Middle East And Africa Closed System Transfer Devices Market

Market Size in USD Million

CAGR :

%

USD

30.99 Million

USD

100.20 Million

2025

2033

USD

30.99 Million

USD

100.20 Million

2025

2033

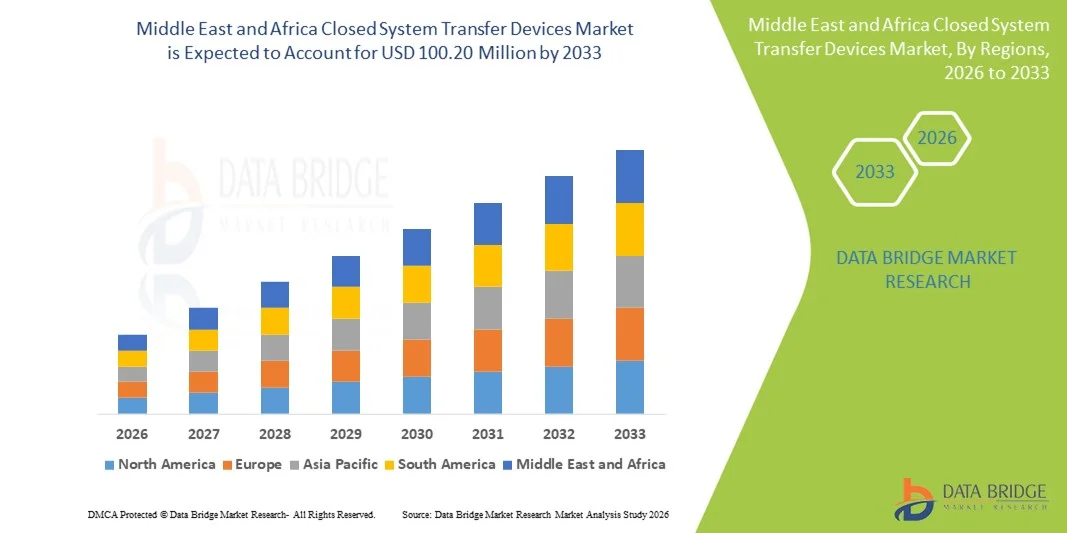

| 2026 –2033 | |

| USD 30.99 Million | |

| USD 100.20 Million | |

|

|

|

|

Middle East and Africa Closed System Transfer Devices Market Size

- The Middle East and Africa closed system transfer devices market size was valued at USD 30.99 million in 2025 and is expected to reach USD 100.20 million by 2033, at a CAGR of 15.8% during the forecast period

- The market growth in MEA is being driven by increasing investments in oncology care infrastructure, greater focus on healthcare worker safety during hazardous drug handling, and improvements in healthcare access across key countries such as Saudi Arabia, UAE, South Africa, and Egypt

- In addition, expanding modern hospital facilities and regulatory emphasis on safer drug transfer systems are encouraging healthcare providers to integrate closed system transfer devices into clinical practice, supporting sustained regional growth

Middle East and Africa Closed System Transfer Devices Market Analysis

- Closed system transfer devices, designed to prevent hazardous drug exposure during preparation and administration, are increasingly critical components of modern healthcare safety protocols in hospitals, oncology centers, and pharmacy settings across key countries due to their role in protecting healthcare workers and ensuring drug containment

- The rising demand for closed system transfer devices is primarily fueled by increasing awareness of occupational safety, stricter regulatory requirements for handling hazardous drugs, and growing adoption of advanced healthcare technologies across public and private medical facilities

- Saudi Arabia dominated the Middle East and Africa closed system transfer devices market in 2025 with the largest revenue share of 28.2%, driven by substantial investments in oncology care infrastructure, modern hospital facilities, and supportive government regulations promoting safe handling of hazardous drugs

- United Arab Emirates (UAE) is expected to be the fastest-growing country in the market during forecast period, due to rapid development of healthcare infrastructure, increasing oncology treatment centers, and rising adoption of advanced safety technologies

- The Needle-free closed system transfer device segment dominated the Middle East and Africa closed system transfer devices market with a market share of 45.9% in 2025, driven by its proven effectiveness in preventing drug leakage and ease of integration into existing chemotherapy and hazardous drug administration protocols

Report Scope and Middle East and Africa Closed System Transfer Devices Market Segmentation

|

Attributes |

Middle East and Africa Closed System Transfer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Closed System Transfer Devices Market Trends

Enhanced Safety Through Advanced Containment Technologies

- A significant and accelerating trend in the Middle East and Africa closed system transfer devices market is the adoption of advanced containment technologies, including needleless connectors, closed system syringes, and integrated drug transfer devices, enhancing healthcare worker safety

- For instance, the ChemoSafe CSTD integrates a dual-valve system to prevent hazardous drug exposure during preparation and administration, ensuring safer workflows in oncology centers

- Advanced CSTDs allow monitoring of drug handling and provide automated alerts if breaches occur, reducing risks and improving compliance with safety protocols. For instance, the Tevadaptor CSTD features built-in leak prevention and visual confirmation for safe drug transfer

- Integration of CSTDs with hospital safety protocols and automated drug handling systems facilitates centralized control over hazardous drug management, allowing healthcare staff to monitor multiple procedures through a unified interface

- This trend towards safer, more efficient, and standardized drug handling systems is reshaping expectations in hospital safety practices. For instance, BD is developing CSTDs with automatic pressure balancing and ergonomic designs to improve usability and safety

- The demand for closed system transfer devices offering advanced containment, monitoring, and integration capabilities is growing rapidly across both public and private healthcare facilities, as hospitals increasingly prioritize worker safety and regulatory compliance

- Hospitals and specialty pharmacies are increasingly seeking modular and reusable CSTD solutions that reduce medical waste and long-term operating costs without compromising containment effectiveness.

Middle East and Africa Closed System Transfer Devices Market Dynamics

Driver

Growing Need Due to Rising Occupational Safety Awareness and Regulatory Mandates

- The increasing awareness of occupational hazards among healthcare workers and the implementation of stricter regulatory requirements are significant drivers for the growing demand for CSTDs

- For instance, in March 2024, BD introduced an upgraded CSTD system compliant with NIOSH and USP <800> standards to enhance hazardous drug safety in hospital pharmacies

- Hospitals and oncology centers are prioritizing devices that prevent accidental exposure, reduce drug leakage, and ensure compliance with local safety guidelines, making CSTDs a critical component of modern medical protocols

- Furthermore, rising investments in healthcare infrastructure, including new cancer treatment centers, are creating a strong demand for integrated and standardized CSTD solutions across the region

- The convenience of safer drug handling, reduced risk of contamination, and adherence to regulatory safety mandates are key factors propelling the adoption of CSTDs in both public and private healthcare facilities

- Increasing collaborations between CSTD manufacturers and healthcare institutions are driving customized device solutions that meet local workflow and safety requirements, accelerating adoption

- Government funding programs and hospital grants specifically targeting oncology safety and hazardous drug handling are supporting faster deployment of CSTDs in both urban and semi-urban healthcare facilities

Restraint/Challenge

High Cost and Regulatory Compliance Complexities

- The relatively high cost of advanced CSTDs compared to traditional drug handling tools poses a challenge for widespread adoption, particularly in smaller hospitals or budget-constrained regions

- For instance, procurement reports from 2023 indicate that premium CSTD systems with automated safety features are priced significantly higher than conventional manual drug transfer systems

- Regulatory compliance challenges, including alignment with NIOSH, USP <800>, and local health authority standards, complicate device adoption and require additional staff training.

- While lower-cost CSTDs exist, devices with advanced containment, monitoring, and ergonomic features are perceived as premium, which can limit uptake in certain regions or smaller medical facilities

- Overcoming these challenges through cost optimization, simplified regulatory approval processes, and training programs for healthcare staff will be essential for sustained market growth

- Limited awareness and training among healthcare staff in smaller clinics and pharmacies can slow adoption of CSTDs, even when devices are available and affordable

- Supply chain constraints and import dependencies for high-quality CSTD components in certain MEA countries can delay availability and limit consistent adoption across the region

Middle East and Africa Closed System Transfer Devices Market Scope

The market is segmented on the basis of type, component, closing mechanism, technology, end user, and distribution channel.

- By Type

On the basis of type, the Middle East & Africa closed system transfer devices market is segmented into membrane-to-membrane systems and needle-free closed system transfer devices (CSTDs). The needle-free closed system transfer device segment dominated the Middle East & Africa closed system transfer devices market with a market share of 45.9% in 2025, driven by its enhanced safety profile that eliminates needle-stick hazards while maintaining effective drug containment. Hospitals and oncology centers prefer needle-free CSTDs for minimizing occupational exposure and supporting compliance with stringent safety regulations. These devices are widely adopted in ambulatory surgical centers and clinics due to their ease of use, lower training requirements, and compatibility with various drug types. The segment’s growth is further supported by rising awareness of healthcare worker safety and increasing adoption of advanced hospital safety protocols.

The membrane-to-membrane systems segment is anticipated to witness the fastest growth rate of 24% from 2026 to 2033, fueled by regulatory emphasis on high containment standards and growing use in high-risk chemotherapy and biologics handling. Membrane-to-membrane systems provide robust containment, compatibility with automated compounding equipment, and long-term durability. Hospitals and research institutes increasingly prefer these systems for multi-drug preparation workflows and complex oncology treatments. Technological improvements enhancing ergonomic design, leak-proof performance, and workflow integration are driving adoption. Rising awareness of occupational safety in smaller clinics and emerging markets further accelerates growth.

- By Component

On the basis of component, the market is segmented into devices and accessories. The devices segment dominated the market with a revenue share of 60% in 2025, as it encompasses core CSTD equipment responsible for safe drug transfer, containment, and administration. Hospitals and oncology centers prioritize high-quality devices to ensure compliance with regulatory guidelines and safeguard healthcare workers. The segment’s dominance is supported by continuous product innovation and integration of ergonomic designs for ease of use in high-pressure clinical settings. Devices are also increasingly compatible with automated drug handling and monitoring systems, making them a crucial investment for modern healthcare facilities. The robustness, reliability, and proven safety of these devices drive repeated procurement and replacement cycles. Healthcare professionals often prefer devices with validated containment efficiency and durability for long-term use.

The accessories segment is expected to witness the fastest CAGR of 23% from 2026 to 2033, fueled by rising demand for complementary items such as adapters, valves, caps, and connectors that enhance the functionality of core devices. Accessories improve workflow efficiency, compatibility with multiple drug types, and ease of integration into existing hospital protocols. Customization options and modularity of accessories also contribute to adoption in oncology and research centers. These items are increasingly marketed as part of complete safety kits, enabling safer and more effective drug handling. The growth of this segment is further supported by demand from emerging hospitals and clinics upgrading their CSTD infrastructure.

- By Closing Mechanism

On the basis of closing mechanism, the market is segmented into push-to-turn systems, color-to-color alignment systems, luer-lock systems, and click-to-lock systems. The push-to-turn systems segment dominated the market with a 35% share in 2025, due to its intuitive operation and consistent containment performance during hazardous drug transfer. Healthcare professionals value these systems for their straightforward mechanism, which minimizes errors during use and reduces the risk of exposure. Hospitals and oncology centers prefer push-to-turn systems for their reliability and compatibility with a wide range of drug vials and administration setups. These systems are widely used in high-volume hospital pharmacies due to their durability and minimal maintenance requirements. Push-to-turn mechanisms also facilitate quick training for staff, making them suitable for facilities with rotating personnel or large teams. The robust design and proven track record reinforce confidence among procurement managers.

The click-to-lock systems segment is projected to witness the fastest growth at 26% CAGR from 2026 to 2033, driven by the demand for rapid, fail-safe connections in busy hospital and clinic environments. These systems reduce operational time while maintaining containment, making them ideal for high-throughput chemotherapy preparation and administration. Click-to-lock mechanisms are increasingly preferred in ambulatory surgical centers and research labs for efficiency and user safety. Growing adoption of modular CSTD platforms that use click-to-lock interfaces is contributing to their expansion. These systems are also compatible with automated drug handling equipment, further accelerating uptake in modern healthcare settings.

- By Technology

On the basis of technology, the market is segmented into diaphragm-based devices, compartmentalized devices, and air cleaning/filtration devices. The diaphragm-based devices segment dominated the market with a 50% share in 2025, driven by their high containment efficiency, reliability, and proven safety record. These devices are widely adopted in hospitals and oncology centers for handling cytotoxic drugs, ensuring minimal exposure risk. Healthcare professionals prefer diaphragm-based devices for their simplicity, low maintenance, and compatibility with multiple vial types. The segment’s dominance is further reinforced by regulatory recommendations emphasizing validated containment performance. Diaphragm-based devices are often integrated into automated compounding and drug preparation workflows, enhancing operational efficiency. Their versatility and reliability make them a first-choice solution for both established hospitals and newly established treatment centers.

The compartmentalized devices segment is expected to witness the fastest growth at 22% CAGR from 2026 to 2033, fueled by increasing use in high-risk chemotherapy, biologics, and multi-drug preparation workflows. These devices segregate drug compartments to prevent cross-contamination, making them ideal for specialized oncology centers and research institutes. Technological advancements improving containment and usability are driving adoption. Hospitals are adopting compartmentalized devices to comply with stringent occupational safety regulations. The growing demand for devices compatible with modular and automated systems further accelerates growth.

- By End User

On the basis of end user, the market is segmented into hospitals, oncology centers & clinics, ambulatory surgical centers, and academic & research institutes. The hospitals segment dominated the market with a 45% share in 2025, driven by large-scale adoption of CSTDs to manage high patient volumes and multiple chemotherapy regimens safely. Hospitals prioritize devices with proven containment efficiency, ergonomic design, and regulatory compliance. Integration with automated compounding and safety monitoring systems further supports hospital adoption. Hospitals also favor devices that require minimal training and maintenance for staff safety. The segment benefits from continuous investments in oncology infrastructure and stringent occupational safety regulations. High-volume chemotherapy preparation and administration in hospitals make them the largest consumers of CSTDs.

The oncology centers & clinics segment is projected to witness the fastest growth at 25% CAGR from 2026 to 2033, due to specialized use of CSTDs for targeted therapy and high-risk cytotoxic drugs. These centers require devices that ensure maximum safety for both staff and patients. Technological innovations and compact device designs are enhancing adoption in smaller oncology clinics. Growing awareness of occupational hazards among healthcare professionals is accelerating uptake. Rising cancer prevalence and expanding oncology services across the Middle East and Africa further support this growth. The convenience, safety, and regulatory compliance of CSTDs make them increasingly essential in oncology-focused facilities.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market with a 65% share in 2025, due to large-scale procurement by hospitals, government health authorities, and oncology chains. Direct tender agreements allow bulk purchases with long-term service and maintenance support, ensuring compliance and cost efficiency. Healthcare facilities prefer direct tenders for reliability, consistent supply, and regulatory documentation. Tender-based procurement often includes training programs for staff, ensuring optimal device usage. The dominance of direct tender is further reinforced by government and institutional contracts in countries such as Saudi Arabia, UAE, and South Africa.

The retail sales segment is expected to witness the fastest growth at 27% CAGR from 2026 to 2033, driven by smaller clinics, ambulatory surgical centers, and research institutes purchasing devices in smaller volumes. Retail availability allows quicker adoption, flexibility in brand choice, and access to newer technologies without waiting for tender cycles. Growing awareness of occupational safety among private practitioners supports retail sales growth. Retail channels also facilitate faster adoption of modular and accessory-compatible devices. Increasing private healthcare investment in MEA is contributing to rapid expansion of retail sales.

Middle East and Africa Closed System Transfer Devices Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa closed system transfer devices market in 2025 with the largest revenue share of 28.2%, driven by substantial investments in oncology care infrastructure, modern hospital facilities, and supportive government regulations promoting safe handling of hazardous drugs

- Healthcare facilities in the country prioritize devices that ensure maximum protection for staff and patients, with needle-free and membrane-to-membrane CSTDs widely adopted to prevent occupational exposure and maintain drug containment standards

- This widespread adoption is further supported by government initiatives promoting safe handling of cytotoxic drugs, increasing awareness among healthcare professionals, and growing investments in modern hospital and oncology infrastructure, establishing CSTDs as a standard solution for drug safety in both public and private healthcare facilities

The Saudi Arabia Closed System Transfer Devices Market Insight

The Saudi Arabia closed system transfer devices market captured the largest revenue share of 28.2% in 2025, fueled by substantial investments in oncology care infrastructure and government regulations promoting healthcare worker safety. Hospitals and cancer treatment centers are prioritizing needle-free and membrane-to-membrane CSTDs to minimize occupational exposure during hazardous drug handling. The growing adoption of modern hospital protocols, along with awareness campaigns for staff safety, further propels the market. Moreover, integration of CSTDs with automated drug preparation and compounding systems is enhancing workflow efficiency. Rising cancer prevalence and expansion of specialized treatment centers are key contributors to market growth. The country’s focus on compliance with international safety standards is driving the continuous procurement of advanced CSTD systems.

United Arab Emirates (UAE) Closed System Transfer Devices Market Insight

The UAE closed system transfer devices market is witnessing rapid growth, driven by modernization of hospitals and increasing investments in oncology and research centers. Adoption of advanced CSTDs is encouraged by government regulations and healthcare policies emphasizing occupational safety and drug containment. Hospitals and clinics prioritize devices with high containment efficiency and ease of use, supporting seamless integration into existing workflows. The country’s growing private healthcare sector and medical tourism further stimulate demand. Awareness programs for staff training on safe drug handling are accelerating adoption. The UAE market benefits from import of high-quality CSTD systems and partnerships with global manufacturers.

South Africa Closed System Transfer Devices Market Insight

The South Africa closed system transfer devices market is expanding steadily due to modernization of hospital pharmacies and increasing oncology services across the country. Rising awareness of healthcare worker safety and regulatory compliance requirements is encouraging the adoption of CSTDs in hospitals and clinics. Needle-free systems are preferred for reducing needle-stick injuries, while membrane-to-membrane devices are adopted for high-volume drug handling. Investment in automated compounding equipment and integration with safety protocols supports market growth. The availability of both imported and locally distributed devices is increasing accessibility. In addition, government funding for occupational safety programs is driving adoption in both urban and semi-urban healthcare facilities.

Egypt Closed System Transfer Devices Market Insight

The Egypt closed system transfer devices market is emerging as a high-growth region, driven by increasing healthcare expenditure and modernization of hospitals and oncology centers. Hospitals and clinics are prioritizing devices that ensure maximum containment and minimize hazardous drug exposure. Growing awareness of occupational safety and regulatory standards is promoting adoption of both needle-free and membrane-to-membrane systems. The rising number of specialized oncology centers and research institutes further supports demand. Training programs for healthcare staff on safe drug handling accelerate uptake. Egypt’s expanding private healthcare sector and focus on international safety compliance contribute to market expansion.

Middle East and Africa Closed System Transfer Devices Market Share

The Middle East and Africa Closed System Transfer Devices industry is primarily led by well-established companies, including:

- EQUASHIELD (U.S.)

- Simplivia (Israel)

- ICU Medical, Inc. (U.S.)

- B. Braun SE (Germany)

- Vygon (France)

- BD (U.S.)

- Baxter (U.S.)

- Terumo Corporation (Japan)

- CODAN Medizinische Geräte GmbH & Co KG (Germany)

- Corning Incorporated (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Yukon Medical LLC (U.S.)

- Corvida Medical Inc. (U.S.)

- Cardinal Health (U.S.)

- Caragen Ltd. (Ireland)

- JMS Co., Ltd. (Japan)

- Practivet, Inc. (U.S.)

- Amsino International, Inc. (U.S.)

- NIPRO CORPORATION (Japan)

- VICTUS Inc. (U.S.)

What are the Recent Developments in Middle East and Africa Closed System Transfer Devices Market?

- In December 2025, EQUASHIELD launched a fully integrated hazardous drug safety and automated compounding platform at ASHP 2025, combining its leading CSTD technology with advanced workflow software to improve safety and efficiency in healthcare compounding. This development highlights innovation in CSTD solutions that integrates automation and pharmacy workflows for improved containment of hazardous drugs

- In May 2025, EQUASHIELD was ranked as the #1 closed system transfer device used in U.S. pharmacies for the seventh consecutive year, reflecting sustained industry recognition and adoption of its CSTD technology in hazardous drug preparation and administration

- In March 2024, EQUASHIELD marked its 15th year of innovation and was recognized as the most used closed system transfer device for hazardous drug preparation, earning top choice status in compounding surveys for a sixth consecutive year. This milestone underscores long-term adoption trends for advanced CSTD systems that are increasingly relevant to global healthcare safety practices, including in Middle East & Africa markets

- In October 2023, EQUASHIELD’s syringe unit received FDA clearance for full-volume use, allowing the entire syringe volume to be safely used when handling hazardous drugs — a significant regulatory advancement in CSTD safety standards that improves efficiency and reduces waste during compounding

- In September 2023, EQUASHIELD was recognized as the most used CSTD in hazardous drug handling and preparation for five consecutive years, based on industry surveys — signaling sustained global confidence and adoption of certain advanced CSTD technologies for oncology and pharmacy safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.