Middle East and Africa Frozen Fruit and Vegetable Mix Market Analysis and Insights

Growing urbanization and increased adoption of a healthy lifestyle is driving the growth of the Middle East and Africa frozen fruit and vegetable mix market. In addition, increasing consumption of canned and frozen food further enhances the market growth. Furthermore, the increasing vegan population is boosting the sales and profit of the players operating in the market.

The major restraint impacting the market growth is the growing awareness regarding the consumption of fresh vegetables and fruits. Further, a high lack of cold chain infrastructure will also restrain the market growth. On the other hand, increasing demand for fruits and vegetables with a longer shelf-life is expected to act as an opportunity for the growth of the Middle East and Africa frozen fruit and vegetable mix market. Whereas, the challenge for the market growth is the high investment cost for the production of frozen vegetables and fruits mix.

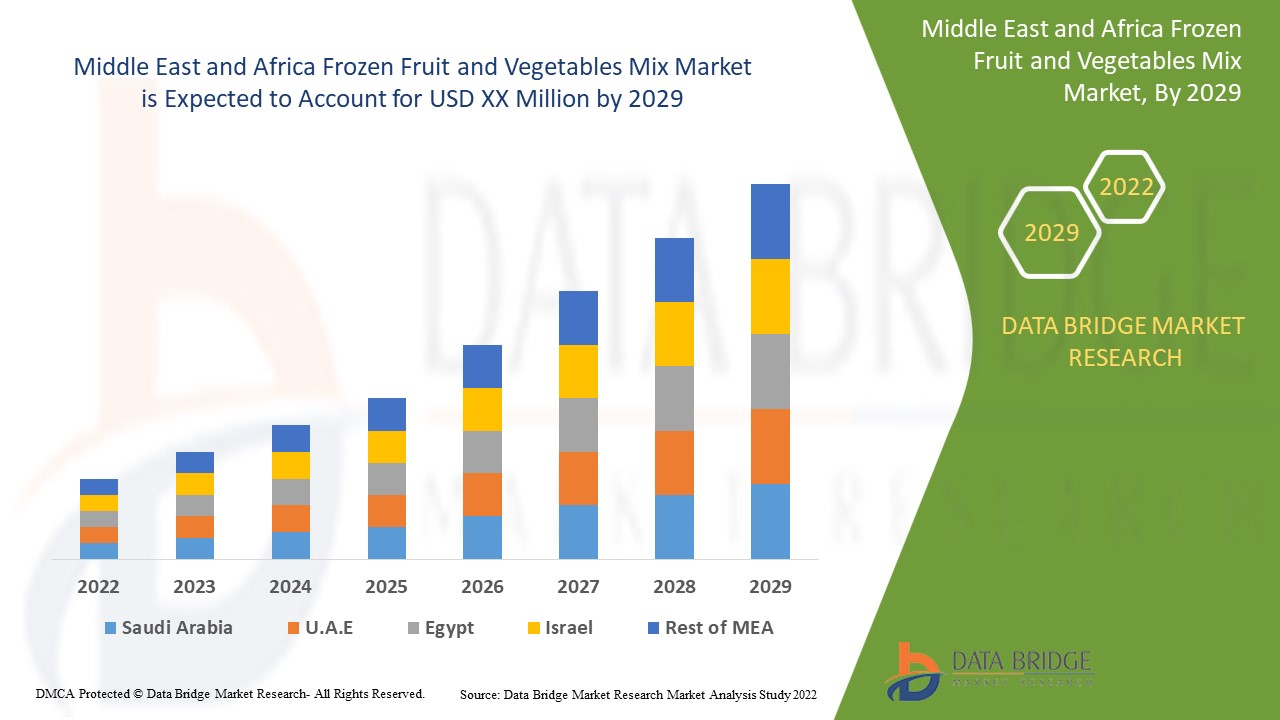

Data Bridge Market Research analyses that the Middle East and Africa frozen fruit and vegetables mix market will grow at a CAGR of 5.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2015) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

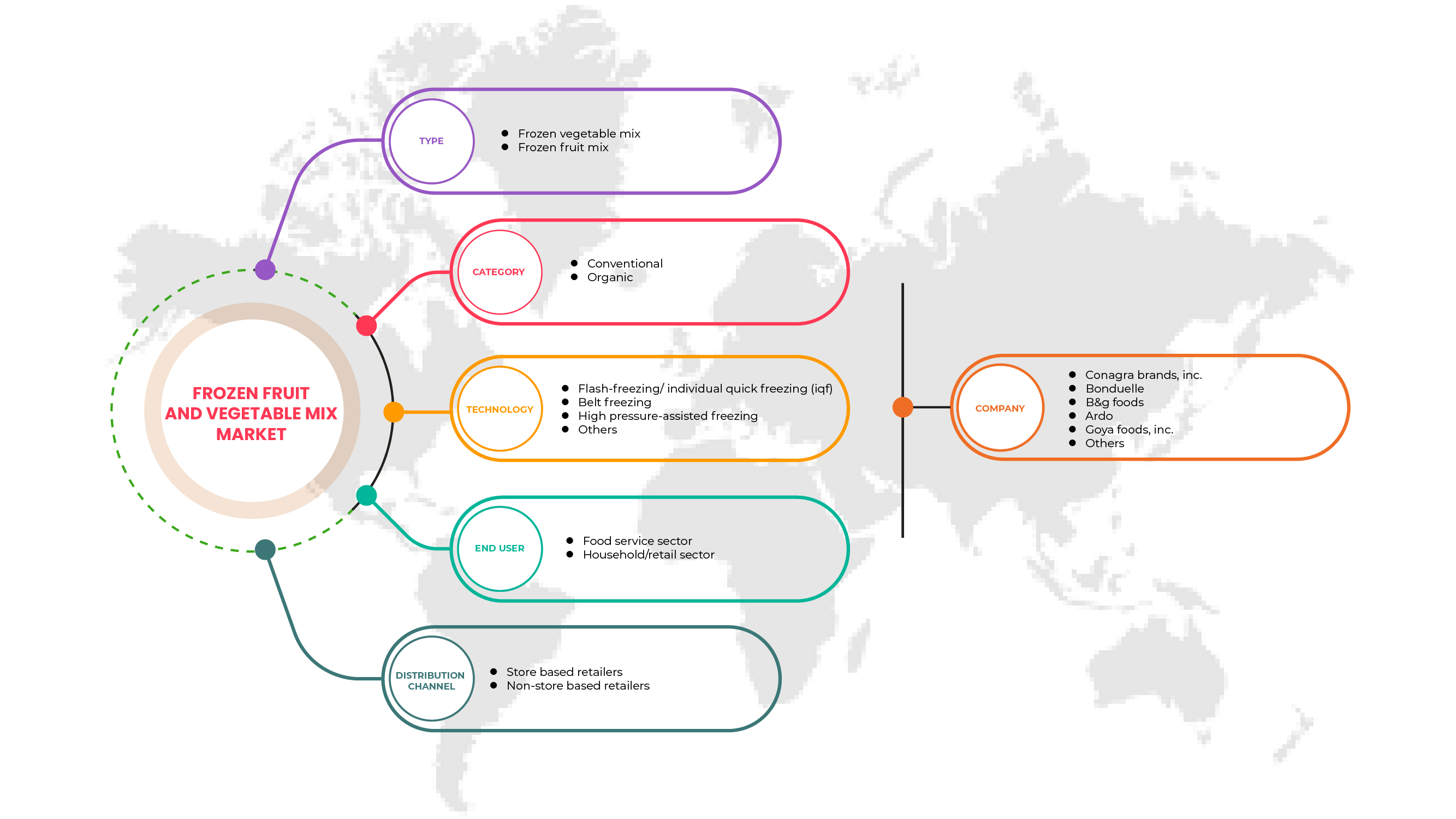

Segments Covered |

By Type (Frozen Vegetable Mix and Frozen Fruit Mix), Category (Organic And Conventional), Technology (Flash-Freezing/ Individual Quick Freezing (IQF), Belt Freezing, High Pressure-Assisted Freezing and Others), End User (Food Service Sector and Household/Retail Sector), Distribution Channel (Store Based Retailer and Non-Store Retailers) |

|

Countries Covered |

Saudi Arabia, U.A.E, Oman, Qatar, Kuwait and Rest of Middle East and Africa |

|

Market Players Covered |

Conagra Brands, Inc, Ardo, Bonduelle, Goya Foods, Inc., Hanover Foods, Grupo Virto, Alasko Foods Inc., Cascadian Farm Organic, Findus Sverige Ab, Healthy Pac Corp, SFI LLC, Stahlbush Island Farms, Sunopta, Axus International, Dole Packaged Food LLC, Frutex Asutralia, Coloma Frozen Foods, Shimlahills, Brecon Foods and B&G-Green Giant |

Market Definition

Frozen fruit is when fruit is frozen, it is picked at the peak of ripeness and flash-frozen soon after to preserve the optimal nutrition benefits. Frozen fruit often lasts several months and may be more economical than buying fresh fruit that goes bad quicker.

Frozen vegetables are vegetables that have had their temperature reduced and maintained to below their freezing point for storage and transportation until they are ready to be eaten. They may be commercially packaged or frozen at home.

Middle East and Africa Frozen Fruit and Vegetables Mix Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

Growth of the urbanization and increased adoption of healthy lifestyle

Nowadays, people are becoming more aware of the health benefits of vegetables and fruits, boosting the market demand. Also, the increasing urbanization involving the high disposable income shifts the consumer's preference toward healthy food alternatives.

Vegetarian Food such as vegetables and fruits is more suitable owing to their health benefits. People are more concerned about food content such as low cholesterols and calorie's which increases the demand for vegetables and fruits.

Thus, various health benefits associated with the consumption of vegetables and fruits are thus attracting many health-conscious consumers towards its consumption and boosting the market's growth.

-

Increase in the consumption of canned and frozen food

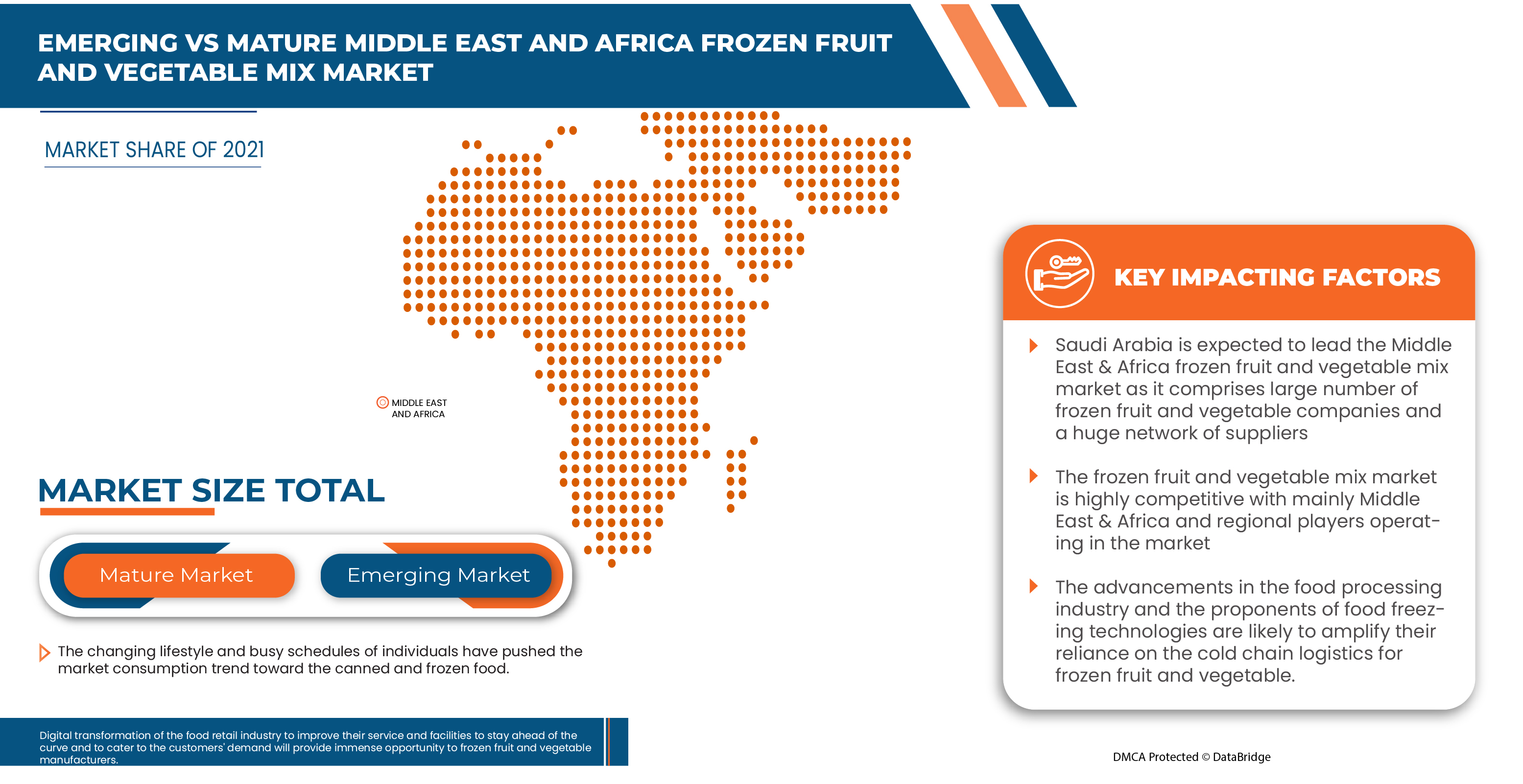

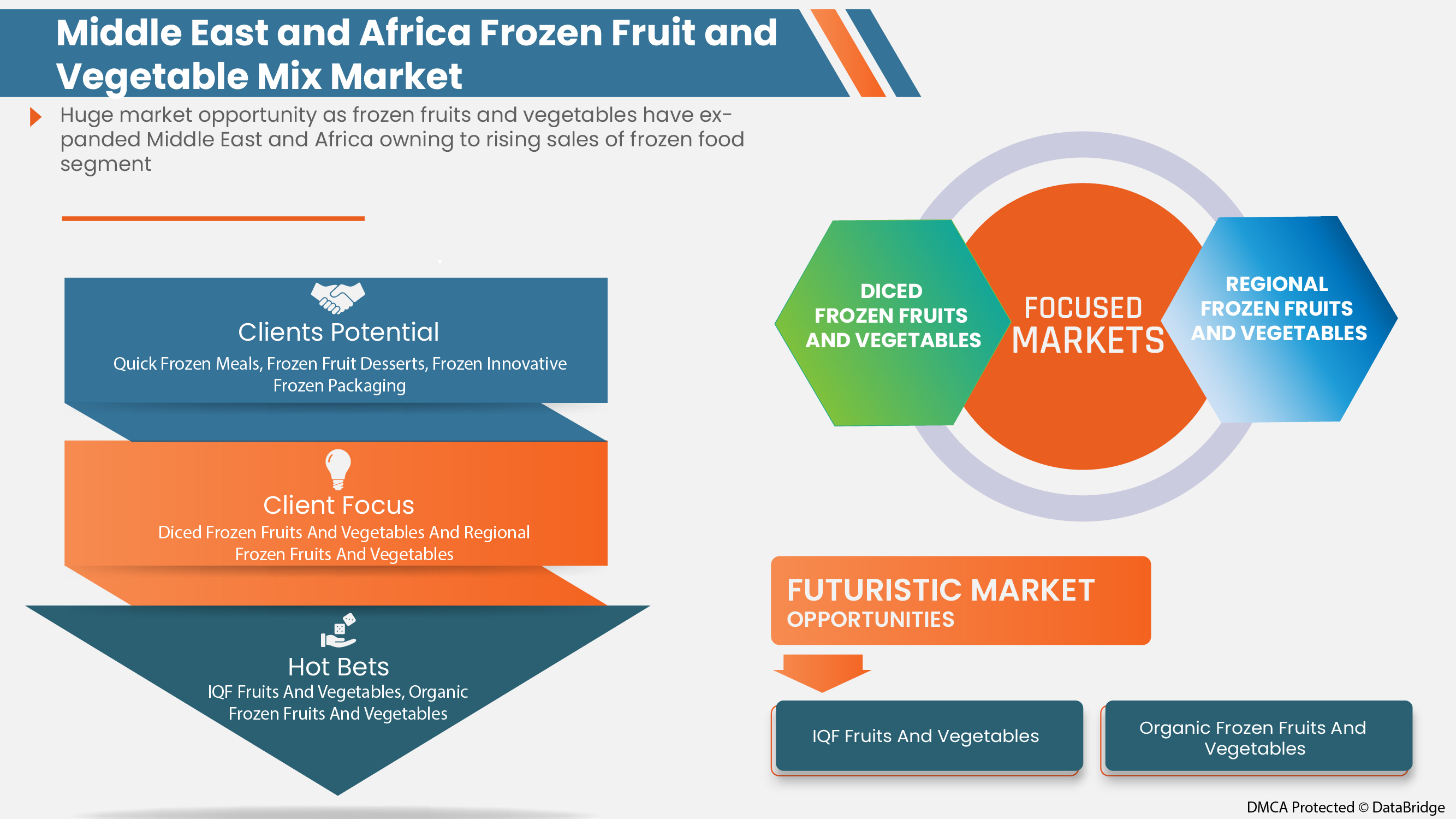

The changing lifestyle and busy schedules of individuals have pushed the market consumption trend toward the canned and frozen Food. This consumption has increased further due to the unfortunate spread of Coronavirus worldwide as consumers stockpiled their freezer with longer shelf items during lockdowns. Also, increased consumption has prompted manufacturers to develop new innovative launches and various healthy alternatives. Among all the innovations, vegetables and fruits are used exclusively as an ingredient in various canned and frozen Foods

Thus with so many launches and expansion of manufacturers towards innovation in frozen and canned vegetables and fruits, the market for vegetables and fruits will grow Middle East and Africa. Moreover, as the frozen and canned food market grows, the industry will see more new and innovative launches and developments to these products, thus, driving the market towards a positive escalation.

Opportunity

-

Digitalization of the retail industry

Digital transformation of the food retail industry to improve their service and facilities to stay ahead of the curve and to cater to the customers' demand will provide immense opportunity to frozen fruits and vegetable manufacturers. The increase in the inclination of consumers towards online shopping of food products due to its convenience coupled with the availability of a wide variety of frozen fruits and vegetables on online platforms is creating a huge opportunity for the frozen fruit and vegetable market.

The online grocery shopping is the major trend, expected to impel the market's growth. Moreover, the online shopping platform helps the manufacturers showcase their wide range of products in different categories and sell their food products. In addition to growing penetration of smartphone and internet usage, retail grocery shopping is emerging as one of the platforms for frozen food manufacturers to grow in the market. The change in pattern of shopping among consumers and increasing demand for convenient grocery shopping is expected to create great opportunities for the frozen fruits and vegetables manufacturers.

The increase in online grocery shopping due to features of a wide variety of options and convenience is expected to boost the growth of the market and will create a great opportunity for the growth of Middle East and Africa frozen fruit and vegetable mix market.

Restraint/Challenge

- Growth in the awareness regarding the consumption of fresh vegetables and fruits

The changing and stagnant lifestyle has made consumers aware about their health, due to which consumers have been considering what they eat. This change has brought in the trend of growing demand for healthy Food, which is gluten-free, low-calorie, sugar free, dairy-free and plant-based Food among consumers. They are also linked to a lower risk of depression and anxiety, obesity, and non-communicable diseases; promote gut health; and counter micronutrient deficiencies. This has attracted consumers towards various fresh vegetables and fruits, encouraging them to lead better and healthier lives.

With this growing trend, consumers have been significantly adopting products such as fresh vegetables and fruits, as they are nutrition dense and have low calories, reducing the risk of various health issues compared to frozen fruit and vegetables, thus restraining the market growth Middle East and Africa.

Post COVID-19 Impact on Middle East and Africa Frozen Fruit and Vegetables Mix Market

The COVID-19 epidemic has had a significant impact on consumer behavior. Consumers are hoarding foods that are shelf-stable, such as frozen fruits and vegetables. The practice of stockpiling has caused a dramatic increase in the market value of the frozen fruit and vegetable market worldwide in 2020, which will normalize with an outbreak-free condition. Because it is believed that frozen fruits enhance the immune system, demand for frozen fruits like frozen berries has increased.

Recent Development

- In March 2019, Group has invested USD 49.5 million over five years to increase capacity at the Belgian frozen food specialist’s vegetable processing plant in Gourin, Brittany. This has helped the company to increase its production capacity

Middle East and Africa Frozen Fruit and Vegetables Mix Market Scope

Middle East and Africa Frozen fruit and vegetables mix market is segmented into five notable segments based on type, category, technology, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Frozen vegetable mix

- Frozen fruit mix

Based on type the Middle East and Africa frozen fruit and vegetable mix market is segmented into frozen vegetable mix and frozen fruit mix.

Category

- Conventional

- Organic

Based on category, the Middle East and Africa frozen fruit and vegetable mix market is segmented into organic and conventional

Technology

- Flash-Freezing/ Individual Quick Freezing (IQF)

- Belt Freezing

- High Pressure-Assisted Freezing

- Others

Based on technology, the Middle East and Africa frozen fruit and vegetable mix market is segmented into flash-freezing/ individual quick freezing (IQF), belt freezing, high pressure-assisted freezing, and others.

End User

- Food Service Sector

- Household/Retail Sector

Based on end user, the Middle East and Africa frozen fruit and vegetable mix market is segmented into food service sector and household/retail sector.

Distribution Channel

- Store Based Retailers

- Non-Store Based Retailers

Based on distribution channel, the Middle East and Africa frozen fruit and vegetable mix market is segmented into the store based retailers and non-store based retailers.

Middle East and Africa Frozen Fruit and Vegetables Mix Market Regional Analysis/Insights

Middle East and Africa frozen fruit and vegetables mix market is analyzed and market size insights and trends are provided based on as referenced above.

The countries covered in the Middle East and Africa frozen fruit and vegetables mix market report are South America, South Africa, Saudi Arabia, U.A.E, Oman, Qatar, Kuwait and Rest of Middle East and Africa.

Saudi Arabia is expected to dominate the Middle East and Africa Frozen fruit and vegetables mix market in terms of market share and market revenue and is estimated to maintain its dominance during the forecast period due to the increasing demand from food service and hospitality industries within Middle East and Africa.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East and Africa brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Frozen Fruit and Vegetables Mix Market Share Analysis

The Middle East and Africa frozen fruit and vegetables mix market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Middle East and Africa frozen fruit and vegetables mix market.

Some of the major players operating in Middle East and Africa frozen fruit and vegetables mix market are Conagra Brands, Inc, Ardo, Bonduelle, Goya Foods, Inc., Hanover Foods, Grupo Virto, Alasko Foods Inc., Cascadian Farm Organic, Findus Sverige Ab, Healthy Pac Corp, SFI LLC, Stahlbush Island Farms, Sunopta, Axus International, Dole Packaged Food LLC, Frutex Asutralia, Coloma Frozen Foods, Shimlahills, Brecon Foods and B&G-Green Giant among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTING COMPANIES

4.1.1 MIDDLE EAST & AFRICA FROZEN FRUIT MIX MARKET

4.1.2 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX MARKET

4.2 EXPORT & IMPORT ANALYSIS- MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

4.3 MARKET TRENDS – 2010-2022

4.4 PRODUCTION CAPACITY

4.5 PRODUCTION BY TOP MANUFACTURERS

4.6 RETAIL TRENDS

4.6.1 INCREASED INVESTMENT IN THE FREEZER

4.6.2 LAUNCH OF IN-STORE FROZEN FRUITS AND VEGETABLE BRANDS

4.6.3 STOCKING BESTSELLERS AND NEW LAUNCHES

4.7 PER CAPITA CONSUMPTION BY COUNTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

5.1.2 INCREASING CONSUMPTION OF CANNED AND FROZEN FOOD

5.1.3 THE INCREASING VEGAN POPULATION IS EXPECTED TO DRIVE THE MARKET GROWTH

5.1.4 EXPANSIONS OF CONVENIENCE STORES

5.2 RESTRAINTS

5.2.1 GROWING AWARENESS REGARDING THE CONSUMPTION OF FRESH VEGETABLES AND FRUITS

5.2.2 HIGHER AMOUNT OF VEGETABLE AND FRUIT WASTAGE

5.2.3 LACK OF COLD CHAIN INFRASTRUCTURE

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

5.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN FRUIT AND VEGETABLE MANUFACTURERS

5.3.3 INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE

5.3.4 ADVANCEMENTS IN FREEZING TECHNOLOGY TO RETAIN THE QUALITY OF FRUITS AND VEGETABLES

5.4 CHALLENGES

5.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

5.4.2 HIGH INVESTMENT COST FOR THE PRODUCTION OF CANNED AND FROZEN VEGETABLES AND FRUITS

6 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE

6.1 OVERVIEW

6.2 FROZEN VEGETABLE MIX

6.2.1 CARROTS, CORN AND BEANS

6.2.2 CARROTS, CORN, BEANS AND PEAS

6.2.3 BROCCOLI, CAULIFLOWER AND CARROT

6.2.4 PEAS, CAULIFLOWER AND CARROT

6.2.5 ONIONS, GREEN PEPPERS, RED PEPPERS AND YELLOW PEPPERS

6.2.6 AVOCADO WITH KALE

6.2.7 OTHER

6.3 FROZEN FRUIT MIX

6.3.1 BERRY MIX (RASPBERRIES, BLACKBERRIES, BLUEBERRIES AND STRAWBERRIES)

6.3.2 PINEAPPLE, STRAWBERRIES, PEACHES AND MANGO

6.3.3 PINEAPPLE, KIWI, MANGO, PAPAYA, STRAWBERRIES

6.3.4 BERRIES AND CHERRY

6.3.5 BERRIES AND MANGO

6.3.6 OTHERS

7 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 CONVENTIONAL

7.3 ORGANIC

8 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 FLASH-FREEZING/INDIVIDUAL QUICK FREEZING(IQF)

8.3 BELT FREEZING

8.4 HIGH-PRESSURE-ASSISTED FREEZING

8.5 OTHERS

9 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE SECTOR

9.2.1 RESTAURANTS

9.2.1.1 QUICK SERVICE RESTAURANTS

9.2.1.2 DINING RESTAURANTS

9.2.1.3 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

9.2.1.4 OTHERS

9.2.2 CAFES

9.2.3 HOTEL

9.2.4 OTHERS

9.3 HOUSEHOLD/RETAIL SECTOR

10 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED RETAILER

10.2.1 SUPERMARKETS/HYPERMARKETS

10.2.2 CONVENIENCE STORES

10.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

10.2.4 SPECIALITY STORES

10.2.5 WHOLESALERS

10.2.6 GROCERY RETAILERS

10.2.7 OTHERS

10.3 NON-STORE RETAILER

10.3.1 ONLINE

10.3.2 COMPANY WEBSITES

11 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 UAE

11.1.3 SOUTH AFRICA

11.1.4 KUWAIT

11.1.5 OMAN

11.1.6 QATAR

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 ARDO

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 BONDUELLE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 CONAGRA BRANDS, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANOVER FOODS

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 FINDUS SVERIGE AB

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 DOLE PLC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUS ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 GOYA FOODS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 SUNOPTA

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 B&G FOODS

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUS ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 STAHLBUSH ISLAND FARMS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 ALASKO FOODS INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 AXUS INTERNATIONAL, LLC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 BRECON FOODS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 CASCADIAN FARM ORGANIC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 COLOMA FROZEN FOODS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 FRUTEX AUSTRALIA

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 VIRTO GROUP

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 HEALTHY PAC CORP

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SFI LLC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 SHIMLAHILLS

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA CONVENTIONAL IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA ORGANIC IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA FLASH-FREEZING/INDIVIDUAL QUICK FREEZING (IQF) IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA BELT FREEZING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA HIGH-PRESSURE-ASSISTED FREEZING IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA OTHERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA RESTAURANTS IN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA STORE BASED RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA STORE BASED RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA NON-STORE RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA NON-STORE RETAILER IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 26 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 28 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 29 MIDDLE EAST AND AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 31 MIDDLE EAST AND AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 33 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 43 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 44 SAUDI ARABIA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 SAUDI ARABIA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 46 SAUDI ARABIA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SAUDI ARABIA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 48 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 58 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 59 U.A.E FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 61 U.A.E FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 63 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 64 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 66 U.A.E FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 67 U.A.E RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 68 U.A.E FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 69 U.A.E STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 U.A.E NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 74 SOUTH AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 76 SOUTH AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 78 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 88 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 89 KUWAIT FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 KUWAIT FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 KUWAIT FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 KUWAIT FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 93 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 94 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 95 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 96 KUWAIT FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 KUWAIT RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 98 KUWAIT FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 99 KUWAIT STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 KUWAIT NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 103 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 104 OMAN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 OMAN FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 106 OMAN FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 OMAN FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS

TABLE 108 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 110 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 111 OMAN FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 112 OMAN RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 OMAN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 114 OMAN STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 OMAN NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 118 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

TABLE 119 QATAR FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 QATAR FROZEN FRUIT MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 121 QATAR FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 QATAR FROZEN VEGETABLE MIX IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 123 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 124 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 125 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 126 QATAR FOOD SERVICE SECTOR IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 127 QATAR RESTAURANTS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 128 QATAR FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 QATAR STORE-BASED RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 QATAR NON-STORE RETAILERS IN FROZEN FRUIT AND VEGETABLE MIX MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 REST OF MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET, BY TYPE, 2020-2029 (PRICE PER TON)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FRUIT AND VEGETABLE MIX MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FROZEN FRUITS AND VEGETABLE MIX MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SEGMENTATION

FIGURE 9 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLES COUPLED WITH INCREASING DEMAND FOR FRUITS AND VEGETABLES WITH LONGER SHELF-LIFE IS LEADING THE GROWTH OF THE MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 10 FROZEN VEGETABLE MIX SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET IN 2022 & 2029

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET

FIGURE 12 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE, 2021

FIGURE 13 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY CATEGORY, 2021

FIGURE 14 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TECHNOLOGY, 2021

FIGURE 15 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY END USER (2021)

FIGURE 16 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 17 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: SNAPSHOT (2021)

FIGURE 18 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2021)

FIGURE 19 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2022 & 2029)

FIGURE 20 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY COUNTRY (2021 & 2029)

FIGURE 21 MIDDLE EAST AND AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: BY TYPE (2022 & 2029)

FIGURE 22 MIDDLE EAST & AFRICA FROZEN FRUIT AND VEGETABLE MIX MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Frozen Fruit And Vegetables Mix Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Frozen Fruit And Vegetables Mix Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Frozen Fruit And Vegetables Mix Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.