Middle East And Africa Drug Device Combination Market

Market Size in USD Billion

CAGR :

%

USD

1.03 Billion

USD

2.00 Billion

2025

2033

USD

1.03 Billion

USD

2.00 Billion

2025

2033

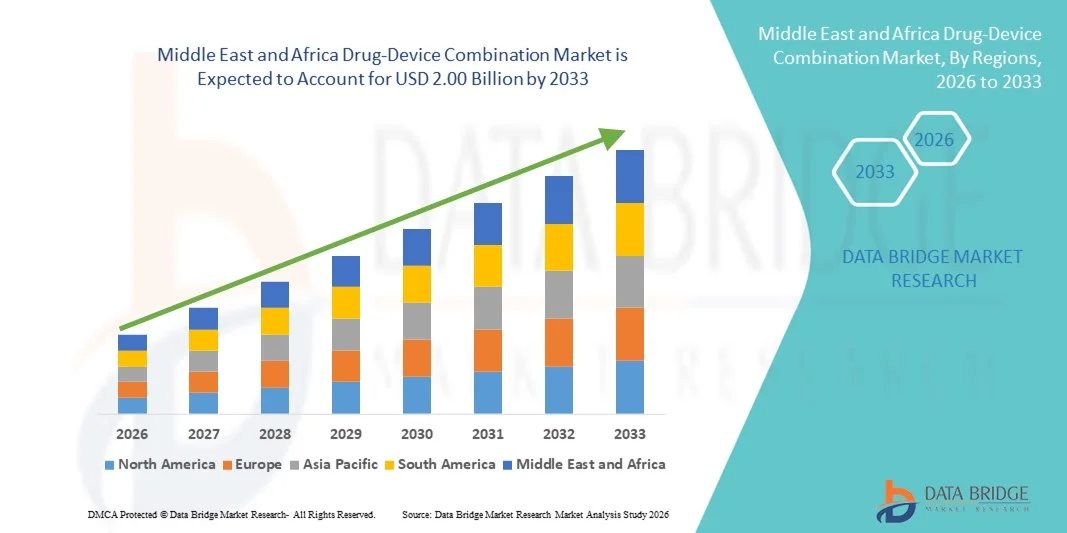

| 2026 –2033 | |

| USD 1.03 Billion | |

| USD 2.00 Billion | |

|

|

|

|

Middle East and Africa Drug-Device Combination Market Size

- The Middle East and Africa drug-device combination market size was valued at USD 1.03 billion in 2025 and is expected to reach USD 2.00 billion by 2033, at a CAGR of 8.7% during the forecast period

- The market growth is largely fueled by increasing healthcare investments, rising prevalence of chronic diseases, and enhanced adoption of advanced drug‑delivery solutions across both public and private healthcare settings in the region

- Furthermore, rising demand for integrated drug‑device therapies along with expanding healthcare infrastructure in GCC countries, South Africa, and North African markets is establishing drug‑device combinations as critical components in modern therapeutic regimens. These converging factors are accelerating solution uptake, thereby significantly boosting overall market growth

Middle East and Africa Drug-Device Combination Market Analysis

- Drug‑device combination products, integrating therapeutic drugs with delivery devices such as injectors, inhalers, and infusion pumps, are becoming increasingly vital in modern healthcare systems across both hospital and homecare settings due to their improved patient compliance, precise dosing, and enhanced treatment outcomes

- The escalating demand for drug‑device combination products is primarily fueled by the rising prevalence of chronic diseases, growing healthcare expenditure, and increasing adoption of advanced drug-delivery solutions that simplify therapy management for patients and healthcare providers

- Saudi Arabia dominated the Middle East and Africa drug‑device combination market in 2025 with a market share of 28.5%, characterized by well-established healthcare infrastructure, government support for innovative medical technologies, and strong presence of key international and domestic players focusing on smart delivery systems and connected devices

- United Arab Emirates is expected to be the fastest growing country during the forecast period due to increasing healthcare investments, rising awareness of modern therapeutic solutions, and expansion of healthcare facilities capable of supporting advanced drug‑device therapies

- Smart inhaler segment dominated the market with a market share of 45.7% in 2025, driven by their convenience, real-time adherence monitoring, and integration with mobile health platforms, making them especially attractive for respiratory disease management in both hospital and homecare settings

Report Scope and Middle East and Africa Drug-Device Combination Market Segmentation

|

Attributes |

Middle East and Africa Drug-Device Combination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Drug-Device Combination Market Trends

Advancement Through Smart Inhalers and Connected Devices

- A significant and accelerating trend in the Middle East and Africa drug‑device combination market is the increasing adoption of smart inhalers and connected delivery devices that integrate with mobile health applications and digital adherence platforms, enhancing patient monitoring and treatment compliance

- For instance, Propeller Health’s smart inhaler connects via Bluetooth to mobile apps, allowing patients to track medication usage and receive adherence reminders, improving therapy outcomes and supporting healthcare provider monitoring

- Connected devices enable features such as dosage tracking, real-time data reporting to healthcare providers, and personalized treatment recommendations. For instance, Adherium’s Hailie smart inhaler provides notifications for missed doses and generates reports for clinicians to optimize care plans

- The integration of drug‑device products with mobile health platforms facilitates centralized management of chronic diseases, allowing patients and providers to monitor therapy effectiveness, track symptoms, and coordinate care remotely

- This trend towards intelligent, connected, and data-driven drug delivery is reshaping expectations for chronic disease management. Consequently, companies such as Teva and Novartis are developing smart inhalers and connected autoinjectors with real-time feedback and adherence monitoring

- The demand for drug‑device combination solutions that integrate digital and connected capabilities is growing rapidly, as patients and healthcare providers increasingly prioritize convenience, adherence, and comprehensive disease management

Middle East and Africa Drug-Device Combination Market Dynamics

Driver

Rising Chronic Disease Prevalence and Healthcare Digitization

- The increasing prevalence of chronic diseases such as asthma, COPD, and diabetes, coupled with growing adoption of digital healthcare platforms, is a significant driver for the heightened demand for drug‑device combination products

- For instance, in March 2025, GlaxoSmithKline launched an initiative to expand smart inhaler programs in Saudi Arabia and UAE, integrating connected devices with patient adherence apps to optimize respiratory care

- As patients and healthcare providers seek improved therapy outcomes, drug‑device combination products offer advanced features such as real-time monitoring, adherence tracking, and integrated data reporting, providing a compelling alternative to conventional delivery methods

- Furthermore, the expansion of hospital networks and homecare services in countries such as South Africa and Egypt is making drug‑device products an integral part of chronic disease management, offering seamless integration with healthcare IT systems

- The convenience of connected devices, ease of self-administration, and ability to remotely share therapy data with healthcare providers are key factors propelling adoption in both hospital and homecare settings, while growing awareness and government support further drive market growth

- The rise of telemedicine and virtual consultations across the region is promoting drug‑device integration, as healthcare providers can remotely monitor patient usage data and provide timely intervention, improving clinical outcomes

Restraint/Challenge

High Cost and Regulatory Compliance Complexity

- The relatively high cost of advanced drug‑device combination products compared to conventional therapies poses a challenge to widespread adoption, particularly in price-sensitive markets across the Middle East and Africa

- For instance, some premium smart inhalers and connected autoinjectors can cost significantly more than standard delivery devices, making them less accessible to patients in lower-income regions or those without insurance coverage

- Regulatory compliance and approvals for combination products in multiple countries in the region can be complex and time-consuming, delaying market entry and limiting availability in certain markets. For instance, navigating approvals in Egypt, UAE, and South Africa requires adherence to varying local medical device and pharmaceutical regulations

- While patient awareness and willingness to adopt advanced drug-delivery systems are increasing, the premium price and regulatory hurdles can still hinder uptake, especially in emerging markets with constrained healthcare budgets

- Overcoming these challenges through pricing strategies, streamlined regulatory pathways, and awareness campaigns highlighting therapy benefits will be vital for sustained market growth in the Middle East and Africa

- For instance, collaborations between local distributors and international companies are helping reduce costs and improve availability of smart inhalers and autoinjectors in key markets such as Egypt and Nigeria

- Slow digital infrastructure adoption in rural and semi-urban areas may limit the effectiveness of connected drug-device products, as devices rely on mobile connectivity for real-time monitoring and data reporting

Middle East and Africa Drug-Device Combination Market Scope

The market is segmented on the basis of product, application type, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into auto-injector, microneedle patch, digital pill, smart inhaler, drug delivery hydrogels, drug-eluting lens, and others. Smart inhaler segment dominated the market with the largest revenue share of 45.7% in 2025, driven by rising prevalence of respiratory diseases such as asthma and COPD across the region. Patients and healthcare providers increasingly prefer smart inhalers due to their ability to monitor adherence, track dosage, and provide real-time data via mobile applications. The segment’s dominance is also supported by robust government initiatives promoting chronic respiratory disease management in countries such as Saudi Arabia, UAE, and South Africa. In addition, partnerships between healthcare providers and tech companies are enhancing the connectivity and usability of these devices, further increasing adoption. The ease of integration with digital health platforms makes smart inhalers particularly attractive for remote patient monitoring programs. Finally, ongoing product innovation, including Bluetooth connectivity and personalized reminders, continues to strengthen the segment’s leading position.

Digital pill segment is anticipated to witness the fastest growth rate from 2026 to 2033 due to increasing adoption for medication adherence monitoring in chronic disease management. Digital pills combine ingestible sensors with pharmaceuticals, allowing real-time tracking of therapy compliance. Healthcare providers are leveraging these devices to reduce hospital readmissions and optimize patient outcomes. The rising awareness among patients and payers regarding the benefits of adherence data is accelerating demand. Furthermore, the growing telemedicine and remote monitoring infrastructure in the region supports the expansion of digital pill adoption. Investment from pharmaceutical companies in smart digital pill platforms also contributes to the rapid market growth. The segment is expected to gain traction especially in high-income countries such as UAE and Saudi Arabia, where digital health adoption is higher.

- By Application Type

On the basis of application type, the market is segmented into orthopedic diseases, respiratory diseases, diabetes, oncology, cardiovascular diseases, and others. Respiratory diseases segment dominated the market in 2025 due to the high prevalence of asthma, COPD, and other chronic respiratory disorders across the Middle East and Africa. The adoption of smart inhalers and connected delivery devices provides real-time adherence monitoring and therapy optimization, driving demand. Healthcare systems increasingly integrate these devices with digital health platforms to improve patient outcomes. Government programs targeting respiratory disease management and patient education campaigns further support market growth. Hospitals, clinics, and homecare providers prefer these solutions for their ability to reduce emergency visits and improve treatment compliance. In addition, rising air pollution and urbanization contribute to higher incidence rates, sustaining strong segment demand.

Diabetes segment is expected to witness the fastest growth from 2026 to 2033 due to increasing prevalence of type 2 diabetes and adoption of connected insulin delivery devices, including auto-injectors and smart pens. Digital monitoring systems allow patients and clinicians to track glucose levels and insulin dosing remotely. Rising awareness campaigns, coupled with government incentives for digital healthcare solutions, are accelerating adoption. Remote patient monitoring initiatives and telemedicine programs make diabetes management more efficient. Continuous innovation in insulin delivery devices, such as dose tracking and mobile connectivity, also supports growth. The segment sees increasing interest from private healthcare providers and specialty clinics aiming to improve patient adherence.

- By End User

On the basis of end user, the market is segmented into clinics, hospitals, home care settings, ambulatory care centers, and others. Hospitals segment dominated the market in 2025 due to their central role in chronic disease management and access to advanced drug-device combination therapies. Hospitals can integrate smart inhalers, auto-injectors, and digital pills with patient monitoring systems to improve adherence and therapy outcomes. High patient volumes and structured treatment protocols favor large-scale adoption. Collaboration between hospitals and device manufacturers ensures consistent supply and training on device use. Hospitals also benefit from economies of scale, making investment in high-cost devices more feasible. The presence of specialized respiratory, oncology, and diabetes centers further drives adoption in hospitals.

Home care settings segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for patient-centric care and the convenience of remote disease management. Smart inhalers, auto-injectors, and digital pills enable patients to self-administer therapy while transmitting adherence and usage data to healthcare providers. Growth in telemedicine infrastructure and remote monitoring programs supports this trend. Patients and caregivers increasingly prefer home-based management to reduce hospital visits and improve quality of life. Rising awareness campaigns and government support for homecare programs in UAE, Saudi Arabia, and South Africa further encourage adoption. The segment also benefits from increasing affordability of connected devices for long-term disease management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. Direct tender segment dominated the market in 2025 due to large-scale procurement by hospitals and government health programs in Saudi Arabia, UAE, and South Africa. Bulk purchasing agreements and tenders allow hospitals and clinics to obtain advanced drug-device combination products at competitive rates. This distribution channel ensures consistent supply and support for patient management programs. Direct tender agreements often include training, maintenance, and software integration for smart devices, enhancing their appeal to healthcare providers. Government-driven healthcare initiatives promoting chronic disease management further strengthen this segment. Manufacturers favor direct tender contracts for predictable revenue streams and market penetration.

Retail sales segment is expected to witness the fastest growth from 2026 to 2033, driven by rising patient demand for over-the-counter or pharmacy-accessible smart inhalers, digital pills, and auto-injectors. Increasing patient awareness and willingness to self-manage chronic conditions drive adoption. The growth of e-pharmacies and online health platforms facilitates convenient access to these products. Retail channels also support bundled digital health services, including apps and remote monitoring features. Rising disposable incomes and smartphone penetration in UAE, Saudi Arabia, and South Africa further accelerate retail sales adoption. Marketing campaigns by device manufacturers highlighting convenience and adherence benefits contribute to segment growth.

Middle East and Africa Drug-Device Combination Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa drug‑device combination market in 2025 with a market share of 28.5%, characterized by well-established healthcare infrastructure, government support for innovative medical technologies, and strong presence of key international and domestic players focusing on smart delivery systems and connected devices

- Patients and healthcare providers in these countries increasingly value connected devices such as smart inhalers, auto-injectors, and digital pills for their ability to improve therapy adherence, enable real-time monitoring, and optimize clinical outcomes in both hospital and homecare settings

- This widespread adoption is further supported by well-established hospitals, specialty clinics, and telemedicine programs, along with rising awareness of chronic disease management and integration of digital health platforms, establishing drug-device combination products as essential tools for modern healthcare delivery

The Saudi Arabia Drug‑Device Combination Market Insight

The Saudi Arabia drug‑device combination market captured the largest revenue share of 28.5% in 2025, driven by increasing prevalence of chronic diseases such as asthma, diabetes, and cardiovascular disorders. Patients and healthcare providers are increasingly adopting connected drug-device products, including smart inhalers and auto-injectors, for enhanced therapy adherence and real-time monitoring. Government initiatives promoting digital health solutions and advanced disease management programs are further accelerating market growth. The integration of these devices with hospital IT systems and telemedicine platforms supports more effective patient care. In addition, rising awareness and educational campaigns for chronic disease management are encouraging adoption in both hospital and homecare settings. The presence of key international and domestic players supplying advanced devices strengthens Saudi Arabia’s leading position in the region.

South Africa Drug‑Device Combination Market Insight

The South Africa drug‑device combination market accounted for a revenue share of 24.3% in 2025, fueled by the country’s well-developed healthcare infrastructure and high adoption of innovative medical technologies. Patients are increasingly using smart inhalers, digital pills, and auto-injectors to manage chronic conditions effectively. The growing prevalence of respiratory diseases, diabetes, and oncology-related conditions drives the adoption of connected drug-device therapies. Telemedicine and remote patient monitoring programs further enhance the utility of these devices. Strong partnerships between local healthcare providers and global manufacturers ensure product availability and support. In addition, government healthcare initiatives targeting chronic disease management reinforce the market’s growth trajectory.

United Arab Emirates Drug‑Device Combination Market Insight

The UAE drug‑device combination market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for patient-centric care and home-based chronic disease management solutions. Increasing awareness of connected drug-device products, coupled with government initiatives promoting telehealth and digital health integration, is accelerating adoption. Patients and providers value the convenience of devices such as smart inhalers and digital pills for real-time adherence monitoring. The country’s robust healthcare infrastructure and high disposable income levels further support market growth. Furthermore, the UAE’s focus on smart hospitals and IoT-enabled healthcare facilities enhances the integration of advanced drug-device therapies. Strategic collaborations between global device manufacturers and local distributors are also boosting market penetration.

Egypt Drug‑Device Combination Market Insight

The Egypt drug‑device combination market is expected to expand at a considerable CAGR during the forecast period, fueled by rising prevalence of chronic diseases and growing awareness of advanced drug-delivery solutions. Patients increasingly rely on smart inhalers, auto-injectors, and digital pills for improved therapy adherence. Telemedicine adoption and homecare programs support the remote monitoring capabilities of these devices. The government’s initiatives to improve healthcare infrastructure and chronic disease management are driving growth. Hospitals and specialty clinics are actively integrating connected drug-device solutions into treatment plans. Furthermore, international partnerships with local distributors ensure availability and training for effective device use.

Middle East and Africa Drug-Device Combination Market Share

The Middle East and Africa Drug-Device Combination industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Novartis AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Sanofi (France)

- Eli Lilly and Company (U.S.)

- GSK plc (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Terumo Corporation (Japan)

- West Pharmaceutical Services, Inc. (U.S.)

- Bayer AG (Germany)

- Merck KGaA (Germany)

- B. Braun SE (Germany)

- WuXi AppTec Co., Ltd. (China)

- Meril Life Sciences (India)

- Dr. Reddy’s Laboratories Ltd. (India)

What are the Recent Developments in Middle East and Africa Drug-Device Combination Market?

- In December 2025, Enable Injections announced that its EMPAVELI® Injector based on enFuse® technology received marketing authorization from the Saudi Food and Drug Authority (SFDA) for sale and distribution in Saudi Arabia, marking a significant regulatory milestone for patient‑centric drug delivery technology in the region

- In February 2025, a study highlighted the growing emphasis on medication adherence and digital delivery models that are increasingly pertinent to chronic treatment delivery in MEA, such as automated dispensers and mail‑order programmes, which reflect emerging real‑world delivery innovations that support drug‑device adoption in the region

- In September 2024, Sobi and Enable Injections announced an agreement to develop and distribute the Aspaveli®/EMPAVELI® combination using the enFuse® delivery system, aiming to expand patient access to streamlined subcutaneous drug delivery solutions in Middle East & Africa and other global markets

- In April 2024, Mundipharma and Vectura announced plans to reformulate their flutiform® pressurised metered‑dose inhaler (fluticasone propionate/formoterol fumarate), a drug‑device combination product, by incorporating a near‑zero emissions propellant to reduce its environmental impact, reflecting innovation toward sustainable respiratory therapies

- In October 2023, Enable Injections received U.S. FDA approval for the EMPAVELI® Injector (enFuse®), a combination drug‑device product designed for self‑administration of pegcetacoplan, representing a major regulatory and therapeutic advancement with potential downstream impact on adoption in regions including Middle East & Africa

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.