Middle East and Africa Healthcare Information Technology (IT) Integration Market Analysis and Size

Healthcare IT integration enables it for healthcare systems to gather data, exchange it with the cloud, and communicate with one another, allowing for the rapid and correct analysis of that data. The Internet of Things (IoT) combines sensor output with communications to provide tasks that were until recently thought of as notional, from monitoring and diagnosis to delivery methods. The sensors can be incorporated into a device, cloud-based, or wearable. With the developments of such sensors and ICT, the healthcare sector now possesses a dynamic collection of patient data that can be used to support diagnostics and preventive care and to assess the likely success of preventive treatment.

In addition, Integration initiatives are often limited in scope. They integrate only a small portion of patient data available because it is difficult to move information among disparate clinical and business software applications within and beyond healthcare enterprise borders. It requires a thorough understanding of data governance, expert knowledge of health messaging standards, access to sophisticated technology, and expertise in systems integration, including service-oriented architecture (SOA) and enterprise architecture management (EAM). CGI’s HIIF defines and describes all the parameters necessary to achieve the integration that healthcare organizations require.

However, the higher costs associated with integrated IT solutions and issues associated with interoperability are anticipated to restrain the market growth.

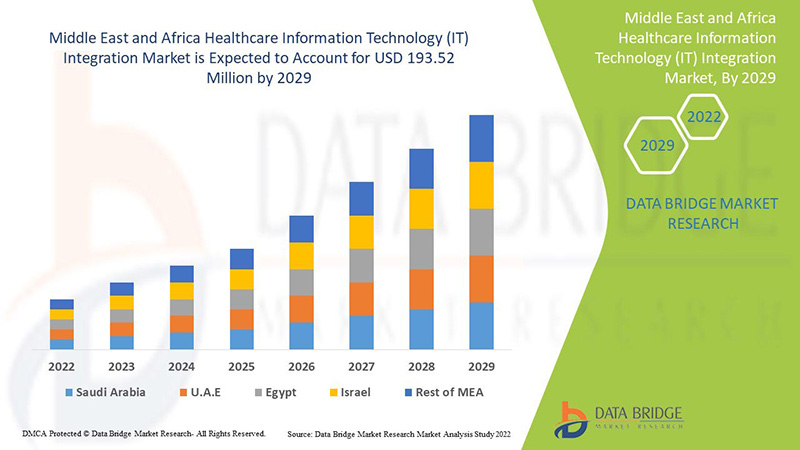

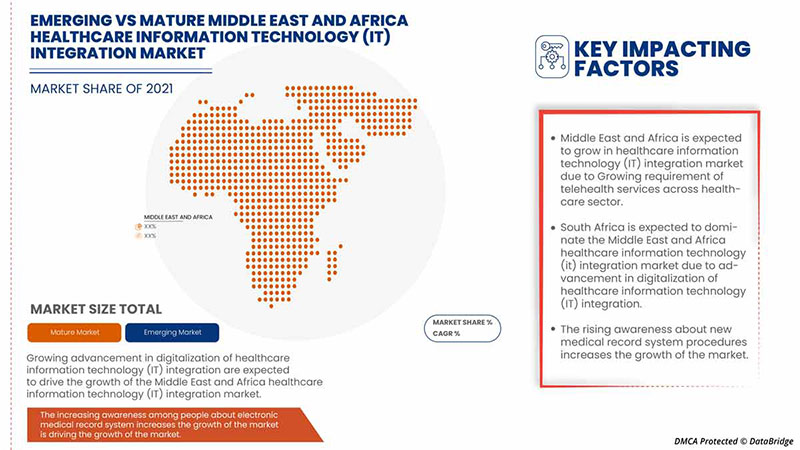

Data Bridge Market Research analyzes that the Middle East & Africa healthcare information technology (IT) integration market is expected to reach the value of USD 193.52 million by 2029, at a CAGR of 10.7% during the forecast period. Product and services account for the largest type segment in the market due to the rapid demand for IT solutions and services in the Middle East & Africa. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product & Services (Product, and Services), Application (Medical Device Integration, Internal Integration, Hospital Integration, Lab Integration, Clinics Integration, and Radiology Integration), Facility Size (Large, Medium, and Small), Purchase Mode (Group Purchase Organization, and Individual), End User (Hospitals, Laboratory, Diagnostic Centers, Radiology Centers, and Clinics). |

|

Countries Covered |

UAE, Israel, South Africa, Saudi Arabia, Egypt, and Rest of the Middle East and Africa. |

|

Market Players Covered |

Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc. Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc, Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc. Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporation, and Meditech, among others. |

Middle East & Africa Healthcare Information Technology (IT) Integration Market Definition

Health IT integration (health information technology) is the area of IT involving the design, development, creation, use, and maintenance of information systems for the healthcare industry. Automated and interoperable healthcare information systems will continue to improve medical care and public health, lower costs, increase efficiency, reduce errors and improve patient satisfaction, and optimize reimbursement for ambulatory and inpatient healthcare providers. The importance of health IT results from the combination of evolving technology and changing government policies that influence the quality of patient care. Some of the healthcare information technology (IT) integration products are interface/integration engines, medical device integration software, and media integration solutions, and services are implementation & integration, support & maintenance, training & education, and consulting. Health IT makes it possible for health care providers to better manage patient care through the secure use and sharing of health information. By developing secure and private electronic health records for most Americans and making health information available electronically when and where it is needed, health IT can improve the quality of care, even as it makes health care more cost-effective. With the help of health IT, health care providers will have: Accurate and complete information about a patient's health. That way, providers can give the best possible care, whether during a routine visit or a medical emergency, The ability to better coordinate the care given. This is especially important if a patient has a serious medical condition, a way to securely share information with patients and their family caregivers over the Internet, for patients who opt for this convenience.

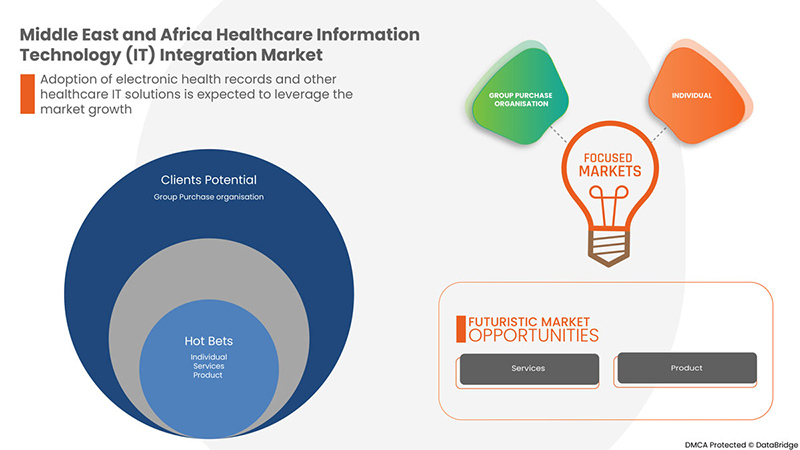

In addition, the rapid adoption of electronic health records and other healthcare IT solutions is one of the high-impact rendering drivers of the market. Moreover, the urgent need to integrate patient data into healthcare systems and favorable government policies, funding programs, and initiatives to deploy healthcare IT integration solutions are the major drivers for the market growth.

Middle East & Africa Healthcare Information Technology (IT) Integration Market Dynamics

This section deals with understanding the market drivers , opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Rapid Adoption of Electronic Health Records and Other Healthcare IT Solutions

Patient data is complex, confidential, and often unstructured. Incorporating this information into the healthcare delivery process is a challenge that must be met in order to realize the opportunity to improve patient care. Although Electronic Health Record (HER) has been in use for over a decade, the market has recently accelerated due to government initiatives in different countries to improve patient data security.

Regulatory requirements imposed by HITECH have spurred the adoption of EHR and EMR. Another important factor, which is fueling the growth of the market is the increasing number of Responsible Care Organizations (ACOs), increasing the demand for EHRs and EMRs.

Government initiatives in other countries, such as Denmark, Sweden, France, and Canada, are also encouraging the adoption of EHRs and mandating their meaningful use to control healthcare costs.

In addition, IT services help to integrate various end-users throughout the healthcare system, including hospitals, nursing units, pharmacies, and health insurance companies. However, integrating this data and its availability in real-time is essential for healthcare professionals to ensure effective decision-making. Therefore, with the anticipated growth of the EHR systems in the coming years, hospitals will focus strongly on enhancing their capacity by integrating different hospital systems with EHR, thereby creating development opportunities for the healthcare information technology (IT) integration market.

- Growing Demand For Telehealth Services and Remote Patient Monitoring Solutions

Currently, telehealth services are being requested for monitoring and consulting purposes. Advances in healthcare solutions have helped to deliver educational content and ensure uninterrupted communication between patients and healthcare providers. The successful operation of remote patient monitoring solutions depends on the successful integration of medical and Information and Communications Technology (ICT) devices that enable the delivery of medical services over long distances.

Since doctors and nurses spend most of their time working without computers in hospitals, it is difficult for them to carry patient records with them on the go. As a result, many market players have started offering mobile platforms, such as mobile apps, for healthcare IT solutions.

Advances in computing have provided an ever-expanding array of options such as advanced broadband, mobile and networking, remote patient monitoring, high-definition video conferencing, and EHR. This has created significant opportunities for solution providers to integrate healthcare information technology. Through an IoT healthcare network consisting of connected medical devices, patients sitting at home can be remotely monitored for their vital signs, such as blood pressure levels, weight, blood glucose level, electrocardiogram, and body temperature, as patient data is automatically sent to the nurse or a doctor.

A connected healthcare environment allows doctors to remotely monitor and adjust a patient's condition. Connected health technologies involve smart sensor technology, advanced connectivity, interface enhancements, and data analytics. These advances help reduce healthcare costs by improving patient acceptance and reducing clinic visits. Additionally, while implementation costs can be high, these technologies are helping to speed up operations for many businesses.

With advancements in technology, these solutions play an important role in improving remote monitoring and patient compliance, and subsequently, their quality of life. Therefore, the growing demand for remote monitoring solutions and remote devices is expected to drive the growth of the Middle East & Africa healthcare information technology (IT) integration solution providers in the coming years.

Restraint

- Issues Associated With Interoperability

The heterogeneity of health information systems possesses major challenges for the successful implementation and use of health informatics solutions. Many countries do not have specific IT standards for storing and exchanging data, which leads to interoperability issues. While there are many different data storage, transport, and security standards, implementing and integrating these interoperability standards presents a major challenge for care providers, and health and medical IT solution providers. Due to the lack of a single health information system to meet all the administrative, clinical, technical, and laboratory requirements of major healthcare providers, interoperability requirements and interoperability standards have become important. Vendors also follow different data formats and standards due to poor knowledge or lack of technical knowledge of the defined standards, which makes it difficult to share real-time data with partner systems, which increases the cost of healthcare IT integration. Issues with data quality and integrity, non-compliance with established standards, lack of qualified professionals, and variation in uptime between healthcare providers are among the issues acting as major obstacles to implementing a fully interoperable healthcare IT infrastructure. These factors are expected to restrain the growth of the market.

Opportunity/ Challenges

- Data Integration Related Challenges

Information related to patients have created from different departments. At all points of treatment within the healthcare organization, making it a more highly information-intensive industry and reliable patient records, however, it is essential to give reliable information by combining huge amounts of data in order to produce comprehensive and trustworthy patient records because a variety of medical equipment and diagnostic instruments are used in healthcare systems and is a growing need to connect all of these systems to assist healthcare practitioners in responding quickly at various care delivery points.

Several information management applications, including asset management systems, imaging systems, email management systems, forms management systems, clinical information systems, workforce management systems, database management systems, content management systems, revenue cycle management systems, clinical and non-clinical workflow systems, and customer relations management systems that, have been invested in by numerous healthcare organizations. As healthcare organizations are increasingly adopting various healthcare IT systems, there is a greater need to integrate different types of IT systems into the IT architecture of the organization to ensure the optimum utilization of these systems and aid in accurate decision-making. The successful combination of healthcare IT systems with other systems is a focus of IT infrastructure development projects in healthcare organizations.

Thus, each organization in healthcare uses different systems, and there is a high chance of misdiagnosis and improper examination of the report due to the data integration that demolishes the usage of healthcare information technology, which can act as a challenge to the market growth.

Post-COVID-19 Impact On Middle East & Africa Healthcare Information Technology (IT) Integration Market

The COVID-19 outbreak had a drastic effects on the Middle East & Africa healthcare, with the UK amongst the countries most severely impacted. Due to the COVID-19 outbreak, all healthcare clinics are under immense pressure, and healthcare facilities worldwide have been overcrowded by the daily visits of numerous patients. The rising prevalence of coronavirus disease has driven the demand for accurate diagnosis and treatment devices in several countries worldwide. In this regard, connected care technologies have proven to be very helpful. They allow healthcare providers to monitor patients using digitally connected noninvasive devices such as home blood pressure monitors and pulse oximeters. Moreover, the rapid spread of this disease in the Middle East & Africa has led to a shortage of hospital beds and healthcare workers. As a result, connected medical devices were increasingly adopted to monitor vital signs, and a similar trend is likely to be observed in the coming years

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pharmacogenetics testing market.

Recent Developments

- In August 2022, Cognizant announced that it has been selected by AXA UK & Ireland as a technology partner to help consolidate, modernize and manage part of its IT operations. AXA UK & Ireland is transforming its technology ecosystem to create a more digitally-enabled, modern, and agile IT environment that is data-rich, secure, and sustainable with lower overall cost. Cognizant will provide integrated IT services spanning service desk support and maintenance, end-user computing, application development and maintenance, cloud operations, and IT infrastructure management. This has helped the company to expand its business.

- In July 2022, NXGN Management, LLC, have demonstrated its award-winning NextGen Office, the only Electronic Health Record (EHR) integrated into the American Podiatric Medical Association (APMA) Registry, at the group’s annual conference held on July 28 to 31 in Orlando. NextGen Healthcare is a founding partner of the APMA Registry, which provided clinically relevant insights to NextGen Healthcare clients. This has helped the company to show its products in APMA and get recognition.

Middle East & Africa Healthcare Information Technology (IT) Integration Market Scope

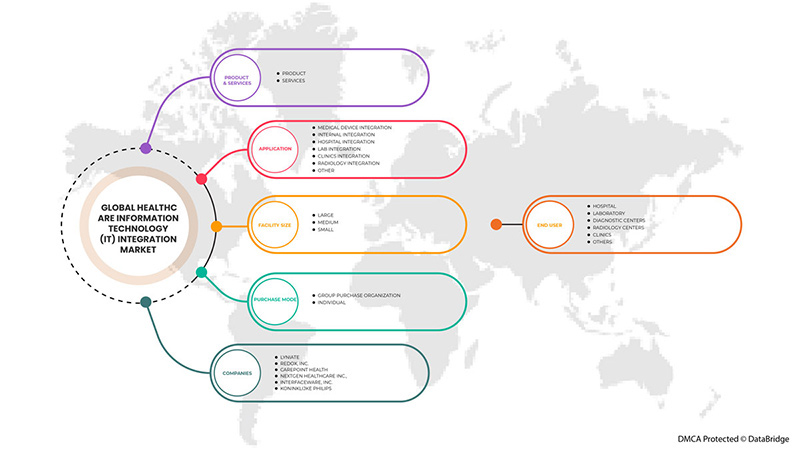

Middle East & Africa healthcare information technology (IT) integration market is segmented into product & services, application, facility size, purchase mode, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

By Product & Services

- Product

- Services

On the basis of product & services, the Middle East & Africa healthcare information technology (IT) integration market is segmented into products, and services.

By Applications

- Medical Device Integration

- Internal Integration

- Hospital Integration

- Lab Integration

- Clinics Integration

- Radiology Integration

- Other

On the basis of application, the Middle East & Africa healthcare information technology (IT) integration market is segmented into medical device integration, internal integration, hospital integration, lab integration, clinics integration, radiology integration and others.

By Facility Size

- Large

- Medium

- Small

On the basis of facility size, the Middle East & Africa healthcare information technology (IT) integration market is segmented into large, medium, and small.

By Purchase Mode

- Group Purchase Organization

- Individual

On the basis of purchase mode, the Middle East & Africa healthcare information technology (IT) integration market is segmented into group purchases, and individual.

By End User

- Hospital

- Laboratory

- Diagnostic Centers

- Radiology Centers

- Clinics

- Others

On the basis of end users, the Middle East & Africa healthcare information technology (IT) integration market is segmented into hospitals, laboratories, diagnostic centers, radiology centers, clinics, and others.

Middle East & Africa Healthcare Information Technology (IT) Integration Market Regional Analysis/Insights

The Middle East & Africa healthcare information technology (IT) integration market is analyzed. Market size information is provided by product & services, application, facility size, purchase mode, and end user.

The countries covered in this market report are South Africa, Saudi Arabia, Egypt, and rest of the Middle East and Africa.

In 2022, Middle East & Africa is dominating due to the rise in government initiatives and R&D. South Africa is expected to grow due to the rise in technological advancement in healthcare IT.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East & Africa Healthcare Information Technology (IT) Integration Market Share Analysis

Middle East & Africa healthcare information technology (IT) integration market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the Middle East & Africa healthcare information technology (IT) integration market.

Some of the major players operating in the Middle East & Africa healthcare information technology (IT) integration market are Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc., Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc, Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc., Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporation, and Meditech, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 U.A.E.

13.1.4 EGYPT

13.1.5 ISRAEL

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 EGYPT HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 73 EGYPT SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 74 EGYPT PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 EGYPT INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 76 EGYPT MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 77 EGYPT MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 EGYPT HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 EGYPT HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 80 EGYPT HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 86 ISRAEL MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 90 ISRAEL HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 91 ISRAEL HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 REST OF MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.