Market Analysis and Insights: Middle East and Africa Identity Verification and Authentication Market

Market Analysis and Insights: Middle East and Africa Identity Verification and Authentication Market

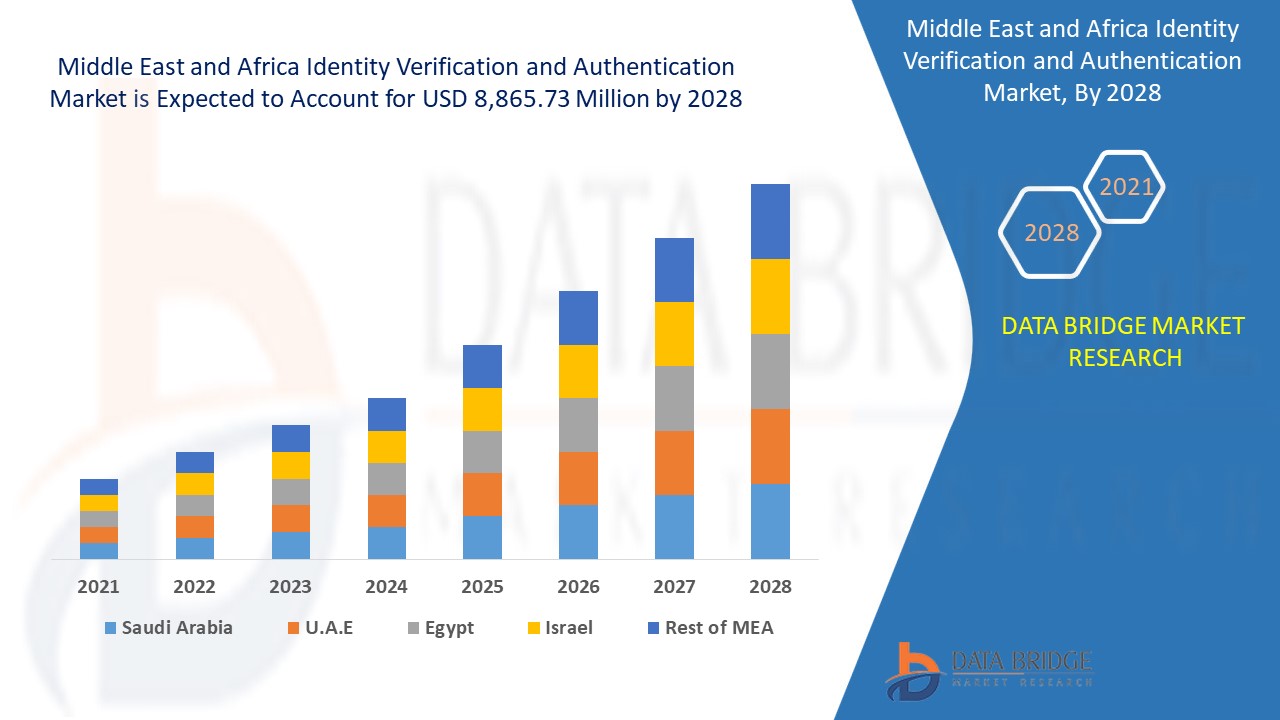

Middle East and Africa identity verification and authentication market is expected to grow in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.2% in the forecast period of 2021 to 2028 and is expected to reach USD 8,865.73 million by 2028. Growing adoption of identity verification and authentication solutions and surge in fraudulent activities can be major factors for market growth.

Identity verification and authentication refers to the services and solutions used to verify the authenticity of a person's physical identity or documents such as a driver’s license, passport, or nationally issued identity document. Identity verification and authentication is an important process that ensures a person’s identity matches the one that is supposed to be. Identity verification and authentication solution and services ensure that a real person is operating behind a process and proves the one they claim to be, preventing false identities or committing fraud. Identity verification is an essential requirement in many business processes and procedures. Various methods for identity verification and authentication services include biometric identity, identity and access management (IAM) solutions, security assertion mark-up language authentication (SAML) solutions, and biometric authentication solutions. The verification of identity process can be carried out in many different ways depending on the channel and the way the verification. Identity verification and authentication services are used in many industries to provide complete security, to avoid fraud, financial crimes, and identity theft. One such way to avoid this can be deploying anti-money laundering solutions to improve the customer experience and avoid costly fines and other benefits.

Some of the factors driving the market are the rapid growth in digitalization across the business in the Middle East and Africa regions. But high initial costs and hurdles in determining accurate identity verification can be a restraining factor. The Middle East and Africa identity verification and authentication market is rising due to the wide adoption of authentication solutions across financial sectors such as banks and insurance companies. The heightened adoption of razor-sharp biometrics identity verification solutions can be an opportunity for the market. Strict regulations imposed by the government on information collection can be a major challenge for the market growth in these regions.

This identity verification and authentication market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Identity Verification and Authentication Market Scope and Market Size

Middle East and Africa Identity Verification and Authentication Market Scope and Market Size

Middle East and Africa identity verification and authentication market is segmented on the basis of component, type, deployment mode, organization size, and vertical. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of component, the Middle East and Africa identity verification and authentication market is segmented into solution and services. In 2021, the solution segment held a larger share in the identity verification and authentication market owing to factors such as the shift toward digital transformation by various industries mostly financial sectors, increasing need to fight against data breaches and fraudulent activities.

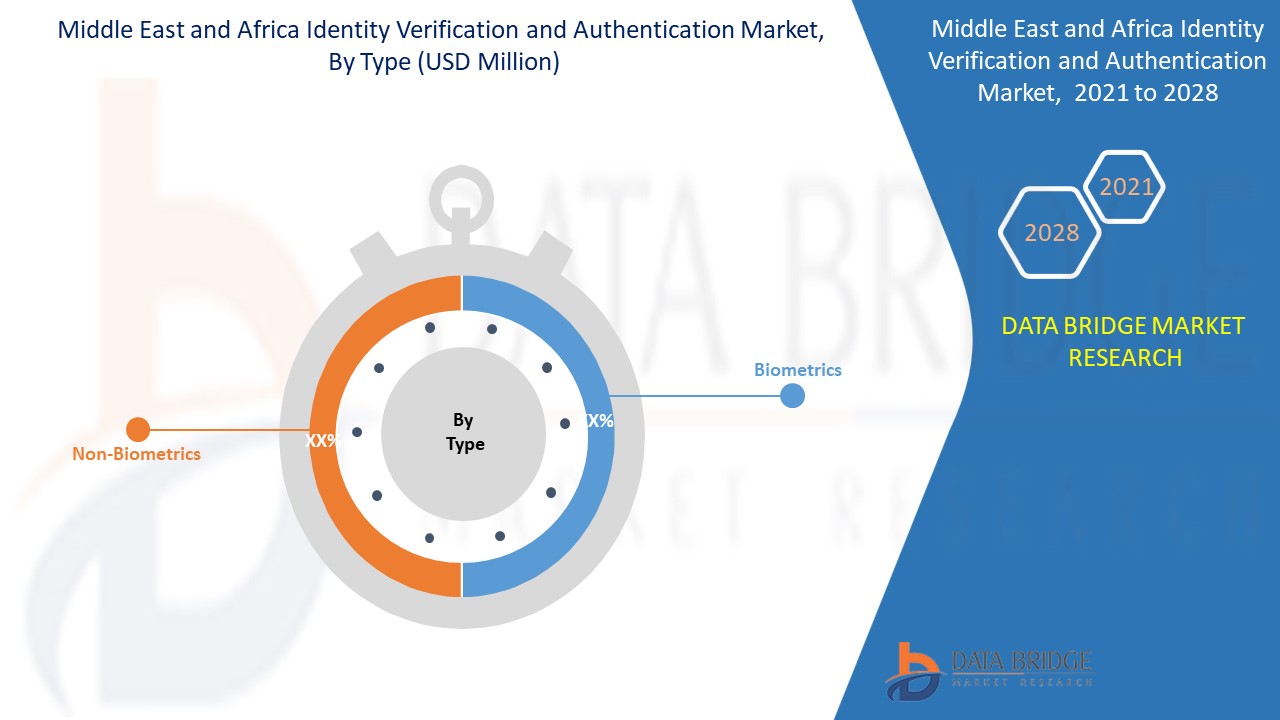

- On the basis of type, the Middle East and Africa identity verification and authentication market has been segmented into non-biometrics and biometrics. In 2021, the biometrics segment held a larger share in the identity verification and authentication market due to increasing smartphone penetration in merging countries and developed countries.

- On the basis of deployment mode, the Middle East and Africa identity verification and authentication market has been segmented into on-premise and cloud. In 2021, the cloud segment held a larger share in the identity verification and authentication market, and it is gaining popularity among government and defense agencies.

- On the basis of organization size, the Middle East and Africa identity verification and authentication market has been segmented into large enterprises and SME’s. In 2021, the large enterprises segment held a larger share in the identity verification and authentication market due to protection against increased cases of money laundering, data breach, identity theft, secured processing of high-risk transactions.

- On the basis of vertical, the Middle East and Africa identity verification and authentication market has been segmented into BFSI, government and defense, energy and utilities, retail and e-commerce, IT and telecom, healthcare, gaming, and others. In 2021, the BFSI segment held the largest share in the identity verification and authentication market due to the strong need to minimize cyber threats and the adoption of a risk-based fraud defense strategy.

Middle East and Africa Identity Verification and Authentication Market Country Level Analysis

Middle East and Africa identity verification and authentication market is analyzed, and market size information is provided by component, type, deployment mode, organization size, and vertical.

The countries covered in the Middle East and Africa identity verification and authentication Market report are Saudi Arabia, Israel, U.A.E., South Africa, Egypt, the Rest of the Middle East, and Africa.

Saudi Arabia dominates the identity verification and authentication market due to the growing adoption of identity verification and authentication solutions. The surge in fraudulent activities can also act as a major factor for the growth of the market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Identity Verification and Authentication Market

Middle East and Africa identity verification and authentication market also provide a detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development identity verification and authentication, and changes in regulatory scenarios with their support for the identity verification and authentication market. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Identity Verification and Authentication Market Share Analysis

Middle East and Africa identity verification and authentication market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies’ focus on the Middle East and Africa identity verification and authentication market.

The major players covered in the Middle East and Africa identity verification and authentication report are LexisNexis Risk Solutions Group, Experian Information Solutions, Inc., IDEMIA, TransUnion LLC, Equifax, Inc., AccuraTechnolabs, Acuant, Inc., Onfido, Ping Identity, among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately. Many product developments are also initiated by companies worldwide, which also accelerates the growth of the identity verification and authentication market.

For instance,

- In October 2020, TransUnion LLC launched a document verification and facial recognition solution in the U.K. to help businesses combat identity fraud. This new solution enables real-time, online verification through the customer’s device and also helps to strengthen fraud controls and improve operational efficiencies. This has helped the company to enhance its offerings, and better meet consumers demand in the market

- In May 2021, Acuant, Inc. entered into a partnership with Airside, and the key feature was to strengthen its verified digital identity capability. Through this partnership, the company can better innovate its products and offer quality services to its customer

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also benefits the organization to improve its identity verification and authentication market offering through an expanded range of sizes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA IDENTITY VERIFICATION & AUTHENTICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IDENTITY VERIFICATION AND AUTHENTICATION - CONSUMER VS WORKFORCE

4.1.1 CONSUMER IDENTITY VERIFICATION AND AUTHENTICATION (CIVA)

4.1.2 WORKFORCE IDENTITY VERIFICATION AND AUTHENTICATION (WIVA)

4.2 IDENTITY ACCESS MANAGEMENT

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND FOR NEAR-FIELD COMMUNICATION (NFC) TECHNOLOGIES

5.1.2 HEIGHTEN DEPENDENCY ON CLOUD IDENTITY AND ACCESS MANAGEMENT SOLUTIONS

5.1.3 GROW IN ADOPTION OF IDENTITY VERIFICATION AND AUTHENTICATION SOLUTIONS

5.1.4 SURGE IN FRAUDULENT ACTIVITIES

5.1.5 RAPID GROWTH IN DIGITALIZATION ACROSS BUSINESS

5.2 RESTRAINTS

5.2.1 HURDLES IN DETERMINING ACCURATE IDENTITY VERIFICATION

5.2.2 LACK OF AWARENESS REGARDING IDENTITY VERIFICATION AND AUTHENTICATION SOLUTIONS

5.2.3 HIGH INITIAL COST

5.3 OPPORTUNITIES

5.3.1 HEIGHTENED ADOPTION OF RAZOR-SHARP BIOMETRICS IDENTITY VERIFICATION SOLUTIONS

5.3.2 INCREASE IN DEMAND FOR IDENTITY VERIFICATION SERVICES IN SMARTPHONES

5.3.3 WIDE RANGE ADOPTION OF AUTHENTICATION SOLUTIONS ACROSS BFSI

5.3.4 GROW IN ADOPTION OF DIGITAL PAYMENT SOLUTIONS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS WHILE OFFERING SERVICE FOR IDENTITY VERIFICATION AND AUTHENTICATION SOLUTIONS

5.4.2 STRICT REGULATIONS IMPOSED BY THE GOVERNMENT ON INFORMATION COLLECTION

5.4.3 STORAGE CHALLENGE FOR HUGE VARIANTS OF DATA/INFORMATION

6 IMPACT OF COVID-19 ON MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON IDENTITY VERIFICATION AND AUTHENTICATION MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOLUTION

7.2.1 DOCUMENT/ID VERIFICATION

7.2.2 AUTHENTICATION

7.2.3 DIGITAL/ELECTRONIC IDENTITY VERIFICATION

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.1.1 CONSULTING

7.3.1.2 IMPLEMENTATION

7.3.1.3 TRAINING & SUPPORT

7.3.2 MANAGED SERVICES

7.3.3 INTEGRATION SERVICES

8 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 BIOMETRICS

8.2.1 PHYSIOLOGICAL

8.2.2 BEHAVIORAL

8.3 NON-BIOMETRICS

9 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 ON-PREMISE

9.3 CLOUD

10 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 SMALL & MEDIUM ENTERPRISES

11 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BFSI

11.2.1 SOFTWARE

11.2.2 SERVICES

11.3 GOVERNMENT & DEFENSE

11.3.1 SOFTWARE

11.3.2 SERVICES

11.4 ENERGY & UTILITIES

11.4.1 SOFTWARE

11.4.2 SERVICES

11.5 RETAIL & ECOMMERCE

11.5.1 SOFTWARE

11.5.2 SERVICES

11.6 IT & TELECOM

11.6.1 SOFTWARE

11.6.2 SERVICES

11.7 HEALTHCARE

11.7.1 SOFTWARE

11.7.2 SERVICES

11.8 GAMING

11.8.1 SOFTWARE

11.8.2 SERVICES

11.9 OTHERS

11.9.1 SOFTWARE

11.9.2 SERVICES

12 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 ISRAEL

12.1.3 U.A.E.

12.1.4 EGYPT

12.1.5 SOUTH AFRICA

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT

15 COMPANY PROFILE

15.1 LEXISNEXIS RISK SOLUTIONS GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SOLUTION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 THALES GROUP

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SOLUTION PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 EQUIFAX, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 IDEMIA

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 EXPERIAN INFORMATION SOLUTIONS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SOLUTION AND SERVICES PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 TRANSUNION LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ACCURATECHNOLABS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCTPORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ACUANT, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 AUTHENTEQ

15.9.1 COMPANY SNAPSHOT

15.9.2 SERVICE PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FINANSIELL ID-TEKNIK BID AB

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 GB GROUP PLC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SOLUTION PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 IDKOLLEN I SVERIGE AB

15.12.1 COMPANY SNAPSHOT

15.12.2 SERVICE PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 JUMIO

15.13.1 COMPANY SNAPSHOT

15.13.2 SERVICE PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MITEK SYSTEMS, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 SOLUTION PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 OKTA

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 ONFIDO

15.16.1 COMPANY SNAPSHOT

15.16.2 SERVICE PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 PENNEO A/S

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 SOLUTION PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 PING IDENTITY

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 PRECISE BIOMETRICS AB

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SOLUTION PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 ZIGNSEC AB

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 (CIVA) -VS- (WIVA)

TABLE 2 MIDDLE EAST AND AFRICA GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA IDENTITY ACCESS MANAGEMENT MARKET, BY GEOGRAPHY, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION,2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA BIOMETRICS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA BIOMETRICS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA NON-BIOMETRICS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT MODE, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA ON-PREMISE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA CLOUD IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA LARGE ENTERPRISES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA SMALL & MEDIUM ENTERPRISES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA GOVERNMENT & DEFENSE IN IDENTITY VERIFICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA GOVERNMENT & DEFENSE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 54 SAUDI ARABIA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 55 SAUDI ARABIA SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 56 SAUDI ARABIA SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 57 SAUDI ARABIA PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 58 SAUDI ARABIA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 59 SAUDI ARABIA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 60 SAUDI ARABIA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 61 SAUDI ARABIA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 62 SAUDI ARABIA BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 63 SAUDI ARABIA GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 64 SAUDI ARABIA IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 65 SAUDI ARABIA RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 66 SAUDI ARABIA HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 67 SAUDI ARABIA ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 68 SAUDI ARABIA GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 69 SAUDI ARABIA OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 70 ISRAEL IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 71 ISRAEL SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 72 ISRAEL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 73 ISRAEL PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 74 ISRAEL IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 75 ISRAEL IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 76 ISRAEL IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 77 ISRAEL IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 78 ISRAEL BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 79 ISRAEL GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 80 ISRAEL IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 81 ISRAEL RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 82 ISRAEL HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 83 ISRAEL ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 84 ISRAEL GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 85 ISRAEL OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 86 U.A.E. IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 87 U.A.E. SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 88 U.A.E. SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 89 U.A.E. PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 90 U.A.E. IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 91 U.A.E. IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 92 U.A.E. IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 93 U.A.E. IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 94 U.A.E. BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 95 U.A.E. GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 96 U.A.E. IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 97 U.A.E. RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 98 U.A.E. HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 99 U.A.E. ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 100 U.A.E. GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 101 U.A.E. OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 102 EGYPT IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 103 EGYPT SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 104 EGYPT SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 105 EGYPT PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 106 EGYPT IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 107 EGYPT IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 108 EGYPT IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 109 EGYPT IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 110 EGYPT BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 111 EGYPT GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 112 EGYPT IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 113 EGYPT RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 114 EGYPT HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 115 EGYPT ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 116 EGYPT GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 117 EGYPT OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 118 SOUTH AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 119 SOUTH AFRICA SOLUTION IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 120 SOUTH AFRICA SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 121 SOUTH AFRICA PROFESSIONAL SERVICES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

TABLE 122 SOUTH AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 123 SOUTH AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY DEPLOYMENT, 2019-2028 (USD MILLION)

TABLE 124 SOUTH AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY ORGANIZATION SIZE, 2019-2028 (USD MILLION)

TABLE 125 SOUTH AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY VERTICAL, 2019-2028 (USD MILLION)

TABLE 126 SOUTH AFRICA BFSI IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 127 SOUTH AFRICA GOVERNMENT & DEFENCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 128 SOUTH AFRICA IT & TELECOM IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 129 SOUTH AFRICA RETAIL & ECOMMERCE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 130 SOUTH AFRICA HEALTHCARE IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 131 SOUTH AFRICA ENERGY & UTILITIES IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 132 SOUTH AFRICA GAMING IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 133 SOUTH AFRICA OTHERS IN IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 134 REST OF MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET, BY COMPONENT, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA IDENTITY AND AUTHENTICATION VERIFICATION MARKET: SEGMENTATION

FIGURE 10 INCREASE IN FRAUDULENT ACTIVITIES IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET

FIGURE 13 GROWTH IN NFC TECHNOLOGIES USAGE

FIGURE 14 NUMBER OF FRAUD COMPLAINTS IN U.S., FROM 2016 TO 2020

FIGURE 15 NUMBER OF FRAUD COMPLAINTS IN U.S., FROM 2016 TO 2020

FIGURE 16 NUMBER OF SMARTPHONE USERS WORLDWIDE, FROM 2016 TO 2020

FIGURE 17 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY COMPONENT, 2020

FIGURE 18 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY TYPE, 2020

FIGURE 19 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY DEPLOYMENT MODE, 2020

FIGURE 20 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY ORGANIZATION SIZE, 2020

FIGURE 21 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY VERTICAL, 2020

FIGURE 22 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: SNAPSHOT (2020)

FIGURE 23 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY COUNTRY (2020)

FIGURE 24 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: BY COMPONENT (2021-2028)

FIGURE 27 MIDDLE EAST AND AFRICA IDENTITY VERIFICATION AND AUTHENTICATION MARKET: COMPANY SHARE 2020 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.