Market Analysis and Size

Fruit and vegetable packaging is a farm practice that involves taking fresh crops from the field to the customer. Since all fruits and vegetables are perishable crops, choosing the right packaging for fruits and vegetables is crucial for farmers to survive in the market. The main function of packaging is to maintain fruits and vegetables in order maintain their quality and extend their storage life

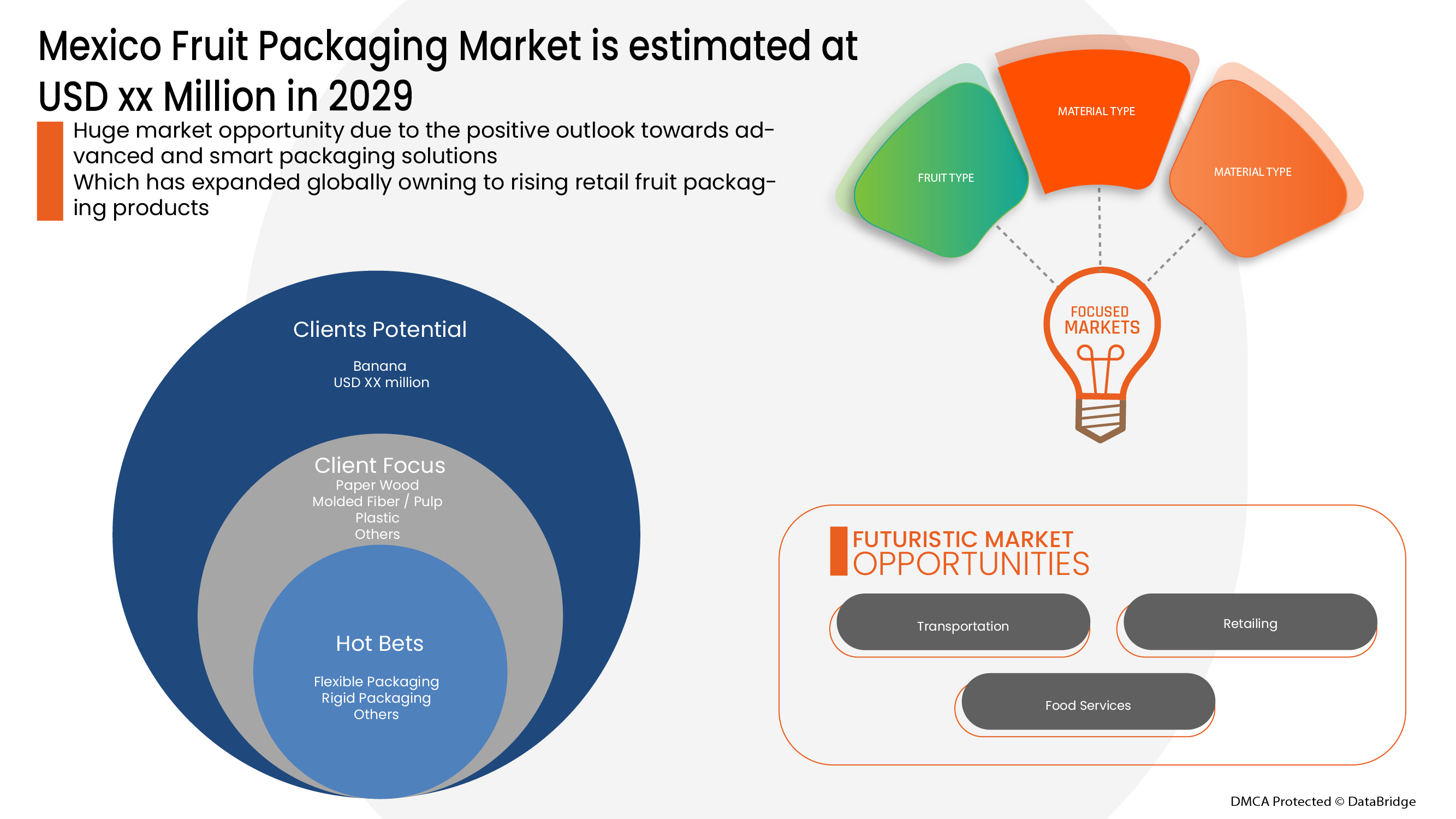

The fruit packaging is highly beneficial used for convenient and flexible packaging. Data Bridge Market Research analyses that the fruit packaging is expected to reach the value of USD 3,932.63 million by the year 2029, at a CAGR of 1.4% during the forecast period. Banana accounts for the most prominent fruit type segment in the respective market owing to rising e-commerce, courier, and fruit delivery services. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Million Units, Pricing in USD |

|

Segments Covered |

By Fruit Type (Banana, Apple, Berries, Grapes, Orange, Tropical Fruits, Pomegranate and Others), Material Type (Plastic, Paper, Molded Fiber/Pulp, Wood and Others), Product Type (Rigid Packaging, Flexible Packaging and Others), Application (Retailing, Transportation, Food Services and Others), Distribution Channel (Direct and Indirect) |

|

Country Covered |

Mexico |

|

Market Players Covered |

Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company and Huhtamaki among others |

Market Definition

Bags, containers, and boxes made up of wood, plastic, and paper among others are the predominant material for fruit and vegetable consumer packaging. Besides the very low material costs, automated bagging machines further reduce packing costs. Film bags are clear, allowing for easy inspection of the contents, and readily accept high-quality graphics.

Regulatory Framework

- According to the Fair Packaging and Labeling Act of FDA, Food Labeling web pages address the labeling requirements for foods under the Federal Food, Drug, and Cosmetic Act and its amendments. Food labeling is required for most prepared and raw food items including fruits and vegetables. This act issued regulations requiring that all "consumer commodities" be labeled to disclose net contents, the identity of the commodity, and the name and place of business of the products

- According to FDA (The Food and Drug Administration), every container in which any fruit product is packed shall be so sealed that it cannot be opened without destroying the licensing number and the special identification mark of the manufacturer to be displayed on the top or neck of the bottle. For canned fruits, sanitary top cans made up of suitable kinds of tin plates shall be used, whereas, for bottled fruits, only bottles/ jars capable of giving a hermetic seal shall be used. Candied fruits and peels and dried fruits can be packed in paper bags, cardboard or wooden boxes, new tins, bottles, jars, aluminum, and other suitable approved containers. Fruits and Vegetable products can also be packed in aseptic and flexible packaging material having good grade quality conforming to the required standards laid down by the Federal government

These standards provide qualification for fruit packaging production, protocols, and guidelines that ensures a high level of security and certifies the material for use.

COVID-19 had a Minimal Impact on Mexico’s Fruit Packaging Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the fruit packaging market. The operations and supply chain of fruit packaging, with multiple manufacturing facilities, were still operating in the region. The service providers continued offering fruit packaging following sanitation and safety measures in the post-COVID scenario.

The Market Dynamics of the Mexico Fruit Packaging Market Include:

Drivers/Opportunities faced by the Mexico Fruit Packaging Market Industry

- Growing demand for convenient and flexible packaging

Flexible packaging’s features make life more convenient. It is easy to store, easy to reseal, easy to open, extends product life, and is easy to carry. The rise in disposable income and improving standards of living among consumers in developing countries are factors contributing significantly to the rising demand for packaged foods including fruits, and this is further driving the demand for packaging solutions and materials that are more convenient to use. In conclusion, growing demand from the major retailers for extended shelf life, and from consumers for convenience products, are also driving the demand of flexible packaging and thus contributing to the growth of the Mexico fruit packaging market

- Rising e-commerce, courier, and fruit delivery services

E-commerce has transformed the way of business around the world. Much of the growth for the industry has been triggered by an increase in internet and smartphone penetration. Also, advancements in technology and the growth of available marketplaces have made it easier to buy and sell goods through online portals. The Merchants and the delivery services continue to follow consumer demand in online platforms, flocking to e-commerce in record numbers. Furthermore, there has been a continuous rise in the demand for standardized packaging needs and aerated humidifying delivery setup for longer shelf life while transporting perishable items such as fruits and vegetables. This in turn increases the demand for fruit packaging and thus propelling the growth of Mexico’s fruit packaging market

- Positive outlook towards advanced and smart packaging solutions

The aim of smart packaging technology is to sustain product quality and prolong shelf life. Active packaging responds to a triggering event (such as exposure to ultraviolet light or a decrease in pressure) by releasing or absorbing substances from or into the packaged product or its surrounding environment. Typically, this involves different components, such as moisture or gas scavengers or antimicrobial films, being embedded into the packaging itself. Furthermore, the adoption of advanced packaging technologies is on the rise in order to offer consumers personalized packaging solutions. This in turn increases the demand for fruit packaging and thus creating an opportunity for Mexico’s fruit packaging market.

Restraints/Challenges faced by the Mexico Fruit Packaging Market

- Stringent government rules and regulations regarding packaging materials

The regulations imposed by the governments’ play an important part in influencing the packaging design for many manufacturers in the market. There are various stringent regulations and policies which must be complied by the packing product manufacturers. The government organizations regulate and monitor packaging products of food, drug, cosmetic packaging and usage of raw materials, in order to protect the environment and ensure consumer safety and confidence. In conclusion, the increasing rule and regulations towards the production of packaging products in all the regions have impacted the demand of packaging products. This in turn decreases the demand for fruit packaging and thus restricting the growth of Mexico fruit packaging market.

- Managing packaging waste is difficult

Modern food packaging provides a way to make food safe, reliable, shelf-stable and clean. Unfortunately, most food packaging is designed to be single use and is not recycled. Instead, packaging is thrown away and often litters our waterways. Hence, this is a problem not only for human beings, but also for all aquatic life. There are other environmental impacts from food packaging as well, including to our air and soil. In conclusion, plastics packaging manufacturing is responsible for a significant amount of greenhouse gas emissions and hence affecting the air of the environment. This in turn reduces the demand of fruit packaging products and hence challenging the growth of the Mexico fruit packaging market.

This Mexico fruit packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the rodenticides market contact Data Bridge Market Research for an Analyst Brief. Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In March, 2021, International Paper announced the acquisition of two state-of-the-art corrugated box plants in Spain. This enabled the company to reinforce its capabilities in Madrid and Catalonia. This enhanced the company’s packaging solutions in the industrial, fresh fruit and vegetable, and e-commerce segments.

- In March, 2021, Packaging Corporation of America announced plans to launch three-year, USD 440 million projects to permanently convert a paper machine at its mill in Clarke County to produce linerboard used for corrugated packaging. The company will install an OCC plant for recycling old corrugated containers and various pulp mill modifications. This led to the development of new products by the company.

- In March, 2022, Amcor plc received three 2022 Flexible Packaging Achievement Awards, winning across multiple categories out of a record number of entries. The awards have recognized Amcor for solving complex customer challenges, advancing sustainability and elevating the overall contribution of flexible packaging.

Mexico Fruit Packaging Market Regional Analysis/Insights

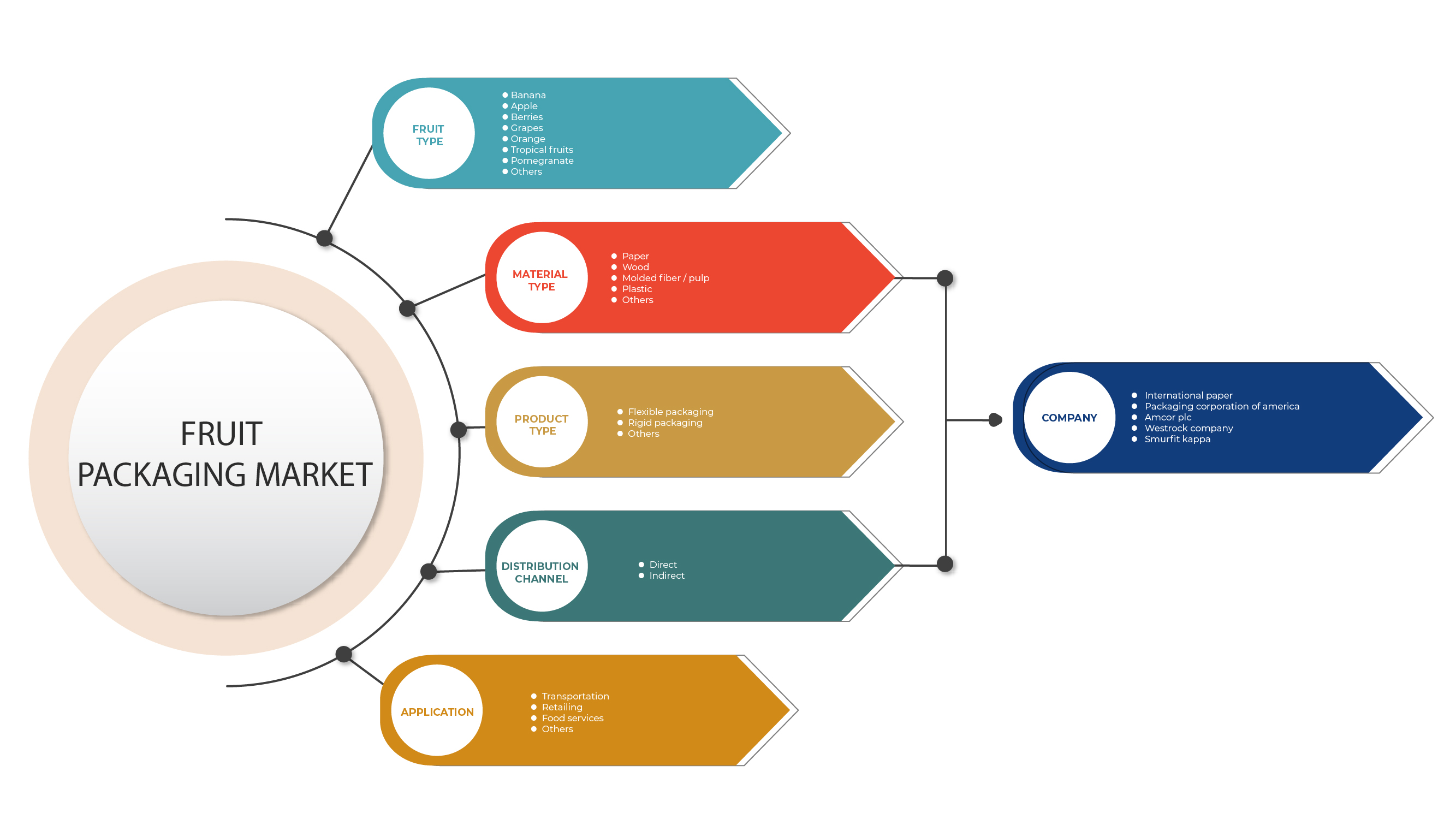

The Mexico fruit packaging market is segmented into five notable segments which are based on the fruit type, material type, product type, application and distribution channel.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Mexico Fruit Packaging Market Scope

The Mexico fruit packaging market is segmented on the basis of fruit type, material type, product type, application and distribution channel. The growth amongst these segments will help you analyze growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Fruit Type

- Banana

- Apple

- Berries

- Grapes

- Orange

- Tropical Fruits

- Pomegranate

- Others

On the basis of fruit type, Mexico fruit packaging market is segmented into banana, apple, berries, grapes, orange, tropical fruits, pomegranate and others.

Material Type

- Paper

- Wood

- Molded Fiber / Pulp

- Plastic

- Others

On the basis of material type, Mexico fruit packaging market is segmented into plastic, paper, molded fiber/pulp, wood and others.

Product Type

- Flexible Packaging

- Rigid Packaging

- Others

On the basis of product type, Mexico fruit packaging market is segmented into rigid packaging, flexible packaging and others.

Application

- Transportation

- Retailing

- Food Services

- Others

On the basis of application, Mexico fruit packaging market is segmented into retailing, transportation, food services and others.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, Mexico fruit packaging market is segmented into direct and indirect.

Competitive Landscape and Mexico Fruit Packaging Market Share Analysis

The Mexico fruit packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Mexico fruit packaging market.

The players operating in the Mexico fruit packaging market are Mondi, DS Smith, Amcor plc, Packaging Corporation of America, International Paper, Smurfit Kappa, Sealed Air, Sonoco Products Company, WestRock Company and Huhtamaki among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO FRUIT PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.2 LABELING AND CLAIMS

4.3 REVENUE OF SUPPLIERS

4.4 SUPPLY CHAIN ANALYSIS:

4.5 VALUE CHAIN ANALYSIS:

4.6 MARKET SHARE OF MOLDED FIBER VS OTHER SUBSTRATES AND ITS PROJECTION

4.7 MEXICO FRUIT PACKAGING MARKET, NEW PRODUCT LAUNCH STRATEGY

4.7.1 OVERVIEW

4.7.2 NUMBER OF PRODUCT LAUNCHES

4.7.2.1 LINE EXTENSION

4.7.2.2 NEW PACKAGING

4.7.2.3 RE-LAUNCHED

4.7.2.4 NEW FORMULATION

4.7.3 DIFFERENTIAL PRODUCT OFFERING

4.7.4 MEETING CONSUMER REQUIREMENT

4.7.5 PACKAGE DESIGNING

4.7.6 PRICING ANALYSIS

4.7.7 PRODUCT POSITIONING

4.7.8 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING

6.1.2 INCREASING ADOPTION OF ECO-FRIENDLY AND BIODEGRADABLE PRODUCTS FOR FRUIT PACKAGING

6.1.3 RISING E-COMMERCE, COURIER, AND FRUIT DELIVERY SERVICES

6.1.4 GAINING POPULARITY OF FRUITS IN PREVENTING CHRONIC DISEASES

6.2 RESTRAINTS

6.2.1 STRINGENT GOVERNMENT RULES AND REGULATIONS REGARDING PACKAGING MATERIALS

6.2.2 USE OF HARMFUL ADDITIVES FOR WATER/OIL RESISTANCE IN FOOD PACKAGING

6.3 OPPORTUNITIES

6.3.1 POSITIVE OUTLOOK TOWARD ADVANCED AND SMART PACKAGING SOLUTIONS

6.3.2 RISING DEMAND FOR MODIFIED ATMOSPHERE PACKAGING (MAP)

6.4 CHALLENGES

6.4.1 MANAGING PACKAGING WASTE IS DIFFICULT

6.4.2 MAINTAINING STANDARD QUALITY OF PACKAGING PRODUCT

7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE

7.1 OVERVIEW

7.2 BANANA

7.3 APPLE

7.4 BERRIES

7.4.1 STRAWBERRY

7.4.2 BLUEBERRY

7.4.3 RASPBERRY

7.4.4 BLACKBERRY

7.4.5 CRANBERRY

7.4.6 OTHERS

7.5 GRAPES

7.6 ORANGE

7.7 TROPICAL FRUITS

7.7.1 MANGO

7.7.2 PAPAYA

7.7.3 PASSION FRUIT

7.7.4 DRAGON FRUIT

7.7.5 JACKFRUIT

7.7.6 OTHERS

7.8 POMEGRANATE

7.9 OTHERS

8 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER

8.3 WOOD

8.4 MOLDED FIBER / PULP

8.4.1 CARDBOARD

8.4.2 RECYCLED PAPER

8.4.3 NATURAL FIBER

8.4.3.1 SUGARCANE

8.4.3.2 BAMBOO

8.4.3.3 WHEAT STRAW

8.4.3.4 OTHERS

8.4.4 OTHERS

8.5 PLASTIC

8.5.1 POLYETHYLENE TEREPHTHALATE

8.5.2 POLYPROPYLENE (PP)

8.5.3 POLY-VINYL CHLORIDE (PVC)

8.5.4 POLYSTYRENE

8.5.5 ETHYL VINYL ACETATE (EVA)

8.5.6 OTHERS

8.6 OTHERS

9 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FLEXIBLE PACKAGING

9.2.1 CORRUGATED

9.2.2 LAMINATED FOIL

9.2.3 OTHERS

9.3 RIGID PACKAGING

9.3.1 BOXBOARD

9.3.2 TRAYS

9.3.3 CONTAINERS

9.3.4 OTHERS

9.4 OTHERS

10 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 TRANSPORTATION

10.2.1 TRANSPORTATION, BY MATERIAL TYPE

10.2.1.1 PAPER

10.2.1.2 WOOD

10.2.1.3 MOLDED FIBER / PULP

10.2.1.3.1 CARDBOARD

10.2.1.3.2 RECYCLED PAPER

10.2.1.3.3 NATURAL FIBER

10.2.1.3.3.1 SUGARCANE

10.2.1.3.3.2 BAMBOO

10.2.1.3.3.3 WHEAT STRAW

10.2.1.3.3.4 OTHERS

10.2.1.3.4 OTHERS

10.2.1.4 PLASTIC

10.2.1.4.1 POLYETHYLENE TEREPHTHALATE

10.2.1.4.2 POLYPROPYLENE (PP)

10.2.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.2.1.4.4 POLYSTYRENE

10.2.1.4.5 ETHYL VINYL ACETATE (EVA)

10.2.1.4.6 OTHERS

10.2.1.5 OTHERS

10.3 RETAILING

10.3.1 RETAILING, BY MATERIAL TYPE

10.3.1.1 PAPER

10.3.1.2 WOOD

10.3.1.3 MOLDED FIBER / PULP

10.3.1.3.1 CARDBOARD

10.3.1.3.2 RECYCLED PAPER

10.3.1.3.3 NATURAL FIBER

10.3.1.3.3.1 SUGARCANE

10.3.1.3.3.2 BAMBOO

10.3.1.3.3.3 WHEAT STRAW

10.3.1.3.3.4 OTHERS

10.3.1.3.4 OTHERS

10.3.1.4 PLASTIC

10.3.1.4.1 POLYETHYLENE TEREPHTHALATE

10.3.1.4.2 POLYPROPYLENE (PP)

10.3.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.3.1.4.4 POLYSTYRENE

10.3.1.4.5 ETHYL VINYL ACETATE (EVA)

10.3.1.4.6 OTHERS

10.3.1.5 OTHERS

10.4 FOOD SERVICES

10.4.1 FOOD SERVICES, BY MATERIAL TYPE

10.4.1.1 PAPER

10.4.1.2 WOOD

10.4.1.3 MOLDED FIBER / PULP

10.4.1.3.1 CARDBOARD

10.4.1.3.2 RECYCLED PAPER

10.4.1.3.3 NATURAL FIBER

10.4.1.3.3.1 SUGARCANE

10.4.1.3.3.2 BAMBOO

10.4.1.3.3.3 WHEAT STRAW

10.4.1.3.3.4 OTHERS

10.4.1.3.4 OTHERS

10.4.1.4 PLASTIC

10.4.1.4.1 POLYETHYLENE TEREPHTHALATE

10.4.1.4.2 POLYPROPYLENE (PP)

10.4.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.4.1.4.4 POLYSTYRENE

10.4.1.4.5 ETHYL VINYL ACETATE (EVA)

10.4.1.4.6 OTHERS

10.4.1.5 OTHERS

10.5 OTHERS

10.5.1 OTHERS, BY MATERIAL TYPE

10.5.1.1 PAPER

10.5.1.2 WOOD

10.5.1.3 MOLDED FIBER / PULP

10.5.1.3.1 CARDBOARD

10.5.1.3.2 RECYCLED PAPER

10.5.1.3.3 NATURAL FIBER

10.5.1.3.3.1 SUGARCANE

10.5.1.3.3.2 BAMBOO

10.5.1.3.3.3 WHEAT STRAW

10.5.1.3.3.4 OTHERS

10.5.1.3.4 OTHERS

10.5.1.4 PLASTIC

10.5.1.4.1 POLYETHYLENE TEREPHTHALATE

10.5.1.4.2 POLYPROPYLENE (PP)

10.5.1.4.3 POLY-VINYL CHLORIDE (PVC)

10.5.1.4.4 POLYSTYRENE

10.5.1.4.5 ETHYL VINYL ACETATE (EVA)

10.5.1.4.6 OTHERS

10.5.1.5 OTHERS

11 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 MEXICO FRUIT PACKAGING MARKET, BY COUNTRY

12.1 MEXICO

13 MEXICO FRUIT PACKAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MEXICO

13.1.1 MERGERS & ACQUISITIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 INTERNATIONAL PAPER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 PACKAGING CORPORATION OF AMERICA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 WESTROCK COMPANY

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 SMURFIT KAPPA

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 DS SMITH

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 HUHTAMAKI

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 MONDI

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SEALED AIR

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 SONOCO PRODUCTS COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD MILLION)

TABLE 3 REVENUE OF SUPPLIERS (USD MILLION) (2021)

TABLE 4 MOLDED FIBER MARKET SHARE, BY MATERIAL TYPE (2022 AND 2029) (IN %)

TABLE 5 MOLDED FIBER MARKET SHARE, BY APPLICATIONS (2022 AND 2029) (IN %)

TABLE 6 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 7 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 8 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 11 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 12 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 13 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 15 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 17 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 19 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 21 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 23 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 25 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 26 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 27 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 28 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 29 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 30 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 31 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 32 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 33 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 34 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 35 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 36 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 39 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (USD MILLION)

TABLE 40 MEXICO FRUIT PACKAGING MARKET, BY FRUIT TYPE, 2020-2029 (MILLION UNITS)

TABLE 41 MEXICO BERRIES IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MEXICO TROPICAL FRUITS IN FRUIT PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (MILLION UNITS)

TABLE 45 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 46 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE , 2020-2029 (USD MILLION)

TABLE 47 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 48 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MEXICO FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MEXICO FLEXIBLE PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MEXICO RIGID PACKAGING IN FRUIT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 MEXICO FRUIT PACKAGING MARKET, BY APPLICATION, 2020-2029 (MILLION UNITS)

TABLE 54 MEXICO TRANSPORTATION IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 55 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 56 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 57 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 58 MEXICO RETAILING IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 59 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 60 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO FOOD SERVICES IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 63 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 MEXICO OTHERS IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO PLASTIC IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO MOLDED FIBER / PULP IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO NATURAL FIBER IN FRUIT PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FRUIT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MEXICO FRUIT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO FRUIT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MEXICO FRUIT PACKAGING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 MEXICO FRUIT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO FRUIT PACKAGING MARKET: MATERIAL TYPE LIFE LINE CURVE

FIGURE 7 MEXICO FRUIT PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 MEXICO FRUIT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MEXICO FRUIT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MEXICO FRUIT PACKAGING MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MEXICO FRUIT PACKAGING MARKET: CHALLENGE MATRIX

FIGURE 12 MEXICO FRUIT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MEXICO FRUIT PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR CONVENIENT AND FLEXIBLE PACKAGING IS DRIVING THE MEXICO FRUIT PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 15 BANANA IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO FRUIT PACKAGING MARKET IN 2022 & 2029

FIGURE 16 MEXICO FRUIT PACKAGING MARKET- SUPPLY CHAIN ANALYSIS

FIGURE 17 MEXICO FRUIT PACKAGING MARKET- VALUE CHAIN ANALYSIS

FIGURE 18 MEXICO FRUIT PACKAGING MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO FRUIT PACKAGING MARKET

FIGURE 20 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 21 WASTE GENERATION BY PACKAGING MATERIAL IN 2019 IN EUROPE

FIGURE 22 MEXICO FRUIT PACKAGING MARKET: BY FRUIT TYPE, 2021

FIGURE 23 MEXICO FRUIT PACKAGING MARKET: BY MATERIAL TYPE, 2021

FIGURE 24 MEXICO FRUIT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 25 MEXICO FRUIT PACKAGING MARKET: BY APPLICATION, 2021

FIGURE 26 MEXICO FRUIT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 27 MEXICO FRUIT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Mexico Fruit Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Mexico Fruit Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Mexico Fruit Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.