Middle East and Africa Indium Market Analysis and Insights

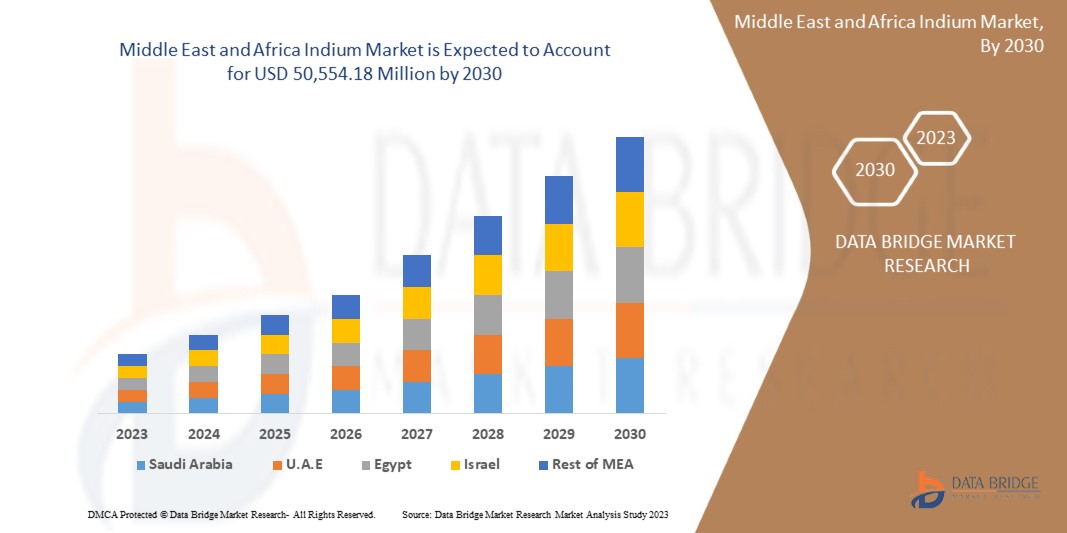

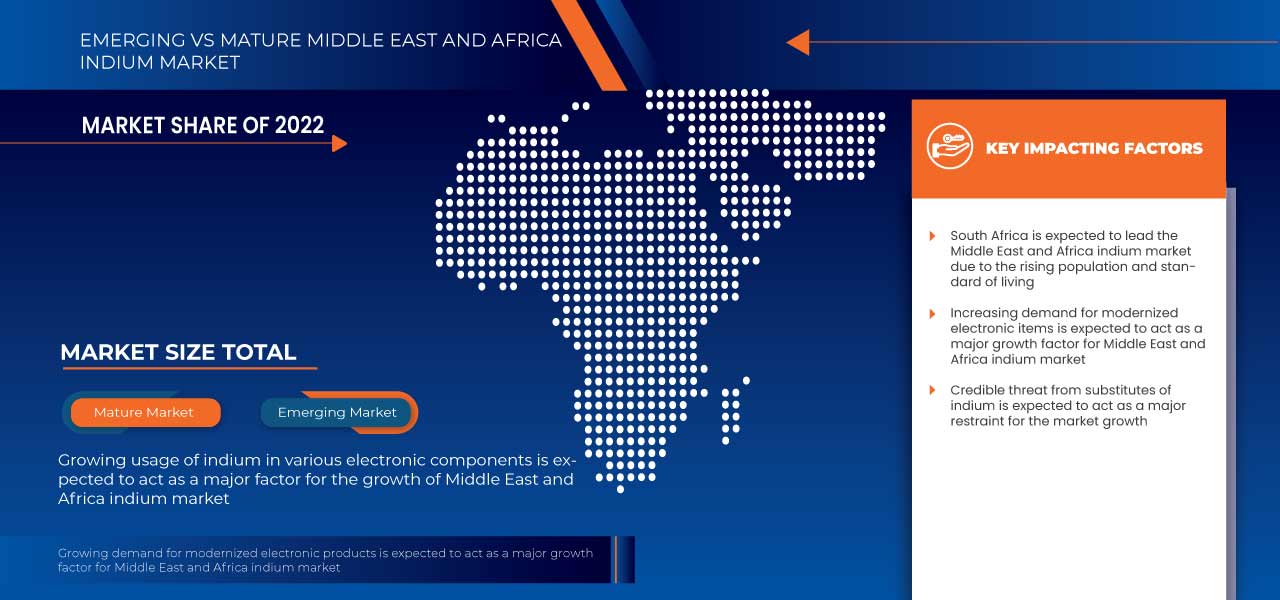

The Middle East and Africa indium market is expected to grow significantly from 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.7% in the forecast period of 2023 to 2030 and is expected to reach USD 50,554.18 million by 2030. The major factor driving the growth of the indium market is the rising demand for electronic items Increasing popularity of solar panels and usage in dental alloys are expected to propel the Middle East and Africa indium market growth.

Growth in the semiconductor industry and the ability to recycle indium metal are expected to provide opportunities in the Middle East and Africa indium markets. However, fluctuations in raw material prices and significant demand and supply gaps are projected to challenge the market growth. The major restraints that may negatively impact the Middle East and Africa indium market are the credible threat of substitutes and environmental and health issues associated with indium.

The Middle East and Africa indium market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. Contact us for an analyst brief to understand the analysis and the market scenario. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product (Primary, Secondary, and Type III), Application (Flat Panel Displays, Semiconductor Materials, Photovoltaics, Solders, Alloys, Thermal Interface Materials, and Batteries) |

|

Countries Covered |

Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa |

|

Market Players Covered |

Nippon Rare Metal Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc., Ahpmat.com., Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co. Ltd., and Xinlian Environmental Protection Technology Co., Ltd. among others. |

Market Definition

Indium is a metal with various distinctive properties and is a soft silvery-white metal occurring naturally and combined with zinc and some other metals. It has unique properties such as exclusive bonding with cold welding, a high thermal transfer rate, non-metallic substances, reliable properties at cryogenic temperatures, and smoothness.

Middle East and Africa Indium Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Rise in demand for electronic items

The demand for electronic items such as smartphones, tablets, flat panel displays, laptops, and monitors has increased worldwide. Demand for such electronic products is attributed to various reasons, such as new technology development, rising disposable income, and improving living standards have encouraged customers to purchase them. The recent COVID-19 pandemic has flourished the sales of such products as most working employees and students were working and learning from home, respectively. The technological advancements have found their usage in multiple fields, including app development, software, artificial intelligence, personalized healthcare, and robotics, which further have surged the demand for such equipment. In addition, several developing countries are undergoing a digital transformation, further driving the sales of such electronic products.

- Increase in the popularity of solar panels

Sunlight is a renewable energy source. Producing and supplying solar energy is indefinite. Compared to other energy sources, such as fossil fuels, which are non-renewable, the production of solar energy is easier and less costly. Using solar energy does not even contribute to Middle East and Africa warming. Solar architecture, concentrated solar energy, photovoltaic cells, and panels are some examples of solar energy technology.

Indium is a metal used in the production of solar panels. Even though the indium demand has recently been low, it is necessary for heterojunction photovoltaics. Due to their optical transparency, electrical conductivity properties, and chemical resistance to moisture, indium tin oxides are widely used materials in solar panels.

- Usage in dental alloys

Alloys utilized to make dentures mostly have gold, silver, and palladium as their primary metals, with 0.5% to 10% indium added. Dental implants' corrosion resistance and hardness can be considerably increased by using a minimal amount of metal indium. Additionally, dental amalgam fillings frequently include indium. To avoid the filling becoming hazardous, indium helps maintain mercury. Thus, indium helps save individuals from mercury's toxic side effects in dental amalgam fillings.

Opportunities

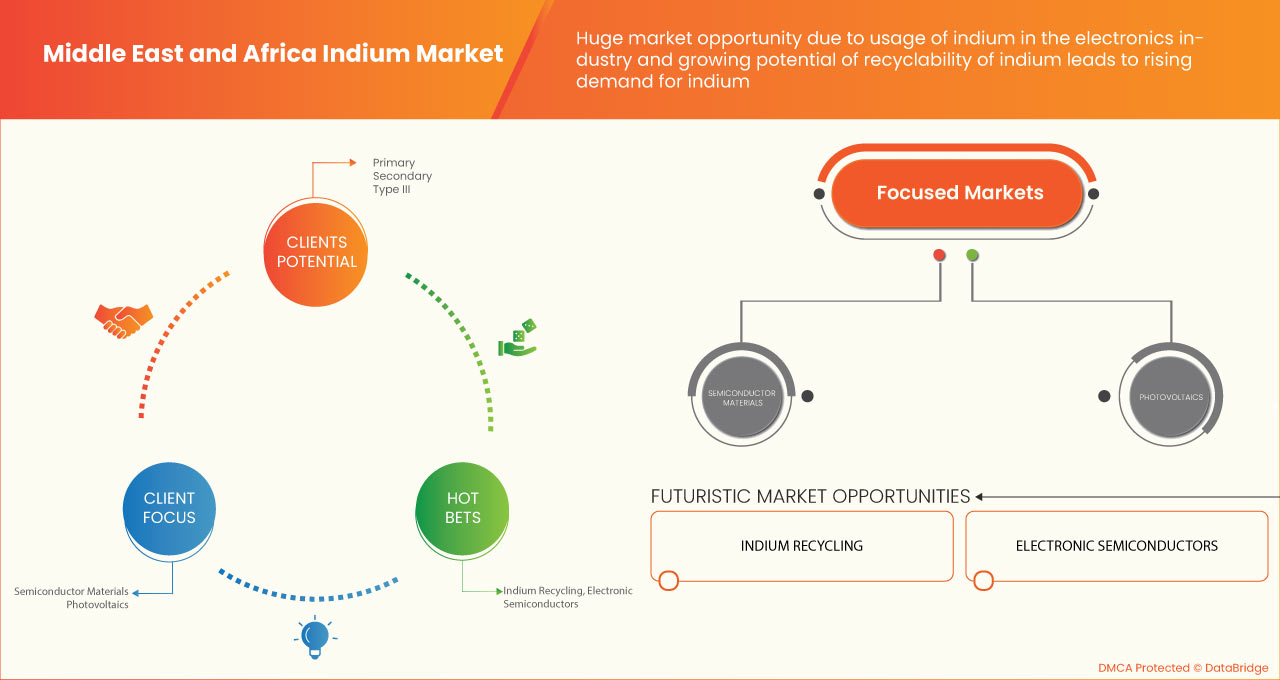

- Growth in the semiconductor industry

High boiling point, corrosion resistance, and low resistance are a few of the properties of indium, due to which they are used widely in the semiconductor industry. Indium-based compounds such as indium trichloride are well-known for building semiconductor layers such as electronic circuits, lasers, and LEDs. Moreover, indium has applications in high and low-temperature transistors. Indium is also used in solar assembly as semiconductor copper indium gallium selenide. Such high-end application of indium in industries will further create opportunities for increased sales for the products in which the indium is used.

- Ability to recycle indium metal

Due to its performance in semiconductors and optoelectronics, indium has gained increasing attention. Indium is a crucial strategic resource listed as one of the key resources by the European Commission. There are no indium ores of their own; instead, it is predominantly produced from lead and zinc byproducts.

As indium is widely used in LCDs, indium recycling from such LCD panels is performed. The damaged LCDs are collected and further dismantled manually or automatically.

Restraints

- Environmental and health issues associated with indium

Indium has polluted and negatively impacted the environment and our health due to its extensive use in various applications. The amount of indium in the Earth's crust is about 0.052 ppm, and it is normally recovered as a byproduct of the manufacture of zinc and copper because it does not readily form its minerals. The adverse impacts of mining are deforestation, fishery and wildlife habitats, irregular pattern of rainfall, and ecological disruption. In addition to the actual mines, infrastructure constructed to assist mining operations, such as roads, power lines, and railway track, influences animal migration paths and worsen habitat diversity. Such negative environmental impacts restrain the growth of the Middle East and Africa indium market.

- Low concentration in Earth's crust and extraction-related issues

Indium has been a widely accepted metal applied in various fields, such as flat-panel display electronics items, photovoltaic devices, and semiconductor devices. Due to such wide applications, indium is one of the most demanded metals. Inside the Earth's crust, indium is very low in quantity, about 160 ppb by weight. Indium's Middle East and Africa production accounts for as low as 800 tonnes per year. Also, such a low quantity of indium has increased the price of pure indium to hit US $900 per kilogram. Such low production, less concentration in Earth's crust, and high demand for indium from industries have been resisting the growth of the Middle East and Africa indium market.

Challenges

- Fluctuation in raw material prices

Indium is applied daily using products such as LEDs, flat panel devices, solders, solar panels, and many more. However, indium is a byproduct obtained from copper and zinc ores. So it does not have it is own its minerals. Thus, the production price of indium depends upon the demand and prices of the metals obtained from such ores. Also, it is one of the scarcest elements found on the Earth's crust. The prices of indium also vary depending upon the competition of end-users to get it.

Any new, popular use could significantly change overall demand, which might expand more quickly than available capacity. This could continue for about a decade or more, depending on the time required to dramatically boost production capacity.

- Significant demand and supply gap

A product supply and demand discrepancy is known as a supply and demand gap. As a rare earth metal, indium is one of the rarest found in the Earth's crust. In the case of indium, 95% of production is done from zinc ores processing. Indium production is disadvantaged as it is not occurring in the native state. Indium is found in metal ores such as zinc and tin. Therefore, the indium demand and supply also depend upon other metals like zinc. This gap further leads to volatility in the raw material prices of indium. Such volatility can influence the prices of end products also to get fluctuate.

China produces more than 50% of the world's refined indium. In the past three years, China has produced around 1.000 MT per year of indium and has also stockpiled more than 3.000 MT.

Recent Development

- In December 2022, Umicore and PowerCo, a Volkswagen battery company, extended their collaboration in battery materials. They are exploring a strategic long-term supply agreement to serve PowerCo's future battery Gigafactory for electric vehicles (EVs) in North America. This development will help strengthen the company's operations

Middle East and Africa Indium Market Scope

The Middle East and Africa indium market is categorized based on product and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Primary

- Secondary

- Type III

Based on product, the Middle East and Africa indium market is classified into three segments primary, secondary, and type III.

Application

- Flat Panel Displays

- Semiconductor Materials

- Photovoltaics

- Solders

- Alloys

- Thermal Interface Materials

- Batteries

Based on the application, the Middle East and Africa indium market is classified into seven segments flat panel displays, semiconductor materials, photovoltaics, solders, alloys, thermal interface materials, and batteries.

Middle East and Africa Indium Market Regional Analysis/Insights

The Middle East and Africa indium market is segmented based on product and application.

The countries in the Middle East and Africa indium market are Egypt, Saudi Arabia, United Arab Emirates, South Africa, Israel and Rest of the Middle East and Africa.

South Africa is dominating the Middle East and Africa indium market due to the rise in demand for electronic items.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Indium Market Share Analysis

Middle East and Africa Indium market competitive landscape provide details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies focusing on the Middle East and Africa indium market.

Some of the prominent participants operating in the Middle East and Africa indium market are Nippon Rare Metal, Inc, Umicore, Teck Resources Limited, Nyrstar, Avalon Advanced Materials Inc. Ahpmat.com. Indium Corporation, Lipmann Walton & Co. Ltd, Zhuzhou Keneng New Material Co., Ltd. Inc., ESPI Metals, AIM Metals & Alloys LP, DOWA Electronics Materials Co., Ltd. and Xinlian Environmental Protection Technology Co., Ltd. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INDIUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PURITY LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT-EXPORT SCENARIO

4.2 PRICING ANALYSIS

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 SUBSTITUTE COMPETITIVE ANALYSIS

4.5 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR ELECTRONIC ITEMS

5.1.2 INCREASE IN THE POPULARITY OF SOLAR PANELS

5.1.3 USAGE IN DENTAL ALLOYS

5.1.4 APPLICATION IN BALL BEARINGS MANUFACTURING AND FIRE SPRINKLER SYSTEM

5.2 RESTRAINTS

5.2.1 CREDIBLE THREAT OF SUBSTITUTES

5.2.2 ENVIRONMENTAL AND HEALTH ISSUES ASSOCIATED WITH INDIUM

5.2.3 LOW CONCENTRATION IN EARTH'S CRUST AND EXTRACTION-RELATED ISSUES

5.3 OPPORTUNITIES

5.3.1 GROWTH IN THE SEMICONDUCTOR INDUSTRY

5.3.2 ABILITY TO RECYCLE INDIUM METAL

5.4 CHALLENGES

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 SIGNIFICANT DEMAND AND SUPPLY GAP

6 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 PRIMARY

6.3 SECONDARY

6.4 TYPE III

7 MIDDLE EAST & AFRICA INDIUM MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 FLAT PANEL DISPLAYS

7.2.1 TELEVISION & DIGITAL SIGNAGE

7.2.2 PC & LAPTOP

7.2.3 SMARTPHONE & TABLETS

7.2.4 VEHICLE DISPLAY

7.2.5 SMART WEARABLES

7.2.6 OTHERS

7.3 SEMICONDUCTOR MATERIALS

7.3.1 ALUMINIUM GALLIUM INDIUM PHOSPHIDE

7.3.2 INDIUM GALLIUM ARSENIDE

7.4 PHOTOVOLTAICS

7.4.1 GROUND MOUNTED

7.4.2 ROOFTOP

7.4.3 OTHERS

7.5 SOLDERS

7.5.1 WIRES

7.5.2 PASTE

7.5.3 PERFORMS

7.5.4 BARS

7.5.5 OTHERS

7.6 ALLOYS

7.6.1 INDIUM-TIN ALLOY

7.6.2 INDIUM-LEAD ALLOY

7.6.3 INDIUM-LEAD ALLOY

7.7 THERMAL INTERFACE MATERIALS

7.8 BATTERIES

7.8.1 AUTOMOTIVE

7.8.2 PORTABLE

7.8.3 INDUSTRIAL

8 MIDDLE EAST & AFRICA INDIUM MARKET, BY REGION

8.1 MIDDLE EAST AND AFRICA

8.1.1 SOUTH AFRICA

8.1.2 ISRAEL

8.1.3 SAUDI ARABIA

8.1.4 UNITED ARAB EMIRATES

8.1.5 EGYPT

8.1.6 REST OF MIDDLE EAST AND AFRICA

9 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 EXPANSION

9.3 COLLABORATION

9.4 AWARD

9.5 EVENTS

9.6 RECOGNITION

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 UMICORE

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 TECK RESOURCES LIMITED

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATE

11.3 NYRSTAR

11.3.1 COMPANY SNAPSHOT

11.3.2 COMPANY SHARE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT UPDATES

11.4 AIM METALS & ALLOYS LP

11.4.1 COMPANY SNAPSHOT

11.4.2 COMPANY SHARE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT UPDATE

11.5 INDIUM CORPORATION

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATE

11.6 AHPMAT.COM

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 AVALON ADVANCED MATERIALS INC.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATE

11.8 DOWA ELECTRONICS MATERIALS CO., LTD.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ESPI METALS, INC.

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATES

11.1 LIPMANN WALTON & CO. LTD

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 NIPPON RARE METALS, INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 XINLIAN ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATES

11.13 ZHUZHOU KENENG NEW MATERIALS CO., LTD.

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF NIOBIUM "COLUMBIUM", GALLIUM, INDIUM, VANADIUM, AND GERMANIUM, N.E.S.; HS CODE – 811299 (USD THOUSAND)

TABLE 3 SUBSTITUTE MATERIALS FOR INDIUM ALONG WITH THEIR CHARACTERISTICS, APPLICATIONS, AND MANUFACTURING COMPANIES

TABLE 4 REGULATORY FRAMEWORK

TABLE 5 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 7 MIDDLE EAST & AFRICA PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA PRIMARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 9 MIDDLE EAST & AFRICA SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA SECONDARY IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 11 MIDDLE EAST & AFRICA TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA TYPE III IN INDIUM MARKET, BY REGION, 2021-2030 (TONS)

TABLE 13 MIDDLE EAST & AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA SOLDERS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA ALLOYS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA THERMAL INTERFACE MATERIALS IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA BATTERIES IN INDIUM MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA INDIUM MARKET, BY COUNTRY, 2021-2030 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 31 MIDDLE EAST AND AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 SOUTH AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 40 SOUTH AFRICA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 41 SOUTH AFRICA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 SOUTH AFRICA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 SOUTH AFRICA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 SOUTH AFRICA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 SOUTH AFRICA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 SOUTH AFRICA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 ISRAEL INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 49 ISRAEL INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 50 ISRAEL FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 ISRAEL SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 ISRAEL PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 ISRAEL SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 ISRAEL ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 ISRAEL BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 SAUDI ARABIA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 58 SAUDI ARABIA INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 59 SAUDI ARABIA FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 SAUDI ARABIA SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SAUDI ARABIA PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 SAUDI ARABIA SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SAUDI ARABIA ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SAUDI ARABIA BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 66 UNITED ARAB EMIRATES INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 67 UNITED ARAB EMIRATES INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 68 UNITED ARAB EMIRATES FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 UNITED ARAB EMIRATES SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 UNITED ARAB EMIRATES PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 UNITED ARAB EMIRATES SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 UNITED ARAB EMIRATES ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 UNITED ARAB EMIRATES BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

TABLE 76 EGYPT INDIUM MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT FLAT PANEL DISPLAYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT SEMICONDUCTOR MATERIALS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT PHOTOVOLTAICS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT SOLDERS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT ALLOYS IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT BATTERIES IN INDIUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 84 REST OF MIDDLE EAST AND AFRICA INDIUM MARKET, BY PRODUCT, 2021-2030 (TONS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA INDIUM MARKET

FIGURE 2 MIDDLE EAST & AFRICA INDIUM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INDIUM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INDIUM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INDIUM MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA INDIUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA INDIUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA INDIUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA INDIUM MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA INDIUM MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA INDIUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA INDIUM MARKET: SEGMENTATION

FIGURE 14 RISING DEMAND FOR ELECTRONIC ITEMS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INDIUM MARKET IN THE FORECAST PERIOD

FIGURE 15 PRIMARY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INDIUM MARKET IN 2022 & 2029

FIGURE 16 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PRICE ANALYSIS FOR THE MIDDLE EAST & AFRICA INDIUM MARKET (USD/KG)

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INDIUM MARKET

FIGURE 19 MIDDLE EAST & AFRICA INDIUM MARKET: BY PRODUCT, 2022

FIGURE 20 MIDDLE EAST & AFRICA INDIUM MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST AND AFRICA INDIUM MARKET: SNAPSHOT (2022)

FIGURE 22 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022)

FIGURE 23 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 MIDDLE EAST AND AFRICA INDIUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA INDIUM MARKET: BY PRODUCT (2023 - 2030)

FIGURE 26 MIDDLE EAST & AFRICA INDIUM MARKET: COMPANY SHARE 2022 (%)

Middle East And Africa Indium Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Indium Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Indium Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.