Middle East And Africa Cooling System For Edge Computing Market

Market Size in USD Million

CAGR :

%

USD

82.93 Million

USD

183.01 Million

2024

2032

USD

82.93 Million

USD

183.01 Million

2024

2032

| 2025 –2032 | |

| USD 82.93 Million | |

| USD 183.01 Million | |

|

|

|

|

Middle East and Africa Cooling System for Edge Computing Market Size

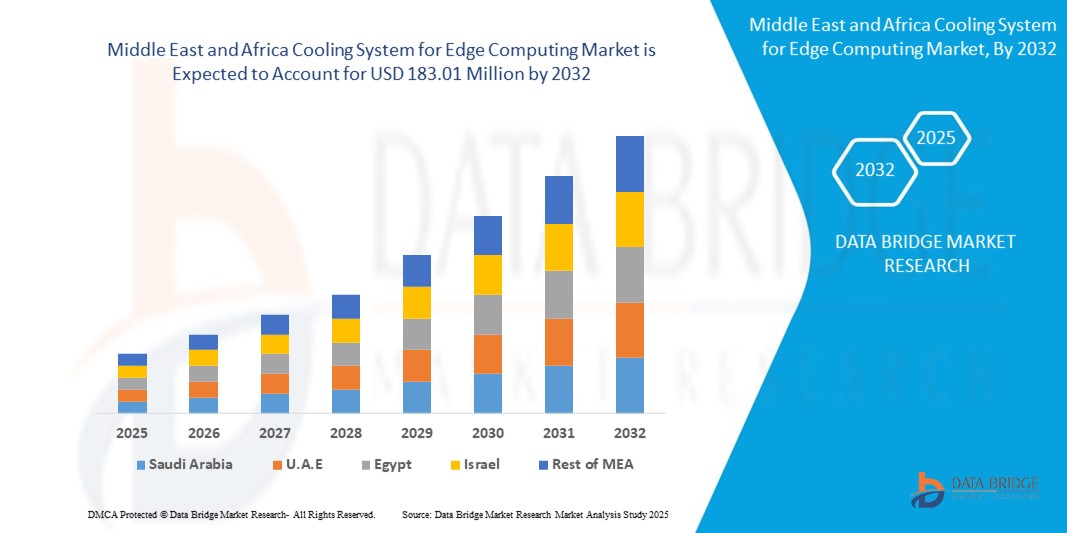

- The Middle East and Africa cooling system for edge computing market size was valued at USD 82.93 million in 2024 and is expected to reach USD 183.01 million by 2032, at a CAGR of 10.40% during the forecast period

- The market growth is largely fuelled by the rising adoption of edge computing across industries, increasing demand for efficient and sustainable cooling technologies, and the growing need to manage heat in high-density computing environments

- Advancements in liquid cooling and immersion cooling solutions, along with rising investments in data centers closer to end-users, are further contributing to market expansion

Middle East and Africa Cooling System for Edge Computing Market Analysis

- The Middle East and Africa cooling system for edge computing market is experiencing significant momentum as enterprises accelerate digital transformation and deploy edge infrastructure for faster data processing

- The increasing focus on reducing latency and ensuring uninterrupted system performance has elevated the need for innovative cooling technologies that minimize energy consumption while maintaining high operational efficiency

- Saudi Arabia dominated the Middle East cooling system for edge computing market in 2024, fueled by large-scale investments in digital transformation projects and the expansion of smart city initiatives like NEOM

- U.A.E. is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa cooling system for edge computing market due to increasing adoption of edge computing in telecom and cloud sectors, rising demand for sustainable cooling solutions, and ongoing investments in data center innovation

- The air-based segment held the largest market revenue share in 2024, supported by its cost-effectiveness, widespread availability, and easy integration with existing infrastructure. Air cooling remains a preferred option for small and medium-scale edge deployments where efficiency requirements are moderate

Report Scope and Middle East and Africa Cooling System for Edge Computing Market Segmentation

|

Attributes |

Middle East and Africa Cooling System for Edge Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Middle East and Africa Cooling System for Edge Computing Market Trends

Adoption Of Liquid Cooling And Immersion Cooling Technologies

- The shift toward advanced liquid cooling and immersion cooling systems is reshaping the cooling system for edge computing market by addressing high heat densities in compact infrastructures. These technologies enable efficient heat management at the edge, ensuring consistent system uptime and performance even under heavy workloads

- The growing demand for sustainable cooling methods is accelerating the adoption of liquid-based systems that consume less power and water compared to traditional air cooling. This trend is particularly strong in regions with strict carbon reduction targets, where energy-efficient operations are prioritized

- The scalability and modular design of immersion cooling systems make them suitable for small and medium-sized edge deployments, helping reduce operational costs while extending equipment lifespan. Their adaptability provides a strong advantage for enterprises expanding edge networks in urban as well as remote areas

- For instance, in 2023, several telecom operators have deployed modular liquid cooling units across edge data centers, resulting in significant reductions in energy usage and improved reliability of network services. This not only enhances performance but also supports long-term sustainability goals

- While liquid and immersion cooling are enabling higher efficiency and greater environmental benefits, their widespread impact depends on lowering upfront costs, developing industry standards, and providing training for operators. Vendors must focus on localized deployment strategies to maximize adoption across diverse edge environments

Middle East and Africa Cooling System for Edge Computing Market Dynamics

Driver

Rising Data Traffic And Growing Demand For Low-Latency Processing

- The exponential increase in data traffic driven by IoT devices, 5G networks, and real-time applications is placing immense pressure on edge computing infrastructure. To maintain performance and avoid downtime, efficient cooling has become a critical enabler of edge deployment

- Enterprises are increasingly aware of the financial and operational risks associated with overheating, including equipment damage, energy inefficiency, and service disruptions. This awareness has translated into greater adoption of next-generation cooling systems that ensure seamless operations

- Governments and industry regulators are supporting edge infrastructure development through energy-efficiency initiatives and green IT policies. These frameworks encourage enterprises to invest in modern cooling solutions that reduce carbon footprints and align with sustainability mandates

- For instance, in 2022, several data center operators are increasingly adopting advanced immersion cooling systems to comply with energy-efficiency directives, boosting market demand for high-performance cooling technologies

- While demand for low-latency processing is a key driver, addressing energy consumption, system integration, and operational training will be essential to ensure sustained adoption of advanced cooling systems at the edge

Restraint/Challenge

High Deployment Costs And Technical Barriers In Edge Environments

- The high capital expenditure required for advanced cooling solutions such as liquid immersion and direct-to-chip cooling remains a major barrier to adoption, especially for small enterprises and emerging markets. Many organizations still rely on conventional systems due to cost constraints

- A lack of skilled technicians and limited expertise in handling specialized cooling technologies in remote or distributed edge locations further restricts deployment. This challenge is compounded by the absence of standardized practices and technical guidelines across the industry

- Market penetration is also hindered by infrastructure challenges, including power availability and maintenance issues in certain edge environments. These constraints can delay the deployment of efficient cooling systems, forcing reliance on less effective alternatives

- For instance, in 2023, many small-scale edge data centers continue using legacy air-based cooling systems due to high costs and limited availability of advanced liquid cooling technologies

- While innovation continues to improve the efficiency of cooling systems, overcoming cost, infrastructure, and skills-related barriers is essential. Market stakeholders must invest in modular, cost-effective, and easily deployable solutions to unlock broader adoption across the edge ecosystem

Middle East and Africa Cooling System for Edge Computing Market Scope

The market is segmented on the basis of type of cooling systems, cooling capacity, deployment type, cooling management system, cooling method, and vertical.

- By Type of Cooling Systems

On the basis of type of cooling systems, the Middle East and Africa cooling system for edge computing market is segmented into air-based, liquid-based, and hybrid. The air-based segment held the largest market revenue share in 2024, supported by its cost-effectiveness, widespread availability, and easy integration with existing infrastructure. Air cooling remains a preferred option for small and medium-scale edge deployments where efficiency requirements are moderate.

The liquid-based segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior heat dissipation capability and growing adoption in high-density edge data centers. Liquid-based cooling solutions are gaining traction for their ability to reduce energy usage and support sustainability goals, making them ideal for next-generation computing environments.

- By Cooling Capacity

On the basis of cooling capacity, the market is categorized into medium-scale cooling systems, small-scale cooling systems, and large-scale cooling systems (above 200KW). The medium-scale cooling systems segment accounted for the largest revenue share in 2024, primarily due to their adoption in regional and edge facilities that require moderate cooling loads.

The large-scale cooling systems segment is expected to witness the fastest growth rate from 2025 to 2032, as edge computing expands into large telecom hubs and enterprise-grade facilities. Their ability to manage intensive workloads and maintain high system reliability positions them as a critical choice for large-scale edge networks.

- By Deployment Type

On the basis of deployment type, the market is segmented into room-based cooling units, in-rack cooling units, outdoor cooling units, direct-to-chip liquid cooling units, portable cooling units, and immersion cooling units. The room-based cooling units segment dominated the market share in 2024, owing to their established use in traditional edge facilities and data centers.

The direct-to-chip liquid cooling units segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for energy-efficient and space-saving cooling solutions. These systems provide targeted heat management and are increasingly deployed in high-performance edge environments.

- By Cooling Management System

On the basis of cooling management system, the market is bifurcated into integrated cooling management systems and standalone cooling management systems. The integrated cooling management systems segment held the largest share in 2024, as enterprises increasingly favor centralized systems that enhance monitoring, automation, and energy optimization.

The standalone cooling management systems segment is expected to witness the fastest growth rate from 2025 to 2032, particularly among small-scale facilities and cost-sensitive operators who prefer flexible and independent setups.

- By Cooling Method

On the basis of cooling method, the Middle East and Africa cooling system for edge computing market is segmented into chilled water cooling, direct expansion (DX) cooling, liquid cooling, and others. The chilled water cooling segment accounted for the largest revenue share in 2024, attributed to its reliability, scalability, and widespread adoption across medium to large-scale edge facilities.

The liquid cooling segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing power densities at the edge and the need for highly efficient and sustainable cooling technologies.

- By Vertical

On the basis of vertical, the market is segmented into IT & telecom, manufacturing, government & public sectors, healthcare, transportation & logistics, retail & consumer goods, and others. The IT & telecom segment dominated the market in 2024, fueled by large-scale deployment of 5G networks and the rising demand for edge data centers.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, as the adoption of edge computing in telemedicine, medical imaging, and real-time patient monitoring drives the need for reliable and energy-efficient cooling systems.

Middle East and Africa Cooling System for Edge Computing Market Regional Analysis

- Saudi Arabia dominated the Middle East cooling system for edge computing market in 2024, fueled by large-scale investments in digital transformation projects and the expansion of smart city initiatives like NEOM

- Enterprises in the country are deploying advanced cooling solutions to support high-capacity data centers and telecom infrastructure

- The dominance is supported by strong government funding, rapid digital adoption, and the integration of edge systems into oil & gas, logistics, and public sector operations

U.A.E. Cooling System for Edge Computing Market

The U.A.E. cooling system for edge computing market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid expansion of cloud services, fintech, and AI-based applications. The country is witnessing strong demand for sustainable cooling technologies to support its carbon neutrality goals. Additionally, the presence of major global data center operators, combined with favorable government policies and smart city initiatives, is fueling accelerated adoption.

Middle East and Africa Cooling System for Edge Computing Market Share

The Middle East and Africa cooling system for edge computing industry is primarily led by well-established companies, including:

- Zamil Air Conditioners (Saudi Arabia)

- SKM Air Conditioning LLC (U.A.E.)

- Cool Tech (Saudi Arabia)

- Al Salem Johnson Controls (Saudi Arabia)

- Qatar Cool (Qatar)

- Bin Dasmal Group (U.A.E.)

- Arabian Air Conditioning Company (Saudi Arabia)

- Petra Engineering Industries Co. (Jordan)

- Gulf Air Conditioning Manufacturing Industries (Saudi Arabia)

- Clima Tech Airconditioners (Egypt)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Cooling System For Edge Computing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Cooling System For Edge Computing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Cooling System For Edge Computing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.