Market Analysis and Size

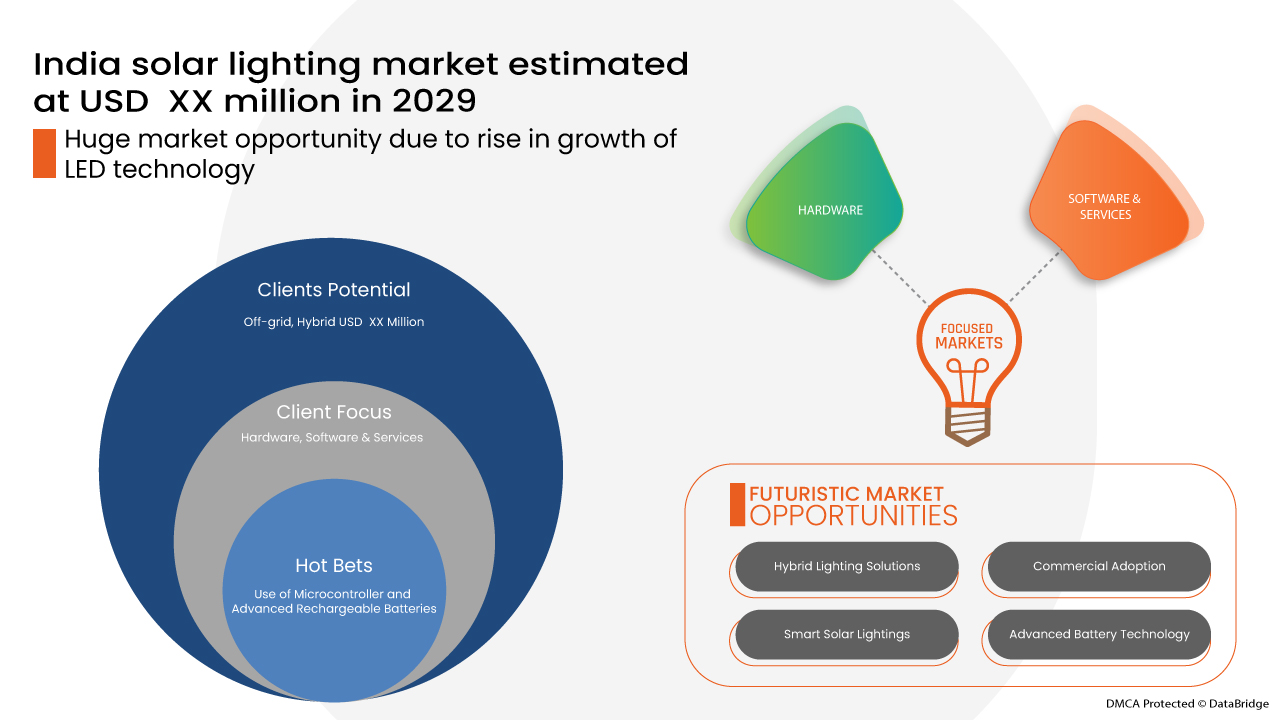

The demand in the India solar lighting market is mainly driven by the growing renewable energy sector. Rising infrastructure development and the increasing need for energy-efficient lighting systems have been driving the demand in the Indian market. The rise in the growth of LED technology has further created opportunities for market growth.

Data Bridge Market Research analyses that the solar lighting market is expected to reach the value of USD 650.44 million by the year 2029, at a CAGR of 16.8% during the forecast period. Hardware accounts for the most prominent component segment in the respective market as this includes components such as solar PV modules, batteries, and lighting fixtures which constitute most of the cost of the solution. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Components (Hardware and Software & Services), Light Source (LED and Others), Grid Type (Off-Grid, Hybrid), Capacity (Less than 5 Watt, 5 Watt to 20 Watt, 20 Watt to 35 Watt, 35 Watt to 50 Watt and Above 50 Watt), End Use (Highways & Roadways, Residential, Commercial, Industrial and Others), Application (Indoor, Outdoor), Installation Type (New, Retrofit), Sales Channel (Direct Sales, Wholesales/Retail, Online) |

|

Countries Covered |

India |

|

Market Players Covered |

Renesas Electronic Corporation, Steelhacks IndustriesWipro Lighting, Signify Holding, Fevino Industries LLP, GautamSolar, UM Green Pvt. Ltd., Systellar , Urja Global Limited, Inter Solar Systems, NESSA, Solmitra Power & Steel Pvt Ltd., Easy Photovoltech Private Limited., Sun World Solar Systems, Solex Energy Limited |

Market Definition

Solar lighting system operates on electricity from batteries, charged through the use of solar photovoltaic panels. It is composed of a battery, solar panel, LED lamp, and charge controller. The working principle of the solar lighting system lies in the collection of solar energy and transforms it into lighting by using the photovoltaic effect which is being used in a photovoltaic panel and solar panel. The stored energy is collected in a rechargeable gel cell battery used later to produce lighting at night. The rapid infrastructure development in all sectors of India is pushing local solar light manufacturers to compete and deliver innovative solar lighting products at low prices to increase their presence in the market.

Market Dynamics of the Solar Lighting Market Include:

Drivers-

- Growing renewable energy sector

Renewable energy is produced from natural sources or from renewable resources that are constantly replenished. India is third-largest consumer of electricity in the world after U.S. and China. The increasing demand for electricity is forcing India to search for new ways, especially renewable, to produce energy due to which India is constantly investing and developing its renewable energy sector.

- Rising infrastructure development

The growth in the infrastructure of highways, railways, inland highways, ports, and aviation is acting as drivers for the Indian solar lighting market because of government schemes, ease of street light installation, and minimum maintenance post installation

- Increasing need for energy-efficient lighting systems

As solar lighting products are now more sophisticated with LED and microcontrollers, it allows the user to control the illumination level of solar lighting products hence consuming less energy. This advantage of solar lighting systems and the need for energy-efficient systems act as drivers for the Indian solar lighting market.

- Increasing use of solar lanterns in rural areas

The increased use of solar lanterns in rural areas is hoisting the market growth of the Indian solar lighting market by providing the various option of solar lantern products at subsidies rates.

Opportunities-

- Rise in growth of LED technology

LED lights have massively entered into residential, commercial, streetlight and yard lighting but still it has to go long way. The Indian LED Lighting market is growing as LEDs have gained a mainstream in the lightings market due to continuous declining LED prices in the country and favourable government initiatives, such as UJALA and SLNP, offering LEDs at a subsidized cost and solar LED system installation projects for streetlights, respectively. Thus, boosting the use of LED as lighting source and solar energy sector is providing a lucrative opportunity for the growth of Indian solar lighting market.

- High presence of off-grid population

Presence of high population off grid and frequent electricity cut in the rural areas has attracted rural population towards solar energy and this is providing growth opportunities for Indian solar lighting products and services in rural areas.

Restraints/Challenges Faced by The Solar Lighting Market

- High dependence on conventional source of energy for electricity generation

This high dependency on coal and other fossil fuel for electricity generation has slowed the transition and decency on solar energy restraining the demand and growth of solar lighting in the Indian market.

- Lack of awareness about renewable energy

High initial cost of installing solar lighting system is therefore acting as a major challenge for the growth of India solar lighting market.

This solar lighting market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Solar Lighting Market contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In June 2021, Wipro Lighting and Enlighted signed a strategic partnership. Under this partnership, the company had to utilize the Internet of Things (IoT) solutions of Enlighted to innovate and produce solutions for solar farms, panels and commercial buildings for various customer segments. Through this step, the company is aiming to capture more market share in solar lightning and commercial lightning.

- In March 2020, Signify partnered with SRF Foundation to provide the lighting solution to five school playgrounds in Mewat, Haryana. Through this partnership, the company promotes its solar light product in rural India. The company is aiming to boost the sales of its solar product after this partnership.

India Solar Lighting Market Scope

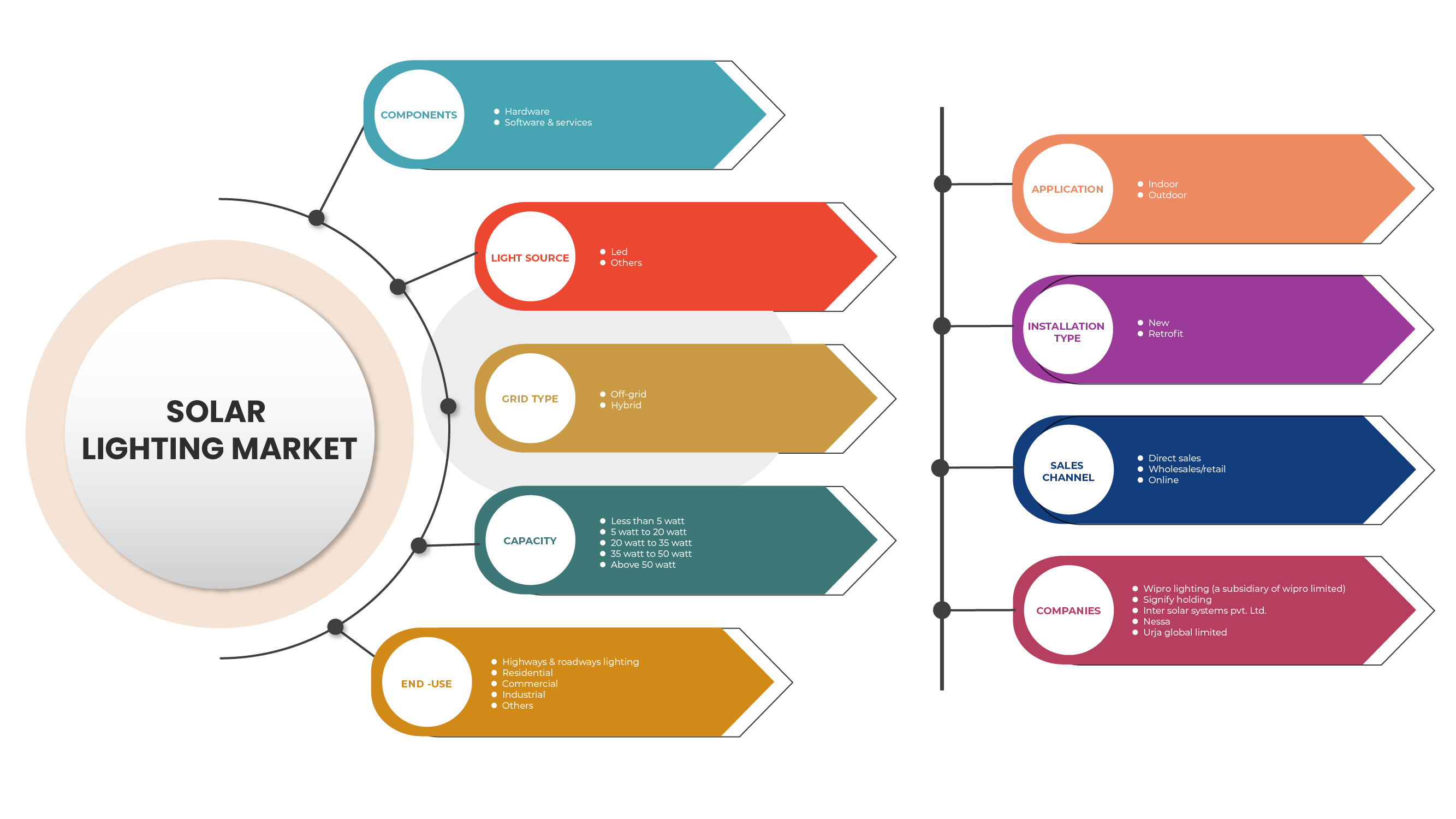

The solar lighting market is segmented on the basis of components, light source, grid type, capacity, end use, application, installation type, and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software & Services

On the basis of the components, India solar lighting market is segmented into hardware and software & services.

Light Source

- LED

- Others

On the basis of the light source, India solar lighting market is segmented into LED and others.

Grid Type

- Off-Grid

- Hybrid

On the basis of the grid type, India solar lighting market is segmented into off-grid and hybrid.

Capacity

- Less than 5 Watt

- 5 Watt to 20 Watt

- 20 Watt to 35 Watt

- 35 Watt to 50 Watt

- Above 50 Watt

On the basis of the capacity, India solar lighting market is segmented into less than 5 watt, 5 watt to 20 watt, 20 watt to 35 watt, 35 watt to 50 watt and above 50 watt.

End Use

- Highways & Roadways Lighting

- Residential

- Commercial

- Industrial

- Others

On the basis of the end use, India solar lighting market is segmented into highways & roadways lighting, residential, commercial, industrial and others.

Application

- Indoor

- Outdoor

On the basis of the applications, India solar lighting market is segmented into indoor and outdoor.

Installation Type

- New

- Retrofit

On the basis of the installation type, India solar lighting market is segmented into new and retrofit.

Sales Channel

- Direct Sales

- Wholesale/Retail

- Online

On the basis of the sales channel, India solar lighting market is segmented into direct sales, wholesales/retails and online.

Competitive Landscape and Solar Lighting Market Share Analysis

The solar lighting market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the solar lighting market.

Some of the major players operating in the solar lighting market are Renesas Electronic Corporation, Steelhacks IndustriesWipro Lighting, 7Signify Holding, Fevino Industries LLP, GautamSolar, UM Green Pvt. Ltd., Systellar, Urja Global Limited, Inter Solar Systems, NESSA, Solmitra Power & Steel Pvt Ltd., Easy Photovoltech Private Limited., Sun World Solar Systems, and Solex Energy Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA SOLAR LIGHTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENTS CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRICING ANALYSIS OF SOLAR LIGHTS IN INDIA

4.2 KEY INDUSTRY TRENDS

4.2.1 SMART SOLAR STREET AND ROADWAYS LIGHTING SYSTEMS

4.2.2 THE BATTERY INDUSTRY WILL BECOME MORE COMPETITIVE

4.3 APPLICATION OF MICROCONTROLLERS IN SOLAR LIGHTING

5 REGIONAL SUMMARY

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING RENEWABLE ENERGY SECTOR

6.1.2 RISING INFRASTRUCTURE DEVELOPMENT

6.1.3 INCREASING NEED FOR ENERGY-EFFICIENT LIGHTING SYSTEMS

6.1.4 INCREASING USE OF SOLAR LANTERNS IN RURAL AREAS

6.2 RESTRAINT

6.2.1 HIGH DEPENDENCE ON CONVENTIONAL SOURCES OF ENERGY FOR ELECTRICITY GENERATION

6.3 OPPORTUNITIES

6.3.1 GROWING GOVERNMENT INITIATIVES FOR ALTERNATE SOURCES OF ENERGY

6.3.2 HIGH PRESENCE OF OFF-GRID POPULATION

6.3.3 RISE IN GROWTH OF LED TECHNOLOGY

6.4 CHALLENGE

6.4.1 HIGH COST OF SOLAR LIGHTING SYSTEM

7 IMPACT ANALYSIS OF COVID-19 ON THE INDIA SOLAR LIGHTING MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 IMPACT ON PRICE

7.7 CONCLUSION

8 INDIA SOLAR LIGHTING MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 SOLAR/PV PANELS

8.2.2 LIGHTING FIXTURES

8.2.3 RECHARGEABLE BATTERY

8.2.4 MICROCONTROLLER

8.2.4.1 BY PINS

8.2.4.1.1 20 PINS TO 40 PINS

8.2.4.1.2 LESS THAN 20 PINS

8.2.4.1.3 MORE THAN 40 PINS

8.2.4.2 BY COMPONENTS

8.2.4.2.1 CPU

8.2.4.2.2 MEMORY

8.2.4.2.2.1 EMBEDDED MEMORY MICROCONTROLLER

8.2.4.2.2.2 EXTERNAL MEMORY MICROCONTROLLER

8.2.4.2.3 SERIAL PORTS

8.2.4.2.4 OTHERS

8.2.5 OTHERS

8.3 SOFTWARE & SERVICES

9 INDIA SOLAR LIGHTING MARKET, BY LIGHT SOURCE

9.1 OVERVIEW

9.2 LED

9.3 OTHERS

10 INDIA SOLAR LIGHTING MARKET, BY GRID TYPE

10.1 OVERVIEW

10.2 OFF-GRID

10.3 HYBRID

11 INDIA SOLAR LIGHTING MARKET, BY CAPACITY

11.1 OVERVIEW

11.2 5 WATT TO 20 WATT

11.3 20 WATT TO 35 WATT

11.4 35 WATT TO 50 WATT

11.5 LESS THAN 5 WATT

11.6 ABOVE 50 WATT

12 INDIA SOLAR LIGHTING MARKET, BY END USE

12.1 OVERVIEW

12.2 HIGHWAYS & ROADWAYS LIGHTING

12.2.1 NEW

12.2.2 RETROFIT

12.3 RESIDENTIAL

12.3.1 NEW

12.3.2 RETROFIT

12.4 INDUSTRIAL

12.4.1 NEW

12.4.2 RETROFIT

12.5 COMMERCIAL

12.5.1 NEW

12.5.2 RETROFIT

12.6 OTHERS

12.6.1 NEW

12.6.2 RETROFIT

13 INDIA SOLAR LIGHTING MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 OUTDOOR

13.2.1 SOLAR STREET LIGHTS

13.2.2 SOLAR GARDEN LIGHTS

13.2.2.1 SOLAR LANTERNS

13.2.2.2 SOLAR LAWN LIGHTS

13.2.2.3 SOLAR FENCE LIGHTS

13.2.2.4 SOLAR STING LIGHTS

13.2.2.5 SOLAR SIGN LIGHTS

13.2.2.6 OTHERS

13.2.3 SOLAR TRAFFIC LIGHTS

13.2.4 SOLAR PARKING LOT LIGHTS

13.2.5 SOLAR EMERGENCY LIGHTS

13.2.6 OTHERS

13.3 INDOOR

13.3.1 SOLAR DECK LIGHTS

13.3.2 SOLAR SHED LIGHTS

14 INDIA SOLAR LIGHTING MARKET, BY INSTALLATION TYPE

14.1 OVERVIEW

14.2 NEW

14.3 RETROFIT

15 INDIA SOLAR LIGHTING MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 DIRECT SALES

15.3 WHOLESALE/RETAIL

15.4 ONLINE

16 INDIA SOLAR LIGHTING MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: INDIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 WIPRO LIGHTING (A SUBSIDIARY OF WIPRO LIMITED)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCTS PORTFOLIO

18.1.4 RECENT DEVELOPMENTS

18.2 SIGNIFY HOLDING

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCTS PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.3 INTER SOLAR SYSTEMS PVT. LTD.

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 NESSA

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 URJA GLOBAL LIMITED

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 EASY PHOTOVOLTECH PRIVATE LIMITED

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 FEVINO INDUSTRIES LLP

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCTS PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 GAUTAMSOLAR

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 RENESAS ELECTRONIC CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCTS PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 SOLEX ENERGY LIMITED

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 SOLMITRA POWER & STEEL PVT LTD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 STEELHACK INDUSTRIES

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCTS PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 SUN WORLD SOLAR SYSTEMS

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SYSTELLAR

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCTS PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 UM GREEN PVT. LTD.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCTS PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 INDIA SOLAR LIGHTING MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 2 INDIA HARDWARE IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 INDIA MICROCONTROLLER IN SOLAR LIGHTING MARKET, BY PINS, 2020-2029 (USD MILLION)

TABLE 4 INDIA MICROCONTROLLER IN SOLAR LIGHTING MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 5 INDIA MEMORY IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 INDIA SOLAR LIGHTING MARKET, BY LIGHT SOURCE, 2020-2029 (USD MILLION)

TABLE 7 INDIA SOLAR LIGHTING MARKET, BY GRID TYPE, 2020-2029 (USD MILLION)

TABLE 8 INDIA SOLAR LIGHTING MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 9 INDIA SOLAR LIGHTING MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 10 INDIA HIGHWAYS & ROADWAYS LIGHTING IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 INDIA RESIDENTIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 12 INDIA INDUSTRIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 13 INDIA COMMERCIAL IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 14 INDIA OTHERS IN SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 15 INDIA SOLAR LIGHTING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 INDIA SOLAR LIGHTING MARKET, BY APPLICATION, 2020-2029 (UNITS)

TABLE 17 INDIA OUTDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 INDIA OUTDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 19 INDIA SOLAR GARDEN LIGHTS IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 INDIA SOLAR GARDEN LIGHTS IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 21 INDIA INDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 INDIA INDOOR IN SOLAR LIGHTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 23 INDIA SOLAR LIGHTING MARKET, BY INSTALLATION TYPE, 2020-2029 (USD MILLION)

TABLE 24 INDIA SOLAR LIGHTING MARKET, BY SALES CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 INDIA SOLAR LIGHTING MARKET: SEGMENTATION

FIGURE 2 INDIA SOLAR LIGHTING MARKET : DATA TRIANGULATION

FIGURE 3 INDIA SOLAR LIGHTING MARKET: DROC ANALYSIS

FIGURE 4 INDIA SOLAR LIGHTING MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA SOLAR LIGHTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA SOLAR LIGHTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA SOLAR LIGHTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA SOLAR LIGHTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA SOLAR LIGHTING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 INDIA SOLAR LIGHTING MARKET: CHALLENGE MATRIX

FIGURE 11 INDIA SOLAR LIGHTING MARKET: SEGMENTATION

FIGURE 12 RISING INFRASTRUCTURE DEVELOPMENT IS EXPECTED TO BE A KEY DRIVER THE MARKET FOR INDIA SOLAR LIGHTING MARKETIN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 13 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF INDIA SOLAR LIGHTING MARKETIN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF INDIA SOLAR LIGHTING MARKET

FIGURE 15 TOTAL ENERGY SUPPLY, 2019

FIGURE 16 INDIA SOLAR LIGHTING MARKET: BY COMPONENTS, 2021

FIGURE 17 INDIA SOLAR LIGHTING MARKET: BY LIGHT SOURCE, 2021

FIGURE 18 INDIA SOLAR LIGHTING MARKET: BY GRID TYPE, 2021

FIGURE 19 INDIA SOLAR LIGHTING MARKET: BY CAPACITY, 2021

FIGURE 20 INDIA SOLAR LIGHTING MARKET: BY END USE, 2021

FIGURE 21 INDIA SOLAR LIGHTING MARKET: BY APPLICATION, 2021

FIGURE 22 INDIA SOLAR LIGHTING MARKET: BY INSTALLATION TYPE, 2021

FIGURE 23 INDIA SOLAR LIGHTING MARKET: BY SALES CHANNEL, 2021

FIGURE 24 INDIA SOLAR LIGHTING MARKET: COMPANY SHARE 2021 (%)

India Solar Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its India Solar Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as India Solar Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.