 Billion

USD

861.70 Billion

2024

2032

USD

587.70 Billion

USD

861.70 Billion

2024

2032

| 2025 –2032 | |

| USD 587.70 Billion | |

| USD 861.70 Billion | |

|

|

|

|

Middle East and Africa Laxative Market Size

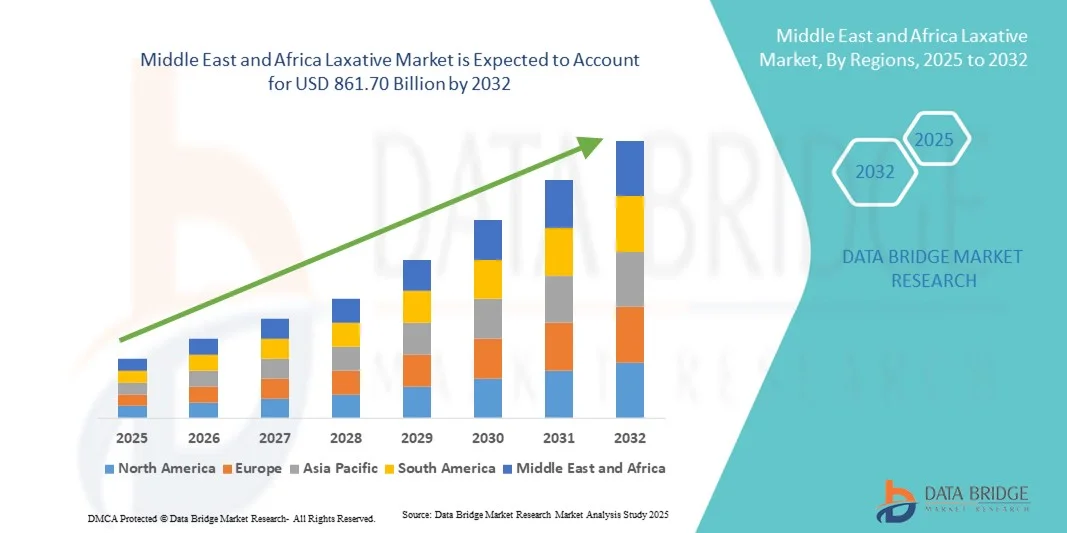

- The Middle East and Africa laxative market size was valued at USD 587.70 billion in 2024 and is expected to reach USD 861.70 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of constipation and gastrointestinal disorders, coupled with rising awareness among consumers regarding digestive health. Improved access to healthcare, changing lifestyles, and dietary habits are contributing to higher demand for effective laxative solutions globally

- Furthermore, the market is being driven by the development of innovative and specialized laxatives, including osmotic, stimulant, bulk-forming, and herbal formulations. Expanding e-commerce channels, strategic partnerships between pharmaceutical companies, and growing consumer preference for over-the-counter (OTC) options are significantly boosting the adoption of laxative products and overall market growth

Middle East and Africa Laxative Market Analysis

- The Laxative Market is witnessing significant growth due to the rising prevalence of constipation and gastrointestinal disorders, increasing awareness of digestive health, and changing dietary habits and lifestyles. Growing OTC availability and consumer preference for self-medication are driving higher adoption of laxative products globally

- Furthermore, the market is propelled by the development of innovative laxatives, including bulk-forming, osmotic, stimulant, and herbal formulations. Expansion of e-commerce platforms, strategic collaborations between pharmaceutical companies, and increasing health-conscious consumer behavior are significantly boosting the market’s growth

- Saudi Arabia dominated the laxative market in the Middle East with the largest revenue share of 41.2% in 2024, driven by high healthcare expenditure, growing awareness of digestive health, and strong access to OTC medications. The country leads the region due to early adoption of new formulations and a well-established retail and pharmacy network

- The U.A.E is expected to be the fastest-growing market in the Middle East during the forecast period (2025–2032), with a CAGR of 9.3%, owing to rising urbanization, increasing disposable incomes, expanding healthcare infrastructure, and growing consumer awareness about digestive wellness

- The Oral segment dominated the largest market revenue share of 84.3% in 2024, driven by ease of administration, convenience, and high patient compliance. Oral formulations cater to both chronic and acute constipation management

Report Scope and Laxative Market Segmentation

|

Attributes |

Laxative Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Laxative Market Trends

Rising Demand Driven by Increasing Digestive Health Awareness

- A significant and accelerating trend in the Middle East and Africa laxative market is the growing awareness of digestive health and preventive care among the population. Consumers are increasingly prioritizing gut health, dietary management, and overall well-being, which is driving demand for effective and safe laxative

- For instance, health-conscious consumers in the region are opting for fiber-based and natural laxative formulations that offer gentle relief without causing dependency, boosting the popularity of plant-derived products. Similarly, pharmaceutical companies are focusing on developing formulations that combine efficacy with minimal side effects, catering to both chronic and occasional constipation cases

- Market players are investing in innovative product delivery formats such as chewable tablets, powders, and drink mixes to enhance convenience and patient compliance. Moreover, there is an increasing emphasis on pediatric and geriatric formulations that meet the specific physiological needs of these populations

- The integration of laxatives into preventive healthcare regimens, combined with growing physician awareness and recommendation, is expanding market adoption. Companies are also conducting awareness campaigns to educate consumers on the importance of fiber intake, hydration, and lifestyle modifications, driving sustained demand

- This trend towards more effective, safe, and user-friendly laxative products is fundamentally reshaping consumer expectations and encouraging product innovation. Consequently, key players are launching formulations that cater to a wide range of consumers, including those with sensitive digestive systems, chronic conditions, and lifestyle-related constipation

- The demand for diverse laxative options that provide both efficacy and convenience is growing rapidly across retail and pharmacy channels, as consumers increasingly prioritize digestive wellness and accessible solutions

Middle East and Africa Laxative Market Dynamics

Driver

Growing Need Due to Rising Digestive Health Awareness and Lifestyle Changes

- The increasing prevalence of digestive disorders, irregular bowel movements, and lifestyle-related constipation in the Middle East and Africa is a significant driver for the heightened demand for laxatives

- For instance, in March 2024, a leading pharmaceutical company introduced a novel plant-based laxative targeting chronic constipation, addressing the growing preference for natural remedies. Such product developments by key companies are expected to drive the Laxative Market growth in the forecast period

- As healthcare professionals emphasize preventive care and proper digestive health management, consumers are seeking products that provide safe and effective relief. This has prompted manufacturers to enhance formulations, improve taste, and reduce side effects

- Furthermore, increasing urbanization, sedentary lifestyles, and dietary changes are contributing to the rising prevalence of constipation, driving the adoption of laxatives. Awareness campaigns and physician endorsements are also bolstering consumer confidence and expanding market penetration

- Convenience, accessibility, and variety of product types, including over-the-counter and prescription-based formulations, are key factors propelling market growth. The trend towards wellness-oriented consumption and proactive digestive health management further contributes to the adoption of laxatives in both retail and healthcare channels

Restraint/Challenge

Concerns Regarding Safety, Side Effects, and Product Costs

- Concerns surrounding potential side effects, such as dehydration, electrolyte imbalance, or dependency, pose a significant challenge to broader market adoption of laxatives. Consumers may hesitate to use certain formulations without medical guidance, limiting the uptake of stronger or prescription-based products

- For instance, reported cases of abdominal discomfort or bloating from stimulant laxatives have made some consumers cautious about their usage, affecting market penetration in certain segments

- Addressing these safety concerns through clinical studies, transparent labeling, and physician guidance is crucial for building consumer trust. Companies are also focusing on the development of natural, fiber-based, and low-dose formulations to minimize adverse effects and reassure consumers. In addition, the relatively high cost of certain innovative or specialty laxatives compared to traditional options can be a barrier for price-sensitive consumers, particularly in developing regions

- While generic products provide affordability, premium formulations with advanced delivery mechanisms or dual-action benefits often come at a higher price point, potentially limiting accessibility.

- Overcoming these challenges through rigorous safety testing, consumer education on proper usage, and the development of cost-effective and safer laxative options will be vital for sustained market growth

Middle East and Africa Laxative Market Scope

The market is segmented on the basis of type, flavors, source, indication, mode of purchase, dosage form, route of administration, population type, sales channel, and distribution channel.

- By Type

On the basis of type, the Laxative Market is segmented into osmotic laxatives, stimulant laxatives, bulk laxatives, and lubricant & emollient laxatives. The Osmotic Laxatives segment dominated the largest market revenue share of 42.5% in 2024, driven by its widespread recommendation for managing chronic constipation and irritable bowel syndrome with constipation. These laxatives work by retaining water in the bowel, softening stools, and promoting bowel movements, which enhances patient compliance. The segment benefits from broad physician endorsement and inclusion in treatment guidelines. Osmotic laxatives are preferred due to their relatively mild side effects and predictable efficacy. Over-the-counter availability and awareness campaigns further boost usage. Integration into combination therapies with probiotics and dietary supplements supports demand. Patients often continue osmotic laxatives for long-term management, sustaining revenue. The segment sees consistent growth in both pediatric and adult populations. Increasing prevalence of constipation-related disorders in aging populations further consolidates market dominance. Convenience of oral formulations such as tablets, powders, and liquids enhances adoption. Global penetration in emerging markets supports continued market share.

The Stimulant Laxatives segment is expected to witness the fastest CAGR of 19.2% from 2025 to 2032, fueled by rising use in acute and opioid-induced constipation cases. These agents act by stimulating intestinal motility, providing rapid relief. Awareness of opioid-induced constipation among healthcare providers and patients drives adoption. Innovations in formulation, including sustained-release tablets and combination products, improve efficacy and reduce adverse effects. Hospitals and elderly care centers increasingly recommend stimulant laxatives for short-term interventions. Expansion of e-commerce and online pharmacy sales further accelerates growth. The segment benefits from a rising number of chronic pain patients using opioids, leading to increased demand. Targeted marketing and awareness campaigns strengthen visibility. Healthcare providers are increasingly integrating stimulant laxatives into treatment protocols for acute constipation. The segment’s predictable onset of action ensures repeat usage and prescription loyalty. Regulatory approvals in multiple markets enhance availability.

- By Flavors

On the basis of flavors, the market is segmented into flavored and unflavored laxatives. The With Flavor segment dominated the largest market revenue share of 55.3% in 2024, driven by increasing patient preference for palatable oral formulations, especially among children and elderly patients. Flavored laxatives improve adherence and reduce aversion, making them highly popular in syrup and liquid forms. The segment benefits from product innovations in fruity, mint, and neutral flavors. Pediatric formulations are particularly targeted with appealing flavors to ensure compliance. Flavoring agents are incorporated without affecting efficacy, maintaining therapeutic standards. The segment also supports over-the-counter sales, increasing accessibility. Marketing campaigns highlight taste advantages for children and sensitive populations. The availability of flavored powders and liquids further strengthens adoption. Hospitals and homecare providers recommend flavored options for long-term use. Increasing preference for pleasant-tasting medications globally consolidates market share.

The Without Flavor segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, primarily due to cost-effectiveness and suitability for adult patients requiring routine supplementation. Unflavored formulations allow combination with other beverages or foods, offering flexible administration. Adult patients and hospitals prefer neutral-taste options for ease of consumption. Bulk purchasing and generic versions contribute to faster growth. The segment is widely used in institutional settings, including hospitals and elderly care centers. Clinicians often recommend unflavored formulations for consistent dosing. Online pharmacy sales of unflavored powders accelerate market penetration. Regulatory compliance with flavoring standards supports continued adoption. The segment provides a reliable, long-term solution for chronic constipation management.

- By Source

On the basis of source, the market is segmented into natural, synthetic, and others. The Natural segment dominated the largest market revenue share of 48.6% in 2024, driven by rising consumer preference for herbal and plant-based products due to perceived safety and fewer side effects. Ingredients like senna, psyllium husk, and aloe are widely used. Awareness about natural remedies and preventive health drives adoption. Natural laxatives appeal to health-conscious patients seeking long-term use without chemical exposure. Increasing e-commerce and OTC availability strengthen growth. Pediatric and adult populations increasingly prefer natural formulations. Integration with dietary supplements and functional foods boosts market reach. Market penetration is supported by health stores and pharmacies emphasizing natural labeling. Physicians recommend natural options for mild chronic constipation. Natural segment marketing focuses on holistic wellness benefits. Flavor and palatability enhancements further improve patient compliance.

The Synthetic segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, due to higher potency, faster relief, and widespread hospital use. Synthetic agents like polyethylene glycol and lactulose are clinically preferred for rapid management of severe or opioid-induced constipation. Growth is driven by clinical adoption, standardization, and availability in multiple dosage forms. Hospitals and elderly care centers rely on synthetic options for acute interventions. Online pharmacies and direct-to-consumer marketing expand reach. Continuous product innovations, including liquid, powder, and tablet forms, improve patient adherence. Regulatory approvals and international guidelines support wider clinical adoption. Market demand is fueled by increasing prevalence of constipation-related disorders.

- By Indication

On the basis of indication, the market is segmented into chronic constipation, irritable bowel syndrome with constipation (IBS-C), opioid-induced constipation, acute constipation, and others. The Chronic Constipation segment dominated the largest market revenue share of 46.8% in 2024, driven by the growing elderly population and rising awareness of long-term bowel health. Chronic constipation requires consistent management, increasing repeat purchases of laxatives. Healthcare providers recommend a combination of dietary management and pharmacological intervention. The segment benefits from OTC availability, hospital prescriptions, and online sales. Adults and geriatric populations are primary users. Marketing emphasizes improved quality of life and symptom relief. Product diversification into tablets, liquids, powders, and gels enhances adoption. Clinical guidelines support routine use of osmotic and bulk laxatives. Growing prevalence of lifestyle-related constipation contributes to sustained demand. Pharmaceutical companies actively promote chronic constipation products through awareness campaigns.

The Opioid-Induced Constipation segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, fueled by the increasing use of opioid analgesics for chronic pain management. The need for effective bowel management in opioid users drives demand for stimulant and osmotic laxatives. Hospitals, elderly care centers, and home healthcare increasingly recommend prophylactic use. Novel formulations with rapid onset of action are under development. Online pharmacies expand accessibility for home use. Awareness campaigns target clinicians and patients for preventive care. Growth is also supported by guidelines recommending constipation management in opioid therapy. Rising prevalence of chronic pain globally further accelerates market growth.

- By Mode of Purchase

On the basis of mode of purchase, the market is segmented into prescription and over-the-counter (OTC). The OTC segment dominated the largest market revenue share of 58.2% in 2024, driven by high consumer convenience and growing awareness of self-care. OTC availability allows patients to manage mild-to-moderate constipation without a prescription, encouraging self-medication practices. Marketing campaigns and retail promotions further enhance adoption. OTC formulations include tablets, powders, liquids, and gels, catering to various patient preferences. Increasing preference for home-based therapy and ease of purchase contribute to market dominance. OTC distribution through pharmacies, grocery stores, and online channels ensures widespread accessibility. Repeat purchases and long-term use in chronic conditions sustain revenue growth. Demographic trends toward self-medication, urbanization, and increasing internet penetration support adoption. The segment benefits from cost-effectiveness and ease of availability. Healthcare professionals often recommend OTC laxatives for mild constipation before considering prescription options. Patient adherence is higher due to easy-to-use formulations. The segment also sees increasing adoption among elderly populations for home-based care. Overall, the segment’s dominance is reinforced by convenience, affordability, and product variety.

The Prescription segment is expected to witness the fastest CAGR of 19.6% from 2025 to 2032, driven by severe cases like opioid-induced constipation, IBS-C, and chronic conditions requiring supervised treatment. Prescription laxatives are often combined with other therapies and administered in clinical settings. Hospitals, specialty clinics, and healthcare providers play a key role in driving growth. Regulatory approvals and guideline recommendations support adoption. Prescription segment growth is also fueled by increasing awareness of treatment protocols among physicians. Advanced formulations such as targeted osmotic or stimulant agents enhance efficacy. Hospital procurement and patient monitoring systems strengthen market penetration. Growth is supported by rising prevalence of chronic constipation in adult and geriatric populations. Online pharmacies providing prescription fulfillment contribute to faster adoption. Specialized patient populations, including oncology and post-operative patients, drive demand. The segment benefits from clinical preference and institutional endorsement. Education and training programs for healthcare professionals also support growth.

- By Dosage Form

On the basis of dosage form, the market is segmented into tablets, capsules, powder, liquid & gels, suppositories, and others. The Tablets segment dominated the largest market revenue share of 47.9% in 2024, due to ease of use, portability, and physician preference. Tablets are suitable for both chronic and acute management and are cost-effective compared to other dosage forms. Available in flavored and unflavored options, tablets ensure high patient adherence. OTC and hospital distribution channels contribute significantly to market dominance. Tablets are widely preferred across pediatric, adult, and geriatric populations. The segment benefits from repeated purchases and long-term usage for chronic constipation. Product innovations in coating and dissolution profiles improve efficacy. Combination tablets with fiber supplements or probiotics further drive adoption. Tablet formulations are easy to manufacture, ensuring global availability. The segment benefits from marketing efforts emphasizing convenience and reliability. High patient compliance rates sustain revenue growth. Tablets remain the default choice in institutional and homecare settings.

The Powder segment is expected to witness the fastest CAGR of 20.2% from 2025 to 2032, driven by easy formulation into flavored drinks, improved solubility, and suitability for home healthcare. Pediatric and geriatric populations benefit from easy-to-consume powders. Online pharmacies enhance accessibility and distribution reach. Powders are ideal for combination therapies and functional ingredients. Growth is fueled by rising awareness of hydration and fiber intake in constipation management. Hospitals and care centers increasingly adopt powder formulations for flexibility. Innovative flavors and solubility improvements enhance patient compliance. The segment benefits from increasing e-commerce penetration for health products. Global expansion of homecare services supports adoption. Multi-dose sachets and pre-measured packs improve convenience. Targeted marketing to parents and caregivers drives sales.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral and rectal. The Oral segment dominated the largest market revenue share of 84.3% in 2024, driven by ease of administration, convenience, and high patient compliance. Oral formulations cater to both chronic and acute constipation management. Tablets, powders, liquids, and gels offer multiple options for patient preference. The segment benefits from widespread OTC availability and physician recommendation. Repeated usage in chronic cases ensures consistent revenue growth. Oral formulations are preferred across age groups and demographics. Marketing emphasizes home-based administration and self-care advantages. Integration with flavored and fiber-based products boosts adoption. Oral dosage forms are easier to manufacture and distribute, increasing accessibility. Physicians often recommend oral solutions for mild to moderate constipation first. Online pharmacy channels strengthen sales and patient reach. The segment is supported by education campaigns promoting regular bowel health.

The Rectal segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, primarily for acute relief and hospital-based interventions including suppositories and enemas. Rectal formulations provide rapid relief in severe constipation cases. Hospitals, elderly care centers, and emergency settings drive adoption. Innovation in suppository composition enhances comfort and effectiveness. The segment is used in both pediatric and adult acute care. Increasing awareness of safe and effective rectal options supports growth. Market penetration is further strengthened by prescription protocols. Rectal administration ensures targeted delivery with minimal systemic absorption. Integration with hospital-based care services supports revenue growth. Advanced formulations with improved stability increase shelf-life. The segment benefits from clinical preference in acute interventions. Online pharmacy availability improves accessibility. Healthcare training and education programs encourage correct usage.

- By Population Type

On the basis of population type, the market is segmented into children and adults. The Adults segment dominated the largest market revenue share of 72.5% in 2024, due to higher prevalence of chronic constipation, IBS-C, and opioid-induced constipation. Adult populations, including elderly patients, are the primary users of both OTC and prescription laxatives. Adoption is supported by physician recommendations and self-care trends. OTC availability and online sales increase access. Repeated usage for chronic conditions ensures sustained market growth. Hospitals and home healthcare services contribute significantly to segment dominance. Product variety in tablets, powders, and liquids caters to adult patient preferences. Awareness campaigns on bowel health enhance adoption. Adults are also primary consumers of synthetic and stimulant laxatives. Clinical guidelines support routine use for adults with lifestyle-related constipation. Marketing emphasizes quality-of-life improvements. The segment is supported by insurance coverage and hospital protocols.

The Children segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, driven by growing awareness of pediatric bowel health and palatable formulations. Flavored syrups, powders, and chewable tablets enhance compliance. Parents increasingly prefer gentle, natural, and safe options. OTC availability and home healthcare services support rapid adoption. Pediatric constipation awareness campaigns and education programs increase usage. Hospitals and pediatric clinics recommend specialized pediatric laxatives. Online pharmacy platforms improve access to age-appropriate formulations. Repeat purchases for chronic cases support sustained growth. Product innovations in taste, texture, and solubility improve adherence. Regulatory approvals for pediatric use enhance credibility. The segment benefits from rising incidence of functional constipation in children.

- By Sales Channel

On the basis of sales channel, the market is segmented into hospitals, elderly care centers, home healthcare, pharmacy stores, grocery/health & beauty stores, and others. The Pharmacy Stores segment dominated the largest market revenue share of 52.8% in 2024, fueled by OTC availability, wide retail presence, and repeat purchases. Pharmacies provide convenience, accessibility, and trusted guidance for consumers. Product variety in flavors, dosage forms, and formulations supports high adoption. Urban penetration ensures consistent sales. Retail promotions and marketing enhance visibility. OTC availability ensures consumer self-care, sustaining demand. Adult and pediatric populations benefit from easy access. The segment is supported by growing awareness of bowel health and chronic constipation management. Integration with e-pharmacy channels further strengthens reach. Pharmacies serve as key distribution points for both natural and synthetic laxatives. Repeated purchases for chronic cases support market dominance. Wide geographic coverage ensures penetration into urban and semi-urban regions.

The Home Healthcare segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, driven by the increasing trend of home-based therapy for chronic constipation and elderly care. Rising elderly population and convenience of in-home administration drive growth. Online pharmacy integration supports accessibility and home delivery. Home healthcare providers recommend flavored and easy-to-use formulations. Growth is fueled by patient preference for self-management and minimal hospital visits. Repeated use in chronic conditions sustains revenue. Caregivers and parents prefer home healthcare solutions for children and adults. Telehealth awareness campaigns further boost adoption. Direct-to-consumer marketing enhances visibility. Hospitals and clinics coordinate homecare prescriptions. Expansion of homecare networks supports market growth. Pediatric and geriatric adoption contributes significantly to segment CAGR.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, wholesalers, and others. The Direct Sales segment dominated the largest market revenue share of 45.7% in 2024, driven by hospital and institutional procurement, direct-to-consumer initiatives, and online pharmacy partnerships. Hospitals and elderly care centers rely on direct supply for bulk procurement. Manufacturers’ direct sales ensure better pricing, consistent supply, and brand loyalty. Growth is supported by marketing campaigns targeting institutions. Online pharmacy partnerships strengthen reach to end-users. Repeat purchases for chronic management contribute to revenue. Direct relationships with healthcare providers improve market penetration. Product variety and fast delivery enhance adoption. Hospitals prefer direct sales for reliable supply. Adult and pediatric formulations are included in institutional bulk orders. Regulatory compliance and contractual agreements support stability. Direct supply channels support premium product distribution.

The Wholesalers segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, fueled by increasing demand from retail pharmacies and institutional buyers. Wholesalers provide large-volume distribution across urban and semi-urban regions. Growth is supported by expanding pharmacy chains and hospital networks. Distribution efficiency and broad reach accelerate adoption. Emerging markets increasingly rely on wholesale distribution. Retail and institutional partnerships improve market penetration. Wholesalers facilitate accessibility for OTC and prescription formulations. Supply chain reliability supports consistent availability. Online pharmacy collaborations further boost growth. Wholesalers handle multiple dosage forms and flavored options. Market expansion and demand from homecare services sustain CAGR. Wholesale networks also support cost-effective distribution.

Middle East and Africa Laxative Market Regional Analysis

- Middle East dominated the Laxative Market with the largest revenue share in 2024, driven by high healthcare expenditure, growing awareness of digestive health, and strong access to OTC medications. The region benefits from early adoption of innovative formulations and a well-established retail and pharmacy network

- Consumers in the Middle East are increasingly prioritizing digestive wellness and preventive care, driving the demand for safe, effective, and convenient laxative options

- This widespread adoption is further supported by increasing urbanization, rising disposable incomes, and a growing emphasis on overall health and wellness, establishing laxatives as a preferred solution for both occasional and chronic constipation management

Saudi Arabia Laxative Market Insight

The Saudi Arabia laxative market captured the largest revenue share of 41.2% in 2024 within the Middle East, fueled by high healthcare expenditure, strong physician recommendations, and widespread access to OTC medications. The country leads the region due to the early adoption of novel formulations, a growing focus on digestive health, and a robust retail and pharmacy network. Moreover, increasing awareness campaigns and health initiatives are significantly contributing to market growth.

U.A.E. Laxative Market Insight

The U.A.E laxative market is expected to be the fastest-growing market in the Middle East during the forecast period (2025–2032), with a CAGR of 9.3%, owing to rising urbanization, increasing disposable incomes, expanding healthcare infrastructure, and growing consumer awareness about digestive wellness. The country is witnessing increasing demand for innovative and convenient laxative formulations, supported by expanding pharmaceutical distribution networks and improved access to healthcare services.

Middle East and Africa Laxative Market Share

The Laxative Market industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- GlaxoSmithKline plc (U.K.)

- Boehringer Ingelheim International GmbH (Germany)

- Procter & Gamble Company (U.S.)

- Sanofi (France)

- Takeda Pharmaceutical Company Ltd (Japan)

- Pfizer Inc. (U.S.)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Reckitt Benckiser Group plc (U.K.)

- Nestlé S.A. (Switzerland)

- Dr. Reddy’s Laboratories Ltd (India)

- Cipla Ltd (India)

Latest Developments in Middle East and Africa Laxative Market

- In February 2023, Perrigo Company plc introduced a new over‑the‑counter stimulant laxative in the U.S., designed for patients suffering from chronic constipation. The product features an improved, easier‑to‑swallow form and targets a broader demographic of adult users

- In April 2023, Teva Pharmaceutical Industries Ltd. launched a non‑habit forming laxative in the U.S. market based on natural extracts, which aims to provide a milder but effective alternative for people experiencing irregular bowel movements

- In June 2023, Ferring Pharmaceuticals announced an expansion of its prescription‑only laxative portfolio in Europe, offering new products for both adult and pediatric patients that employ novel mechanisms of action for faster, more predictable relief

- In December 2023, Lupin Life Sciences Ltd. launched “Softovac Liquifibre”, a 100 % herbal liquid laxative combining psyllium fibre with additional herbal actives, targeting patients seeking natural alternatives for bowel regularity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.