Middle East And Africa Digital Experience Platform Market

Market Size in USD Million

CAGR :

%

USD

2,981.53 Million

USD

9,774.69 Million

2021

2029

USD

2,981.53 Million

USD

9,774.69 Million

2021

2029

| 2022 –2029 | |

| USD 2,981.53 Million | |

| USD 9,774.69 Million | |

|

|

|

|

Market Analysis and Size

The advancement of content management software and its combination with various technologies such as IoT, virtual reality, and enhanced graphics is assisting enterprises to provide lively experiences to customers. Sectors such as BFSI have incorporated DXPs in order to provide personalised banking experiences to its customers via its official application, portals, and websites, making banking easier.

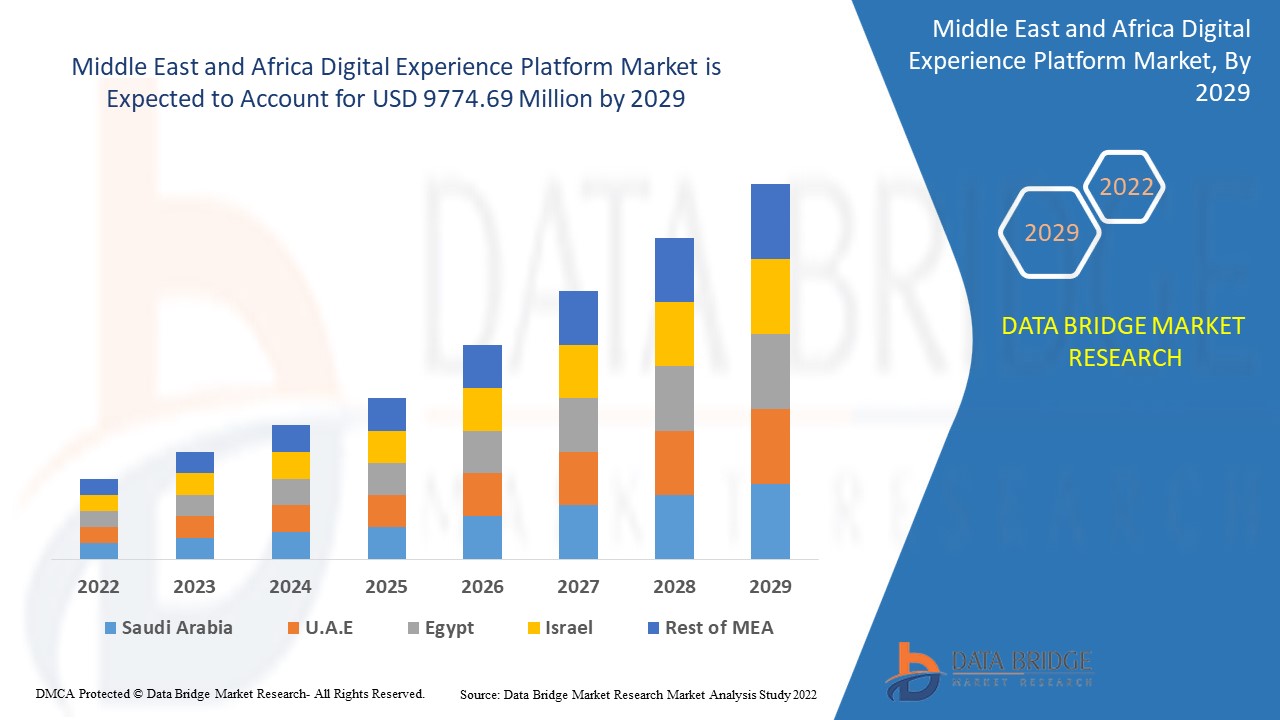

Data Bridge Market Research analyses that the digital experience platform market was valued at USD 2981.53 million in 2021 and is expected to reach the value of USD 9774.69 million by 2029, at a CAGR of 16.00% during the forecast period of 2022 to 2029.

Market Definition

A digital experience platform (DXP) is a well-integrated and cohesive set of technologies that enables the creation, management, delivery, and optimization of contextualised digital experiences across multi experience customer journeys. A DXP can provide optimal digital experiences to a wide range of constituents, including consumers, partners, employees, citizens, and students, as well as help ensure continuity throughout the entire customer lifetime journey. It provides presentation orchestration, which connects capabilities from various applications to create seamless digital experiences. Through API-based integrations with adjacent technologies, a DXP becomes a part of a digital business ecosystem.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Platform, Services), Deployment Model (Cloud, On Premises), Organization Size (Small & Medium Enterprise, Large Enterprise), Application (Business to Customer, Business to Business), Vertical (Retail, BFSI, Travel & Hospitality, IT & Telecom, Healthcare, Manufacturing, Media and Entertainment, Education) |

|

Countries Covered |

Saudi Arabia, U.A.E., South Africa, Israel, Egypt, Rest of Middle East and Africa |

|

Market Players Covered |

Xandr Inc.(U.S), Verizon (U.S), Kayzen (China), NextRoll, Inc. (U.S), Google (U.S), Adobe (U.S), Magnite, Inc (U.S), MediaMath (U.S), IPONWEB Limited (U.S), VOYAGE GROUP (Japan), Integral Ad Science Inc.(Denmark), The Trade Desk (U.S), Connexity (U.S), Centro, Incorporated (U.S), RhythmOne, LLC (U.S) |

|

Opportunities |

|

Digital Experience Platform Market Dynamics

Drivers

- Increased cloud based solution across various enterprises

One of the major factors driving the growth of the digital experience platform market is the increased deployment of cloud-based solutions across various enterprises. Increased company initiatives to deliver personalised, optimised, and integrated user engagement and experience across multiple marketing channels, as well as increased demand for platforms to understand customers' immediate needs, are driving market growth.

- Rising adoption of digital experience platforms to reach customer base across multiple levels

The increased adoption of digital experience platforms (DXPs) by marketers for the purpose of seamlessly reaching customers across multiple digital devices and promoting cross-selling and upselling, as well as high usage due to accurate data obtained through DXP used for marketing and customer engagement, all have an impact on the market. Furthermore, use to reduce customer churn rate, rise in demand for big data analytics, urbanisation and digitization, and preference for Omni channel approach all have a positive impact on the digital experience platform market. Furthermore, the rise in demand for personalised experiences for each customer in real time, as well as the implementation of advanced technologies such as AI, data analytics, and cloud computing, will provide profitable opportunities to market participants during the forecast period.

Opportunity

The widespread use of self-service and interactive kiosks for financial services such as internet banking and mobile banking is expected to drive the adoption of digital experience platforms by banks, financial institutions, and non-banking financial companies (NBFCs). As the digital experience platform eliminates siloed systems, many organisations have begun to deploy DXP to improve their customer interaction and engagement strategies in order to compete with market leaders.

Restraints

On the other hand, the difficulties in integrating omni-channel-generated data, as well as concerns about unclear ROI data are expected to stymie market growth. Integration issues with various software are expected to pose a challenge to the digital experience platform market during the forecast period.

This digital experience platform market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital experience platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Digital Experience Platform Market

There was an unavoidable surge in the field of digital platforms and technologies during the Covid-19 pandemic years. These steps paved the way for new work and life models, providing a significant impetus for the digitization of all business operations. During the lockdown period, the majority of market players in every field focused on improving their digital platform experience for their customers. Massive investment in DXP content management by online service providers created new opportunities for the development and growth of the digital experience platform market size. However, because the success of any customer engagement service is dependent on the availability of products or services, Covid-19 did have some negative effects on commerce experience management platforms.

Recent Development

- Adobe collaborated with ServiceNow, a leading cloud computing company, to develop an industry-first solution for integrating digital experience data with customer data. Customers would benefit from seamless digital workflows and personalised CXs across all touchpoints.

- Oracle partnered with TWINSET, an Italian clothing brand, in March 2019 to provide the company with Oracle Retail's modern Point-of-Service (POS) technology. This technology would help to improve customer experience at TWINSET stores by providing all transactional details to in-store staff, allowing them to recommend necessary styling and information about the latest merchandise, among other things.

- SAP acquired Qualtrics International, one of the world's pioneers of experience management software, in January 2019. This acquisition would aid SAP in accelerating CX solutions by combining experience and operational data.

Middle East and Africa Digital Experience Platform Market Scope

The digital experience platform market is segmented on the basis of component, deployment model, organization size, application and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Platform

- Services

Product Type

- Customer Identity Management Software

- Transaction Monitoring Software

- Currency Transaction Reporting Software

- Compliance Management Software

- Others

Organization size

- Large Organization

- Small & Medium Organization

Deployment

- On-premise

- Cloud

Application

- Business to Customer

- Business to Business

Vertical

- Retail

- BFSI

- Travel & Hospitality

- IT & Telecom

- Healthcare

- Manufacturing

- Media and Entertainment

- Education

Digital Experience Platform Market Regional Analysis/Insights

The digital experience platform market is analysed and market size insights and trends are provided by country, component, deployment model, organization size, application and vertical as referenced above.

The countries covered in the digital experience platform market report are Saudi Arabia, U.A.E., South Africa, Israel, Egypt, Rest of Middle East and Africa.

South Africa dominates the Middle East and Africa digital experience platform market due to the country's rapid growth in the retail and manufacturing sectors, as well as its high DXP adoption rate among all countries in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Experience Platform Market Share Analysis

The digital experience platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital experience platform market.

Some of the major players operating in the digital experience platform market are:

- Xandr Inc.(U.S)

- Verizon (U.S)

- Kayzen (China)

- NextRoll, Inc. (U.S)

- Google (U.S)

- Adobe (U.S)

- Magnite, Inc (U.S)

- MediaMath (U.S)

- IPONWEB Limited (U.S)

- VOYAGE GROUP (Japan)

- Integral Ad Science Inc.(Denmark)

- The Trade Desk (U.S)

- Connexity (U.S).

- Centro, Incorporated (U.S)

- RhythmOne, LLC (U.S)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY OPERATING SYSTEMS

5 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: IMPACT ANALYSIS OF COVID-19

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GROWTH IN DIGITALIZATION

6.1.2 RICH EXPERIENCE WITH TOUCHPOINT OPTIMIZATION

6.1.3 INCREASED CUSTOMER RETENTION THROUGH DXP

6.1.4 GROWTH IN CLOUD TECHNOLOGY AND IOT BASED DEVICES

6.1.5 GROWTH IN BIG DATA ANALYTICS

6.2 RESTRAINTS

6.2.1 LACK OF KNOWLEDGE REGARDING DIGITAL EXPERIENCE PLATFORM

6.2.2 ISSUE WITH CYBER SECURITY

6.2.3 MULTILINGUAL CONTENT AVAILABLE MIDDLE EAST AND AFRICALY

6.3 OPPORTUNITIES

6.3.1 INCREASING GROWTH IN ARTIFICIAL INTELLIGENCE TECHNOLOGY

6.3.2 GROWTH IN E-COMMERCE TRANSFORMING THE RETAIL MARKET

6.3.3 IMPLEMENTING BUSINESS INTELLIGENCE IN DXP

6.4 CHALLENGES

6.4.1 COMPLICATIONS INVOLVED IN INTEGRATION OF DIFFERENT PLATFORMS INVOLVED

6.4.2 TRACKING CROSS CHANNEL USER BEHAVIOUR

7 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 PLATFORM

7.3 SERVICES

7.3.1 PROFESSIONAL SERVICES

7.3.2 MANAGED SERVICES

8 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 ON PREMISES

8.3 CLOUD

9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISE

9.3 SMALL & MEDIUM ENTERPRISE

10 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BUSINESS TO CUSTOMER

10.2.1 ON PREMISES

10.2.2 CLOUD

10.3 BUSINESS TO BUSINESS

10.3.1 ON PREMISES

10.3.2 CLOUD

10.4 OTHERS

11 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 RETAIL

11.2.1 PLATFORM

11.2.2 SERVICES

11.3 BFSI

11.3.1 PLATFORM

11.3.2 SERVICES

11.4 IT & TELECOM

11.4.1 PLATFORM

11.4.2 SERVICES

11.5 TRAVEL & HOSPITALITY

11.5.1 PLATFORM

11.5.2 SERVICES

11.6 MEDIA AND ENTERTAINMENT

11.6.1 PLATFORM

11.6.2 SERVICES

11.7 EDUCATION

11.7.1 PLATFORM

11.7.2 SERVICES

11.8 HEALTHCARE

11.8.1 PLATFORM

11.8.2 SERVICES

11.9 MANUFACTURING

11.9.1 PLATFORM

11.9.2 SERVICES

11.1 OTHERS

12 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY GEOGRAPHY

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 ISRAEL

12.1.3 SAUDI ARABIA

12.1.4 U.A.E.

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SWOT ANALYSIS

15 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR ANALYSIS

16 COMPANY PROFILE

16.1 ADOBE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAP SE

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANLYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ORACLE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SALESFORCE.COM, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ACCENTURE

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SERVICE PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACQUIA, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BLOOMREACH INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CENSHARE AG

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT & SERVICE PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 CROWNPEAK TECHNOLOGY, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 EPISERVER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HCL TECHNOLOGIES LIMITED

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 INFOSYS LIMITED

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 SERVICE PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 JAHIA SOLUTIONS GROUP SA

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 KENTICO SOFTWARE

16.14.1 COMPANY SNAPSHOT

16.14.2 SOLUTION PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 LIFERAY INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 OPEN TEXT CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SOLUTION PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SDL PLC

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 SOFTWARE PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SITECORE

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 SQUIZ

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 WIPRO LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 SERVICE PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DIGITAL EXPERIENCE PLATFORM REVIEW BASED ON CUSTOMER FEEDBACK

TABLE 2 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA PLATFORM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA ON PREMISES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA CLOUD IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA LARGE ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA SMALL & MEDIUM ENTERPRISE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 29 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA OTHERS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 53 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 54 SOUTH AFRICA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 55 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 56 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 57 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 58 SOUTH AFRICA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 59 SOUTH AFRICA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 60 SOUTH AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 61 SOUTH AFRICA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 62 SOUTH AFRICA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 63 SOUTH AFRICA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 64 SOUTH AFRICA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 65 SOUTH AFRICA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 66 SOUTH AFRICA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 67 SOUTH AFRICA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 68 SOUTH AFRICA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 69 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 70 ISRAEL SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 71 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 72 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 73 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 74 ISRAEL BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 75 ISRAEL BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 76 ISRAEL DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 77 ISRAEL RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 78 ISRAEL BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 79 ISRAEL IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 80 ISRAEL TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 81 ISRAEL MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 82 ISRAEL EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 83 ISRAEL HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 84 ISRAEL MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 85 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 86 SAUDI ARABIA SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 87 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 88 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 89 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 90 SAUDI ARABIA BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 91 SAUDI ARABIA BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 92 SAUDI ARABIA DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 93 SAUDI ARABIA RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 94 SAUDI ARABIA BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 95 SAUDI ARABIA IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 96 SAUDI ARABIA TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 97 SAUDI ARABIA MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 98 SAUDI ARABIA EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 99 SAUDI ARABIA HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 100 SAUDI ARABIA MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 101 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 102 U.A.E. SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 103 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 104 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 105 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 106 U.A.E. BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 107 U.A.E. BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 108 U.A.E. DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 109 U.A.E. RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 110 U.A.E. BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 111 U.A.E. IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 112 U.A.E. TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 113 U.A.E. MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 114 U.A.E. EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 115 U.A.E. HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 116 U.A.E. MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 117 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 118 EGYPT SERVICES IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 119 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 120 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY ORGANISATION SIZE, 2018-2027 (USD MILLION)

TABLE 121 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 122 EGYPT BUSINESS TO CUSTOMER IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 123 EGYPT BUSINESS TO BUSINESS IN DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT MODEL, 2018-2027 (USD MILLION)

TABLE 124 EGYPT DIGITAL EXPERIENCE PLATFORM MARKET, BY VERTICAL, 2018-2027 (USD MILLION)

TABLE 125 EGYPT RETAIL IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 126 EGYPT BFSI IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 127 EGYPT IT & TELECOM IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 128 EGYPT TRAVEL & HOSPITALITY IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 129 EGYPT MEDIA AND ENTERTAINMENT IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 130 EGYPT EDUCATION IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 131 EGYPT HEALTHCARE IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 132 EGYPT MANUFACTURING IN DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

TABLE 133 REST OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET, BY COMPONENT, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: MULTIVARIATE MODELING

FIGURE 11 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SEGMENTATION

FIGURE 12 INCREASED CUSTOMER RETENTION THROUGH DXP IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 PLATFORM IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET IN 2020 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET

FIGURE 15 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COMPONENT, 2019

FIGURE 16 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY DEPLOYMENT MODEL, 2019

FIGURE 17 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY ORGANISATION SIZE, 2019

FIGURE 18 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY APPLICATION, 2019

FIGURE 19 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY VERTICAL, 2019

FIGURE 20 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: SNAPSHOT (2019)

FIGURE 21 MIDDLE EAST AND AFRICA DIGITAL EXPERIENCE PLATFORM MARKET: BY COUNTRY (2019)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.