Middle East And Africa Dental Instruments Market

Market Size in USD Billion

CAGR :

%

USD

16.62 Billion

USD

28.34 Billion

2025

2033

USD

16.62 Billion

USD

28.34 Billion

2025

2033

| 2026 –2033 | |

| USD 16.62 Billion | |

| USD 28.34 Billion | |

|

|

|

|

Middle East and Africa Dental Instruments Market Size

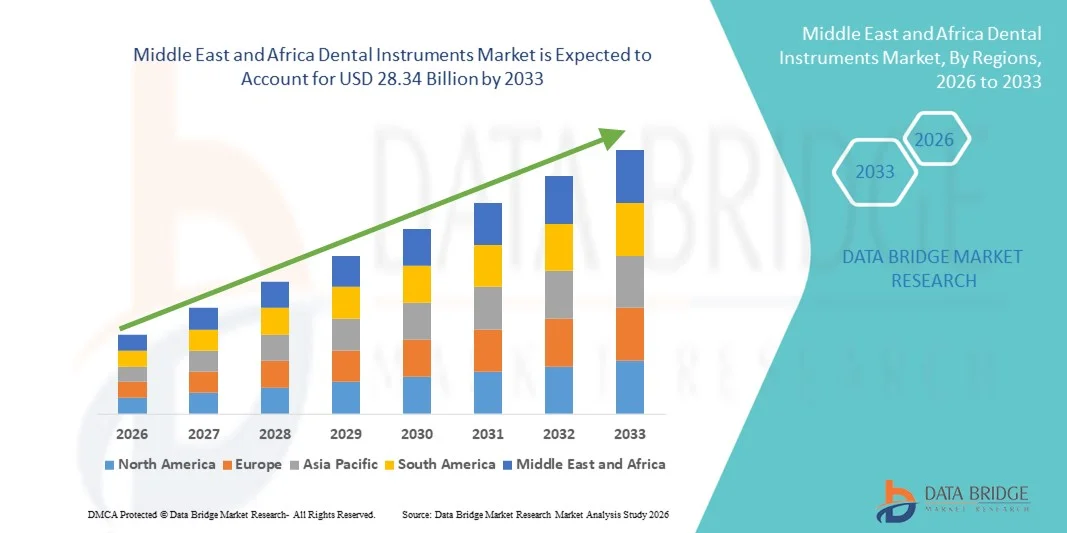

- The Middle East and Africa dental instruments market size was valued at USD 16.62 billion in 2025 and is expected to reach USD 28.34 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by the increasing prevalence of dental disorders, rising awareness regarding oral hygiene, and technological advancements in dental care equipment, leading to greater adoption of advanced dental instruments across clinics, hospitals, and specialty dental centers

- Furthermore, growing demand for cosmetic and restorative dental procedures, increasing healthcare expenditure, and continuous innovation in minimally invasive and precision-based dental instruments are establishing dental instruments as essential tools in modern dentistry. These converging factors are accelerating the uptake of Dental Instruments solutions, thereby significantly boosting the industry's growth

Middle East and Africa Dental Instruments Market Analysis

- Dental instruments, encompassing a wide range of diagnostic, preventive, restorative, and surgical tools, are fundamental components of modern oral healthcare delivery across hospitals, dental clinics, and academic institutes, owing to their critical role in accurate diagnosis, precision treatment, and improved patient outcomes

- The escalating demand for dental instruments is primarily fueled by the rising prevalence of dental caries, periodontal diseases, and tooth loss, along with increasing awareness of oral hygiene, growing demand for cosmetic dentistry procedures, and continuous technological advancements in minimally invasive and ergonomic instrument design

- Saudi Arabia dominated the Middle East and Africa dental instruments market with the largest revenue share of 29.4% in 2025, supported by substantial government investments in healthcare infrastructure under Vision 2030, expansion of public and private dental care facilities, and rising awareness regarding preventive and cosmetic dentistry. The country’s increasing demand for advanced restorative and surgical dental procedures, along with the growing presence of international dental equipment suppliers, continues to drive steady adoption of high-precision dental instruments

- The U.A.E. is expected to be the fastest-growing market for dental instruments in the Middle East and Africa during the forecast period, owing to strong growth in dental tourism, rising disposable incomes, increasing number of specialty dental clinics, and continuous adoption of technologically advanced dental equipment. The U.A.E. accounted for approximately 18.9% of the regional market share in 2025, and its focus on premium cosmetic and aesthetic dental treatments is further accelerating market expansion

- The Examination Instruments segment held the largest market revenue share of 34.8% in 2025, driven by their essential role in routine dental diagnostics and check-ups

Report Scope and Dental Instruments Market Segmentation

|

Attributes |

Dental Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Dental Instruments Market Trends

Rising Adoption of Advanced and Minimally Invasive Dental Technologies

- A significant and accelerating trend in the dental instruments market is the growing adoption of advanced, precision-based, and minimally invasive dental technologies across clinics and hospitals. Dental professionals are increasingly shifting toward high-performance instruments that enhance procedural accuracy, reduce patient discomfort, and improve overall treatment outcomes. This transition is being supported by technological advancements in rotary instruments, digital imaging-compatible tools, ergonomic handpieces, and laser-assisted dental devices

- For instance, several leading dental clinics in Germany and France have upgraded to next-generation electric handpieces and precision endodontic instruments that enable faster root canal procedures with improved accuracy and reduced chair time. Such upgrades are improving workflow efficiency while enhancing patient satisfaction

- The increasing focus on cosmetic dentistry, including veneers, teeth whitening, and smile correction procedures, is further accelerating the demand for specialized dental instruments designed for aesthetic precision

- In addition, the integration of digital dentistry solutions, such as CAD/CAM-supported restorative tools and implantology instrument kits, is enabling more accurate and customized treatment planning

- The growing emphasis on infection control and sterilization standards in European dental practices is also encouraging the adoption of high-quality stainless steel and autoclavable instruments that ensure safety and regulatory compliance

- This trend toward technologically advanced, ergonomic, and procedure-specific dental instruments is reshaping clinical practices across Europe, prompting manufacturers to continuously innovate and expand their product portfolios

Middle East and Africa Dental Instruments Market Dynamics

Driver

Increasing Prevalence of Dental Disorders and Growing Geriatric Population

- The rising prevalence of dental conditions such as dental caries, periodontal diseases, tooth loss, and oral infections is a major driver for the Dental Instruments market. Poor dietary habits, tobacco consumption, and inadequate oral hygiene practices continue to increase the burden of oral diseases across

- For instance, according to European oral health reports, a significant proportion of adults suffer from untreated dental caries and gum disease, prompting governments and healthcare providers to expand preventive and restorative dental services. This growing patient pool directly increases the demand for diagnostic, surgical, and restorative dental instruments

- The rapidly growing geriatric population in countries further contributes to market expansion, as older individuals are more prone to tooth decay, edentulism, and implant procedures

- Increasing awareness campaigns promoting preventive dental check-ups and early diagnosis are encouraging more frequent dental visits, thereby boosting procedural volumes and instrument demand

- Furthermore, the expansion of private dental clinics and cosmetic dentistry centers is increasing procurement of advanced dental surgical tools, implant kits, orthodontic instruments, and restorative devices

Restraint/Challenge

High Equipment Costs and Stringent Regulatory Requirements

- The high cost of advanced dental instruments, particularly specialized surgical kits, implantology systems, and digital-compatible tools, remains a significant challenge for small and mid-sized dental practices

- For instance, premium implant surgical instrument systems and precision rotary tools require substantial capital investment, limiting adoption among newly established clinics or independent practitioners

- Strict regulatory requirements under European medical device regulations (MDR) impose rigorous quality, safety, and documentation standards on manufacturers, increasing compliance costs and extending product approval timelines

- In addition, the need for continuous training and skill development to effectively use advanced dental instruments can create operational challenges for clinics lacking adequate technical expertise

- Economic uncertainties and reimbursement limitations in certain European countries may also reduce discretionary spending on cosmetic dental procedures, indirectly affecting the procurement of specialized dental instruments

- Overcoming these challenges through cost-effective product development, regulatory compliance strategies, and training initiatives will be essential for sustained market growth across the region

Middle East and Africa Dental Instruments Market Scope

The market is segmented on the basis of product, instrument type, end user, and distribution channel.

- By Product

On the basis of product, the Dental Instruments market is segmented into Perio/Oral Surgery, Hygiene, Diagnostic, Endodontic, Operative, and Others. The Hygiene segment dominated the largest market revenue share of 29.4% in 2025, driven by the rising global emphasis on preventive dental care and routine oral check-ups. Increasing awareness regarding oral health and gum diseases has significantly boosted the demand for scaling and cleaning instruments. Dental hygienists frequently use ultrasonic scalers, curettes, and polishing instruments in routine procedures, ensuring consistent demand. The growth of cosmetic dentistry and teeth whitening procedures further supports segment expansion. Government initiatives promoting preventive dental care programs have also strengthened hygiene instrument adoption. Technological advancements in ultrasonic and air-polishing devices have improved efficiency and patient comfort. The segment benefits from high procedure frequency compared to surgical treatments. Dental clinics increasingly invest in advanced hygiene tools to enhance operational productivity. The rise in dental insurance coverage for preventive services further stimulates demand. Expanding dental tourism markets also contribute to higher procedure volumes. Continuous product innovation and ergonomic instrument design improve practitioner comfort and efficiency. The growing aging population susceptible to periodontal diseases further solidifies its leading position.

The Endodontic segment is anticipated to witness the fastest CAGR of 8.6% from 2026 to 2033, fueled by the increasing prevalence of dental caries and root canal procedures worldwide. Rising consumption of sugary foods and beverages has led to higher incidences of pulp infections, driving procedural demand. Advancements in rotary endodontic systems and nickel-titanium instruments have significantly improved treatment precision and reduced procedure time. Growing awareness about tooth preservation rather than extraction is encouraging patients to opt for endodontic treatments. Increased access to dental care facilities in emerging economies further supports segment growth. Technological integration such as digital apex locators and endodontic motors enhances clinical outcomes. Dental professionals increasingly prefer minimally invasive root canal techniques, boosting instrument adoption. Expansion of dental clinics and specialty practices contributes to higher demand. The segment also benefits from rising dental insurance reimbursement policies. Educational training programs for advanced endodontic techniques increase practitioner adoption rates. Improved sterilization standards encourage replacement demand for endodontic files and tools. Growing geriatric populations prone to pulp-related disorders further accelerate growth momentum.

- By Instrument Type

On the basis of instrument type, the Dental Instruments market is segmented into Examination Instruments, Cutting Instruments, and Others. The Examination Instruments segment held the largest market revenue share of 34.8% in 2025, driven by their essential role in routine dental diagnostics and check-ups. Instruments such as mouth mirrors, explorers, and probes are fundamental tools used in nearly every dental visit. The increasing frequency of preventive dental examinations globally sustains consistent demand. Rising awareness regarding early diagnosis of oral diseases further strengthens segment growth. Technological improvements in diagnostic accuracy and ergonomic design enhance usability. Government-supported oral screening programs boost procurement across public healthcare facilities. Growing dental clinic networks worldwide contribute to higher instrument volumes. Examination tools are cost-effective yet indispensable, ensuring steady replacement cycles. Increased dental insurance penetration promotes regular patient visits. Expanding dental education institutions also procure examination kits in bulk. The rise in cosmetic dentistry consultations further increases diagnostic procedures. Continuous product innovation in anti-fog mirrors and lightweight materials improves efficiency and durability.

The Cutting Instruments segment is projected to witness the fastest CAGR of 9.1% from 2026 to 2033, supported by increasing restorative and surgical dental procedures. Rising cases of tooth decay and periodontal surgeries significantly drive demand for burs, chisels, and surgical blades. Technological advancements in carbide and diamond burs enhance cutting precision and longevity. Growing adoption of minimally invasive dentistry supports innovation in high-performance cutting tools. Dental implant procedures are increasing globally, further accelerating demand. Expansion of cosmetic and reconstructive dentistry contributes to higher usage rates. Improved sterilization and infection control standards promote frequent instrument replacement. Rising disposable income in emerging markets boosts access to advanced dental treatments. Continuous R&D investments enhance product efficiency and reduce chair time. Dental professionals increasingly seek durable and high-speed instruments for improved workflow. The growth of ambulatory dental surgical centers further supports expansion. Increased training in advanced surgical techniques accelerates adoption of specialized cutting tools.

- By End User

On the basis of end user, the Dental Instruments market is segmented into Hospitals, Clinics, Dental Laboratories, Scientific Research, and Others. The Clinics segment accounted for the largest market revenue share of 41.6% in 2025, driven by the high volume of outpatient dental procedures performed globally. Independent and group dental practices handle routine check-ups, cosmetic treatments, and minor surgeries. Increasing urbanization has led to a surge in private dental clinics. Clinics often invest in advanced instruments to enhance patient satisfaction and service efficiency. Rising dental insurance coverage encourages patients to seek clinical treatments. Growing dental tourism markets further boost clinic-based procedures. Technological upgrades in clinic infrastructure increase procurement rates. Flexible appointment systems in clinics attract higher patient footfall. The expansion of franchise-based dental chains strengthens purchasing power. Preventive and aesthetic dentistry trends further support consistent demand. Clinics typically maintain faster instrument replacement cycles compared to hospitals. The growth of specialized dental clinics contributes significantly to market dominance.

The Hospitals segment is expected to witness the fastest CAGR of 7.9% from 2026 to 2033, driven by the increasing integration of dental departments within multispecialty hospitals. Rising complex oral surgeries and trauma cases boost hospital-based dental procedures. Hospitals are equipped with advanced surgical infrastructure supporting high-end dental instruments. Growing healthcare investments in emerging economies strengthen hospital expansion. Increasing collaborations between dental specialists and medical professionals support integrated treatments. Government funding for public hospitals increases procurement budgets. Rising geriatric populations requiring surgical dental interventions further fuel growth. Hospitals often manage severe oral disease cases requiring advanced tools. Technological adoption in hospital settings enhances instrument demand. Expanding medical tourism also contributes to higher hospital admissions for dental treatments. Improved reimbursement frameworks for surgical procedures encourage patient inflow. Continuous modernization of healthcare infrastructure accelerates instrument procurement.

- By Distribution Channel

On the basis of distribution channel, the Dental Instruments market is segmented into Direct Tender, Third Party Distributors, and Retail Sales. The Third Party Distributors segment dominated the largest market revenue share of 46.2% in 2025, owing to their extensive supply networks and strong relationships with dental clinics and hospitals. Distributors provide a wide portfolio of brands and product options under one channel. They ensure timely delivery and after-sales service support. Bulk purchasing capabilities enable competitive pricing for end users. Expanding dental infrastructure in emerging regions strengthens distributor presence. Distributors often provide product demonstrations and technical training. Their established logistics systems enhance market penetration. Smaller clinics rely heavily on distributors for consistent supply. Inventory management services offered by distributors improve operational efficiency. Partnerships with international manufacturers expand product availability. Flexible credit policies further encourage procurement. Regional distribution networks ensure deeper rural and semi-urban market reach.

The Direct Tender segment is projected to register the fastest CAGR of 8.3% from 2026 to 2033, driven by increasing government and institutional procurement activities. Public hospitals and large dental chains prefer direct contracts for cost efficiency. Direct tenders allow bulk purchasing at negotiated prices, improving budget optimization. Growing healthcare infrastructure investments strengthen institutional buying power. Manufacturers increasingly participate in government bids to expand market share. Transparent procurement processes encourage large-scale purchases. Direct supply agreements reduce intermediary costs and improve margins. Expanding public oral healthcare programs further stimulate tender-based purchases. Institutional buyers demand advanced and standardized instruments. Large hospitals prefer long-term supplier contracts for consistency. Growing regulatory compliance requirements favor established manufacturers. The expansion of universal healthcare coverage further boosts direct procurement demand.

Middle East and Africa Dental Instruments Market Regional Analysis

- The Middle East and Africa Dental Instruments market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of dental disorders, rising demand for cosmetic and restorative procedures, and growing awareness regarding oral hygiene across both developed and emerging economies in the region. Rising healthcare expenditure, improving access to dental services, and expanding private healthcare participation are further contributing to steady market growth

- The expansion of public and private dental healthcare systems across Middle Eastern and African countries, along with continuous technological advancements in precision-based, ergonomic, and minimally invasive dental instruments, is fostering sustained market development. Increasing investments in advanced dental clinics, modernization of hospital infrastructure, and the gradual integration of digital dentistry solutions such as CAD/CAM systems and imaging technologies are supporting adoption across general dentistry, orthodontics, implantology, prosthodontics, and endodontics applications

- The region is witnessing consistent growth across hospitals, private dental clinics, and specialty dental centers, with modern dental instruments being incorporated into new facility setups as well as ongoing infrastructure upgrades. Government-led healthcare reforms and strategic partnerships with international dental equipment manufacturers are further strengthening market penetration across key countries

Saudi Arabia Dental Instruments Market Insight

The Saudi Arabia dental instruments market dominated the Middle East and Africa region with the largest revenue share of 29.4% in 2025 and is anticipated to grow at a noteworthy CAGR during the forecast period. This dominance is supported by substantial government investments in healthcare infrastructure under Vision 2030, rapid expansion of public and private dental care facilities, and rising awareness regarding preventive and cosmetic dentistry. The country’s increasing demand for advanced restorative, orthodontic, and surgical dental procedures, along with the growing presence of international dental equipment suppliers, continues to drive steady adoption of high-precision and technologically advanced dental instruments. Furthermore, improvements in healthcare accessibility and modernization initiatives are expected to further strengthen Saudi Arabia’s leading market position.

U.A.E. Dental Instruments Market Insight

The U.A.E. dental instruments market is expected to be the fastest-growing market in the Middle East and Africa during the forecast period. The U.A.E. accounted for approximately 18.9% of the regional market share in 2025, reflecting its expanding contribution to the overall regional landscape. Market growth is supported by strong growth in dental tourism, rising disposable incomes, an increasing number of specialty and cosmetic dental clinics, and continuous adoption of technologically advanced dental equipment. The country’s strong focus on premium cosmetic and aesthetic dental treatments, coupled with high standards of healthcare infrastructure and increasing investments in digital dentistry, is further accelerating market expansion across the U.A.E.

Middle East and Africa Dental Instruments Market Share

The Dental Instruments industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Straumann Group (Switzerland)

- Danaher Corporation (U.S.)

- 3M Company (U.S.)

- Henry Schein, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- GC Corporation (Japan)

- Hu-Friedy Mfg. Co., LLC (U.S.)

- Brasseler USA (U.S.)

- VDW GmbH (Germany)

- Septodont Holding (France)

- Ultradent Products, Inc. (U.S.)

- Coltene Group (Switzerland)

- Planmeca Group (Finland)

- A-dec Inc. (U.S.)

- Yoshida Dental Mfg. Co., Ltd. (Japan)

- NSK Ltd. (Japan)

- Morita Holdings Corporation (Japan)

- Osstem Implant Co., Ltd. (South Korea)

Latest Developments in Middle East and Africa Dental Instruments Market

- In March 2023, the Straumann Group unveiled a range of advanced digital implantology and orthodontic solutions at the International Dental Show (IDS) in Cologne, including the Straumann Falcon navigation system, Smilecloud design platform, and ClearCorrect mobile collaboration tools, enhancing clinical workflows and patient care across European dental practices. This launch highlighted Europe’s growing leadership in digital dentistry and adoption of integrated solutions to improve dental restoration and procedural accuracy

- In June 2024, Planmeca launched the Planmeca European Roadshow, a touring showcase of its latest dental technologies — including digital imaging systems, AI-powered Romexis software, and 3D printing solutions — visiting dental practices across multiple European countries to demonstrate cutting-edge equipment and support practitioner adoption of digital workflows. This initiative helped accelerate knowledge transfer and equipment uptake among dental professionals throughout Europe

- In June 2024, Danaher Corporation introduced a new line of ergonomically designed surgical hand instruments for dental professionals in Europe, aimed at improving comfort and efficiency during complex oral procedures and strengthening the company’s presence in high-growth markets such as Germany and France. This product launch highlighted the ongoing modernization of core dental instrument portfolios to enhance practitioner performance

- In June 2024, Dentsply Sirona also expanded its regional logistics network by establishing a dedicated distribution center in Milan, Italy, to enhance supply chain efficiency and ensure faster delivery of surgical instruments to both urban and rural dental clinics across Europe. This development demonstrated strategic investment to support market growth and timely access to essential dental instruments

- In September 2024, Mectron S.p.A. introduced a series of educational workshops across Germany and Switzerland focused on piezoelectric surgical techniques, aiming to increase awareness and adoption of its advanced piezoelectric dental instruments among specialist dental surgeons. These training campaigns supported deeper market penetration of innovative surgical tools in key European markets

- In November 2024, KaVo Dental (a division of Envista Holdings) opened a state-of-the-art surgical instrument production facility in the Netherlands, strengthening local manufacturing capabilities and enhancing supply reliability for high-quality instruments used across European dental practices. This investment underscored continued regional infrastructure growth in dental instrument production

- In March 2025, LM-Dental expanded its ergonomic hand instrument portfolio with new additions to the LM-Arte product line showcased at the IDS 2025 exhibition in Cologne, Germany, featuring the LM-Arte Replica Anterior instrument designed to simplify composite restorations in anterior dental work. This development underscored ongoing innovation in precision restorative instruments by European manufacturers to meet clinician needs for improved handling and restoration outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.