Middle East And Africa Clinical Laboratory Services Market

Market Size in USD Billion

CAGR :

%

USD

12.71 Billion

USD

18.35 Billion

2025

2033

USD

12.71 Billion

USD

18.35 Billion

2025

2033

| 2026 –2033 | |

| USD 12.71 Billion | |

| USD 18.35 Billion | |

|

|

|

|

Middle East and Africa Clinical Laboratory Services Market Size

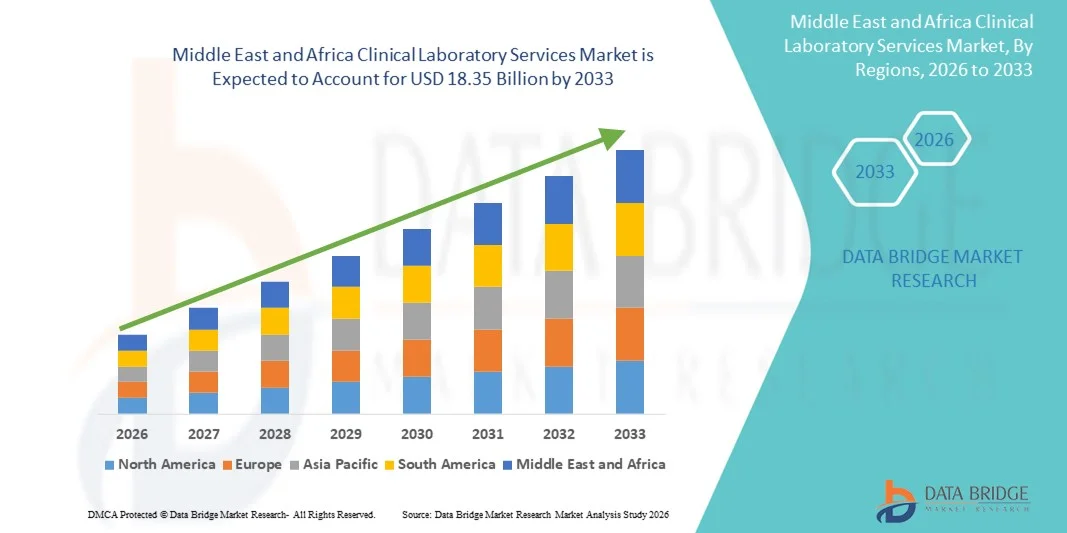

- The Middle East and Africa clinical laboratory services market size was valued at USD 12.71 billion in 2025 and is expected to reach USD 18.35 billion by 2033, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing demand for accurate, timely, and high-quality diagnostic testing, driven by rising prevalence of chronic diseases, infectious diseases, and lifestyle-related health conditions across the globe

- Furthermore, growing awareness about preventive healthcare, advancements in laboratory technologies, automation in clinical diagnostics, and the expansion of healthcare infrastructure are accelerating the uptake of clinical laboratory services solutions, thereby significantly boosting the overall growth of the Clinical Laboratory Services market

Middle East and Africa Clinical Laboratory Services Market Analysis

- Clinical laboratory services, encompassing diagnostic testing, pathology, and other laboratory-based analyses, are increasingly critical in modern healthcare for early disease detection, monitoring chronic conditions, and supporting personalized treatment plans

- The market growth is primarily driven by rising prevalence of chronic diseases, increasing demand for preventive healthcare, technological advancements in laboratory automation and diagnostic platforms, and expanding healthcare infrastructure across the globe

- Saudi Arabia dominated the clinical laboratory services market, accounting for approximately 39.8% of the regional revenue share in 2025, supported by strong government healthcare initiatives, investments in advanced diagnostic facilities, and widespread adoption of modern laboratory technologies in hospitals, clinics, and specialized diagnostic centers. The presence of leading regional laboratory service providers and growing patient awareness about quality diagnostics further strengthen Saudi Arabia’s dominance in the market

- The U.A.E. is expected to be the fastest-growing country, with an estimated CAGR of 9.1% from 2026 to 2033, driven by rapid expansion of private healthcare infrastructure, increasing government initiatives for preventive health, rising medical tourism, and growing adoption of advanced diagnostic and automation technologies across clinical laboratories

- The Independent & Reference Laboratories segment dominated the largest market revenue share of 45.1% in 2025, due to their extensive service portfolios, state-of-the-art testing capabilities, and ability to serve multiple hospitals and clinics

Report Scope and Clinical Laboratory Services Market Segmentation

|

Attributes |

Clinical Laboratory Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

• LabCorp (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Clinical Laboratory Services Market Trends

Expansion of Advanced Diagnostic Services

- A significant and accelerating trend in the Middle East and Africa Clinical Laboratory Services market is the expansion of advanced diagnostic and testing services, driven by the growing demand for precision medicine and specialized testing capabilities

- For instance, in 2024, leading diagnostic providers such as Al Borg Diagnostics expanded their molecular and genomic testing services across the UAE and Saudi Arabia to meet increasing patient demand. The adoption of high-throughput testing platforms and automation in labs is enhancing efficiency, reducing turnaround times, and improving accuracy

- Integration of laboratory information systems (LIS) with hospital and clinic networks is enabling seamless patient data management and reporting. Hospitals and diagnostic centers are increasingly investing in advanced testing capabilities for oncology, infectious diseases, and metabolic disorders

- Patient awareness and demand for early diagnosis and preventive care are driving the uptake of specialized clinical tests. Government initiatives promoting healthcare infrastructure development and public health monitoring further accelerate growth

- Accreditation and quality certifications such as ISO and CAP are encouraging laboratories to upgrade technologies and service portfolios. Collaborations between diagnostic service providers and research institutions enhance testing capabilities and clinical trial support

- The adoption of integrated testing services across multiple locations allows for wider patient access and operational efficiency. Training programs for lab personnel ensure proper handling of complex tests and adherence to regulatory standards

Middle East and Africa Clinical Laboratory Services Market Dynamics

Driver

Increasing Demand for Specialized and High-Accuracy Testing

- The rising prevalence of chronic diseases, infectious diseases, and genetic disorders in the Middle East and Africa is a major driver of market growth

- For instance, in 2025, Al Borg Diagnostics introduced next-generation sequencing and molecular diagnostic services in Saudi Arabia, significantly enhancing their service capabilities

- Healthcare providers are seeking accurate, rapid, and comprehensive diagnostic solutions to guide patient management and treatment decisions

- Expansion of hospitals and diagnostic chains across urban and semi-urban areas supports higher testing volumes

- Government healthcare initiatives and public-private partnerships are promoting laboratory modernization and capacity expansion

- Increasing clinical research and participation in regional epidemiology studies create additional demand for specialized tests

- Patient preference for early detection, preventive healthcare, and personalized treatment drives the adoption of advanced laboratory services

- Technological upgrades in lab equipment and adoption of automated platforms ensure higher throughput and reduced error rates

- Collaboration between laboratories and pharmaceutical companies for clinical trials is fueling specialized test demand. Continuous training and skill development for laboratory professionals improve service quality and accuracy

- The expansion of insurance coverage and reimbursement for diagnostic tests supports affordability and uptake. Overall, growing clinical demand, technological advancement, and supportive healthcare policies collectively drive the Clinical Laboratory Services market in the region

Restraint/Challenge

High Operational Costs and Limited Skilled Workforce

- The high cost of establishing and maintaining advanced clinical laboratories is a significant challenge for smaller diagnostic centers

- For instance, investment in automated molecular testing platforms and high-throughput analyzers can run into millions of dollars, limiting expansion for new entrants

- A shortage of trained laboratory technicians and specialized pathologists restricts the ability to scale services efficiently

- Regulatory compliance and quality accreditation processes can be time-consuming and costly. Maintaining advanced equipment and ensuring calibration and quality control adds to operational expenses

- Infrastructure limitations in remote and rural regions reduce patient access to advanced laboratory services

- High costs of reagents, consumables, and test kits can further increase service prices, affecting affordability

- Limited awareness and adoption of preventive testing in some populations may restrict market penetration

- Despite the growing demand, the scarcity of skilled professionals remains a key barrier to delivering high-quality diagnostic services consistently

- Strategic partnerships, training programs, and cost-sharing models are essential to overcome these challenges

- Developing scalable, cost-effective laboratory solutions and regional training initiatives can mitigate workforce and cost issues

- Addressing these barriers is crucial to sustaining long-term growth in the Middle East and Africa Clinical Laboratory Services market

Middle East and Africa Clinical Laboratory Services Market Scope

The market is segmented on the basis of specialty, provider, application, and service type.

- By Specialty

On the basis of specialty, the Clinical Laboratory Services market is segmented into Clinical Chemistry Testing, Hematology Testing, Microbiology Testing, Immunology Testing, Drugs of Abuse Testing, Cytology Testing, and Genetic Testing. The Clinical Chemistry Testing segment dominated the largest market revenue share of 38.6% in 2025, driven by the high prevalence of chronic diseases such as diabetes, cardiovascular disorders, and metabolic syndromes in the Middle East and Africa. Routine chemical panels, liver function tests, and kidney function tests are widely requested in hospitals and outpatient clinics, establishing Clinical Chemistry as a core lab service. Advancements in automated analyzers and high-throughput platforms have increased efficiency and accuracy, reducing turnaround times and enhancing reliability. Healthcare facilities prioritize Clinical Chemistry Testing for its ability to provide rapid, comprehensive diagnostic data. The adoption of integrated laboratory information systems enables streamlined patient data management, ensuring better clinical decision-making. Furthermore, government initiatives promoting preventive healthcare and early diagnosis encourage regular chemical testing. Expansion of hospital networks and independent laboratories in urban and semi-urban regions also supports high demand. Additionally, collaborations with pharmaceutical and research entities for clinical trials bolster the utilization of clinical chemistry assays. Accreditation and standardization practices in laboratories further enhance confidence in testing results. Rising patient awareness about routine health monitoring strengthens market dominance. Clinical Chemistry Testing remains central to clinical diagnostics due to its cost-effectiveness, accessibility, and wide applicability across diseases.

The Hematology Testing segment is expected to witness the fastest CAGR of 15.9% from 2026 to 2033, driven by increasing demand for complete blood counts, coagulation profiles, and specialized hematological assays in hospitals and diagnostic centers. The rise in anemia, leukemia, and other blood disorders is boosting test volumes. Expanding hospital capacities, especially in Saudi Arabia, UAE, and Egypt, contributes to growth. Automation of hematology analyzers reduces errors and improves turnaround. Growing adoption in preventive healthcare packages, health checkups, and insurance-covered testing accelerates uptake. Hematology tests are critical for preoperative evaluations, chronic disease management, and therapeutic monitoring. Strategic partnerships between laboratories and diagnostic technology providers introduce innovative solutions. Additionally, increased focus on research and clinical trials for hematologic disorders supports segment growth. Training of skilled lab personnel ensures reliable execution of complex tests. The integration of hematology testing in broader diagnostic panels improves workflow efficiency. Rising awareness about blood health and early diagnosis encourages more frequent testing. Regional government health programs promoting anemia and disease monitoring contribute further. Overall, Hematology Testing is positioned as the fastest-growing specialty segment due to clinical importance and increasing accessibility.

- By Provider

On the basis of provider, the market is segmented into Independent & Reference Laboratories, Hospital-Based Laboratories, and Nursing and Physician Office-Based Laboratories. The Independent & Reference Laboratories segment dominated the largest market revenue share of 45.1% in 2025, due to their extensive service portfolios, state-of-the-art testing capabilities, and ability to serve multiple hospitals and clinics. These labs offer specialized testing services and high-throughput diagnostics, often integrating molecular, genetic, and esoteric assays. Patients increasingly prefer independent labs for convenience, faster turnaround, and comprehensive testing options. The rise of centralized diagnostic hubs in urban regions ensures wide geographic coverage. Investments in automation and LIS systems enhance operational efficiency and result accuracy. Partnerships with pharmaceutical companies for clinical trials and bioanalytical services strengthen revenue streams. Accreditation under ISO and CAP standards ensures quality and reliability, attracting institutional clients. Independent labs also provide courier services and home sample collection, improving patient accessibility. Strategic expansion into semi-urban areas supports market penetration. Collaboration with research institutions facilitates cutting-edge testing adoption. The segment’s reputation for accuracy, efficiency, and diversity of services reinforces its dominant position.

Hospital-Based Laboratories are expected to witness the fastest CAGR of 16.7% from 2026 to 2033, driven by the increasing number of hospitals and healthcare facilities in the region. Hospital labs integrate testing directly with patient care, ensuring timely results for diagnosis and treatment. Expansion of multispecialty hospitals in Saudi Arabia, UAE, and Egypt supports demand. Growing adoption of point-of-care testing, automation, and LIS integration enhances service efficiency. Hospital labs also play a key role in clinical trials and pharmacogenomic studies, contributing to segment growth. Rising awareness among physicians about in-house testing for rapid clinical decision-making promotes uptake. Investments in modern equipment for hematology, molecular diagnostics, and immunology strengthen capabilities. Collaboration with health insurance providers improves test affordability. Skilled workforce development in hospitals ensures accuracy in complex assays. The segment benefits from higher patient throughput and integrated care delivery. Government programs encouraging laboratory infrastructure expansion drive market adoption. Overall, hospital-based laboratories are positioned as the fastest-growing provider segment.

- By Application

On the basis of application, the Clinical Laboratory Services market is segmented into Drug Discovery Related Services, Drug Development Related Services, Bioanalytical & Lab Chemistry Services, Toxicology Testing Services, Cell & Gene Therapy Related Services, Preclinical & Clinical Trial Related Services, and Other Clinical Laboratory Services. The Preclinical & Clinical Trial Related Services segment dominated the largest market revenue share of 39.8% in 2025, owing to the increasing number of clinical trials and research studies in oncology, infectious diseases, and metabolic disorders. Contract research organizations (CROs) and pharmaceutical companies are collaborating with regional labs to support drug development. Expansion of clinical research centers in the UAE, Saudi Arabia, and Egypt fuels testing volumes. Adoption of standardized protocols and advanced instrumentation ensures accurate data for regulatory compliance. Integration of bioinformatics and data management platforms enhances research efficiency. Growth of academic and research institutions provides additional demand. Preclinical services, including toxicology and pharmacokinetics, complement clinical trial activities. High patient enrollment in studies drives repeated testing requirements. Laboratories offering multi-site testing capabilities gain preference. Demand for pharmacogenomic and molecular assays supports segment expansion. The emphasis on regulatory compliance ensures consistent revenue generation. Overall, the segment remains critical for supporting clinical research and drug development.

The Drug Development Related Services segment is expected to witness the fastest CAGR of 17.3% from 2026 to 2033, driven by increasing outsourcing of analytical, bioanalytical, and laboratory services by pharmaceutical and biotech companies. Growing investments in new drug development pipelines and rising clinical trial activity across oncology, immunology, and rare diseases fuel demand. Advanced testing platforms, high-throughput workflows, and standardized quality systems enable rapid adoption. Expansion of regional laboratories with CRO partnerships accelerates growth. Regulatory requirements for accurate pharmacokinetic and safety data boost market potential. The integration of preclinical, bioanalytical, and clinical testing services facilitates end-to-end support for drug development. Growing focus on personalized medicine and molecular diagnostics enhances demand. Strategic collaborations between pharmaceutical companies and local labs optimize service delivery. Training and development of skilled lab personnel ensure accurate testing. Increasing government incentives for research and development further drive adoption. Rising awareness among pharma stakeholders about quality data generation ensures sustained growth. The segment is positioned as the fastest-growing application in the region.

- By Service Type

On the basis of service type, the Clinical Laboratory Services market is segmented into Routine Testing Services, Esoteric Services, and Anatomic Pathology Services. The Routine Testing Services segment dominated the largest market revenue share of 41.5% in 2025, driven by high volumes of standard diagnostic tests such as blood counts, metabolic panels, and urinalysis conducted across hospitals and outpatient centers. Routine services are widely used for preventive health checkups, chronic disease monitoring, and preoperative assessments. The adoption of automated analyzers and high-throughput platforms ensures fast turnaround times and reliable results. Expansion of healthcare facilities across urban and semi-urban areas supports high patient volumes. Integration with LIS and hospital networks improves reporting and workflow efficiency. Insurance coverage for routine tests encourages higher patient participation. Government-led preventive healthcare initiatives promote routine diagnostics. Independent and hospital-based laboratories actively expand routine testing capabilities to meet growing demand. Training and quality control measures maintain accuracy across high test volumes. Partnerships with research institutions enhance service breadth. Accessibility and affordability reinforce dominance in the service-type segment.

The Esoteric Services segment is expected to witness the fastest CAGR of 18.1% from 2026 to 2033, driven by growing demand for specialized molecular, genetic, and immunology testing. Advanced techniques such as next-generation sequencing, PCR-based assays, and biomarker analysis are increasingly required for precision medicine and rare disease diagnostics. Expansion of independent and hospital-based labs with esoteric testing capabilities accelerates adoption. Pharmaceutical companies rely on esoteric services for clinical trials and drug development support. Rising patient awareness for genetic testing and personalized healthcare encourages uptake. Government initiatives promoting advanced diagnostics contribute to growth. Integration with research and bioinformatics platforms enhances data accuracy and reporting. Skilled workforce training ensures precise execution of complex tests. Increased collaboration between labs and research institutions boosts capabilities. High profitability and low competition attract new market entrants. Overall, Esoteric Services represent the fastest-growing service type in the Middle East and Africa Clinical Laboratory Services market.

Middle East and Africa Clinical Laboratory Services Market Regional Analysis

- The MEA clinical laboratory services market is projected to expand at a substantial CAGR throughout the forecast period

- Primarily driven by strong government healthcare initiatives, investments in advanced diagnostic facilities, and the widespread adoption of modern laboratory technologies in hospitals, clinics, and specialized diagnostic centers

- The presence of leading regional laboratory service providers and growing patient awareness about quality diagnostics are further contributing to market growth across the region

Saudi Arabia Clinical Laboratory Services Market Insight

Saudi Arabia clinical laboratory services market dominated the MEA Clinical Laboratory Services market, accounting for approximately 39.8% of the regional revenue share in 2025, supported by robust government healthcare initiatives, significant investments in advanced diagnostic facilities, and the widespread adoption of modern laboratory technologies. The country’s leading laboratory service providers and increasing patient awareness about quality diagnostics further strengthen its market dominance.

U.A.E. Clinical Laboratory Services Market Insight

The U.A.E. clinical laboratory services market is expected to be the fastest-growing country in the region, registering an estimated CAGR of 9.1% from 2026 to 2033, driven by the rapid expansion of private healthcare infrastructure, increasing government initiatives for preventive health, rising medical tourism, and growing adoption of advanced diagnostic and automation technologies across clinical laboratories.

Middle East and Africa Clinical Laboratory Services Market Share

The Clinical Laboratory Services industry is primarily led by well-established companies, including:

• LabCorp (U.S.)

• Quest Diagnostics (U.S.)

• Eurofins Scientific (Luxembourg)

• Synlab (Germany)

• Cerba Healthcare (France)

• SRL Diagnostics (India)

• Unilabs (Switzerland)

• Acibadem Labmed (Turkey)

• Dr. Lal PathLabs (India)

• NMC Healthcare Labs (U.A.E.)

• PathCare (South Africa)

• BioReference Laboratories (U.S.)

• Aspen Medical Laboratories (Australia)

• Maccabi Healthcare Services Labs (Israel)

• Al Mokhtabar Labs (Egypt)

• HealthHub Laboratories (U.A.E.)

Latest Developments in Middle East and Africa Clinical Laboratory Services Market

- In May 2025, Laboratory Corporation of America (LabCorp) launched a new regional diagnostic center in Chantilly, Virginia, its largest facility to date, staffed with over 200 professionals and able to process more than 26,000 patient specimens daily, expanding services in histology and cytology to improve diagnostic capabilities

- In February 2025, Myriad Genetics, Inc. entered into a collaboration with INTERLINK Care Management and CancerCARE for Life to expand access to its MyRisk with RiskScore hereditary cancer test to more than one million individuals, enhancing genetic screening and cancer risk prediction services

- In April 2025, Scientist.com launched Clinical Labs Navigator™, a procurement platform tool designed to streamline sourcing and management of clinical trial services, increasing efficiency and collaboration between sponsors and laboratory providers

- In March 2025, IQVIA Laboratories introduced the Site Lab Navigator suite, including an electronic requisition solution that allows sites to submit test requisitions and manage specimens digitally, reducing manual errors and improving clinical trial laboratory workflows

- In February 2025, SK pharmteco unveiled an upgraded analytical testing laboratory focused on High Potency Active Pharmaceutical Ingredients (HPAPIs), enhancing laboratory service capabilities for complex drug substance analysis

- In August 2024, LEAP Consulting Group launched a practice to support clinical laboratories with compliance, including guidance on FDA regulations for laboratory‑developed tests (LDTs), reflecting the industry’s focus on regulatory preparedness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.