Market Analysis and Insights: Middle East and Africa Heat Shrink Tubing for Automotive Market

Market Analysis and Insights: Middle East and Africa Heat Shrink Tubing for Automotive Market

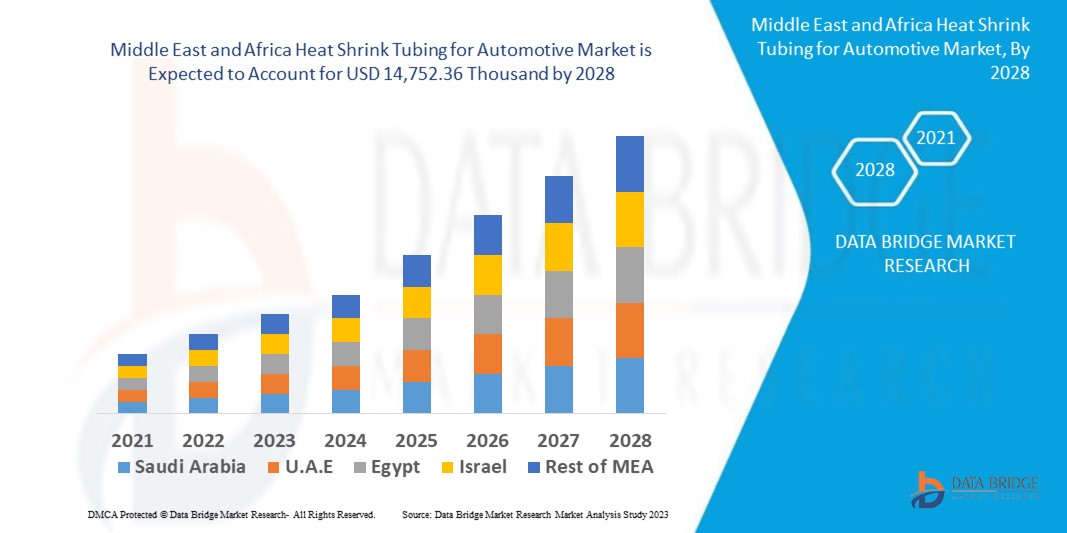

The Middle East and Africa heat shrink tubing for automotive market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.4% in the forecast period of 2021 to 2028 and is expected to reach USD 14,752.36 thousand by 2028. The growing demand for vehicle wiring harnesses for automotive safety systems is expected to drive the market's growth significantly.

Heat shrink tubing is used to insulate wire providing abrasion resistance and environmental protection for the stranded solid wire conductors with connections, joints, and terminals in electrical work. In general, a tube with a lower shrink temperature will shrink faster. When heat shrink tubing is wrapped around wire arrays and electrical components, it collapses radially to fit the contours of the equipment, forming a protective layer. It can protect against abrasion, low impact, cuts, moisture, and dust by covering individual wires or encasing entire arrays. Plastic manufacturers begin by extruding a thermoplastic tube to create heat shrink tubing. Heat shrink tubing materials vary depending on the intended application.

An increase in the demand for a wide range of insulating materials for preventive maintenance is the major driving factor in the Middle East and Africa heat shrink tubing for automotive market. Lack of operator expertise about the installation of heat shrinking tubes can prove to be a challenge. However, automation in the heat shrink tubing process can be an opportunity for the market. The stringent government regulations on the emission of toxic gases restrain the Middle East and Africa heat shrink tubing for automotive market.

The Middle East and Africa heat shrink tubing for automotive market report provide details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis of the Middle East and Africa heat shrink tubing for automotive market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Heat Shrink Tubing for Automotive Market Scope and Market Size

Middle East and Africa Heat Shrink Tubing for Automotive Market Scope and Market Size

The Middle East and Africa heat shrink tubing for automotive market is segmented into eight notable segments based on application, material, type, sales channel, color, voltage, fuel type, and vehicle type. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of application, the Middle East and Africa heat shrink tubing for automotive market is segmented into hoses, connectors, ring terminals, in-line splices, brake pipes, diesel injection clusters, under bonnet cable protection, gas pipes, miniature splices. In 2021, the hoses segment is expected to dominate the market as they carry fluids through the air or fluid environments.

- On the basis of material, the Middle East and Africa heat shrink tubing for automotive market is segmented into polyolefin, polyvinyl chloride, polytetrafluoroethylene, fluorinated ethylene propylene, perfluoroalkoxy alkane, ethylene tetrafluoroethylene, and others. In 2021, the polyolefin segment is expected to dominate the market as it has excellent physical, chemical, and electrical characteristics and is resistant to abrasion and flame.

- On the basis of color, the Middle East and Africa heat shrink tubing for automotive market is segmented into red, yellow and others. In 2021, the red segment is expected to dominate the market as they are highly flame retardant and can be used in a wide range of industrial applications.

- On the basis of type, the Middle East and Africa heat shrink tubing for automotive market is segmented into single wall shrink tubing and dual wall shrink tubing. In 2021, the single wall shrink tubing segment is expected to dominate the market as it offers superior insulation strain relief and protection against mechanical damage.

- On the basis of voltage, the Middle East and Africa heat shrink tubing for automotive market is segmented into low, medium, and high. In 2021, the low voltage segment is expected to dominate the market due to its increase in the utilization of heat shrink tubing, mainly for sealing cables and insulation.

- On the basis of fuel type, the Middle East and Africa heat shrink tubing for automotive market is segmented into petrol/diesel, CNG, and electric. In 2021, the petrol segment is expected to dominate the market as it allows for the quick starting, faster acceleration, and easy combustion of the fuel in automobiles.

- On the basis of sales channel, the Middle East and Africa heat shrink tubing for automotive market is segmented into OEM and aftermarket. In 2021, the OEM segment is expected to dominate the market as product specifications have greater transparency.

- On the basis of vehicle type, the Middle East and Africa heat shrink tubing for automotive market is segmented into passenger cars, LCV, HCV, and electric vehicles. In 2021, the passenger cars segment is expected to dominate the market due to its increasing usage of private mobility nowadays.

Middle East and Africa Heat Shrink Tubing for Automotive Market Country Level Analysis

The Middle East and Africa heat shrink tubing for automotive market is analyzed, and market size information is provided by the country, application, material, type, sales channel, color, voltage, fuel type and vehicle type as referenced above.

The countries covered in the Middle East and Africa heat shrink tubing for automotive market report are South Africa, Israel, U.A.E., Saudi Arabia, Egypt, the Rest of the Middle East and Africa.

Saudi Arabia dominates the Middle East and Africa region because of rapid growth in automotive industry and manufacturing dominance in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rise in technological advancements to increase vehicle performance is boosting the market growth of Middle East and Africa heat shrink tubing for automotive market

The Middle East and Africa heat shrink tubing for automotive market also provide you with detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2010 to 2019.

Competitive Landscape and Middle East and Africa Heat Shrink Tubing for Automotive Market Share Analysis

The Middle East and Africa Heat shrink tubing for automotive market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to the Middle East and Africa heat shrink tubing for automotive market.

Some of the major players operating in the Middle East and Africa heat shrink tubing for automotive market are ABB, SHAWCOR, HellermannTyton, 3M, Alpha Wire, Molex, TE Connectivity, Panduit, among others.

Many contracts and agreements are also initiated by the companies worldwide, which are also accelerating the Middle East and Africa heat shrink tubing for automotive market.

For instance,

- In February 2021, Panduit launched a 400G Next Generation CS Connector to optimize data center fiber to rack density. The CS Connector is available for unitary Single-mode and Multimode fiber options. The launch of this high-density fiber connector solution optimizes the data center for next-generation applications, which helps in improving the product portfolio of the company

- In March 2019, HellermannTyton introduced various alternative-diesel heat shrink products in diesel technologies. The company enhanced its business portfolio generating more income and profit for it

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 APPLICATION TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS

5.1.2 RISE IN TECHNOLOGICAL ADVANCEMENT TO INCREASE VEHICLE PERFORMANCE

5.1.3 INCREASING VEHICLE SALES AND DEMAND FOR PREMIUM VEHICLES

5.1.4 INCREASING DEMAND FOR WIDE RANGE OF INSULATING MATERIAL FOR PREVENTIVE MAINTENANCE

5.2 RESTARINTS

5.2.1 STRINGENT GOVERNMENT REGULATION ON EMISSION OF TOXIC GASES

5.2.2 TRADE BARRIERS IN LEAST DEVELOPED COUNTRIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN STRATEGIC ACQUISITIONS & PARTNERSHIPS BETWEEN ORGANIZATIONS

5.3.2 INVOLVEMENT OF AUTOMATION IN HEAT SHRINK TUBING PROCESS

5.3.3 INCREASE IN PENETRATION OF ELECTRIC VEHICLE ACROSS THE GLOBE

5.3.4 EASY PRODUCTION OF HEAT SHRINK TUBING PRODUCTS

5.4 CHALLENGES

5.4.1 INCREASE IN PRICES OF RAW MATERIALS FOR TUBING

5.4.2 AVAILABILITY OF DUPLICATE & INEXPENSIVE PRODUCTS IN THE MARKET

5.4.3 LACK OF OPERATOR EXPERTISE FOR INSTALLATION OF HEAT SHRINKING TUBE

6 IMPACT ANALYSIS OF COVID-19 ON MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.1 AFTERMATH OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

6.2 OPPORTUNITIES FOR THE MARKET POST-COVID-19 PANDEMIC

6.3 IMPACT ON SUPPLY, DEMAND, AND PRICES

6.4 CONCLUSION

7 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 HOSES

7.2.1 HEATING AND COOLING SYSTEM HOSES

7.2.2 FUEL DELIVERY SYSTEM HOSES

7.2.3 BRAKING SYSTEM HOSES

7.2.4 TURBOCHARGER HOSES

7.2.5 POWER STEERING SYSTEM HOSES

7.3 CONNECTORS

7.3.1 BY TYPE

7.3.1.1 WIRE TO WIRE

7.3.1.2 WIRE TO BOARD

7.3.1.3 BOARD TO BOARD

7.3.2 BY SYSTEM TYPE

7.3.2.1 UNSEALED

7.3.2.2 SEALED

7.3.3 BY APPLICATION

7.3.3.1 HTAT

7.3.3.2 ATUM

7.3.3.3 CGPT

7.3.3.4 LSTT<150 C

7.3.3.5 OTHERS

7.4 RING TERMINAL

7.4.1 12-10 GAUGE HEAT SHRINK RING TERMINALS

7.4.2 14-16 GAUGE HEAT SHRINK RING TERMINALS

7.4.3 18-20 GAUGE HEAT SHRINK RING TERMINALS

7.5 IN-LINE SPLICES

7.6 BRAKE PIPES

7.7 DIESEL INJECTION CLUSTERS

7.8 UNDER BONNET CABLE PROTECTION

7.9 GAS PIPES

7.1 MINIATURE SPLICES

8 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLYOLEFIN

8.3 POLYVINYL CHLORIDE

8.4 POLYTETRAFLUOROETHYLENE

8.5 FLOURINATED ETHYLENE PROPYLENE

8.6 PERFLUOROALKOXY ALKANES

8.7 ETHYLENE TETRAFLUORO ETHYLENE

8.8 OTHERS

9 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR

9.1 OVERVIEW

9.2 RED

9.3 YELLOW

9.4 OTHERS

10 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE

10.1 OVERVIEW

10.2 SINGLE WALL SHRINK TUBING

10.3 DUAL WALL SHRINK TUBING

11 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE

11.1 OVERVIEW

11.2 LOW VOLTAGE

11.3 MEDIUM VOLTAGE

11.4 HIGH VOLTAGE

12 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE

12.1 OVERVIEW

12.2 PETROL

12.3 DIESEL/CNG

12.4 ELECTRIC

13 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE

14.1 OVERVIEW

14.2 PASSENGER CARS

14.2.1 BY TYPE

14.2.1.1 SUV

14.2.1.2 SEDAN

14.2.1.3 CROSSOVER

14.2.1.4 COUPE

14.2.1.5 HATCHBACK

14.2.1.6 MPV

14.2.1.7 CONVERTIBLE

14.2.1.8 OTHERS

14.2.2 BY APPLICATION

14.2.2.1 HOSES

14.2.2.2 CONNECTORS

14.2.2.3 RING TERMINALS

14.2.2.4 IN-LINE SPLICES

14.2.2.5 BRAKING PIPES

14.2.2.6 DIESEL INJECTION CLUSTERS

14.2.2.7 UNDER BONNET CABLE PROTECTION

14.2.2.8 GAS PIPES

14.2.2.9 MINIATURE SPLICES

14.3 LCV

14.3.1 BY TYPE

14.3.1.1 PICKUP TRUCKS

14.3.1.2 VANS

14.3.1.2.1 CARGO VANS

14.3.1.2.2 PASSENGER VANS

14.3.1.3 MINI BUS

14.3.1.4 COACHES

14.3.1.5 OTHERS

14.3.2 BY APPLICATION

14.3.2.1 HOSES

14.3.2.2 CONNECTORS

14.3.2.3 RING TERMINALS

14.3.2.4 IN-LINE SPLICES

14.3.2.5 BRAKE PIPES

14.3.2.6 DIESEL INJECTION CLUSTERS

14.3.2.7 UNDER BONNET CABLE PROTECTION

14.3.2.8 GAS PIPES

14.3.2.9 MINIATURE SPLICES

14.4 ELECTRIC VEHICLE

14.4.1 BY TYPE

14.4.1.1 BATTERY OPERATED VEHICLES

14.4.1.2 PLUGIN VEHICLES

14.4.1.3 HYBRID VEHICLES

14.4.1.4 FUEL CELL ELECTRIC VEHICLES

14.4.2 BY APPLICATION

14.4.2.1 HOSES

14.4.2.2 CONNECTORS

14.4.2.3 RING TERMINALS

14.4.2.4 IN-LINE SPLICES

14.4.2.5 BRAKING PIPES

14.4.2.6 DIESEL INJECTION CLUSTERS

14.4.2.7 UNDER BONNET CABLE PROTECTION

14.4.2.8 GAS PIPES

14.4.2.9 MINIATURE SPLICES

14.5 HCV

14.5.1 BY TYPE

14.5.1.1 TRUCKS

14.5.1.1.1 DUMP TRUCKS

14.5.1.1.2 TOW TRUCKS

14.5.1.1.3 CEMENT TRUCKS

14.5.1.2 BUSES

14.5.2 BY APPLICATION

14.5.2.1 HOSES

14.5.2.2 CONNECTORS

14.5.2.3 RING TERMINALS

14.5.2.4 IN-LINE SPLICES

14.5.2.5 BRAKING PIPES

14.5.2.6 DIESEL INJECTION CLUSTERS

14.5.2.7 UNDER BONNET CABLE PROTECTION

14.5.2.8 GAS PIPES

14.5.2.9 MINIATURE SPLICES

15 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION

15.1 MIDDLE EAST AND AFRICA

15.1.1 SAUDI ARABIA

15.1.2 SOUTH AFRICA

15.1.3 U.A.E.

15.1.4 EGYPT

15.1.5 ISRAEL

15.1.6 REST OF MIDDLE EAST & AFRICA

16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TE CONNECTIVITY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SHAWCOR

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 ABB

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE AANLYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 HELLERMANNTYTON

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOILIO

18.5.4 RECENT DEVELOPMENT

18.6 AUTOSPARKS

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ALPHA WIRE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 DEE FIVE SHRINK INSULATION PVT. LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 DASENGH, INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 FLEX WIRES INC.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GREMCO GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVLOPMENT

18.13 INSULTAB, PEXCO

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENTS

18.14 IS-RAYFAST LTD

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 3M

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 MOLEX

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENTS

18.17 NELCO

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 PARAS ENTERPRISES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PANDUIT

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENTS

18.2 QUALTEK ELECTRONICS CORP.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 RADPOL S.A.

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 SUZHOU FEIBO COLD AND HEAT SHRINKING CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENTS

18.24 TECHFLEX, INC.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 THERMOSLEEVE USA

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 THE ZIPPERTUBING COMPANY

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENTS

18.27 TEXCAN

18.27.1 COMPANY SNAPSHOT

18.27.2 PRODUCT PORTFOLIO

18.27.3 RECENT DEVELOPMENT

18.28 ZEUS INDUSTRIAL PRODUCTS, INC.

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 2 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA IN-LINE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BRAKE PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA DIESEL INJECTION CLUSTERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA UNDER BONNET CABLE PROTECTION IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA GAS PIPES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA MINIATURE SPLICES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA POLYOLEFIN IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA POLYVINYL CHLORIDE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA POLYTETRAFLUOROETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA FLUORINATED ETHYLENE PROPYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA PERFLUOROALKOXY ALKANES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA ETHYLENE TETRAFLUORO ETHYLENE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RED IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA YELLOW IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA SINGLE WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA DUAL WALL SHRINK TUBING IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA LOW VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA MEDIUM VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HIGH VOLTAGE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA PETROL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA DIESEL/CNG IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA ELECTRIC IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA OEM IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA AFTERMARKET IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 MIDDLE EAST & AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 79 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 MIDDLE EAST & AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 81 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 82 SAUDI ARABIA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 84 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 SAUDI ARABIA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 86 SAUDI ARABIA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 88 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 89 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 90 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 91 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 92 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 93 SAUDI ARABIA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 94 SAUDI ARABIA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 SAUDI ARABIA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 96 SAUDI ARABIA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 SAUDI ARABIA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 SAUDI ARABIA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 99 SAUDI ARABIA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 SAUDI ARABIA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 SAUDI ARABIA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 102 SAUDI ARABIA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 SAUDI ARABIA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 104 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 105 SOUTH AFRICA HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 SOUTH AFRICA CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 109 SOUTH AFRICA RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 110 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 111 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 112 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 114 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 116 SOUTH AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 SOUTH AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 SOUTH AFRICA PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 119 SOUTH AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 SOUTH AFRICA VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 SOUTH AFRICA LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 122 SOUTH AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 SOUTH AFRICA TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 124 SOUTH AFRICA HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 125 SOUTH AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 SOUTH AFRICA ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 127 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 128 U.A.E. HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 129 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 130 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 131 U.A.E. CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 132 U.A.E. RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 134 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 135 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 137 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 139 U.A.E. HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 U.A.E. PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 U.A.E. PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 142 U.A.E. LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 U.A.E. VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 144 U.A.E. LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 145 U.A.E. HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 U.A.E. TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 U.A.E. HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 148 U.A.E. ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 149 U.A.E. ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 150 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 151 EGYPT HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 152 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 154 EGYPT CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 155 EGYPT RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 156 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 157 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 158 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 159 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 160 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 161 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 162 EGYPT HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 163 EGYPT PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 164 EGYPT PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 165 EGYPT LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 166 EGYPT VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 167 EGYPT LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 168 EGYPT HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 169 EGYPT TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 170 EGYPT HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 171 EGYPT ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 172 EGYPT ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 173 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 174 ISRAEL HOSES IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 175 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 176 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SYSTEM TYPE, 2019-2028 (USD THOUSAND)

TABLE 177 ISRAEL CONNECTORS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 178 ISRAEL RING TERMINAL IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 179 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY MATERIAL 2019-2028 (USD THOUSAND)

TABLE 180 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY COLOUR, 2019-2028 (USD THOUSAND)

TABLE 181 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 182 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VOLTAGE, 2019-2028 (USD THOUSAND)

TABLE 183 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY FUEL TYPE, 2019-2028 (USD THOUSAND)

TABLE 184 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY SALES CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 185 ISRAEL HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY VEHICLE TYPE, 2019-2028 (USD THOUSAND)

TABLE 186 ISRAEL PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 187 ISRAEL PASSENGER CARS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 188 ISRAEL LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 189 ISRAEL VANS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 190 ISRAEL LCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 191 ISRAEL HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 192 ISRAEL TRUCKS IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 193 ISRAEL HCV IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 194 ISRAEL ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 195 ISRAEL ELECTRIC VEHICLE IN HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

TABLE 196 REST OF MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET, BY APPLICATION, 2019-2028 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 10 GROWING DEMAND FOR VEHICLE WIRING HARNESS FOR AUTOMOTIVE SAFETY SYSTEMS & RISE IN TECHNOLOGICAL ADVANCEMENTS TO IMPROVE VEHICLE PERFORMANCE IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 HOSES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN 2021 & 2028

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET

FIGURE 14 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY APPLICATION, 2020

FIGURE 15 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY MATERIAL, 2020

FIGURE 16 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COLOUR, 2020

FIGURE 17 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY TYPE, 2020

FIGURE 18 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VOLTAGE, 2020

FIGURE 19 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY FUEL TYPE, 2020

FIGURE 20 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY SALES CHANNEL, 2020

FIGURE 21 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY VEHICLE TYPE, 2020

FIGURE 22 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: SNAPSHOT (2020)

FIGURE 23 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020)

FIGURE 24 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2021 & 2028)

FIGURE 25 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COUNTRY (2020 & 2028)

FIGURE 26 MIDDLE EAST AND AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: BY COMPONENT (2021-2028)

FIGURE 27 MIDDLE EAST & AFRICA HEAT SHRINK TUBING FOR AUTOMOTIVE MARKET: COMPANY SHARE 2020 (%)

Middle East And Africa Heat Shrink Tubing For Automotive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Heat Shrink Tubing For Automotive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Heat Shrink Tubing For Automotive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.