Mexico Private Health Insurance Market Analysis and Size

The health insurance policy consists of several types of features and benefits. It provides financial coverage to policyholders against certain treatments. Health insurance policy offers advantages including cashless hospitalization, coverage of pre and post-hospitalization, reimbursement, and various add-ons.

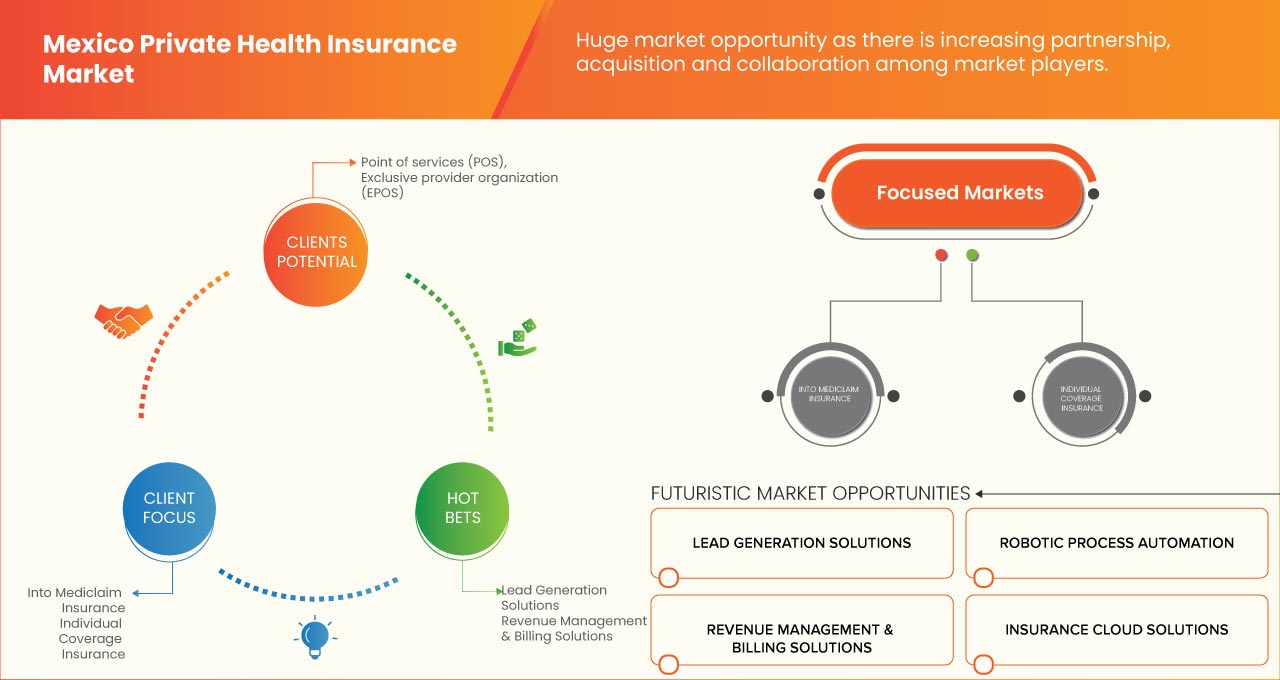

The increasing cost of medical services and health expenditure are driving factors of Mexico private health insurance market. However, the high cost of insurance premiums is restraining the growth of the Mexico private health insurance market. Advantages of health insurance policies to provide opportunities for Mexico private health insurance market growth. However, a lack of awareness regarding the benefits of health insurance has become a challenge for market growth. Data Bridge Market Research analyses that the Mexico private health insurance market is expected to reach the value of USD 140,015.67 million by 2030, at a CAGR of 4.5% during the forecast period. The Mexico private health insurance market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020-20216) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, and Pricing in USD |

|

Segments Covered |

By Product Type (Into Mediclaim Insurance, Hospitalization Coverage Insurance, Critical Illness Insurance, Individual Coverage Insurance, Family Floater Coverage Insurance, Senior Citizen Coverage Insurance, Unit Linked Health Plans, Permanent Health Insurance, and Others), Business Solution (Lead Generation Solutions, Revenue Management and Billing Solutions, Robotic Process Automation, Insurance Cloud Solutions, Claims Administration Cloud Solutions, Value-Based Payments Solutions, Artificial Intelligence & Blockchain Solutions, Intelligent Case Management Solutions, and Others), Assistance/Service Type (Inpatient/Daycare, Hospital Accommodation, Medical Evacuation, Oncology, Rehabilitation Treatment, Palliative Care, Organ Transplant, Psychiatry and Psychotherapy, Laser Eye Treatment, Accidental Death Benefit, Maternity, Dental, Out-Patient, Repatriation Plan, and Others), Level Of Coverage (Bronze, Silver, Gold, and Platinum), Type Of Insurance Plans (Point Of Service (POS), Exclusive Provider Organization (EPOS), Indemnity Health Insurance, Health Savings Account (HSA), Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS), Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), and Others), Demographics (Adults, Minors, and Senior), Coverage Type (Lifetime Coverage and Term Coverage), End User (Family, Corporate, Individual, and Others), Distribution Channel (Direct Sales, Financial Institutions, E-Commerce, Hospitals, Clinics, and Others) |

|

Country Covered |

Mexico |

|

Market Players Covered |

AXA, GNP Seguros (A subsidiary of SAB National Provincial Group), Pan- American Life Insurance Group, Banco Bibao Vizcaya Argentaria S.A., Seguros Monterrey New York Life, MetLife, Inc., Chub, Guardian Insurance MX., Allianz, Now Health International, Best Doctors Insurance, Zurich Santander Seguros México, SA, and Bupa, among others. |

Market Definition

Health insurance is a type of insurance that provides coverage for all kinds of surgical expenses as well as medical treatment incurred from an illness or injury. It applies to a comprehensive or limited range of medical services covering full or partial costs of specific services. Insurance also helps the policyholder financially by covering all of their medical costs when they are admitted to the hospital for treatment. However, it covers pre as well as post-hospitalization expenses.

In the health insurance plan, several types of coverage are available: cashless or reimbursement claim. The cashless benefit is available when the policyholder takes treatment from the network hospitals of the insurance company. If the policyholder takes treatment from hospitals that are not in the list network, in that case, the policyholder meets all the medical expenses and then claims the reimbursement from the insurance company by submitting all the medical bills.

Mexico Private Health Insurance Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing cost of medical services and health expenditure

Health insurance provides financial support in cases of serious sickness or accident. Increasing medical services costs for surgeries and hospital stays have created a new financial epidemic in Mexico and around the world. The cost of medical services is comprised of the cost of surgery, doctor fees, hospital stay cost, cost of the emergency room, and diagnostic testing costs, among others.

- In 2020, approximately USD 4 trillion was spent on health care in America. Out of this, USD 1.24 trillion was spent on hospital services, and USD 2,607 is the average per day hospital stay cost in the U.S., California (USD 3,726 per day) just edging out Oregon (USD 3,271) for the most expensive

Due to such high medical service costs, 60% of all bankruptcies are related to medical expenses, especially for those families who don't have health insurance or have limited budgets. The high cost of medical services has burdened the patients. However, health insurance provides financial support to the patients since it funds all the medical services' costs according to the terms and conditions of the insurance plan. Therefore, this increase in the cost of medical services propels the growth of the market.

- Growing number of daycare procedures

Daycare procedures are those types of medical procedure or surgery that primarily requires less stay time in the hospitals. In the daycare procedure, patients are required to stay in the hospital for a short period. Most health insurance companies are now covering the procedures of daycare in their insurance plans, and for the claim of such types of surgery, there is no compulsion to spend 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While most health insurance plans cover hospital stays and major surgeries, the policyholders can also claim daycare procedures under their health insurance policy, which propels the market's demand.

Opportunity

- Advantages of health insurance policies

In health insurance plans, the policyholder gets reimbursement insured for their medical expenses such as hospitalization, surgeries, and treatments that arise from the injuries. A health insurance policy is a type of agreement between the policyholder and the insurance company, where the insurance company agrees to guarantee payment for the treatment costs in case of future medical issues, and the policyholder agrees to pay the amount of premium according to the insurance plan.

The health insurance policy provides access to the best healthcare. A good insurance policy should offer comprehensive coverage. The benefits and advantages of health insurance policies are framed based on the needs of individuals as well as families and senior citizens. Increasing benefits and advantages of health insurance policies are boosting the demand for health insurance among people.

Restraint/Challenge

- High cost of insurance premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder since it covers all the medical expenses when the policyholder is hospitalized for treatment. Health insurance also covers pre as well as post-hospitalization expenses. To purchase health insurance, the policyholder has to pay insurance premiums regularly to keep the health insurance policy active. The cost of insurance premiums is high in the majority of cases based on the insurance plan, which is hampering the growth of the market.

The premium amount of health insurance is an upfront payment that is made on behalf of the individual as well as families to keep their policy of health insurance active. The cost of health insurance premiums is usually paid on a monthly basis to keep the policy in force.

Post COVID-19 Impact on Mexico Private Health Insurance Market

COVID-19 created a negative impact on the Mexico private health insurance market due to the shutdown of Mexico logistics and transportation and lack of testing for the system.

The COVID-19 pandemic has impacted the Mexico private health insurance market to an extent in negative manner. However, Automation has become a key focus for many industries, including automotive, electronics, and aerospace, as it offers several benefits, including increased productivity, improved quality control, and reduced labor costs. The private health insurance market plays a critical role in automation by providing non-destructive testing of products and components during the manufacturing process. The increasing demand for automation is thus affecting positively for the demand of the private health insurance market across the globe. The market players under the Mexico private health insurance market are responding by increasing their product portfolio for inspection systems.

The market players are conducting multiple research and development activities to improve the technology involved in the accessories. With this, the companies will bring advancement and innovation for the market. In addition, government funding for the private health insurance market has led the market growth.

Recent Development

- In February 2023, Seguros Monterrey New York Life, S.A. de C.V. (SMNYL Financial )'s Strength Rating (FSR) of A++ (Superior), Long-Term Issuer Credit Rating (Long-Term ICR) of "aa+" (Superior), and Mexico National Scale Rating of "aaa. MX" (Exceptional) have all been confirmed by AM Best (Mexico City, Mexico). The ratings take into account SMNYL's good operating performance, positive business profile, and effective enterprise risk management, which AM Best rates as the company with the strongest balance sheet (ERM).

- In March 2022, complete acquisition of Raven Capital Management by MetLife Investment Management. This strengthens the company existing robust private credit platform and broadens our capability for origination.

Mexico Private Health Insurance Market Scope

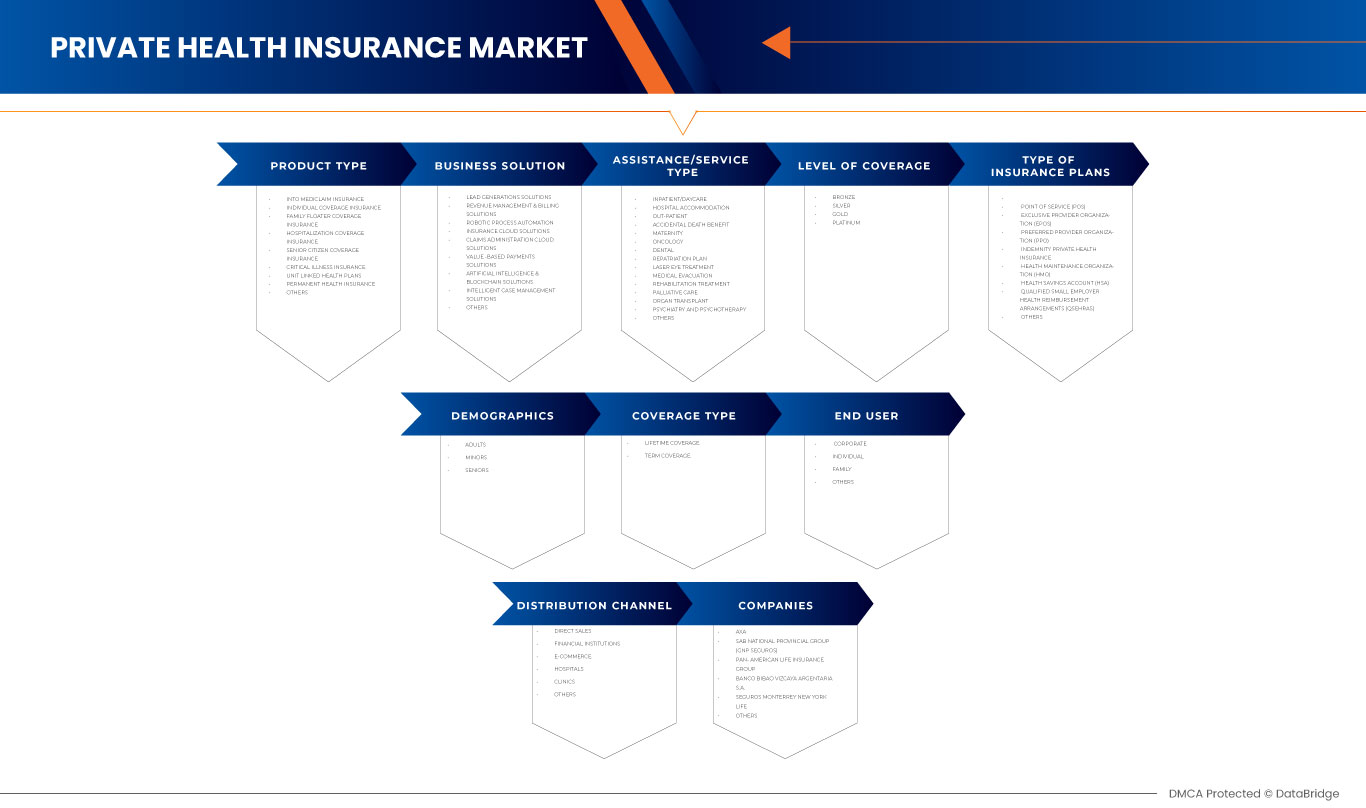

The Mexico private health insurance market is segmented on the basis of the product type, business solution, assistance/service type, level of coverage, type of insurance plans, demographics, coverage type, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

PRODUCT TYPE

- INTO MEDICLAIM INSURANCE

- HOSPITALIZATION COVERAGE INSURANCE

- CRITICAL ILLNESS INSURANCE

- INDIVIDUAL COVERAGE INSURANCE

- FAMILY FLOATER COVERAGE INSURANCE

- SENIOR CITIZEN COVERAGE INSURANCE

- UNIT LINKED HEALTH PLANS

- PERMANENT HEALTH INSURANCE

- OTHERS

On the basis of product type, the market is segmented into mediclaim insurance, hospitalization coverage insurance, critical illness insurance, individual coverage insurance, family floater coverage insurance, senior citizen coverage insurance, unit linked health plans, permanent health insurance, and others.

BUSINESS SOLUTION

- LEAD GENERATION SOLUTIONS

- REVENUE MANAGEMENT & BILLING SOLUTIONS

- ROBOTIC PROCESS AUTOMATION

- INSURANCE CLOUD SOLUTIONS

- CLAIMS ADMINISTRATION CLOUD SOLUTIONS

- VALUE-BASED PAYMENTS SOLUTIONS

- ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

- INTELLIGENT CASE MANAGEMENT SOLUTIONS

- OTHERS

On the basis of business solution, the market is segmented into lead generation solutions, revenue management & billing solutions, robotic process automation, insurance cloud solutions, claims administration cloud solutions, value-based payments solutions, artificial intelligence & blockchain solutions, intelligent case management solutions, and others.

ASSISTANCE/SERVICE TYPE

- INPATIENT/DAYCARE

- HOSPITAL ACCOMMODATION

- MEDICAL EVACUATION

- ONCOLOGY

- REHABILITATION TREATMENT

- PALLIATIVE CARE

- ORGAN TRANSPLANT

- PSYCHIATRY AND PSYCHOTHERAPY

- LASER EYE TREATMENT

- ACCIDENTAL DEATH BENEFIT

- MATERNITY

- DENTAL

- OUT-PATIENT

- REPATRIATION PLAN

- OTHERS

On the basis of assistance/service type, the market is segmented into inpatient/daycare, hospital accommodation, medical evacuation, oncology, rehabilitation treatment, palliative care, organ transplant, psychiatry and psychotherapy, laser eye treatment, accidental death benefit, maternity, dental, out-patient, repatriation plan, and others.

LEVEL OF COVERAGE

- BRONZE

- SILVER

- GOLD

- PLATINUM

On the basis of the level of coverage, the market is segmented into bronze, silver, gold, and platinum.

TYPE OF INSURANCE PLANS

- POINT OF SERVICE (POS)

- EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

- INDEMNITY PRIVATE HEALTH INSURANCE

- HEALTH SAVINGS ACCOUNT (HSA)

- QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

- PREFERRED PROVIDER ORGANIZATION (PPO)

- HEALTH MAINTENANCE ORGANIZATION (HMO)

- OTHERS

On the basis of type of insurance plans, the market is segmented into point of service (POS), exclusive provider organization (EPOS), indemnity health insurance, health savings account (HSA), qualified small employer health reimbursement arrangements (QSEHRAS), preferred provider organization (PPO), health maintenance organization (HMO), and others.

DEMOGRAPHICS

- ADULTS

- MINORS

- SENIORS

On the basis of demographics, the market is segmented into adults, minors, and seniors.

COVERAGE TYPE

- LIFETIME COVERAGE

- TERM COVERAGE

On the basis of coverage type, the market is segmented into lifetime coverage and term coverage.

END USER

- FAMILY

- CORPORATE

- INDIVIDUAL

- OTHERS

On the basis of end user, the market is segmented into family, corporate, individual, and others.

DISTRIBUTION CHANNEL

- DIRECT SALES

- FINANCIAL INSTITUTIONS

- E-COMMERCE

- HOSPITALS

- CLINICS

- OTHERS

On the basis of distribution channel, the market is segmented into direct sales, financial institutions, e-commerce, hospitals, clinics, and others.

Mexico Private Health Insurance Market Country Analysis/Insights

The Mexico private health insurance market is analysed, and market size insights and trends are provided by country, product type, business solution, assistance/service type, level of coverage, type of insurance plans, demographics, coverage type, end user, and distribution channel range as referenced above. The country covered in the Mexico private health insurance market report is Mexico. Mexico is dominating the market as the country has a private health insurance market because of the strong base of healthcare facilities, stringent regulation and implementation of standards mandated by various associations and the rising number of research activities in this region. The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Mexico brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Mexico Private Health Insurance Market Share Analysis

The Mexico private health insurance market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the Mexico private health insurance market.

Some of the major players operating in the market are AXA, GNP Seguros (A subsidiary of SAB National Provincial Group), Pan- American Life Insurance Group, Banco Bibao Vizcaya Argentaria S.A., Seguros Monterrey New York Life, MetLife, Inc., Chub, Guardian Insurance MX., Allianz, Now Health International, Best Doctors Insurance, Zurich Santander Seguros México, SA, and Bupa, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNNOLICAL ROADMAP

4.2 PORTER’S FIVE FORCE ANALYSIS

4.3 COMPANY COMPARITIVE AANALYSIS

4.4 REGULATORY STANDARDS

4.4.1 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES AND HEALTH EXPENDITURE

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING PARTNERSHIP, ACQUISITION AND COLLABORATION AMONG MARKET PLAYERS

5.3.3 EXPANSION OF MEXICAN HEALTHCARE INFRASTRUCTURE

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

5.4.2 LIMITED COVERAGE IN MEDICAL CARE BY MARKET PLAYERS

6 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 INTO MEDICLAIM INSURANCE

6.3 INDIVIDUAL COVERAGE INSURANCE

6.4 FAMILY FLOATER COVERAGE INSURANCE

6.5 HOSPITALIZATION COVERAGE INSURANCE

6.6 SENIOR CITIZEN COVERAGE INSURANCE

6.7 CRITICAL ILLNESS INSURANCE

6.8 UNIT LINKED HEALTH PLANS

6.9 PERMANENT HEALTH INSURANCE

6.1 OTHERS

7 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY BUSINESS SOLUTION

7.1 OVERVIEW

7.2 LEAD GENERATIONS SOLUTIONS

7.3 REVENUE MANAGEMENT & BILLING SOLUTIONS

7.4 ROBOTIC PROCESS AUTOMATION

7.5 INSURANCE CLOUD SOLUTIONS

7.6 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

7.7 VALUE -BASED PAYMENTS SOLUTIONS

7.8 ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

7.9 INTELLIGENT CASE MANAGEMENT SOLUTIONS

7.1 OTHERS

8 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY ASSISTANCE/SERVICE TYPE

8.1 OVERVIEW

8.2 INPATIENT/DAYCARE

8.3 HOSPITAL ACCOMMODATION

8.4 OUT-PATIENT

8.5 ACCIDENTAL DEATH BENEFIT

8.6 MATERNITY

8.7 ONCOLOGY

8.8 DENTAL

8.9 REPATRIATION PLAN

8.1 LASER EYE TREATMENT

8.11 MEDICAL EVACUATION

8.12 REHABILITATION TREATMENT

8.13 PALLIATIVE CARE

8.14 ORGAN TRANSPLANT

8.15 PSYCHIATRY AND PSYCHOTHERAPY

8.16 OTHERS

9 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

10 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY TYPE OF INSURANCE PLANS

10.1 OVERVIEW

10.2 POINT OF SERVICES (POS)

10.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

10.4 PREFERRED PROVIDER ORGANIZATION (PPO)

10.5 INDEMNITY PRIVATE HEALTH INSURANCE

10.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

10.7 HEALTH SAVINGS ACCOUNT (HSA)

10.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

10.9 OTHERS

11 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

11.1 OVERVIEW

11.2 ADULTS

11.3 MINORS

11.4 SENIORS

12 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY COVERAGE TYPE

12.1 OVERVIEW

12.2 LIFETIME COVERAGE

12.3 TERM COVERAGE

13 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY END USER

13.1 OVERVIEW

13.2 CORPORATE

13.3 INDIVIDUAL

13.4 FAMILY

13.5 OTHERS

14 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 FINANCIAL INSTITUTIONS

14.4 E-COMMERCE

14.5 HOSPITALS

14.6 CLINICS

14.7 OTHERS

15 MEXICO PRIVATE HEALTH INSURANCE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MEXICO

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 SAB NATIONAL PROVINCIAL GROUP (GNP SEGUROS)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 METLIFE, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 AXA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BANCO BIBAO VIZCAYA ARGENTARIA S.A.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 ALLIANZ

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BEST DOCTORS INSURANCE

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 BUPA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CHUB

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 SERVICE PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 GUARDIAN INSURANCE MX.

17.9.1 COMPANY SNAPSHOT

17.9.2 SERVICE PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 NOW HEALTH INTERNATIONAL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 PAN-AMERICAN LIFE INSURANCE GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 SEGUROS MONTERREY NEW YORK LIFE

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ZURICH SANTANDER SEGUROS MÉXICO, SA

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES (IN USD)

TABLE 2 LIST OF DAYCARE PROCEDURES

TABLE 3 AVERAGE EMPLOYEE PREMIUMS IN U.S. (2020)

TABLE 4 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY BUSINESS SOLUTION, 2021-2030 (USD MILLION

TABLE 6 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY ASSISTANCE/SERVICE TYPE, 2021-2030 (USD MILLION

TABLE 7 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY LEAVEL OF COVERAGE, 2021-2030 (USD MILLION

TABLE 8 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY TYPE OF INSURANCE PLANS, 2021-2030 (USD MILLION)

TABLE 9 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2021-2030 (USD MILLION)

TABLE 10 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2021-2030 (USD MILLION)

TABLE 11 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 12 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MEXICO PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 MEXICO PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 MEXICO PRIVATE HEALTH INSURANCE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MEXICO PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO PRIVATE HEALTH INSURANCE MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 MEXICO PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO PRIVATE HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 11 MEXICO PRIVATE HEALTH INSURANCE MARKET: CHALLENGE MATRIX

FIGURE 12 MEXICO PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS IS EXPECTED TO DRIVE THE MEXICO PRIVATE HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO PRIVATE HEALTH INSURANCE MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MEXICO PRIVATE HEALTH INSURANCE MARKET

FIGURE 16 PERCENTAGE OF OUT-OF-POCKET EXPENDITURE ON HEALTH (2019)

FIGURE 17 HEALTH INSURANCE COVERAGE

FIGURE 18 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY PRODUCT TYPE, 2022

FIGURE 19 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY BUSINESS SOLUTION, 2022

FIGURE 20 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY ASSISTANCE/SERVICE TYPE, 2022

FIGURE 21 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2022

FIGURE 22 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY TYPE OF INSURANCE PLANS, 2022

FIGURE 23 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2022

FIGURE 24 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2022

FIGURE 25 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY END USER, 2022

FIGURE 26 MEXICO PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 27 MEXICO PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.