Middle East And Africa Food Authenticity Testing Market

Market Size in USD Billion

CAGR :

%

USD

8.49 Billion

USD

13.45 Billion

2024

2032

USD

8.49 Billion

USD

13.45 Billion

2024

2032

| 2025 –2032 | |

| USD 8.49 Billion | |

| USD 13.45 Billion | |

|

|

|

Middle East and Africa Food Authenticity Testing Market Analysis

The Middle East and Africa food authenticity testing market is experiencing significant growth due to increasing consumer demand for food safety, quality, and transparency. Key drivers include rising concerns over food fraud, contamination, and the growing trend of plant-based and organic food consumption. Testing methods like DNA barcoding, spectroscopy, and chromatography are widely used to verify food origin, ingredients, and production processes. The market is further fueled by stringent regulatory standards and the adoption of advanced technologies for more accurate and rapid testing. North America and Europe dominate the market, but the Asia-Pacific region is expected to grow significantly due to rising awareness and food safety concerns. Leading market players are focusing on innovations to enhance testing accuracy and reliability.

Food Authenticity Testing Market Size

The Middle East and Africa food authenticity testing market is expected to reach USD 13.45 billion by 2032 from USD 8.49 billion in 2024, growing with a substantial CAGR of 6.1% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Food Authenticity Testing Market Trend

“Rising Food Safety Concerns and Regulatory Pressure”

The Middle East and Africa food authenticity testing market is witnessing key trends driven by rising food safety concerns and regulatory pressure. Advancements in technologies like DNA barcoding, infrared spectroscopy, and mass spectrometry are enhancing testing accuracy and speed. There is a growing demand for testing to verify organic, halal, and non-GMO claims, as consumers increasingly seek transparency. The rise of e-commerce platforms also pushes for greater authenticity verification to avoid fraud. Additionally, food fraud concerns in the meat, dairy, and olive oil sectors are spurring growth. Geographic expansion in emerging markets like Asia-Pacific is notable, as consumer awareness of food safety increases. Companies are focusing on integrated solutions and partnerships to strengthen their market positions, while regulatory bodies are tightening standards for food traceability.

Report Scope and Market Segmentation

|

Attributes |

Food authenticity testing Ingredients Key Market Insights |

|

Segments Covered |

|

|

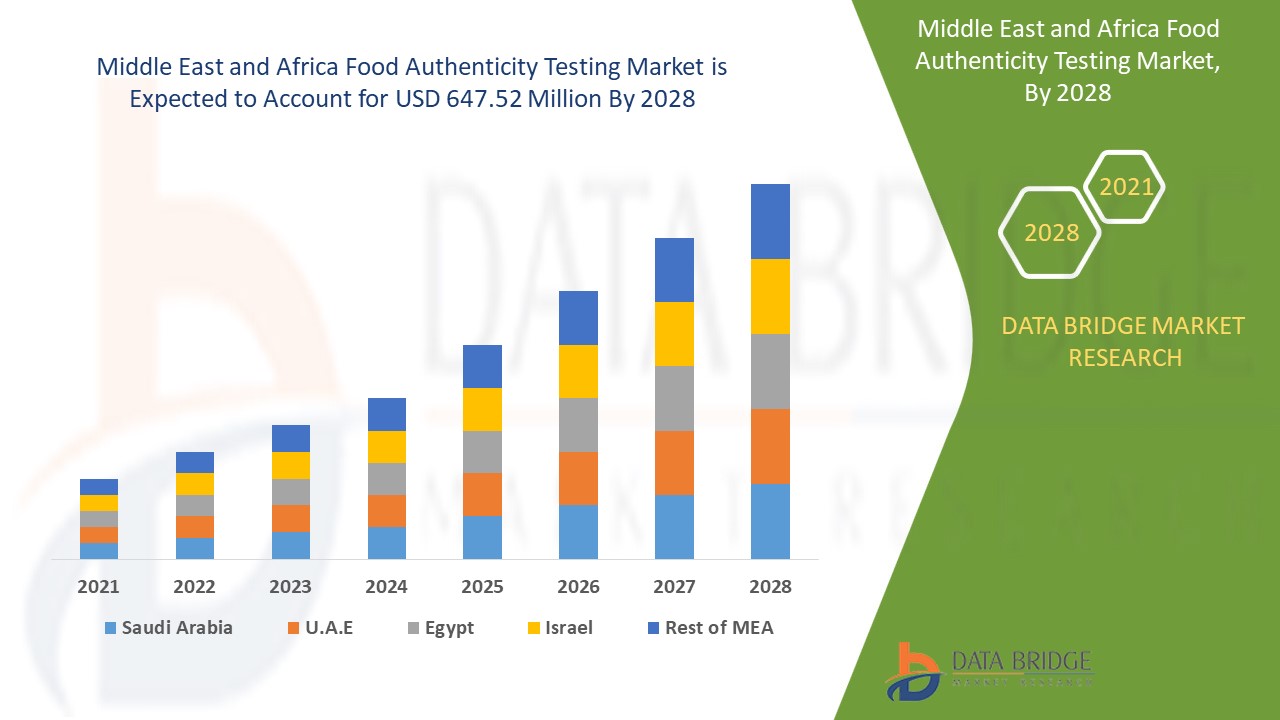

Countries Covered |

Saudi Arabia, U.A.E., Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA. (Switzerland), Intertek Group plc (U.K.), Thermo Fisher Scientific Inc. (U.S.), ALS (Australia), TÜV SÜD (Germany), SCIEX (U.S.), Cotecna(Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Authenticity Testing Market Definition

The food authenticity testing ensures the authenticity, quality, and safety of food products by detecting fraud, adulteration, and mislabeling. Food authenticity testing involves methods to identify practices such as adulteration (adding unauthorized substances), substitution (replacing high-value ingredients with cheaper alternatives), and mislabeling (making false claims about origin, organic certification, or species). Key technologies employed include DNA analysis, spectroscopy, chromatography, and mass spectrometry, which are used by food manufacturers, regulatory bodies, retailers, and testing laboratories.

Food Authenticity Testing Market Dynamics

Drivers

- Increasing Instances of Food Adulteration, Counterfeiting and False Labeling

As consumers become increasingly conscious of the quality, safety, and authenticity of the food they consume, the demand for stringent testing methods has surged. Food adulteration, involving the deliberate addition of substandard or harmful substances to food products, poses significant health risks. Counterfeiting and mislabeling, on the other hand, deceive consumers regarding the origin, composition, or nutritional value of products, undermining trust in food supply chains. The Middle East and Africaization of the food trade has introduced complex supply chains, making it easier for adulteration and counterfeiting to go undetected. Simultaneously, rising consumer awareness and regulatory stringency compel manufacturers to verify the authenticity of their products. For instance, rising cases of counterfeit olive oil, diluted honey, and mislabeled seafood have led to public outcry, encouraging governments and organizations to implement stricter policies and testing standards.

For instance,

In April 2021, according to an article by ResearchGate GmbH, an example of food fraud is the addition of melamine to Chinese milk products, falsely increasing their nitrogen content to mimic higher protein levels. This fraudulent act caused widespread health crises, including fatalities, underscoring the critical need for robust food authenticity systems to protect public health and ensure supply chain integrity

In December 2023, according to an article by DOAJ, the pervasive issue of food fraud Middle East and Africaly was driven by increasing food demand and weak enforcement of regulations. Commonly targeted products include organic foods, seafood, supplements, and olive oil. Complex supply chains and inadequate technological tools exacerbate detection challenges. Collaborative Middle East and Africa standards and interventions are recommended to combat these fraudulent activities effectively

- Growing Consumer Demand for Transparency and Clean-Label Products

Today’s consumers are more aware of what goes into their food, preferring products with simple, natural ingredients and minimal processing. Clean-label products, which exclude artificial additives, preservatives, and colors, are especially popular among health-conscious consumers who seek foods that align with their values of sustainability and authenticity. This demand for transparency is largely driven by concerns over food safety and integrity, particularly in the wake of food fraud scandals. Food fraud, where products are misrepresented, adulterated, or falsely labeled, has led to growing mistrust among consumers. For instance, various incidents such as the mislabeling of meat products, honey adulteration, and olive oil fraud have highlighted the need for reliable verification methods. As a result, food authenticity testing has become a crucial tool in ensuring that what is promised on the label matches what is inside the product. These testing methods, which include DNA testing, isotope analysis, and chemical profiling, help verify the authenticity of ingredients and confirm the legitimacy of product claims, such as "organic," "non-GMO," or "free-range."

For instance,

In October 2024, according to an article by Food Safety Works, the clean label movement in the food and beverage industry focuses on transparency and natural ingredients, with consumers favoring products free from artificial additives. This shift is prompting companies to reformulate items, often highlighting certifications such as organic or non-GMO, particularly in baby food and plant-based categories

Opportunities

- Rising Demand for Ethical Sources and Environment Friendly Products

As consumers become more conscious of the environmental and social impact of their purchasing decisions, they increasingly seek products that align with their values. This shift in consumer behavior is not limited to organic food but extends to a broader range of sustainable, ethical, and responsibly sourced goods. In the food industry, ethically sourced products are those that are produced using methods that prioritize environmental sustainability, fair labor practices, and animal welfare. As a result, consumers are demanding transparency about the origins and production processes of their food, leading to an increased emphasis on food authenticity testing. This testing ensures that food products labeled as organic, fair-trade, or environmentally friendly are genuinely produced using sustainable practices and that their claims are accurate and verifiable.

- Technological Advancements and Introduction of Portable and Real-Time Testing Devices

Technological advancements are transforming the market, with the introduction of portable and real-time testing devices offering significant opportunities. These innovations enable on-site testing, making food authenticity verification more accessible and efficient. Portable devices such as handheld spectrometers and portable DNA analyzers allow food producers, retailers, and regulators to conduct quick and reliable tests, ensuring compliance with safety standards and authenticity claims. These devices improve efficiency by reducing the need for costly laboratory tests and lengthy waiting periods. They also allow for real-time analysis, enabling quicker decision-making and reducing the risk of food fraud. As the demand for fast, accurate testing grows, these technological advancements cater to both small and large-scale operations. Moreover, these tools are becoming more affordable, enabling widespread adoption across various sectors, from food production to supply chain management.

Restraints/Challenges

- High Testing Costs

Food authenticity tests are essential for ensuring food safety, quality, and regulatory compliance, particularly in detecting fraud. However, various effective testing methods, such as DNA-based tests, isotope ratio mass spectrometry (IRMS), and chromatography, require expensive equipment and skilled technicians, making them cost-prohibitive for smaller companies or developing nations. This increases the financial burden on food manufacturers, who must balance the need for stringent testing with the high operational costs. Additionally, the complexity of food supply chains, coupled with the need for extensive testing to authenticate various products, compounds these costs. Multiple tests may be necessary for a single product to confirm its authenticity across different parameters, such as origin, composition, and processing methods. Furthermore, frequent testing, required to ensure consistent compliance with quality standards, can add up, particularly for companies managing large volumes of goods.

For instance,

In May 2023, according to an article published by Elsevier B.V., high testing costs for meat authenticity methods, such as DNA-based techniques (PCR, next-gen sequencing) and mass spectrometry, limit their widespread use. These methods often require expensive equipment, specialized expertise, and lengthy processing times, making them impractical for regular or large-scale testing. As a result, their adoption is hindered despite their effectiveness.

- Evolving Food Fraud Trends and Techniques

As food fraud becomes more sophisticated, traditional testing methods often struggle to keep up. Fraudsters employ increasingly advanced tactics to adulterate or misrepresent food products, from adding cheaper ingredients to counterfeiting premium items such as organic or specialty foods. The rise of fake organic or fair-trade claims is another example, as manufacturers seek to capitalize on consumer demand for ethical, environmentally friendly products. This undermines consumer trust and also harms legitimate businesses that adhere to regulatory standards. To combat these evolving threats, the food industry is increasingly turning to advanced testing technologies such as DNA barcoding, mass spectrometry, and blockchain-based traceability solutions. These technologies enable more accurate identification of food ingredients and sourcing, even within complex and fragmented supply chains.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Middle East and Africa Food Authenticity Testing Market Scope

The market is segmented on the basis of test type, category, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Test Type

- Mass Spectrometry

- PCR (Polymerase Chain Reaction) Based

- DNA Sequencing/Barcoding

- NMR Technique/Molecular Spectrometry

- Immunoassay-Based/Elisa (Enzyme-Linked Immunosorbent Assay)

- Isotope Methods

- Next-Generation Sequencing

Category

- Adulteration Tests

- Organic

- Allergen Testing

- Meat Speciation

- GMP Testing

- Halal Verification

- Kosher Verification

- Protected Geographical Indication (PGI)

- Protected Denomination of Origin (PDO)

- False Labeling

- Others

Application

- Food

- Beverages

Middle East and Africa Food Authenticity Testing Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, test type, category, and application as referenced above.

The countries covered in the market are South Africa, Saudi Arabia, U.A.E., Egypt, Israel and Rest of Middle East and Africa.

Saudi Arabia dominates the Middle East and Africa food authenticity testing market due to its strong regulatory framework, increased consumer demand for safe and high-quality food, and the country's strategic investments in advanced testing technologies and food safety infrastructure.

Saudi Arabia is the fastest-growing in the Middle East and Africa food authenticity testing market due to its expanding food industry, stringent food safety regulations, growing consumer awareness about food quality, and investments in advanced testing technologies to ensure product integrity.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Food Authenticity Testing Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Food Authenticity Testing Market Leaders Operating in the Market Are:

- Eurofins Scientific (Luxembourg)

- SGS Société Générale de Surveillance SA. (Switzerland)

- Intertek Group plc (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- ALS (Australia)

- TÜV SÜD (Germany)

- SCIEX (U.S.)

Latest Developments in Middle East and Africa Food Authenticity Testing Market

- In October 2024, Intertek Caleb Brett has opened a new state-of-the-art laboratory in Algeciras, Spain, enhancing services for the maritime and energy sectors. The facility specializes in fuel testing, compliance with ISO 8217, and environmental monitoring, strengthening support for international trade and regulatory compliance

- In May 2021, Thermo Fisher Scientific Inc. announced that Marc N. Casper, chairman, president, and chief executive officer, will present virtually at the BofA Securities 2021 Health Care Conference. This will help the company interact among various bioscience and healthcare professionals and conclude better resolutions and efforts towards the healthcare industry

- In April 2021, Thermo Fisher Scientific Inc. announced a definitive agreement with PPD, Inc. a leading Middle East and Africa provider of clinical research services to the pharma and biotech industry. This will help the company TOprovide customers with important clinical research services and help them in new ways as they move a scientific idea to an approved medicine quickly

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS OF DIFFERENT TYPES OF FOOD AUTHENTICITY TESTING

4.1.1 PCR (POLYMERASE CHAIN REACTION)-BASED TESTING

4.1.1.1 ADVANTAGES

4.1.1.2 LIMITATIONS

4.1.2 ISOTOPE METHODS

4.1.2.1 ADVANTAGES

4.1.2.2 LIMITATIONS

4.1.3 IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY)

4.1.3.1 ADVANTAGES

4.1.3.2 LIMITATIONS

4.1.4 DNA SEQUENCING/BARCODING

4.1.4.1 ADVANTAGES

4.1.4.2 LIMITATIONS

4.1.5 NEXT-GENERATION SEQUENCING (NGS)

4.1.5.1 ADVANTAGES

4.1.5.2 LIMITATIONS

4.1.6 NMR (NUCLEAR MAGNETIC RESONANCE) TECHNIQUE

4.1.6.1 ADVANTAGES

4.1.6.2 LIMITATIONS

4.1.7 MASS SPECTROMETRY

4.1.7.1 ADVANTAGES

4.1.7.2 LIMITATIONS

4.1.8 LIQUID CHROMATOGRAPHY (LC) AND GAS CHROMATOGRAPHY (GC)

4.1.8.1 ADVANTAGES

4.1.8.2 LIMITATIONS

4.1.9 CONCLUSION

4.2 CONSUMER TRENDS IN THE MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET

4.2.1 GROWING CONCERN ABOUT FOOD FRAUD

4.2.2 INCREASING FOCUS ON TRANSPARENCY AND SUSTAINABILITY

4.2.3 DEMAND FOR TRACEABILITY AND SUPPLY CHAIN INTEGRITY

4.2.4 RISING POPULARITY OF HEALTH-CONSCIOUS CONSUMERS

4.2.5 EMERGENCE OF DIGITAL TOOLS AND CONSUMER ENGAGEMENT

4.2.6 REGULATORY COMPLIANCE AND GOVERNMENT INITIATIVES

4.2.7 TECHNOLOGICAL INNOVATIONS IN TESTING METHODS

4.2.8 CONCLUSION

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3.1 DRIVERS OF MARKET GROWTH

4.3.2 KEY TECHNOLOGICAL ADVANCEMENTS

4.3.3 KEY TRENDS AND FUTURE OUTLOOK

4.3.4 GEOGRAPHICAL TRENDS

4.3.5 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INSTANCES OF FOOD ADULTERATION, COUNTERFEITING AND FALSE LABELING

6.1.2 GROWING CONSUMER DEMAND FOR TRANSPARENCY AND CLEAN-LABEL PRODUCTS

6.1.3 STRINGENT REGULATIONS AND STANDARDS FOR FOOD LABELING AND AUTHENTICITY

6.1.4 INCREASED GLOBALIZATION OF FOOD TRADE

6.2 RESTRAINTS

6.2.1 HIGH TESTING COSTS

6.2.2 COMPLEXITY OF TESTING PROCESSES

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR ETHICAL SOURCES AND ENVIRONMENT FRIENDLY PRODUCTS

6.3.2 TECHNOLOGICAL ADVANCEMENTS AND INTRODUCTION OF PORTABLE AND REAL-TIME TESTING DEVICES

6.3.3 INCREASING ONLINE FOOD SALES DEMAND STRICT QUALITY CONTROLS AND TESTING MEASURES

6.4 CHALLENGES

6.4.1 EVOLVING FOOD FRAUD TRENDS AND TECHNIQUES

6.4.2 DATA MANAGEMENT AND INTEGRATION CHALLENGES

7 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 MASS SPECTROMETRY

7.3 PCR (POLYMERASE CHAIN REACTION)-BASED

7.4 DNA SEQUENCING/BARCODING

7.5 NMR TECHNIQUE/MOLECULAR SPECTROMETRY

7.6 IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY)

7.7 ISOTOPE METHODS

7.8 NEXT-GENERATION SEQUENCING

8 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ADULTERATION TESTS

8.3 ORGANIC

8.4 ALLERGEN TESTING

8.5 MEAT SPECIATION

8.6 GMO TESTING

8.7 HALAL VERIFICATION

8.8 KOSHER VERIFICATION

8.9 PROTECTED GEOGRAPHICAL INDICATION (PGI)

8.1 PROTECTED DENOMINATION OF ORIGIN (PDO)

8.11 FALSE LABELING

8.12 OTHERS

9 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FOOD

9.3 BEVERAGES

10 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 SOUTH AFRICA

10.1.3 U.A.E.

10.1.4 KUWAIT

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 EUROFINS SCIENTIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 INTERTEK GROUP PLC

13.3.1 COMPANY SNAPSHOT

13.3.2 RECENT FINANCIAL

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 THERMO FISHER SCIENTIFIC INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 ALS

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 SERVICE PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ANALYTIK JENA GMBH

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIA ANALYTICAL LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CAMPDEN BRI

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COTECNA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 EMSL ANALYTICAL, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FOODCHAIN ID

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 FOOD FORENSICS LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MÉRIEUX NUTRISCIENCES

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MICROBAC LABORATORIES, INC.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PATHOGENIA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PREMIER ANALYTICS SERVIES

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 READING SCIENTIFIC SERVICES LTD

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 SCIEX

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 TÜV SÜD

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA PCR (POLYMERASE CHAIN REACTION)-BASED IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA DNA SEQUENCING/BARCODING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA NMR TECHNIQUE/MOLECULAR SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA IMMUNOASSAY-BASED/ELISA (ENZYME-LINKED IMMUNOSORBENT ASSAY) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA ISOTOPE METHODS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA NEXT-GENERATION SEQUENCING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ADULTERATION TESTS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA ORGANIC IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ALLERGEN TESTING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MEAT SPECIATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA GMO TESTING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA HALAL VERIFICATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA KOSHER VERIFICATION IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA PROTECTED GEOGRAPHICAL INDICATION (PGI) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PROTECTED DENOMINATION OF ORIGIN (PDO) IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA FALSE LABELING IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MIDDLE EAST AND AFRICA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MIDDLE EAST AND AFRICA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 MIDDLE EAST AND AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 MIDDLE EAST AND AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 MIDDLE EAST AND AFRICA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MIDDLE EAST AND AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MIDDLE EAST AND AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MIDDLE EAST AND AFRICA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MIDDLE EAST AND AFRICA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SAUDI ARABIA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SAUDI ARABIA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 SAUDI ARABIA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 96 SAUDI ARABIA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 97 SAUDI ARABIA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SAUDI ARABIA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SAUDI ARABIA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SAUDI ARABIA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SAUDI ARABIA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SAUDI ARABIA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SAUDI ARABIA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SAUDI ARABIA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SAUDI ARABIA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 SAUDI ARABIA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SAUDI ARABIA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SAUDI ARABIA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SAUDI ARABIA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SAUDI ARABIA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 SAUDI ARABIA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 SAUDI ARABIA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 123 SAUDI ARABIA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SAUDI ARABIA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SAUDI ARABIA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH AFRICA MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH AFRICA FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH AFRICA FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH AFRICA FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH AFRICA CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH AFRICA DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH AFRICA CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH AFRICA MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH AFRICA CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH AFRICA EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH AFRICA CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SOUTH AFRICA PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SOUTH AFRICA OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SOUTH AFRICA MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH AFRICA CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH AFRICA PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH AFRICA BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SOUTH AFRICA SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH AFRICA LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH AFRICA OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH AFRICA PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH AFRICA SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH AFRICA COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH AFRICA NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SOUTH AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SOUTH AFRICA PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 158 SOUTH AFRICA BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH AFRICA ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH AFRICA NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SOUTH AFRICA PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SOUTH AFRICA BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 U.A.E. FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 U.A.E. MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 U.A.E. FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 U.A.E. FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 U.A.E. FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.A.E. CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 U.A.E. CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 U.A.E. DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 U.A.E. CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.A.E. MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 U.A.E. CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 U.A.E. EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 U.A.E. CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 U.A.E. OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 U.A.E. PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 U.A.E. OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 U.A.E. MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 U.A.E. CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 U.A.E. PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 U.A.E. BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 U.A.E. SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 U.A.E. LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 U.A.E. OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 U.A.E. PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 U.A.E. SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 U.A.E. COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 U.A.E. NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 U.A.E. NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 U.A.E. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 U.A.E. PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 U.A.E. BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 U.A.E. ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 U.A.E. NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 U.A.E. PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 U.A.E. BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 KUWAIT FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 KUWAIT MASS SPECTROMETRY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 KUWAIT FOOD AUTHENTICITY TESTING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 201 KUWAIT FOOD AUTHENTICITY TESTING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 202 KUWAIT FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 KUWAIT CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 KUWAIT CEREALS & GRAINS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 KUWAIT DAIRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 KUWAIT CHEESE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 KUWAIT MILK BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 KUWAIT CHEESE BASED DESSERTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 KUWAIT EDIBLE OILS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 KUWAIT CHOCOLATES & CONFECTIONERY IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 KUWAIT OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 KUWAIT PEA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 KUWAIT OIL SEEDS & PULSES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 KUWAIT MEAT & POULTRY PRODUCTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 KUWAIT CHICKEN IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 KUWAIT PORK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 KUWAIT BEEF IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 KUWAIT SEAFOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 KUWAIT LAMB IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 KUWAIT OTHERS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 KUWAIT PROCESSED FOOD IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 KUWAIT SYRUPS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 KUWAIT COCOA IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 KUWAIT NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 KUWAIT NUTS IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 KUWAIT PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 KUWAIT PLANT-BASED MEAT AND MEAT ALTERNATIVES IN FOOD AUTHENTICITY TESTING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 228 KUWAIT BEVERAGE IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 KUWAIT ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 KUWAIT NON-ALCOHOLIC IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 KUWAIT PLANT BASED MILK IN FOOD AUTHENTICITY TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 KUWAIT BEVERAGES IN FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 REST OF MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET

FIGURE 2 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SEVEN SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET, BY TEST TYPE

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING CONSUMER DEMAND FOR TRANSPARENCY AND CLEAN-LABEL PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MASS SPECTROMETRY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET

FIGURE 18 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: BY TEST TYPE, 2024

FIGURE 19 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: BY CATEGORY, 2024

FIGURE 20 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: BY APPLICATION, 2024

FIGURE 21 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: SNAPSHOT (2024)

FIGURE 22 MIDDLE EAST AND AFRICA FOOD AUTHENTICITY TESTING MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Food Authenticity Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Food Authenticity Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Food Authenticity Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.