Middle East And Africa Automotive Logistics Market

Market Size in USD Billion

CAGR :

%

USD

20.00 Billion

USD

30.10 Billion

2024

2032

USD

20.00 Billion

USD

30.10 Billion

2024

2032

| 2025 –2032 | |

| USD 20.00 Billion | |

| USD 30.10 Billion | |

|

|

|

|

Middle East and Africa Automotive Logistics Market Size

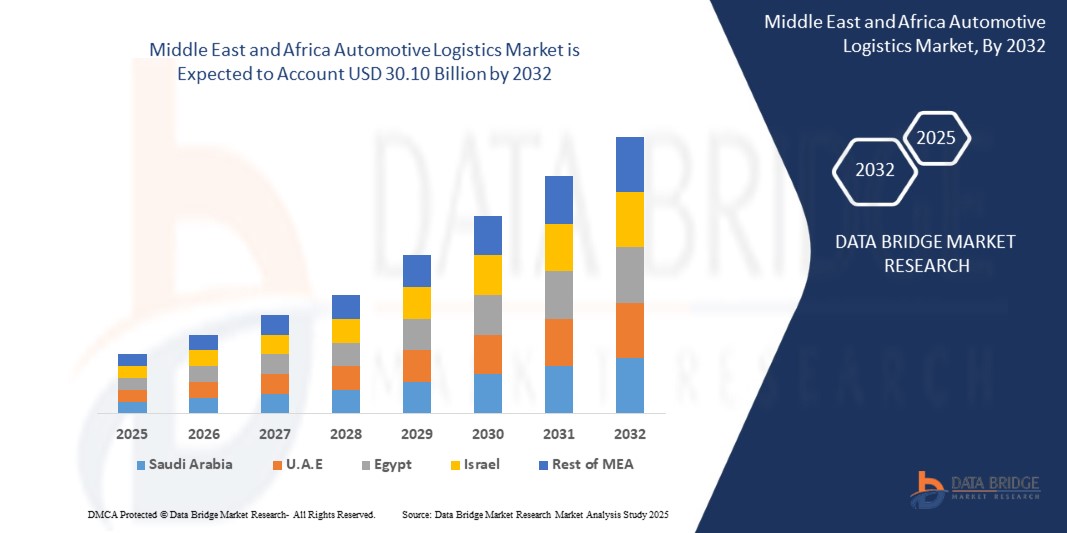

- The Middle East and Africa Automotive Logistics Market was valued at USD 20 billion in 2025 and is projected to reach USD 30.10 billion by 2032, growing at a CAGR of 6% during the forecast period.

- Growth is supported by increasing vehicle production in countries like South Africa and Morocco, expanding intra-regional trade, port modernization initiatives, and growing investment in EV infrastructure and smart transport corridors.

Middle East and Africa Automotive Logistics Market Analysis

- The MEA automotive logistics market is evolving as governments prioritize economic diversification, infrastructure development, and automotive localization.

- Free trade zones (FTZs) in the UAE, Saudi Arabia, and Egypt are enabling efficient regional and re-export automotive logistics by offering customs incentives and proximity to major ports.

- Rising vehicle demand, especially in commercial fleets and passenger cars, is pushing logistics providers to optimize warehousing, route planning, and parts distribution strategies.

- The increasing penetration of connected and electric vehicles is generating new demand for high-tech logistics services, including temperature-controlled EV battery storage, hazardous goods handling, and reverse logistics for recycling.

- Smart city initiatives (e.g., NEOM in Saudi Arabia) are integrating AI and IoT into logistics planning, enabling predictive fleet tracking and real-time delivery management.

Report Scope and Middle East and Africa Automotive Logistics Market Segmentation

|

Attributes |

Automotive Logistics Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Automotive Logistics Market Trends

“Localization, Trade Zone Expansion, and Smart Infrastructure Reshaping MEA Automotive Logistics”

- A growing focus on local vehicle production and assembly is transforming the MEA automotive logistics landscape. Countries such as Morocco, Egypt, and South Africa are becoming regional manufacturing hubs, increasing the need for efficient inbound logistics, regional warehousing, and domestic distribution networks.

- Expansion of free trade zones (FTZs) and automotive industrial parks across the GCC and North Africa is attracting global OEMs and logistics providers. These zones offer customs incentives, infrastructure support, and direct access to ports, helping streamline cross-border automotive logistics.

- Governments across the region are investing in smart infrastructure projects, including digitized ports, intelligent transportation systems, and integrated rail-road corridors. These upgrades enhance connectivity, reduce transit times, and support the development of multimodal logistics networks.

- Public-private partnerships (PPPs) are playing a crucial role in driving logistics innovation, enabling the deployment of automated warehousing, cloud-based transport management systems (TMS), and AI-powered route planning tools tailored to regional conditions.

- The rapid rise in aftermarket parts demand, especially in East and West Africa, is boosting the need for responsive logistics services, including last-mile delivery, reverse logistics for returns, and decentralized parts hubs to serve growing vehicle populations.

Middle East and Africa Automotive Logistics Market Dynamics

Driver

“Government Infrastructure Investment and Free Trade Zone Development Fueling Logistics Growth”

• Governments across the Middle East and Africa are heavily investing in transport infrastructure, including roads, ports, dry ports, and rail systems to strengthen regional connectivity and reduce logistics bottlenecks. Initiatives like Saudi Arabia’s Vision 2030, the UAE’s Industrial Strategy 300bn, and Africa’s Continental Free Trade Area (AfCFTA) are significantly improving cross-border trade flow and logistics capacity.

• Special Economic Zones (SEZs) and automotive-focused free trade zones, particularly in the UAE, Egypt, Morocco, and South Africa, are encouraging OEMs and logistics providers to localize operations. These zones offer customs exemptions, streamlined documentation, and integrated access to port and airport infrastructure—cutting down lead times and improving cost efficiency.

• The rise in regional vehicle production and assembly—especially in countries like Morocco, Egypt, and South Africa—is creating strong demand for localized inbound logistics, supplier integration, and distribution networks. Governments are offering incentives to attract OEMs and component manufacturers, further driving logistics infrastructure development.

• Public-private partnerships (PPPs) are accelerating investment in logistics parks, smart warehouses, and dedicated automotive terminals. These collaborations are enabling faster implementation of large-scale infrastructure projects, while ensuring alignment with international logistics standards and automation trends.

Restraint/Challenge

“Underdeveloped Infrastructure, Security Concerns, and Regulatory Fragmentation Impede Market Scalability”

- Many parts of Sub-Saharan Africa and rural regions in the Middle East still lack adequate road and rail infrastructure, which results in higher transit times, limited accessibility, and unreliable delivery networks for automotive components and vehicles.

- Political instability and security risks in countries such as Sudan, Libya, and parts of West Africa disrupt supply chain continuity, elevate insurance and risk management costs, and deter foreign logistics investment.

- Inconsistent customs regulations and trade documentation standards across MEA countries lead to delays and increased administrative burdens for cross-border automotive logistics, especially for vehicle imports, parts exports, and aftermarket distribution.

- A shortage of skilled logistics personnel, coupled with limited access to advanced fleet technologies and warehousing automation, constrains the market’s ability to scale rapidly or modernize operations in many emerging economies within the region.

Middle East and Africa Automotive Logistics Market Scope

The market is segmented on the basis of service type, mode of transport, logistics type, and vehicle type.

• By Service Type

The Automotive Logistics Market in the Middle East and Africa is segmented into Transportation, Warehousing, Inventory Management, and Distribution. In 2025, the Transportation segment dominates due to the growing need for regional movement of components, CKD kits, and finished vehicles across expanding production and assembly zones. Warehousing and inventory management are also gaining traction, particularly in trade hubs like the UAE and Morocco, where logistics providers are supporting just-in-time (JIT) and just-in-sequence (JIS) delivery models.

• Mode of Transport

Modes of transport include Roadways, Railways, Maritime, and Air. Road transport leads the segment, driven by its flexibility and dominance in last-mile and inland logistics. However, maritime logistics is rapidly expanding due to strategic investments in port infrastructure in the UAE, South Africa, and Egypt. Railways, while limited in parts of Sub-Saharan Africa, are gaining relevance in North Africa. Air freight plays a crucial role in the rapid delivery of critical automotive components and aftermarket parts.

• By Logistics Type

This segment includes Inbound, Outbound, Reverse Logistics, and Aftermarket. Inbound logistics holds the largest share, driven by increasing vehicle production and the import of components to regional assembly hubs. Outbound logistics, which includes the export and distribution of finished vehicles, is growing due to trade initiatives and port expansions. Reverse logistics and aftermarket logistics are gaining importance as OEMs and suppliers expand support for warranty, repair, and recycling services across developing MEA markets.

• By Vehicle Type

Vehicle types include Passenger Cars, Commercial Vehicles, and Electric Vehicles (EVs). Passenger cars dominate the market due to their widespread demand and strong domestic assembly operations. However, electric vehicles are projected to grow rapidly, especially in the GCC and North Africa, driven by government incentives and rising investments in EV infrastructure. This shift is increasing demand for specialized battery logistics and hazardous materials compliance in warehousing and distribution.

•By Distribution

The market is segmented into Domestic and International logistics. Domestic logistics holds a significant share due to rising intra-country vehicle demand, urbanization, and aftermarket parts circulation—especially in countries like South Africa, Egypt, and Nigeria. Meanwhile, international logistics is expanding steadily as the UAE, Morocco, and Saudi Arabia strengthen their roles as export and re-export hubs for finished vehicles and components across Africa, Asia, and Europe.

• By Stage

Logistics stages in the Middle East and Africa Automotive Logistics Market are categorized into Raw Materials Stage, Sub-Assembly Modules, Finished Product, and Final Product Delivery. The Raw Materials Stage involves the transportation of essential inputs such as metals, plastics, and electronics to component manufacturers or Tier-1 suppliers. Sub-Assembly Modules focus on the movement of key parts like engines, axles, and batteries to final assembly plants. The Finished Product stage encompasses the logistics of moving fully assembled vehicles from factories to ports or directly to dealerships. Lastly, Final Product Delivery refers to last-mile transport of vehicles to end users or retail points, which increasingly demands precision coordination and multimodal logistics solutions, particularly in densely populated or logistically complex urban environments.

Middle East and Africa Automotive Logistics Market– Regional Analysis

- The Middle East and Africa Automotive Logistics Market is projected to grow steadily through 2028, driven by increasing investments in vehicle assembly, infrastructure development, and regional trade connectivity. Growing EV demand in countries like the UAE and South Africa, along with rising intra-African trade supported by the African Continental Free Trade Area (AfCFTA), is expanding the scope of inbound, outbound, and aftermarket logistics operations.

- The region benefits from strategic port locations, ongoing digitization of customs and transport systems, and government-backed special economic zones (SEZs) that attract OEMs and global logistics players. Public-private partnerships and logistics modernization programs are further enabling multimodal growth, particularly through road and maritime networks.

United Arab Emirates (UAE) Automotive Logistics Market Insight

The UAE leads the region in logistics innovation, driven by its world-class ports (e.g., Jebel Ali, Khalifa Port), well-developed road networks, and strong focus on re-exporting automotive goods. The country’s free zones and customs-efficient trade corridors support rapid vehicle and parts movement. EV-focused logistics, digital TMS/WMS integration, and smart warehousing are also gaining traction in line with the UAE’s net-zero and smart mobility goals.

Saudi Arabia Automotive Logistics Market Insight

Saudi Arabia is undergoing a logistics transformation under Vision 2030, with major investments in inland logistics hubs, rail corridors, and electric mobility infrastructure. The Kingdom is prioritizing domestic EV production and has launched initiatives to develop automotive-focused industrial zones. This is driving increased demand for inbound logistics, battery handling services, and last-mile delivery systems within urban clusters.

South Africa Automotive Logistics Market Insight

South Africa remains a major automotive manufacturing and export base for Sub-Saharan Africa. Durban and Port Elizabeth serve as key logistics gateways, supported by a maturing road and rail infrastructure. The country also has a strong aftermarket ecosystem, generating demand for reverse logistics, warehousing, and regional distribution. South Africa’s shift towards local EV assembly is creating new logistics opportunities in battery storage and component transportation.

Morocco Automotive Logistics Market Insight

Morocco has emerged as a competitive automotive export base, with strong ties to Europe. Tanger Med Port is one of Africa’s largest automotive gateways, supporting efficient outbound logistics and international vehicle shipments. The country’s logistics sector is benefiting from EU trade partnerships, OEM investments, and integrated supply chain models for both finished vehicles and sub-assemblies.

Kenya & Nigeria Automotive Logistics Market Insight

In East and West Africa, Kenya and Nigeria are developing into key distribution hubs due to rising vehicle imports and aftermarket parts demand. While infrastructure challenges remain, governments are focusing on port modernization, regional road connectivity, and local assembly partnerships. These efforts are fueling logistics growth, particularly in spare parts distribution, retail vehicle movement, and warehouse development.

Middle East and Africa Automotive Logistics Market Share

The Middle East and Africa Automotive Logistics Market is led by a mix of global and regional logistics service providers:

- CEVA LOGISTICS AG

- DB Schenker

- DHL International GmbH

- DSV A/S

- GEODIS

- Kuehne + Nagel International AG

- Nippon Express Co., Ltd.

- XPO Logistics, Inc.

- United Parcel Service of America, Inc.

Latest Developments in Middle East and Africa Automotive Logistics Market

- In February 2025, DHL Global Forwarding announced the expansion of its automotive logistics hub in Dubai South, aimed at serving OEMs across the GCC and North Africa. The facility includes bonded warehousing, multimodal access, and temperature-controlled zones for EV battery handling.

- In December 2024, CEVA Logistics partnered with Morocco’s Tanger Med Port Authority to launch a dedicated automotive logistics terminal, improving the flow of finished vehicle exports to Europe and increasing storage capacity for CKD kits.

- In September 2024, DB Schenker signed a strategic agreement with the Saudi Industrial Development Fund (SIDF) to establish smart logistics centers in Riyadh and Dammam, focused on supporting the Kingdom’s emerging EV assembly and component supply chain.

- In July 2024, Aramex introduced a last-mile electric vehicle fleet for auto parts delivery across urban centers in the UAE, supporting its broader sustainability roadmap and catering to rising B2C aftermarket demand.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.