Market Analysis and Size

Plastic pipes are thermoplastic materials produced from the polymerization of ethylene. The plastic pipes are manufactured by extrusion in sizes ranging from ½" to 63". The materials are available in rolled coils of various lengths or straight lengths up to 40 feet. Generally, small diameters are coiled, and large diameters are in straight lengths. PE pipes of plastics are available in many varieties of wall thicknesses. A significant benefit of plastic pipe is their small environmental impact compared to other materials.

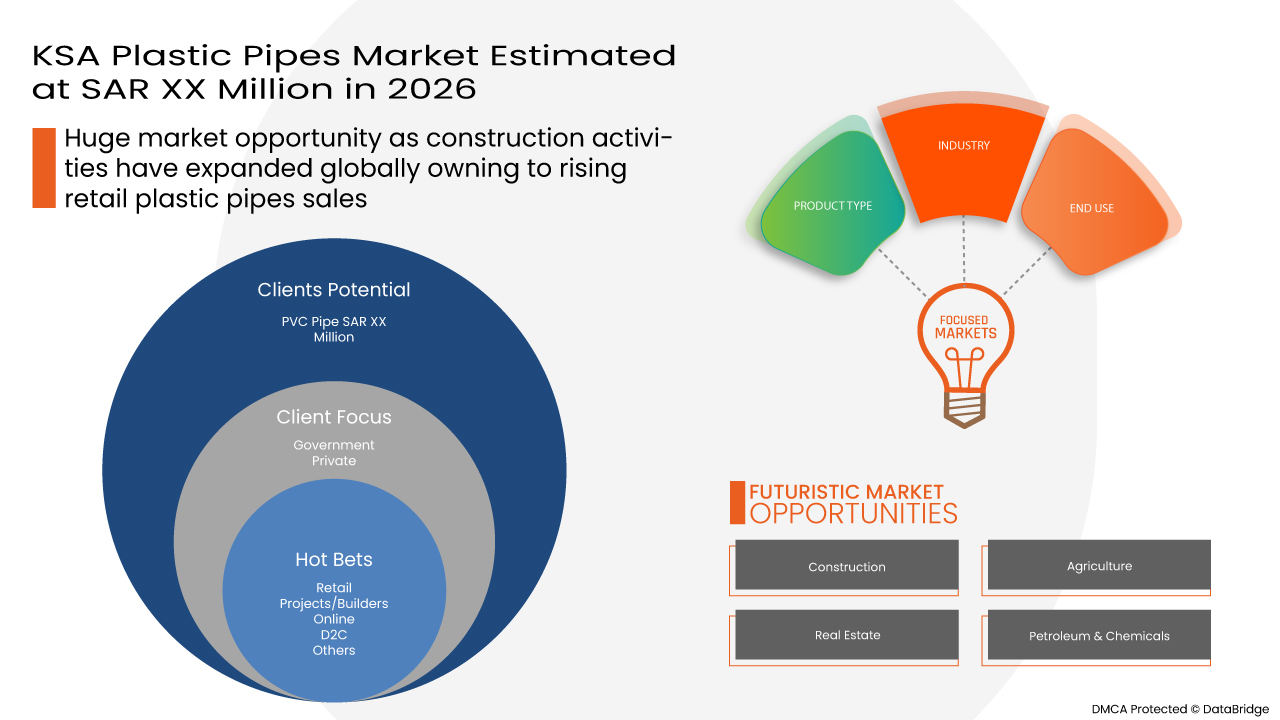

These plastic pipes are highly beneficial in replacing old or obsolete municipal pipe systems. Data Bridge Market Research analyses that the plastic pipes market is expected to reach the value of SAR 4,755.01 million by 2026, at a CAGR of 4.5% during the forecast period. “PVC pipes “accounts for the most prominent product type segment in the respective market owing to rise in the construction activities. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2026 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in SAR Million, Pricing in SAR |

|

Segments Covered |

By Product Type (PVC Pipe, PE Pipes, PPR Pipes, PVC Fittings, PPR Fittings, PPR Manifolds, Electrical Pipes, Stretch Film and Others), Industry (Private and Government), End Use (Construction, Hospitals, Agriculture, Real Estate, Petroleum & Chemicals and Others), Channel (D2C, Retail, Projects/Builders, Online and Others) and Cities (AL-Ahsa, Arar, Dammam, Jeddah, Khamis, Madinah, Riyadh, Tabuk, Qassim and rest of KSA) |

|

Country Covered |

KSA |

|

Market Players Covered |

AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group L.L.C., Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO and SAUDI PIPE SYSTEM |

Market Definition

Most model plumbing codes recognise plastic or PE pipe as acceptable for water services, drainage, and sewer applications. Plastic can be used in low temperatures without the risk of brittle failure. Thus, a major application for certain PE piping formulations is for low-temperature heat transfer applications such as radiant floor heating, snow melting, ice rinks, and geothermal ground source heat pump piping.

Regulatory Framework

- ISO 13953: 2001: This International Standard describes a test method for the determination of the tensile strength and tensile failure mode of butt-fused plastic (PE) pipe assemblies. The method is applicable to butt-fused joints between PE pipes with a nominal outside diameter. The method may be used, together with other test methods, to evaluate the quality of the butt-fused joints

- API SPEC 15LE: 2008: This specification aims to provide standards for plastic (PE) line pipe suitable for conveying oil, gas and non-potable water in the underground, above ground and reliner applications for the oil and gas producing industries. The standard does not propose to address all of the safety concerns associated with the design, installation or use of products suggested herein

These standards provide qualification for plastic pipes production, protocols and guidelines that ensures a high level of security and certifies the material for use.

COVID-19 had a Minimal Impact on KSA Plastic Pipes Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the plastic pipes market. The operations and supply chain of plastic pipes, with multiple manufacturing facilities, were still operating in the region. The service providers continued offering plastic pipe products following sanitation and safety measures in the post-COVID scenario.

The Market Dynamics of the KSA Plastic Pipes Market Include:

- Growing demand for ready-to-eat food products

Ready-to-cook food requires perfect packaging solutions to protect the food from biological contamination and physical influence. This has increased the demand for thermal insulating packaging materials, contributing to the growth of the North America Thermal insulation packaging market.

- Ongoing rehabilitation and construction of old or obsolete municipal pipe systems

Municipal sewer line breaks pose an array of environmental and safety hazards, and require the immediate attention of city planning officials. Neglecting a sewer line break can lead to more expensive and severe problems, including toxic water contamination or flooding, street and sidewalk damage and many others. Therefore, the new lines of piping systems are replaced with damaged and compromised sewer systems through the usage of new PE piping technologies. In conclusion, the usage of PE systems has made the municipal pipe repair and construction system more easy and safe. This in turn, increased the demand for plastic pipes and thus contributing to the growth of KSA plastic pipes market.

- Increasing application of HDPE pipes in various end use industries

Creating new and advanced innovations for end-use applications would result in high market penetration and a variety of new products. In addition, HDPE pipes are used across the globe for applications such as water mains, gas mains, sewer mains, slurry transfer lines, rural irrigation, fire system supply lines, and electrical and communications conduit, and stormwater and drainage pipes. In conclusion, HDPE’s high ductility and ability to resist deflections from ground movement can withstand the shock, pressure and movement that can potentially destroy the rigid pipe. This in turn increased the demand for plastic pipes and thus contributing to the growth of KSA plastic pipes market.

- The growth in demand from water irrigation systems in agricultural industry

PVC PE pipes are durable and can withstand sudden pressure and stress with ease for years. Therefore, PVC pipe’s long life span gives it an edge over other pipes, especially when it comes to agricultural usage. Under appropriate conditions, the pipe can even last for more than 50 years without being supplanted. Compared to a metal pipe, an agriculture PVC PE pipe comes at a fraction of the cost, which is quite economical for farmers. In conclusion, PVC PE pipes are very customizable, and hence the market is flooded with numerous fittings of different types and sizes of the pipes. This, in turn increased the demand for plastic pipes and thus contributing to the growth of KSA plastic pipes market.

- Innovation and technological advancements in PE pipe

Advancements in HDPE pipe model and technology are improving for use in PE pipe, which is further used for construction applications, wires and cabling, medical tubing, flooring, fabrics and other industrial applications. New advancements include PVC-O fittings, oriented PPR, and modified PVC fittings PE pipes which are considerably stronger, allowing the wall thickness to be reduced close to 50% while maintaining the same pressure strength. Furthermore, the rising and fast-paced advancement in technology of plastic pipes production will help manufacturers achieve more profits and help them increase their production capacities, which will, in turn, fulfill the increasing demand for plastic pipes. This will act as a major opportunity for the expansion and growth of the KSA plastic pipes market.

Restraints/Challenges faced by the KSA Plastic Pipes Market

- Risk associated with pipe breakages

Bursting water pipes is one of the common plumbing issues that homeowners have to contend with. Whether in the house’s plumbing network or the supply pipes, water pipes can burst without warning, leading to a major repair requiring a qualified plumber's attention. Burst pipes are often the result of a significant level of structural damage, including bad piping structure and poor quality. In conclusion, when a clog occurs within the pipes, it can cause pressure to build up within those pipes, leading to pipe breakages. This in turn, decreases the demand for PE pipes and thus restricting the demand of KSA plastic pipes market.

- Volatility in the prices of raw materials

During the production of plastic pipes, the harmful gases can stimulate diseases in plants, inhibit seed production, and hinder fertilization. Therefore, strict regulations regarding the manufacturing of plastic pipes can bring society and industry various benefits, hence making production and supply chains cleaner and safer and reducing the risk of accidents. It also provides incentives to develop safer piping products and more resource-efficient along with safer production methods. In conclusion, PE pipe is recognized as acceptable plumbing piping for water services, drainage, and sewer applications in most model plumbing codes, which further calls for different rules and regulations set for the application of the PE pipes. This in turn decreases the demand for plastic pipes and hence challenging the growth of the KSA plastic pipes market

This KSA Plastic Pipes Market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the rodenticides market contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Development

- In October 2016, Tahweel Pipes acquired the (DVGW) Certificate, a German certificate is proving that Tahweel pipes are healthy and free of microbial growth and harmful sediments, making it suitable for drinking use. This has helped the company to gain a good market share all over the world.

- In October 2020, Alwasail Industrial Company undertook irrigation projects in Neom, Saudi Arabia, contributing to the city's transformation into a leading global innovation & trade center. It has helped the company to earn more revenue in the long run

- In March 2021, Alwasail Industrial Company conducted training of students for the higher institute for plastic industries inside the Alwasail Industrial Company’s Factory, Al-Qassim. It has helped the company increase its production capacity in plastic pipes.

KSA Plastic Pipes Market Scope

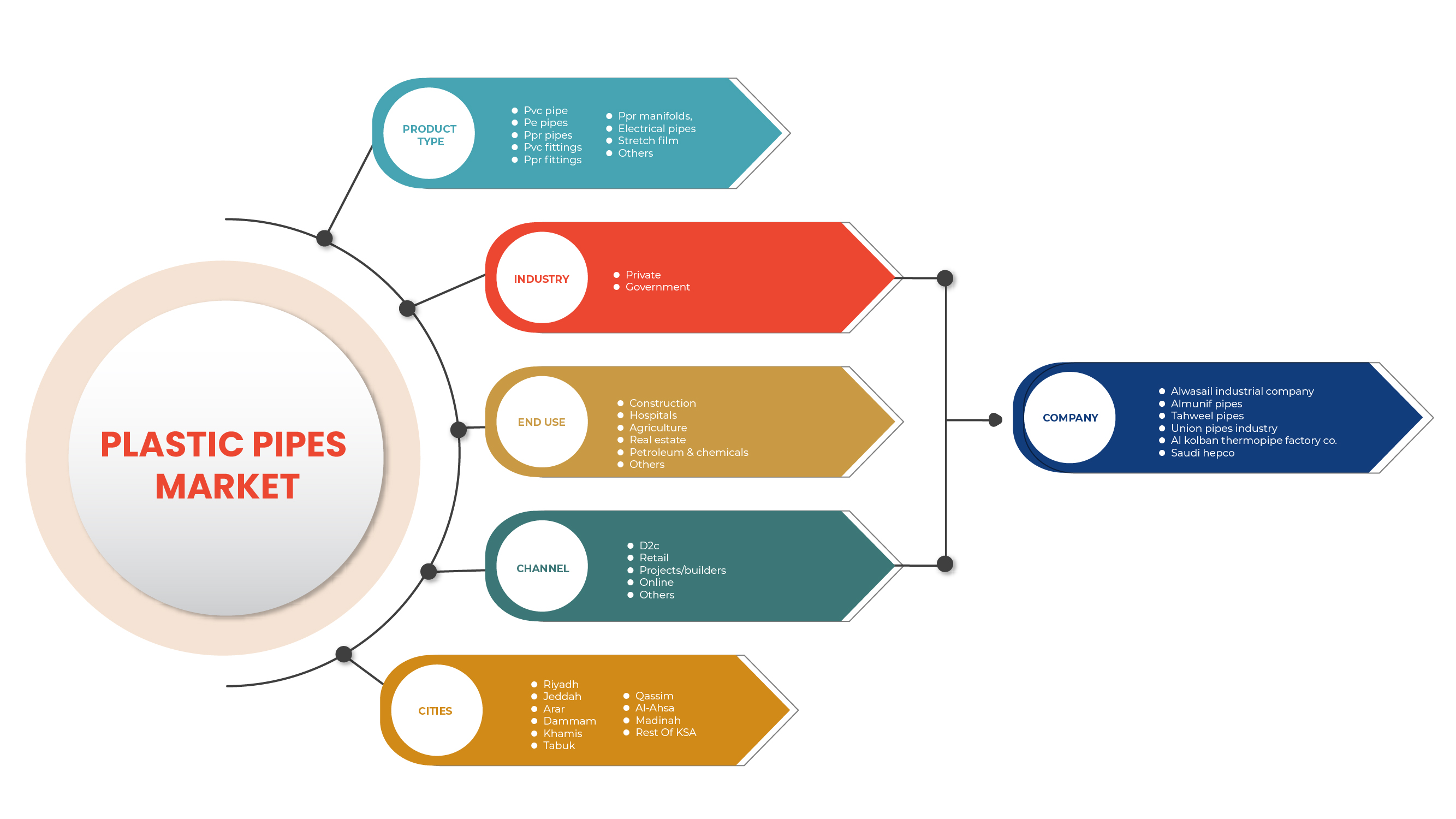

The KSA plastic pipes market is segmented based on product type, industry, end use, channel and cities. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- PVC Pipe

- PE Pipes

- PPR Pipes

- PVC Fittings

- PPR Fittings

- PPR Manifolds

- Electrical Pipes

- Stretch Film

- Others

Based on product type, the KSA plastic pipes market is segmented into PVC pipe, PE pipes, PPR pipes, PVC fittings, PPR fittings, PPR manifolds, electrical pipes, stretch film and others. The PVC pipe segment is expected to dominate the market as they are lightweight, which makes them easy to transport and are safe to use and thus increasing its demand in the country

Industry

- Government

- Private

Based on industry, the KSA plastic pipes market is segmented into private and government. The government segment is expected to dominate the market due to the growing industrialization along with the adoption of various government projects in recent times, which increases its demand in KSA

End Use

- Construction

- Real Estate

- Agriculture

- Petroleum & Chemicals

- Hospitals

- Others

Based on end use, the KSA plastic pipes market is segmented into construction, hospitals, agriculture, real estate, petroleum & chemicals and others. The construction segment is expected to dominate the market due to the increasing population and rapid construction of offices and buildings, which increases its demand in the country.

Channel

- Retail

- Projects/Builders

- Online

- D2C

- Others

Based on channel, the KSA plastic pipes market is segmented into D2C, retail, projects/builders, online and others. The retail segment is expected to dominate the market as retail stores provide a wide variety of products and are easily available, which increases its demand in the country

Cities

- Riyadh

- Jeddah

- Arar

- Dammam

- Khamis

- Tabuk

- Qassim

- Al-Ahsa

- Madinah

- Rest of KSA

Based on cities, the KSA plastic pipes market is segmented into AL-Ahsa, Arar, Dammam, Jeddah, Khamis, Madinah, Riyadh, Tabuk, Qassim and rest of KSA. The Riyadh city is expected to dominate the market as most of the construction activities are undertaken in that city, which increases its demand in the country.

Competitive Landscape and KSA Plastic Pipes Market Share Analysis

The KSA plastic pipes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, KSA presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to KSA plastic pipes market.

Some of the major players operating in the KSA plastic pipes market are AL KOLBAN Thermopipe Factory Co., Manaf Holding Company, Knoah Technology, Alwasail Industrial Company, Tahweel Pipes, Abdur Rahman A. Al-Rajhi Group L.L.C., Saudi Hepco, Union Pipes Industry, New Products Industries Co Ltd. (Neproplast), SAPPCO and SAUDI PIPE SYSTEM among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA PLASTIC PIPES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMMISSIONS/REWARDS OFFERED TO PLUMBERS BY THE KEY PLAYERS

4.2 COMMISSION/BONUS STRUCTURE PROVIDED BY KEY PLAYERS

4.2.1 SALE TEAM

4.2.2 MARKETING TEAM

4.3 DETAILS SCENARIO OF SHOPS BY CITY

4.3.1 RIYADH

4.3.2 JEDDAH

4.3.3 MECCA

4.3.4 MEDINA

4.3.5 SULTANAH

4.3.6 DAMMAM

4.3.7 TAIF

4.3.8 REST OF KSA

4.4 DETAILS OF SHOPS IN KSA

4.5 MARKET SHARE OF TOP MANUFACTURES

4.5.1 TOP MANUFACTURERS, BY PRODUCT TYPE

4.5.1.1 ALWASAIL INDUSTRIAL COMPANY

4.5.1.2 ALMUNIF PIPES

4.5.1.3 TAHWEEL PIPES

4.5.1.4 UNION PIPES INDUSTRY

4.5.1.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.2 TOP MANUFACTURERS, BY CITIES

4.5.2.1 ALWASAIL INDUSTRIAL COMPANY

4.5.2.2 ALMUNIF PIPES

4.5.2.3 TAHWEEL PIPES

4.5.2.4 UNION PIPES INDUSTRY

4.5.2.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.5.3 TOP MANUFACTURERS, BY CHANNEL

4.5.3.1 ALWASAIL INDUSTRIAL COMPANY

4.5.3.2 ALMUNIF PIPES

4.5.3.3 TAHWEEL PIPES

4.5.3.4 UNION PIPES INDUSTRY

4.5.3.5 AL KOLBAN THERMOPIPE FACTORY CO.

4.6 CREDIT TERMS OFFERED BY KEY PLAYERS

4.7 TRADE DISCOUNTS & SALES REBATES OFFERED BY KEY PLAYERS

4.8 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (%) (2021)

4.9 PRIMARY REASONS FOR RETURNS

5 CLIMATE CHANGE SCENARIO

5.1 CLIMATE CHANGE SCENARIO

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 ONGOING REHABILITATION AND CONSTRUCTION OF OLD OR OBSOLETE MUNICIPAL PIPE SYSTEMS

7.1.2 INCREASING APPLICATION OF HDPE PIPES IN VARIOUS END-USE INDUSTRIES

7.1.3 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY

7.2 RESTRAINTS

7.2.1 VOLATILITY IN RAW MATERIAL PRICES

7.2.2 RISK ASSOCIATED WITH PIPE BREAKAGES

7.3 OPPORTUNITIES

7.3.1 RAPID URBANIZATION ALONG WITH INCREASING INDUSTRIAL PRODUCTION

7.3.2 INNOVATION AND TECHNOLOGICAL ADVANCEMENTS IN PE PIPE

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY COMPLIANCES REGARDING THE USAGE OF PE BASED PIPES

8 KSA PLASTIC PIPES MARKET, COUNTRY ANALYSIS

8.1 OVERVIEW

9 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 PVC PIPE

9.3 PE PIPES

9.4 PPR PIPES

9.5 PVC FITTINGS

9.6 PPR FITTINGS

9.7 PPR MANIFOLDS

9.8 ELECTRICAL PIPES

9.9 STRETCH FILM

9.1 OTHERS

10 KSA PLASTIC PIPES MARKET, BY INDUSTRY

10.1 OVERVIEW

10.2 GOVERNMENT

10.3 PRIVATE

11 KSA PLASTIC PIPES MARKET, BY END-USE

11.1 OVERVIEW

11.2 CONSTRUCTION

11.3 REAL ESTATE

11.4 AGRICULTURE

11.5 PETROLEUM & CHEMICALS

11.6 HOSPITALS

11.7 OTHERS

12 KSA PLASTIC PIPES MARKET, BY CHANNEL

12.1 OVERVIEW

12.2 RETAIL

12.3 PROJECTS/BUILDERS

12.4 ONLINE

12.5 D2C

12.6 OTHERS

13 KSA PLASTIC PIPES MARKET, BY CITIES

13.1 OVERVIEW

13.2 RIYADH

13.3 JEDDAH

13.4 ARAR

13.5 DAMMAM

13.6 KHAMIS

13.7 TABUK

13.8 QASSIM

13.9 AL-AHSA

13.1 MADINAH

13.11 REST OF KSA

14 KSA PLASTIC PIPES MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

14.1.1 EXPANSIONS

14.1.2 NEW PRODUCT DEVELOPMENT

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ALWASAIL INDUSTRIAL COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 PRODUCT PORTFOLIO

16.1.3 RECENT UPDATES

16.2 ALMUNIF PIPES

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT UPDATES

16.3 TAHWEEL PIPES

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT UPDATES

16.4 UNION PIPES INDUSTRY

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT UPDATES

16.5 AL KOLBAN THERMOPIPE FACTORY CO.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT UPDATE

16.6 SAUDI HEPCO

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATE

16.7 SAPPCO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 ABDUR RAHMAN A. AL-RAJHI GROUP L.L.C.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 KNOAH TECHNOLOGY

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 NEW PRODUCTS INDUSTRIES CO LTD. (NEPROPLAST)

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 SAUDI PIPE SYSTEMS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 EXPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE (PE), HS - 391721 (SAR MILLION)

TABLE 2 IMPORT DATA OF RIGID TUBES, PIPES, AND HOSES OF POLYMERS OF ETHYLENE, HS - 391721 (SAR MILLION)

TABLE 3 SALARY STRUCTURE OF SALE TEAM

TABLE 4 SALARY STRUCTURE OF MARKETING TEAM

TABLE 5 NUMBER OF SHOPS IN RIYADH

TABLE 6 NUMBER OF SHOPS IN JEDDAH

TABLE 7 NUMBER OF SHOPS IN MECCA

TABLE 8 NUMBER OF SHOPS IN MEDINA

TABLE 9 NUMBER OF SHOPS IN SULTANAH

TABLE 10 NUMBER OF SHOPS IN DAMMAM

TABLE 11 NUMBER OF SHOPS IN MEDINA

TABLE 12 NUMBER OF SHOPS IN REST OF KSA

TABLE 13 DETAILS OF SHOPS IN KSA

TABLE 14 PRODUCT TYPE WISE RETURN AS PER INDUSTRY STANDARD (IN %) (2021)

TABLE 15 KSA PLASTIC PIPES MARKET, BY COUNTRY, 2017-2026 (SAR MILLION)

TABLE 16 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2017-2026 (SAR MILLION)

TABLE 17 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2017-2026 (SAR MILLION)

TABLE 18 KSA PLASTIC PIPES MARKET, BY END-USE, 2017-2026 (SAR MILLION)

TABLE 19 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2017-2026 (SAR MILLION)

TABLE 20 KSA PLASTIC PIPES MARKET, BY CITIES, 2017-2026 (SAR MILLION)

List of Figure

FIGURE 1 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 2 KSA PLASTIC PIPES MARKET: DATA TRIANGULATION

FIGURE 3 KSA PLASTIC PIPES MARKET: DROC ANALYSIS

FIGURE 4 KSA PLASTIC PIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 KSA PLASTIC PIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA PLASTIC PIPES MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 KSA PLASTIC PIPES MARKET: MULTIVARIATE MODELLING

FIGURE 8 KSA PLASTIC PIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 KSA PLASTIC PIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 KSA PLASTIC PIPES MARKET: APPLICATION COVERAGE GRID

FIGURE 11 KSA PLASTIC PIPES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 KSA PLASTIC PIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 KSA PLASTIC PIPES MARKET: SEGMENTATION

FIGURE 14 GROWTH IN DEMAND FOR WATER IRRIGATION SYSTEMS IN THE AGRICULTURAL INDUSTRY IS EXPECTED TO DRIVE THE KSA PLASTIC PIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2026

FIGURE 15 PVC PIPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA PLASTIC PIPES MARKET IN 2022 & 2026

FIGURE 16 ALWASAIL INDUSTRIAL COMPANY, BY PRODUCT TYPE, 2021 (%)

FIGURE 17 ALMUNIF PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 18 TAHWEEL PIPES, BY PRODUCT TYPE, 2021 (%)

FIGURE 19 UNION PIPES INDUSTRY, BY PRODUCT TYPE, 2021 (%)

FIGURE 20 AL KOLBAN THERMOPIPE FACTORY CO., BY PRODUCT TYPE, 2021 (%)

FIGURE 21 ALWASAIL INDUSTRIAL COMPANY, BY CITIES, 2021 (%)

FIGURE 22 ALMUNIF PIPES, BY CITIES, 2021 (%)

FIGURE 23 TAHWEEL PIPES, BY CITIES, 2021 (%)

FIGURE 24 UNION PIPES INDUSTRY, BY CITIES, 2021 (%)

FIGURE 25 AL KOLBAN THERMOPIPE FACTORY CO., BY CITIES, 2021 (%)

FIGURE 26 ALWASAIL INDUSTRIAL COMPANY, BY CHANNEL, 2021 (%)

FIGURE 27 ALMUNIF PIPES, BY CHANNEL, 2021 (%)

FIGURE 28 TAHWEEL PIPES, BY CHANNEL, 2021 (%)

FIGURE 29 UNION PIPES INDUSTRY, BY CHANNEL, 2021 (%)

FIGURE 30 AL KOLBAN THERMOPIPE FACTORY CO., BY CHANNEL, 2021 (%)

FIGURE 31 PLASTIC PIPE MANUFACTURING - SUPPLY CHAIN ANALYSIS

FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE KSA PLASTIC PIPES MARKET

FIGURE 33 KSA PLASTIC PIPES MARKET, BY PRODUCT TYPE, 2021

FIGURE 34 KSA PLASTIC PIPES MARKET, BY INDUSTRY, 2021

FIGURE 35 KSA PLASTIC PIPES MARKET, BY END-USE, 2021

FIGURE 36 KSA PLASTIC PIPES MARKET, BY CHANNEL, 2021

FIGURE 37 KSA PLASTIC PIPES MARKET, BY CITIES, 2021

FIGURE 38 KSA PLASTIC PIPES MARKET: COMPANY SHARE 2021 (%)

FIGURE 39 PROFILED COMPANY SHARE 2021 (%)

Ksa Plastic Pipes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Ksa Plastic Pipes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Ksa Plastic Pipes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.