Middle East And Africa Biodegradable Film Market

Market Size in USD Million

CAGR :

%

USD

837.72 Million

USD

1,164.23 Million

2025

2033

USD

837.72 Million

USD

1,164.23 Million

2025

2033

| 2026 –2033 | |

| USD 837.72 Million | |

| USD 1,164.23 Million | |

|

|

|

|

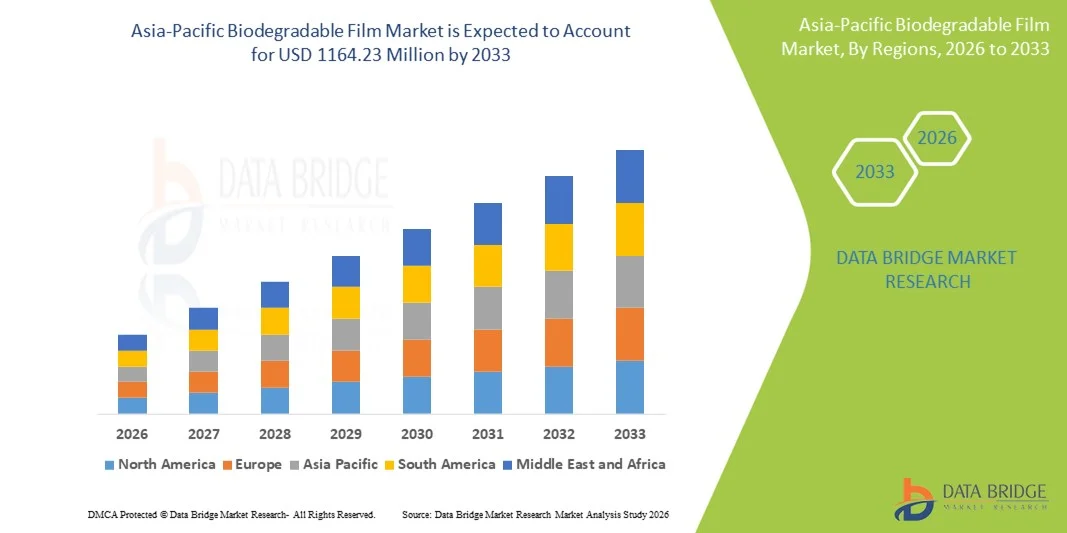

What is the Asia-Pacific Biodegradable Film Market Size and Growth Rate?

- The Asia-Pacific biodegradable film market size was valued at USD 837.72 million in 2025 and is expected to reach USD 1164.23 million by 2033, at a CAGR of 4.2% during the forecast period

- The fluctuation in price and long-term availability of fossil fuels is acting as a driver and boosting the demand for the biodegradable film market. The comparatively higher production cost with respect to plastic films is hampering the demand for the biodegradable film market

What are the Major Takeaways of Biodegradable Film Market?

- The growth of the sustainable film market is acting as an opportunity for the biodegradable film market. Inability of biodegradable film to degrade when certain environmental conditions are not met which is acting as a challenge for hampering the demand of the biodegradable film market

- Saudi Arabia dominated the Middle East and Africa biodegradable film market with a leading revenue share of 32.25% in 2025, driven by growing government initiatives to reduce plastic waste, increasing adoption of sustainable packaging in food and retail sectors, and rising investments in bio-based material manufacturing

- Egypt is expected to record the fastest CAGR of 11.58% from 2026 to 2033 within the Middle East and Africa Biodegradable Film market, driven by rapid urbanization, rising packaged food consumption, and increasing government focus on environmental sustainability

- The PLA segment dominated the market with an estimated 38.9% share in 2025, driven by its excellent transparency, printability, compostability, and widespread adoption in food packaging, labels, and disposable applications

Report Scope and Biodegradable Film Market Segmentation

|

Attributes |

Biodegradable Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Biodegradable Film Market?

Rapid Shift Toward High-Performance, Sustainable, and Compostable Biodegradable Films

- The biodegradable film market is witnessing increasing adoption of high-performance, compostable, and bio-based films designed to deliver improved mechanical strength, barrier properties, and controlled degradation across packaging and agricultural applications

- Manufacturers are introducing multi-layer biodegradable films with enhanced tear resistance, heat sealability, and moisture barriers to replace conventional plastic films in food packaging, retail, and industrial uses

- Rising emphasis on circular economy practices, including renewable feedstocks, compostability certifications, and reduced carbon footprints, is accelerating sustainable material adoption globally

- For instance, companies such as BASF, Futamura, Walki Group, Avery Dennison, and Novamont are developing advanced biodegradable and compostable films for food packaging, labels, carrier bags, and agricultural mulch applications

- Increasing regulatory pressure on single-use plastics across the U.S., Europe, and Asia-Pacific is driving demand for certified biodegradable and compostable film solutions

- As sustainability regulations tighten and brand owners prioritize eco-friendly packaging, Biodegradable Films will remain critical for reducing plastic waste and meeting environmental compliance goals

What are the Key Drivers of Biodegradable Film Market?

- Growing global regulations banning or restricting single-use plastics in packaging, agriculture, and retail are significantly boosting demand for biodegradable films

- For instance, in 2024–2025, companies such as BASF, Futamura, and Walki Group expanded their biodegradable film portfolios to support compostable packaging and agricultural film requirements across Europe and Asia-Pacific

- Rising consumer awareness regarding plastic pollution, food safety, and environmental sustainability is encouraging adoption of biodegradable alternatives with certified compostability

- Technological innovations, including PLA-, PHA-, starch-, and cellulose-based films, are improving flexibility, barrier performance, and shelf-life compatibility

- Increasing demand from food & beverage packaging, agriculture mulch films, personal care, and e-commerce packaging continues to strengthen market growth

- Supported by sustainability mandates, brand commitments, and advancements in bio-based polymers, the Biodegradable Film market is projected to experience strong long-term expansion

Which Factor is Challenging the Growth of the Biodegradable Film Market?

- Higher costs of bio-based raw materials, specialty polymers, and certification processes limit adoption compared to conventional plastic films

- During 2024–2025, price volatility of PLA, PHA, cellulose, and starch-based materials increased production costs for several global manufacturers

- Performance limitations such as lower heat resistance, moisture sensitivity, and shorter shelf life can restrict usage in certain high-demand packaging applications

- Limited industrial composting infrastructure and lack of consumer awareness regarding proper disposal reduce the environmental effectiveness of biodegradable films in some regions

- Competition from low-cost conventional plastics and oxo-degradable alternatives creates pricing pressure and slows market penetration

- To address these challenges, manufacturers are focusing on cost optimization, material innovation, infrastructure partnerships, and education initiatives to accelerate global adoption of Biodegradable Films

How is the Biodegradable Film Market Segmented?

The market is segmented on the basis of type, product type, crop type, and application.

- By Type

On the basis of type, the biodegradable film market is segmented into PLA, Starch Blends, Biodegradable Polyester, PHA, Soy-Based, Cellulose-Based, Lignin-Based, and Others. The PLA segment dominated the market with an estimated 38.9% share in 2025, driven by its excellent transparency, printability, compostability, and widespread adoption in food packaging, labels, and disposable applications. PLA films offer good mechanical strength and are compatible with existing processing technologies, making them a preferred choice for manufacturers transitioning from conventional plastics.

The PHA segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by its superior biodegradability in marine and soil environments, growing R&D investments, and increasing use in high-performance packaging and agricultural films. Rising regulatory pressure and demand for fully biodegradable materials further support growth across emerging bio-based polymer types.

- By Product Type

Based on product type, the market is segmented into Oxo-Biodegradable and Hydro-Biodegradable films. The Hydro-Biodegradable segment dominated the market with a revenue share of approximately 64.5% in 2025, due to increasing regulatory support for compostable and bio-based materials that fully degrade without leaving microplastic residues. These films are widely used in food packaging, agriculture, and consumer goods, supported by compostability certifications and sustainability mandates.

The Oxo-Biodegradable segment is projected to grow at a moderate pace, mainly in cost-sensitive and transitional markets, where conventional plastics blended with additives are still permitted. However, the Hydro-Biodegradable segment is expected to remain the fastest-growing from 2026 to 2033, driven by stricter plastic bans, growing environmental awareness, and expanding industrial composting infrastructure across Europe and Asia-Pacific.

- By Crop Type

By crop type, the biodegradable film market is segmented into Fruits & Vegetables, Grains & Oilseeds, Flowers & Plants, and Others. The Fruits & Vegetables segment dominated the market with an estimated 42.3% share in 2025, owing to extensive use of biodegradable mulch films for moisture retention, weed control, soil temperature regulation, and improved crop yield. Short crop cycles and high adoption of sustainable farming practices further support demand in this segment.

The Flowers & Plants segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising commercial floriculture, greenhouse cultivation, and demand for eco-friendly growing solutions. Increasing government incentives for sustainable agriculture and growing adoption of biodegradable films in horticulture are expected to accelerate growth across developing and developed agricultural markets.

- By Application

On the basis of application, the market is segmented into Food Packaging, Agriculture & Horticulture, Cosmetic & Personal Care Products, Industrial Packaging, and Others. The Food Packaging segment dominated the market with a 46.8% share in 2025, driven by increasing demand for sustainable packaging solutions, stringent regulations on single-use plastics, and strong adoption by food brands seeking compostable alternatives. Biodegradable films are widely used in wraps, pouches, trays, and labeling applications.

The Agriculture & Horticulture segment is expected to witness the fastest growth from 2026 to 2033, supported by rising adoption of biodegradable mulch films, soil health preservation initiatives, and government-backed sustainable farming programs. Growing demand for eco-friendly agricultural inputs continues to strengthen long-term market expansion.

Which Region Holds the Largest Share of the Biodegradable Film Market?

- Saudi Arabia dominated the Middle East and Africa biodegradable film market with a leading revenue share of 32.25% in 2025, driven by growing government initiatives to reduce plastic waste, increasing adoption of sustainable packaging in food and retail sectors, and rising investments in bio-based material manufacturing

- Expanding demand for eco-friendly food packaging, agricultural films, and retail carry bags, supported by national sustainability programs and waste reduction policies, is accelerating the use of biodegradable films across the Kingdom

- Strong industrial infrastructure, increasing private-sector participation, and government-backed environmental regulations continue to reinforce Saudi Arabia’s leadership in the MEA biodegradable film market

South Africa Biodegradable Film Market Insight

In South Africa, steady demand for biodegradable films is supported by increasing awareness of plastic pollution, growing enforcement of extended producer responsibility (EPR) regulations, and rising adoption of sustainable packaging across food, beverage, and retail industries. Biodegradable films are increasingly used in food wraps, carrier bags, labels, and agricultural mulch films, particularly within commercial farming and export-oriented agriculture. Growing investments in local biodegradable packaging production, coupled with corporate sustainability initiatives by major retailers, are supporting market expansion. Improvements in waste management systems and gradual development of composting infrastructure further sustain stable growth in South Africa’s biodegradable film market.

Egypt Biodegradable Film Market Insight

Egypt is expected to record the fastest CAGR of 11.58% from 2026 to 2033 within the Middle East and Africa Biodegradable Film market, driven by rapid urbanization, rising packaged food consumption, and increasing government focus on environmental sustainability. Growing adoption of biodegradable films in food packaging, agricultural applications, and personal care products is fueling demand. Government initiatives promoting sustainable materials, expanding local manufacturing capabilities, and increasing awareness of plastic waste management are accelerating market penetration. Rising investments by regional packaging companies in PLA- and starch-based biodegradable films further strengthen Egypt’s position as a high-growth market within the MEA region.

Which are the Top Companies in Biodegradable Film Market?

The biodegradable film industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- TAGHLEEF INDUSTRIES GROUP (U.A.E.)

- Shreejistretchfilm (India)

- Polyplex Corporation Ltd. (India)

- STOROPACK HANS REICHENECKER GMBH (Germany)

- Grafix Plastics (U.S.)

- Profol GmbH (Germany)

- Walki Group Oy (Finland)

- BioBag Americas, Inc. (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Cortec Corporation (U.S.)

- BI-AX International Inc. (U.S.)

- Futamura Group (Japan)

- Poysha Packaging Private Limited (India)

- Plastika Kritis S.A. (Greece)

What are the Recent Developments in Global Biodegradable Film Market?

- In September 2024, Pester Pac Automation collaborated with Solutum Technologies to introduce an innovative eco-friendly packaging film designed to replace conventional plastic materials. This biodegradable film breaks down completely in soil and water, leaving no microplastic residue. With excellent tear resistance, it enables the use of thinner material, resulting in lower costs. Moreover, it integrates seamlessly with Pester’s stretch wrapping and overwrapping equipment, ensuring enhanced operational efficiency and sustainability. This advancement marks a significant step towards reducing environmental impact in packaging operations

- In January 2024, CAMM Solutions unveiled a biodegradable stretch film that offers a sustainable substitute for conventional plastic stretch films used in logistics and packaging. Made from a combination of natural ingredients and advanced PVOH formulations, the film matches the performance of traditional stretch films while eliminating microplastic pollution. It dissolves quickly in nature, making it harmless if it escapes into the environment and provides reliable stabilization for pallets and transported goods. This development reflects the growing demand for eco-friendly logistics solutions

- In February 2022, SRF announced plans to establish a new BOPP film manufacturing facility in Indore, India, with a focus on producing biodegradable films. The facility will contribute to expanding the availability of sustainable packaging options in the region, supporting both domestic and international demand for environmentally responsible film solutions. This investment highlights SRF’s commitment to advancing biodegradable film production in India

- In October 2021, Walki Group expanded its market presence by acquiring Rollpack, strengthening its capabilities in the production of sustainable films and packaging solutions. This acquisition enhances Walki Group’s portfolio of biodegradable film offerings and reinforces its position as a key player in the global eco-friendly packaging sector

- In December 2021, researchers from Harvard University and Nanyang Technological University successfully developed a new biodegradable film derived from corn protein. This breakthrough provides a renewable, plant-based alternative to conventional plastic films and aligns with growing efforts to reduce plastic waste. The innovation underscores the role of scientific collaboration in driving sustainable material advancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Biodegradable Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Biodegradable Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Biodegradable Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.