Middle East and Africa Lab Automation Market Analysis and Insights

The demand for the lab automation market is increasing due to the advancement of technology all around the world. For the healthcare sector lab automation equipment and tools are used. As healthcare expenditure has become higher due to several factors, the leading pharma & healthcare companies have to automate the labs to deliver advanced healthcare services at the doorstep within less time.

The growing healthcare demand in the market is the main cause of competition between the leading healthcare and pharma companies in the improvement of lab automation worldwide. The rise in the use of equipment, analyser and software for the lab has been used. The focus for the market players is to provide variability of tools, equipment, machines and techniques to support the development and manufacturing of automated laboratory infrastructure. Market players are coming up with more investments and funding to build advanced technology and methods.

Healthcare expenditure has become higher due to several factors, such as the aging population, chronic disease prevalence, rising drug prices, healthcare service costs and administrative costs among others. Moreover, hospitals, private labs, clinical research and diagnostics centres are rising, increasing the lab automation market demand.

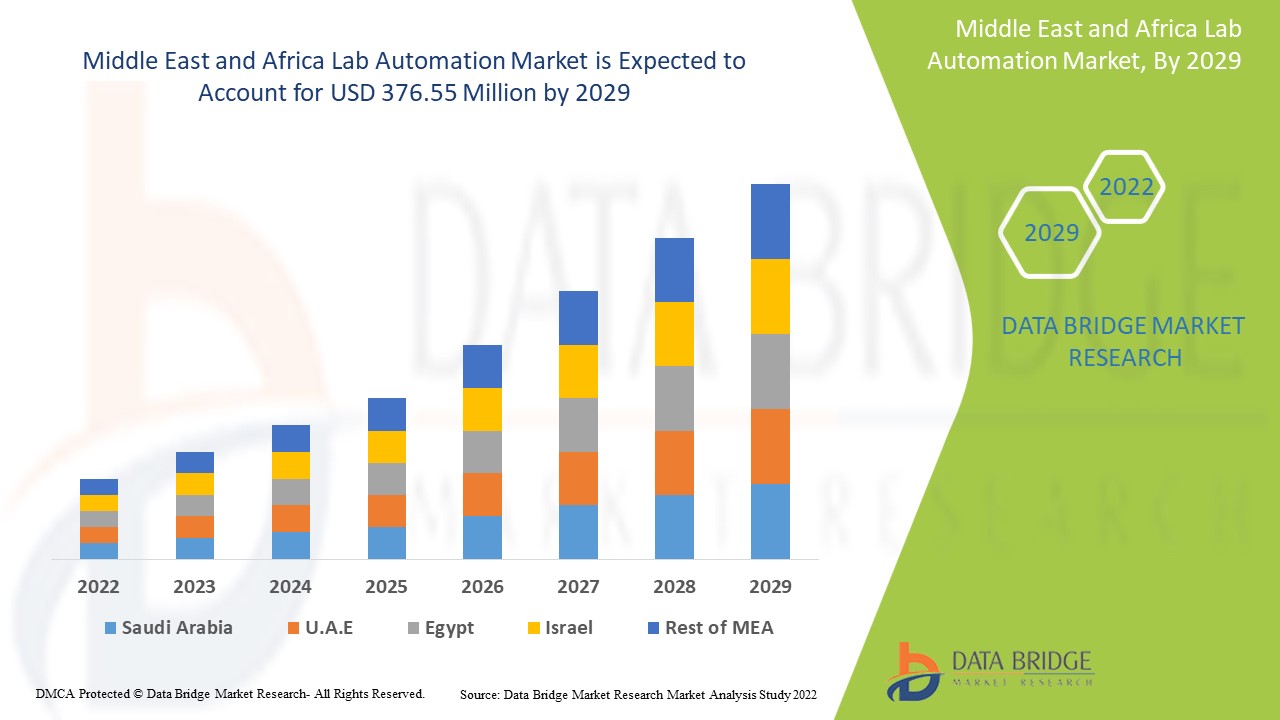

The Middle East and Africa lab automation market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2022 to 2029 and is expected to reach USD 376.55 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Equipment, Software & Informatics and Analyzer), Automation Type (Modular Automation and Total Lab automation), Application (Drug Discovery, Clinical Diagnostics, Genomics Solutions, Proteomics Solutions, Bio Analysis, Protein Engineering, Lyophilization, System Biology, Analytical Chemistry and Others), End Users (Biotechnology & Pharmaceuticals, Hospitals & Laboratories, Research and Academic Institutions and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E and Rest of Middle East and Africa |

|

Market Players Covered |

Danaher, PerkinElmer Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN, F. Hoffman-La Roche Ltd, Siemens Healthcare GmbH, Abbott, Aurora Biomed Inc., BD, BIOMÉRIEUX, Eppendorf SE, LabVantage Solutions Inc. and LabWare among others |

Market Definition

Laboratory automation is the combination of automated technologies in the laboratory to enable new and improved processes. It is used as a strategy to research, develop, optimize and capitalize on technologies in the laboratory. It is specially used for automating laboratory processes requiring minimal human input and eliminating human error. Lab automation is used with the aim of providing more efficient testing and diagnostics.

Lab automation enables researchers and technicians to efficiently and effectively produce output in less time, which is expected to drive the lab automation market. Furthermore, the rapid spread of diseases, along with new discoveries in the field of healthcare, ascend the demand for diagnoses and treatments, which is expected to fuel the lab automation market. High government and private funding for research and discovery research and the presence of major market players also contribute to the market growth.

Lab Automation Market Dynamics

- Increasing investment & strategic initiatives by market players

The market for laboratory automation is increasing as there is high demand for specialized advanced automated services which eliminate human errors. The focus of the market players and the companies is to provide a variability of tools, equipment, machines and techniques to support the development and manufacturing of automated laboratory infrastructure. The market for laboratory automation is increasing as there is high demand for specialized advanced automated services which eliminate human error. In order to capture the global market share, the market players are coming up with more investments and funding to build advanced technology and methods. These players are more focused on reducing manual efforts and hands-on time for the traditionally labor-intensive process. This is expected to drive the market's growth.

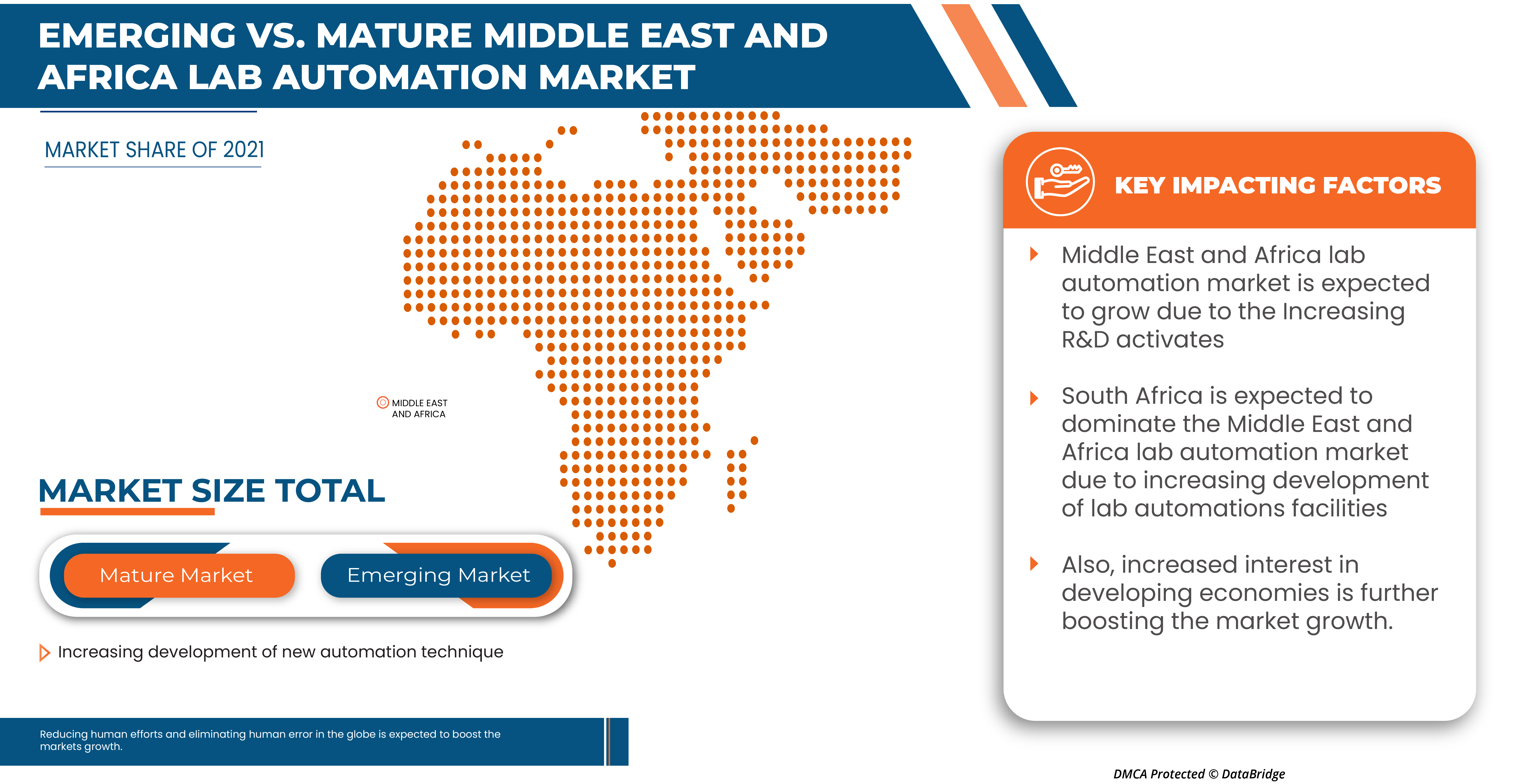

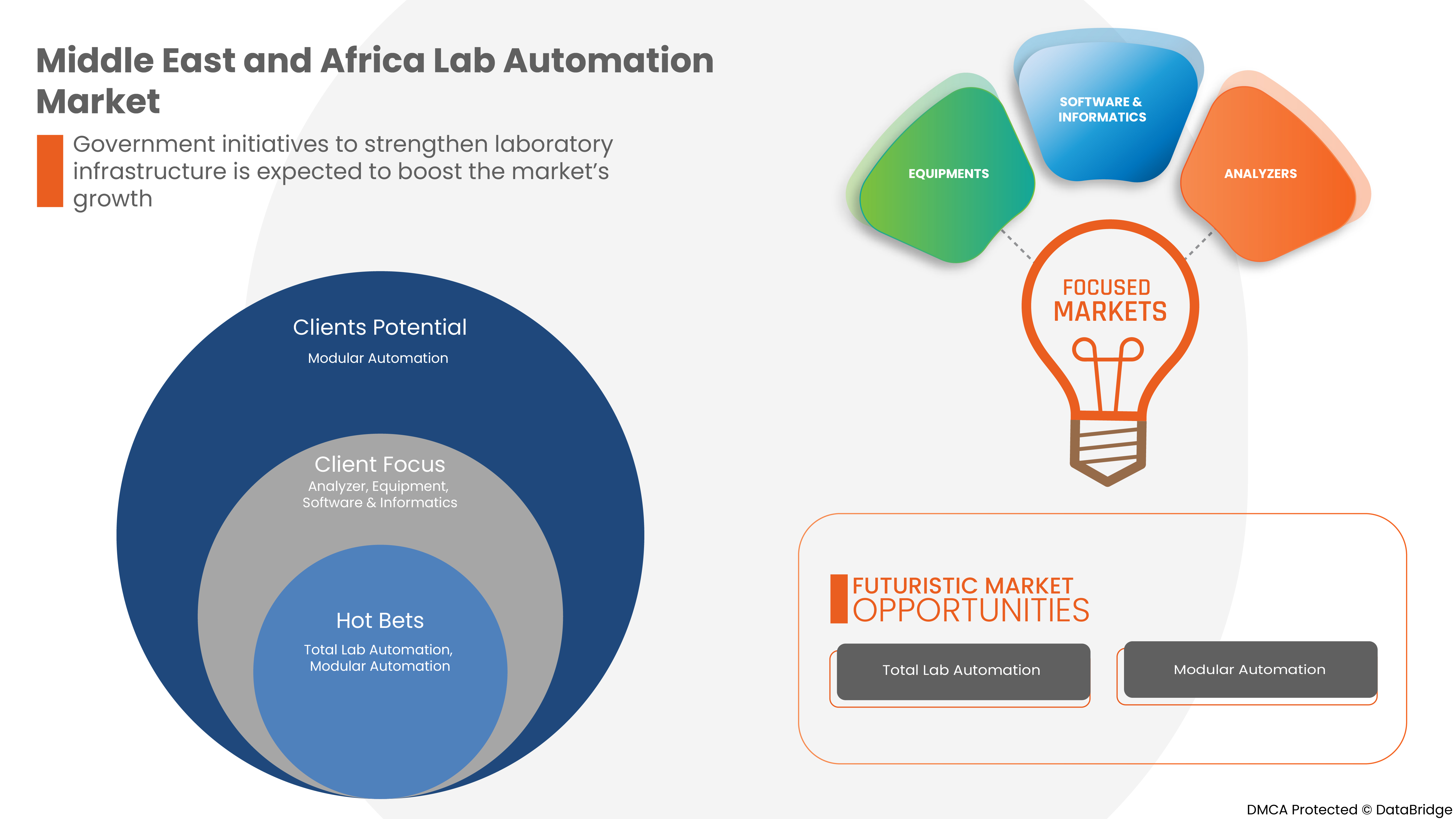

- Government initiatives to strengthen laboratory infrastructures

In order to further strengthen the healthcare sector and laboratory infrastructure, government organizations play a significant role. The government's funding and initiative to expand laboratory automation will help the market growth and increase the market players. The government collaborations and agreements with the market's key players will further strengthen the laboratory infrastructure.

- Growing expenditure on lab automation tools and equipment

The growing expenditure on lab automation tools and equipment is increasing. This is mainly due to the demand for laboratory examinations increasing rapidly for various reasons, such as an aging population, chronic disease growth, the discovery of new and more effective biomarkers and an increase in general health or diagnostic demands.

- Reducing human efforts and eliminating human error

There are several traditional ways to reduce human errors, but developing a system to minimize the risk of human error will help ensure that you don't repeat the same mistakes again. Manufacturing facilities are focused on building advanced systems in order to utilize artificial intelligence technology to recognize and correct issues before they occur.

Opportunities

-

Rising healthcare expenditure

Healthcare expenditure has become higher due to several factors, such as the aging population, chronic disease prevalence, rising drug prices, healthcare service costs and administrative costs among others. However, 2020 was the turning point where the expenses ranked the highest due to the COVID-19 pandemic. It has been found that in 2020, healthcare expenditure grew at the fastest rate of growth experienced since 2002 due to the pandemic.

-

Strategic initiatives by key players

Various initiatives have been taken by the leading pharma & healthcare companies to automate the labs to deliver advanced healthcare services to the doorstep within less time. The growing healthcare demand in the market is the main cause of competition between the leading healthcare & pharma companies in the improvement of lab automation worldwide. Hence, the strategic initiatives by market players are expected to act as an opportunity for the lab automation market's growth.

-

Rise in the number of pharma companies

The pharmaceutical industry has experienced significant growth during the past two decades. Growing disposable incomes, increased access to healthcare facilities, growing consciousness towards healthcare among people and increased penetration of medical services are making the pharma companies rise in number to fulfill the demand.

The COVID-19 pandemic had a great impact on the pharmaceutical industry because of the increased demand for medical services and drug supplies. Pharma industries have been growing fastly worldwide to fulfill the high demand of mankind and hence the service should be delivered at the earliest. So, to achieve error-free fast serving advanced healthcare facilities within less time, lab automation is needed. Thus, the rise in the number of pharma companies is expected to act as an opportunity for the lab automation market growth.

Restraints/Challenges

- Limitation analyzing novel complex product

There are various factors that contribute to the complexity of novel products used in automated laboratories. The continued engagement between staff and device manufacturers early in the development process is much needed and becomes mandatory to understand in order to operate the part or overall setup. Limitations in the detection and analysis of novel complex products such as machines, tools and equipment are hampering the installation and working of automated labs in the market.

- High cost for installation and setup

Lab automation installation and setup are much more labor- intensive and complex procedures. The setting up of automated labs requires a lot of time, effort, planning, implementation and approvals from various government departments. Moreover, the essential thing for setting up a new lab requires a critical investment in infrastructure due to the high cost of advanced machines, tools and equipment.

- Upgradation, maintenance and periodical checkups

Operating labs efficiently is the primary concern after setup. The maintenance, up-gradation and periodical check-ups of equipment are necessary for the operation. The expense that is required for this is one of the main restraining factors for the market players. The laboratory holders are made mandatory by regulation or quality control to test their products irrespective of the manufacturing companies in order to operate smoothly and avoid circumstances. This may restrain the market growth.

Post-COVID-19 Impact on the Lab Automation Market

COVID-19 has positively affected the automation market. Due to the pandemic, people health has been affected, due to which high diagnostic tests happened and demand got increased. Private labs, hospitals and clinical research got increased due to the pandemic. Thus, COVID-19 increased the lab automation market positively.

Recent Developments

- In June 2022, BD announced that they had completed the acquisition of Straub Medical AG, a privately held company. With this acquisition, the company has added the valuable expertise and experience of Straub Medical AG and expanded its product portfolio

- In January 2022, QIAGEN announced that it has entered into new collaborations with Atlia Biosystems to provide non-invasive prenatal testing solutions.

Middle East and Africa Lab Automation Market Scope

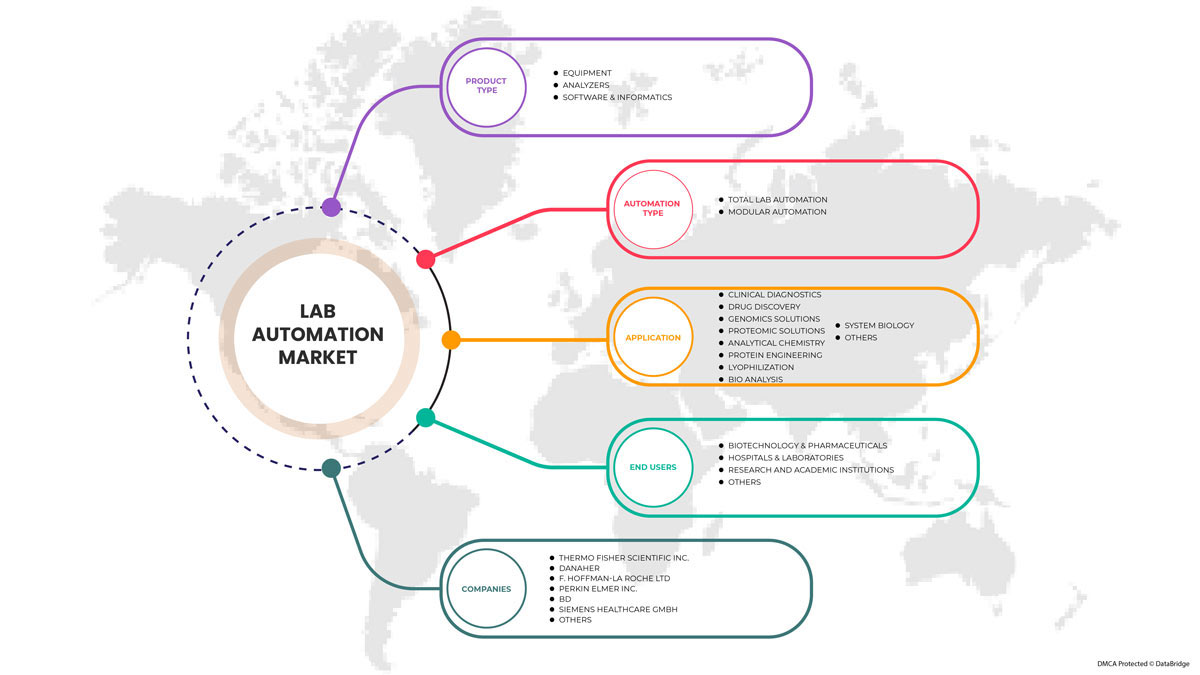

Middle East and Africa lab automation market is segmented into product type, automated systems, application and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Equipment

- Analyzer

- Software & Informatics

Based on product type, the Middle East and Africa lab automation market is segmented into equipment, analyser and software and informatics.

Automated Systems

- Total Lab Automation

- Modular Lab Automation

Based on automated systems, the Middle East and Africa lab automation market is segmented into total lab automation and modular lab automation.

Application

- Clinical Diagnostics

- Drug Discovery

- Genomics Solutions

- Proteomic Solutions

- Analytical Chemistry

- Protein Engineering

- Lyophilization

- Bio Analysis

- System Biology

- Others

Based on application, the Middle East and Africa lab automation market is segmented into drug discovery, clinical diagnostics, genomic solutions, proteomic solutions, bio analysis, protein engineering, lyophilisation, system biology, analytical chemistry and others.

End User

- Biotechnology And Pharmaceuticals

- Hospitals & Laboratories

- Research And Academic Institutes

- Others

Based on end user, the Middle East and Africa lab automation market is segmented into biotechnology & pharmaceuticals, hospitals & laboratories, research and academic institutions and others.

Middle East and Africa Lab Automation Market Regional Analysis/Insights

Middle East and Africa lab automation market is analysed and market size insights and trends are provided by country, product type, automated systems, application and end user.

Countries covered in market are South Africa, Saudi Arabia, U.A.E and Rest of Middle East and Africa.

South Africa is expected to dominate the Middle East and Africa lab automation market due to a growing number of research activities and an increase in demand for modular automation.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Central America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Lab Automation Market Share Analysis

The Middle East and Africa lab automation market competitive landscape provide details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth and application dominance. The above data points provided are only related to the companies' focus on Middle East and Africa lab automation market.

Some of the major players operating in the Middle East and Africa lab automation market are Danaher, PerkinElmer Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., QIAGEN, F. Hoffman-La Roche Ltd, Siemens Healthcare GmbH, Abbott, Aurora Biomed Inc., BD, BIOMÉRIEUX, Eppendorf SE, LabVantage Solutions Inc. and LabWare among others

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 SOUTH AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 SOUTH AFRICA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 65 U.A.E. SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 REST OF MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA LAB AUTOMATION MARKET

FIGURE 14 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 23 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 27 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 31 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 32 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA LAB AUTOMATION MARKET: PRODUCT TYPE (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.