Middle East and Africa Cosmetics Market Analysis and Size

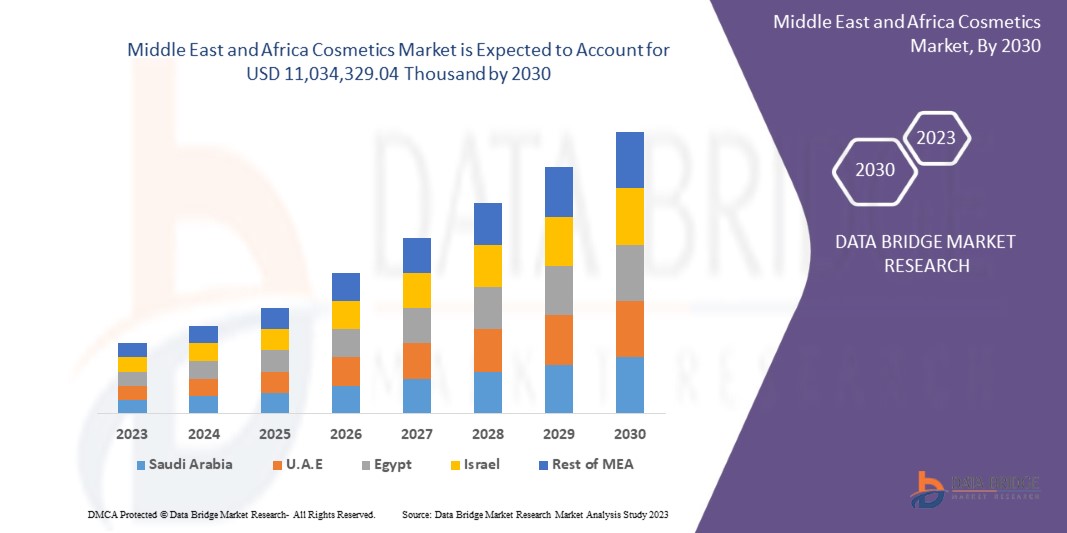

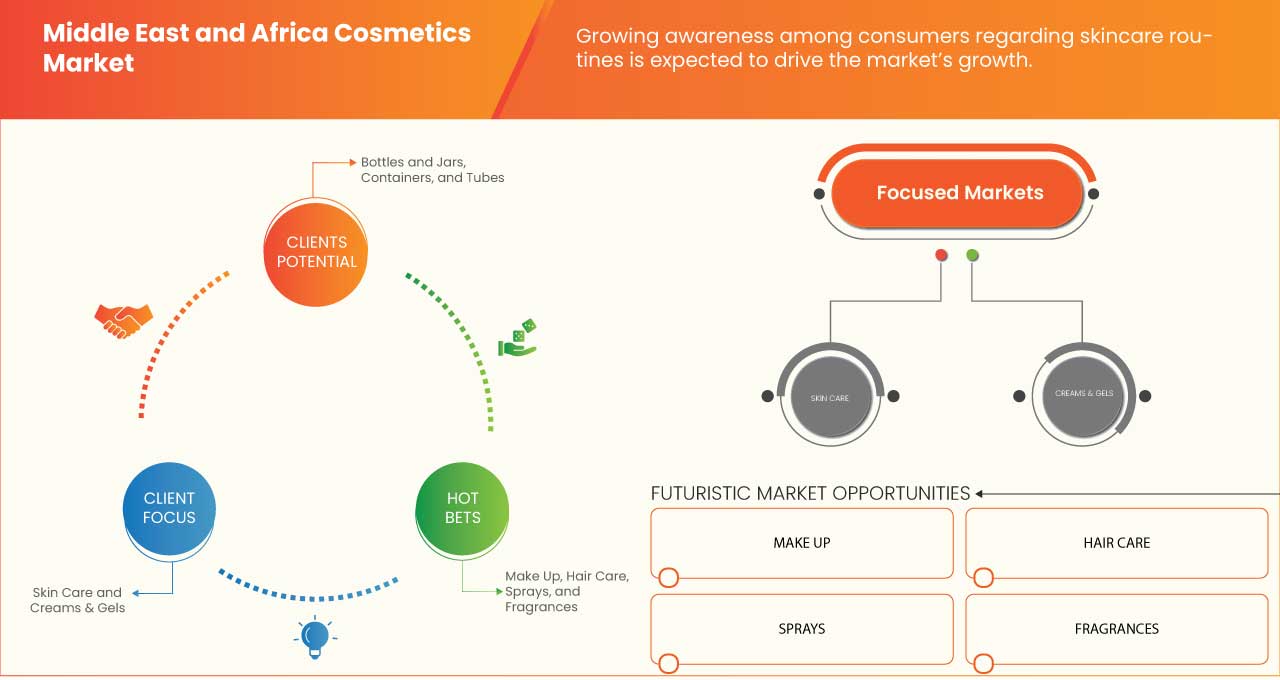

The cosmetics market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.8% in the forecast period of 2023 to 2030 and is expected to reach USD 11,034,329.04 thousand by 2030. The rising awareness regarding skincare routines has been the major driver for the Middle East and Africa cosmetics market.

The cosmetics market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Product Type (Skin Care, Hair Care, Make Up, Fragrances, and Others), Nature (Inorganic and Organic), Category (Mass Product, Premium Product, and Professional Product), Packaging Type (Bottles and Jars, Tubes, Containers, Pumps and Dispensers, Sticks, Aerosol Cans, Pouches, and Blisters & Strip Packs), Distribution Channel (Offline and Online), Application (Women and Men) |

|

Countries Covered |

Saudi Arabia, United Arab Emirates, Egypt, Israel, South Africa, and Rest of Middle East and Africa |

|

Market Players Covered |

Procter & Gamble , L’Oréal S.A. , The Estée Lauder Companies Inc. , Coty Inc. , Shiseido Company, Limited , Colgate-Palmolive Company , Kao Corporation , Beiersdorf Group , Unilever , Revlon, Inc. , and Henkel AG & Co. KGaA among others |

Market Definition

Cosmetics are largely designed to be used or applied to enhance a personage's beauty and physical appearance. Chiefly, these cosmetic products are manufactured from artificial sources. Cosmetic products are mainly intended for external cleaning, perfumes, changing appearances, correcting body odor, protecting skin, and conditioning. From antiperspirants, fragrances, make-up, and shampoos to soaps, sunscreens, toothpaste, cosmetics, and personal care products are essential in all consumer life stages.

Cosmetics are manufactured using mixtures of chemical compounds; these compounds are either derived from natural sources or are artificial. Cosmetics can be for personal use for retail buyers or professional uses in the beauty and entertainment industry. In the entertainment industry, cosmetics are heavily used for enhancing one's natural features, adding color to a person's face, and can be used to change the appearance of the face entirely to resemble a different person, creature, or object.

There is an increased pressure to enhance one appearance as it signifies confidence among the people with the increasing standard of living in the developed economies. This has led the cosmetics industry to grow in the recent past. Government agencies regulate cosmetics as they might contain harmful chemicals and ingredients for the human body and the environment.

Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Rising Awareness Regarding Skin Care Routine

The cosmetics market has recently benefitted from the renewed focus on hygiene and self-care routines. The increasing demand for self-care products to combat stress & anxiety, and the tendency of consumers to increase their engagement in self-care routines to feel good and look better, has been the major driver for the cosmetics market. The interest in natural and organic ingredients has further increase the awareness and demand for skin care products such as face masks, body scrubs, toners, and serums among users, as it emphasizes changing their existing skin care.

The focus of the skin care industry has been on women, and the market was infused with women-centric products for the longest time. The major factors leading to market growth include surging scrutiny of product ingredients, new product launches, and the addition of an anti-aging range in the skin care segment. Also, in recent years, social media, e-commerce, and the necessity to look good have gained acceptance and popularity among men. This has increased the number of products focused on men’s skincare, enhancing the demand in the overall cosmetics market.

- Innovative Product Branding and Advertising Strategies is Fueling Demand for Cosmetics

The advent of digital technologies has influenced consumers' buying behavior in the cosmetics market across the Middle East and African region. The major cosmetics brands such as L'Oréal S.A. and others in the market are leveraging digital technologies to enable consumers to experience brands in an entirely new way, as the modern consumer expects a two-way conversation to connect more with the brand. Technological advancements, innovative branding, and advertising strategies have made it easy for beauty lovers to access trends, looks, content, and experiences.

Major beauty companies and brands continuously innovate their product branding and advertising strategies to reach a wider audience base and increase customer engagement. Many brands use social media platforms to enhance brand reach, which is the major strategy in recent years. This has enabled the brands to increase their user base and popularity in the cosmetics market, which is expected to drive growth.

- Availability of Customized Beauty & Skincare Products

Beauty companies and manufacturers continuously introduce customization and digitalization in cosmetic products, attributed to the increasing demand for personalized skin care. Consumers are becoming aware of the beauty and skincare products in the market. The technological advancements in the industry are leading consumers away from the cosmetic product just made for the generic skin type. Consumers are becoming extremely careful about choosing the product according to their skin type. As a result, beauty companies focus on catering to such consumers with ideal products, enabling them to increase consumer engagement in the market. Consumers are concerned about their need for skin care, hair care, and color cosmetics. The major players are integrating technology, science, and beauty with e-commerce to enable consumers to shop for products customized to their needs.

Opportunities

- Increasing Developments in Sustainable Cosmetics

Sustainability is becoming a key priority for several brands across the ever-evolving beauty industry. Companies are constantly focusing on moving forward with greener initiatives without compromising the product's quality and reach to appeal to a growing population of eco-conscious consumers. Many major players are making efforts and setting goals to reach carbon neutrality. Companies are actively involved in reducing the environmental impact of their packaging processes across the lifecycle and using eco-friendly ingredients. The beauty industry is witnessing valuable collaborations and partnerships for exploring alternative materials and more responsible concepts in packaging design.

- Increasing Demand for Vegan Beauty Products

In recent years, the adoption of an alternative vegan lifestyle among the world population has increased. People are taking up the lifestyle to improve their overall health while benefitting their bodies inside and out. Such developments are seen influencing the cosmetic industry also. Consumers are actively trying to search and switch to vegan cosmetic products as awareness increases. This can be attributed to the easy accessibility to online information about benefits and environmental impact.

Consumer awareness regarding animal products such as hair, fur, and others in cosmetics brands is increasing. Consumers find cruelty towards animals unethical and are spreading awareness against this act. This has set the trend in the Middle East and Africa cosmetics marketplace to embrace plant-based personal care products. Major cosmetics manufacturing companies across the globe realize the importance of making products that use mineral- or plant-based ingredients rather than manufacturing products infused with animal-extracted ingredients.

Restraint

- Side Effects Due to the Use of Synthetic Chemicals

There are many instances in the beauty industry where the users have claimed not getting the result as projected by the brand. Substandard quality, grade, and harmful compositions can result in allergies, discoloration, texture alteration, or permanent damage to the skin or hair. Increased usage and unregulated production have led to a steep rise in side effects suffered by consumers.

It is important for the consumer to thoroughly inspect and study the cosmetic product before using it, as it may contain ingredients not suited for one’s skin or to which one is allergic. The product's chemical may get absorbed into the skin and cause irritation and other side effects. The increasing side effect regarding such instances may restrain the market's growth.

Challenge

- Increasing Movement Across Consumers for Transparency and Traceability of Ingredients Used in Products

End-to-end transparency and traceability are gaining focus as consumers become more educated and aware of the cosmetic product they trust and adopt. The challenge lies with the manufacturers in making this information available to the consumers to advance in safety, quality, and sustainability in the market.

With a clean beauty movement on the edge of the industry, it has become more important for consumers to understand the product and its source. Thus, a clean product can easily be problematic via ecological harm and unethical practices linked to its ingredient sourcing.

This poses a challenge for many market players claiming to provide sustainable solutions to make their consumers aware of their ingredients origins if they are truly serious about sustainability.

Recent Development

- In September 2021, The Estée Lauder Companies Inc. announced the launch of redesigned bottles under its Clinique brand. This new product enabled the company to reduce production waste by 10-15%. According to the company, the co-development of the Clinique bottle represented an important step in the company’s push to improve packaging design.

Middle East and Africa Cosmetics Market Scope

The cosmetics market is categorized based on product type, nature, category, packaging type, distribution channel, and application. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Skin Care

- Hair Care

- Make Up

- Fragrances

- Others

On the basis of product type, the market is segmented into skin care, hair care, make up, fragrances, and others.

Nature

- Inorganic

- Organic

On the basis of nature, the market is segmented into inorganic and organic.

Category

- Mass Product

- Premium Product

- Professional Product

On the basis of category, the market is segmented into mass product, premium product, and professional product.

Packaging Type

- Bottles and Jars

- Tubes

- Containers

- Pumps & Dispensers

- Sticks

- Aerosol Cans

- Pouches

- Blisters & Strip Packs

On the basis of packaging type, the market is segmented into bottles and jars, tubes, containers, pumps & dispensers, sticks, aerosol cans, pouches, and blisters & strip packs.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the market is segmented into offline and online.

Application

- Women

- Men

On the basis of application, the market is segmented into women and men.

Middle East and Africa Cosmetics Market Regional Analysis/Insights

The cosmetics market is segmented on the basis of product type, nature, category, packaging type, distribution channel, and application.

The countries covered in the market are Saudi Arabia, United Arab Emirates, Egypt, Israel, South Africa, and Rest of Middle East and Africa.

Saudi Arabia is expected to dominate the market due to its diversity and dynamic market range, with enormous demands for various products. Moreover, the need for cosmetics is huge in countries including U.A.E. and Egypt due to a large consumer base and the presence of top market players.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Cosmetics Market Share Analysis

The cosmetics market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the cosmetics market.

Some of the major market players operating in the market are Procter & Gamble, L’Oréal S.A., The Estée Lauder Companies Inc., Coty Inc., Shiseido Company, Limited, Colgate-Palmolive Company, Kao Corporation, Beiersdorf Group, Unilever, Revlon, Inc., and Henkel AG & Co. KGaA, and others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 CONSUMER TRENDS AND PREFERENCES

4.3 FACTORS AFFECTING BUYING DECISION

4.4 CONSUMER PRODUCT ADOPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING AWARENESS REGARDING SKIN CARE ROUTINE

5.1.2 INNOVATIVE PRODUCT BRANDING AND ADVERTISING STRATEGIES IS FUELLING DEMAND FOR COSMETICS

5.1.3 AVAILABILITY OF CUSTOMIZED BEAUTY & SKINCARE PRODUCTS

5.1.4 CHANGING LIFESTYLE AND INCREASING URBAN POPULATION

5.1.5 SURGE IN E-COMMERCE FUELING THE DEMAND OF COSMETICS PRODUCTS

5.2 RESTRAINTS

5.2.1 SIDE EFFECTS DUE TO THE USE OF SYNTHETIC CHEMICALS

5.2.2 INCREASING TRENDS IN PRODUCT RECALLS

5.3 OPPORTUNITIES

5.3.1 INCREASING DEVELOPMENTS IN SUSTAINABLE COSMETICS

5.3.2 INCREASING DEMAND FOR VEGAN BEAUTY PRODUCTS

5.3.3 TECHNOLOGICAL INTEGRATION FOR OFFERING PERSONALISED BEAUTY EXPERIENCE

5.3.4 INCREASING DEMAND FOR COSMETICS AMONG AGING POPULATION

5.4 CHALLENGES

5.4.1 INCREASING MOVEMENT ACROSS CONSUMERS FOR TRANSPARENCY AND TRACEABILITY OF INGREDIENTS USED IN PRODUCTS

5.4.2 ISSUES IN PRODUCT DELIVERY LIFECYCLE ACROSS SUPPLY CHAINS

6 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY COUNTRY

6.1 SAUDI ARABIA

6.2 UNITED ARAB EMIRATES

6.3 EGYPT

6.4 ISRAEL

6.5 SOUTH AFRICA

6.6 REST OF MIDDLE EAST AND AFRICA

7 COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

7.1.1 PARTNERSHIP

7.1.2 ACQUISITION

7.1.3 NEW PRODUCT LAUNCH

7.1.4 EXPANSION

7.1.5 NEW PLATFORM LAUNCH

7.1.6 PATENTS

7.1.7 SUSTAINABILITY INITIATIVES

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 L’ORÉAL S.A.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 THE ESTÉE LAUDER COMPANIES INC.

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 UNILEVER

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 PRODUCT PORTFOLIO

9.3.4 RECENT DEVELOPMENTS

9.4 PROCTER & GAMBLE

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENTS

9.5 BEIERSDORF GROUP

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 PRODUCT PORTFOLIO

9.5.4 RECENT DEVELOPMENTS

9.6 COLGATE-PALMOLIVE COMPANY

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENTS

9.7 COTY INC.

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT DEVELOPMENTS

9.8 HENKEL AG & CO. KGAA

9.8.1 COMPANY SNAPSHOT

9.8.2 REVENUE ANALYSIS

9.8.3 PRODUCT PORTFOLIO

9.8.4 RECENT DEVELOPMENTS

9.9 KAO CORPORATION

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENTS

9.1 REVLON, INC.

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENTS

9.11 SHISEIDO COMPANY, LIMITED

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 SAUDI ARABIA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 SAUDI ARABIA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 SAUDI ARABIA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 SAUDI ARABIA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 UNITED ARAB EMIRATES COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 UNITED ARAB EMIRATES COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 37 UNITED ARAB EMIRATES COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 40 UNITED ARAB EMIRATES OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 UNITED ARAB EMIRATES COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 UNITED ARAB EMIRATES WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 UNITED ARAB EMIRATES MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 EGYPT COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 EGYPT SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 EGYPT HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 EGYPT HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 EGYPT HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 EGYPT MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 EGYPT COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 51 EGYPT COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 52 EGYPT COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 EGYPT COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 54 EGYPT OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 EGYPT COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 56 EGYPT WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 EGYPT MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 ISRAEL COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 ISRAEL SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 ISRAEL HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 ISRAEL HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 ISRAEL HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 ISRAEL MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 ISRAEL COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 65 ISRAEL COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 66 ISRAEL COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 ISRAEL COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 68 ISRAEL OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 ISRAEL COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 70 ISRAEL WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 ISRAEL MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA SKIN CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA HAIR CARE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 SOUTH AFRICA HAIR COLOR IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 SOUTH AFRICA HAIR COLOR IN COSMETICS MARKET, BY HAIR TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 SOUTH AFRICA MAKE UP IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH AFRICA COSMETICS MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA COSMETICS MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA COSMETICS MARKET, BY PACKAGING TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA COSMETICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA OFFLINE IN COSMETICS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA COSMETICS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA WOMEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA MEN IN COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 REST OF MIDDLE EAST AND AFRICA COSMETICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA COSMETICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA COSMETICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA COSMETICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA COSMETICS MARKET: MIDDLE EAST AND AFRICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA COSMETICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA COSMETICS MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST AND AFRICA COSMETICS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST AND AFRICA COSMETICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST AND AFRICA COSMETICS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST AND AFRICA COSMETICS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA COSMETICS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST AND AFRICA COSMETICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST AND AFRICA COSMETICS MARKET: SEGMENTATION

FIGURE 14 SURGE IN E-COMMERCE FUELING THE DEMAND OF COSMETICS PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA COSMETICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 SKIN CARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET IN 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA COSMETICS MARKET

FIGURE 17 MIDDLE EAST AND AFRICA COSMETICS MARKET: SNAPSHOT (2022)

FIGURE 18 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2022)

FIGURE 19 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 20 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 21 MIDDLE EAST AND AFRICA COSMETICS MARKET: BY PRODUCT TYPE (2023 & 2030)

FIGURE 22 MIDDLE EAST AND AFRICA COSMETICS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.