Middle East And Africa Active Medical Implantable Devices Market

Market Size in USD Million

CAGR :

%

USD

826.38 Million

USD

1,184.22 Million

2025

2033

USD

826.38 Million

USD

1,184.22 Million

2025

2033

| 2026 –2033 | |

| USD 826.38 Million | |

| USD 1,184.22 Million | |

|

|

|

|

Middle East and Africa Active Medical Implantable Devices Market Size

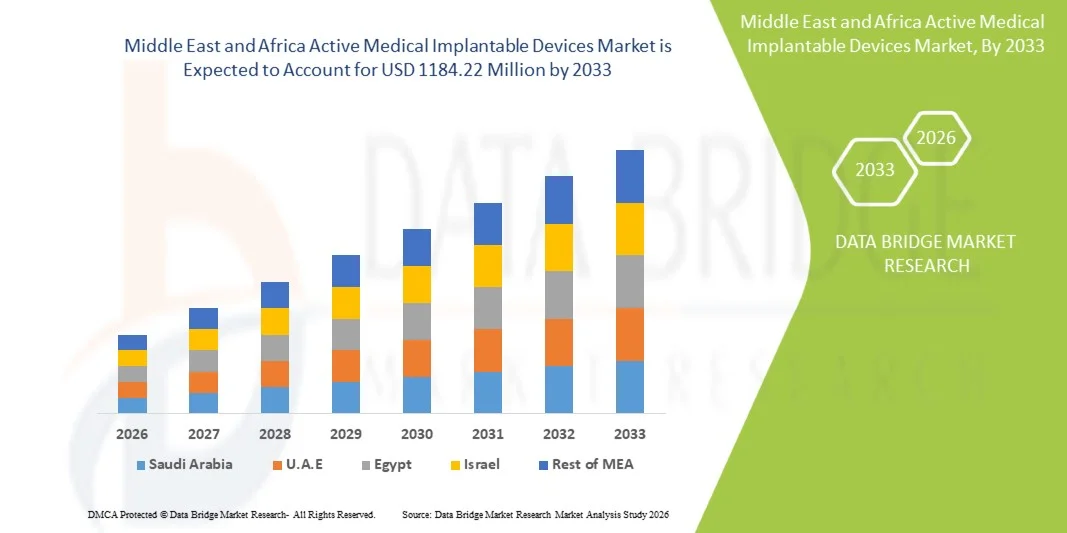

- The Middle East and Africa Active Medical Implantable Devices Market size was valued at USD 826.38 Million in 2025 and is expected to reach USD 1184.22 Million by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, increasing aging population, and continuous technological advancements in active medical implantable devices such as pacemakers, implantable cardioverter defibrillators, neurostimulators, and implantable drug delivery systems, leading to improved patient outcomes and long-term disease management

- Furthermore, growing demand for minimally invasive treatments, enhanced device reliability, longer battery life, and improved integration of digital health technologies is establishing active medical implantable devices as essential solutions in modern healthcare. These converging factors are accelerating the uptake of Active Medical Implantable Devices, thereby significantly boosting the industry’s growth

Middle East and Africa Active Medical Implantable Devices Market Analysis

- Active medical implantable devices, including pacemakers, implantable cardioverter defibrillators (ICDs), neurostimulators, and implantable drug delivery systems, are increasingly vital components of modern healthcare due to their ability to continuously monitor, regulate, and treat chronic and life-threatening medical conditions with high precision and long-term reliability

- The escalating demand for active medical implantable devices is primarily fueled by the rising prevalence of cardiovascular and neurological disorders, an aging population, and growing preference for minimally invasive and technologically advanced treatment solutions that improve patient outcomes and quality of life

- Saudi Arabia dominated the Middle East and Africa Active Medical Implantable Devices Market with the largest revenue share of approximately 35.4% in 2025, characterized by strong government investment in healthcare infrastructure, expansion of tertiary care hospitals, and increasing adoption of advanced cardiac and neurological implant technologies supported by national healthcare modernization initiatives

- The U.A.E. is expected to be the fastest-growing country in the Middle East and Africa Active Medical Implantable Devices Market during the forecast period, driven by rapid expansion of private healthcare facilities, increasing medical tourism, growing availability of specialized cardiac and neurology centers, and rising adoption of technologically advanced implantable therapies

- Traditional surgical methods accounted for the largest revenue share of 61.9% in 2025, supported by their long-standing clinical acceptance and availability across a wide range of healthcare facilities globally

Report Scope and Middle East and Africa Active Medical Implantable Devices Market Segmentation

|

Attributes |

Middle East and Africa Active Medical Implantable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Middle East and Africa Active Medical Implantable Devices Market Trends

“Advancements in Miniaturization and Remote Monitoring Integration”

- A key and accelerating trend in the Middle East and Africa Active Medical Implantable Devices Market is the rapid advancement in device miniaturization combined with integrated remote monitoring capabilities, enabling more efficient long-term patient management

- For instance, next-generation implantable cardiac rhythm management devices and neurostimulators are increasingly designed with compact form factors, allowing minimally invasive implantation procedures and improved patient comfort

- Modern implantable devices are now frequently equipped with wireless telemetry systems that enable continuous transmission of physiological data to healthcare providers, supporting real-time monitoring and early detection of complications

- Integration with digital health platforms allows clinicians to remotely adjust therapy settings, monitor device performance, and assess patient adherence without requiring frequent in-person visits, improving clinical outcomes and operational efficiency

- Furthermore, the adoption of cloud-connected implantable monitoring systems is facilitating predictive healthcare approaches, enabling physicians to identify disease progression patterns and intervene earlier

- As healthcare systems worldwide increasingly emphasize remote patient monitoring and value-based care, the demand for compact, connected implantable medical technologies is expected to expand significantly across cardiovascular, neurological, and orthopedic applications

Middle East and Africa Active Medical Implantable Devices Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases and Aging Population”

- The growing global burden of chronic diseases such as cardiovascular disorders, neurological conditions, and diabetes is a major driver accelerating demand for active medical implantable devices

- For instance, the increasing incidence of arrhythmias, heart failure, Parkinson’s disease, and chronic pain conditions is leading to higher adoption of implantable pacemakers, defibrillators, neurostimulators, and drug-delivery systems

- The rapidly expanding geriatric population, which is more susceptible to chronic and degenerative diseases, is further fueling the need for long-term therapeutic implant solutions that provide continuous treatment and monitoring

- Technological improvements that enhance device longevity, battery efficiency, and therapeutic precision are also encouraging physicians to recommend implantable therapies as preferred treatment options over repeated surgical or pharmacological interventions

- In addition, improved reimbursement frameworks and expanding healthcare infrastructure in emerging economies are increasing patient access to implantable device therapies, contributing to sustained market growth during the forecast period

Restraint/Challenge

“High Procedure Costs and Stringent Regulatory Requirements”

- High overall treatment costs, including device prices, surgical implantation procedures, and post-operative care, remain a significant barrier to widespread adoption, particularly in cost-sensitive healthcare markets

- For instance, implantable cardiac devices and neurostimulation systems often involve substantial upfront expenses, limiting accessibility for uninsured or underinsured patient populations in several regions

- Stringent regulatory approval processes for implantable medical technologies also present challenges for manufacturers, as extensive clinical trials and long evaluation timelines increase development costs and delay product commercialization

- Concerns related to device safety, long-term reliability, and potential complications such as infections or device malfunctions further necessitate rigorous compliance requirements, increasing operational complexity for companies

- Addressing these challenges through cost-effective manufacturing strategies, improved reimbursement coverage, and streamlined regulatory pathways will be critical to ensuring broader accessibility and sustained expansion of the Middle East and Africa Active Medical Implantable Devices Market

Middle East and Africa Active Medical Implantable Devices Market Scope

The market is segmented on the basis of product, surgery type, procedure, and end user.

• By Product

On the basis of product, the Medical Implantable Devices market is segmented into Cardiac Resynchronization Therapy Devices (CRT-D), Implantable Cardioverter Defibrillators, Implantable Cardiac Pacemakers, Eye Implants, Neurostimulators, Active Implantable Hearing Devices, Ventricular Assist Devices, Implantable Heart Monitors/Insertable Loop Recorders, Brachytherapy, Implantable Glucose Monitors, Dropped Foot Implants, Shoulder Implants, Implantable Infusion Pumps, and Implantable Accessories. Implantable Cardiac Pacemakers dominated the market with a revenue share of 28.6% in 2025, driven by the increasing global prevalence of arrhythmias and aging populations requiring long-term cardiac rhythm management. Pacemakers remain one of the most widely implanted cardiac devices due to their clinical reliability, established reimbursement frameworks, and continuous technological advancements such as MRI-compatible and leadless pacemakers. Healthcare providers increasingly prefer next-generation pacemakers offering extended battery life, wireless monitoring, and improved patient safety. The strong adoption across both developed and emerging economies further contributes to the segment’s dominance. Rising awareness regarding early cardiac disease detection and growing screening programs also support procedural growth. In addition, the integration of remote patient monitoring systems enhances long-term patient outcomes, encouraging physician preference. Government healthcare initiatives aimed at cardiovascular disease management also increase implantation rates. The widespread availability of trained cardiac specialists and procedural infrastructure supports steady utilization. Technological innovations that reduce procedural complexity further strengthen adoption trends. Increasing hospital procurement volumes and strong manufacturer investments also drive revenue growth. Continuous upgrades and replacement cycles for older pacemaker systems further sustain demand. As cardiovascular diseases remain a leading cause of mortality globally, pacemakers are expected to maintain a strong market position over the forecast period.

Neurostimulators are expected to witness the fastest growth with a projected CAGR of 9.7% from 2026 to 2033, driven by expanding applications in chronic pain management, Parkinson’s disease, epilepsy, and spinal cord injuries. Increasing neurological disorder prevalence globally is significantly boosting demand for advanced neuromodulation therapies. Continuous technological developments, including rechargeable batteries, miniaturized implants, and adaptive stimulation systems, are improving treatment effectiveness and patient acceptance. Rising awareness among clinicians and patients regarding minimally invasive neuromodulation procedures is also encouraging adoption. Favorable reimbursement coverage in developed healthcare systems supports market expansion. Growing investments in neuroscience research and product innovation by major medical device manufacturers further accelerate adoption. Increasing preference for drug-free long-term pain management solutions also contributes to rising demand. Expansion of specialized neurology treatment centers worldwide is strengthening procedural accessibility. Improvements in device precision and programmable stimulation features enhance treatment outcomes, driving physician preference. In addition, aging populations prone to neurological disorders continue to create a strong patient pool. Regulatory approvals for new neuromodulation indications are expected to expand clinical usage significantly. These combined factors position neurostimulators as the fastest-growing product segment in the forecast period.

• By Surgery Type

On the basis of surgery type, the market is segmented into Traditional Surgical Methods and Minimally Invasive Surgery. Traditional surgical methods accounted for the largest revenue share of 61.9% in 2025, supported by their long-standing clinical acceptance and availability across a wide range of healthcare facilities globally. Many complex implantable device procedures, particularly advanced cardiovascular and orthopedic implants, still require open surgical techniques to ensure precise placement and optimal outcomes. Hospitals with established surgical infrastructure and experienced surgical teams continue to rely on conventional procedures for complicated cases. In addition, reimbursement frameworks in several regions remain more aligned with traditional surgical practices, supporting their continued utilization. The presence of standardized surgical protocols further enhances clinician confidence in these methods. Emerging economies with limited access to advanced minimally invasive equipment also contribute significantly to traditional procedure volumes. Complex device implantation involving multiple surgical steps often necessitates open surgical approaches, maintaining demand stability. Training programs for surgeons have historically focused on conventional procedures, reinforcing procedural familiarity. Certain high-risk patients also require open surgery for improved monitoring and control during implantation. Furthermore, cost considerations in developing healthcare systems often favor traditional procedures over advanced minimally invasive technologies. The continued necessity of these approaches for specific clinical indications ensures sustained segment dominance throughout the forecast period.

Minimally invasive surgery is projected to grow at the fastest rate, registering a CAGR of 10.6% from 2026 to 2033, driven by increasing demand for shorter recovery times, reduced surgical trauma, and lower hospitalization costs. Technological advancements in imaging, robotic assistance, and catheter-based implantation techniques are enabling broader adoption across multiple implantable device procedures. Patients increasingly prefer minimally invasive procedures due to faster rehabilitation and improved cosmetic outcomes. Healthcare providers are also promoting these approaches as they reduce complications and postoperative care costs. Growing availability of specialized minimally invasive surgical training programs is improving physician adoption. Device manufacturers are designing implants specifically optimized for catheter-based or small-incision implantation techniques, further supporting segment expansion. Rising healthcare investments in advanced surgical infrastructure are accelerating accessibility worldwide. In addition, favorable reimbursement policies for minimally invasive procedures in several developed countries are encouraging adoption. Continuous innovation in robotic surgery platforms further enhances procedural precision and success rates. Expansion of ambulatory surgical centers equipped with minimally invasive capabilities also strengthens procedural growth. Increasing patient awareness regarding surgical alternatives is contributing to demand acceleration. These factors collectively position minimally invasive surgery as the fastest-growing surgical segment over the forecast period.

• By Procedure

On the basis of procedure, the market is segmented into Neurovascular, Cardiovascular, Hearing, and Others. Cardiovascular procedures dominated the market with a 44.3% revenue share in 2025, driven by the high global prevalence of heart diseases requiring implantable cardiac devices such as pacemakers, defibrillators, ventricular assist devices, and cardiac monitors. Increasing incidence of hypertension, coronary artery disease, and heart rhythm disorders significantly contributes to the high procedural volume. Continuous improvements in cardiac implant technologies enhance clinical outcomes and encourage physician adoption. Government initiatives aimed at reducing cardiovascular mortality also support procedural expansion. The strong availability of specialized cardiac hospitals and trained cardiologists further drives procedural growth. Increasing health insurance coverage for cardiac procedures in multiple regions supports accessibility. Aging populations, particularly in developed economies, significantly contribute to patient demand. Technological innovations such as remote cardiac monitoring systems also increase the long-term use of implantable cardiac devices. Rising awareness of early diagnosis and preventive cardiology programs is further supporting implantation rates. Continuous product launches and device upgrades sustain replacement demand cycles. The strong clinical necessity of cardiac implants ensures sustained dominance of cardiovascular procedures.

Neurovascular procedures are projected to witness the fastest growth, expanding at a CAGR of 9.9% from 2026 to 2033, driven by the rising prevalence of neurological disorders such as stroke, epilepsy, and Parkinson’s disease. Increasing adoption of neurostimulators and advanced neurovascular implants for therapeutic management is significantly driving procedural growth. Continuous technological advancements enabling precise neural targeting and programmable stimulation are improving clinical success rates. Growing awareness among neurologists regarding neuromodulation therapy effectiveness is accelerating adoption. Expanding healthcare investments in neuroscience research are also supporting new treatment applications. Increasing geriatric populations prone to neurological conditions further expand the patient base. Favorable reimbursement support for neuromodulation therapies in several developed markets encourages treatment adoption. The growth of specialized neurology centers worldwide enhances procedural accessibility. Minimally invasive implantation techniques further increase patient preference for neurovascular interventions. Rising clinical trials exploring new neuromodulation indications are expected to expand treatment scope. Increasing collaborations between device manufacturers and healthcare providers also strengthen adoption. These drivers collectively position neurovascular procedures as the fastest-growing segment during the forecast period.

• By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Clinics. Hospitals accounted for the largest revenue share of 58.7% in 2025, primarily due to their advanced surgical infrastructure, availability of multidisciplinary specialists, and ability to manage complex implantation procedures requiring intensive postoperative monitoring. Most implantable device surgeries, particularly cardiovascular and neurological procedures, are performed in hospital settings due to the need for advanced imaging systems and emergency care facilities. Hospitals also handle a higher patient volume, contributing significantly to procedural numbers. Favorable reimbursement frameworks often support hospital-based procedures, reinforcing segment dominance. In addition, hospitals typically maintain long-term patient follow-up programs for implanted devices, strengthening institutional preference. Increasing government investments in hospital infrastructure, particularly in emerging economies, further expand procedural capacity. The presence of highly trained surgeons and specialized surgical units enhances procedural reliability. Hospitals also participate in clinical trials and early adoption of advanced implant technologies, strengthening their leadership position. Growing collaborations between hospitals and medical device manufacturers for advanced device adoption also support revenue growth. High patient trust and referral patterns further drive hospital utilization. These combined factors ensure continued dominance of hospitals throughout the forecast period.

Ambulatory Surgical Centers (ASCs) are expected to witness the fastest growth with a CAGR of 10.8% from 2026 to 2033, driven by increasing demand for cost-effective outpatient surgical procedures and the growing adoption of minimally invasive implantation techniques. ASCs offer shorter procedure times, reduced hospitalization costs, and faster patient turnover, making them attractive to both healthcare providers and patients. Improvements in minimally invasive device implantation technologies allow more procedures to be safely performed in outpatient settings. Favorable reimbursement models encouraging outpatient care are also supporting segment expansion. Increasing investments in advanced surgical equipment within ASCs enhance procedural capabilities. Patients increasingly prefer outpatient facilities due to reduced waiting times and quicker discharge. Expansion of private healthcare providers establishing specialized ASCs is also contributing to market growth. Regulatory support for decentralized surgical care further accelerates adoption. Continuous improvements in anesthesia and postoperative monitoring technologies enhance procedural safety in outpatient settings. Growing physician partnerships with ASCs also expand service availability. Rising healthcare system focus on cost optimization further supports outpatient surgical growth. These factors collectively position ASCs as the fastest-growing end-user segment in the medical implantable devices market.

Middle East and Africa Active Medical Implantable Devices Market Regional Analysis

- The Middle East and Africa Active Medical Implantable Devices Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare investments, expanding access to advanced surgical procedures, and the growing prevalence of cardiovascular and neurological disorders across the region

- Governments are actively strengthening healthcare infrastructure through modernization initiatives, establishment of specialized cardiac and neurology centers, and expansion of tertiary care hospitals, which is accelerating the adoption of implantable medical technologies

- In addition, rising awareness regarding early disease management and improved reimbursement frameworks in several countries are supporting broader patient access to implantable therapies across both public and private healthcare sectors

Saudi Arabia Middle East and Africa Active Medical Implantable Devices Market Insight

Saudi Arabia Middle East and Africa Active Medical Implantable Devices Market dominated the Middle East and Africa Active Medical Implantable Devices Market with the largest revenue share of approximately 35.4% in 2025, supported by strong government investment in healthcare infrastructure, expansion of tertiary care hospitals, and increasing adoption of advanced cardiac rhythm management devices, neurostimulators, and implantable drug-delivery systems. National healthcare transformation programs focusing on advanced treatment accessibility, combined with the growing burden of chronic cardiovascular and neurological diseases, are significantly driving demand for implantable therapeutic technologies in the country. Continuous investments in specialized treatment centers and training programs for advanced surgical procedures are further strengthening market growth.

U.A.E. Middle East and Africa Active Medical Implantable Devices Market Insight

The U.A.E. Middle East and Africa Active Medical Implantable Devices Market is expected to be the fastest-growing country in the Middle East and Africa Active Medical Implantable Devices Market during the forecast period, driven by rapid expansion of private healthcare facilities, increasing medical tourism, and the growing availability of highly specialized cardiac and neurology treatment centers. Rising adoption of technologically advanced implantable therapies, supported by favorable healthcare policies and increasing investments in digital health and precision medicine initiatives, is further accelerating market expansion. In addition, the presence of internationally accredited hospitals and strong collaboration between global device manufacturers and regional healthcare providers is enhancing accessibility to next-generation implantable medical technologies across the country.

Middle East and Africa Active Medical Implantable Devices Market Share

The Active Medical Implantable Devices industry is primarily led by well-established companies, including:

- Medtronic plc (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- BIOTRONIK SE & Co. KG (Germany)

- LivaNova PLC (U.K.)

- Cochlear Limited (Australia)

- Sonova Holding AG (Switzerland)

- Demant A/S (Denmark)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- MicroPort Scientific Corporation (China)

- Lepu Medical Technology (China)

- Nihon Kohden Corporation (Japan)

- Olympus Corporation (Japan)

- Nurotron Biotechnology Co., Ltd. (China)

- Integer Holdings Corporation (U.S.)

- Smith & Nephew plc (U.K.)

- Stryker Corporation (U.S.)

- Terumo Corporation (Japan)

- Siemens Healthineers AG (Germany)

Latest Developments in Middle East and Africa Active Medical Implantable Devices Market

- In July 2023, Abbott, a global healthcare technology leader, announced that the U.S. Food and Drug Administration (FDA) approved the AVEIR DR dual-chamber leadless pacemaker system, the world’s first leadless pacemaker capable of pacing both the right atrium and right ventricle simultaneously. The device utilizes implant-to-implant (i2i) communication technology to enable synchronized beat-to-beat communication between two miniature pacemakers implanted directly in the heart, eliminating the need for traditional pacing leads and surgical pockets. This approval significantly expanded access to leadless pacing therapy for patients with abnormal heart rhythms and marked a major advancement in minimally invasive cardiac implantable device technology

- In June 2024, Abbott announced that the AVEIR DR dual-chamber leadless pacemaker system received CE Mark approval in Europe, expanding the availability of the world’s first dual-chamber leadless pacing technology to European markets. The system enables wireless synchronization between two implanted devices using high-frequency conductive communication, reducing complications associated with traditional leads while enhancing patient comfort and recovery outcomes. This regulatory milestone strengthened Abbott’s presence in the cardiac rhythm management segment and accelerated adoption of next-generation leadless implantable cardiac devices globally

- In September 2024, Senseonics Holdings announced that the U.S. FDA cleared the Eversense® 365 implantable continuous glucose monitoring (CGM) system, the first implantable CGM designed to operate continuously for up to one year. The small implantable sensor, inserted beneath the skin of the upper arm, provides real-time glucose readings every five minutes to a mobile application, significantly extending device longevity compared with earlier six-month implantable CGM models. This development represented a major advancement in implantable diabetes monitoring technology and improved long-term patient adherence and convenience

- In February 2025, Medtronic announced that the U.S. Food and Drug Administration (FDA) approved its adaptive deep brain stimulation (DBS) system for the treatment of Parkinson’s disease, marking the first brain-implant system capable of adjusting stimulation in real time based on patient neurological signals. The adaptive implant dynamically responds to brain activity to improve symptom control and reduce involuntary movements, representing a significant milestone in intelligent neurostimulation technology and strengthening the role of smart implantable devices in neurological disorder management

- In October 2025, Abbott announced the commercial launch of the AVEIR DR dual-chamber leadless pacemaker system in India, introducing the world’s first dual-chamber leadless pacing technology to the region. The miniature implantable system, smaller than a AAA battery, is implanted through a minimally invasive catheter procedure and enables synchronized pacing without wires, reducing complication risks and improving patient recovery time. The regional launch expanded global access to advanced cardiac implantable technologies and supported the growing adoption of minimally invasive implantable devices in emerging healthcare markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.