Middle East and Africa Condensing Unit Market, By Type (Air-Cooled Condensing Unit, Water Cooled Condensing Unit and Evaporative Condensing Unit), Function (Air Conditioning, Heat Pump, Refrigeration And Others), Refrigerant Type (Fluorocarbons, Hydrocarbons, Inorganics and Others), Compressor Technology (Reciprocating, Hermetic, Semi-Hermetic, Open, Rotary, Scroll, Rotary Vane, Screw, Centrifugal and Others), Application (High Temperature, Medium Temperature and Low Temperature), End User (Residential, Commercial and Industrial), Country (South Africa, Saudi Arabia, U.A.E, Egypt, Israel, and Rest of Middle East and Africa) Industry Trends and Forecast to 2029.

Market Analysis and Insights : Middle East and Africa Condensing Unit Market

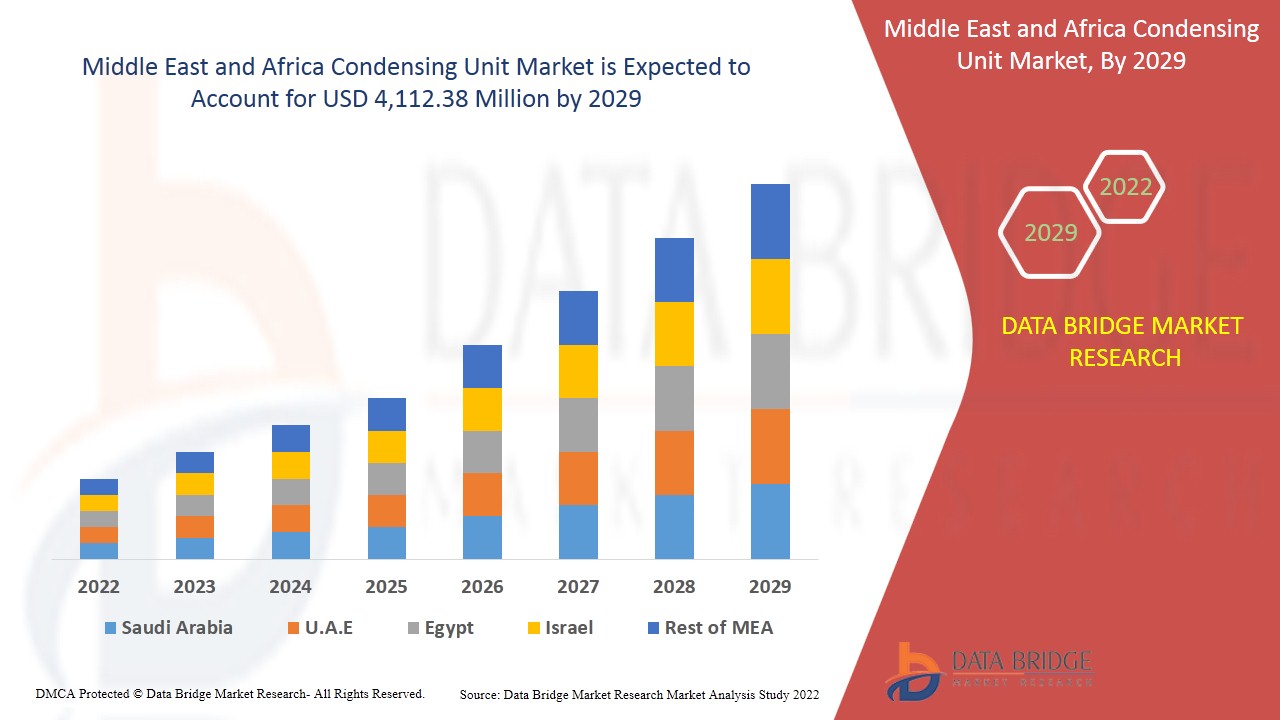

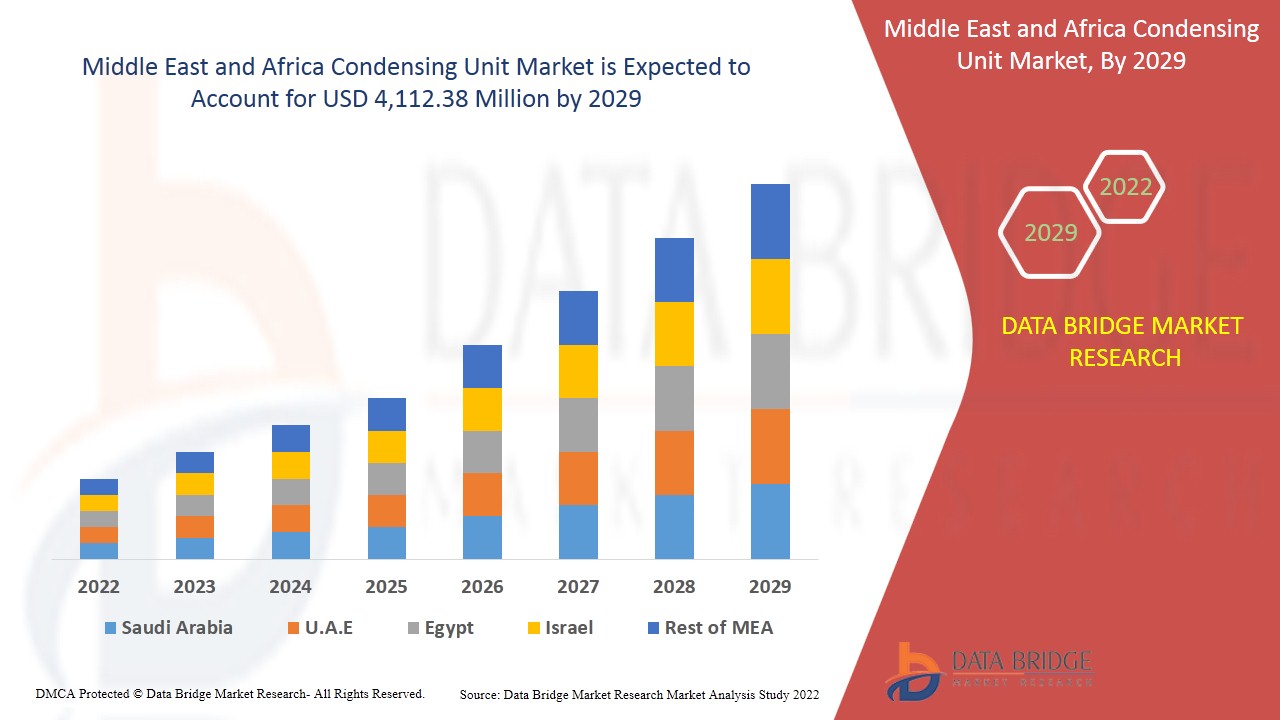

The condensing unit market is expected to grow in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.3% in the forecast period of 2022 to 2029 and is expected to reach USD 4,112.38 million by 2029 from USD 2,362.47 million in 2021. The growing demand of condensing units in commercial and industrial sectors is expected to drive the market growth.

The temperature control devices are used to condense material from its gaseous state to a liquid state by cooling which is known as the condensing unit. This machine may either be a heat pump or an air conditioning unit. For condensation purposes, condensing systems are primarily used in refrigerators, air conditioners, heat pumps, and chillers. It consists of three major components namely, compressor, fan, and condensing coil. They move energy in the form of heat by compressing a gas known as a "refrigerant," then pumping it through a system of coils and using the air around the coils to heat and cool spaces. Electronic controls, fans, pumps, and coils manage the condenser's work.

The growing demand for condensing units in commercial and industrial sectors in the developing economies, rising demand for improved quality condensing units for various applications, increasing growth of the retail sector are some of the major as well as vital factors which will likely augment the growth of the condensing unit market. On the other hand, the growing number of technological advancements along with the rising demand for natural refrigerants will provide growth opportunities for market growth. However, stringent environmental regulations on refrigerants used will limit the market growth. In addition, the rising number of complexities and uncertainties for manufacturers will act as a challenge for condensing the unit market.

The condensing unit market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the condensing unit market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

Condensing Unit Market Scope and Market Size

The condensing unit market is segmented into six notable segments which are type, function, refrigerant type, compressor technology, application and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the condensing unit market is segmented into the air-cooled condensing unit, water cooled condensing unit and evaporative condensing unit. In 2022, the air-cooled condensing unit segment is expected to dominate the market due to the easy installation and low maintenance of air-cooled condensing units.

- On the basis of function, the condensing unit market is segmented into the air conditioning, heat pump, refrigeration, and others. In 2022, the air conditioning segment is expected to dominate the market due to the advancements in air conditioning systems that are more efficient and environmentally friendly.

- On the basis of refrigerant type, the condensing unit market is segmented into the fluorocarbons, hydrocarbons, inorganics and others. In 2022, the fluorocarbons segment is expected to dominate the market due to the growing use of fluorocarbon refrigerant in commercial refrigeration.

- On the basis of compressor technology, the condensing unit market is segmented into reciprocating, hermetic, semi-hermetic, open, rotary, scroll, rotary vane, screw, centrifugal and others. In 2022, the reciprocating segment is expected to dominate the market due to growing use of reciprocating compressors to compress gases and refrigerants of a wide range of molecular density.

- On the basis of application, the condensing unit market is segmented into the high temperature, medium temperature and low temperature. In 2022, high temperature segment is expected to dominate the market due to the growing use of high temperature condensing units in cold rooms.

- On the basis of end user, the condensing unit market is segmented into the residential, commercial and industrial. In 2022, the industrial segment is expected to dominate the market due to the growing demand for advanced refrigeration from various application areas, such as power plants, retail stores, dairy cabinets, hospitals, cryogenic containers, and cooling systems.

Condensing Unit Market Country Level Analysis

The condensing unit market is analyzed, and market size information is provided by the type, function, refrigerant type, compressor technology, application and end user as referenced above.

The countries covered in the condensing unit market report are the South Africa, Saudi Arabia, U.A.E, Egypt, Israel, and Rest of Middle East and Africa.

Saudi Arabia is expected to dominate the market due to the rising demand for improved quality condensing units for various applications.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to Enhance the Awareness for Condensing Unit is Boosting the Market Growth of Condensing Unit Market

The condensing unit market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2012 to 2020.

Competitive Landscape and Condensing Unit Market Share Analysis

The condensing unit market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points are only related to the company’s focus on the condensing unit market.

Some of the major players operating in the condensing unit market are Emerson Electric Co., Carrier, Danfoss, Heatcraft Worldwide Refrigeration, BITZER Kühlmaschinenbau GmbH, Dorin S.p.A., FRASCOLD SPA, FreezeIndia, Howe Corporation, Hussmann Corporation, DAIKIN INDUSTRIES, Ltd., Blue Star Limited., MTA S.p.A., National Comfort Products., SCM Frigo S.p.A., GEA Group Aktiengesellschaft, Tecumseh Products Company, Prijai Heat Exchangers Pvt. Ltd., KeepRite Refrigeration, Voltas, Inc., among others.

For instance,

- In May 2021, Danfoss has launched multi-refrigerant, A2L-ready condensing units for ultra-low GWP installations. This product launch has helped the company to widen its product portfolio.

- In March 2018, KeepRite Refrigeration has launched new generation of condensing units. The products are KEZ SCROLL Condensing Units, KEH HERMETIC Condensing Units and KES SEMI-HERMETIC Condensing Units. This product launch has helped the company to widen its product portfolio.

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player enhance the company's footprints in the condensing unit market, which also benefits the organization’s profit growth.

SKU-