Middle East And Africa Foot Ankle Allograft Market

Market Size in USD Million

CAGR :

%

USD

38.35 Million

USD

61.97 Million

2021

2029

USD

38.35 Million

USD

61.97 Million

2021

2029

| 2022 –2029 | |

| USD 38.35 Million | |

| USD 61.97 Million | |

|

|

|

Middle East and Africa Foot and Ankle Allografts Market Analysis and Insights

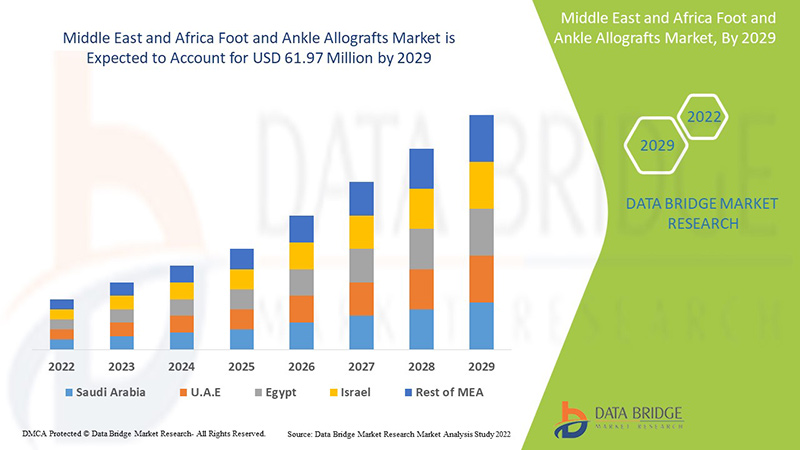

Foot and ankle allografts market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the Middle East and Africa market is growing with a CAGR of 5.9% in the forecast period of 2022 to 2029 and is expected to reach USD 61.97 million by 2029 from USD 38.35 million in 2021. Rising prevalence of orthopaedic diseases and foot and ankle disorders, along with the increase in continuous product commercialization and rising geriatric population; are the major drivers which propelled the demand of the market in the forecast period.

High costs associated with foot and ankle allograft devices and lack of formal education and training may hamper the future growth of foot and ankle allografts market. The partnerships and acquisitions by major market players act as opportunity for the growth of foot and ankle allografts market.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Foot and Ankle Allografts Market, By Product Type (Allograft Wedges, Allograft Tendons, Allograft Acellular Dermal Matrix, Cartilage Allograft Matrix, Skin Allografts, Amniotic Membranes), Surgery Type (Orthopaedic Reconstruction, Cartilage Restoration, Soft Tissue Tendon and Ligament Repair, Wound Care), By Procedure (Midfoot Procedures, Hindfoot Procedures) End-User (Hospitals, Orthopaedic Clinics, Ambulatory Surgical Centres, Academic and Research Institutes, Other End Users) |

|

Countries Covered |

South Africa, Saudi Arabia, UAE, Egypt, Israel, Rest of Middle East and Africa |

|

Market Players Covered |

CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), Arthrex (U.S.), Integra LifeSciences (U.S.), Smith+Nephew (UK), Zimmer Biomet (U.S.), AlloSource (U.S.), Amniox Medical, Inc. (U.S.), RTI Surgical Holdings, Inc. (U.S.), JRF Ortho (U.S.), Bone Bank Allografts (U.S.), Smith & Nephew. (UK), Paragon 28 (U.S.), Bioventus, (U.S.), NVision Biomedical Technologies (U.S.), DePuy Synthes Companies (U.S.) |

Foot and Ankle Allografts Market Dynamics

- Growing Geriatric Population

Geriatric population are more prone to the conditions leading to fragile bones and joints. In such patients allografts are used in the procedure to provide them immediate and efficient benefits associated with their body.

- Increasing incidence of Musculoskeletal Disorder

Musculoskeletal disorders comprises of fractures associated with bone fragility, osteoarthritis, injuries and systemic inflammatory conditions such as rheumatoid arthritis. Allografts have been used to correct these deformities or to fill bone defects secondary to trauma, osteochondral lesions, or intercalary arthrodesis.

Restraint

- Stringent Regulatory Guidelines

The allografts are regulated by a structure of laws, rules, and regulations that are extensive and complex to safeguard them from use in any potential harmful treatment. The need for more stringent privacy policies and regulations has limited the growth of this market

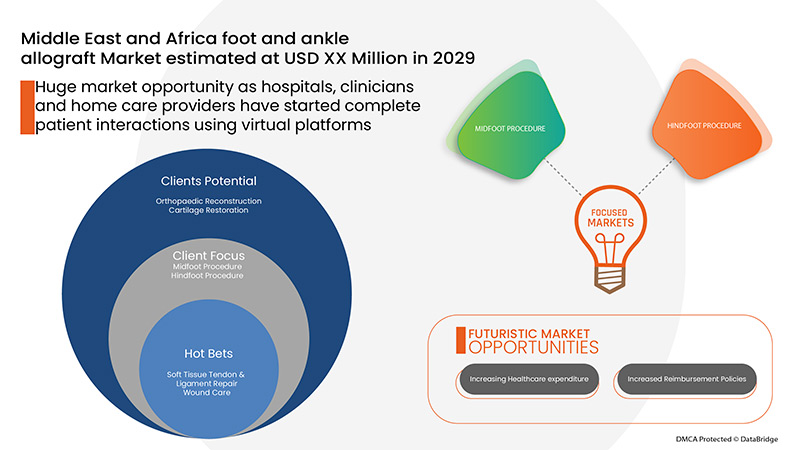

Opportunity

- Increasing Reimbursement Policies

Increasing Universal Health Coverage (UHC) is widely believed to drive better patient accessibility to healthcare systems. Moreover, a number of organizations have initiated reimbursement policies. The policies programs help in covering healthcare needs of population are expected to create a significant opportunity for the market.

Challenge

- Lack of Awareness for Foot and Ankle Solutions

A large number of population suffers from foot and ankle cases in underdeveloped countries. These cases tend to get neglected or mismanaged, as ankle orthopedics has yet to establish itself as the specialty of orthopedics in developing countries. Moreover, lack of knowledge about the availability of foot and ankle solutions in society as well as in medical population pose as a major challenge for the market.

The Foot and ankle allografts market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal.

Post COVID-19 Impact on Foot and Ankle Allografts Market

COVID-19 has resulted in a substantial upsurge in demand for medical supplies from both healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the allograft market for feet and ankles.

Foot and Ankle Allografts Market Scope and Market Size

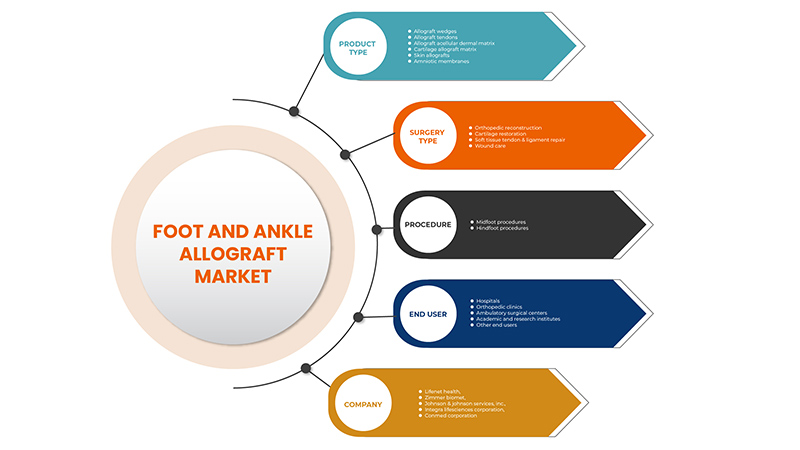

Foot and ankle allografts market is segmented on the based on the basis of product type, surgery type, procedure and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product Type

- Allograft Wedges

- Allograft Tendons

- Allograft Acellular Dermal Matrix

- Cartilage Allograft Matrix

- Skin Allografts

- Amniotic Membranes

On the basis of product type, market is segmented into allograft wedges, allograft tendons, allograft acellular dermal matrix, cartilage allograft matrix, skin allografts, amniotic membranes.

Surgery Type

- Orthopedic Reconstruction

- Cartilage Restoration

- Soft Tissue Tendon and Ligament Repair

- Wound Care

On the basis of surgery type, the market is segmented into orthopedic reconstruction, cartilage restoration, soft tissue tendon and ligament repair & wound care.

Procedure

- Midfoot Procedures

- Hindfoot Procedures

On the basis of procedure, the market is segmented into midfoot procedures, and hindfoot procedures.

End User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centres

- Academic and Research Institutes

- Other End Users

On the basis of end user, the market is segmented into hospital, orthopedic clinics, ambulatory surgical centres, academic and research institutes, other end users.

Foot and Ankle Allografts Market Country Level Analysis

The foot and ankle allografts market is analyzed and market size information is provided by product type, surgery type, procedures and end user.

The countries covered in the foot and ankle allografts market report are the South Africa, Saudi Arabia, U.A.E, Egypt, Israel, Rest of Middle East and Africa.

In 2022, Middle East and Africa is dominating due to the increasing geriatric population. South Africa is expected to grow due to rise in continuous product commercialization.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Foot and ankle allografts market also provides you with detailed market analysis for every country growth in foot and ankle allografts market industry. Moreover, it provides detailed information regarding foot and ankle allografts market sales, impact of regulatory scenarios, and trending parameters regarding Foot and ankle allografts market. The data is available for historic period 2011 to 2020.

Competitive Landscape and Foot and Ankle Allografts Market Share Analysis

Foot and ankle allografts market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to foot and ankle allografts market.

The major companies which are dealing in the foot and ankle allografts market are CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), Arthrex (U.S.), Integra LifeSciences (U.S.), Smith+Nephew (UK), Zimmer Biomet (U.S.), AlloSource (U.S.), Amniox Medical, Inc. (U.S.), RTI Surgical Holdings, Inc. (U.S.), JRF Ortho (U.S.), Bone Bank Allografts (U.S.), Smith & Nephew. (UK), Paragon 28 (U.S.), Bioventus, (U.S.), NVision Biomedical Technologies (U.S.), DePuy Synthes Companies (U.S.), and others

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 END USER LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

5 INDUSTRIAL INSIGHTS:

5.1 CONCLUSION:

6 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: REGULATIONS

6.1 U.S.

6.2 CANADA

6.3 EUROPE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING GERIATRIC POPULATION

7.1.2 INCREASE IN PREVALENCE OF MUSCULOSKELETAL DISORDER

7.1.3 INCREASE IN HEALTHCARE EXPENDITURE

7.1.4 INCREASE IN STRATEGIC INITIATIVES BY MAJOR MARKET PLAYERS

7.2 RESTRAINTS

7.2.1 STRINGENT REGULATORY

7.2.2 COMPLICATION AND RISK OF ALLOGRAFTS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN NUMBER OF SPORTS INJURIES

7.3.2 RISE IN AWARENESS INITIATIVES ABOUT THE ALLOGRAFT PROCEDURE:

7.3.3 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS:

7.4 CHALLENGES

7.4.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET

7.4.2 ALLOGRAFT IS OFTEN CONSIDERED TOO EXPENSIVE IN LOW-INCOME TO MIDDLE-INCOME COUNTRIES:

7.4.3 HIGHER ADOPTION OF ALTERNATIVE THERAPIES FOR THE TREATMENT OF FOOT AND ANKLE DISORDERS:

8 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ALLOGRAFT WEDGES

8.3 ALLOGRAFT TENDONS

8.4 ALLOGRAFT ACELLULAR DERMAL MATRIX

8.5 CARTILAGE ALLOGRAFT MATRIX

8.6 SKIN ALLOGRAFTS

8.7 AMNIOTIC MEMBRANES

9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE

9.1 OVERVIEW

9.2 ORTHOPEDIC RECONSTRUCTION

9.2.1 NON-UNIONS FRACTURES

9.2.2 ARTHRODESIS PROCEDURES

9.2.3 OSTEOTOMY PROCEDURES

9.3 CARTILAGE RESTORATION

9.3.1 TALAR DOME REPAIR

9.3.2 TIBIAL PLAFOND REPAIR

9.3.3 METATARSAL REPAIR

9.3.4 TALONAVICULAR JOINT REPAIR

9.3.5 SUBTALAR JOINT REPAIR

9.4 SOFT TISSUE TENDON & LIGAMENT REPAIR

9.4.1 TENDON AUGMENTATION

9.4.2 LIGAMENT REPAIR

9.4.3 FAT PAD REPLACEMENT

9.4.4 PLANTAR PLATE REPAIR

9.5 WOUND CARE

9.5.1 ANKLE ULCER TREATMENT

9.5.2 NEUROPATHIC FOOT ULCER TREATMENT

10 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 MIDFOOT PROCEDURES

10.2.1 CUBOID FRACTURE

10.2.2 FIRST TARSOMETATARSAL JOINT ARTHRODESIS

10.2.3 MEDIAL COLUMN ARTHRODESIS

10.2.4 LISFRANC

10.2.5 MEDIAL CUNEIFORM DORSAL OPENING WEDGE (COTTON) OSTEOTOMY

10.2.6 NAVICULAR CUNEIFORM ARTHRODESIS

10.2.7 NAVICULAR FRACTURE

10.2.8 OTHER MIDFOOT PROCEDURES

10.3 HIND-FOOT PROCEDURES

10.3.1 CALCANEAL FRACTURE

10.3.2 LATERAL COLUMN LENGTHENING

10.3.3 TALONAVICULAR JOINT ARTHRODESIS

10.3.4 TRIPLE ARTHRODESIS

10.3.5 OTHER HINDFOOT PROCEDURES

11 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 ORTHOPEDIC CLINICS

11.4 AMBULATORY SURGICAL CENTERS

11.5 ACADEMIC AND RESEARCH INSTITUTES

11.6 OTHER END USERS

12 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 LIFENET HEALTH

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.4.1 CONFERENCE

15.1.4.2 PRODUCT LAUNCH

15.2 ZIMMER BIOMET

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 PARTNERSHIP

15.3 JOHNSON & JOHNSON SERVICES, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.3.5.1 EVENT

15.3.5.2 PRODUCT LAUNCH

15.4 INTEGRA LIFESCIENCES

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.4.5.1 POSITIVE CLINICAL OUTCOME

15.4.5.2 AGREEMENT

15.4.5.3 ACQUISITION

15.5 CONMED CORPORATION (2022)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.5.5.1 ACQUISITION

15.6 ALLOSOURCE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.6.3.1 PRODUCT LAUNCH

15.7 ALON SOURCE GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AMNIOX MEDICAL INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.8.3.1 PARTNERSHIP

15.9 ARTHREX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.9.3.1 PRODUCT LAUNCH

15.1 BIOVENTUS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.10.4.1 CO-DEVELOPMENT

15.11 BONE BANK ALLOGRAFTS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.11.3.1 PARTNERSHIP

15.12 GLOBUS MEDICAL

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.12.4.1 M&A

15.13 INSTITUT STRAUMANN

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 JRF ORTHO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 PARTNERSHIP

15.15 NVISION BIOMEDICAL TECHNOLOGIES.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 ACQUISITION

15.16 PARAGON28, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.16.4.1 ACQUISITION

15.17 ORGANOGENESIS INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.17.4.1 CONFERENCE

15.17.4.2 ACQUISITION

15.18 SMITH + NEPHEW

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.18.4.1 EVENT

15.18.4.2 ACQUISITION

15.19 STRYKER

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 GENERAL AND MEDICAL INFLATION RATES

TABLE 2 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA ALLOGRAFT WEDGES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ALLOGRAFT TENDONS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA ALLOGRAFT ACELLULAR DERMAL MATRIX IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA CARTILAGE ALLOGRAFT MATRIX IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SKIN ALLOGRAFTS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA AMNIOTIC MEMBRANES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA HIND-FOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA HIND-FOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA HOSPITALS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ORTHOPEDIC CLINICS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA ACADEMIC AND RESEARCH INSTITUTES IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHER END USERS IN FOOT AND ANKLE ALLOGRAFTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY COUNTRY 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 72 ISRAEL ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 ISRAEL CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 74 ISRAEL SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT ORTHOPEDIC RECONSTRUCTION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 83 EGYPT CARTILAGE RESTORATION IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT SOFT TISSUE TENDON & LIGAMENT REPAIR IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT WOUND CARE IN FOOT AND ANKLE ALLOGRAFT MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 87 EGYPT MIDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 88 EGYPT HINDFOOT PROCEDURES IN FOOT AND ANKLE ALLOGRAFT MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT FOOT AND ANKLE ALLOGRAFT MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 REST OF MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR FOOT AND ANKLE ALLOGRAFTS WORLDWIDE AND INCREASING GERIATRIC POPULATION IS DRIVING THE MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ALLOGRAFT WEDGES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFT MARKET

FIGURE 14 SPORTS INJURIES IN ADULTS

FIGURE 15 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: SNAPSHOT (2021)

FIGURE 32 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2021)

FIGURE 33 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 MIDDLE EAST AND AFRICA FOOT AND ANKLE ALLOGRAFT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 36 MIDDLE EAST & AFRICA FOOT AND ANKLE ALLOGRAFTS MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.