Middle East and Africa Biodegradable Paper & Plastic Packaging Market, By Type (Plastic and Paper), Material (Plastic and Paper), End-User (Packaging, Food and Beverage, Catering Servicewares, Personal and Home Care, Healthcare and Others), Country (South Africa and Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Market Analysis and Insights: Middle East and Africa Biodegradable Paper and Plastic Packaging Market

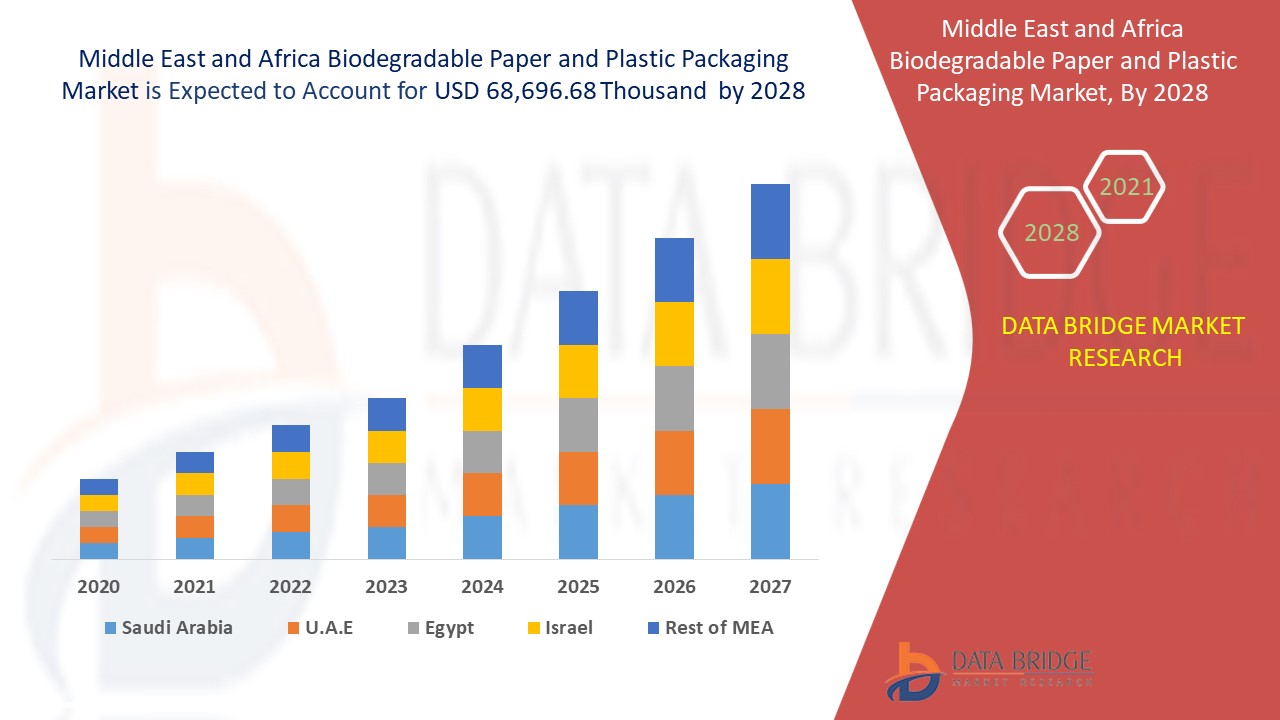

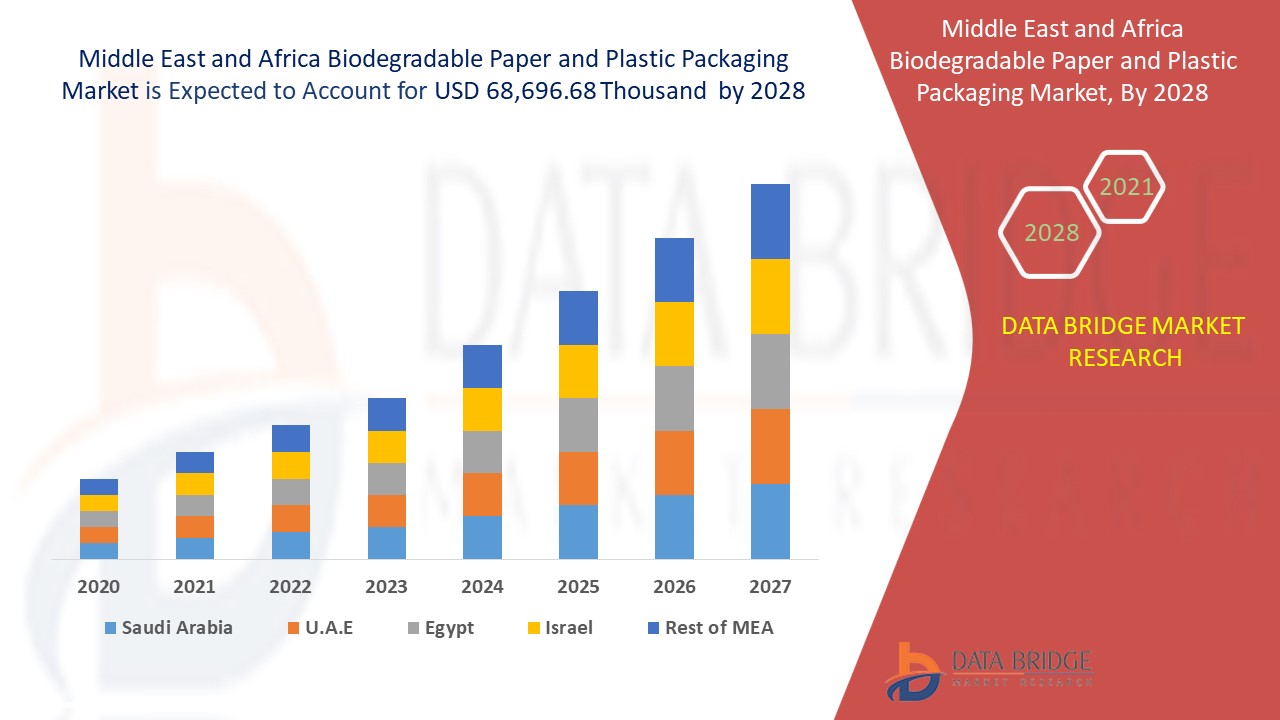

Biodegradable paper & plastic packaging market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing at a CAGR of 3.1% in the forecast period of 2021 to 2028 and expected to reach USD 68,696.68 thousand by 2028.

Increasing demand in personal care industry with easy high availability of raw materials for the manufacturing of biodegradable paper & plastic packaging is driving the market of biodegradable paper & plastic packaging.

Middle East and Africa region is dominating as increase in awareness about less carbon emitting materials which boosts the demand of Biodegradable paper & plastic packaging among the consumers. The growing demand of the Biodegradable paper & plastic packaging is due to use of more green products to combat the environmental issues.

Biodegradable packaging is a way to provide 100% naturally degradable property to the packaging solutions with low impact on environment. A lateral shift from synthetic plastic to the biodegradable paper & plastic packaging is observed with change in government regulation to safeguard the environment with no carbon emission. The biodegradable packaging has numerous applications in industries such as packaging, food and beverages and healthcare industry and others.

This biodegradable paper & plastic packaging market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East and Africa Biodegradable Paper & Plastic Packaging Market Scope and Market Size

Middle East and Africa biodegradable paper & plastic packaging market is segmented on the basis of type, material and end-user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of material, the biodegradable paper & plastic packaging market is segmented into plastic and paper. In Middle East & Africa, the demand of Plastic has increased as MEA has high production capacity of polyolefin one of the raw materials of Plastic.

- On the basis of type, the biodegradable paper & plastic packaging market is segmented into plastic and paper. In Middle East & Africa, the demand of Plastic has increased because of the growing in healthcare and personal care segment.

- On the basis of end-user, the biodegradable paper & plastic packaging market is segmented into packaging, food and beverage, catering servicewares, personal and home care, healthcare and others. In Middle East & Africa, the demand of food and beverage has increased because of the growing income level of the population of the region.

Biodegradable Paper & Plastic Packaging Market Country Level Analysis

Middle East and Africa biodegradable paper & plastic packaging market is analysed and market size information is provided by country, type, material and end-user as referenced above.

The countries covered in Middle East and Africa biodegradable paper & plastic packaging market report are South Africa and Rest of Middle East and Africa.

Germany in Middle East and Africa biodegradable paper & plastic packaging market is dominating due to increasing usage of biodegradable paper & plastic packaging in the personal care and food and beverage industry with rise in number of job opportunity in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Awareness among Consumer about Eco-Friendly Packaging

Middle East and Africa biodegradable paper & plastic packaging market also provides you with detailed market analysis for every country growth in installed base of different kind of products for biodegradable paper & plastic packaging market, impact of technology using life line curves and changes in requirement of healthcare and consumer goods products, regulatory scenarios and their impact on the Biodegradable Paper & Plastic Packaging market. The data is available for historic period 2010 to 2019.

Competitive Landscape and Biodegradable Paper & Plastic Packaging Market Share Analysis

Middle East and Africa biodegradable paper & plastic packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Middle East and Africa biodegradable paper & plastic packaging market.

The major players covered in the report are Hsing Chung paper ltd, Stora Enso, Be Green Packaging HQ, DoECO, Ultra Green Sustainable Packaging and Ecoware, among other players domestic and global. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

SKU-