Middle East And Africa Aroma Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

66.66 Billion

USD

144.53 Billion

2025

2033

USD

66.66 Billion

USD

144.53 Billion

2025

2033

| 2026 –2033 | |

| USD 66.66 Billion | |

| USD 144.53 Billion | |

|

|

|

|

What is the Middle East and Africa Aroma Chemicals Market Size and Growth Rate?

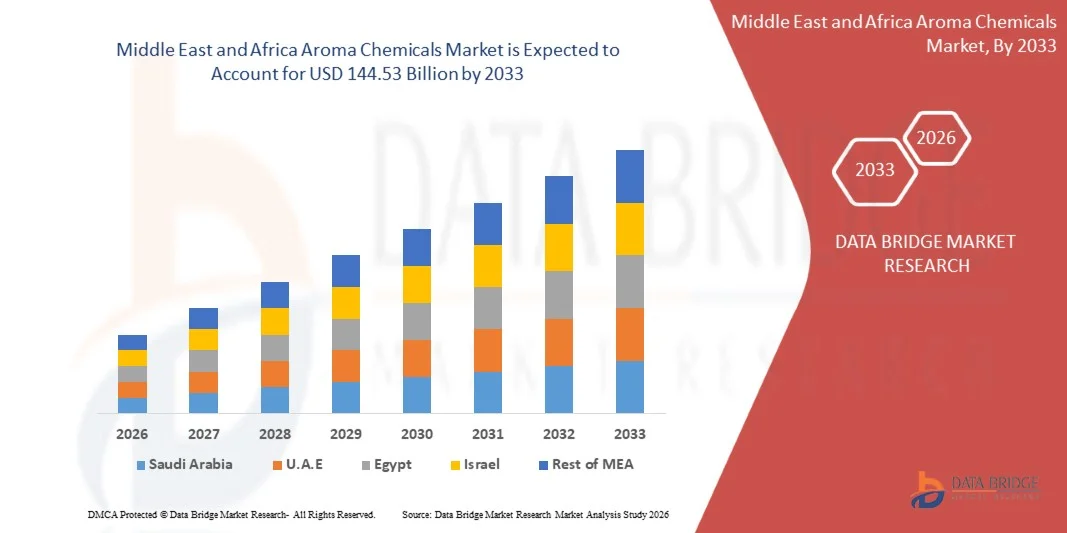

- The Middle East and Africa Aroma Chemicals market size was valued at USD 66.66 billion in 2025 and is expected to reach USD 144.53 billion by 2033, at a CAGR of 7.0% during the forecast period

- Increasing construction and infrastructure activities, including commercial, residential, and industrial projects, are driving the demand for Aroma Chemicals to protect structures from water ingress, moisture, and environmental degradation, thereby supporting market growth

- The high initial cost of premium membranes and installation, coupled with the need for skilled labor and specialized machinery, increases the overall project expenditure, which can limit adoption in small-scale or cost-sensitive projects

What are the Major Takeaways of Aroma Chemicals Market?

- Advancements in waterproofing technologies, such as self-adhesive membranes, liquid-applied solutions, and high-performance synthetic sheets, are improving durability and ease of installation, presenting significant growth opportunities for market players

- Challenges such as leakage issues, improper installation, and maintenance requirements continue to impact cost efficiency and performance, posing key obstacles for widespread adoption of Aroma Chemicals in Middle East and Africa

- Saudi Arabia dominated the Middle East and Africa aroma chemicals market with a 34.5% revenue share in 2025, supported by growing adoption of high-quality aroma chemicals in fragrances, personal care, food, and beverage industries

- The U.A.E. is projected to register the fastest CAGR of 9.8% from 2026 to 2033, fueled by the adoption of natural, sustainable, and innovative aroma chemicals in perfumery, personal care, and food & beverage sectors

- The Terpenes segment dominated the market with a 54% revenue share in 2025, driven by high demand in fine fragrances, personal care, and food applications due to their versatility and natural aroma profile

Report Scope and Aroma Chemicals Market Segmentation

|

Attributes |

Aroma Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Aroma Chemicals Market?

“Rising Demand for Sustainable and High-Performance Aroma Chemicals”

- The Middle East and Africa aroma chemicals market is witnessing a key trend of increasing adoption of eco-friendly, clean-label, and multifunctional aroma ingredients. This trend is driven by growing consumer awareness of health, wellness, and sustainability, particularly in food, beverage, cosmetics, and personal care applications

- For instance, companies such as Firmenich and Givaudan are developing plant-derived, biodegradable aroma chemicals with enhanced stability and superior sensory profiles to meet stringent regulatory standards and consumer expectations

- Rising demand for natural, low-allergen, and clean-label aroma chemicals is accelerating adoption across Middle East and Africa’s food, beverage, and personal care industries

- Manufacturers are integrating advanced extraction technologies, microencapsulation, and solvent-free processing to improve performance, shelf-life, and safety

- Increasing R&D in novel flavor compounds, sustainable sourcing, and odor-masking technologies is fostering innovation

- As consumers continue prioritizing wellness, sustainability, and high-quality sensory experiences, premium and natural aroma chemicals are expected to remain central to product development

What are the Key Drivers of Aroma Chemicals Market?

- Growing emphasis on clean-label, natural, and sustainable ingredients is a major driver of market expansion

- For instance, in 2025, DSM and Symrise launched plant-based, allergen-free aroma chemicals for food, beverages, and personal care, targeting health-conscious consumers

- Increasing demand for premium and functional flavors and fragrances in packaged foods, beverages, and cosmetics is driving adoption

- Technological advancements in extraction, purification, and encapsulation are enabling manufacturers to produce more stable and potent aroma ingredients

- Rising regulatory focus on safety, labeling, and sustainable sourcing is supporting the market growth

- With continued investment in R&D, sustainable sourcing, and consumer-driven innovation, the Middle East and Africa Aroma Chemicals market is expected to maintain robust growth momentum over the coming years

Which Factor is Challenging the Growth of the Aroma Chemicals Market?

- High cost of premium natural and plant-based aroma chemicals limits adoption, particularly for small-scale manufacturers and price-sensitive products

- For instance, during 2024–2025, fluctuations in raw material prices, extraction costs, and regulatory compliance impacted production and pricing for leading players

- Strict regulatory requirements for safety, allergen labeling, and environmental compliance increase operational complexity and costs

- Limited consumer awareness about the benefits of natural and functional aroma chemicals can restrict mass adoption

- Competition from synthetic aroma chemicals, low-cost local alternatives, and imported substitutes creates pricing pressure and affects market penetration

- To address these challenges, manufacturers are focusing on cost-efficient extraction methods, sustainable sourcing, eco-certified products, and education programs to deliver high-quality, safe, and sustainable aroma chemical solutions

How is the Aroma Chemicals Market Segmented?

The market is segmented on the basis of chemical type, aroma node, color, source, form, application, product type, and distribution channel.

• By Chemical Type

On the basis of chemical type, the market is segmented into Terpenes, Benzenoids, Musk Chemicals, Esters, Ketones, and Others. The Terpenes segment dominated the market with a 54% revenue share in 2025, driven by high demand in fine fragrances, personal care, and food applications due to their versatility and natural aroma profile.

Musk chemicals are projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing preference for long-lasting, premium fragrances in high-end perfumes and personal care products. Continuous innovation in synthetic and natural terpene extraction supports market expansion, while terpenes remain preferred for clean-label and functional applications.

• By Aroma Node

Based on aroma node, the market is segmented into Floral, Woody, Citrus, Fruity, Herbal, Tropical, and Others. The Floral segment dominated with 38.6% revenue share in 2025, owing to widespread use in perfumes, toiletries, and personal care products.

Woody aroma chemicals are projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for warm, earthy fragrance profiles in luxury and niche products. Innovations in encapsulation and stabilizing techniques ensure consistent aroma retention across applications.

• By Color

On the basis of color, the market is segmented into Colorless, White, Yellowish, and Others. The Colorless segment dominated the market with a 46.2% revenue share in 2025, as these chemicals are highly versatile, easier to blend, and preferred across beverages, cosmetics, and food applications.

Yellowish aroma chemicals are projected to grow at the fastest CAGR from 2026 to 2033, driven by consumer preference for naturally derived, visually appealing ingredients and expanding applications in specialty perfumery.

• By Source

Based on source, the market is segmented into Natural and Synthetic. The Synthetic segment dominated with a 51.3% revenue share in 2025, owing to consistent quality, scalability, and lower cost compared to natural extracts.

Natural aroma chemicals are projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer preference for clean-label, organic, and sustainable fragrance solutions across food, beverage, and personal care sectors.

• By Form

On the basis of form, the market is segmented into Liquid and Dry. The Liquid segment dominated with a 57.4% revenue share in 2025, driven by ease of formulation, high solubility, and broad industrial applicability.

Dry aroma chemicals are projected to grow at the fastest CAGR from 2026 to 2033, supported by advancements in encapsulation, powder blending, and stability technologies for functional foods and beverages.

• By Application

Based on application, the market is segmented into Toiletries, Fine Fragrance/Perfumes, Personal Care, Beverages, Food, and Others. The Fine Fragrance/Perfumes segment dominated with 44.7% revenue share in 2025, fueled by rising demand for luxury and niche fragrance products.

Beverages are projected to grow at the fastest CAGR from 2026 to 2033, driven by functional drinks, flavored water, and premium beverages requiring unique aroma profiles.

• By Product Type

On the basis of product type, the market is segmented into Vainilla Vainas Madagascar, Tixosil 38 x, Vainillin, Carvacrol, Propilenglicol USP, Dipropilenglicol, Dipropilenglicol Metil Eter, Dihidromircenol, Cis-3-Hexenol, Aldehide c-18, Linalool, Lysmeral, Cinnamic Aldehyde, Citronelol, Galaxolide, Iso E Super, Geraniol, Hexylcinnamic Aldehyde, Aldehide C-14, Isoborniyl Acetate, Phenylethyl Alcohol, Anethole, Eugenol, Furaneol, Raspberry Ketone, Gamma-Decalactone, Timbersilk, Delta-Dodecalactona, Diphenyl Oxide, Eucaliptol, Anisaldehyde, Cetalox, Hedione // MDJ, Alpha Ionone, Yara Yara, Ionone Beta, Linalyl Acetate, Isoamyl Acetate, Butirato De Etilo, Triol 91 Kosher, Ethyl Vainilline, Canphor, Citral, Terpinoleones, Bromelia, Jasmacyclene / Verdyl Acetate, Aldehide c-12 MNA, Verdox // OTBC Acetate, Gamma-Octalactone, Triacetine, Benzyl Acetate, Citronelal, Benzyl Alcohol, Heliotropine, Gamma Methyl Ionone, Terpineols, Bourgeonal, Dynascone, Bacdanol, Thymol, Coumarine, Dihydrocoumarine, Amyl Salicylate, Hexyl Salicilate, Methyl Salicilate, Verdyl propionate, Undecavertol, Citrnelyl Nitryle, Methyl Antranilate, Terpinyl Acetate, Methyl Cyclo Pentenolone, Ptbc Acetate, Ethylciclopentenolone, Butyric Acid, Aldehydes c-12 (MOA, MNA, etc..), Aldehydes c-11, Rosalin, Rose Oxyde 90:10, Maltol, Ethyl Maltol, Triplal, Ethyl Caproate, Hexanoates and Heptanoates Ethyl and Methyl, Menthol, Natural, Synthetic, Spearmint 60% and 80%, Nerol, Exaltolide, Strialyl Acetate, Tetrahydrolinalool, Tetrahydromyrcenol, Allyl Amyl Glycolate, Borneol Cristalizado, Isoborneol, Tonalid, Violiff, Tibutyirine, Javanol and Others. The Vanillin segment dominated with 36.8% revenue share in 2025, owing to its widespread use in confectionery, beverages, and perfumery.

Hedione is projected to grow at the fastest CAGR from 2026 to 2033, supported by high-end perfumery trends and growing preference for sophisticated scent compositions.

• By Distribution Channel

Based on distribution channel, the market is segmented into Indirect and Direct. The Direct segment dominated with 53.6% revenue share in 2025, as manufacturers supply aroma chemicals directly to large food, beverage, and personal care companies ensuring quality and traceability.

Indirect channels are projected to grow at the fastest CAGR from 2026 to 2033, fueled by online marketplaces, distributors, and specialty suppliers expanding reach to small and medium enterprises.

Which Region Holds the Largest Share of the Aroma Chemicals Market?

- Saudi Arabia dominated the Middle East and Africa aroma chemicals market with a 34.5% revenue share in 2025, supported by growing adoption of high-quality aroma chemicals in fragrances, personal care, food, and beverage industries. Rising consumer preference for premium perfumes, natural flavors, and clean-label products is driving regional growth

- Government regulations on safety, labeling, and environmental compliance are encouraging manufacturers to adopt sustainable sourcing, eco-friendly formulations, and advanced production processes. Rapid urbanization, expanding retail networks, and industrial development further accelerate market adoption across the region

- Key players are leveraging technological advancements in extraction, encapsulation, and synthetic aroma chemical production to enhance product consistency, quality, and consumer appeal, particularly in high-end commercial and retail applications

U.A.E. Aroma Chemicals Market Insight

The U.A.E. is projected to register the fastest CAGR of 9.8% from 2026 to 2033, fueled by the adoption of natural, sustainable, and innovative aroma chemicals in perfumery, personal care, and food & beverage sectors. Investments in production facilities, green chemistry initiatives, and high-quality ingredient manufacturing support long-term market growth in the country.

Which are the Top Companies in Aroma Chemicals Market?

The aroma chemicals industry is primarily led by well-established companies, including:

- Takasago International Corporation (Japan)

- BASF SE (Germany)

- DSM (Netherlands)

- Firmenich SA (Switzerland)

- Symrise (Germany)

- Oriental Aromatics (India)

- Bordas S.A. (France)

- Privi Speciality Chemicals Limited (India)

- Bell Flavors & Fragrances (U.S.)

- Hindustan Mint & Agro Products Pvt. Ltd. (India)

- Treatt Plc (U.K.)

- Vigon International, Inc. (U.S.)

- Cedarome (U.S.)

- INOUE Perfume MFG. CO., LTD. (Japan)

- MANE (France)

- De Monchy Aromatics (Netherlands)

- Givaudan (Switzerland)

- Kao Corporation (Japan)

What are the Recent Developments in Middle East and Africa Aroma Chemicals Market?

- In April 2025, Eternis Fine Chemicals and ChainCraft B.V. entered into a landmark strategic partnership to advance the development of low-carbon, bio-based aroma chemicals. This collaboration combines ChainCraft’s innovative SensiCraft product line, powered by plant-based fermentation technology, with Eternis’ manufacturing expertise and robust supply chain, setting a new benchmark for sustainability in the fragrance industry. The partnership is expected to accelerate adoption of next-generation, eco-friendly fragrance ingredients

- In April 2025, BASF launched aroma ingredients with reduced Product Carbon Footprints, enabling customers to achieve their sustainability targets and reduce environmental impact across formulations. This initiative reinforces the focus on eco-conscious and high-performance aroma chemicals

- In October 2024, Prigiv commenced operations at its newly established Mahad Fragrance Ingredients Plant, a joint venture between Givaudan (49%) and Privi (51%). The facility is designed to produce a broad range of enhanced fragrance products, with plans to scale up operations over the next few years, supporting market expansion in high-quality aroma chemicals

- In May 2023, Firmenich International SA completed its merger with DSM, forming DSM-Firmenich, a leading innovation partner in nutrition, health, beauty, and aroma chemicals. This consolidation strengthens global capabilities and expands sustainable ingredient development

- In April 2023, Bedoukian Research Inc. partnered with Inscripta to develop and commercialize natural ingredients with superior quality, consistency, and reduced environmental impact. Using Inscripta’s GenoScaler platform to optimize microbial strains, BRI can now produce high-volume, eco-friendly ingredients efficiently, reinforcing sustainable practices in the aroma chemicals sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Aroma Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Aroma Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Aroma Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.