Market Analysis and Insights

Data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss. The various issues related to data integration are compelling the government and various authorities to increase the regulation due to data threats involved in data transfer. While data integration is increasing the use of hybrid data integration, also the increasing stringent regulations and compliance related to data integration are increasing the demand for data integration in the market. However, high data integration software cost hamper the growth of the market.

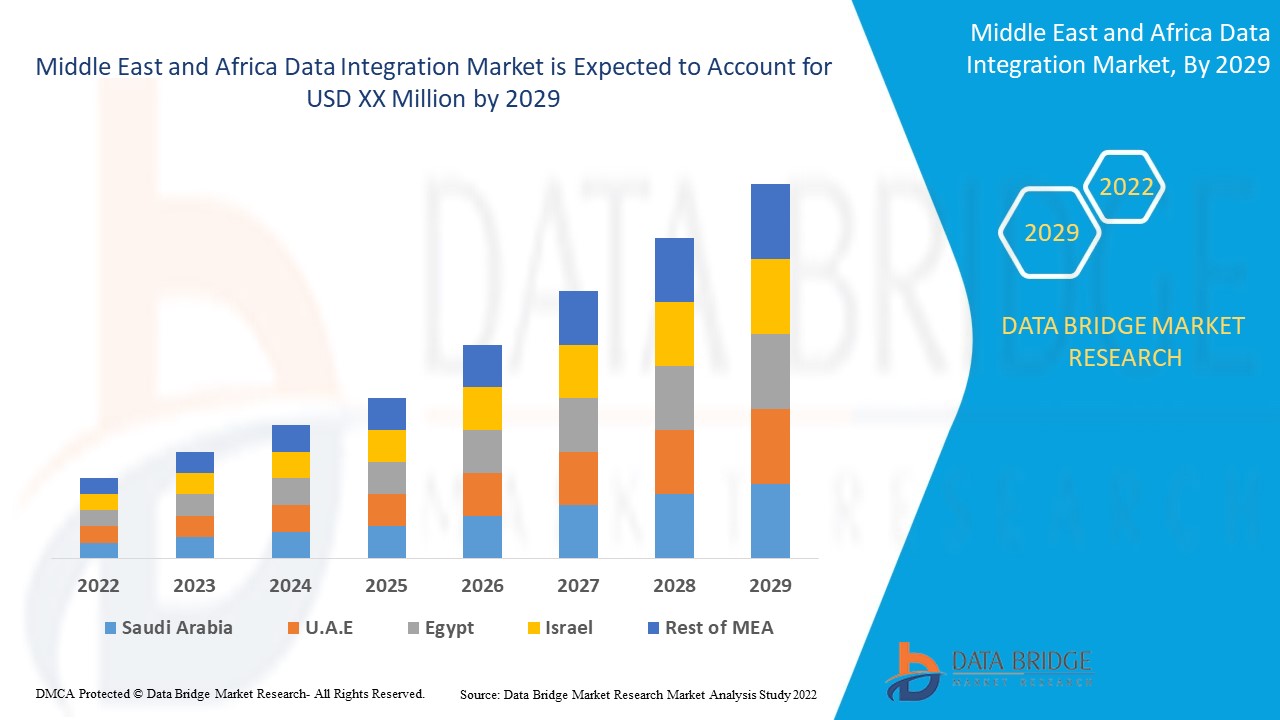

Data Bridge Market Research analyzes that the data integration market will grow at a CAGR of 13.5% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Offering (Tools, Services), Business Application (Sales, Marketing, Finance, Operations, Human Resources), Enterprise Size (Small Enterprise, Medium Enterprise, Large Enterprise), Deployment Mode (On-Premise, Cloud), Vertical (Manufacturing, Healthcare & Life Sciences, IT & Telecom, Media & Entertainment, Retail & Consumer Goods, BFSI, Energy & Utilities, Government & Defence, and Others) |

|

Countries Covered |

U.A.E, Saudi Arabia, Israel, South Africa, Egypt and rest of Middle East and Africa |

|

Market Players Covered |

Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation ( Subsidiary of Hitachi, Ltd.), Salesforce, Inc. , Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. among others |

Market Definition

Data integration is the process of combining data from different sources into a single, unified view. Integration begins with the ingestion process, and includes steps such as cleansing, ETL mapping, and transformation. Data integration ultimately enables analytics tools to produce effective, actionable business intelligence. Organizations are moving to become more data-driven, yet data sources are more distributed and fragmented than ever before. By connecting systems that contain valuable data and integrating them across departments and locations, organizations are able to achieve one-point data storage and access, data availability, and data quality.

Data Integration Market Dynamics

Drivers

- Increasing use of hybrid data integration

Hybrid data integration has been in use lately due to its ability to connect applications, data files, and business partners across cloud and on-premises systems. The purpose of using hybrid data for data integration is because hybrid data integration primarily focuses on deployment model element. Data integration has become a major network and data transfer solution from source to destination. Every year billions of dollars are being transferred and those data are being protected with data integration software implemented in systems.

- Increasing stringent regulations and compliance related to data integration

Data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss. The various issues related to data integration are compelling the government and various authorities to increase the regulation due to data threats involved in data transfer.

- Growing demand for data integration tools and software

Financial institution, information technology, hospitals, telecom, military and defence industries deal with day-to-day data transfer which requires more protection due to privacy, sensitivity and confidentiality of data. Data integration tools used in financial institutions leverage the power of data in motion to drive personalized customer experiences, proactively mitigate cyber risks and drive regulatory compliances.

Tools such as data lakes are used in data integration for real-time analytics and fraud detection. Data are integrated into modern cloud-based services for data visualization and reporting. These tools also helps in analysis of transaction in real-time to detect fraudulent transaction and send notifications.

- Growing demand for application based integration

Application based integration has become an important part of data integration systems. Industry such as banking, medical, IT & Telecom, manufacturing, retail & consumer goods, media and entertainment prefer application based integration methods in order to keep an eye out for any suspicious transactions, financial crimes from customers. Application integration software combines and enhances data flows between two separate software’s applications. Businesses often use application integration software’s to create a bridge between a new cloud application and older application hosted on-premise, enabling a wide range of independently designed application to work together.

Opportunities

- Increasing adoption of data integration by various departments such as Operations, Finance

Data integration is the autonomous or semi-autonomous system that analyse data or content using sophisticated techniques and tools which is quite different from the traditional business intelligence. These analytics gives a deeper analysis with which the system predicts and generate recommendations. Advanced analytics in data integration solutions can play vital role in detecting transaction activities, data storage from different sources, among others. Moreover, advanced analytics can play a vital role in advanced transaction monitoring.

- Integration of AI, ML in developing data integration solutions

Data integration has become a very important data transferring method for analysis of data by companies to derive meaningful analysis from historic raw data. According to the survey, data integration is estimated to be used by 65% of companies globally. There are various other issues such as data loss, signal distortion, storage capacity of platforms used for data integration.

Restraint/Challenge

- High data integration software cost

Data integration related to software solution should ensure that a device installed with different integration softwares is able to detect suspicious activities associated with transferring virus involving data, fraud, and terrorist funding and report to the appropriate authorities. A data integration software solution should not only focus on the effectiveness of internal systems but also needs focus on detection capabilities. The key components of data integration systems are data mitigation, enterprise application integration, master data management, and data aggregation. Designing data integration systems can be a challenging task as the complexity involved in designing multiple modules is very high.

COVID-19 Impact on Data Integration Market

The confinement and lockdown period during the COVID-19 crisis has shown the importance of good, reliable internet connectivity at large industry. A high-speed connection at large industry has opened up the possibility of efficient teleworking, maintaining entertainment habits and keeping close contacts. Data traffic in all networks has increased significantly during the pandemic period. COVID-19 has increased the demand of data integration in the market. Fixed broadband networks have gained immense popularity for keeping the world connected. Traffic grew 30-40% overnight, driven primarily by working from large industry (video conferencing and collaboration, VPNs), learning from large industry (video conferencing and collaboration, e-learning platforms) and entertainment (online gaming, video streaming, social media). Moreover, limited supply and shortage of software has significantly affected data integration in the market. The flow of new equipments, such as computers, servers, switches, and Customer Premise Equipment (CPE) has either fully stopped or is delayed, with lead times of up to 12 months for different items.

Manufacturers are making various strategic decisions to bounce back post COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the data integration. With this, the companies will bring advanced data integration to the market.

For instance,

- In June 2022, salesforce expands mulesoft, a unified solution for automation, integration and APIs to easily automate workflow. This solution was expanded in order to integrate complex systems and data. This solution expansion took place for easy to standardize automation and integration process

Thus, COVID-19 has increased the demand of data integration in the market but limited supply and shortage of software has significantly affected data integration process in the market.

Recent Developments

- In June 2022, TIBCO Software Inc., relaunched its platform TIBCO Analytics Forum (TAF) for their consumer base. The platform will help the enterprises to connect, unify and confidently predict business outcomes. The platform will help in data integration and expansion of their solution portfolio. This will attract more new customers for the company

- In May 2022, Informatica Inc launched platform Intelligent Data Management Cloud (IDMC) for Financial Services to boost data life cycle of enterprises. The solution was launched by the company to enhance customer experience in terms of data. The company will be able to expand its solution portfolio for new customers

Global Data Integration Market Scope

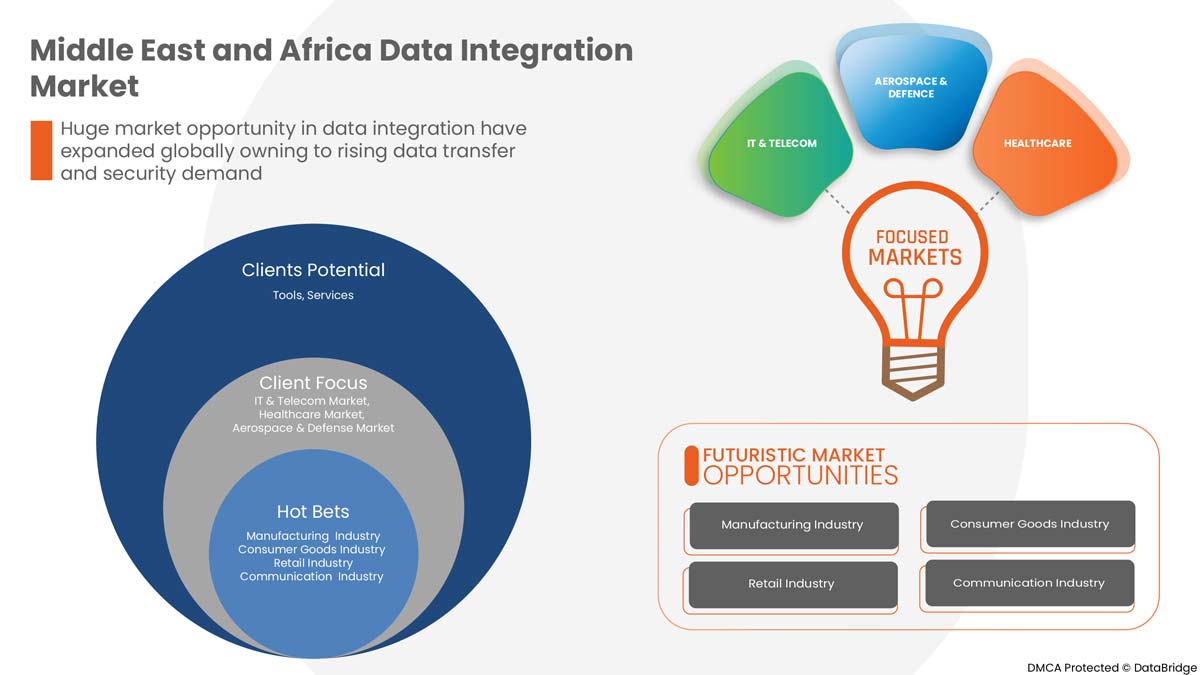

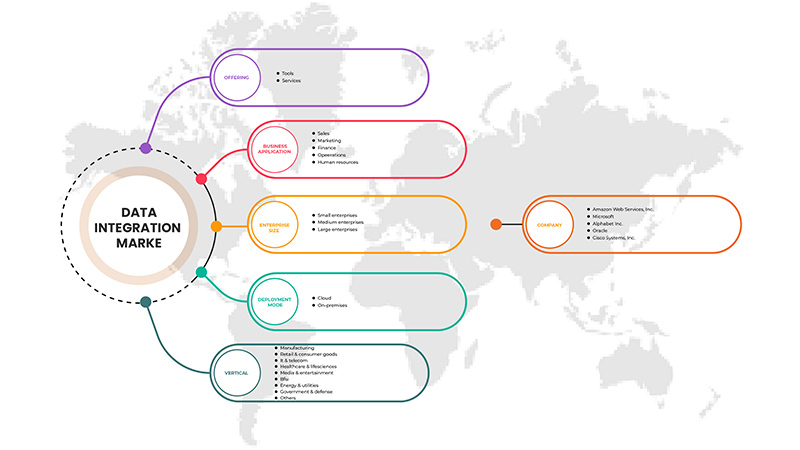

The data integration market is segmented on the basis of offering, business application, enterprise size, deployment mode and vertical.

Offering

- Tools

- Services

On the basis of offering, the global data integration market is segmented into tools and services.

Business Application

- Sales

- Marketing

- Operations

- Finance

- Human Resources

On the basis of business application, the global data integration market is segmented into sales, marketing, operations, finance and human resources.

Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small Enterprises

On the basis of enterprise size, the global data integration market is segmented into large enterprises, medium enterprises and small enterprises.

Deployment Mode

- Cloud

- On-Premises

On the basis of deployment model, the global data integration market is segmented into cloud and on-premises.

Vertical

- IT& Telecom

- Healthcare & Life Sciences

- Retail & Consumer Goods, Media & Entertainment

- BFSI, Energy & Utilities

- Government & Defense

- Others

On the basis of vertical, the global data integration market is segmented into IT & telecom, healthcare & life sciences, retail & consumer goods, media & entertainment, BFSI, energy & utilities, government & defense, and others.

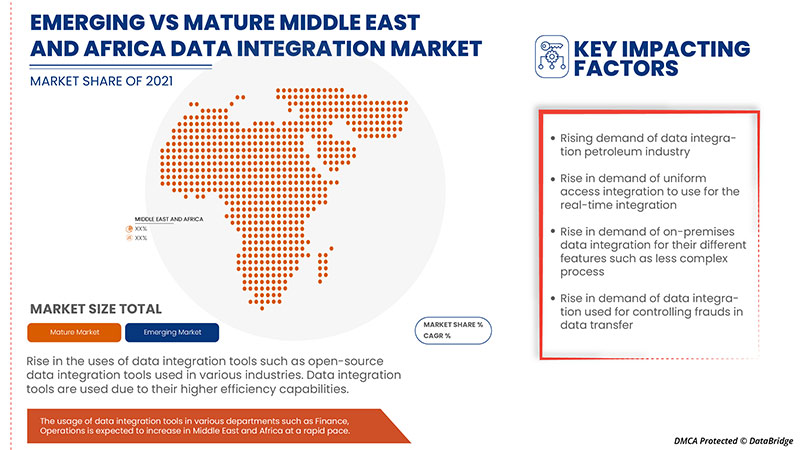

Middle East and Africa Data Integration Market

The data integration market is analyzed and market insights and trends are provided on the basis of offering, business application, enterprise size, deployment mode and vertical as referenced above.

Middle East and Africa data integration market covers countries such as U.A.E, Saudi Arabia, Israel, South Africa, Egypt and rest of Middle East and Africa.

U.A.E is expected to dominate the Middle East and Africa data integration market as hybrid data integration has been in use lately due to its ability to connect applications, data files and business partners across cloud and on-premises systems and also data integration compliance program is a set of regulations or rules that a financial institution, companies such as large enterprises, small enterprises and medium enterprises must follow to prevent data loss and the growth of the country in Middle East and Africa data integration market.

The country section of the data integration market report also provides individual market impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Data Integration Market Share Analysis

The Data integration market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the Data integration market.

Some of the major players operating in the Middle East and Africa data integration market are Microsoft, Amazon Web Services, Inc. Alphabet Inc, SAS Institute Inc., IBM Corporation, Oracle, SAP SE, Informatica Inc., Cisco Systems, Inc., Hitachi Vantara Corporation ( Subsidiary of Hitachi, Ltd.), Salesforce, Inc. , Precisely, TALEND, Denodo Technologies, TIBCO Software Inc., Actian Corporation, KPMG LLP, Software AG, Adeptia, SnapLogic. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA DATA INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS

4.2 CASE STUDIES

4.2.1 ARCHITECTURE CREATION & VALIDATION

4.3 TECHNOLOGICAL TRENDS

4.3.1 RISE OF HYBRID INTEGRATION

4.3.2 BLOCKCHAIN IN DATA AND ANALYTICS

4.3.3 APIS AT THE CENTER STAGE OF BUSINESS PERFORMANCE

4.3.4 PROLIFERATION OF IOT

4.4 VALUE CHAIN FOR MIDDLE EAST & AFRICA DATA INTEGRATION MARKET

5 REGULATIONS

5.1 OVERVIEW

5.1.1 EUROPE

5.1.2 CHINA

5.1.3 INDIA

5.1.4 AUSTRALIA

6 REGIONAL SUMMARY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE USE OF HYBRID DATA INTEGRATION

7.1.2 INCREASE IN THE STRINGENT REGULATIONS AND COMPLIANCE RELATED TO DATA INTEGRATION

7.1.3 GROWTH IN THE DEMAND FOR DATA INTEGRATION TOOLS AND SOFTWARE

7.1.4 GROWTH IN THE DEMAND FOR APPLICATION-BASED INTEGRATION

7.1.5 RISE IN BIG DATA AND CLOUD COMPUTING TECHNOLOGIES

7.2 RESTRAINTS

7.2.1 HIGH DATA INTEGRATION SOFTWARE COST

7.2.2 LACK OF STORAGE CAPACITY IN CLOUD

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE ADOPTION OF DATA INTEGRATION BY VARIOUS DEPARTMENTS SUCH AS OPERATION AND FINANCE

7.3.2 INTEGRATION OF AI AND ML IN DEVELOPING DATA INTEGRATION SOLUTIONS

7.4 CHALLENGES

7.4.1 HIGH COMPLEXITY INVOLVED IN DATA INTEGRATION

7.4.2 DATA THREATS INVOLVED IN DATA INTEGRATION SOFTWARE

8 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY OFFERING

8.1 OVERVIEW

8.2 TOOLS

8.3 SERVICES

8.3.1 PROFESSIONAL SERVICES

8.3.2 MANAGED SERVICES

9 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION

9.1 OVERVIEW

9.2 SALES

9.3 MARKETING

9.4 FINANCE

9.5 OPERATIONS

9.6 HUMAN RESOURCES

10 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISE

10.3 MEDIUM ENTERPRISE

10.4 SMALL ENTERPRISE

11 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE

11.1 OVERVIEW

11.2 CLOUD

11.3 ON-PREMISES

12 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 IT & TELECOM

12.2.1 TOOLS

12.2.2 SERVICES

12.2.2.1 PROFESSIONAL SERVICES

12.2.2.2 MANAGED SERVICES

12.3 MANUFACTURING

12.3.1 TOOLS

12.3.2 SERVICES

12.3.2.1 PROFESSIONAL SERVICES

12.3.2.2 MANAGED SERVICES

12.4 HEALTHCARE & LIFESCIENCES

12.4.1 TOOLS

12.4.2 SERVICES

12.4.2.1 PROFESSIONAL SERVICES

12.4.2.2 MANAGED SERVICES

12.5 MEDIA & ENTERTAINMENT

12.5.1 TOOLS

12.5.2 SERVICES

12.5.2.1 PROFESSIONAL SERVICES

12.5.2.2 MANAGED SERVICES

12.6 RETAIL & CONSUMER GOODS

12.6.1 TOOLS

12.6.2 SERVICES

12.6.2.1 PROFESSIONAL SERVICES

12.6.2.2 MANAGED SERVICES

12.7 ENERGY & UTILITIES

12.7.1 TOOLS

12.7.2 SERVICES

12.7.2.1 PROFESSIONAL SERVICES

12.7.2.2 MANAGED SERVICES

12.8 BFSI

12.8.1 TOOLS

12.8.2 SERVICES

12.8.2.1 PROFESSIONAL SERVICES

12.8.2.2 MANAGED SERVICES

12.9 GOVERNMENT & DEFENSE

12.9.1 TOOLS

12.9.2 SERVICES

12.9.2.1 PROFESSIONAL SERVICES

12.9.2.2 MANAGED SERVICES

12.1 OTHERS

12.10.1 TOOLS

12.10.2 SERVICES

12.10.2.1 PROFESSIONAL SERVICES

12.10.2.2 MANAGED SERVICES

13 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY REGION

13.1 MIDDLE EAST AND AFRICA

13.1.1 U.A.E

13.1.2 SAUDI ARABIA

13.1.3 ISRAEL

13.1.4 SOUTH AFRICA

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AMAZON WEB SERVICES, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 SOLUTION PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ALPHABET INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 SOLUTION PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 ORACLE CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 INDUSTRIAL SOLUTION PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 CISCO SYSTEMS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 SOLUTION PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 ACTIAN CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ADEPTIA

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 DENODO TECHNOLOGIES

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 HITACHI VANTARA CORPORATION (SUBSIDIARY OF HITACHI, LTD.)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 IBM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 SOLUTION PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 INFORMATICA INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 KPMG LLP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 PRECISELY

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 SALESFORCE, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 SAS INSTITUTE INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT & SOLUTION PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 SAP SE

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT & SERVICES PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 SOFTWARE AG

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 SNAPLOGIC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 TALEND

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 TIBCO SOFTWARE INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA TOOLS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SALES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA MARKETING IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA FINANCE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA OPERATIONS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA HUMAN RESOURCES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA LARGE ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEDIUM ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SMALL ENTERPRISE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA CLOUD IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ON-PREMISES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA IT & TELECOM IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA MANUFACTURING IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA BFSI IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA OTHERS IN DATA INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 72 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.A.E DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 77 U.A.E IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.A.E MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 U.A.E MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 U.A.E BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.A.E GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.A.E SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 SAUDI ARABIA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 96 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SAUDI ARABIA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SAUDI ARABIA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 99 SAUDI ARABIA DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 100 SAUDI ARABIA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 101 SAUDI ARABIA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SAUDI ARABIA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SAUDI ARABIA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SAUDI ARABIA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 SAUDI ARABIA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 SAUDI ARABIA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 SAUDI ARABIA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 SAUDI ARABIA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SAUDI ARABIA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SAUDI ARABIA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 ISRAEL DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 120 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 ISRAEL RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 ISRAEL ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 ISRAEL BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 ISRAEL GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 ISRAEL OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 ISRAEL SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 SOUTH AFRICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 144 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 SOUTH AFRICA DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 SOUTH AFRICA DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 147 SOUTH AFRICA DATA INTEGRATION MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 148 SOUTH AFRICA DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 149 SOUTH AFRICA IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 SOUTH AFRICA MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 SOUTH AFRICA HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SOUTH AFRICA MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SOUTH AFRICA RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SOUTH AFRICA ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SOUTH AFRICA BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SOUTH AFRICA GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 165 SOUTH AFRICA OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 SOUTH AFRICA SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 EGYPT DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 168 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 EGYPT DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 EGYPT DATA INTEGRATION MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 171 EGYPTL DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 172 EGYPT DATA INTEGRATION MARKET, BY VERTICAL, 2020-2029 (USD MILLION)

TABLE 173 EGYPTL IT & TELECOM IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 EGYPT MANUFACTURING IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 EGYPT HEALTHCARE & LIFESCIENCES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 EGYPT MEDIA & ENTERTAINMENT IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 EGYPT RETAIL & CONSUMER GOODS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 EGYPT ENERGY & UTILITIES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 EGYPT BFSI IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 EGYPT GOVERNMENT & DEFENSE IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 188 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 EGYPT OTHERS IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 EGYPT SERVICES IN DATA INTEGRATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 REST OF MIDDLE EAST & AFRICA DATA INTEGRATION MARKET, BY OFFERING, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: SEGMENTATION

FIGURE 11 RISE IN DEMAND FOR DATA INTEGRATION TOOLS IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA DATA INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TRANSCEIVERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA DATA INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA DATA INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA DATA INTEGRATION MARKET

FIGURE 15 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: BY OFFERING, 2021

FIGURE 16 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: BY BUSINESS APPLICATION, 2021

FIGURE 17 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 18 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 19 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: BY VERTICAL, 2021

FIGURE 20 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA DATA INTEGRATION MARKET: BY OFFERING (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA DATA INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Data Integration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Data Integration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Data Integration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.