Middle East And Africa Cardiac Computed Tomography Cct Market

Market Size in USD Billion

CAGR :

%

USD

97.72 Billion

USD

131.69 Billion

2025

2033

USD

97.72 Billion

USD

131.69 Billion

2025

2033

| 2026 –2033 | |

| USD 97.72 Billion | |

| USD 131.69 Billion | |

|

|

|

|

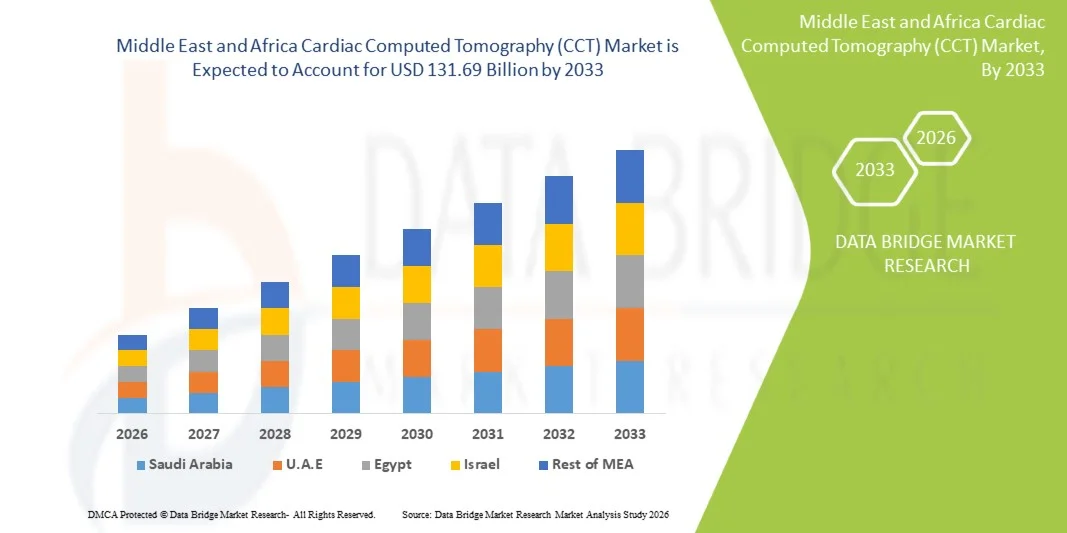

Middle East and Africa Cardiac Computed Tomography (CCT) Market Size

- The Middle East and Africa Cardiac Computed Tomography (CCT) market size was valued at USD 97.72 million in 2025 and is expected to reach USD 131.69 million by 2033, at a CAGR of 3.80% during the forecast period

- The market expansion in the region is primarily driven by increasing healthcare expenditure, rising prevalence of cardiovascular diseases, and ongoing investments in advanced imaging technologies that support early diagnosis and non‑invasive cardiac assessment

- Furthermore, growing demand for accurate, high‑resolution cardiac diagnostics across hospitals and specialty imaging centers coupled with broader adoption of CT‑based coronary imaging and calcium scoring positions CCT as an essential modality within regional cardiac care pathways, accelerating its uptake across both established and emerging healthcare markets in the MEA

Middle East and Africa Cardiac Computed Tomography (CCT) Market Analysis

- Cardiac computed tomography (CCT), providing non-invasive imaging for coronary arteries and cardiac structures, is becoming an essential diagnostic tool in hospitals and specialty cardiac centers due to its high-resolution imaging, rapid acquisition, and ability to support early detection of cardiovascular diseases

- The growing adoption of CCT is primarily fueled by rising prevalence of cardiovascular diseases, increasing healthcare expenditure, and expanding investments in advanced imaging infrastructure across key MEA countries

- Saudi Arabia dominated the MEA CCT market in 2025 with the largest revenue share of 26.7%, supported by government initiatives to modernize healthcare facilities, increasing availability of advanced CT scanners, and growing patient awareness regarding early cardiac diagnostics

- The UAE is expected to be the fastest-growing country in the MEA CCT market during the forecast period due to hospital expansions, rising number of specialty cardiac centers, and adoption of next-generation CT technologies

- Coronary CT angiography segment dominated the MEA CCT market with a market share of 45.9% in 2025, driven by its proven accuracy in detecting coronary artery disease, non-invasive nature, and growing preference among cardiologists for high-quality diagnostic imaging

Report Scope and Middle East and Africa Cardiac Computed Tomography (CCT) Market Segmentation

|

Attributes |

Middle East and Africa Cardiac Computed Tomography (CCT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Cardiac Computed Tomography (CCT) Market Trends

“Advanced Imaging Capabilities and AI-Assisted Diagnostics”

- A significant and accelerating trend in the MEA CCT market is the integration of advanced imaging technologies with AI-assisted diagnostic tools, improving scan accuracy, reducing acquisition time, and enhancing early detection of cardiovascular diseases

- For instance, Siemens’ SOMATOM Drive CT integrates AI-powered reconstruction algorithms that optimize image quality while minimizing radiation exposure, enabling faster and more precise cardiac assessment

- AI-assisted CCT enables predictive analytics, automated detection of coronary artery blockages, and generation of detailed 3D cardiac models for improved diagnosis. For instance, GE Healthcare’s Revolution CT utilizes AI to detect subtle anomalies and provide intelligent reporting for clinicians

- The seamless integration of CCT with hospital PACS systems and electronic health records (EHRs) allows centralized management of cardiac imaging data, improving workflow efficiency and facilitating multidisciplinary care planning

- This trend towards more accurate, automated, and AI-enabled cardiac imaging is reshaping diagnostic expectations, leading companies such as Philips Healthcare to develop AI-driven CT solutions with real-time analysis and optimized cardiac workflow

- The demand for CCT systems with AI integration and high-resolution imaging is growing rapidly across both public and private hospitals, as clinicians increasingly prioritize faster diagnosis, reduced patient risk, and improved clinical outcomes

- Another emerging trend is the use of cloud-based cardiac imaging analytics platforms, enabling remote interpretation and collaboration among cardiologists across multiple locations. For instance, some hospitals in the UAE are leveraging cloud solutions for tele-cardiology services

- Portable and compact CCT scanners are also gaining attention in the MEA region, particularly for smaller clinics and diagnostic centers, allowing faster deployment and flexible cardiac imaging solutions

Middle East and Africa Cardiac Computed Tomography (CCT) Market Dynamics

Driver

“Rising Cardiovascular Disease Prevalence and Healthcare Investments”

- The increasing prevalence of cardiovascular diseases, coupled with expanding healthcare infrastructure and investments, is a key driver of CCT adoption in the MEA region

- For instance, in March 2025, Cleveland Clinic Abu Dhabi expanded its cardiac imaging department with advanced CT scanners to meet rising patient demand, demonstrating how infrastructure investments drive market growth

- As clinicians seek non-invasive and high-accuracy diagnostic solutions, CCT provides rapid coronary assessment, calcium scoring, and 3D modeling, offering advantages over conventional diagnostic techniques

- Furthermore, increasing government initiatives for early cardiac screening and preventive healthcare are promoting CCT adoption across hospitals and specialty cardiac centers

- The availability of hospital-grade AI-enabled CCT systems, combined with growing awareness among physicians and patients, is fueling demand in both established markets such as Saudi Arabia and emerging markets such as Egypt

- Rising medical tourism in countries such as the UAE and Qatar is driving demand for advanced CCT facilities, as international patients seek high-quality, non-invasive cardiac imaging services

- Public-private partnerships and collaborations between hospitals and imaging technology providers are facilitating the introduction of new CCT solutions, accelerating adoption in key MEA countries

Restraint/Challenge

“High Cost and Limited Skilled Workforce”

- The high acquisition and maintenance costs of advanced CCT systems pose a significant challenge for wider adoption, particularly in smaller hospitals and clinics

- For instance, premium CCT scanners with AI-assisted analytics can cost several million USD, making them inaccessible for budget-constrained healthcare facilities

- In addition, a limited number of trained radiologists and CT technicians in some MEA countries restricts the effective utilization of sophisticated cardiac imaging equipment

- While prices are gradually decreasing for mid-range scanners, smaller hospitals may still struggle to adopt cutting-edge CCT technology, limiting regional market penetration

- Overcoming these challenges through government subsidies, public-private partnerships, training programs for healthcare professionals, and development of cost-effective AI-assisted CCT solutions will be crucial for sustained growth in the MEA market

- Infrastructure limitations, such as inconsistent electricity supply or limited IT support in some regions, can hinder the operation and maintenance of advanced CCT systems

- Regulatory approval processes and local compliance requirements for importing medical imaging devices may slow market entry for new CCT technologies, particularly in smaller MEA countries

Middle East and Africa Cardiac Computed Tomography (CCT) Market Scope

The market is segmented on the basis of offerings, product type, application, end user, and distribution channel.

- By Offerings

On the basis of offerings, the MEA CCT market is segmented into system, service, and software. The system segment dominated the market in 2025 with the largest revenue share, driven by the high demand for advanced CT scanners in hospitals and specialty cardiac centers. Hospitals prioritize system purchases due to their critical role in accurate coronary imaging, calcium scoring, and procedural planning. The availability of both single and dual-source CT systems with AI-assisted functionalities enhances the appeal of the system segment. In addition, system sales are often coupled with service and software packages, providing integrated solutions that facilitate diagnostics and workflow efficiency. The segment benefits from ongoing infrastructure investments in countries such as the UAE and Saudi Arabia, where upgrading cardiac imaging departments is a priority.

The service segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for managed imaging services, installation support, preventive maintenance, and remote monitoring. Service contracts allow hospitals and diagnostic centers to optimize equipment uptime and performance while minimizing operational challenges. Increasing adoption of outsourced imaging services in emerging MEA countries contributes to rapid service growth. The integration of AI-powered diagnostic software and predictive maintenance features in service offerings further accelerates adoption. Hospitals and specialty centers increasingly rely on service providers to ensure high-quality imaging results with minimal downtime.

- By Product Type

On the basis of product type, the MEA CCT market is segmented into single source CT, dual source cardiac CT, and spectral CT. The dual source cardiac CT segment dominated in 2025 with the largest revenue share, owing to its superior temporal resolution, higher accuracy for coronary artery disease detection, and reduced scan times. Dual source CT is preferred in busy cardiac centers for patients with high heart rates or complex coronary anatomy. Hospitals and specialty centers in Saudi Arabia and the UAE often adopt dual source CT for advanced coronary CT angiography and calcium scoring procedures. The segment benefits from growing investments in AI-assisted imaging and integration with PACS systems, which enhance clinical workflow. Dual source scanners also support multi-purpose imaging, enabling cardiac, pulmonary, and vascular assessments from a single scan.

The spectral CT segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to provide enhanced tissue characterization and quantitative analysis for cardiac and vascular diseases. Spectral CT offers improved plaque differentiation and better assessment of myocardial perfusion. The technology is increasingly adopted in advanced cardiac centers across the UAE and Egypt. Hospitals are leveraging spectral CT to improve diagnostic accuracy for complex cardiac conditions, reducing the need for invasive procedures. Its potential to integrate with AI-powered post-processing software further accelerates adoption.

- By Application

On the basis of application, the MEA CCT market is segmented into calcium scoring, coronary CT angiography (CTA), device implantation, pulmonary vein isolation (PVI), and left atrial appendage occlusion (LAAO). The coronary CT angiography (CTA) segment dominated in 2025 with the largest revenue share of 45.9% due to its non-invasive nature, high diagnostic accuracy, and widespread adoption for coronary artery disease evaluation. Hospitals prefer CTA for early detection and treatment planning, and it is increasingly used for risk stratification in patients with suspected coronary lesions. CTA also integrates effectively with AI-assisted imaging platforms, allowing automated plaque detection and 3D reconstruction. The segment is supported by increasing government cardiac screening initiatives and rising patient awareness in countries such as Saudi Arabia and the UAE.

The calcium scoring segment is expected to witness the fastest growth from 2026 to 2033, driven by its role in preventive cardiology and early detection of atherosclerosis. Calcium scoring scans are quick, low-dose, and widely recommended for high-risk patients. The adoption of calcium scoring is growing in emerging MEA countries such as Egypt and Morocco, where preventive healthcare awareness is increasing. Integration with AI software allows automated scoring, reporting, and risk stratification, enhancing clinical utility. The cost-effectiveness and non-invasive nature of calcium scoring procedures further accelerate market growth in the region.

- By End User

On the basis of end user, the MEA CCT market is segmented into hospitals, specialty centers, diagnostic & imaging centers, and others. The hospital segment dominated the market in 2025 with the largest revenue share, driven by high patient volumes, availability of advanced CT infrastructure, and preference for centralized cardiac imaging. Hospitals in Saudi Arabia, UAE, and South Africa invest heavily in dual-source CT systems and AI-powered software to improve diagnostic accuracy and throughput. Hospitals also benefit from bundled service contracts and post-sale support, ensuring optimal utilization of imaging assets. The segment growth is further supported by rising government initiatives to enhance cardiac care facilities and screening programs.

The diagnostic & imaging centers segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for specialized outpatient cardiac imaging services. These centers cater to both local and medical tourism patients seeking quick and affordable cardiac diagnostics. Growth is driven by adoption of compact and portable CT systems, AI-assisted reporting software, and subscription-based service models. Diagnostic centers in UAE and Egypt are increasingly expanding cardiac imaging offerings, leveraging dual-source and spectral CT technologies. Convenience, cost-effectiveness, and accessibility make this segment highly attractive for rapid adoption.

- By Distribution Channel

On the basis of distribution channel, the MEA CCT market is segmented into direct tender and third-party distributor. The direct tender segment dominated in 2025 with the largest revenue share, driven by government procurement for hospitals, specialty centers, and national cardiac screening programs. Direct tenders ensure standardized pricing, compliance with local regulations, and timely delivery of high-value CCT systems. Countries such as Saudi Arabia and UAE often procure dual-source CT systems and AI-enabled software directly from global vendors to maintain quality standards. The segment benefits from long-term service agreements and technical support bundled with direct sales.

The third-party distributor segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing presence of private hospitals, diagnostic chains, and emerging cardiac centers that rely on distributor networks for flexible procurement. Distributors provide mid-range and compact CT solutions, post-sale support, and AI-enabled software packages, making adoption more feasible for smaller hospitals. Countries such as Egypt, Morocco, and South Africa are increasingly leveraging distributor channels for rapid deployment of cardiac CT systems. Distributor networks also enable faster access to spare parts, software updates, and training services.

Middle East and Africa Cardiac Computed Tomography (CCT) Market Regional Analysis

- Saudi Arabia dominated the MEA CCT market in 2025 with the largest revenue share of 26.7%, supported by government initiatives to modernize healthcare facilities, increasing availability of advanced CT scanners, and growing patient awareness regarding early cardiac diagnostics

- Hospitals and specialty cardiac centers in the country prioritize high-resolution CT systems and AI-assisted imaging software to enhance diagnostic accuracy and support early detection of cardiovascular diseases

- The widespread adoption is further supported by rising patient awareness, strong government healthcare funding, and a focus on preventive cardiology, establishing CCT as a preferred diagnostic tool for both public and private healthcare providers

The Saudi Arabia Cardiac Computed Tomography (CCT) Market Insight

The Saudi Arabia Cardiac Computed Tomography (CCT) market captured the largest revenue share of 26.7% in 2025, fueled by significant investments in advanced cardiac imaging infrastructure and government initiatives to expand healthcare facilities. Hospitals and specialty cardiac centers are increasingly prioritizing dual-source and AI-assisted CT scanners to enhance diagnostic accuracy and early detection of cardiovascular diseases. Rising patient awareness, preventive healthcare programs, and the modernization of hospital imaging departments are key factors propelling the market. The adoption of AI-enabled software for automated coronary assessment further strengthens demand. Moreover, the country’s emphasis on improving cardiac care and screening programs is expected to continue driving market growth.

UAE Cardiac Computed Tomography (CCT) Market Insight

The UAE Cardiac Computed Tomography (CCT) market is projected to expand at a substantial CAGR throughout the forecast period, driven by the rapid development of specialty cardiac centers and growing medical tourism. The adoption of high-end dual-source and spectral CT systems is increasing due to their accuracy and non-invasive capabilities. Hospitals and diagnostic centers benefit from integrated AI-assisted imaging workflows, improving efficiency and clinical outcomes. Government support for preventive cardiology and early disease detection is encouraging CCT adoption. Furthermore, the growing number of private healthcare facilities and investments in digital health initiatives are fostering market growth.

South Africa Cardiac Computed Tomography (CCT) Market Insight

The South Africa Cardiac Computed Tomography (CCT) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising cardiovascular disease prevalence and modernization of healthcare infrastructure. Hospitals and private specialty centers are upgrading imaging systems to dual-source CT and AI-enabled platforms. Increasing patient demand for non-invasive cardiac diagnostics and awareness of advanced coronary imaging options further fuels growth. Public and private investments in cardiac care, along with training programs for imaging professionals, are expected to stimulate market expansion. The integration of CCT with electronic health records and PACS systems enhances workflow efficiency, supporting adoption across the country.

Egypt Cardiac Computed Tomography (CCT) Market Insight

The Egypt Cardiac Computed Tomography (CCT) market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of early cardiac disease detection and preventive healthcare initiatives. Hospitals and diagnostic centers are adopting advanced single and dual-source CT systems with AI-assisted imaging capabilities. The growing number of specialty cardiac centers and availability of portable CT scanners are enhancing market penetration. Government support for national health programs and urbanization trends contribute to higher CCT adoption. In addition, the affordability of mid-range CT systems and collaborations with technology providers are facilitating market growth.

Middle East and Africa Cardiac Computed Tomography (CCT) Market Share

The Middle East and Africa Cardiac Computed Tomography (CCT) industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Neusoft Medical Systems Co., Ltd. (China)

- United Imaging Healthcare (China)

- Shimadzu Corporation (Japan)

- Samsung Medison Co., Ltd. (South Korea)

- FUJIFILM Healthcare Corporation (Japan)

- Hitachi High-Tech Corporation (Japan)

- Mindray Medical International Limited (China)

- Shenzhen Anke High-Tech Co., Ltd. (China)

- Carestream Health (U.S.)

- Analogic Corporation (U.S.)

- NeuroLogica Corp. (U.S.)

- Agfa HealthCare (Belgium)

- Planmed Oy (Finland)

- Cybermed Inc. (South Korea)

- Unison Healthcare Group (Taiwan)

- Shanghai United Imaging Healthcare Co., Ltd. (China)

What are the Recent Developments in Middle East and Africa Cardiac Computed Tomography (CCT) Market?

- In June 2025, The Nairobi Hospital in Kenya officially launched East Africa’s first AI‑powered 256‑slice CT scanner, featuring dual‑source and AI‑assisted imaging to boost diagnostic capacity for cardiovascular, pediatric, trauma, and neurological cases. The advanced CT system enables ultra‑fast, high‑resolution scans while minimizing radiation exposure and reducing reliance on overseas medical care, marking a major step in regional diagnostic imaging capabilities

- In April 2025, Sheba Medical Center in Israel installed the Middle East’s first next‑generation photon‑counting CT scanner, the Naeotom Alpha by Siemens, redefining cardiac and multi‑organ imaging with unparalleled resolution and reduced radiation exposure. This advanced CT technology delivers up to nine times higher image clarity than traditional scanners, enabling more accurate visualization of small coronary vessels, heavily calcified arteries, stents, and prosthetic valves, which enhances non‑invasive cardiac diagnostic confidence and may reduce the need for invasive procedures

- In February 2025, Sheba Medical Center in Israel and the broader Middle East implemented a next‑generation photon‑counting CT scanner (Naeotom Alpha), offering up to nine times higher image resolution than traditional CT and reduced radiation dose. This upgrade significantly improves visualization of coronary vessels, heavily calcified arteries, stents, and prosthetic valves, advancing non‑invasive cardiac assessment and potentially reducing the need for invasive procedures

- In February 2024 at Arab Health 2024, Neusoft Medical Systems showcased AI‑empowered CT imaging technologies at the region’s leading healthcare exhibition. The showcased devices integrated advanced AI capabilities into CT imaging workflows, highlighting growing adoption of intelligent imaging solutions across the Middle East and Africa and providing clinicians with enhanced diagnostic tools for complex conditions, including cardiovascular diseases

- In February 2023 at Arab Health 2023, United Imaging announced multiple partnerships and product deployments in the Middle East and Africa, including collaborative agreements to install advanced imaging technology (including cardiac CT) at My Doctor Medical Center in Qatar and I‑ONE Nuclear Medicine & Oncology Center in Saudi Arabia. These partnerships aim to expand access to advanced cardiac imaging and research capabilities across the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.