Middle East And Africa Fiber Optic Heat Detector And System Integrator Market

Market Size in USD Million

CAGR :

%

USD

160.39 Million

USD

231.96 Million

2023

2030

USD

160.39 Million

USD

231.96 Million

2023

2030

| 2024 –2030 | |

| USD 160.39 Million | |

| USD 231.96 Million | |

|

|

|

Fiber Optic Heat Detector and System Integrator Market Analysis

The Middle East and Africa fiber optic heat detector and system integrator market is driven by the increasing demand for advanced fire detection technologies in sectors such as oil & gas, industrial, and transportation. The growth of smart buildings and infrastructure is further fueling the adoption of fiber optic heat detection systems due to their high sensitivity, reliability, and ease of integration. Technological advancements in fiber optic sensors, such as real-time monitoring capabilities, are expected to enhance market growth. Additionally, the rise in safety regulations and the need for continuous monitoring of critical assets contribute to the market expansion. However, high initial installation costs and limited awareness in emerging markets may hinder market growth.

Fiber Optic Heat Detector and System Integrator Market Size

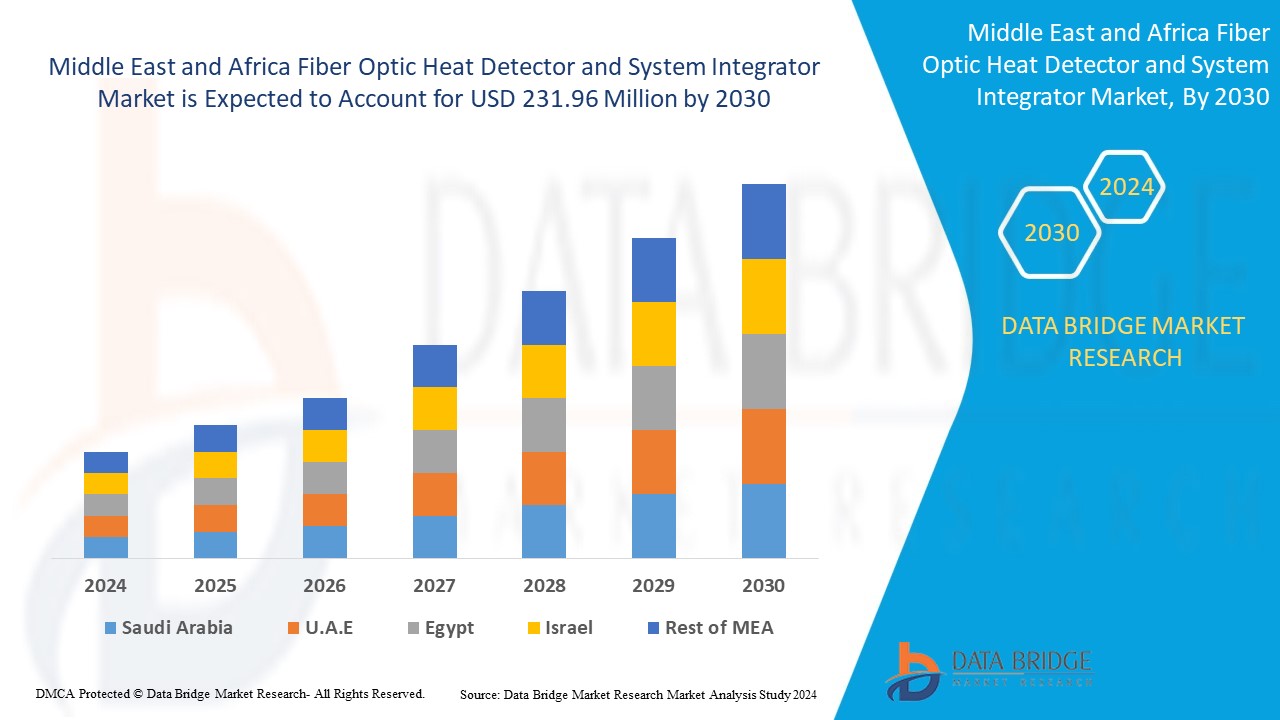

Middle East and Africa fiber optic heat detector and system integrator market size was valued at USD 160.39 million in 2023 and is projected to reach USD 231.96 million by 2030, growing with a CAGR of 5.7% during the forecast period of 2024 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Fiber Optic Heat Detector and System Integrator Market Trends

“Significant Expansion in the Manufacturing Sector”

The manufacturing industry is expanding rapidly, propelled by growing automation, industrialization, and the desire for more efficient production methods. As industrial facilities grow and adapt, there is a greater need for reliable safety measures to reduce the risks connected with fires and heat-related hazards. The use of modern technology, such as fiber optic heat detectors, is becoming an increasingly important component in ensuring operational safety and compliance with strict fire safety rules. Given the complexities of contemporary production processes and the high value of equipment and inventory, early detection of fire or heat is critical to avoiding costly damage and delay. As a result, the expanding scale of industrial processes is a major driver in the Middle East and Africa optical heat detector market.

Report Scope and Fiber Optic Heat Detector and System Integrator Market Segmentation

|

Attributes |

Fiber Optic Heat Detector and System Integrator Key Market Insights |

|

Segments Covered |

By Industry: Oil & Gas, Metal & Mining, Electronics And Electric Machinery, Railway/Civil, Refinery & Petrochemical, Power/IPP (Independent Power Producer), Chemical, Iron & Steel, Automotive, Food & Beverages, Waste Management, Pulp & Paper, and Others |

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

APi Group.(U.S.), IMPACT FIRE SERVICES, LLC(U.S.), APS FireCo (U.S.), Pacific Fire & Security, Inc. (U.S.), Everon, LLC. (U.S.), MEI Electrical Contractors & Systems Integrators(U.S.), inControl Systems Inc, (U.S.), AM FIRE (U.S.), Witness Security Solutions(U.S.), LONG Building Technologies(U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Fiber Optic Heat Detector and System Integrator Market Definition

The Middle East and Africa fiber optic heat detector and system integrator market focuses on the adoption of advanced fiber optic technologies for heat detection and fire safety across industries like transportation, manufacturing, and energy. It includes systems that monitor temperature variations using distributed sensing technologies and their integration with existing fire safety and management systems. These solutions are essential for ensuring safety, reliability, and efficiency in critical environments, with applications in metros, tunnels, refineries, and industrial facilities. The market also covers system integrators that design, deploy, and maintain these solutions to meet industry standards and client-specific needs.

Fiber Optic Heat Detector and System Integrator Market Dynamics

Drivers

- Integration of iot and Smart Sensors with Fiber Optic Detectors

The integration of fire detection systems with Internet of Things (IoT) devices and smart building infrastructure is emerging as a significant opportunity for the Middle East and Africa fiber optic heat/fire detector market. As companies and cities adopt smart technology, the demand for networked and automated safety solutions grows. IoT-enabled fire detection systems enable real-time monitoring and remote access, resulting in improved situational awareness and faster response times. In smart buildings, these systems can be combined with other sensors to form a comprehensive safety network, allowing for more effective building operations management. This trend toward automation and connectivity not only enhances fire safety, but it also coincides with larger efforts to increase energy efficiency and sustainability.

For instance,

- As per the Zenatix article on September 2024, the rapid growth of IoT-based automation in commercial buildings, expected to reach USD 67.5 billion by 2030, presents a significant opportunity for the optical heat detector market. As IoT adoption increases, integrating advanced fire detection systems, like optical heat detectors, becomes crucial for enhanced safety and operational efficiency. These detectors offer real-time monitoring, essential for smart buildings where energy efficiency and predictive maintenance are priorities. Moreover, as building automation trends emphasize sustainability, the need for reliable, non-intrusive fire detection technologies will grow

Rising Adoption of Fire Safety Systems in Power Plants, Data Centres, and Transportation Hubs

The rising need for fire detection systems in critical infrastructure is propelling the Middle East and Africa fiber optic heat/fire detector market. High-risk industries, such as power plants, data centers, and transportation hubs, are more prone to fires due to their complexity, the availability of highly combustible materials, and the concentration of expensive assets. Because these facilities handle sensitive and mission-critical operations, implementing strong safety measures is a high concern. This has resulted in a rising use of advanced fire detection technologies that provide high precision, long-range monitoring, and the capacity to operate in tough conditions. The demand for dependable and quick fire detection systems in such facilities is driving market growth.

For instance,

- As per the IAEA Safety Standards publication on 2022, Fire detection systems, such as those utilizing optical fiber technology, are crucial in nuclear power plants due to their high sensitivity, real-time monitoring, and ability to detect early fire signs in critical areas. These systems provide precise location tracking, ensuring rapid response to potential hazards. These detectors can withstand temperature ranges of -40°C to 85°C, making them suitable for harsh operating conditions. Their robust design makes them resistant to harsh conditions, aligning with safety standards. Incorporating optical fibers enhances fire safety and operational reliability

Opportunities

- Increase Investment in Infrastructure Development

As Middle East and Africa urbanization accelerates, infrastructure development is becoming a top priority, particularly in the building of Smart Cities. These projects prioritize innovative technologies, not only to improve operational efficiency, but also to ensure the safety and security of people and companies. Smart city initiatives frequently include the integration of novel safety systems to suit the growing demand for real-time monitoring and risk prevention. Fire safety and detection systems are key components in these settings because they help to reduce risks in complicated and densely populated urban areas. With investments flowing into large-scale infrastructure projects, there is an increasing demand for cutting-edge technologies that provide dependability, precision, and scalability. This growing need is driving up the market for fiber optic heat/fire detection systems.

For instance,

- As per the India Brand Equity Foundation date in 2024, India's focus on enhancing infrastructure to meet its 2025 economic growth target, particularly in transport and real estate, will drive the demand for advanced safety systems like optical heat detectors. Increased investments in roads, railways, aviation, and shipping infrastructure, along with surging real estate investments, create a need for reliable fire detection solutions. As these sectors grow, fire safety regulations become more stringent, encouraging the adoption of optical heat detectors. The rise in infrastructure projects, including REITs and InvITs, will further boost the demand for sophisticated fire detection systems. These detectors are critical for early fire detection in high-risk environments such as transportation hubs, construction sites, and commercial properties

The Development of Solar-Powered, Wireless Optical Flame Detectors

The growth of the solar-powered, wireless optical flame detector market represents a significant opportunity, particularly for industries operating in remote and hazardous environments. With an increasing need for more reliable, efficient, and sustainable technologies, these advanced detectors are emerging as a key solution for monitoring fire hazards in places that are difficult to reach or pose safety risks to traditional monitoring systems. As industries like oil and gas, mining, and power generation expand their operations into such areas, these devices are providing a valuable tool for both safety and operational efficiency.

Solar-powered, wireless optical flame detectors offer the unique advantage of being both energy-efficient and highly adaptable. By utilizing solar power, these devices eliminate the need for external power sources, reducing both cost and maintenance efforts. Their wireless capability makes installation and monitoring more flexible, enabling real-time detection of potential fire hazards without the need for complex wiring or infrastructure. This is particularly beneficial in remote locations such as offshore platforms, deserts, or mountain ranges, where traditional flame detection systems may be impractical or impossible to install. Moreover, the ability to monitor flame activity remotely improves both safety and response time, making it easier to manage emergency situations.

- As per the Husaini Engineers article on December 2023, modern gas sensors, including personal detectors and fixed systems, now feature remote operating, solar-powered, real-time connectivity, allowing data transmission to safety teams for quick response. These sensors can detect flammable and toxic gases with high accuracy, even at low concentrations, helping prevent accidents. Innovations such as IoT integration, smart algorithms, and low-power consumption are reducing costs and extending sensor life. Furthermore, multi-gas and connected systems offer versatility and improve environmental monitoring, providing a safer, more efficient work environment

Restraints/Challenges

- High Production and Installation Costs of Fiber Optic Systems

The high initial installation costs of fiber optic heat/fire detection systems sometimes impede their adoption. While these systems provide long-term benefits such as high precision, dependability, and fewer false alarms, the initial expenditure can be expensive, particularly for small and medium-sized businesses (SMEs). Many organizations find the expense of purchasing and installing these systems unnecessarily expensive, especially when compared to traditional fire detection technologies, which may appear more reasonable at first. The necessity for specialist installation and maintenance increases the financial load, making it difficult for smaller enterprises to justify the expense.

Despite these obstacles, the long-term benefits of fiber optic heat/fire detectors may offset their initial price. These systems provide numerous benefits, including the capacity to detect fires at an early stage, reducing possible damage and downtime. In industries where safety is crucial, such as energy, manufacturing, and infrastructure, the high initial cost might be justified as an investment in lowering the risks associated with fire dangers. Furthermore, the cheap maintenance costs and ease to integrate these systems with existing safety infrastructure may result in long-term cost benefits that outweigh the initial investment.

For instance,

- As per the Yokogawa Article on December 2024, a major restraint in the optical fire detector market is the high cost associated with deploying fiber optic cables, especially in applications requiring hundreds or thousands of sensors. Wiring each sensor to a central data acquisition system significantly increases installation and maintenance expenses. This makes traditional detection systems more appealing in cost-sensitive projects. Overcoming these cost barriers is essential for wider adoption of optical fire detection technologies

The Complexities Related to False Alarms and Sensitivity

False alarms and sensitivity issues represent significant challenges in the adoption and effectiveness of fiber optic heat/fire detection systems. While these systems are known for their high accuracy and precision in detecting temperature changes, they can sometimes trigger false alarms due to their sensitivity. In certain environments, even minor fluctuations in temperature or non-threatening conditions, such as HVAC system changes or normal operational heat, can cause the system to detect an anomaly, leading to unnecessary alarms. These false alarms can cause operational disruptions, increase maintenance costs, and lead to alarm fatigue, where personnel become less responsive to genuine threats due to the frequency of false alerts.

To overcome these problems, manufacturers are attempting to improve the sensitivity of fiber optic systems so they can discern between true fire dangers and regular environmental changes. Advanced algorithms and artificial intelligence (AI) are being used to improve these systems' ability to analyze data effectively and reduce false positives. Furthermore, combining fiber optic detectors with additional detection technologies, such as smoke detectors or thermal cameras, can provide a more complete picture of the environment, lowering the possibility of false alarms while retaining high detection accuracy.

For instance,

- As per the Coopersfire blog in January 2022, 42% of Fire Rescue Services (FRS) incidents attended were due to false fire alarms. False fire alarms pose a significant challenge for the market, as they are often triggered by non-fire events, leading to unnecessary disruptions and costly responses. The lack of adoption of advanced fire detection systems, such as optical fire detectors, contributes to this issue.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Fiber Optic Heat Detector and System Integrator Market Scope

The market is segmented on the basis of measurement method, mounting type, number of channels, application, coverage area, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Measurement Method

- Single-Ended

- Double-Ended

By Mounting Type

- Rack Mounted

- Wall Mounted

By Number of Channels

- 1

- 4

- 2

By Application

- Tunnels

By Type

- Traffic Tunnels

- Rail Tunnels

- Utility Tunnels

- Data Centers

- Oil/Gas Tanks

- High Voltage Power Cables

- Nuclear Facility

- Metro

- Cable Trays

- Conveyor Belts

- Parking Garages

- Public Buildings

- Rooftop Solars Panel

- Others

By Coverage Area

- LESS Than 10 KM

- MORE Than 10 KM

By Industry

- OIL & GAS

- Metal & Mining

- Electronics and Electric Machinery

- Railway/CIVIL

- Refinery & Petrochemical

- Power/IPP (Independent Power Producer)

- Chemical

- Iron & Steel

- Automotive

- Food & Beverages

- Waste Management

- Pulp & Paper

- Others

Fiber Optic Heat Detector and System Integrator Market Regional Analysis

The market is analyzed and market size insights and trends are provided by measurement method, mounting type, number of channels, application, coverage area, and industry as referenced above.

The countries covered in the market are U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Saudi Arabia leads the Middle East and Africa fiber optic heat detector and system integrator market due to its advanced technological infrastructure and high demand for fire detection solutions across various industries. The region’s strong presence of key market players and the increasing adoption of smart buildings contribute significantly to its market dominance.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Fiber Optic Heat Detector and System Integrator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Fiber Optic Heat Detector and System Integrator Market Leaders Operating in the Market Are:

- APi Group.(U.S.)

- IMPACT FIRE SERVICES, LLC(U.S.)

- APS FireCo (U.S.)

- Pacific Fire & Security, Inc. (U.S.)

- Everon, LLC. (U.S.)

- MEI Electrical Contractors & Systems Integrators(U.S.)

- inControl Systems Inc, (U.S.)

- AM FIRE (U.S.)

- Witness Security Solutions(U.S.)

- LONG Building Technologies(U.S.)

Latest Developments in Middle East and Africa Fiber Optic Heat Detector and System Integrator Market

- In April 2024, APi Group announced the completion of its acquisition of Elevated Facility Services Group. APi Group has acquired Elevated Facility Services for $570 million to expand into the U.S. elevator and escalator services market, with Elevated expected to contribute $220 million in annual revenue. APi Group will benefit by diversifying its revenue streams and strengthening its position in the life safety services market through this strategic acquisition

- In April 2024, Everon has inaugurated its Innovation and Operations Center (iO) in the Dallas area, showcasing its commitment to innovation and service excellence. The iO combines a solutions showcase, innovation lab, and 24/7 monitoring center, offering hands-on demonstrations and cutting-edge collaboration for advanced security solutions. This facility strengthens Everon’s position as a leader in commercial security, enhancing customer trust and driving innovation to meet evolving industry needs

- In September 2024, Impact Fire service LLC, announced its acquisition of Ultimate Fire Protection in Atlanta, GA. This acquisition enhances Impact Fire’s service offerings by adding expertise in water-based fire protection systems, including sprinkler systems, backflow devices, and fire pumps. Impact Fire will benefit by expanding its southeastern presence and strengthening its ability to serve customers with reliable fire protection solutions

- In October 2024, Integrating HVAC Systems with Building Automation Systems. The technology supports standard BAS protocols and allows real-time communication, remote access, and simplified commissioning. By offering easy installation and improved equipment visibility, CoolAutomation helps engineers and technicians save time, reduce costs, and increase customer satisfaction, benefiting the company by improving service efficiency

- In April 2024, Pye-Barker Fire & Safety has acquired Pacific Fire & Security in Seattle, expanding its presence on the West Coast. Pacific Fire & Security offers a wide range of fire alarm and security services, including installation, maintenance, and code compliance for commercial and multi-family clients. This acquisition strengthens Pye-Barker’s commitment to providing nationwide fire safety solutions and enhancing service offerings for customers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MEASUREMENT METHOD TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 TIME GRID

2.11.1 MARKET INITIATION PHASE

2.11.2 LOW PENETRATION PHASE

2.11.3 STAGNANT PHASE

2.12 DBMR MARKET CHALLENGE MATRIX

2.12.1 LEADER TECHNOLOGY

2.12.2 SUBSTITUTE TECHNOLOGY

2.12.3 CHALLENGING TECHNOLOGY

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 METHOD OF ADAPTION AND ROLL OUT OF FIBER OPTIC HEAT DETECTOR SYSTEM AS AN INTEGRATOR OVER EXISTING PRODUCTS

4.2 FIRE CERTIFICATE

4.2.1 FIRE RISK MANAGEMENT CERTIFICATIONS (FRM)

4.2.2 IMPORTANCE OF FRM

4.2.3 UL521/ULC530 CERTIFICATION

4.2.3.1 Scope of UL 251

4.2.3.2 Scope of UL 251

4.3 COMPANIES COMPLIANT WITH UL521/ULC530 CERTIFICATION

4.3.1 FM3210 CERTIFICATION

4.4 COMPARISON OF LINE TYPE VS FIBER OPTIC HEAT DETECTION SYSTEM

4.4.1 A REASON FOR ADOPTION LINE TYPE DETECTOR BY SYSTEM INTEGRATOR

4.4.2 ADOPTION OF FIBER OPTIC HEAT DETECTOR BY SYSTEM INTEGRATORS

4.5 LIST OF THE INDUSTRIES AND APPLICATIONS WHERE FIBER OPTIC HEAT DETECTORS ARE MORE PROMISING

4.5.1 OIL AND GAS

4.5.2 METAL & MINING

4.5.3 WAREHOUSE AND DISTRIBUTION

4.5.4 PHARMACEUTICALS/CHEMICAL

4.5.5 METRO

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INTEGRATION OF IOT AND SMART SENSORS WITH FIBER OPTIC DETECTORS

5.1.2 SIGNIFICANT EXPANSION IN THE MANUFACTURING SECTOR

5.1.3 RISING ADOPTION OF FIRE SAFETY SYSTEMS IN POWER PLANTS, DATA CENTRES, AND TRANSPORTATION HUBS

5.1.4 INCREASING NEED OF HEAT DETECTOR IN PUBLIC PLACES

5.2 RESTRAINTS

5.2.1 HIGH PRODUCTION AND INSTALLATION COSTS OF FIBER OPTIC SYSTEMS

5.2.2 THE COMPLEXITIES RELATED TO FALSE ALARMS AND SENSITIVITY

5.3 OPPORTUNITIES

5.3.1 INCREASING INVESTMENT IN INFRASTRUCTURE DEVELOPMENT

5.3.2 THE DEVELOPMENT OF SOLAR-POWERED, WIRELESS OPTICAL FLAME DETECTORS

5.3.3 HYBRID DETECTION SYSTEMS COMBINE FIBER OPTICS WITH TRADITIONAL FIRE SAFETY METHODS

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS ABOUT THE BENEFITS OF OPTICAL FIBER HEAT AND FIRE DETECTORS

5.4.2 RAPIDLY CHANGING ENVIRONMENTAL CONDITIONS

6 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD

6.1 OVERVIEW

6.2 SINGLE-ENDED

6.3 DOUBLE-ENDED

7 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE

7.1 OVERVIEW

7.2 RACK MOUNTED

7.3 WALL MOUNTED

8 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY

8.1 OVERVIEW

8.2 OIL & GAS

8.3 METAL & MINING

8.4 ELECTRONICS AND ELECTRIC MACHINERY

8.5 RAILWAY/CIVIL

8.6 REFINERY & PETROCHEMICAL

8.7 POWER/IPP (INDEPENDENT POWER PRODUCER)

8.8 CHEMICAL

8.9 IRON & STEEL

8.1 AUTOMOTIVE

8.11 FOOD & BEVERAGES

8.12 WASTE MANAGEMENT

8.13 PULP & PAPER

8.14 OTHERS

9 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS

9.1 OVERVIEW

9.2 1

9.3 4

9.4 2

10 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TUNNELS

10.2.1 TUNNELS, BY TYPE

10.2.1.1 Traffic Tunnels

10.2.1.2 Rail Tunnels

10.2.1.3 Utility Tunnels

10.3 DATA CENTERS

10.4 OIL/GAS TANKS

10.5 HIGH VOLTAGE POWER CABLES

10.6 NUCLEAR FACILITY

10.7 METRO

10.8 CABLE TRAYS

10.9 CONVEYOR BELTS

10.1 PARKING GARAGES

10.11 PUBLIC BUILDINGS

10.12 ROOFTOP SOLARS PANEL

10.13 OTHERS

11 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA

11.1 OVERVIEW

11.2 LESS THAN 10 KM

11.3 MORE THAN 10 KM

12 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SAUDI ARABIA

12.1.2 U.A.E

12.1.3 SOUTH AFRICA

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA FIRE SYSTEM INTEGRATOR MARKET

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS FOR MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR MARKET

15 SWOT ANALYSIS FOR MIDDLE EAST AND AFRICA FIBER OPTIC SYSTEM INTEGRATORS MARKET

16 COMPANY PROFILE MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR MARKET

16.1 FPS

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT DEVELOPMENTS

16.2 YAMATO PROTEC CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 ADVANCED PHOTONICS SENSING

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENTS

16.4 THE PROTECTOWIRE CO., INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENTS

16.5 HEXATRONIC GROUP

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 SOLUTION PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 IMEN SAHAND ARYA CO. (SISICO)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

17 COMPANY PROFILE MIDDLE EAST AND AFRICA FIRE SYSTEM INTEGRATOR MARKET

17.1 API GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 SERVICE PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 EVERON, LLC.

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 SERVICE PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 IMPACT FIRE SERVICES, LLC

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 SERVICE PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 A&M FIRE

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICE PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 APS FIRECO

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 SERVICE PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 INCONTROL SYSTEMS INC,

17.6.1 COMPANY SNAPSHOT

17.6.2 SERVICE PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 LONG BUILDING TECHNOLOGIES

17.7.1 COMPANY SNAPSHOT

17.7.2 COMPANY SHARE ANALYSIS

17.7.3 SERVICE PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 MEI ELECTRICAL CONTRACTORS & SYSTEMS INTEGRATORS

17.8.1 COMPANY SNAPSHOT

17.8.2 SERVICE PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 PACIFIC FIRE & SECURITY, INC

17.9.1 COMPANY SNAPSHOT

17.9.2 SERVICE PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 WITNESS SECURITY SOLUTIONS

17.10.1 COMPANY SNAPSHOT

17.10.2 SERVICE PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BENEFITS OF FIBER OPTIC HEAT DETECTION SYSTEM BASED ON REGION, INDUSTRY, APPLICATIONS

TABLE 2 LIST OF PROJECTS LINE TYPE HEAT DETECTOR USED IN INDUSTRY AND APPLICATION BY LUNA INNOVATIONS(APAC REGION)

TABLE 3 LIST OF PROJECTS LINE TYPE HEAT DETECTOR USED IN INDUSTRY AND APPLICATION BY LUNA INNOVATIONS(EMEA REGION)

TABLE 4 LIST OF PROJECTS LINE TYPE HEAT DETECTOR USED IN INDUSTRY AND APPLICATION BY LUNA INNOVATIONS(AMERICAS REGION)

TABLE 5 PRICE FOR THE OPTILE FIBER HEAT DETECTORS.

TABLE 6 TABLE 1: REGION-WISE GROWTH RATE AND INVESTMENT IN INFRASTRUCTURE

TABLE 7 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA SINGLE-ENDED IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA DOUBLE-ENDED IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA RACK MOUNTED IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA WALL MOUNTED IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA OIL & GAS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA METAL & MINING IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA ELECTRONICS AND ELECTRIC MACHINERY IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA RAILWAY/CIVIL IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA REFINERY & PETROCHEMICAL IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA POWER/IPP (INDEPENDENT POWER PRODUCER) IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA CHEMICAL IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA IRON & STEEL IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA AUTOMOTIVE IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA WASTE MANAGEMENT IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA PULP & PAPER IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA OTHERS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA 1 IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA 4 IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA 2 IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA DATA CENTERS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA OIL/GAS TANKS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA HIGH VOLTAGE POWER CABLES IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA NUCLEAR FACILITY IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA METRO IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA CABLE TRAYS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA CONVEYOR BELTS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA PARKING GARAGES IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA PUBLIC BUILDINGS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA ROOFTOP SOLARS PANEL IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA OTHERS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA LESS THAN 10 KM IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA MORE THAN 10 KM IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 57 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 59 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 SAUDI ARABIA TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 62 SAUDI ARABIA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 63 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 64 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 66 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 U.A.E TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 69 U.A.E FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 76 SOUTH AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 77 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 78 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 80 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 ISRAEL TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 83 ISRAEL FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 84 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

TABLE 85 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MOUNTING TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY NUMBER OF CHANNELS, 2021-2030 (USD THOUSAND)

TABLE 87 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 88 EGYPT TUNNELS IN FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY COVERAGE AREA, 2021-2030 (USD THOUSAND)

TABLE 90 EGYPT FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 91 REST OF MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: MEASUREMENT METHOD TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: APPLICATION COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: TIME GRID

FIGURE 13 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: MARKET CHALLENGE MATRIX

FIGURE 14 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: SEGMENTATION

FIGURE 15 EXECUTIVE SUMMARY

FIGURE 16 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET, BY MEASUREMENT METHOD (2023)

FIGURE 17 STRATEGIC DECISIONS

FIGURE 18 INTEGRATION OF IOT AND SMART SENSORS WITH FIBER OPTIC DETECTORS IS EXPECTED TO DRIVE THE MARKET IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET DURING THE FORECAST PERIOD OF 2024 TO 2030

FIGURE 19 SINGLE – ENDED SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET IN 2024 & 2030

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET

FIGURE 21 GROWTH RATE IN MANUFACTURING INDUSTRIES

FIGURE 22 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY MEASUREMENT METHOD, 2023

FIGURE 23 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY MOUNTING TYPE, 2023

FIGURE 24 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY INDUSTRY, 2023

FIGURE 25 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY NUMBER OF CHANNELS, 2023

FIGURE 26 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY APPLICATION, 2023

FIGURE 27 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: BY COVERAGE AREA, 2023

FIGURE 28 MIDDLE EAST AND AFRICA FIBER OPTIC HEAT DETECTOR AND SYSTEM INTEGRATOR MARKET: SNAPSHOT (2023)

FIGURE 29 MIDDLE EAST AND AFRICA FIRE SYSTEM INTEGRATOR MARKET: COMPANY SHARE 2023 (%)

Middle East And Africa Fiber Optic Heat Detector And System Integrator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Fiber Optic Heat Detector And System Integrator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Fiber Optic Heat Detector And System Integrator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.