Market Analysis and Insights: Middle East and Africa Hyperspectral Imaging Systems Market

Market Analysis and Insights: Middle East and Africa Hyperspectral Imaging Systems Market

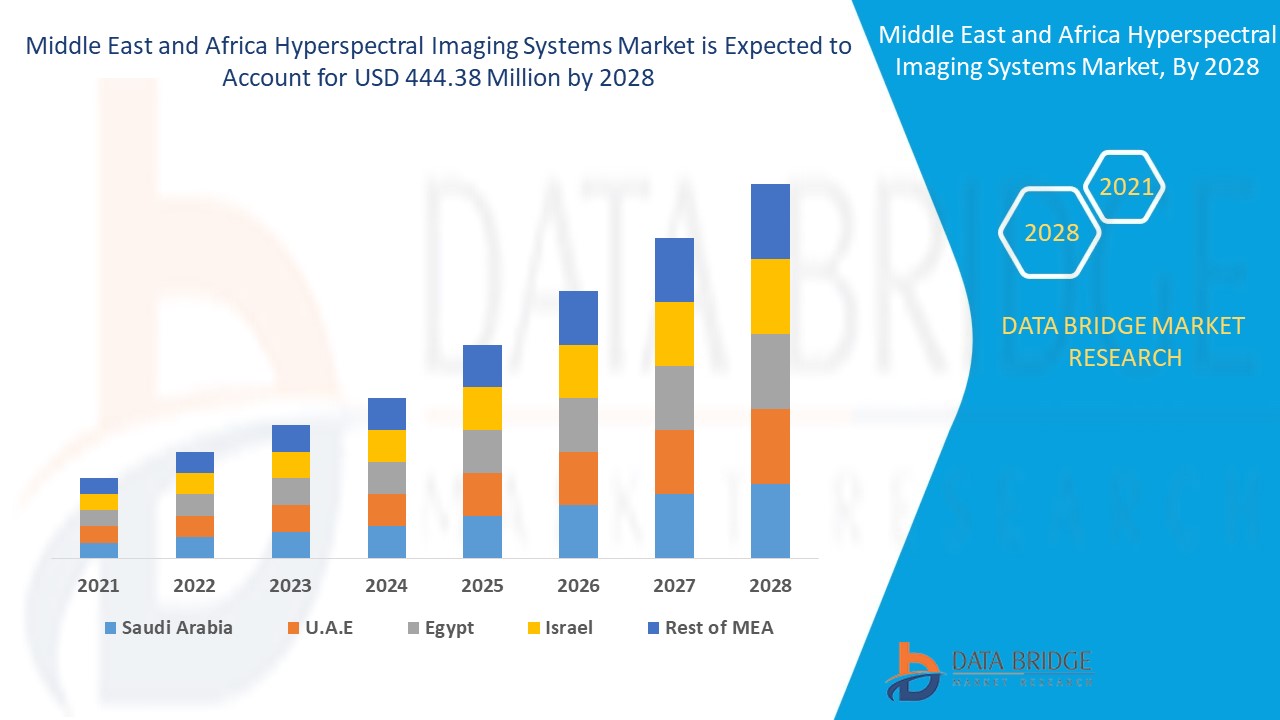

The Middle East and Africa hyperspectral imaging systems market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 16.5% in the forecast period of 2021 to 2028 and is expected to reach 444.38 million by 2028. Increased awareness and adoption of hyperspectral imaging technology for aerial remote sensing application and research is a major factor for the market's growth.

Hyperspectral Imaging is a spectroscopic technique that collects hundreds of images at different wavelengths over a linear spatial area. Hyperspectral imaging aims to collect spectra for each pixel in the sample to identify objects and processes. Hyperspectral imaging collects and processes information from across the electromagnetic spectrum. Hyperspectral imaging helps in identifying the chemical properties of materials, and thus differences in the materials can be analyzed. HSI systems are distinguished from color and multispectral imaging systems (MSI) in some main characteristics. Importantly the color and the MSI systems image the scene in just three to ten spectral bands while the HSI systems image in hundreds of co-registered bands. The technology has found widespread applications in remote sensing, sorting industry, microscopy, military and defense applications, and agriculture. Hyperspectral imaging technology is becoming more popular and has spread into widespread ecology and surveillance, historical manuscript research, and others.

The increasing investments in hyperspectral satellite imaging act as a major factor for the growth of the Middle East and Africa hyperspectral imaging systems market. The surging utilization of airborne hyperspectral imaging solutions has boosted the growth of the market. However, the high cost associated with the use of hyperspectral imaging can act as a major restraint for the market's growth. The Middle East and Africa region has witnessed increasing medical applications of HSI, which opens up opportunities in the market. Lack of skilled professionals can act as a major challenge for the growth of the market.

This Middle East and Africa hyperspectral imaging systems market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Hyperspectral Imaging Systems Market Scope and Market Size

Middle East and Africa Hyperspectral Imaging Systems Market Scope and Market Size

The Middle East and Africa hyperspectral imaging systems market is segmented into seven notable segments based on product, scanning techniques, range, technology and application.

- On the basis of product, the Middle East and Africa hyperspectral imaging systems market is segmented into cameras and accessories. In 2021, the cameras segment is expected to dominate the market as there is increasing adoption of advanced camera technologies in industrial domains such as manufacturing, agriculture, military, and defense.

- On the basis of scanning techniques, the Middle East and Africa hyperspectral imaging Systems market is segmented into spacial scanning, spectral scanning, non-scanning, and spatiospectral scanning. In 2021, the spatial scanning segment is expected to dominate the market as spatial scanning is one of the main methods used for hyperspectral data acquisition and provides high spectral resolution over a wide spectrum range. The technique is used in hyperspectral scanning intensively and thus leading the segment growth.

- On the basis of range, the Middle East and Africa hyperspectral imaging systems market is segmented into less than 400 nm, 400 nm to 1700 nm, and more than 1700 nm. In 2021, the 400 nm to 1700 nm segment is expected to dominate the market as it is the most common range for advanced hyperspectral cameras, which find applications in bio-medical, agriculture, space stations, and defense, among others.

- On the basis of technology, the Middle East and Africa hyperspectral imaging systems market is segmented into pushbroom (line scanning), snapshot (single shot), whiskbroom (point scanning) cameras, and others. In 2021, the pushbroom (line scanning) segment is expected to dominate the market as it is the most commonly used hyperspectral imaging technology. With increasing application in capturing the spectral images of fast-moving objects, pushbroom technology is increasing.

- On the basis of application, the Middle East and Africa hyperspectral imaging systems market is segmented into civil engineering, military surveillance, remote sensing, agriculture, mining/mineral mapping, environmental monitoring, life sciences, and medical diagnostics, machine vision and optical sorting, food processing, mineralogy, and other applications. In 2021, the remote sensing segment is expected to dominate the market as hyperspectral technology is maturing at a great pace for precision agriculture and manufacturing processes. Technological innovations such as remote sensing are increasingly adopted for agriculture and food production systems.

Middle East and Africa Hyperspectral Imaging Systems Market Country Level Analysis

The Middle East and Africa hyperspectral imaging systems market is analyzed, and market size information is provided by country, product, scanning techniques, range, technology, and application.

The countries covered in the Middle East and Africa hyperspectral imaging systems market report are South Africa, Saudi Arabia, U.A.E., Egypt, Israel, the Rest of the Middle East and Africa.

U.A.E dominates the market in the Middle East and Africa region due to the increasing adoption of advanced imaging technologies for industrial applications and adoption of HIS systems for environmental monitoring.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand for Middle East and Africa Hyperspectral Imaging Systems Market

The Middle East and Africa hyperspectral imaging systems market also provides you with detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development in hyperspectral imaging systems, and changes in regulatory scenarios with their support for the market. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Middle East and Africa Hyperspectral Imaging Systems Market Share Analysis

The Middle East and Africa hyperspectral imaging systems market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the Middle East and Africa hyperspectral imaging systems market.

The major players covered in the Middle East and Africa hyperspectral imaging systems market are Corning Incorporated, Hamamatsu Photonics K.K., Cubert GmbH, Headwall Photonics, Inc., Norsk Electro Optik AS, Raptor Photonics, Resonon Inc., Teledyne Digital Imaging Inc. (A Subsidiary of Teledyne Technologies Incorporated), XIMEA Group, among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of the Middle East and Africa hyperspectral imaging systems market.

For instances,

- In September 2021, Cubert GmbH announced the launch of ULTRIS 5. It offered high-resolution data cubes and fast readout speed in a tiny package. The ULTRIS 5 is integrated with a 5 MP sensor and hyperspectral optics into a 30 x 30 x 50 mm housing. The tiny package enabled the industrial users to install the camera in the tightest industrial process systems, and its high-resolution snapshot data cubes were able to record rapidly changing events. With this, the company extended its family of award-winning light field snapshot hyperspectral cameras

- In June 2020, Headwall Photonics, Inc. announced the partnership with perClass BV, a provider of innovative and reliable software for the production deployment of machine learning and spectral imaging solutions. Accordingly, Headwall Photonics, Inc. will incorporate spectral classification algorithms developed by perClass Mira into its Hyperspec MV.X embedded hyperspectral imaging platform to provide added benefits to users from food processing, high-tech manufacturing, and material-sorting for recycling industries

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also benefits the organization to improve its offering for hyperspectral imaging systems through an expanded range of sizes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING INVESTMENTS IN SATELLITES INCORPORATED WITH HIS

5.1.2 SURGE IN UTILIZATION OF AIRBORNE HYPERSPECTRAL IMAGING SOLUTIONS

5.1.3 RISE IN USE OF HYPERSPECTRAL IMAGING FOR AGRICULTURE SECTOR

5.1.4 SURGE IN APPLICATIONS OF HSI FOR ENVIRONMENTAL MONITORING

5.1.5 GROW IN INDUSTRIAL APPLICATIONS OF HYPERSPECTRAL IMAGING

5.2 RESTRAINTS

5.2.1 HIGH COMPLEXITY AND DATA STORAGE ISSUES

5.2.2 HIGH COST ASSOCIATED WITH THE USE OF HYPERSPECTRAL IMAGING

5.3 OPPORTUNITIES

5.3.1 SURGING ADVANCEMENTS OF HYPERSPECTRAL IMAGING FOR REMOTE SENSING

5.3.2 RISE IN DEVELOPMENTS TOWARD THE ADOPTION OF PORTABLE HYPERSPECTRAL CAMERAS

5.3.3 INCREASING MEDICAL APPLICATIONS OF HSI

5.3.4 LEVERAGING AI IN HYPERSPECTRAL IMAGING FOR TECHNOLOGICAL DEVELOPMENTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 LACK OF LABELLED DATA FOR HSI INCORPORATING AI AND ML ALGORITHMS

6 COVID-19 IMPACT ON HYPERSPECTRAL IMAGING SYSTEMS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAMERAS

7.3 ACCESSORIES

8 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES

8.1 OVERVIEW

8.2 SPATIAL SCANNING

8.3 SPECTRAL SCANNING

8.4 SPATIO-SPECTRAL SCANNING

8.5 NON-SCANNING

9 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE

9.1 OVERVIEW

9.2 NM TO 1700 NM

9.3 MORE THAN 1,700 NM

9.4 LESS THAN 400 NM

10 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 PUSHBROOM (LINE SCANNING)

10.3 WHISKBROOM (POINT SCANNING)

10.4 SNAPSHOT (SINGLE SHOT)

10.5 OTHERS

11 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 REMOTE SENSING

11.2.1 CAMERAS

11.2.2 ACCESSORIES

11.3 MILITARY SURVEILLANCE

11.3.1 CAMERAS

11.3.2 ACCESSORIES

11.4 MACHINE VISION & OPTICAL SORTING

11.4.1 CAMERAS

11.4.2 ACCESSORIES

11.5 LIFE SCIENCES & MEDICAL DIAGNOSTICS

11.5.1 CAMERAS

11.5.2 ACCESSORIES

11.6 AGRICULTURE

11.6.1 CAMERAS

11.6.2 ACCESSORIES

11.7 FOOD PROCESSING

11.7.1 CAMERAS

11.7.2 ACCESSORIES

11.8 ENVIRONMENTAL MONITORING

11.8.1 CAMERAS

11.8.2 ACCESSORIES

11.9 MINING/MINERAL MAPPING

11.9.1 CAMERAS

11.9.2 ACCESSORIES

11.1 MINEROLOGY

11.10.1 CAMERAS

11.10.2 ACCESSORIES

11.11 CIVIL ENGINEERING

11.11.1 CAMERAS

11.11.2 ACCESSORIES

11.12 OTHER APPLICATIONS

11.12.1 CAMERAS

11.12.2 ACCESSORIES

12 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SPEED

12.1 OVERVIEW

12.2 UP TO 20 MHZ

12.3 TO 40 MHZ

12.4 MORE THAN 40 MHZ

13 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY NUMBER OF TAPS

13.1 OVERVIEW

13.2 ONE TAP

13.3 TWO TAP

14 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION

14.1 MIDDLE EAST & AFRICA

14.1.1 U.A.E.

14.1.2 SAUDI ARABIA

14.1.3 ISRAEL

14.1.4 EGYPT

14.1.5 SOUTH AFRICA

14.1.6 REST OF MIDDLE EAST & AFRICA

15 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 IMEC

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 CORNING INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 HORIBA, LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HAMAMATSU PHOTONICS K.K.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 THORLABS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BAYSPEC, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECCENT DEVELOPMENTS

17.7 BRANDYWINE PHOTONICS LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CHEMIMAGE CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CUBERT GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 CYTOVIVA, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 DIASPECTIVE VISION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HEADWALL PHOTONICS, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 HINALEA IMAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HYPERMED IMAGING, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 INNO-SPEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LLA INSTRUMENTS GMBH & CO. KG

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NORSK ELECTRO OPTIK AS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PHOTON ETC. INC

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 PHYSICAL SCIENCES INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 RAPTOR PHOTONICS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 RESONON INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SPECIM, SPECTRAL IMAGING LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 STEMMER IMAGING AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 SURFACE OPTICS CORPORATION

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 TELEDYNE DIGITAL IMAGING INC. (A SUBSIDIARY OF TELEDYNE TECHNOLOGIES INCORPORATED)

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 TELOPS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 XIMEA GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA CAMERAS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA ACCESSORIES IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SPATIAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION ,2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA SPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SPATIOSPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA NON-SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA 400 NM TO 1700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA MORE THAN 1,700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA LESS THAN 400 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA PUSHBROOM (LINE SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA WHISKBROOM (POINT SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA SNAPSHOT (SINGLE SHOT) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA OTHERS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-202 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 58 U.A.E. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 59 U.A.E. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 60 U.A.E. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 61 U.A.E. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 62 U.A.E. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 U.A.E. REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 64 U.A.E. MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 65 U.A.E. MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 66 U.A.E. LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 67 U.A.E. FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 68 U.A.E. AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 69 U.A.E. ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 70 U.A.E. MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 71 U.A.E. MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 72 U.A.E. CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 73 U.A.E. OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 74 SAUDI ARABIA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 75 SAUDI ARABIA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 76 SAUDI ARABIA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 77 SAUDI ARABIA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 SAUDI ARABIA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 SAUDI ARABIA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 80 SAUDI ARABIA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 81 SAUDI ARABIA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 82 SAUDI ARABIA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 83 SAUDI ARABIA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 84 SAUDI ARABIA. AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 85 SAUDI ARABIA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 SAUDI ARABIA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 87 SAUDI ARABIA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 88 SAUDI ARABIA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 89 SAUDI ARABIA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 90 ISRAEL HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 91 ISRAEL HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 92 ISRAEL HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 93 ISRAEL HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 94 ISRAEL HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 ISRAEL REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 96 ISRAEL MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 97 ISRAEL MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 98 ISRAEL LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 99 ISRAEL FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 100 ISRAEL AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 101 ISRAEL ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 ISRAEL MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 103 ISRAEL MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 104 ISRAEL CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 105 ISRAEL OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 106 EGYPT HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 107 EGYPT HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 108 EGYPT HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 109 EGYPT HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 110 EGYPT HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 111 EGYPT REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 112 EGYPT MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 113 EGYPT MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 114 EGYPT LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 115 EGYPT FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 116 EGYPT AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 117 EGYPT ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 118 EGYPT MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 119 EGYPT MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 120 EGYPT CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 121 EGYPT OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 122 SOUTH AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 123 SOUTH AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 124 SOUTH AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 125 SOUTH AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 126 SOUTH AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 127 SOUTH AFRICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 128 SOUTH AFRICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 129 SOUTH AFRICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 130 SOUTH AFRICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 131 SOUTH AFRICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 132 SOUTH AFRICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 133 SOUTH AFRICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 134 SOUTH AFRICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 135 SOUTH AFRICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 136 SOUTH AFRICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 137 SOUTH AFRICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 11 INCREASING GOVERNMENT INVESTMENTS IN HYPERSPECTRAL SATELLITE IMAGING TO DRIVE MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 THE CAMERAS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

FIGURE 14 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2020

FIGURE 15 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2020

FIGURE 16 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2020

FIGURE 17 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2020

FIGURE 18 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2020

FIGURE 19 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SNAPSHOT (2020)

FIGURE 20 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020)

FIGURE 21 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 MIDDLE EAST & AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY PRODUCT (2021-2028)

FIGURE 24 MIDDLE EAST AND AFRICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY SHARE 2020 (%)

Middle East And Africa Hyperspectral Imaging Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Hyperspectral Imaging Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Hyperspectral Imaging Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.