Middle East and Africa Hummus Market Analysis and Insights

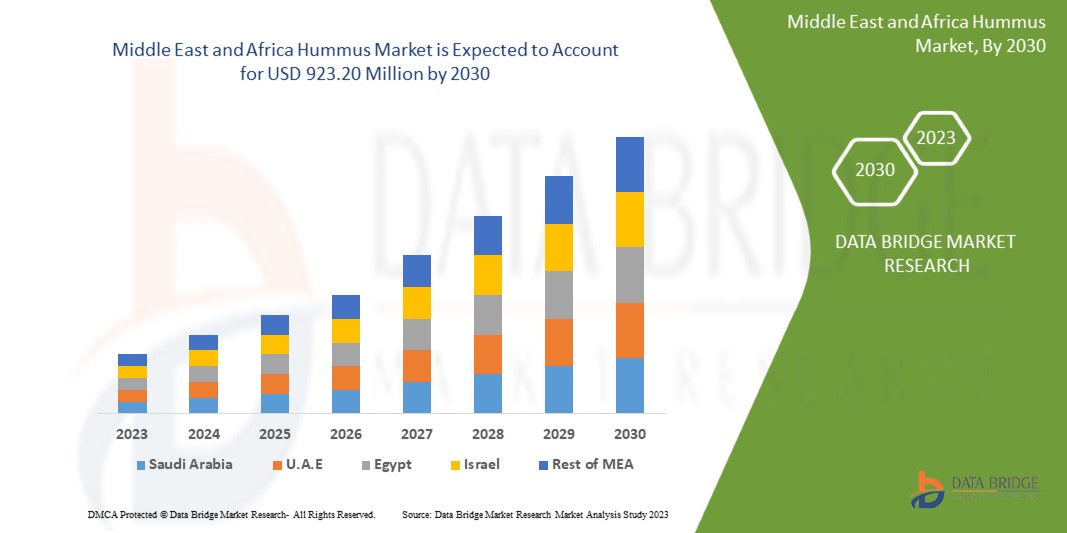

Middle East & Africa hummus market is expected to gain significant growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.1% in the forecast period of 2023 to 2030 and is expected to reach USD 923.20 million by 2030. The major factor driving the growth of the Middle East and Africa hummus market is rising consumer spending towards packaged food items.

Hummus is known for being a clean, healthful dish. Hummus comes in a variety of flavors in the United States and other Western countries. Hummus can be found in basic versions with simply chickpeas and perhaps a vegetable or two for flavour, or in "multi-layer" type hummuses with extra components like olive oil and spices.

Middle East and Africa hummus market report provides details of market share, new developments, and the impact of domestic and localized market players, analysis opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Classic Hummus, Red Pepper Hummus, Roasted Garlic Hummus, Black Olive Hummus, Lentil Hummus, Edamame Hummus, White Bean Hummus, and Others), Raw Material (Chickpeas, Beans, Green Peas, Red Lentil, Eggplant, and Others), Packaging (Tubs / Cups, Pouch, Bottled, Jars, and Others), Origin (Conventional and Organic), Emulsion Type (Permanent, Semi Permanent, and Temporary), Fat Content (Regular, Low Fat, and Fat Free), Packaging Material (Polymers, Metal, Glass, and Others), Application (Paste & Spreads, Sauces & Dips, Desserts, Confectionery, and Others), Distribution Channel (B2C and B2B), End User (Household / Retail,(Commercials and Industrial) |

|

Region Covered |

Saudi Arabia, U.A.E, Oman, Kuwait, Qatar, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

SAVENCIA SA (France), Kasih Food (Jordan), and Elma Farms (U.S.) |

Market Definition

The most well-known Mediterranean and Middle Eastern dish is hummus. It is primarily made from pureed chickpeas, along with lemon, tahini paste, olive oil, and spices such roasted garlic, roasted red peppers and onion. Parsley, chopped tomatoes or cucumbers, pine nuts are also sometimes included in production of hummus. Hummus mostly consists of the chickpeas that is good source of protein, resistant starch, polyunsaturated fatty acids, dietary fiber and various minerals and vitamins such as thiamine, riboflavin, phosphorus, folate, niacin, calcium, and potassium. The high protein content in the hummus makes it a go to option for vegan people to use it as a dips or spreads along with breads and chips. Hummus too has low glycemic index, therefore it does not spikes blood sugar level when compared to other high-carb foods.

Middle East and Africa Hummus Market Dynamics

Drivers

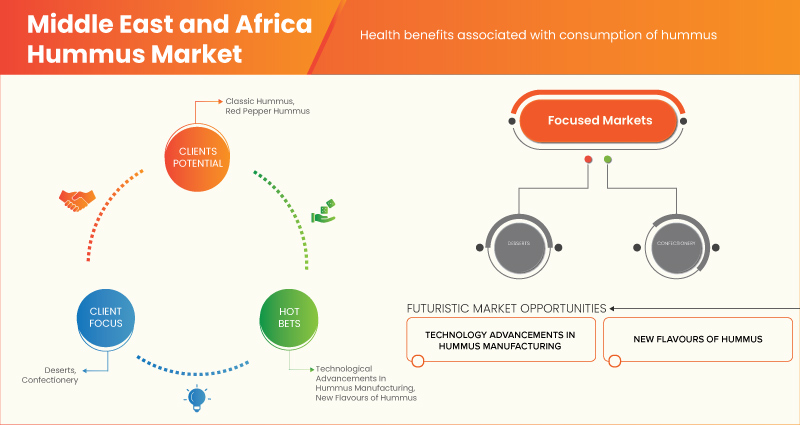

- RISE IN THE NUMBER OF NEW PRODUCT LAUNCHES WITH VARIOUS FLAVOURS COMBINATION

Hummus is a famous Mediterranean spread and as a dip it is high in vitamin, mineral, fiber, and protein content. The ingredients of hummus such as chickpeas, tahini, and olive oil are too well known superfoods. Due to such high nutritional value and benefits, the popularity of hummus is increasing worldwide. There has also been rise in consumer spending towards packaged hummus items. The vegans are too shifting towards the hummus as the snacking option as it is a good source of plant-based protein.

The hummus is mostly used as a veggie dip along with celery, carrots, bell pepper, cucumber slices, snow peas, or broccoli. They are also used as a dip or spreads with pita bread, pretzel chips, crackers, rolls, and sandwich filling. In addition, the trend of snacking through ready to eat options is also a driving force of sales of hummus in the Middle East and Africa market. To attract the new consumers, the manufacturers are trying to launch different flavours. The traditional flavours are too famous, but to attract new customers the manufacturers are developing new type of flavored hummus. Moreover, to reach to the new markets the producers are developing regional taste hummus.

- HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF HUMMUS

A traditional Middle Eastern dish called hummus is produced from pureed cooked chickpeas. It frequently includes extra flavorings, such as tahini, lemon juice, salt, and olive oil. The hummus has been a staple diet in the Mediterranean, Middle East, and North African regions. Hummus mostly consists of the chickpeas that is good source of protein, resistant starch, polyunsaturated fatty acids, dietary fiber and various minerals and vitamins such as thiamine, riboflavin, phosphorus, folate, niacin, calcium, and potassium. Along with, chickpeas, tahini is also one of the ingredients to manufacture hummus. It is a paste made out of toasted ground sesame that is composed of antioxidant lignans, unsaturated fatty acids, tocopherols and minerals consisting of phosphorus and calcium.

Opportunities

- RISING POPULARITY OF MEDITERRANEAN FOOD IN EMERGING MARKETS

In recent years, the Mediterranean food has become popular worldwide. The Mediterranean food is filled with plant-based food that consists of olive oil, whole grains, beans and other legumes, vegetables, spices, nuts, and herbs. Various research studies have shown that the Mediterranean diet has potential to lower the cardiovascular disease risk and other chronic diseases. Mediterranean diet is also suggested from health professionals due to the limited amount of trans fat and saturated fat, omega-3 fatty acids, lower sodium, lesser refined carbohydrates, and high amount of dietary fiber. Foods like pita bread, hummus, fattoush salad, and baklava are few of the famous Mediterranean based food famous whole over the world.

Hummus too have health related benefits as it consists of various healthy ingredients such as chickpeas, olive oil, lemon juice, and tahini. It is a good source of protein for the population who follow vegan diet. The hummus is also convenient for packaging in small containers and is a health snack option. In rising economical regions such as Asia and Africa, there has been also growing market of Mediterranean food that offers a wide range of opportunity for growth of Middle East and Africa hummus market.

- TECHNOLOGICAL ADVANCEMENTS IN HUMMUS MANUFACTURING

Hummus has found its popularity across the world. The health benefits and rise of vegan population have boosted the demand of humus. In recent years there has been increasing technological advancements in hummus manufacturing. The rise of technological advancements have further increased the quality and quantity of hummus produced. The production of hummus starting from the peeling of chickpeas, roasting, grinding, mixing, and filling of hummus in the packets is done automatically in machines without any intervention of human touch.

Moreover, the preservation of hummus is one of the highly researched area regarding to the technological advancements. High pressure processing is one of the highly research method to preserve and sterilize hummus using pressure without using any preservatives. In addition to there has been advancements in packaging technology. Manufacturers too are shifting towards sustainable, recyclable, eco-friendlier, and flexible packaging applications for storage of hummus.

Restraints/Challenges

- FLUCTUATION OF RAW MATERIAL PRICES

Hummus is a spread or dip prepared with mashed chickpeas, lemon juice, beans, garlic, tahini, olive oil, and salt. Other ingredients, such as pine nuts or red pepper, can be added to the food to make it more flavorful. Hummus is a popular Middle Eastern, Mediterranean, Middle East and Africaan, and Middle East and African cuisine. It is a staple ingredient in most vegan and vegetarian diets. People choose ready-made foods from shops and supermarkets. However, buyers have recently seen an increase in hummus pricing.

Increased demand for hummus, along with a scarcity of chickpeas, has resulted in soaring costs. Chickpeas require a lot of water to grow. Drought has been projected to have reduced world legume yield by around 40%. The cost of chickpeas is influenced by two major factors: Russia's conflict against Ukraine and weather. According to the Middle East and Africa Pulse Confederation, the world's supply of the legume is anticipated to fall by roughly 20% in 2022. Weather and conflict have harmed supply of the protein-rich bean, raising food costs and causing problems for food producers.

- INCREASING ADULTERATION IN HUMMUS PRODUCTS

A food is considered adulterated when it includes a "poisonous or detrimental" component that might endanger one's health. Adulteration can occur intentionally or unintentionally, but it causes major difficulties for both customers and producers. There have been some hummus product adulteration cases, which have resulted in recalls from end-users such as retail stores or supermarkets, as well as consumer warnings not to use the adulterated products. This creates a negative impression among consumers, and the manufacturers lose clients and revenue as a result.

Recent Developments

- In June 2021, the leading producer and co-manufacturer of hummus in the country, CEDAR’S MEDITERRANEAN FOODS, INC. has increased distribution to include Amazon Fresh. With more than 8,000 locations nationwide, including Whole Foods Market, Sprouts, Kroger, and Publix, Cedar's is a leading Mediterranean food brand in the natural and organic grocery channel. It will help the company to expand their business and reach to wider customer reach.

- In November 2019, Hannah Foods launched a new product called roasted red pepper cauliflower hommus, which has been a huge success in the Costco Southeast Region. They are pleased to announce that roasted red pepper cauliflower hommus will be available at all Costco Southeast Region locations beginning in January. This enables the corporation to attract more clients who prefer ready-to-eat foods, hence increasing output and income.

- In September 2019, Boar’s Head Brand launched its new FallSpice Selection Pumpkin Pie Dessert Hummus. The hummus is prepared with organic sugar, actual pumpkin, chickpeas, vanilla beans, and pleasant fall spices like cinnamon and nutmeg. The product launch will help to attract the customers who engages in trying different flavours of hummus.

Middle East and Africa Hummus Market Scope

Middle East & Africa hummus market is categorized based on based on type, raw material, packaging, origin, emulsion type, fat content, packaging material, application, distribution channel, and end user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Classic Hummus

- Red Pepper Hummus

- Roasted Garlic Hummus

- Black Olive Hummus

- Lentil Hummus

- Edamame Hummus

- White Bean Hummus

- Others

Based on type, the Middle East & Africa hummus market is segmented into classic hummus, red pepper hummus, roasted garlic hummus, black olive hummus, lentil hummus, edamame hummus, white bean hummus, and others.

Raw Material

- Chickpeas

- Beans

- Green Peas

- Red Lentil

- Eggplant

- Others

Based on raw material, the Middle East and Africa hummus market is segmented into chickpeas, beans, green peas, red lentil, eggplant, and others.

Packaging

- Tubs / Cups

- Pouch

- Bottled

- Jars

- Others

Based on packaging, the Middle East and Africa hummus market is segmented into tubs /cups, pouch, bottled, jars, and others.

Origin

- Conventional

- Organic

Based on origin, the Middle East and Africa hummus market is segmented into conventional and organic.

Emulsion Type

- Permanent

- Semi Permanent

- Temporary

Based on emulsion type, the Middle East and Africa hummus market is segmented into permanent, semi-permanent, and temporary.

Fat Content

- Regular

- Low Fat

- Fat Free

Based on fat content, the Middle East and Africa hummus market is segmented into regular, low fat, and fat free.

Packaging Material

- Polymers

- Metal

- Glass

- Others

Based on paackaging material, the Middle East and Africa hummus market is segmented into polymers, metal, glass, and others.

Application

- Paste & Spreads

- Sauces & Dips

- Desserts

- Confectionery

- Others

Based on application, the Middle East and Africa hummus market is segmented into paste & spreads, sauces & dips, desserts, confectionery, and others.

Distribution Channel

- B2C

- B2B

Based on distribution channel, the Middle East and Africa hummus market is segmented into b2c and b2b.

End-User

- Household/Retail

- Commercials

- Industrial

Based on end-user, the Middle East and Africa hummus market is segmented into household/retail, commercials, and industrial.

Middle East and Africa Hummus Market Regional Analysis/Insights

The Middle East and Africa hummus market is segmented on the basis of type, raw material, packaging, origin, emulsion type, fat content, packaging material, application, distribution channel, and end user.

The countries in the Middle East and Africa hummus market are the Saudi Arabia, U.A.E, Oman, Kuwait, Qatar, South Africa, and rest of Middle East and Africa. Saudi Arabia is dominating the Middle East and Africa hummus market in terms of market share and market revenue due to rising consumer spending towards packaged food items.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of new brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa hummus market Share Analysis

Middle East and Africa hummus market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, patents, product width and breadth, application dominance, product lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East and Africa hummus market.

Some of the prominent participants operating in the Middle East and Africa hummus market are SAVENCIA SA (France), Kasih Food (Jordan), and Elma Farms (U.S.).

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND ANALYSIS

4.2 COMPARATIVE ANALYSIS WITH THE PARENT MARKET

4.2.1 OVERVIEW

4.2.1.1 SALSA

4.2.1.2 MAYONNAISE

4.2.1.3 FRUIT PRESERVES

4.2.1.4 GUACAMOLE

4.3 CONSUMER BUYING BEHAVIOR

4.3.1 OVERVIEW

4.3.1.1 COMPLEX BUYING BEHAVIOR

4.3.1.2 DISSONANCE-REDUCING BUYING BEHAVIOR

4.3.1.3 HABITUAL BUYING BEHAVIOR

4.3.1.4 VARIETY SEEKING BEHAVIOR

4.3.2 CONCLUSION

4.4 PATENT ANALYSIS OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 UPCOMING TECHNOLOGY AND TRENDS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN THE NUMBER OF NEW PRODUCT LAUNCHES WITH VARIOUS FLAVORS COMBINATION

6.1.2 HEALTH BENEFITS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.1.3 THE INCREASING PREVALENCE OF VEGANISM BOOSTS HUMMUS DEMAND

6.1.4 RISING CONSUMER SPENDING TOWARD PACKAGED FOOD ITEMS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF OTHER TYPES OF DIPS

6.3 OPPORTUNITIES

6.3.1 RISING POPULARITY OF MEDITERRANEAN FOOD IN EMERGING MARKETS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN HUMMUS MANUFACTURING

6.4 CHALLENGES

6.4.1 SIDE EFFECTS ASSOCIATED WITH THE CONSUMPTION OF HUMMUS

6.4.2 INCREASING ADULTERATION IN HUMMUS PRODUCTS

7 MIDDLE EAST & AFRICA HUMMUS MARKET, BY REGION

7.1 MIDDLE EAST & AFRICA

7.1.1 SAUDI ARABIA

7.1.2 U.A.E

7.1.3 OMAN

7.1.4 KUWAIT

7.1.5 QATAR

7.1.6 SOUTH AFRICA

7.1.7 REST OF MIDDLE EAST AND AFRICA

8 MIDDLE EAST & AFRICA HUMMUS MARKET, COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 LANCASTER COLONY CORPORATION

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COMPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENTS

10.2 SABRA DIPPING CO., LLC

10.2.1 COMPANY SNAPSHOT

10.2.2 COMPANY SHARE ANALYSIS

10.2.3 PRODUCT PORTFOLIO

10.2.4 RECENT DEVELOPMENT

10.3 BAKKAVOR GROUP PLC

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 BOAR'S HEAD BRAND

10.4.1 COMPANY SNAPSHOT

10.4.2 COMPANY SHARE ANALYSIS

10.4.3 PRODUCT PORTFOLIO

10.4.4 RECENT DEVELOPMENT

10.5 TRIBE MEDITERRANEAN FOODS, INC.

10.5.1 COMPANY SNAPSHOT

10.5.2 COMPANY SHARE ANALYSIS

10.5.3 PRODUCT PORTFOLIO

10.5.4 RECENT DEVELOPMENT

10.6 ABRAHAM'S NATURAL FOODS

10.6.1 COMPANY SNAPSHOT

10.6.2 PRODUCT PORTFOLIO

10.6.3 RECENT DEVELOPMENT

10.7 CEDAR'S MEDITERRANEAN FOODS, INC.

10.7.1 COMPANY SNAPSHOT

10.7.2 PRODUCT PORTFOLIO

10.7.3 RECENT DEVELOPMENTS

10.8 ELMA FARMS

10.8.1 COMPANY SNAPSHOT

10.8.2 PRODUCT PORTFOLIO

10.8.3 RECENT DEVELOPMENT

10.9 ESTI FOODS

10.9.1 COMPANY SNAPSHOT

10.9.2 PRODUCT PORTFOLIO

10.9.3 RECENT DEVELOPMENTS

10.1 HAIG'S DELICACIES

10.10.1 COMPANY SNAPSHOT

10.10.2 PRODUCT PORTFOLIO

10.10.3 RECENT DEVELOPMENTS

10.11 HALIBURTON INTERNATIONAL FOODS, INC.

10.11.1 COMPANY SNAPSHOT

10.11.2 PRODUCT PORTFOLIO

10.11.3 RECENT DEVELOPMENTS

10.12 HANNAH FOODS

10.12.1 COMPANY SNAPSHOT

10.12.2 PRODUCT PORTFOLIO

10.12.3 RECENT DEVELOPMENTS

10.13 ITHACA HUMMUS

10.13.1 COMPANY SNAPSHOT

10.13.2 PRODUCT PORTFOLIO

10.13.3 RECENT DEVELOPMENT

10.14 KASIH FOOD

10.14.1 COMPANY SNAPSHOT

10.14.2 PRODUCT PORTFOLIO

10.14.3 RECENT DEVELOPMENT

10.15 LANTANA FOODS

10.15.1 COMPANY SNAPSHOT

10.15.2 PRODUCT PORTFOLIO

10.15.3 RECENT DEVELOPMENTS

10.16 LILLY'S FOODS

10.16.1 COMPANY SNAPSHOT

10.16.2 PRODUCT PORTFOLIO

10.16.3 RECENT DEVELOPMENTS

10.17 PELOPAC INC.

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 ROOTS HUMMUS

10.18.1 COMPANY SNAPSHOT

10.18.2 PRODUCT PORTFOLIO

10.18.3 RECENT DEVELOPMENT

10.19 SAVENCIA SA

10.19.1 COMPANY SNAPSHOT

10.19.2 COMPANY SHARE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 SEVAN AB

10.20.1 COMPANY SNAPSHOT

10.20.2 PRODUCT PORTFOLIO

10.20.3 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST & AFRICA HUMMUS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 U.A.E HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 U.A.E HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 43 U.A.E HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 44 U.A.E HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 45 U.A.E HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.A.E HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 47 U.A.E HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 48 U.A.E HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 U.A.E PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.A.E OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.A.E HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 55 U.A.E B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.A.E HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 58 U.A.E COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.A.E INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 OMAN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 OMAN HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 62 OMAN HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 63 OMAN HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 64 OMAN HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 65 OMAN HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 66 OMAN HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 67 OMAN HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 OMAN PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 OMAN SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 OMAN DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 OMAN CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 OMAN OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 OMAN HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 74 OMAN B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 OMAN B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 OMAN HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 OMAN COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 OMAN INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 KUWAIT HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 KUWAIT HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 81 KUWAIT HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 82 KUWAIT HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 83 KUWAIT HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 84 KUWAIT HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 85 KUWAIT HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 86 KUWAIT HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 KUWAIT PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 KUWAIT SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 KUWAIT DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 KUWAIT CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 KUWAIT OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 KUWAIT HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 KUWAIT B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 KUWAIT B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 KUWAIT HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 96 KUWAIT COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 KUWAIT INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 QATAR HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 100 QATAR HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 101 QATAR HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 102 QATAR HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 103 QATAR HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 104 QATAR HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 105 QATAR HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 106 QATAR PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 QATAR SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 108 QATAR DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 QATAR CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 QATAR OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 111 QATAR HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 112 QATAR B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 QATAR B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 QATAR HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 115 QATAR COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 QATAR INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SOUTH AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 SOUTH AFRICA HUMMUS MARKET, BY RAW MATERIAL, 2021-2030 (USD MILLION)

TABLE 119 SOUTH AFRICA HUMMUS MARKET, BY PACKAGING, 2021-2030 (USD MILLION)

TABLE 120 SOUTH AFRICA HUMMUS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 121 SOUTH AFRICA HUMMUS MARKET, BY EMULSION TYPE, 2021-2030 (USD MILLION)

TABLE 122 SOUTH AFRICA HUMMUS MARKET, BY FAT CONTENT, 2021-2030 (USD MILLION)

TABLE 123 SOUTH AFRICA HUMMUS MARKET, BY PACKAGING MATERIAL, 2021-2030 (USD MILLION)

TABLE 124 SOUTH AFRICA HUMMUS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 125 SOUTH AFRICA PASTE & SPREADS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 126 SOUTH AFRICA SAUCES & DIPS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 SOUTH AFRICA DESSERTS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 SOUTH AFRICA CONFECTIONERY IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 SOUTH AFRICA OTHERS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 SOUTH AFRICA HUMMUS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 131 SOUTH AFRICA B2B IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 SOUTH AFRICA B2C IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 SOUTH AFRICA HUMMUS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 134 SOUTH AFRICA COMMERCIALS IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 SOUTH AFRICA INDUSTRIAL IN HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST AND AFRICA HUMMUS MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA HUMMUS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HUMMUS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HUMMUS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HUMMUS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HUMMUS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HUMMUS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HUMMUS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HUMMUS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA HUMMUS MARKET VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA HUMMUS MARKET: SEGMENTATION

FIGURE 11 RISE IN THE NUMBER OF NEW PRODUCT LAINCHES WITH VARIOUS FLAVOURS COMBINATION IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA HUMMUS MARKET IN THE FORECAST PERIOD

FIGURE 12 THE CLASSIC HUMMUS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HUMMUS MARKET IN 2023 & 2030

FIGURE 13 MIDDLE EAST & AFRICA HUMMUS MARKET: TYPES OF CONSUMER BUYING BEHAVIOUR

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA HUMMUS MARKET

FIGURE 15 MIDDLE EAST & AFRICA HUMMUS MARKET: SNAPSHOT (2022)

FIGURE 16 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2022)

FIGURE 17 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 MIDDLE EAST & AFRICA HUMMUS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 MIDDLE EAST & AFRICA HUMMUS MARKET: BY TYPE (2023-2030)

FIGURE 20 MIDDLE EAST & AFRICA HUMMUS MARKET: COMPANY SHARE 2022 (%)

Middle East And Africa Hummus Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Hummus Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Hummus Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.