Market Analysis and Size

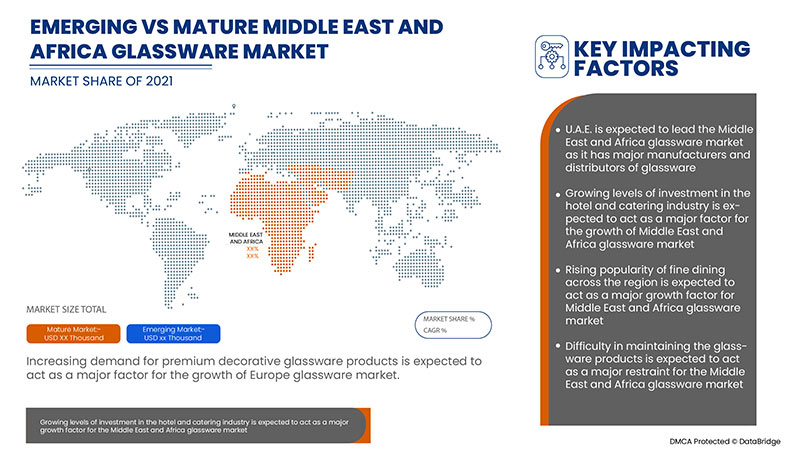

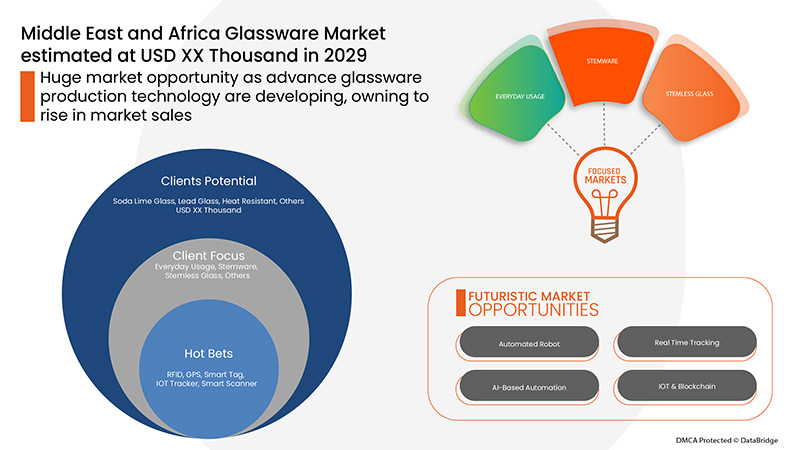

Growing levels of investment in the hotel and catering industry are expected to act as a driver for the growth of the glassware market in the forecast period. Changes in the lifestyle of the consumers are expected to act as a driver for the growth of the glassware market in the forecast period of 2022-2029. Advancements in glassware production technologies are expected to bring growth opportunities for the glassware market in future.

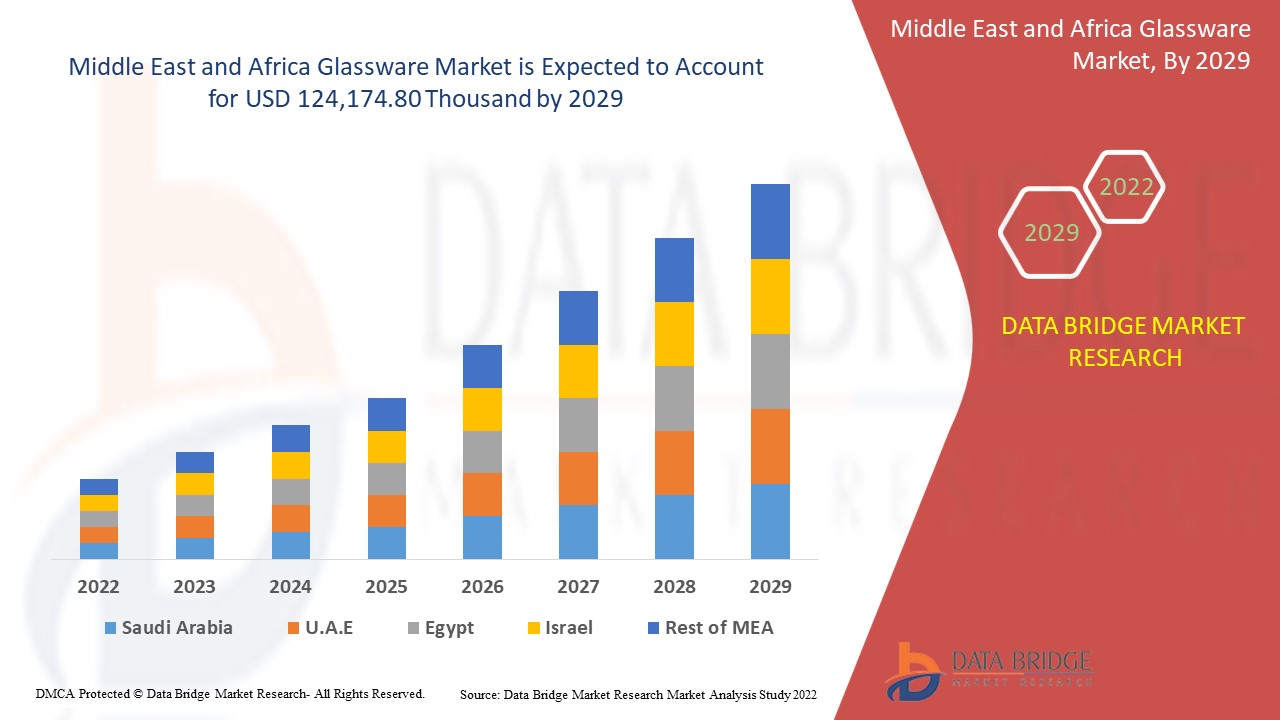

Data Bridge Market Research analyses that the glassware market is expected to reach the value of USD 124,174.80 thousand by 2029, at a CAGR of 4.2% during the forecast period. "soda lime" accounts for the most prominent material segment as this type of glass provides scratch resistant surfaces. The glassware market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Thousand, Volume in Units, Pricing in USD |

|

Segments Covered |

By Material (Soda Lime Glass, Lead Glass, Heat Resistant and Others), Style (Stemless Glass, Stemware, Everyday Usage and Others), Distribution Channel (B2B, Specialized Stores, Supermarkets/Hypermarkets, E Commerce and Others), Price Range (Medium, Premium and Economy), End-Use (Hotels & Restaurants, Bars & Café, Household, Corporate Canteens and Others) |

|

Countries Covered |

UAE, Saudi Arabia, South Africa, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

Hrastnik1860, Oneida, NoritakeUAE, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (A Subsidiary of Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco S.p.A., Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware among others |

Market Definition

Glass is a brittle, rigid material that is generally clear or translucent. It might be made of a mixture of sand, soda, lime, or other minerals. The most typical glass formation method involves heating raw ingredients until they become molten liquid, then rapidly cooling the mixture to make toughened glass. Glass varieties may be classified based on their mechanical and thermal qualities to identify which applications are most suited.

Soda lime glass: Soda-lime glass is the most common form of glass used for windowpanes and glass containers such as bottles and jars for drinks, food, and certain commodities items.

Lead Glass: Lead glass is a glass with a high percentage of lead oxide with exceptional clarity and brightness.

Heat Resistant: Heat-resistant glass is intended to withstand heat stress and is commonly used in kitchens and industrial applications.

Glassware Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- Growing levels of investment in the hotel and catering industry

Tourism has enhanced the business of the hotel and restaurant sector all over the world and provided great scope for the hotel industry. The industry has flourished mainly through tourism and due to diverse landscapes, beliefs, and societies in different countries which provided a great attraction to tourists from different regions. The hotel and catering sectors of many nations have gradually expanded over the last two decades, and development is predicted in the next years, coupled with an increase in demand for various types of glassware goods.

- Changes in lifestyle of the consumers

Consumer lives are constantly evolving. Consumer habits and values are influenced by existing and new trends, as well as the continuously changing demographic mix, worldwide cultural upheavals, and fast developments in technology. Businesses may capitalize on new possibilities by acquiring a deep understanding of customer preferences following shifting behaviours and beliefs. In recent times, consumers from all generations are focusing more on branded products in many areas of their daily lives.

- Rising popularity of fine dining across the globe

A fine dining restaurant is either a specialty or a multi-cuisine establishment that places a premium on quality ingredients, presentation, and impeccable service. The category is increasing at a respectable pace of 15%, which has encouraged the arrival of premium Michelin-starred restaurants and other local competitors. Therefore, the growing demand for fine delicate dining is mainly accomplished by the successful operations of different types of brands of glassware products in hotels and restaurants.

- Availability of cheap quality products

Glass is one of the most complex and adaptable materials, and it is utilized in nearly every industry. The extensive use of glass contributes to the creation of a very hi-tech and modern appearance in both residential and commercial structures. Glass comes in a variety of shapes and sizes to suit a variety of applications and is used in a variety of architectural applications such as doors, windows, and partitions. Glass has come a long way from its humble beginnings as a windowpane to become a sophisticated structural component in the current day.

- Rising demand for steel and paper base drinkware

Paper and plastic are increasingly being used to make disposable plates and glasses, owing to their great environmental performance and rising demand for e-commerce and delivery services. Consumers, brands, and retailers all have high expectations for recyclable paper-based goods. The recycling rate of paper-based materials is around 85 percent, and the paper value chain is improving day by day. To reach even higher recycling objectives while extending the usefulness of paper-based packaging, it is critical, to begin with, the design phase, taking into account both the intended purpose and the end-of-life.

Post COVID-19 Impact on Glassware Market

COVID-19 created a major impact on the glassware market as almost every country has opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing with this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the glassware market is rising due to the government policies to boost international trade post-COVID-19. Also, the opening of lockdown is boosting the hospitality industry which is rising the demand for Glassware in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the Glassware. With this, the companies will bring advanced and accurate solutions to the market. In addition, the government initiatives to boost international trade has led to the market's growth.

Recent Developments

- In October 2020, Libbey Inc. announced the confirmation of a plan of reorganization and expected to complete its court-supervised restructuring and emerge with a stronger balance sheet in the upcoming weeks. The company made this announcement to succeed in the current business operating environment.

- In October 2021, Lenox Corporation acquired Oneida Consumer LLC with its brand of table top products including flatware, dinnerware, and cutlery. The collaboration was undertaken to market a leading portfolio of brands and innovative goods with unrivalled customer awareness across a wide range of retail channels.

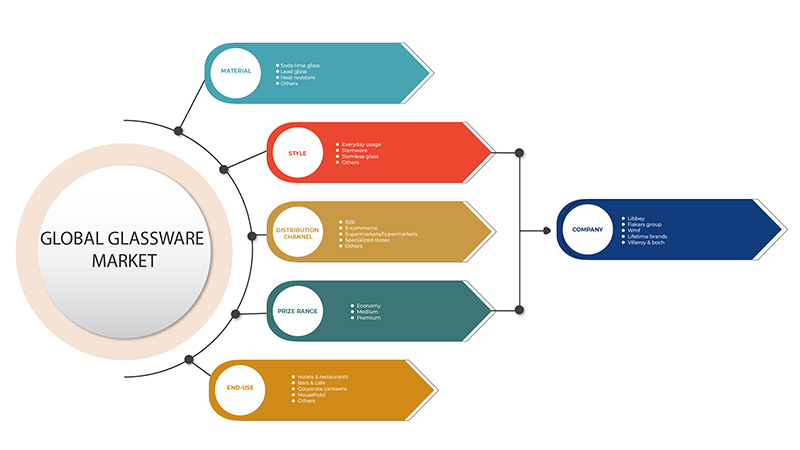

Middle East and Africa Glassware Market Scope

The glassware market is segmented based on material, style, distribution channel, price range, and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Material

- Soda Lime Glass

- Lead Glass

- Heat Resistant

- Others

Based on material, the glassware market is segmented into soda lime glass, lead glass, heat resistant, and others.

By Style

- Stemless Glass

- Stemware

- Everyday Usage

- Others

Based on style, the glassware market has been segmented into stemless glass, stemware, everyday usage, and others.

By Distribution Channel

- B2B

- Specialized Stores

- Supermarkets/Hypermarkets

- E-Commerce

- Others

Based on distribution channel, the glassware market has been segmented into b2b, specialized stores, supermarkets/hypermarkets, e-commerce, and others.

By Price Range

- Medium

- Premium

- Economy

Based on price range, the glassware market has been segmented into medium, premium, and economy.

By End-Use

- Hotels & Restaurants

- Bars & Cafe

- Household

- Corporate Canteens

- Others

Based on end-use, the glassware market has been segmented into hotels & restaurants, bars & café, household, corporate canteens, and others.

Glassware Market Regional Analysis/Insights

The glassware market is analysed and market size insights and trends are provided by country, material, style, distribution channel, price range, and end-use as referenced above.

The countries covered in the glassware market report are UAE, Saudi Arabia, South Africa, Egypt, Israel, Rest of Middle East and Africa.

UAE dominates the Middle East and Africa glassware market. UAE is likely to be the fastest-growing Middle East and Africa glassware market. The rising infrastructure, commercial, and industrial developments in emerging countries such as UAE are credited with the market's dominance. With the increasing development in the countries number of restaurants and bars is increasing, which will boost the demand for glassware products in the Middle East and Africa region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Glassware Market Share Analysis

The glassware market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to glassware market.

Some of the major players operating in the glassware market are Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (A Subsidiary of Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco S.p.A., Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA GLASSWARE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TIME LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S MODEL

4.2 CONSUMER BEHAVIOUR PATTERN

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PSYCHOLOGICAL FACTORS

4.3.2 SOCIAL FACTORS

4.3.3 CULTURAL FACTORS

4.3.4 PERSONAL FACTORS

4.3.5 ECONOMIC FACTORS

4.4 KEY TRENDS

4.4.1 BOROSILICATE GLASSWARE IS A GAME-CHANGER

4.4.2 OMNI-CHANNEL STRATEGY USAGE IS ENCOURAGING THE GROWTH OF THE GLASSWARE MARKET

4.4.3 BEVERAGE INDUSTRY TO REGISTER SIGNIFICANT GROWTH

4.4.4 INCREASE IN TABLEWARE PRODUCTS

4.5 PRICING ANALYSIS

4.6 PRODUCT ADOPTION SCENARIO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING LEVELS OF INVESTMENT IN THE HOTEL AND CATERING INDUSTRY

5.1.2 CHANGES IN LIFESTYLE OF THE CONSUMERS

5.1.3 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE

5.1.4 INCREASING DEMAND FOR PREMIUM DECORATIVE GLASSWARE PRODUCTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF CHEAP QUALITY PRODUCTS

5.2.2 RISING DEMAND FOR STEEL AND PAPER BASE DRINKWARE

5.2.3 DIFFICULTY IN MAINTAINING THE GLASSWARE PRODUCTS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN GLASSWARE PRODUCTION TECHNOLOGIES

5.3.2 RISING DEMAND FOR GLASSWARE PRODUCTS FOR CLINICAL USE IN HOSPITALS AND FORENSIC LABORATORIES

5.4 CHALLENGES

5.4.1 COMPLEXITY IN MANUFACTURING GLASSWARE PRODUCTS

5.4.2 RISING DIFFICULTY IN RECYCLING GLASSWARE PRODUCTS

6 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 SODA LIME GLASS

6.3 LEAD GLASS

6.4 HEAT RESISTANT

6.5 OTHERS

7 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE

7.1 OVERVIEW

7.2 STEMWARE

7.2.1 RED WINE GLASS

7.2.1.1 BORDEAUX

7.2.1.2 CABERNET

7.2.1.3 ZINFANDEL

7.2.1.4 BURGUNDY

7.2.1.5 PINOT NOIR

7.2.1.6 ROSE

7.2.2 WHITE WINE GLASS

7.2.2.1 SPARKLING

7.2.2.2 CHARDONNAY

7.2.2.3 VIOGNIER

7.2.2.4 SWEET WINE

7.2.2.5 VINTAGE

7.3 STEMLESS GLASS

7.3.1 LIQUOR GLASS

7.3.2 BEER GLASS

7.4 EVERYDAY USAGE

7.5 OTHERS

8 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 B2B

8.3 SPECIALIZED STORES

8.4 SUPERMARKETS/HYPERMARKETS

8.5 E-COMMERCE

8.6 OTHERS

9 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE

9.1 OVERVIEW

9.2 MEDIUM

9.3 PREMIUM

9.4 ECONOMY

10 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE

10.1 OVERVIEW

10.2 HOTELS & RESTAURANTS

10.3 BARS & CAFE

10.4 HOUSEHOLD

10.5 CORPORATE CANTEENS

10.6 OTHERS

11 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY GEOGRAPHY

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LIBBEY, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATE

14.2 FISKARS GROUP

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATE

14.3 WMF (A SUBSIDIARY OF GROUPE SEB)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATE

14.4 LIFETIME BRANDS, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 VILLEROY & BOCH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADDRESSHOME

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BORMIOLI ROCCO S.P.A.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELLO WORLD

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CUMBRIA CRYSTAL

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 DEGRENNE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 EAGLE GLASS DECO (P.) LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 GARBO GLASSWARE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HRASTNIK1860

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 JIANGSU RONGTAI GLASS PRODUCTS CO., LTD.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 LENOX CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATE

14.16 MYBOROSIL

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT UPDATE

14.17 NORITAKECHINA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT UPDATE

14.18 OCEAN GLASS PUBLIC COMPANY LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT UPDATE

14.19 ONEIDA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATE

14.2 SHANDONG HIKINGPAC CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATE

14.21 STÖLZLE LAUSITZ GMBH

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 TREO.IN

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATE

14.23 THE ZRIKE COMPANY, INC.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCT PORTFOLIO

14.23.3 RECENT UPDATE

14.24 WONDERCHEF HOME APPLIANCES PVT. LTD

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 TYPE OF REUSABLE CUPS CONSUMERS WOULD PREFER FOR DRINKWARE IN U.S, 2015

TABLE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SODA LIME GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 6 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA LEAD GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 8 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA HEAT RESISTANT IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (THOUSAND UNITS)

TABLE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA EVERYDAY USAGE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA B2B IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA SPECIALIZED STORES IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA SUPERMARKETS/HYPERMARKETS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA E-COMMERCE IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA MEDIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA PREMIUM IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA ECONOMY IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA HOTELS & RESTAURANTS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA BARS & CAFÉ IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA HOUSEHOLD IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA CORPORATE CANTEENS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA OTHERS IN GLASSWARE MARKET, BY REGION, 2016-2029 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY COUNTRY, 2016-2029 (THOUSAND UNITS)

TABLE 39 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 41 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 49 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 50 U.A.E. GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 51 U.A.E. GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 52 U.A.E. STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 53 U.A.E. RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 54 U.A.E. WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 55 U.A.E. STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 56 U.A.E. GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 57 U.A.E. GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 58 U.A.E. GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 59 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 60 SAUDI ARABIA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 61 SAUDI ARABIA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 62 SAUDI ARABIA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 63 SAUDI ARABIA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 64 SAUDI ARABIA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 65 SAUDI ARABIA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 66 SAUDI ARABIA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 67 SAUDI ARABIA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 68 SAUDI ARABIA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 69 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 70 SOUTH AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 71 SOUTH AFRICA GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 72 SOUTH AFRICA STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 73 SOUTH AFRICA RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 74 SOUTH AFRICA WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 75 SOUTH AFRICA STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 76 SOUTH AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 77 SOUTH AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 78 SOUTH AFRICA GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 79 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 80 EGYPT GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 81 EGYPT GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 82 EGYPT STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 83 EGYPT RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 84 EGYPT WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 85 EGYPT STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 86 EGYPT GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 87 EGYPT GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 88 EGYPT GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 89 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 90 ISRAEL GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

TABLE 91 ISRAEL GLASSWARE MARKET, BY STYLE, 2016-2029 (USD THOUSAND)

TABLE 92 ISRAEL STEMWARE IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 93 ISRAEL RED WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 94 ISRAEL WHITE WINE GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 95 ISRAEL STEMLESS GLASS IN GLASSWARE MARKET, BY TYPE, 2016-2029 (USD THOUSAND)

TABLE 96 ISRAEL GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2016-2029 (USD THOUSAND)

TABLE 97 ISRAEL GLASSWARE MARKET, BY PRICE RANGE, 2016-2029 (USD THOUSAND)

TABLE 98 ISRAEL GLASSWARE MARKET, BY END-USE, 2016-2029 (USD THOUSAND)

TABLE 99 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (USD THOUSAND)

TABLE 100 REST OF MIDDLE EAST AND AFRICA GLASSWARE MARKET, BY MATERIAL, 2016-2029 (THOUSAND UNITS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA GLASSWARE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA GLASSWARE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA GLASSWARE MARKET: MATERIAL TIME LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA GLASSWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA GLASSWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA GLASSWARE MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA GLASSWARE MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISING POPULARITY OF FINE DINING ACROSS THE GLOBE IS DRIVING THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 SODA LIME GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA GLASSWARE MARKET IN 2022 & 2029

FIGURE 17 FACTOR INFLUENCING PURCHASE OF PRODUCT

FIGURE 18 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMLESS GLASSES

FIGURE 19 PRICE RANGE COMPARISON OF KEY PLAYERS BY STEMWARE GLASSES

FIGURE 20 PRICE RANGE COMPARISON OF KEY PLAYERS BY EVERYDAY USAGE GLASSES

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA GLASSWARE MARKET

FIGURE 22 MIDDLE EAST & AFRICA LUXURY HOTEL COUNT, IN LUXURY CLASS, 2002-2018 (APPROXIMATE)

FIGURE 23 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY MATERIAL, 2021

FIGURE 24 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY STYLE, 2021

FIGURE 25 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY PRICE RANGE, 2021

FIGURE 27 MIDDLE EAST & AFRICA GLASSWARE MARKET, BY END-USE, 2021

FIGURE 28 MIDDLE EAST AND AFRICA GLASSWARE MARKET: SNAPSHOT (2021)

FIGURE 29 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021)

FIGURE 30 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 MIDDLE EAST AND AFRICA GLASSWARE MARKET: BY MATERIAL (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA GLASSWARE MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Glassware Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Glassware Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Glassware Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.