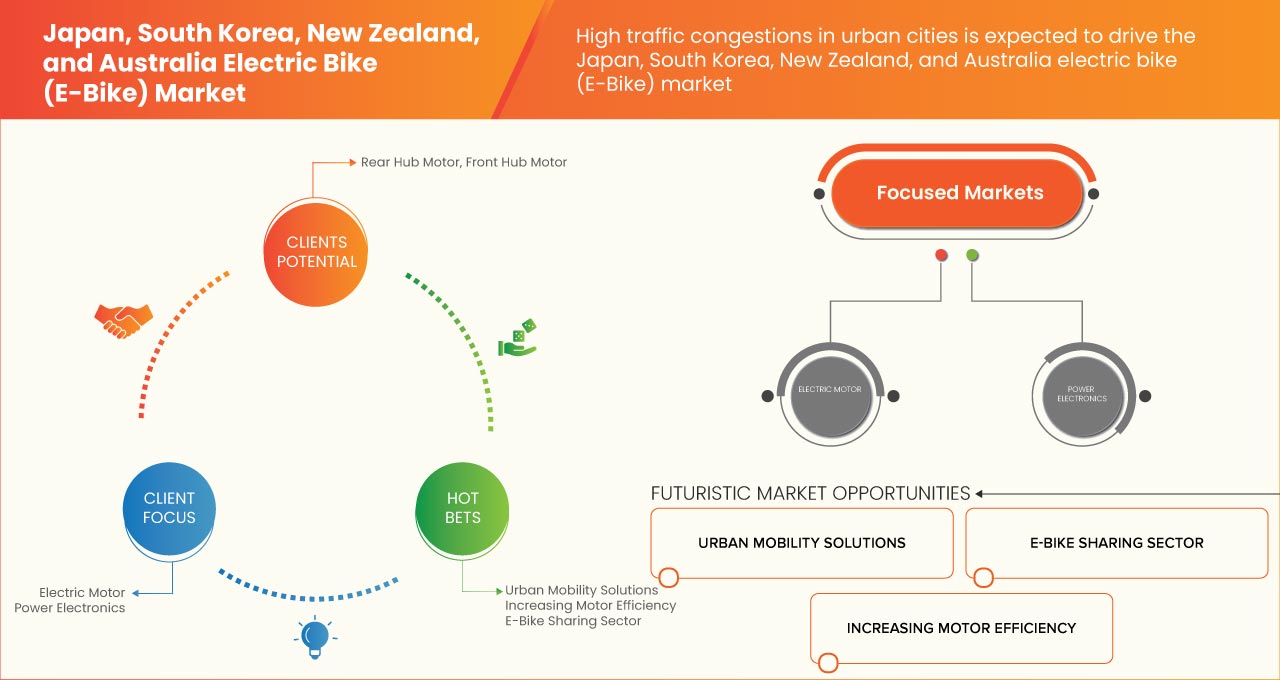

Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market Analysis and Size

It's a well-known fact that cycling is highly beneficial for people's health; the concern for personal health safety has also increased during this pandemic. Individuals are adopting cycling as a part of their hobby and physical activity to increase their fitness. Electric bikes play an important role in fulfilling this purpose as the adoption of electric bikes is high among the higher age group population as it provides pedal assistance that makes the cyclist put in less effort while riding. This has also been a success in the tourism industry, as a cyclist can travel long distances without much effort. It has also made riding on tough terrains and elevated mountains easy. The electric bike (e-bike) can be easily used in congested traffic, saving the cyclist's time and money and developing a healthy lifestyle by adopting it.

Data Bridge Market Research analyses that the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is expected to reach a value of USD 2,790.87 million by 2030, at a CAGR of 11.3% during the forecast period. The Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in Million, Pricing in USD |

|

Segments Covered |

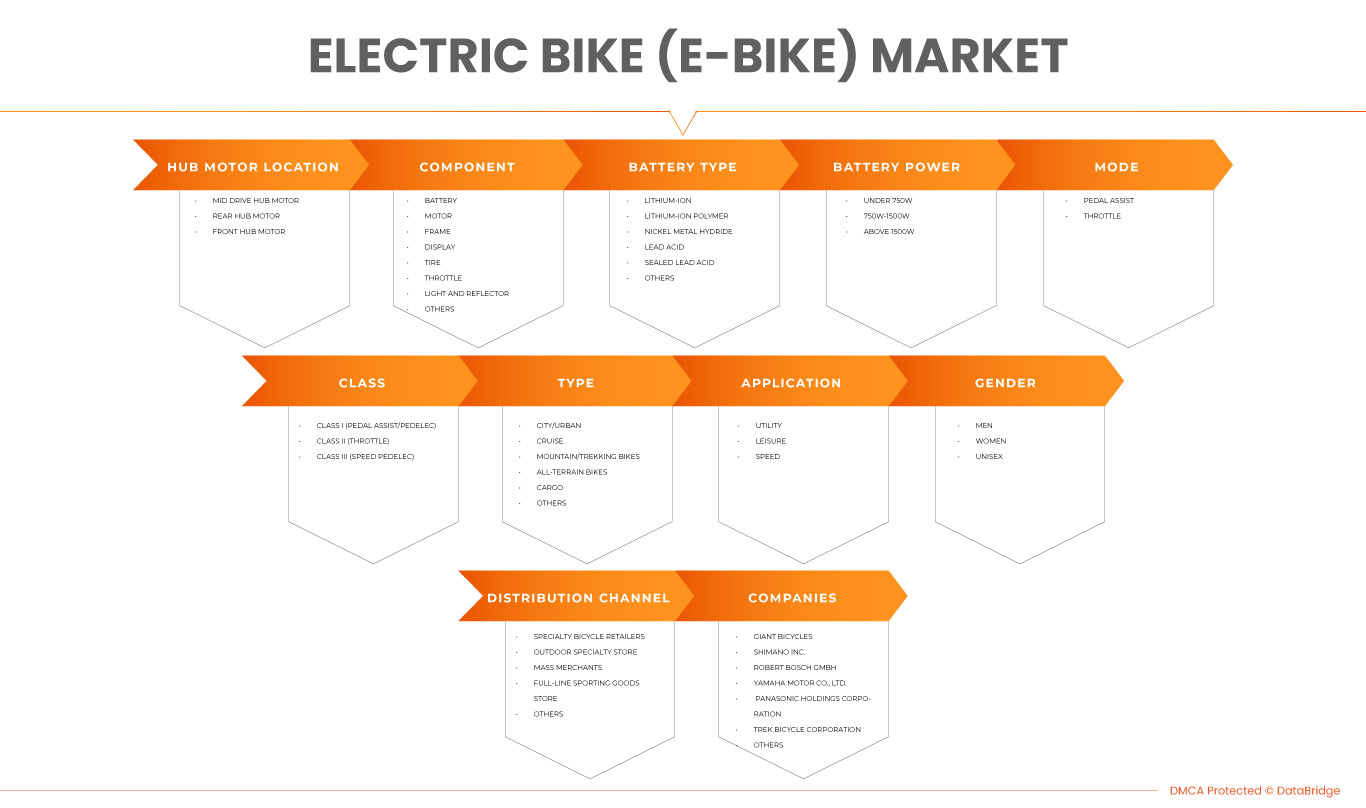

Hub Motor Location (Mid Drive Hub Motor, Rear Hub Motor, and Front Hub Motor), Component (Battery, Motor, Frame, Display, Tire, Throttle, Light and Reflector, and Others), Battery Type (Lithium-Ion, Lithium-Ion Polymer, Nickel Metal Hydride, Lead Acid, Sealed Lead Acid, and Others), Battery Power (Under 750W, and 750W-1500W, and above 1500W), Mode (Pedal Assist and Throttle), Class (Class I (Pedal Assist/Pedelec), Class II (Throttle), and CLASS III (Speed Pedelec)), Type (City/Urban, Cruise, Mountain/Trekking Bikes, All-Terrain Bikes, Cargo, and Others), Application (Utility, Leisure, and Speed), Gender (Men, Women, and Unisex), Distribution Channel (Speciality Bicycle Retailers, Outdoor Speciality Store, Mass Merchants Full-Line Sporting Goods Store, and Others) |

|

Countries Covered |

Japan, South Korea, New Zealand and Australia |

|

Market Players Covered |

Bridgestone Cycle Co, LTD., Panasonic Holdings Corporation, Specialized Bicycle Components, Inc., Giant Bicycles, Aima Technology Group Co., Ltd., Trek Bicycle Corporation, Karbon Kinetics Ltd., Ningbo Lvkang Vehicle Co.,Ltd., SHIMANO INC., Robert Bosch GmbH, ALTON Sports Co., Ltd, Yamaha Motor Co., Ltd., TEBCO ELECTRIC BICYCLE COMPANY, smartmotion bikes, CUBE, Hikobike, Cleverley, Dyson Bikes, Electra Bicycle Company, REEF Bikes, Leitner Electric Bikes Australia |

Market Definition

The material handling equipment facilitates the movement, storage, and control of products and materials throughout the warehousing, manufacturing, distribution, consumption, and disposal processes. These machines enable the fast movement of heavy material and large volumes of goods efficiently. The material handling equipment reduces the need for human intervention in industrial facilities by automating several processes. These generally include LLE, CTO, PNC, lift trucks, and port solutions. Material handling equipment is utilized in the manufacturing, packaging, shipping, and distribution industries, and it is divided into four categories: positioning equipment, transport equipment, unit load formation equipment, and storage equipment. The items and materials must be sorted in order, which is why a sortation conveyor system is one of the most effective pieces of equipment in the industry.

Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

DRIVERS

- HIGH TRAFFIC CONGESTION IN URBAN CITIES

The population is continuously increasing globally, and with that, the cities are getting highly populated, the boundaries are increasing, and the infrastructure is extending to a larger part covering the outer parts of cities too. With this growing population and increasing area, vehicles have also been on a hike. People prefer driving their cars and motorcycles to take public transport for their conveyance. This has led to high congestion of traffic jams in urban cities, especially during office hours.

- RISE IN DEMAND OF GREENER AND CLEANER MODE OF TRANSPORTATION

Motor vehicles have eased the mode of transportation, and individuals can more easily and quickly travel to their desired location. Cars and motorbikes are the most commonly used mode of transportation used daily by most households for commuting purposes; however, these motor vehicles lead to harmful emissions and increase the carbon footprint. This has caused adverse effects on the environment causing global warming and depletion of the ozone layer.

However, people have become more concerned about the environment and are urged to drive environment-friendly vehicles. This increasing need to save the environment from degrading by motor vehicles has led to the growth in the demand for Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) market.

OPPORTUNITY

- INITIATIVES BY COMPANIES FOR E-BIKE INFRASTRUCTURE

The world of cranes is changing; new age technology is shredding up the paper lift plans of old and replacing them with digital procedures generated in computer programmes. Material handling is the movement, protection, storage and control of materials and products throughout manufacturing, warehousing, distribution, consumption and disposal. As a process, material handling incorporates a wide range of manual, semi-automated and automated equipment and systems that support logistics and make the supply chain work. Material handling equipment serve the needs of various industries including retail, food industry, freight & logistics, construction, wood industry, paper industry, chemical industry and others.

RESTRAINT/CHALLENGE

- HIGH COSTS OF PURCHASE AND MAINTENANCE OF E-BIKES

Electric bikes are the easiest mode of conveyance as they offer the extra power of the motor whenever the cyclist needs extra effort to pull the cycle. They are highly economical when compared with vehicles running on fuel. However, the price seems quite high compared to traditional bicycles, both gear and non-gear cycles. The initial cost of an E-bike is high, limiting the market's growth.

Moreover, the maintenance is also high for the E-bikes, as the battery needs to be charged after regular use, and if there is an issue with the battery, a new battery would require. It also consists of a motor and a whole electrical system, which on any issue would require extra investment for maintenance. Moreover, this is associated with the extra cost of buying and the cost of maintenance, which act as a major restraint for the market.

- LIMITED DISTRIBUTION CHANNELS

Bicycles have been the most common mode of transportation starting from the younger age individual. These bicycles are available in retailers in most regions quite easily. However, the e-bike market needs to establish new strategies to penetrate deeper into the market and compete with pre-existing non-electric bicycles and other modes of transport.

The lack of distribution channels is the major drawback of the market's growth. The e-bike industry needs to enter into an e-commerce platform. In addition, e-bike manufacturers must focus on omni-channel for better sales of their vehicles. The days are long gone when the revenue increased with more retail shops opening. The companies need to focus on online platforms to distribute their E-bikes.

Post-COVID-19 Impact on Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market

The Covid-19 pandemic has had a mixed effect on the electric bike (e-bike) market in Japan. On one hand, the pandemic has led to an increase in demand for e-bikes as people have become more health-conscious and are avoiding public transportation. On the other hand, the pandemic has disrupted the supply chain and caused production delays, leading to shortages of e-bikes in some regions.

One trend that has emerged during the pandemic is the rise of e-bikes for delivery services. With the increased demand for online shopping and food delivery, there has been a surge in demand for e-bikes that are specifically designed for commercial use.

Another factor that has impacted the e-bike market in Japan is the government's push towards sustainable transportation. The government has set a target of achieving net-zero emissions by 2050 and is promoting the use of e-bikes as a way to reduce carbon emissions.

Overall, while the pandemic has caused some disruptions in the supply chain, the increasing demand for e-bikes and the government's support for sustainable transportation suggest that the e-bike market in Japan is poised for growth in the coming years.

Recent Development

- In 2017 January, AIMA TECHNOLOGY CO., LTD announced the launch of its new base in Sichuan, China. The new base covered an area of about 15,000 square meters and was used to manufacture electric vehicles. The new base allowed the company to penetrate more into the southwest market.

- In 2021 April, ALTON Sports Co., Ltd reported about collaborating with Seoul City Government to supply bike-sharing services and supplies bikes to an e-bike-sharing platform operator. This has helped the company to enhance revenue growth for the company.

Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market Scope

Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented on the basis of hub motor location, component, battery type, battery power, mode, class, type, application, gender, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

HUB MOTOR LOCATION

- MID DRIVE HUB MOTOR

- REAR HUB MOTOR

- FRONT HUB MOTOR

On the basis of hub motor location, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into mid drive hub motor, rear hub motor, and front hub motor.

COMPONENT

- BATTERY

- MOTOR

- FRAME

- DISPLAY

- TIRE

- THROTTLE

- LIGHT AND REFLECTOR

- OTHERS

On the basis of component, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into battery, motor, frame, display, tire, throttle, light and reflector, and others.

BATTERY TYPE

- LITHIUM-ION

- LITHIUM-ION POLYMER

- NICKEL METAL HYDRIDE

- LEAD ACID

- SEALED LEAD ACID

- OTHERS

On the basis of battery type, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into lithium-ion, lithium-ion polymer, nickel metal hydride, lead acid, sealed lead acid, and others.

BATTERY POWER

- UNDER 750W

- 750W-1500W

- ABOVE 1500W

On the basis of battery power, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into under 750 W, and 750 W-1500W, and above 1500W.

MODE

- PEDAL ASSIST

- THROTTLE

On the basis of mode, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into pedal assist and throttle.

CLASS

- CLASS I (PEDAL ASSIST/PEDELEC)

- CLASS II (THROTTLE)

- CLASS III (SPEED PEDELEC)

On the basis of class, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into class I (pedal assist/pedelec), class II (throttle), and Class III (speed pedelec).

TYPE

- CITY/URBAN

- CRUISE

- MOUNTAIN/TREKKING BIKES

- ALL-TERRAIN BIKES

- CARGO

- OTHERS

On the basis of type, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into city/urban, cruise, mountain/trekking bikes, all-terrain bikes, cargo, and others.

APPLICATION

- UTILITY

- LEISURE

- SPEED

On the basis of application, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into utility, leisure, and speed.

GENDER

- MEN

- WOMEN

- UNISEX

On the basis of gender, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into men, women, and unisex.

DISTRIBUTION CHANNEL

- SPECIALTY BICYCLE RETAILERS

- OUTDOOR SPECIALTY STORE

- MASS MERCHANTS

- FULL-LINE SPORTING GOODS STORE

- OTHERS

On the basis of distribution channel, the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is segmented into specialty bicycle retailers, outdoor specialty store, mass merchants, full-line sporting goods store, and others.

Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market Country Analysis/Insights

Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market is analysed, and market size insights and trends are provided by country, product as referenced above.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Japan, South Korea, New Zealand, and Australia Electric bike (E-Bike) Market Share Analysis

Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market.

Some of the major players operating in the Japan, South Korea, New Zealand, and Australia electric bike (E-Bike) market are Bridgestone Cycle Co,. LTD., Panasonic Holdings Corporation, Specialized Bicycle Components, Inc., Giant Bicycles, Aima Technology Group Co., Ltd., Trek Bicycle Corporation, Karbon Kinetics Ltd., Ningbo Lvkang Vehicle Co.,Ltd., SHIMANO INC., Robert Bosch GmbH, ALTON Sports Co., Ltd, Yamaha Motor Co., Ltd., TEBCO ELECTRIC BICYCLE COMPANY, smartmotion bikes, CUBE, Hikobike, Cleverley, Dyson Bikes, Electra Bicycle Company, REEF Bikes, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 HUB MOTOR LOCATION TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPARATIVE ANALYSIS

4.2 KEY STRATEGIC INITIATIVES

4.3 COMPARATIVE ANALYSIS (EMISSION)

4.3.1 E-BIKE

4.3.2 CARS

4.3.3 MOTOR CYCLE

5 REGULATORY STANDARDS

6 TECHNOLOGICAL TRENDS

7 PATENT ANALYSIS

7.1 JAPAN:

7.2 SOUTH KOREA:

7.3 NEW ZEALAND:

7.4 AUSTRALIA:

8 VALUE CHAIN ANALYSIS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 HIGH TRAFFIC CONGESTION IN URBAN CITIES

9.1.2 RISE IN DEMAND OF GREENER AND CLEANER MODE OF TRANSPORTATION

9.1.3 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVELS

9.1.4 GROWTH IN THE BICYCLE TOURISM INDUSTRY

9.1.5 HIGH FLUCTUATION IN FUEL PRICES

9.2 RESTRAINTS

9.2.1 HIGH COSTS OF PURCHASE AND MAINTENANCE OF E-BIKES

9.2.2 INCREASE OF TECHNOLOGICAL CHALLENGES

9.2.3 LACK OF INFRASTRUCTURE FOR ELECTRIC VEHICLES IN DEVELOPING COUNTRIES

9.3 OPPORTUNITIES

9.3.1 INITIATIVES BY COMPANIES FOR E-BIKE INFRASTRUCTURE

9.3.2 GROWTH IN THE BIKE RENTAL BUSINESS

9.3.3 GROWING HEALTH CONCERNS AMONG THE INDIVIDUALS

9.3.4 INCREASING GROWTH IN THE PRODUCTION OF RENEWABLE ENERGY

9.4 CHALLENGES

9.4.1 LIMITED DISTRIBUTION CHANNELS

9.4.2 HIGH COMPETENCY OFFERED BY MOTORCYCLES AND SCOOTERS IN THE MODE OF FASTER TRANSPORTATION

10 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION

10.1 OVERVIEW

10.2 MID DRIVE HUB MOTOR

10.3 REAR HUB MOTOR

10.4 FRONT HUB MOTOR

11 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE

11.1 OVERVIEW

11.2 LITHIUM-ION

11.3 LITHIUM-ION POLYMER

11.4 NICKEL METAL HYDRIDE

11.5 LEAD ACID

11.6 SEALED LEAD ACID

11.7 OTHERS

12 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER

12.1 OVERVIEW

12.2 UNDER 750W

12.3 750W-1500W

12.4 ABOVE 1500W

13 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY MODE

13.1 OVERVIEW

13.2 PEDAL ASSIST

13.3 THROTTLE

14 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT

14.1 OVERVIEW

14.2 BATTERY

14.3 MOTOR

14.4 FRAME

14.5 DISPLAY

14.6 TIRE

14.7 THROTTLE

14.8 LIGHT AND REFLECTOR

14.9 OTHERS

15 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE

15.1 OVERVIEW

15.2 CITY/URBAN

15.2.1 NON-BELT

15.2.2 BELT

15.3 CRUISE

15.3.1 NON-BELT

15.3.2 BELT

15.4 MOUNTAIN/TREKKING BIKES

15.4.1 NON-BELT

15.4.2 BELT

15.5 ALL-TERRAIN BIKES

15.5.1 NON-BELT

15.5.2 BELT

15.6 CARGO

15.6.1 NON-BELT

15.6.2 BELT

15.7 OTHERS

15.7.1 NON-BELT

15.7.2 BELT

16 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY CLASS

16.1 OVERVIEW

16.2 CLASS I (PEDAL ASSIST/PEDELEC)

16.3 CLASS II (THROTTLE)

16.4 CLASS III (SPEED PEDELEC)

17 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY APPLICATION

17.1 OVERVIEW

17.2 UTILITY

17.3 LEISURE

17.4 SPEED

18 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER

18.1 OVERVIEW

18.2 MEN

18.3 WOMEN

18.4 UNISEX

19 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL

19.1 OVERVIEW

19.2 SPECIALTY BICYCLE RETAILERS

19.3 OUTDOOR SPECIALTY STORE

19.4 MASS MERCHANTS

19.5 FULL-LINE SPORTING GOODS STORE

19.6 OTHERS

20 JAPAN, KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: JAPAN

20.2 COMPANY SHARE ANALYSIS: SOUTH KOREA

20.3 COMPANY SHARE ANALYSIS: AUSTRALIA

20.4 COMPANY SHARE ANALYSIS: NEW ZEALAND

21 SWOT ANALYSIS

22 COMPANY PROFILES

22.1 AIMA TECHNOLOGY CO., LTD

22.1.1 COMPANY SNAPSHOT

22.1.2 PRODUCT PORTFOLIO

22.1.3 RECENT DEVELOPMENT

22.2 ALTON SPORTS CO., LTD

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENT

22.3 BRIDGESTONE CYCLE CO., LTD.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT DEVELOPMENT

22.4 CLEVERLEY

22.4.1 COMPANY SNAPSHOT

22.4.2 PRODUCT PORTFOLIO

22.4.3 RECENT DEVELOPMENT

22.5 CUBE

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 DYSON BIKES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENT

22.7 ELECTRA BICYCLE COMPANY

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 GIANT BICYCLES

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENTS

22.9 HIKOBIKE

22.9.1 COMPANY SNAPSHOT

22.9.2 PRODUCT PORTFOLIO

22.9.3 RECENT DEVELOPMENT

22.1 KARBON KINETICS LTD

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 LEITNER ELECTRIC BIKES AUSTRALIA

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENT

22.12 NINGBO LVKANG VEHICLE CO., LTD.

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENT

22.13 PANASONIC HOLDINGS CORPORATION

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT DEVELOPMENT

22.14 REEF BIKES

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENT

22.15 ROBERT BOSCH GMBH

22.15.1 COMPANY SNAPSHOT

22.15.2 REVENUE ANALYSIS

22.15.3 PRODUCT PORTFOLIO

22.15.4 RECENT DEVELOPMENTS

22.16 SHIMANO INC.

22.16.1 COMPANY SNAPSHOT

22.16.2 REVENUE ANALYSIS

22.16.3 PRODUCT PORTFOLIO

22.16.4 RECENT DEVELOPMENT

22.17 SMARTMOTION BIKES

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENT

22.18 SPECIALIZED BICYCLE COMPONENTS, INC.

22.18.1 COMPANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENTS

22.19 TEBCO ELECTRIC BICYCLE COMPANY

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENT

22.2 TREK BICYCLE CORPORATION

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENT

22.21 YAMAHA MOTOR CO., LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

List of Table

TABLE 1 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2021-2030 (USD MILLION)

TABLE 2 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2021-2030 (USD MILLION)

TABLE 3 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2021-2030 (USD MILLION)

TABLE 4 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2021-2030 (USD MILLION)

TABLE 5 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 6 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 7 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2021-2030 (USD MILLION)

TABLE 9 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2021-2030 (USD MILLION)

TABLE 10 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2021-2030 (USD MILLION)

TABLE 11 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2021-2030 (USD MILLION)

TABLE 12 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2021-2030 (USD MILLION)

TABLE 13 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2021-2030 (USD MILLION)

TABLE 14 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2021-2030 (USD MILLION)

TABLE 15 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2021-2030 (USD MILLION)

TABLE 16 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2021-2030 (USD MILLION)

TABLE 17 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 18 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 19 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 20 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 21 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (THOUSAND UNITS)

TABLE 22 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (THOUSAND UNITS)

TABLE 23 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (THOUSAND UNITS)

TABLE 24 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2021-2030 (THOUSAND UNITS)

TABLE 25 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 30 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 31 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 32 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 33 JAPAN CITY/URBAN IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SOUTH KOREA CITY/URBAN IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 AUSTRALIA CITY/URBAN IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 NEW ZEALAND CITY/URBAN IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 JAPAN CRUISE IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SOUTH KOREA CRUISE IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 AUSTRALIA CRUISE IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 NEW ZEALAND CRUISE IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 JAPAN MOUNTAIN/TREKKING BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 SOUTH KOREA MOUNTAIN/TREKKING BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 AUSTRALIA MOUNTAIN/TREKKING BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NEW ZEALAND MOUNTAIN/TREKKING BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 JAPAN ALL-TERRAIN BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SOUTH KOREA ALL-TERRAIN BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 AUSTRALIA ALL-TERRAIN BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 NEW ZEALAND ALL-TERRAIN BIKES IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 JAPAN CARGO IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SOUTH KOREA CARGO IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 AUSTRALIA CARGO IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NEW ZEALAND CARGO IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 JAPAN OTHERS IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SOUTH KOREA OTHERS IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 AUSTRALIA OTHERS IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 NEW ZEALAND OTHERS IN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 58 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 59 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 60 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY CLASS, 2021-2030 (USD MILLION)

TABLE 61 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 62 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 63 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 65 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 66 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 67 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 68 NEW ZEALND ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 69 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 70 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 71 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: SEGMENTATION

FIGURE 2 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: DROC ANALYSIS

FIGURE 4 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 6 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 7 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 8 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 9 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: DBMR MARKET POSITION GRID

FIGURE 11 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: DBMR MARKET POSITION GRID

FIGURE 12 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: DBMR MARKET POSITION GRID

FIGURE 13 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: DBMR MARKET POSITION GRID

FIGURE 14 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: VENDOR SHARE ANALYSIS

FIGURE 15 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: MULTIVARIATE MODELLING

FIGURE 16 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: HUB MOTOR LOCATION TIMELINE CURVE

FIGURE 17 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: HUB MOTOR LOCATION TIMELINE CURVE

FIGURE 18 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: HUB MOTOR LOCATION TIMELINE CURVE

FIGURE 19 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: HUB MOTOR LOCATION TIMELINE CURVE

FIGURE 20 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: APPLICATION COVERAGE GRID

FIGURE 21 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: APPLICATION COVERAGE GRID

FIGURE 22 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: APPLICATION COVERAGE GRID

FIGURE 23 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: APPLICATION COVERAGE GRID

FIGURE 24 JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: SEGMENTATION

FIGURE 25 RISE IN THE DEMAND FOR GREENER AND CLEANER MODES OF TRANSPORTATION IS EXPECTED TO DRIVE JAPAN ELECTRIC BIKE (E-BIKE) MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 26 HIGH TRAFFIC CONGESTION IN URBAN CITIES IS EXPECTED TO DRIVE THE SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 27 GOVERNMENT INITIATIVES TO REDUCE EMISSION LEVEL IS EXPECTED TO DRIVE AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 28 HIGH FLUCTUATION IN FUEL PRICES IS EXPECTED TO DRIVE THE NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET IN THE FORECAST PERIOD 2023-2030

FIGURE 29 HUB MOTOR LOCATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF JAPAN ELECTRIC BIKE (E-BIKE) MARKET IN 2023 & 2030

FIGURE 30 HUB MOTOR LOCATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET IN 2023 & 2030

FIGURE 31 HUB MOTOR LOCATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET IN 2023 & 2030

FIGURE 32 HUB MOTOR LOCATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET IN 2023 & 2030

FIGURE 33 COMPANY COMPARISON

FIGURE 34 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF JAPAN, SOUTH KOREA, NEW ZEALAND, AND AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET

FIGURE 35 CHANGE IN MOTOR VEHICLE REGISTRATIONS FROM 2020 - 2021 BY STATE AND TERRITORY

FIGURE 36 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2022

FIGURE 37 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2022

FIGURE 38 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2022

FIGURE 39 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY HUB MOTOR LOCATION, 2022

FIGURE 40 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2022

FIGURE 41 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2022

FIGURE 42 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2022

FIGURE 43 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY TYPE, 2022

FIGURE 44 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2022

FIGURE 45 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2022

FIGURE 46 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2022

FIGURE 47 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY BATTERY POWER, 2022

FIGURE 48 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2022

FIGURE 49 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2022

FIGURE 50 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2022

FIGURE 51 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY MODE, 2022

FIGURE 52 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2022

FIGURE 53 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2022

FIGURE 54 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2022

FIGURE 55 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY COMPONENT, 2022

FIGURE 56 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2022

FIGURE 57 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2022

FIGURE 58 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2022

FIGURE 59 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY TYPE, 2022

FIGURE 60 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: BY CLASS, 2022

FIGURE 61 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: BY CLASS, 2022

FIGURE 62 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: BY CLASS, 2022

FIGURE 63 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: BY CLASS, 2022

FIGURE 64 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: BY APPLICATION, 2022

FIGURE 65 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: BY APPLICATION, 2022

FIGURE 66 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: BY APPLICATION, 2022

FIGURE 67 NEEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: BY APPLICATION, 2022

FIGURE 68 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2022

FIGURE 69 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2022

FIGURE 70 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2022

FIGURE 71 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY GENDER, 2022

FIGURE 72 JAPAN ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 73 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 74 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 75 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 76 JAPAN ELECTRIC BIKE (E-BIKE) MARKET: COMPANY SHARE 2022 (%)

FIGURE 77 SOUTH KOREA ELECTRIC BIKE (E-BIKE) MARKET: COMPANY SHARE 2022 (%)

FIGURE 78 AUSTRALIA ELECTRIC BIKE (E-BIKE) MARKET: COMPANY SHARE 2022 (%)

FIGURE 79 NEW ZEALAND ELECTRIC BIKE (E-BIKE) MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.